(Incorporated in the Cayman Islands with limited liability)

Stock Code: 2018

2022Annual Report

This annual report is printed on environmentally friendly paper.

In the event of any inconsistency between the English version and the Chinese version of this annual report, the English version shall prevail.

AAC Technologies is a leading provider

of sensory experience solutions with the

goal of building the future of interactive

sensory technologies. Through continuous

innovation and our global footprint, we

have established long-term strategic

partnerships with global smart device clients.

We have strong capabilities in Acoustics,

Optics, Electromagnetic Drives, Sensors

and Semiconductors, as well as Precision

Manufacturing based on decades of industry

experience. AAC Technologies’ mission is to

create a better sensory experience for the

world, and our vision is to become a global

leader in sensory technology with a broad

solution portfolio. We keep innovating

sensory technologies to create new interactive

experiences. In the future, we will focus our

efforts on smartphones, intelligent vehicles,

virtual reality, augmented reality and smart

homes to help create a new era of sensory

experience.

www.aactechnologies.com

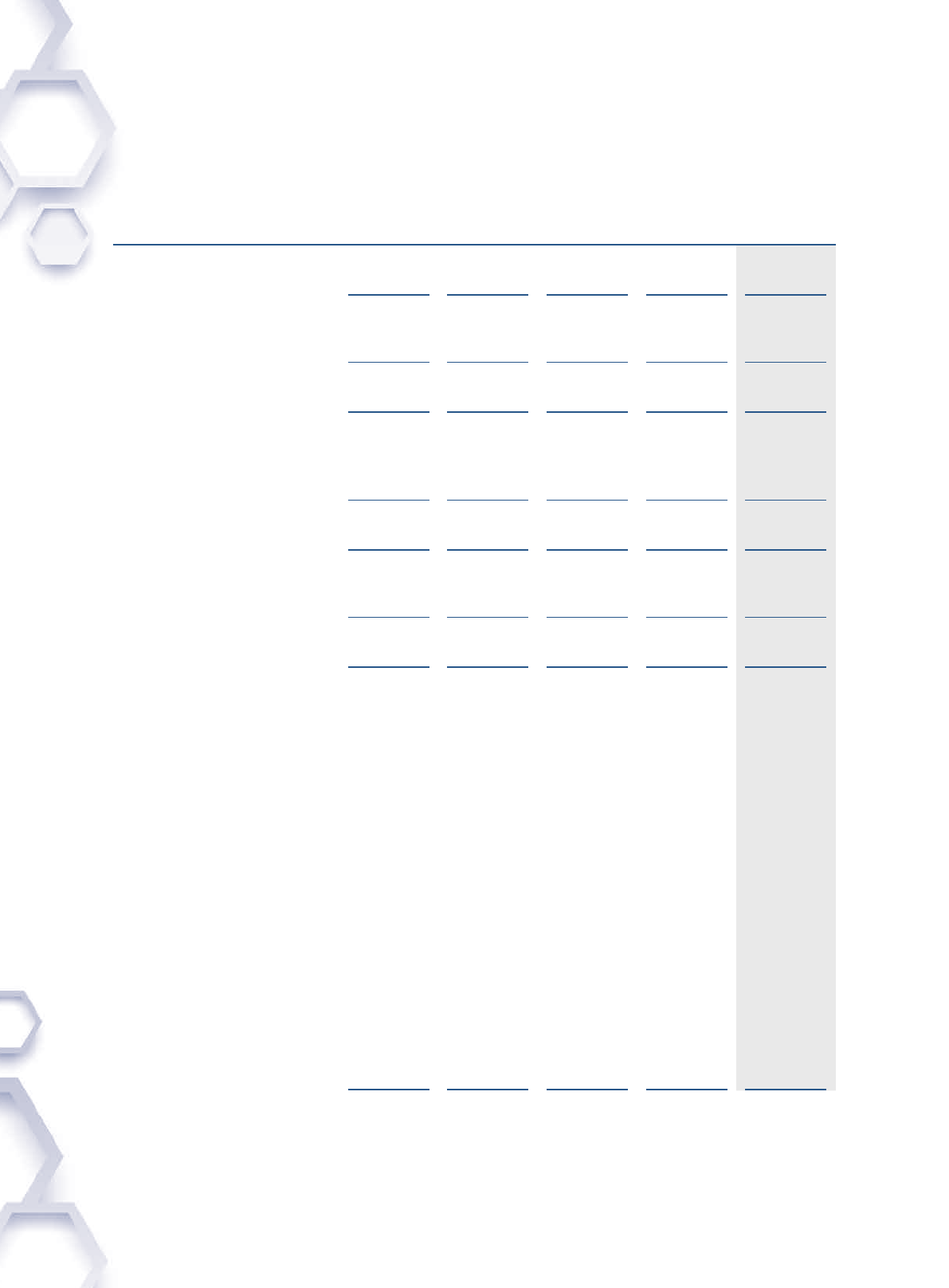

Essence of AAC Technologies

Corporate Information

Core Development Strategies

Financial Highlights

Global Presence

Milestones

CEO Statement

Management Discussion and Analysis

Business and Market Review

Performance and Development of Business Segments

Financial Review

Key Risk Factors

Organization

Biographies of Directors and Senior Management

Governance and Sustainability

Directors’ Report

Corporate Governance Report

Sustainability

Auditor’s Report and Financial Statements

Independent Auditor’s Report

Consolidated Statement of Profit or Loss

Consolidated Statement of Profit or Loss and Other Comprehensive Income

Consolidated Statement of Financial Position

Consolidated Statement of Changes in Equity

Consolidated Statement of Cash Flows

Notes to the Consolidated Financial Statements

5-Year Financial Summary

Others

Investors Information

Definition and Glossary

Contents

2

3

6

8

10

12

14

15

17

20

23

32

48

78

81

85

86

87

89

91

93

182

184

186

The Company has since 2013 issued a stand-alone Sustainability Report every year.

The annual Sustainability Report discloses the details of sustainability performance,

initiatives and its progress on environmental, social and governance issues for the year.

Please visit the website www.aactechnologies.com

to download the reports.

2

AAC Technologies Holdings Inc.

|

Annual Report 2022

Corporate Information

BOARD OF DIRECTORS

Executive Directors

Mr. Pan Benjamin Zhengmin (Chief Executive Officer)

Mr. Mok Joe Kuen Richard

Non-executive Director

Ms. Wu Ingrid Chun Yuan

Independent Non-executive Directors

Mr. Zhang Hongjiang (Chairman of the Board)

Mr. Kwok Lam Kwong Larry

Mr. Peng Zhiyuan

Mr. Au Siu Cheung Albert

(resigned with effect from 31 August 2022)

AUDIT AND RISK COMMITTEE

Mr. Kwok Lam Kwong Larry (Chairman)

(appointed as Chairman with effect from 31 August 2022)

Mr. Au Siu Cheung Albert (Chairman)

(resigned as Chairman with effect from 31 August 2022)

Mr. Peng Zhiyuan

Mr. Zhang Hongjiang

(appointed as member with effect from 31 August 2022)

NOMINATION COMMITTEE

Mr. Zhang Hongjiang (Chairman)

Mr. Kwok Lam Kwong Larry

Mr. Peng Zhiyuan

REMUNERATION COMMITTEE

Mr. Peng Zhiyuan (Chairman)

Mr. Zhang Hongjiang

Mr. Kwok Lam Kwong Larry

(appointed as member with effect from 31 August 2022)

Mr. Au Siu Cheung Albert

(resigned as member with effect from 31 August 2022)

AUTHORIZED REPRESENTATIVES

Mr. Pan Benjamin Zhengmin

Mr. Mok Joe Kuen Richard

JOINT COMPANY SECRETARIES

Mr. Ho Siu Tak Jonathan

Ms. Guan Muyi

(appointed with effect from 1 January 2023)

AUDITOR

Deloitte Touche Tohmatsu

LEGAL ADVISORS

Herbert Smith Freehills

JunHe

PRINCIPAL PLACE OF BUSINESS IN HONG KONG

Unit 1605–7, China Evergrande Centre

38 Gloucester Road, Wanchai, Hong Kong

HONG KONG BRANCH SHARE REGISTRAR

AND TRANSFER OFFICE

Computershare Hong Kong Investor Services Limited

Shops 1712–1716, 17th Floor, Hopewell Centre

183 Queen’s Road East, Wanchai, Hong Kong

REGISTERED OFFICE

Cricket Square, Hutchins Drive

P. O. Box 2681, Grand Cayman, KY1-1111

Cayman Islands

CAYMAN ISLANDS PRINCIPAL SHARE

REGISTRAR AND TRANSFER OFFICE

Maples Fund Services (Cayman) Limited

Boundary Hall, Cricket Square

P. O. Box 1093, Grand Cayman, KY1-1102

Cayman Islands

PRINCIPAL BANKERS

Agricultural Bank of China

Bank of China

Bank of Communications

DBS Bank Limited

The Hongkong and Shanghai Banking Corporation Limited

Ping An Bank

STOCK CODE

2018

WEBSITE

www.aactechnologies.com

FINANCIAL YEAR END

31 December

AAC Technologies Holdings Inc.

|

Annual Report 2022

3

Core Development

Strategies

AAC Technologies is determined to offer

advanced, proprietary technologies,

driving growth through innovation

and smart manufacturing capabilities.

We continue to penetrate new markets

including intelligent vehicles, AR/

VR, AloT, and smart homes through

technological innovation, systematic

product development and a high

standard of quality assurance. We

focus on effective management, talent

development and social responsibilities

to ensure sustainable and high-quality

growth.

4

AAC Technologies Holdings Inc.

|

Annual Report 2022

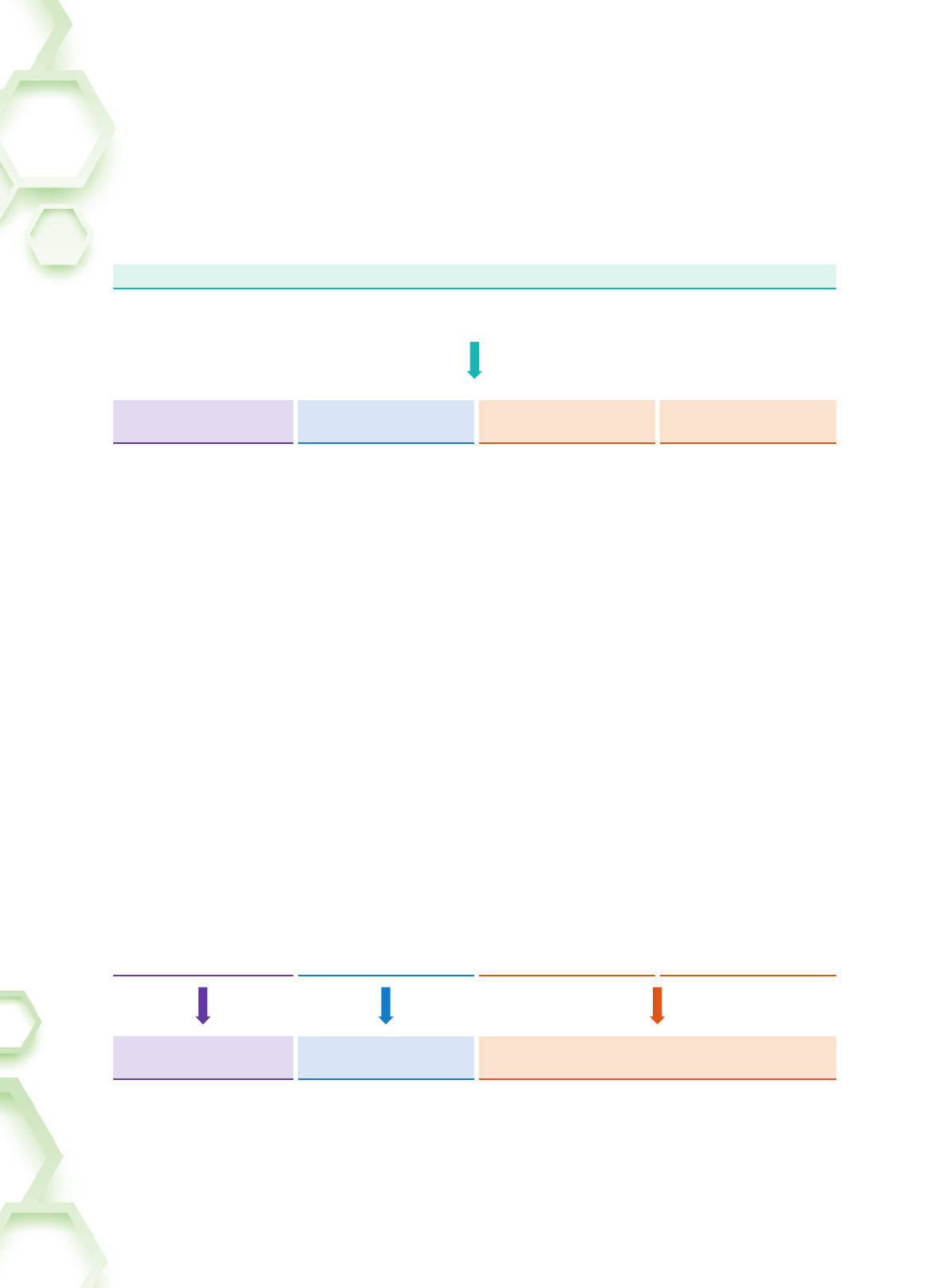

Core Development Strategies

“Two-pronged” approach:

Advanced R&D +

Precision Manufacturing

Holistic Solution Platform

STRATEGY

The Group always aims to “lead

innovation and enhance user

experiences”. Focusing on high

entry barrier technology and high

value-added precision manufacturing

business, and establishing the leading

edge in each segment, we have

achieved sustainable development

capability.

AAC Technologies Holdings Inc.

|

Annual Report 2022

5

Core Development Strategies

CONTINUE TO CONDUCT R&D ON CORE TECHNOLOGIES FOR MAINTAINING THE

LEADING POSITION IN THE GLOBAL TECHNOLOGY MARKET:

Since inception, the Group has identified technology leadership as its competitive strategy. With investment

in R&D accounting for 7.5% of revenue in 2022, the Group has set up 18 R&D centers all over the world, with

3,880 R&D talents, and, by 31 December 2022, obtained 6,380 patents, as well as an addition of 2,737 patent

applications.

CONTINUOUSLY DEVELOP ULTRA-PRECISION PRODUCTION TECHNIQUES AND

ENHANCE PER CAPITA OUTPUT:

The Group has implemented an integrated process of R&D and manufacturing with independent R&D

initiatives, self-developed equipment and automated production lines. Per capita output has continuously

improved by self-developed production techniques, enhanced production yield and our global presence.

Our target is to achieve the per capita output level of developed countries.

ESTABLISH A VERSATILE TECHNOLOGY PLATFORM TO ACHIEVE EFFICIENT USE AND

GREATER INTEGRATION OF R&D RESOURCES:

Our versatile technology platforms enable the Group to invest in specific R&D of these segments: optics,

WLG hybrid lens, acoustics, haptics, precision mechanics and MEMS, to maintain technology leader status

and innovative capabilities.

ESTABLISH A VERSATILE EQUIPMENT PLATFORM TO ENHANCE LEVEL OF STANDARDIZATION

AND DIGITALIZATION:

Our self-developed production equipment has been designed with the capability for continuous upgrades

and further improvements. Hence, our production lines can be modified flexibly for supporting new

requirements of the four business segments. We ensure a quick response to new requirements of production

processes for new products, so that new techniques can be implemented. Such enhanced versatility of

equipment will significantly reduce investment costs of specific production lines of specific segments.

Sensors and

Semiconductors

Acoustics Optics Electromagnetic Drives/

Precision Mechanics

AAC Technologies Holdings Inc.

|

Annual Report 2022

6

Financial Highlights

(RMB million) (RMB million) (RMB)

20,625

22,196

0.69

3.8%

741,963

2,520

43.5%

4,251

6.2%

Revenue EBITDA Earnings Per Share

(RMB million)

Net Asset Net Gearing Ratio ROE

(RMB million) (RMB)

Free Cash Flow CAPEX/EBITDA Per Capita Output

+16.7%

YoY

-1.4%

YoY

-37.2%

YoY

-2.3ppts

YoY

+57.9%

YoY

+285.6%

YoY

-34.8ppts

YoY

-6.2%

YoY

-2.7ppts

YoY

AAC Technologies Holdings Inc.

|

Annual Report 2022

7

Financial Highlights

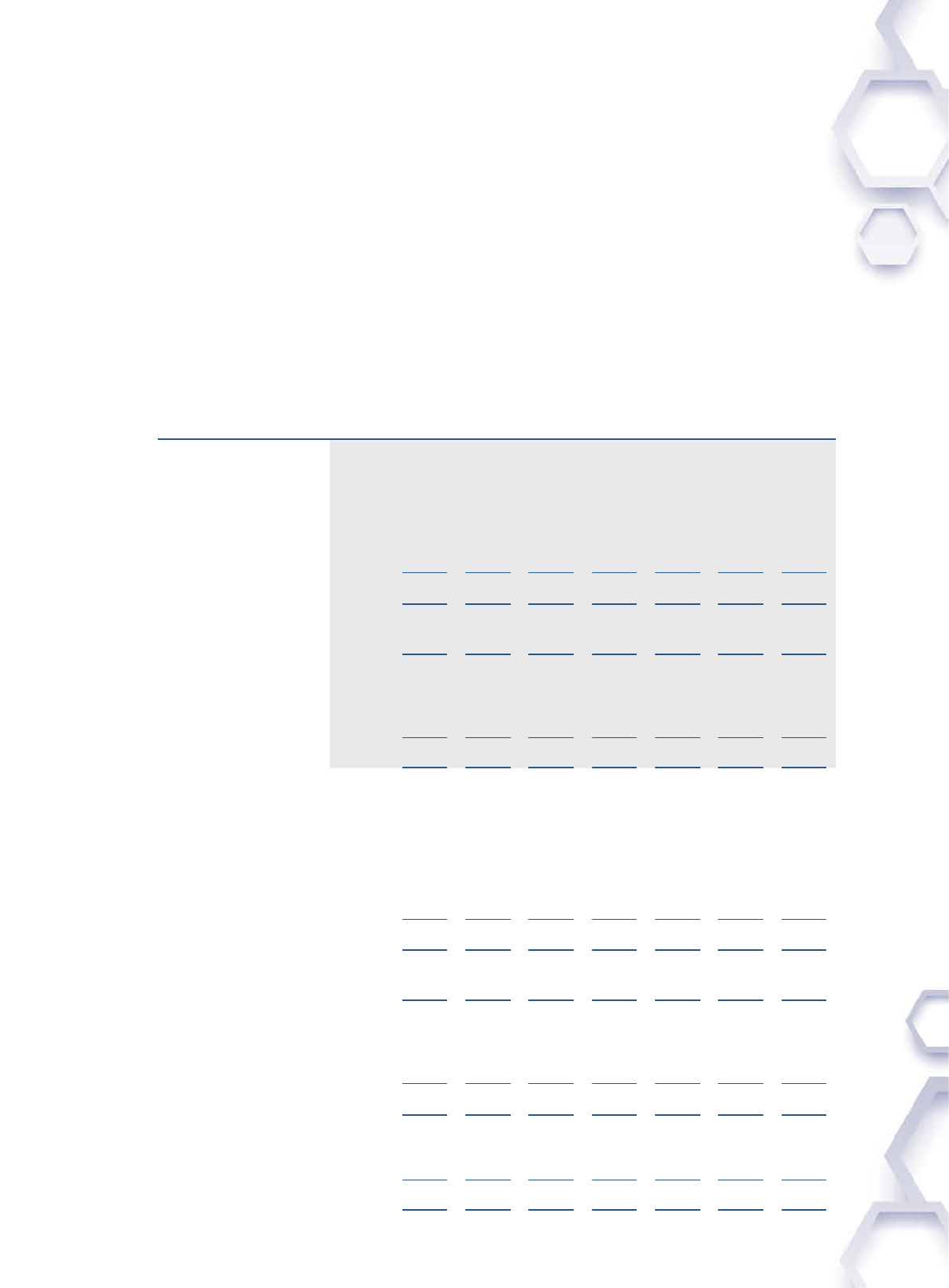

Summary of Past 5-Year Operating Financial Data

Year ended 31 December 2022 vs 2021

2018 2019 2020 2021 2022 YoY Increase

RMB’000 RMB’000 RMB’000 RMB’000 RMB’000 /(Decrease)

Revenue 18,131,153 17,883,757 17,140,219 17,666,967 20,625,092 16.7%

Depreciation and Amortisation 1,763,627 2,176,306 2,477,529 2,702,161 2,986,999 10.5%

Finance costs 217,888 248,210 352,558 415,465 403,084 (3.0%)

Net profit attributable to

owners of the Company 3,795,885 2,222,375 1,506,707 1,316,279 821,305 (37.6%)

EBITDA 6,291,817 4,976,938 4,477,686 4,530,502 4,250,762 (6.2%)

CAPEX (3,903,282) (3,032,874) (5,087,990) (3,548,248) (1,847,510) (47.9%)

Taxation paid (676,286) (370,068) (261,953) (216,633) (303,514) 40.1%

Changes in working capital 1,149,187 (727,941) (527,278) (2,123,494) 420,039 119.8%

Free cash flow 2,861,436 846,055 (1,399,535) (1,357,873) 2,519,777

Gross margin 37.2% 28.6% 24.7% 24.7% 18.3% (6.4ppts)

R&D expenses to Revenue 8.3% 9.6% 11.2% 9.8% 7.5% (2.3ppts)

ROA 12.5% 6.9% 4.1% 3.3% 2.0% (1.3ppts)

ROE 20.8% 11.6% 7.4% 6.1% 3.8% (2.3ppts)

Per capita output

(Revenue/Employees) 504 454 508 470 742 57.9%

Net gearing ratio 6.2% 10.5% 2.2% 8.9% 6.2% (2.7ppts)

Current ratio 1.44 1.92 1.80 1.86 1.89 3.0ppts

CAPEX/EBITDA 62.0% 60.9% 113.6% 78.3% 43.5% (34.8ppts)

8

AAC Technologies Holdings Inc.

|

Annual Report 2022

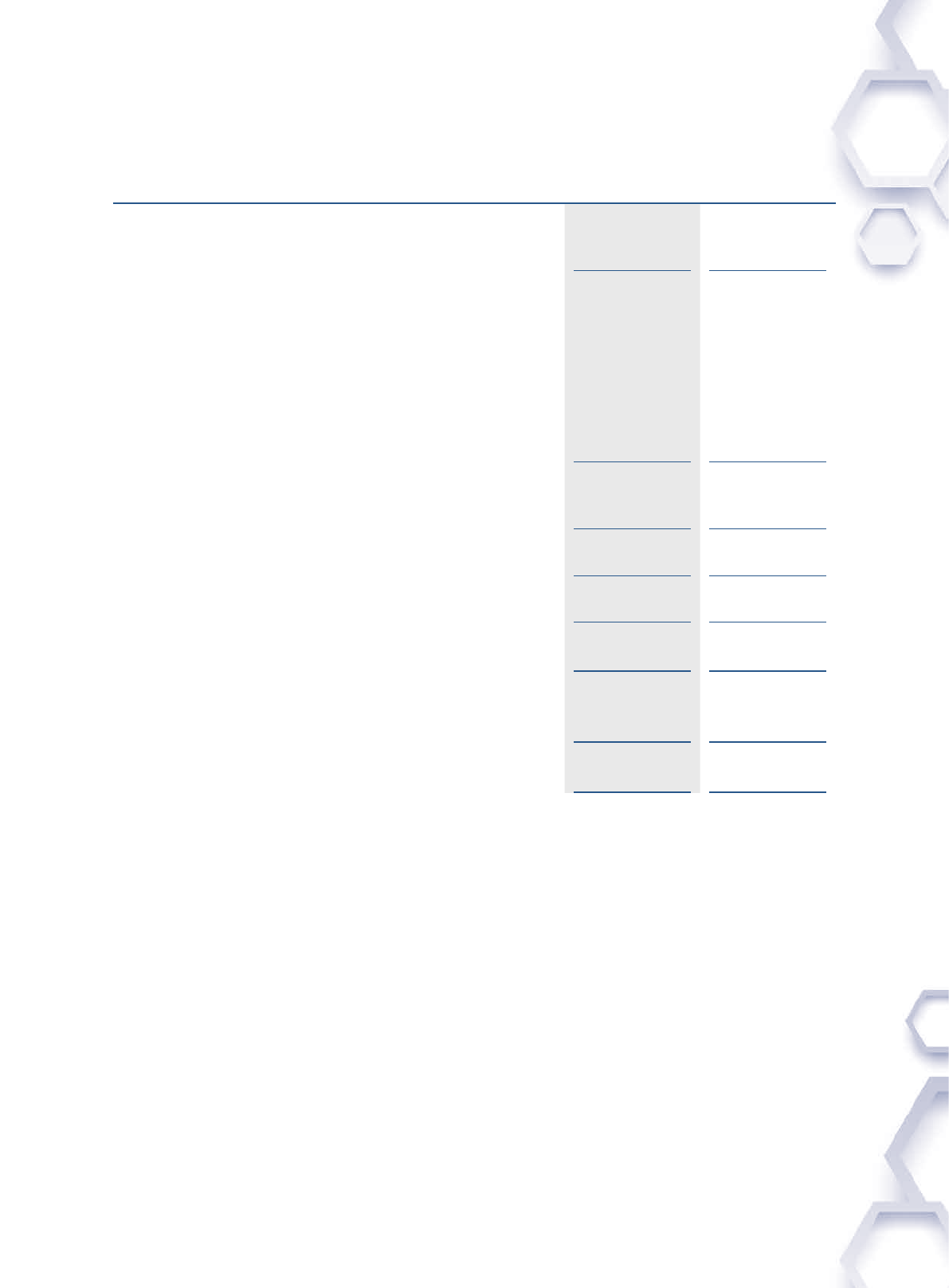

Global Presence

R&D Centers

Patents by Segments

2018 2019 2020 2021 2022

3,366

4,411

7,222

6,034

6,380

Acoustics

Sensors and Semiconductors

Optics

RF

Electromagnetic Drives

Others

PatentsR&D Centers

Patent

Applications

R&D Engineers and

Technicians

2,7373,880 6,38018

Overseas:

2,355

Overseas:

922

R&D

R&D Expenses and

R&D Expenses/Revenue Ratio

(RMB million or %)

2018 2019 2020 2021

2022

1,546

7.5%

1,512

1,717

1,920

8.3%

9.6%

11.2%

1,726

9.8%

Denmark

Copenhagen

United States

Irvine

Finland

Tampere

United Kingdom

Edinburgh

Turku

Singapore

Osaka

Tokyo

Tampines

Japan

Korea

Suwon

China

Changzhou

Nanjing

Shenzhen

Shanghai

Suzhou

Beijing

Taipei

Hsinchu

Acoustics

Electromagnetic Drives

Optics

Sensors and Semiconductors

Precision Mechanics

Guangxi

Nanning

Guangdong

Sensors and Semiconductors

Automation Equipment

Shenzhen (Longgang)

Anhui

Ma’anshan

Components

Battery

Optics

Wuhan

Chongqing

Jiangsu

Changzhou

Acoustics

Electromagnetic Drives

Optics

Precision Mechanics

Shuyang

Components

Precision Mechanics

Suzhou

Precision Mechanics

Optics

Yangzhou

Precision Mechanics

AAC Technologies Holdings Inc.

|

Annual Report 2022

9

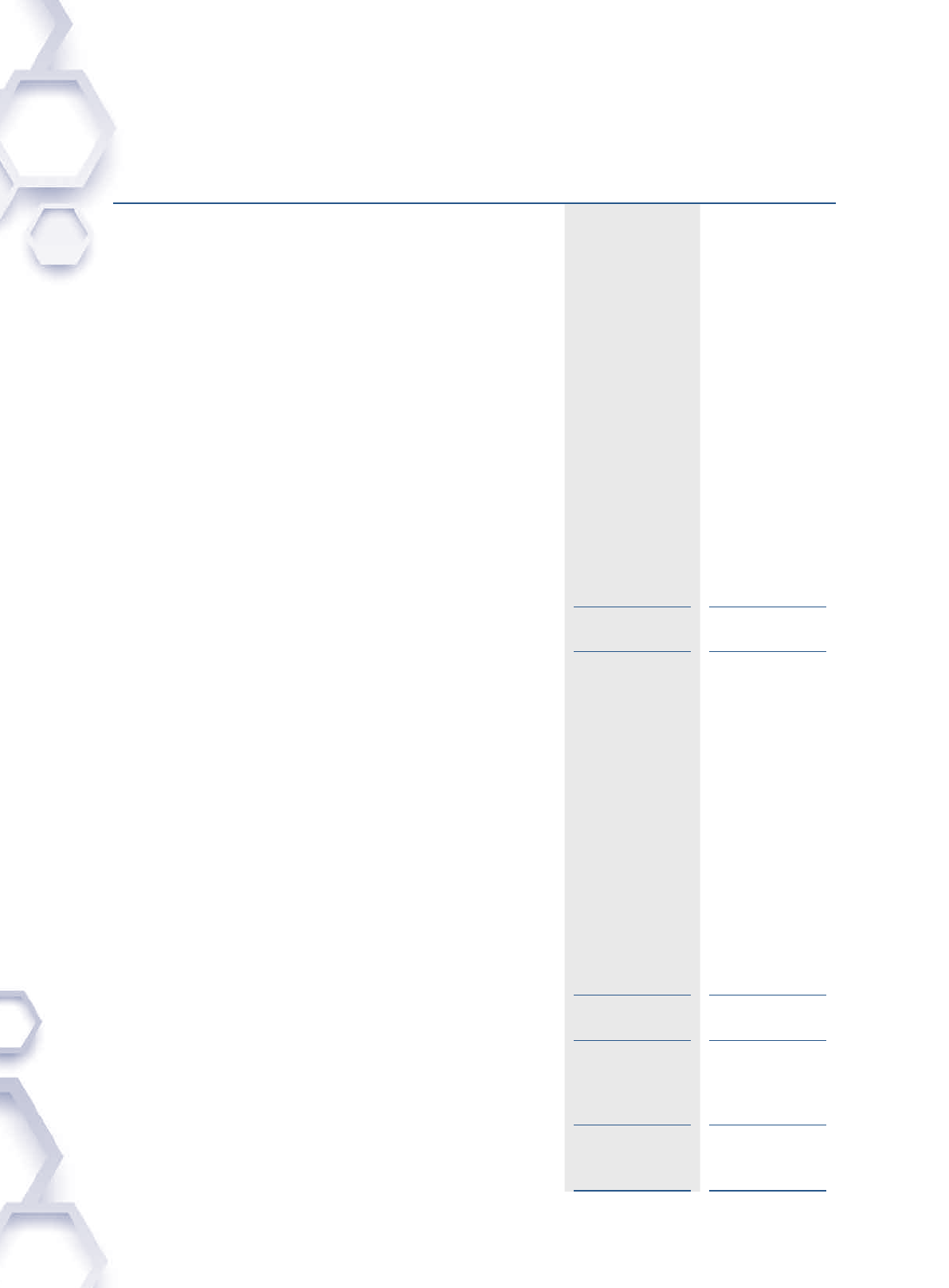

Global Presence

Denmark

Copenhagen

United States

Irvine

Finland

Tampere

United Kingdom

Edinburgh

Turku

Singapore

Osaka

Tokyo

Tampines

Japan

Korea

Suwon

China

Changzhou

Nanjing

Shenzhen

Shanghai

Suzhou

Beijing

Taipei

Hsinchu

Acoustics

Electromagnetic Drives

Optics

Sensors and Semiconductors

Precision Mechanics

Guangxi

Nanning

Guangdong

Sensors and Semiconductors

Automation Equipment

Shenzhen (Longgang)

Anhui

Ma’anshan

Components

Battery

Optics

Wuhan

Chongqing

Jiangsu

Changzhou

Acoustics

Electromagnetic Drives

Optics

Precision Mechanics

Shuyang

Components

Precision Mechanics

Suzhou

Precision Mechanics

Optics

Yangzhou

Precision Mechanics

Diversified Manufacturing Bases

China

Johor

Malaysia

Sensors and Semiconductors

Kozomín

Optical Mold

Czech

Bac Ninh

Acoustics

Vinh Phuc (under development)

Ba Thien IP Industrial Park

Bac Giang (under development)

Hoa Phu Industrial Park

Vietnam

AAC Technologies Holdings Inc.

|

Annual Report 2022

10

Milestones

Shenzhen Yuanyu,

manufactured

miniature acoustic

components

Mass production of

MEMS microphones

Acquired ISQR, a Japanese

lens designer

Set up Singapore RF

design laboratory

Changed Company’s

name to AAC

Technologies

Invested in MEMS

Tech, Singapore for

MEMS Die design

IPO on the Stock

Exchange

Certified supplier for top 5

global mobile phone makers

Mass production of haptics and

waterproof speakers

Invested in Kaleido,

Denmark for WLG

technology

Started fully automated

production of speakers

and receivers

Started to ship

integrated LDS

antennas on

speaker boxes

1993

2005

2007

2009

2011

2010

2008

2012

AAC Technologies Holdings Inc.

|

Annual Report 2022

11

Milestones

Non-Acoustic business

(Haptics and RF Mechanics)

ramping up, contributing

20% of revenue for the

first time

2014

Shipped SLS

acoustic products

2018

Mass production of RF

mechanical solutions

2013

Acquired WiSpry, US for

RF MEMS technology

2015

Launch of SLS platform

Mass production of

plastic lenses

2017

Top 3 global

supplier of plastic

lenses for

smartphones

2019

Mass production

of WLG hybrid

lenses ready

2020

Launched proprietary

Combo and Opera

Coaxial solutions

Mass-production and

shipment of total

automotive acoustics

solutions

2022

Launch of stereo sound

solutions

2016

Established

a new

business

unit for

operation of

Automotive

Business

2021

12

AAC Technologies Holdings Inc.

|

Annual Report 2022

CEO Statement

2022 was a challenging year, we proactively undertook steps to strengthen our operations. Despite the pandemic’s

outbreak, high inflation and relatively weak market demands, the Group strengthened its positioning in the smartphone

market with its leading capabilities in research and development and sound operational management. Against such

market backdrop, the Group achieved market share increase in businesses across acoustics, electromagnetic drives and

precision mechanics, optics, sensors and semiconductors with revenue exceeded RMB20 billion, up 16.7% year-on-year

(“YoY”).

Coping with complex external environment, the Group maintained its long-term focus to create value, and stayed

committed to navigating through economic cycles by continuously enhancing product competitiveness and ensure

prudent cash flow management. In 2022, the Group continued to strive for internal and external improvements. On one

hand, the Group deepened the cooperation with business partners and boosted its market shares. On the other hand,

the Group consistently implemented lean operational management by reducing costs and improving overall operational

efficiency, stringently managing inventory and improving inventory turnover. As a result, the free cash flow position of the

Group has improved significantly, up from RMB-1.38 billion in 2021 to RMB2.52 billion in 2022.

The Group persists in leading industry development through technological innovation and works closely with overseas

customers. By leveraging its advantages in both acoustics and electromagnetic drives, the Group launched its proprietary

Combo and Opera Cap Coaxial solutions, which enabled the Group to provide a superior tactile and auditory experience

to consumers via more cost-effective products. The Group actively prompted and implemented applications of WLG

glass lens in multiple projects including automotive, AR/VR devices, semiconductor manufacturing and testing as well

as other industrial fields. The precision mechanics business has gradually improved with value of products continuously

enhanced, and the proportion of revenue from non-smartphone business continued to rise. Market share of MEMS

products has steadily increased, and the Group has been actively developing products with high signal-to-noise ratio to

meet customers’ demand for product upgrades.

In 2022, the Group proactively forged ahead to create a second growth curve and to activate new growth trajectory.

In addition to solidifying the leading positions in the smartphone market, the Group continues to seize new market

opportunities and explore strategic new markets. The Group also achieved breakthroughs in automotive acoustics market

and the total automotive acoustics solutions business has started mass-production and shipment. In addition, the Group

successfully developed a full set of new modules for automotive MEMS microphones which is expected to be mass

produced in 2023. Other products, such as optics and haptics products, are also being actively expanded in fields such as

AR/VR and automotive applications.

The year 2023 marks the Group’s 30th anniversary. Throughout the past 30 years, AAC Technologies was not only a

contributor in the consumer electronics industry, but also a leading provider of sensory experience solutions. Going

forward, we will continue to pursue opportunities in strategic new markets and accelerate our product deployment to lead

the new era of sensory experience.

The Group will continue to improve its

operational scale and efficiency, and build up

its capability to achieve sustainable growth and

expand its diversified business development,

so as to become a world leading provider of

sensory experience solutions.

AAC Technologies Holdings Inc.

|

Annual Report 2022

13

CEO Statement

On behalf of the Group’s management team, I would like to thank our partners and shareholders for their trust, patience

and support. I would also like to thank all our employees for their creativity and positive attitude. We will continue to

forge ahead with a cohesive force to create greater value for our customers and deliver long-term stable returns to our

shareholders.

Pan Benjamin Zhengmin

Chief Executive Officer

23 March 2023

14

AAC Technologies Holdings Inc.

|

Annual Report 2022

Business and Market Review

In 2022, the Group recorded a revenue of RMB20.63 billion, up 16.7% YoY which was mainly attributed by the strong

demand from overseas customers and the increase in combined revenue contribution from electromagnetic drives and

precision mechanics business as well as optics business. Gross profit margin was 18.3%, down 6.4 percentage points

(“ppts”) YoY due to the increased revenue contribution from business segments with relatively lower gross profit margins.

Net profit was RMB821 million, down 37.6% YoY. For the fourth quarter 2022 (“Q4 2022”), the Group recorded revenue of

RMB5.84 billion, up 21.4% YoY, also due to revenue increase from these three business segments. The Gross profit margin

was 16.6%, down 3.9 ppts YoY, due to the change of product portfolio. Net profit was RMB237 million, up 12.0% YoY.

During the reporting period, the Group remains prudent in financial management and stringently manages capital

expenditure and research and development (“R&D”) expenses. The capital expenditures amounted to RMB1.85 billion in

2022. During the reporting period, the Group conducted active liability management, successfully optimized the debt

structure and maintained stable cash flow. As of 31 December 2022, the operating cash inflows were RMB4.37 billion, cash

on book (including short term fixed deposits) was RMB7.16 billion, net gearing ratio was 6.2%. A sound financial position

is essential to the sustainable growth of the Group, and ensures the Group’s ability to continue to innovate and develop

going forward.

After careful review of the Group’s financial liquidity and business development requirements, the Board of Directors

proposed to declare a final dividend of HK$0.12 per share for FY 2022 (FY 2021: Nil), implying a total annual dividend

amounted to HK$0.12 per share for FY 2022 (FY 2021: HK$0.20 per share) which represents the 15% payout ratio,

same as that of FY 2021. Amidst the dynamic macroeconomic environment, the Group will remain prudent in financial

management and strong in cash flow for business development, so as to create long-term value for shareholders.

AAC Technologies Holdings Inc.

|

Annual Report 2022

15

Performance and Development of

Business Segments

Acoustics Business

In Q4 2022, the Group’s acoustics business revenue was RMB2.38 billion, up 6.3% YoY. Gross profit margin was 31.2%, up

4.4 ppts YoY, driven by increased revenue contribution from overseas customers. In 2022, the Group’s acoustics business

revenue was RMB8.85 billion, up 3.1% YoY. Gross profit margin was 28.1%, down 1.5 ppts YoY mainly due to weaker

demand in the Android market and lower shipment of Android acoustics products, leading to a YoY decline in gross

margin.

In Q4 2022, the Group has continued to work closely with overseas customers, and enhanced its market share steadily.

Affected by the weaker demand in the Android market, the revenue and gross margin of Android acoustics decreased YoY.

To satisfy various customer needs, the Group launched its proprietary Combo and Opera coaxial solutions. This product

effectively enhances consumers’ auditory and tactile experience in application scenarios such as video and audio, gaming

and vertical screens while reducing production costs. Currently, the Group has built up an integrated solution for mobile

audio device including high-performance linear speakers, multi-speaker arrays and the proprietary algorithm. Looking

forward, the Group will provide an immersive auditory experience for customers in multiple application scenarios with

more diversified product portfolio.

In Q4 2022, the Group’s automotive acoustics solutions business has continued to accomplish mass-production and

shipment. The Group also achieved breakthroughs and acquired new landmark automotive acoustics projects. To meet

various customers’ needs and quickly break through the market, the Group provides a comprehensive solution from

ultra-flagship to high cost-performance by covering a set of audio solutions including single component, tuning services,

software systems and flexible combinations of the services. Going forward, the acoustic system will become one of the

core components of the intelligent cockpit. The Group will continue to promote the overall acoustics solution, and deepen

cooperation with partners to enhance consumers’ audio experience.

Optics Business

In Q4 2022, the Group’s optics business revenue was RMB798 million, up 55.6% YoY and 40.8% QoQ, on the back of

continued growth in shipment volume and market share expansion in both plastic lens and camera module businesses.

Benefited from the smooth progress of camera module business and the increased market share, in 2022, the Group’s

optics business revenue was RMB3.22 billion, up 34.7% YoY.

In 2022, the plastic lens business continued to consolidate market share and improve market position despite the

competitive landscape. Facing the fierce market competition, the Group will continue to optimize product portfolio by

improving the shipment proportion of high-end products, and strengthen inventory management to improve the gross

profit margin by enhancing internal management and operational efficiency. Camera module business grew steadily and

annual shipment volume delivered a YoY increase of 121.5%. OIS products have started a small-scale mass production.

WLG hybrid lenses are making good progress and 1G5P and 1G6P products are in steady mass production and delivery.

The Group will continue to enhance its vertical integration capability of optics business, optimize camera module and VCM

business, to achieve the market share gain in the mid-to-high end products.

Electromagnetic Drives and Precision Mechanics Business

For Q4 2022, given the shipment growth from both haptics and metal casing products, as well as contributions from the

acquisition of Toyo Precision, revenue from this combined segment reached RMB2.29 billion, up 27.5% YoY and 11.5%

QoQ. Gross profit margin was 22.2%, up 2.5 ppts YoY and 0.7 ppts QoQ. In 2022, revenue from this combined segment

amounted to RMB7.28 billion, up 29.0% YoY. Gross profit margin was 21.3%, down 0.4 ppts YoY and remained relatively

stable mainly because the change of product portfolio.

16

AAC Technologies Holdings Inc.

|

Annual Report 2022

Performance and Development of

Business Segments

Electromagnetic Drives Business

In 2022, the market shares of Android x-axis haptics further increased with the total shipment volume increased by 41.9%

YoY. In addition to higher penetration in smartphone market, the ultra-wide x-axis haptics motor launched by the Group

can also be used in smart watches, tablets, intelligent automobiles, game consoles, VR/AR, providing consumers with a

one-stop, multi-dimensional, full-scene high-quality tactile feedback experience. The Group has successfully entered into

VR supply chain and provided x-axis haptics motor for a leading global VR player. It is expected that the x-axis haptics will

be widely used in strategic new markets in the future.

Precision Mechanics Business

Relying on the advanced precision manufacturing capabilities, the Group’s metal casing business has gained leading

market shares in the flagship and high-end smartphones among key customers. In Q4 2022, given the strong demand

of customers’ high-end smartphone models, the utilization rate of metal casing products has increased and gross profit

margin also improved YoY. The Group will continue to explore projects with high values to optimize product portfolio

and enhance profitability. Toyo Precision’s business has integrated smoothly and provided additional growth for the

segment. The Group has been actively acquiring new projects and accelerating its pace in expanding overseas production

capacity of precision mechanics, aiming to further ramp up the revenue contribution from Toyo Precision and the overall

profitability of this business segment.

Sensor and Semiconductor Business

For Q4 2022, the Sensor and Semiconductor business recorded a revenue of RMB356 million, up by 49.5% YoY, due to

strong demand from overseas customers and increased market penetration of Android MEMS products. Gross profit

margin was 13.9%, up 1.4 ppts YoY and 6.6 ppts QoQ. In 2022, the Sensor and Semiconductor business revenue was

RMB1.26 billion, up 24.0% YoY, due to market share increase. The gross profit margin was 11.6%, down 3.5 ppts YoY,

mainly due to increased raw material costs.

In Q4 2022, the factory facility in Malaysia commenced production, which further strengthened the Group’s global

production capacity. The Group continues to promote proprietary MEMS microphones with optimized structural designs

to enhance reliability, offering proprietary and differentiated designs to cater to various specification requirements of

customers. The Group has entered into a partnership with Soundskrit in launching the world’s first high-performance

directional MEMS microphone to end users across consumer electronics and automotive markets. Alongside a gradual

increase in demand for intelligent audio interaction in fields such as artificial intelligence, smart home appliances,

automobiles and other markets, MEMS business will foresee an expansion in market demand and more market

development opportunities.

Prospect

According to International Data Corporation (“IDC”) report, the global smartphone shipment in 2023 is expected to

decline by 1.1% YoY to 1.19 billion units. Although the prospect of global smartphone shipment remains relatively

stable, the Group will continue to strengthen the collaborations with existing customers, strive for higher market shares

and continuously invest in research and development to improve the end-user experience. Combined with continued

focus in operational efficiency and cash flow management, these efforts will lay a solid foundation for the Group’s

long-term development. The development of the NEV market brings additional growth opportunities, especially with

the development of intelligent cockpit and autonomous driving technologies, which will drive a new wave of upgrades

in vehicle’s hardware and software. The Group intends to capture more opportunities in the automotive market, develop

new sources of revenue, and maximize returns for shareholders by leveraging on its leading advantages in miniaturized

technology and precision manufacturing capabilities.

AAC Technologies Holdings Inc.

|

Annual Report 2022

17

Financial Review

Revenue

In 2022, the Group’s revenue increased YoY by 16.7%, to RMB20.63 billion. Owing to factors discussed under “Business

and Market Review” above, revenue from the electromagnetic drives and precision mechanics and optics increased by

RMB1,637 million and RMB828 million respectively. The acoustic business was relatively stable as compare with the same

period of last year.

Gross Profit and Gross Profit Margin

In 2022, gross profit was RMB3.78 billion, representing a decrease by 13.5% from the gross profit of RMB4.36 billion in

2021. The drop in gross profit was mainly contributed by market competition in optics business and the decline was partly

offset by the improved gross profit of electromagnetic drives and precision mechanics due to increase in sales volume.

Gross profit margin decrease to 18.3% in 2022 as compared with 24.7% in 2021. The decrease in gross profit margin was

mainly contributed by the increased sales from precision mechanics and optics with lower gross profit margin.

Other income, gains and losses, and other expenses

The net other income/gains increased by RMB180 million. This was mainly contributed by the gain on repurchase of

unsecured notes of RMB169 million and increase in government grants of RMB133 million. The increment was offset by the

restructuring costs of RMB125 million.

Administrative Expenses

Administrative expenses in 2022 were RMB1,036 million, 25.7% higher, compared with RMB824 million in 2021. The

increase was mainly contributed by the increase in staff related cost, share incentive expenses and discretionary bonus. To

cope with the new strategic developments and drive long term growth, the Group had enhanced the management team

and launched share award plan.

Distribution and Selling Expenses

Distribution and selling expenses of RMB448 million in 2022, increased by 34.7%, compared with RMB333 million in

2021. The increase was mainly contributed by the increased in staff related cost, discretionary bonus and share incentive

expenses to strengthen our sales force in new market segment like automotive.

Research and Development Expenses

R&D expenses in 2022 were RMB1,546 million, 10.4% lower than RMB1,726 million in 2021. The decrease was primarily

attributable to improved cost efficiency in research and development.

Finance Costs

Finance costs in 2022 amounted to RMB403 million, representing a decrease of 3.0% compared with RMB415 million in

2021. Such decrease was mainly due to the reduction of average bank loan balance, which was offset by the additional

interest on unsecured notes accompany with the issuance of 5-year unsecured notes USD300 million at annual interest

rate 2.625% and 10-year unsecured notes USD350 million at annual interest rate 3.75% in June 2021.

Taxation

Taxation expenses of the Group were calculated based on the assessable profits of the subsidiaries at the rates prevailing

in the relevant jurisdictions. Taxation expenses in 2022 amounted to RMB231 million, representing an increase of 93.3%

from RMB120 million in 2021. The increase was mainly due the reduction of deferred tax credit relating to tax losses and

other temporary difference from RMB116 million to RMB17 million.

18

AAC Technologies Holdings Inc.

|

Annual Report 2022

Financial Review

Profit attributable to the owners of the Company

Reported net profit for 2022 was RMB0.82 billion, a decline by 37.6% compared with RMB1.32 billion in 2021. The decline

of was mainly due to the decline of gross profit and the increase in operation costs during the period which was partly

offset by the increase in other income and decrease in non-controlling interests.

LIQUIDITY AND FINANCIAL RESOURCES

The Group has always emphasized financial discipline and continues to maintain a strong liquidity position. Cash flows

from (used in) our operating, investing and financing activities, are as below:

For the year ended 31 December

2022 2021

RMB million RMB million

Net cash from operating activities 4,372.0 2,176.0

Net cash used in investing activities (2,349.3) (4,245.4)

Net cash (used in) from financing activities (1,438.7) 632.6

Operating Activities

Cash inflow from operating activities was mainly generated from cash receipts from the Group’s sales. Cash outflows were

related to raw materials purchases, payroll, distribution and selling expenses, expenses incurred in R&D, administrative

items and taxation charges. Net cash generated from operating activities was RMB4,372.0 million for 2022 (2021:

RMB2,176.0 million).

i. Trade Receivables and Payables

As at 31 December 2022, turnover days of trade receivables decreased by 5 days to 78 days as compared to 31

December 2021. Trade receivables decreased by RMB0.22 billion to RMB4.28 billion. Aging of trade receivables (net

of allowance for doubtful debts) based on invoice dates between 0–90 days, 91–180 days and over 180 days were

RMB4,098.4 million (31 December 2021: RMB4,133.2 million), RMB169.8 million (31 December 2021: RMB293.7

million) and RMB10.5 million (31 December 2021: RMB70.4 million) respectively. The Company has received

subsequent settlement totaling RMB2,678.8 million up to 28 February 2023, representing 62.6% of the total

amount outstanding, net of allowances, as at the end of the reporting period.

The Group’s trade payables turnover days decreased by 28 days to 81 days as compared to 31 December 2021.

Trade payables decreased by RMB1.02 billion to RMB3.24 billion. Aging of trade payables based on invoice dates

between 0–90 days, 91–180 days and over 180 days were RMB2,576.8 million (31 December 2021: RMB3,300.4

million), RMB654.9 million (31 December 2021: RMB949.9 million) and RMB11.2 million (31 December 2021:

RMB13.4 million) respectively.

ii. Inventory Turnover

As at 31 December 2022, the inventories have decreased by RMB1.29 billion compared to 31 December 2021.

The inventory turnover days decreased to 109 days for the year ended 31 December 2022 from 133 days for 31

December 2021.

Investing Activities

Net cash used in investing activities in 2022 amounted to RMB2,349.3 million (2021: RMB4,245.4 million). It mainly

represents the cash used in capital expenditures (“CAPEX”) of RMB1,768.0 million (2021: RMB3,738.1 million), placement

of short-term fixed deposits of RMB341.3 million (2021: Nil) and acquisition of equity instruments at FVTOCI and financial

assets at FVTPL of RMB273.4 million (2021: RMB580.3 million), offsetting by the cash inflow arising from the government

grant of RMB172.4 million (2021: RMB307.1 million) as well as the withdrawal of time deposits of RMB2.2 million for 2022

(2021: RMB92.2 million).

AAC Technologies Holdings Inc.

|

Annual Report 2022

19

Financial Review

CAPEX included acquisition of land use rights, additional production plant and property, and, latest automation machinery

and equipment for modifications and upgrades as well as capacity expansion. For 2022 and 2021, total CAPEX incurred

were RMB1,847.5 million and RMB3,548.2 million respectively. Investing activities are focused on sustained CAPEX

programs in building technology platforms per the Group’s business progress to capture new market opportunities and

support its long-term business strategies. CAPEX are funded by internal resources and bank loans, and are subject to

annual CAPEX budgeting and approval by the Board.

Financing Activities

The Group recorded net cash outflow from financing activities of approximately RMB1,438.7 million for 2022. Major

outflows from repayment of bank loans of RMB3,021.2 million (2021: RMB6,767.3 million) and payment for repurchase

of unsecured notes of RMB949.7 million, and major inflows was due to bank loans raised of RMB3,243.2 million (2021:

RMB4,114.2 million), and issuance of unsecured notes of RMB4,163.4 million in 2021.

Cash and Cash Equivalents and Short Term Fixed Deposits

As at 31 December 2022, the unencumbered cash and cash equivalents and short term fixed deposits of the Group

amounted to RMB7,155.0 million (31 December 2021: RMB6,051.4 million), of which 55.7% (31 December 2021: 57.9%) was

denominated in US dollar, 39.8% (31 December 2021: 36.1%) in RMB, 2.5% (31 December 2021: 1.3%) in Hong Kong dollar,

0.5% (31 December 2021: 1.4%) in Euros, 0.5% (31 December 2021: 1.1%) in Vietnamese Dong, 0.2% (31 December 2021:

1.0%) in Malaysian Ringgit, 0.2% (31 December 2021: 0.4%) in Japanese Yen, 0.2% (31 December 2021: 0.3%) in Singapore

dollar, and 0.4% (31 December 2021: 0.5%) in other currencies.

Gearing Ratio and Indebtedness

As at 31 December 2022, the Group’s gearing ratio, defined as total loans and unsecured notes divided by total assets, was

23.9% (31 December 2021: 23.3%). Netting off cash and cash equivalents and short term fixed deposits, net gearing ratio

was 6.2% (31 December 2021: 8.9%).

As at 31 December 2022, the unsecured notes of the Group were RMB6,087.8 million (31 December 2021: RMB6,573.2

million), the short-term bank loans and long-term bank loans of the Group amounted to RMB1,832.6 million (31 December

2021: RMB2,902.4 million) and RMB1,727.2 million (31 December 2021: RMB330.0 million) respectively.

Charges on Group Assets

Apart from bank deposits amounting to RMB0.2 million that were pledged to secure credit facilities as at 31 December

2022 (31 December 2021: RMB2.2 million), no other Group assets were charged to any financial institutions.

OFFBALANCE SHEET TRANSACTIONS

As at 31 December 2022, the Group had not entered into any material off-balance sheet transactions.

20

AAC Technologies Holdings Inc.

|

Annual Report 2022

Key Risk Factors

The Company has structured risk management and internal control systems for the management of strategic, market,

operational, financial and compliance risks. In our pursuit of technology innovation, the Company is committed to

building sustainable risk management and operational information systems. We have been focusing on systematic

review and upgrading our risk and control measures in chosen business processes, benchmarking against international

best practices. Such systems are designed to manage the risk of failure to achieve business objectives, and can provide

reasonable assurance against material misstatement or loss. Certain key risk factors affecting the Group are outlined

below. The list of these factors is non-exhaustive, and there may be other risks and uncertainties which are not known to

the Group or which may be immaterial now but could become material in the future. Besides, this annual report does not

constitute a recommendation or an advice for anyone to invest in the securities of the Company. Investors are advised to

make their own judgment or consult their own investment advisors before making any investment in the securities of the

Company.

Risks Pertaining to the Smartphones Market

A substantial part of the Group's revenue is derived from the smartphone sector of the consumer electronics market. There

are uncertainties due to the potential slow-down in global economy and the ensuing dampened consumer sentiment and

weaker demand. A decline in global economic conditions, in particular in China and other geographic regions, may affect

our operating results and financial performance. To tackle this, the Company is continuously widening its product and

technologies platforms to extend its reach to different end applications, so as to diversify the sources of revenue and profit

to reduce its dependency on any single segment.

Reliance on a Number of Key Customers

The Group's five largest customers, which accounted for 83.9% of the Group's total revenue for 2022, are all related to the

consumer electronics industry, characterized by innovation-driven and user experience-oriented business growth. Loss of

or changes in market position of any of these customers may materially and adversely affect the Group's business, financial

condition and results of operations. Nevertheless, the Group has focused on technology innovation to continuously

enhance user experience meeting customers' specification upgrade needs. We have also implemented standardized

procedures for handling all forms of customer information to ensure it is not improperly or inadvertently disclosed to third

parties. The Group has established strong relationships with these major customers; all of them have been our customers

for over 11 years. The credit terms granted to them are in the range of 60- to 90-day periods and are generally in line with

those granted to other customers.

Risks of Supply Chain and Production Disruption due to Unforeseeable Events

The COVID-19 pandemic broke out globally in 2020. The ongoing of the pandemic in 2021 and 2022 has adversely

impacted the global economy recovery. As the world gradually returns to normal after the pandemic, it is hopeful that the

disruption of the pandemic to the Company's operation will gradually diminish.

Geopolitical events between different nations may impose unpredictable impacts to the global markets and the Company,

such as disruption to the global supply of commodities including base metals and driving up the commodities' prices.

The continuous increase in the prices of raw materials might lead to margin compression. Furthermore, geopolitical

uncertainties may directly or indirectly impact the Group's customers, which in turn may disrupt supply chain and impact

end-consumer demand.

In view of the uncertain market outlook, the Group will actively monitor the market and allocate resources flexibly to meet

customers' changing demand. To mitigate the potential impacts from geopolitical events, the Group will actively manage

the procurement channels, operation and production.

AAC Technologies Holdings Inc.

|

Annual Report 2022

21

Key Risk Factors

Operational and Obsolescence Risks

The Group's operation is subject to a number of risk factors specific to designing and providing new technology solutions.

Our business continues to focus on miniature components and develop new products and technologies platforms.

In meeting future design specifications and production quality requirements, our successful track record would not

guarantee continual success. Changes in technological design and performance specifications or other external factors

may have various levels of negative impact on the results of operations. Additionally, production, data security and quality

issues may happen despite internal systems and policies set up for their prevention, which may lead to financial loss,

litigation, or damage in reputation.

We believe that the Company has a seasoned process to ensure design specifications and quality requirements are

met and possesses multiple overlapping core design and production competencies. This will put the Company in a

strong competitive position in terms of design capacity and manufacturability, time-to-market delivery and continuous

enhancement of user experience. Also, the Company continuously treats information security as a priority strategic topic,

and has implemented a comprehensive range of measures to safeguard its data assets from breaches, leaks and hacks.

In addition, the Company constantly reviews competition and market trends. The Company is committed to striving

for innovation and maintaining a competitive position with a wide lead in knowledge. The Company has reinvested

significant resources on research and development to build broad sustainable technology roadmaps and intellectual

property portfolios.

The Company has put in place a quality management system. All products are subject to thorough and comprehensive

testing to meet customers' requirements and international standards. The Company will continue to improve internal

process capability, including live surveillance management of production stations and evaluation of "big data" systems in

our operation, and set up a solid base for continual improvement in product reliability.

Liquidity and Interest Rate Risks

The Group manages liquidity risk by maintaining an adequate level of cash and cash equivalents through continuously

monitoring forecast and actual cash flows and matching the maturity profiles of financial assets and liabilities.

The Group is exposed to interest rate risks on its bank loans for working capital and CAPEX that are associated with the

expansion of the Group. The Group focuses on mitigating the liquidity and interest rate risks, with an appropriate mix of

RMB/USD borrowings that are constantly reviewed and adjusted. The Group's USD deposits served as a natural hedge to

the risk of interest rate volatilities to some extent. The Group also maintains an appropriate mix of fixed/floating rate debts,

an even debt repayment profile and a diversified source of funding, including the issuance of long term five-year and

ten-year unsecured notes.

The Group's financial assets include bank balances and cash, pledged bank deposits, trade and other receivables, amounts

due from related companies, derivative financial instruments, financial assets at fair value through profit or loss and equity

instruments at fair value through other comprehensive income, which represent the Group's maximum exposure to credit

risk in relation to financial assets. The credit risk on liquidity is limited because the counterparties are established banks

with good credit-ratings.

22

AAC Technologies Holdings Inc.

|

Annual Report 2022

Key Risk Factors

Foreign Exchange Risks

Given our international operations and presence, the Group faces foreign exchange exposures including transaction and

translation exposures, and is exposed to exchange rate risks that could impact financial reporting results. The Group's

reporting currency is RMB and our sales to overseas customers are predominantly denominated in USD.

It is the Group's consistent policy to centralize foreign exchange management to monitor total foreign currency exposure,

to net off affiliate positions, and, if necessary, to consolidate hedging transactions with banks. The cash inflow to the

Group in denomination of the two currencies, namely RMB and USD, are mostly, over time, in balanced proportions. In

addition, various bank facilities have been arranged in these two currencies, to meet our daily operating expenses and

capital investment requirements. Hence, in our operating business model, the Group's revenue is mostly matched to the

currencies of the outlay. As far as possible, the Group aims to achieve natural hedging by investing and borrowing in the

functional currencies. Where a natural hedge is not possible, the Group will mitigate foreign exchange risks via appropriate

foreign exchange contracts.

Intensifying Global Trade Frictions

Prolonged and intensified trade frictions might lead to a slowdown of the global consumer electronic market and a

decline of the orders by the key customers of the Group, which could have a material adverse effect on the Group's

business, results of operations and financial conditions. Furthermore, export controls and similar regulations may include

restrictions and prohibitions on the sale or supply of certain products and on the transfer of parts, components, and

related technical information and know-how to certain countries, regions, governments, persons and entities.

The Group believes that it is in compliance with applicable export control regulations, and as at the date of this annual

report, the Group's results of operations have not been materially affected by expansion of export control regulations or

the novel rules or measures adopted to counteract them. Nevertheless, depending on future developments in the global

trade tensions, there is no assurance that such regulations, rules, or measures will not have an adverse impact on the

Group's business and operations.

The Group has implemented the trade control compliance management system and has set up a trade compliance

committee for overall management of the Group's trade compliance activities initiatives. A new Trade Compliance

Department has also been established to coordinate with and support other departments on trade compliance matters.

The Group's dedication to R&D to develop proprietary innovative technologies, and the Group's strategy in integrating

R&D all over the world with our diversified manufacturing bases should help to continue to provide the best solutions to

customers and mitigate some of the adverse business impact of the trade frictions.

PAST PERFORMANCE AND FORWARDLOOKING STATEMENTS

The performance and the results of operation of the Group as set out in this annual report are historical in nature and

past performance is not a guarantee of future performance. This annual report may contain certain statements that are

forward-looking or which use certain forward-looking terminologies. These forward-looking statements are based on the

current beliefs, assumptions and expectations of the Board regarding the industry and markets in which it operates. Actual

results may differ materially from expectations discussed in such forward-looking statements and opinions. The Group,

the Directors, employees and agents of the Group assume (a) no obligation to correct or update the forward-looking

statements or opinions contained in this annual report; and (b) no liability in the event that any of the forward-looking

statements or opinions do not materialise or turn out to be incorrect.

AAC Technologies Holdings Inc.

|

Annual Report 2022

23

Biographies of Directors and Senior Management

EXECUTIVE DIRECTORS

Mr. Pan Benjamin Zhengmin (“Mr. Pan”)

Aged 54, ED and CEO

Appointed to the Board: 15 December 2003

Mr. Pan co-founded the Group in 1993. He is responsible for providing strategic direction and leadership and for

developing and implementing the Group’s strategic objectives and business plans. Specifically, Mr. Pan has held critical

leadership roles with responsibilities for overseeing the sales, marketing, research and development, manufacturing,

along with the Group’s international expansions and operations. In addition to his experience in sales and marketing,

manufacturing and management, he has also been instrumental in leading our research and development strategy, and

has developed a number of patents used in the design and manufacturing some of the Company’s acoustic products.

Mr. Pan graduated from 江蘇省武進師範學校 (Jiangsu Province Wujin Teacher School) in 1987. Mr. Pan is the spouse of

Ms. Wu Ingrid Chun Yuan (“Ms. Wu”), the non-executive Director and a substantial Shareholder of the Company; and the

father of Mr. Kelvin Pan, the Executive Vice President and Chief Innovation Officer of the Company.

Save as disclosed above, Mr. Pan does not have any relationships with other Directors, senior management, substantial

shareholders or controlling shareholders (as defined in the Hong Kong Listing Rules) of the Group.

The term of appointment of Mr. Pan and the interests of Mr. Pan in the shares (within the meaning of Divisions 7 and 8 of

Part XV of the SFO are respectively set out in the “DIRECTORS AND SERVICE CONTRACTS” section and “DIRECTORS’ AND

CHIEF EXECUTIVE’S INTEREST IN SHARES AND UNDERLYING SHARES AND DEBENTURES” section of the Directors’ Report on

pages 33 to 35 of this annual report.

24

AAC Technologies Holdings Inc.

|

Annual Report 2022

Biographies of Directors and Senior Management

Mr. Mok Joe Kuen Richard (“Mr. Mok”)

Aged 59, ED

Appointed to the Board: April 2005 as INED

Redesignated: 5 October 2009 as ED

Mr. Mok is responsible for the finance operations, and legal and compliance of the Group. He has over 20 years of

experience in the financial services industry, including employments with international accountancy firms such as KPMG,

the Hong Kong-listed South China Holdings Company Limited, the investment banking firm, Asian Capital Partners Group

and the Hong Kong-listed financial services group Dah Sing Financial Holdings Limited.

Mr. Mok is a member of the HKICPA and the Institute of Chartered Accountants in England and Wales. He graduated with

a Bachelor degree of Economics from the London School of Economics and Political Science, London University and held a

diploma in applied psychology from Hong Kong Baptist University.

Mr. Mok does not have any relationships with other Directors, senior management, substantial shareholders, or controlling

shareholders (as defined in the Hong Kong Listing Rules) of the Group.

The term of appointment of Mr. Mok and the interests of Mr. Mok in the shares (within the meaning of Divisions 7 and 8 of

Part XV of the SFO) are respectively set out in the “DIRECTORS AND SERVICE CONTRACTS” section and “DIRECTORS’ AND

CHIEF EXECUTIVE’S INTEREST IN SHARES AND UNDERLYING SHARES AND DEBENTURES” section of the Directors’ Report on

pages 33 to 35 of this annual report.

AAC Technologies Holdings Inc.

|

Annual Report 2022

25

Biographies of Directors and Senior Management

NON-EXECUTIVE DIRECTOR

Ms. Wu Ingrid Chun Yuan

Aged 52, Non-executive Director

Appointed to the Board: 4 December 2003

Ms. Wu co-founded the Group in 1993. As a non-executive Director of the Group, she is not involved in the day-to-day

operations of the Group.

Ms. Wu graduated from 常州衛生學校 (Changzhou School of Public Health) in 1989. She is the spouse of Mr. Pan, an

executive Director, CEO and a substantial Shareholder of the Company; and the mother of Mr. Kelvin Pan, the Executive

Vice President and Chief Innovation Officer of the Company. She is also a director of Sapphire Hill Holdings Limited and

K&G International Limited, both substantial Shareholders of the Company.

Save as disclosed above, Ms. Wu does not have any relationships with other Directors, senior management, substantial

shareholders, or controlling shareholders (as defined in the Hong Kong Listing Rules) of the Group.

The term of appointment of Ms. Wu and the interests of Ms. Wu in the shares (within the meaning of Divisions 7 and 8 of

Part XV of the SFO) are respectively set out in the “DIRECTORS AND SERVICE CONTRACTS” section and “DIRECTORS’ AND

CHIEF EXECUTIVE’S INTEREST IN SHARES, UNDERLYING SHARES AND DEBENTURES” section of the Directors’ Report on

pages 33 to 35 of this annual report.

26

AAC Technologies Holdings Inc.

|

Annual Report 2022

Biographies of Directors and Senior Management

INDEPENDENT NON-EXECUTIVE DIRECTORS

Mr. Zhang Hongjiang (“Mr. Zhang”)

Aged 62, INED, Chairman of the Board

Appointed to the Board: 1 January 2019

Chairman of Nomination Committee

Member of Audit and Risk Committee and Remuneration Committee

Mr. Zhang is currently an independent director of Zepp Health Corporation (formerly known as Huami Corp, listed in the

US), and an independent non-executive director of XPeng Inc. (listed in the US and Hong Kong). He is a venture partner

of Source Code Capital and a Senior Advisor to The Carlyle Group’s Asian private equity platform and chairman of Beijing

Academy of Artificial Intelligence.

Previously, Mr. Zhang was an independent director of Digital China Group Co., Ltd. (神州數碼集團股份有限公司) (listed

in Shenzhen) and an independent non-executive director of BabyTree Group (listed in Hong Kong), and was the chief

executive officer and executive director of Kingsoft Corporation Limited (listed in Hong Kong) and a former director of

Cheetah Mobile Inc., Xunlei Ltd. and 21Vianet Group, Inc. (all listed in the US). Mr. Zhang was a director and chief executive

officer at Kingsoft Cloud Holdings Limited. He also served as the chief technology officer at Microsoft Asia R&D Group and

assistant managing director of Microsoft Research Asia. He was appointed as one of the first 10 Microsoft Distinguished

Scientists in 2010.

Mr. Zhang is a foreign member of US National Academy of Engineering, a Fellow of IEEE and ACM. Mr. Zhang received a

Philosophy Doctor in Electrical Engineering from the Technical University of Denmark. He graduated with a Bachelor of

Science degree from Zhengzhou University.

Mr. Zhang was the recipient of the 2012 ACM SIGMM Outstanding Technical Achievement Award, the 2010 IEEE Computer

Society Technical Achievement Award, and the 2008 Asian American Engineer of the Year award.

Mr. Zhang does not have any relationships with other Directors, senior management, substantial shareholders, or

controlling shareholders (as defined in the Hong Kong Listing Rules) of the Group.

The term of appointment of Mr. Zhang is set out in the “DIRECTORS AND SERVICE CONTRACTS” section of the Directors’

Report on page 33 of this annual report.

AAC Technologies Holdings Inc.

|

Annual Report 2022

27

Biographies of Directors and Senior Management

Mr. Kwok Lam Kwong Larry (“Mr. Kwok”), SBS, JP

Aged 67, INED

Appointed to the Board: 1 February 2018

Chairman of Audit and Risk Committee

Member of Remuneration Committee and Nomination Committee

Mr. Kwok is currently an independent non-executive director of Café de Coral Holdings Limited, Shenwan Hongyuan

(H.K.) Limited, Starlite Holdings Limited (all listed in Hong Kong) and China Oilfield Services Limited (listed in Hong Kong

and Shanghai), and a non-executive director of First Shanghai Investments Limited (listed in Hong Kong). He is also an

independent non-executive director of CMB Wing Lung Bank Limited, a private company in Hong Kong, and vice-chairman

of Heep Hong Society, a non-profit organization in Hong Kong.

Mr. Kwok is a practicing solicitor in Hong Kong, and is a partner of Kwok Yih & Chan, Solicitors. He is also qualified to

practice as a solicitor in Australia, England and Wales and Singapore. Mr. Kwok is a fellow member of HKICPA, CPA Australia

and The Institute of Chartered Accountants in England and Wales. Mr. Kwok graduated from the University of Sydney,

Australia with bachelor’s degrees in economics and laws respectively as well as a master’s degree in laws. He also obtained

the Advanced Management Program Diploma from the Harvard Business School.

Mr. Kwok does not have any relationships with other Directors, senior management, substantial shareholders, or

controlling shareholders (as defined in the Hong Kong Listing Rules) of the Group.

The term of appointment of Mr. Kwok is set out in the “DIRECTORS AND SERVICE CONTRACTS” section of the Directors’

Report on page 33 of this annual report.

28

AAC Technologies Holdings Inc.

|

Annual Report 2022

Biographies of Directors and Senior Management

Mr. Peng Zhiyuan (“Mr. Peng”)

Aged 50, INED

Appointed to the Board: 1 January 2019

Chairman of Remuneration Committee

Member of Audit and Risk Committee and Nomination Committee

Mr. Peng has over 20 years of experience in corporate finance and management. He has served as senior management

in various multi-national institutions over the past 20 years. He is currently the Global Strategy Officer for Sands Capital

Management.

Previously, Mr. Peng was the founder and chief executive officer of a start-up company in Virginia in innovative

eco-friendly technology applications. He was the managing director in the Securities Division and the Investment Banking

Division at Goldman Sachs (Asia), and executive director in the Fixed Income Division at Morgan Stanley. Mr. Peng also

served in various roles with Standard Chartered Bank, Bank One (now J.P. Morgan), and AVIC International.

Mr. Peng is a board member of the board of Trustees for University of Virginia Health Foundation, and the board

of directors for CAV Angels, a non-profit early stage angel investment network affiliated with University of Virginia

community. He also served on the board of Trustees for University of Virginia Darden School Foundation, and Virginia

Foundation for Independent Colleges. Mr. Peng holds a Master of Business Administration from University of Virginia’s

Darden Business School, and a Bachelor’s degree in Engineering and Finance from Beijing University of Aeronautics and

Astronautics.

Mr. Peng does not have any relationships with other Directors, senior management, substantial shareholders, or

controlling shareholders (as defined in the Hong Kong Listing Rules) of the Group.

The term of appointment of Mr. Peng is set out in the “DIRECTORS AND SERVICE CONTRACTS” section of the Directors’

Report on page 33 of this annual report.

CHANGES IN DIRECTORS’ INFORMATION DISCLOSED UNDER RULE 13.51B(1) OF THE HONG

KONG LISTING RULES

Change(s) in Directors’ information since the date of the 2022 interim report of the Company, which are required to be

disclosed pursuant to Rule 13.51B(1) of the Hong Kong Listing Rules, are set out below:

1. Mr. Zhang Hongjiang has ceased to act as an independent non-executive director of BabyTree Group (listed in

Hong Kong) with effect from 11 August 2022.

AAC Technologies Holdings Inc.

|

Annual Report 2022

29

Biographies of Directors and Senior Management

SENIOR MANAGEMENT

Mr. Pan Kaitai Kelvin (“Mr. Kelvin Pan”)

Aged 31, Executive Vice President and Chief Innovation Officer

Date of Appointment: 1 January 2021

Mr. Kelvin Pan joined the Company in March 2014 and currently serves as the Executive Vice President (effective from 1

January 2021) and Chief Innovation Officer (effective from 24 August 2019) of AAC Technologies.

In 2016, Mr. Kelvin Pan started AAC Technologies’ first digital transformation when he served as the Vice President of IT and

R&D department, during which he led major reforms in corporate product roadmaps, new technology introductions, and

system solutions product lines.

In 2018, Mr. Kelvin Pan collaborated with McKinsey & Co and personally led the strategic corporate transformation of the

Company. This included developing the Android haptics motors business from scratch to a multi-million-dollar business,

continuously building up the system product capabilities, and leading his team to promote AAC Technologies’ automotive

audio system to market.

Since 2021, Mr. Kelvin Pan serves as the Executive Vice President and Chief Innovation Officer of the Group, and is

responsible for the Company’s overall business operation, while leading the Company’s strategic planning and execution,

new business planning and organisational structure optimisation, and introduced professional management teams and

process reforms. In 2022, Mr. Kelvin Pan led the completion of the Company’s corporate transformation, which resulted

in a remarkable increase in annual revenue amid difficult external market environment, and expansion into new business

markets such as automotive intelligent cockpit device solutions and AR/VR device products, successfully achieving mass

production. Meanwhile, Mr. Kelvin Pan was committed to promoting a vertically integrated value chain business model,

and providing sensory experience solutions integrated with hardware, chips and algorithms.

Mr. Kelvin Pan holds a Bachelor of Science degree in Mathematics and Computer Science awarded by Boston University.

He is the son of Mr. Pan, the ED and CEO of the Company, and Ms. Wu, the non-executive Director of the Company, both of

them are the substantial Shareholders of the Company.

30

AAC Technologies Holdings Inc.

|

Annual Report 2022

Biographies of Directors and Senior Management

Ms. Guo Dan (“Ms. Guo”)

Aged 40, Chief Financial Officer

Date of Appointment: 2 November 2020

Ms. Guo joined the Company in March 2020 and has been appointed as the Chief Financial Officer of the Company with

effect from 2 November 2020. Ms. Guo is responsible in leading the Group’s global finance team to formulate and execute

financial strategies to deliver the Group’s strategic growth targets and drive long term value to shareholders.

Ms. Guo has over thirteen years of investment banking experience at Goldman Sachs (Asia) L.L.C., where she served as

Executive Director, and has extensive experience in leading capital raising, investment and risk management deals. She

is active in supporting non-profit sectors across various initiatives including diversity and equal opportunities etc. She

currently serves as a Board member of HandsOn Hong Kong (HOHK), a non-profit organization promoting volunteerism

and providing broad-based support to over one hundred NGOs in Hong Kong.

Ms. Guo completed undergraduate and master’s studies at the University of Oxford and received a Master of Science

degree from the University.

Ms. Ma Nuo (“Ms. Ma”)

Aged 48, Chief Human Resources Officer

Date of Appointment: 1 October 2021

Ms. Ma joined the Company in October 2021 as Chief Human Resources Officer. Ms. Ma is responsible for leading global

human resources teams in the development and execution of human resources strategies that allow the Company

to attract, develop and retain the best talents worldwide while building a high-performance culture of engagement,

agility and innovation to support the Company’s vision, mission and long-term growth strategy. Ms. Ma brings over 27

years of business and senior human resources leadership experience in both Henkel (China) Investment Co., Ltd. and

Inventus Power. Ms. Ma is recognized as effective agent of change, culture re-shaping, cross-cultural communications,

organizational design and human resources system/process development etc.

Ms. Ma holds an MBA degree from Tianjin University in China, and an EMBA from Washington University in St. Louis, USA.

Dr. Kim Chul Ho (“Dr. Kim”)

Aged 61, Chairman of Asia Pacific Region (ex-PRC)

Date of Appointment: 20 November 2019

Dr. Kim joined the Company in December 2007. Effective from 20 November 2019, Dr. Kim serves as chairman of Asia

Pacific Region (ex-PRC), with the objective to establish a stronger corporate presence in this region and responsible for

enforcing strategic relationships with key customers, suppliers and partners, contributing to the Group’s global expansion

initiatives, establishing relations with regional governments and institutions, and locating and recruiting world-class

talents of top technical, marketing and management personnel in this region. Dr. Kim is experienced in the development

of electronic device and related mass production technologies, and also did research and development management

for over 15 years in Samsung Korea. Dr. Kim has successfully developed many key devices and related mass production

technologies for mobile terminal.

Dr. Kim obtained a Doctor’s degree of Material Science at Seoul National University and finished post doctor course in

Korean Institute of Science and Technologies (KIST).

AAC Technologies Holdings Inc.

|

Annual Report 2022

31

Biographies of Directors and Senior Management

Mr. David Plekenpol (“Mr. Plekenpol”)

Aged 63, Chairman of European and American Regions

Date of Appointment: 20 November 2019

Formerly our Chief Strategic Officer, Mr. Plekenpol joined the Company in February 2010. He had led the advanced

technology team to identify forward-looking technologies to be integrated with the Company’s products and solution

platforms to contribute to the creation of superior and differentiated end-user experiences. Mr. Plekenpol has been

appointed as chairman of European and American Regions, with the objective to establish a stronger corporate presence

in these regions and re-enforce strategic relationships between the Group and regional customers, suppliers and

governments. He is responsible for the investigation and tracking of new technologies from these regions and their

potential impact to AAC Technologies. Importantly, through the globalization strategy of AAC Technologies, he will assist

the Group to identify and recruit top technical, marketing and management personnel in these regions.

Mr. Plekenpol has spent over 25 years in the telecom industry, with executive positions in both Lucent and Alcatel. He has

founded two Silicon Valley venture capital backed startup companies, led sales and marketing for an optical component

startup in Scotland and spent two years with a venture capital backed Chinese mobile design startup in Shanghai before

joining AAC Technologies. Mr. Plekenpol is a member of the international advisory board for the University of Edinburgh

Business School. He has an undergraduate degree from Dartmouth College and an MBA from the Graduate School of

Business at Stanford University.

JOINT COMPANY SECRETARIES

Mr. Ho Siu Tak Jonathan (“Mr. Ho”)

Aged 50, Group Legal Director, Joint Company Secretary

Date of Appointment: 25 March 2020

Mr. Ho joined the Company in April 2018. He is the Group Legal Director and Joint Company Secretary of the Company.

He was a Hong Kong qualified solicitor with more than 20 years’ post qualification experience. He was awarded with a

Master’s degree in Economics Law from the Peking University and a Bachelor’s degree of Law from the University of Hong

Kong. Before joining the Company, Mr. Ho worked in various Hong Kong blue chip listed companies as senior role.

Ms. Guan Muyi (“Ms. Guan”)

Aged 41, Legal and Compliance Director, Joint Company Secretary

Date of Appointment: 1 January 2023

Ms. Guan joined the Company in October 2020. She is the Legal and Compliance Director and Joint Company Secretary

of the Company. Ms. Guan has over 15 years of experience in handling legal regulatory compliance and corporate

governance matters. She was awarded with a degree in Master of Laws from the City University of Hong Kong, majoring

in international business law, and a degree in Bachelor of Laws from Guangdong University of Finance and Economics.

Ms. Guan holds 中國法律職業資格 (PRC Law Practitioner Qualification), and is a member of each of The Chartered

Governance Institute and The Hong Kong Chartered Governance Institute. Before joining the Company, Ms. Guan worked

at Baker & McKenzie and various Hong Kong main board listed companies.

32

AAC Technologies Holdings Inc.

|

Annual Report 2022

Directors’ Report

The Directors of the Company present their annual report and the audited consolidated financial statements for the year

ended 31 December 2022, which were approved by the Board of Directors on 23 March 2023.

PRINCIPAL ACTIVITIES

The Company acts as an investment holding company. The principal activities of its principal subsidiaries are set out in

note 43 to the consolidated financial statements.

BUSINESS REVIEW AND PERFORMANCE

A review of the business of the Group during the year and a discussion on the Group’s future business development

are provided in Management Discussion and Analysis on pages 14 to 16 of this annual report. Also, the financial risk

management objectives and policies of the Group can be found in note 38 to the consolidated financial statements.

Details of principal risks and uncertainties affecting the Company are provided in Key Risk Factors on pages 20 to 22 of

this annual report. An analysis of the Group’s performance is provided in the summary of the results and of the assets and

liabilities of the Group for the last five financial years as set out on pages 182 to 183 of this annual report. Analysis using

financial key performance indicators (KPIs) are provided in the Financial Highlights on pages 6 to 7 and Financial Review

on pages 17 to 19 of this annual report. In addition, discussions on the Group’s environmental, social and governance

policies, relationships with its key stakeholders and compliance with relevant laws and regulations which have a

significant impact on the Group are contained in the Corporate Governance Report and section of Sustainability on pages

48 to 80. The sustainability report for 2022 is available on the Company’s website on the same date as the publication of

this annual report.

RESULTS AND DIVIDENDS

The results of the Group for the year are set out in the consolidated statement of profit or loss and other comprehensive

income on pages 85 to 86.

After careful review of the Group’s financial liquidity and business development requirements, the Board of Directors

proposed to declare a final dividend of HK$0.12 per share for FY 2022 (FY 2021: Nil), implying a total annual dividend

amounted to HK$0.12 per share for FY 2022 (FY 2021: HK$0.20 per share) which represents the 15% payout ratio,

same as that of FY 2021. Amidst the dynamic macroeconomic environment, the Group will remain prudent in financial

management and strong in cash flow for business development, so as to create long-term value for shareholders.

PROPERTY, PLANT AND EQUIPMENT

Details of the movements in property, plant and equipment of the Group during the year are set out in note 13 to the