Topic: Periodic Monthly Statement

1

February 2012

Periodic Monthly Statement (PMS) Overview

Periodic Monthly Statement is a feature of the Automated Commercial Environment

(ACE) that simplifies the payment and collection of duties and fees and promotes

account based processing.

Periodic Monthly Statement allows users to consolidate the payment of duties and fees

on a monthly basis. With this capability, operations for many filers have changed from a

day-by-day payment process to a consolidated, account-based, Periodic Monthly

Statement process. Filers now have three payment options for each entry summary:

1. Single Pay – Users pay per entry

2. Daily Statement – Users consolidate all shipments and pay per day

3. Periodic Monthly Statement – Users combine eligible shipments and pay

monthly

Entry summaries included on a Periodic Monthly Statement must be

covered under a continuous bond and paid via Automated

Clearinghouse (ACH) Debit or Credit.

Periodic Monthly Statement summarizes Periodic Daily Statements into a consolidated

statement each month. Periodic Daily Statements contain entry summaries that the filer

What’s Inside:

Periodic Monthly Statement Overview

Page 1

Periodic Monthly Statement Benefits

Page 2

Information on the ACE Portal

Page 3

Monitoring Periodic Monthly Statement Entry

Summaries

Page 5

Periodic Monthly Statement Process

Page 6

Participation in Periodic Monthly Statement

Page 12

Procedures to Apply for Participation

Page 12

Confirmation from CBP

Page 13

Additional ACE Resources

Page 14

Topic: Periodic Monthly Statement

2

February 2012

has scheduled for a single day. The Periodic Daily Statements are consolidated for a

monthly payment due on the 15

th

working day of the month scheduled by the filer.

Entry summaries not eligible for inclusion on a Periodic Monthly Statement include:

NAFTA Duty Deferral, Entry Type 08;

Reconciliation, Entry Type 09; and

Entry summaries with IRS tax class codes.

Entry summaries flagged for reconciliation may be included on a Periodic

Monthly Statement if they do not include taxes.

Periodic Monthly Statement Benefits

Participation in Periodic Monthly Statement offers many benefits to importers and

brokers, such as:

Consolidating individual entry summaries for goods that are released during a

given month and allowing them to be paid as late as the 15

th

working day of the

following month;

Providing additional flexibility in the management of the working capital required

for duty payments as well as potentially significant cash flow advantages;

Allowing importers who are Automated Broker Interface (ABI) self-filers and

brokers to pay designated entry summaries for a given month on one

statement;

Streamlining accounting and reporting processes;

Allowing filers (including importers who are self-filers) to select either a national

or a port statement;

Allowing brokers to pay on behalf of importers;

Shifting the payment process from a transaction-by-transaction payment

process to an interest-free Periodic Monthly Statement process; and

Allowing users to view the Periodic Monthly Statement as it is being built during

the month.

Topic: Periodic Monthly Statement

3

February 2012

A participant with a Broker Portal Account in ACE will be able to view all

Periodic Monthly Statements and entry summaries containing their filer code.

A participant with an Importer Portal Account in ACE will be able to view all

Importer designated Periodic Monthly Statements. The importer will not be

able to view the broker’s statement. The importer can view entry summaries

with their IRS number designated for an Importer Periodic Monthly

Statement.

A participant with an Importer Non-Portal account will not have access to ACE

and will not be able to view Periodic Monthly Statements or entry summaries.

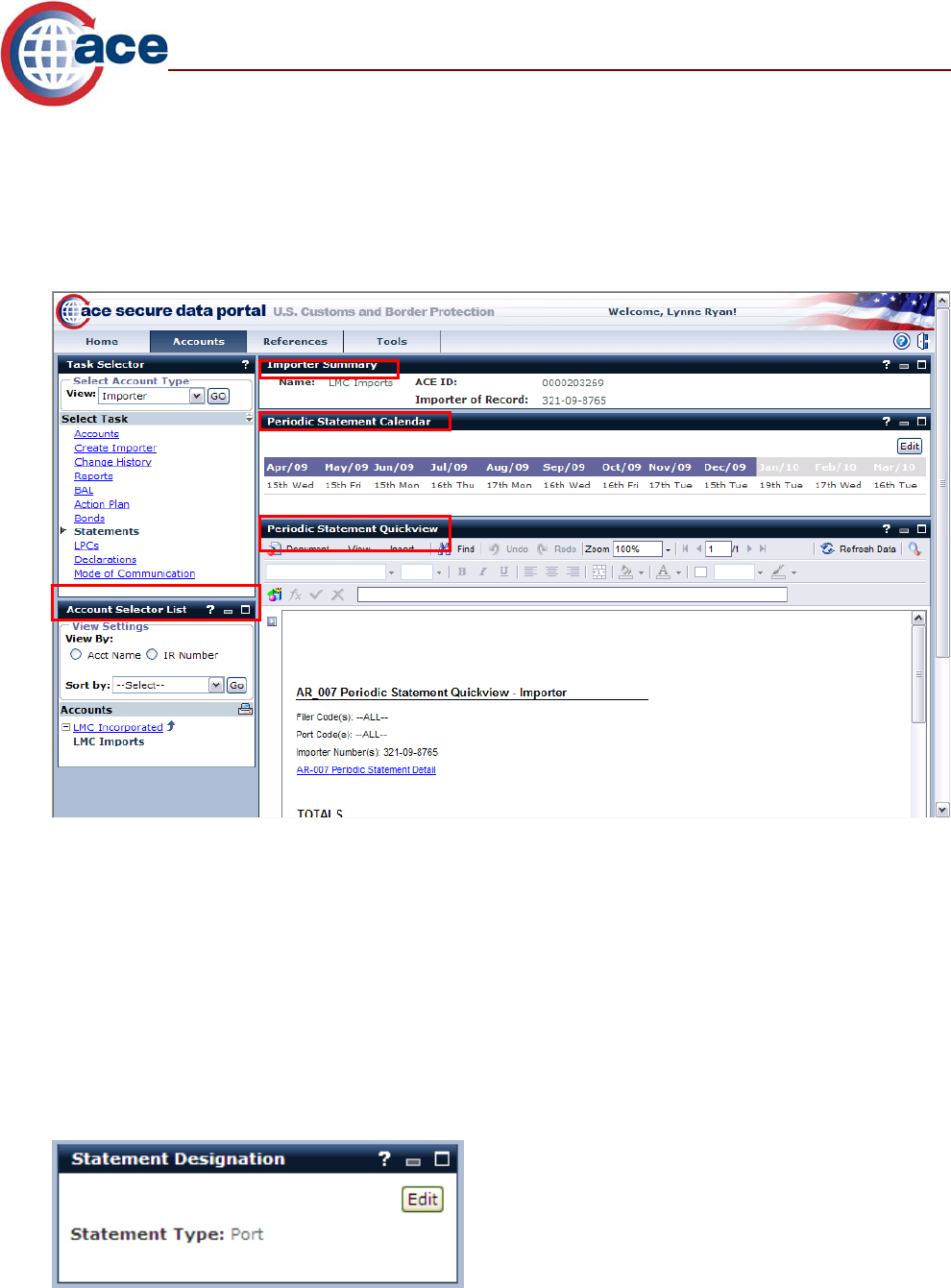

Information on the ACE Portal

Within the ACE Secure Data Portal, Periodic Monthly Statement information can be

found within the “Accounts” hyperlink. Follow the steps below:

1. Select the Accounts hyperlink.

2. Once you are on the “Accounts” page, the “Task Selector” portlet will appear on

the left. Select the Statements hyperlink.

Within this Statements task, there are several portlets.

1. Account Selector

2. Statement Designation (for brokers or self filers)

Topic: Periodic Monthly Statement

4

February 2012

3. Broker or Importer Summary

4. Periodic Statement Calendar

5. Periodic Statement Quickview

Account Selector List

The “Account Selector List” will display all Importer of Record (IR) numbers associated

with the account in the Importer view. The “Account Selector List” will display all port

codes associated with the account in the Broker view.

Statement Designation

For brokers and self-filers, a “Statement Designation” portlet will appear in the bottom

left corner. This is where brokers and self-filers can select a national or port statement.

Topic: Periodic Monthly Statement

5

February 2012

Importer or Broker Summary

This portlet displays the name of the entity, ACE ID number and the corresponding IR

number or filer code.

Periodic Statement Calendar

Within this portlet, importers and brokers can choose a date, between the 1

st

and 11

th

working day of each month, for which the preliminary Periodic Monthly Statement will be

generated by Customs and Border Protection (CBP). The default date is the 11th

working day of the month and CBP recommends all parties use this default date. If the

filer wishes to change the preliminary Periodic Monthly Statement date, select Edit in

the Periodic Statement Calendar portlet. Once the “Edit – Periodic Statement Calendar”

portlet appears, use the drop down arrow for each month and select the desired date for

the generation of the periodic daily statement. Remember to select Save. Please note

that users cannot edit the statement generation dates between the 1

st

and 11

th

working

day of the current month.

Periodic Statement Quickview

This portlet displays the most current AR007 “Periodic Statement Quickview – Importer

or Broker” report in which the Periodic Monthly Statement number and the total duties

and fees of all open entry summaries flagged for Periodic Monthly Statement are

displayed. Drilldown capability will allow the user to access the Periodic Daily

Statement and the flagged entry summaries.

Monitoring Periodic Monthly Statement Entry Summaries

Importers and brokers are able to monitor entry summaries flagged for Periodic Monthly

Statement.

Topic: Periodic Monthly Statement

6

February 2012

1. Within the “Account Selector List” portlet, select the company under “Accounts”

to display the specific IR number or broker/filer port code of interest.

2. The “Periodic Statement Quickview” portlet will show all periodic monthly

statements containing open entry summaries.

3. From the “Statements” hyperlink, select any periodic daily or monthly statement

number to view the details.

4. Another option to view all current open entry summaries flagged for Periodic

Monthly Statement is to select the “Reports” hyperlink and run the Periodic

Statement Detail report, AR-007, from the Accounts Revenue list of available

reports.

IR numbers activated for Periodic Monthly Statement that are not included

within the “Account Selector List” are considered non-portal accounts.

Importers will not be able to view non-portal account statements.

Importers will not receive a national statement unless they file using their own

filer code. In situations in which the importer is NOT a self-filer, they will

receive a port statement.

Periodic Monthly Statement Process

For brokers and self-filers, the procedure for obtaining, viewing, and processing Periodic

Monthly Statements can be broken down into 11 steps (four of which are optional and

used only in situations in which entry summaries are to be removed from the

statement).

1. Process entry summaries for Periodic Daily Statement

2.

Optional: Remove/change entry summaries before preliminary Periodic Daily

Statement

3. Produce preliminary Periodic Daily Statement

4. Optional: Remove/change entry summaries before ACH Authorization

5. Process Periodic Daily Statement ACH Debit authorization and/or entry summary

presentation

6. Produce final Periodic Daily Statement

7. Optional: Remove entry summaries before preliminary Periodic Monthly

Statement

Topic: Periodic Monthly Statement

7

February 2012

8. Produce preliminary Periodic Monthly Statement

9. Optional: Remove entry summaries before final Periodic Monthly Statement

10. Process payment using ACH Credit/ACH Debit

11. Produce final Periodic Monthly Statement

The following is a description of each of the 11 Periodic Monthly Statement steps:

Step 1) Process entry summaries for Periodic Daily Statement

This process may be thought of as the existing daily statement process

with no payment due until the 15

th

working day of the month following

entry or release.

The periodic statement month (field on record identifier 30 for Automated

Commercial System (ACS) entry summaries and record identifier 10 for

ACE entry summaries) indicates the month for payment. This controls

the Periodic Monthly Statement on which the entry summary will be

included.

Please note: Entry summary receivables can be viewed on the sub-

ledger report (AR006) through the “Reports” hyperlink of the ACE

Secure Data Portal. Also note that CBP does not edit the accuracy of

the statement month. The accuracy and timeliness of the statement

date and payment remain the filer’s responsibility.

Step 2) Optional: Remove/change entry summaries before preliminary

Periodic Daily Statement

The entry summary payment type indicator, PMS month and preliminary

statement print date can be updated using the Statement Delete or ‘HP’

application identifier.

This allows the method of payment to change from a single payment

to a statement payment (daily statement or Periodic Daily Statement)

or vice versa.

If changing the entry summary to appear on a Periodic Daily Statement,

the periodic statement month indicates the month for payment. This

designation establishes the Periodic Monthly Statement in which the

Periodic Daily Statement listing the entry summary will be included. An

entry summary change reverses/updates a receivable in the subsidiary

ledger for the entry summary.

Step 3) Produce preliminary Periodic Daily Statement

Topic: Periodic Monthly Statement

8

February 2012

Preliminary Periodic Daily Statements are generated on the

predetermined date established by the filer at the time the entry

summary was filed.

Based on the preliminary statement print date indicated on the entry

summary transmission, CBP will route the preliminary Periodic Daily

Statement (application identifier ‘QR’) to the filer through ABI.

The record layouts for a daily statement and a Periodic Daily Statement

are the same.

The payment type indicator value (record identifier B of the ‘QR’

application identifier) indicates the statement type:

2 - Broker/Filer Daily Statement

3 - Importer Daily Statement

5 – Importer Combined Daily Statement

6 - Broker/Filer Periodic Daily Statement

7 - Importer Periodic Daily Statement

8 - Importer Combined Periodic Daily Statement

This step adds the Periodic Daily Statement number to the entry summary

receivables in the subsidiary ledger.

Step 4) Optional: Remove/change entry summaries before ACH Authorization

The entry summary payment type indicator can be updated using the ‘HP’

application identifier. This allows for the following:

Deletion of an entry from an unpaid preliminary Periodic Daily Statement

Change of the payment type indicator and preliminary statement print date

after the preliminary daily statement is issued

Change of the periodic statement month (Note: The Periodic Daily

Statement print date will also need to be changed in order to do this.)

Step 5) Process Periodic Daily Statement ACH Debit authorization and/or entry

summary presentation

A new application identifier, ‘PN’, is used for Periodic Daily Statement

ACH Debit authorization and/or entry summary presentation.

For ACH Debit participants this is similar to the existing ACH Debit

authorization (application identifier ‘QN’) for daily statements.

Topic: Periodic Monthly Statement

9

February 2012

For ACH Credit participants, this step is new. ACH Credit participants

will not use the payer unit number field of this transaction. (They need to

space fill this field.)

Like the ‘QN’ transaction for the existing daily statements, multiple

Periodic Daily Statements can be included in a single ‘PN’ transaction.

The ‘PN’ transaction stops the “10 working day” clock for entry summary

filing purposes and sets the entry summary filing date. Please remember

to present entry summaries and a copy of the Periodic Daily Statement

by the 10

th

working day.

Whenever the Periodic Daily Statement indicates zero money is due, the

filer must still transmit the ‘PN’ transaction. The ‘PN’ will designate the

Periodic Daily Statement for Periodic Monthly processing and sets the

entry summary filing date for the listed entry summaries.

When the ‘PN’ transaction is processed, the Periodic Monthly Statement

number is added to the entry summary receivables in the subsidiary

ledger.

At this time the Periodic Monthly Statement (to which the Periodic Daily

Statement belongs) can be viewed through the “Statements” hyperlink

on the ACE Secure Data Portal.

If after sending the authorization an error has been found, the filer may

contact the client representative to have the authorization removed but

this procedure can only be done the same day that the authorization was

sent (before end of day processing).

Step 6) Produce final Periodic Daily Statement

Final Periodic Daily Statements are generated after the Periodic Daily

Statement ACH Debit authorization and/or entry summary presentation

is processed. During the ACS end-of-day cycle, on the night the ‘PN’

transaction is processed, CBP will route the final Periodic Daily

Statement (application identifier ‘QR’) to the filer.

Step 7) Optional: Remove entry summaries before preliminary Periodic

Monthly Statement

An entry summary can be removed from a Periodic Daily Statement after

the final Periodic Daily Statement has been generated but prior to

payment of the Periodic Monthly Statement.

An entry summary is removed by changing the statement type to ‘1’ or

‘single payment’ through the use of the existing ‘HP’ application

identifier. (A “single pay” is an entry summary that is paid individually by

cash or check at the CBP cashier desk. It is not paid by ACH).

Topic: Periodic Monthly Statement

10

February 2012

This reverses a receivable in the subsidiary ledger for the entry

summary.

If an entry summary is removed after the final Periodic Daily Statement

has been generated, it will be included with record identifier ‘Q7’ as part

of the preliminary and final periodic monthly statement transmission

(application identifier ‘MS’).

Please note: An account is liable for liquidated damages if a “single pay” is

not paid by the 10th working day.

Step 8) Produce preliminary Periodic Monthly Statement

Preliminary Periodic Monthly Statements are generated on the

predetermined date established by the Trade Account Owner through

the ACE Secure Data Portal.

A date from the 1

st

through the 11

th

working day of the month may be

selected, but the default date will be the 11

th

working day of the month,

which CBP recommends all parties use.

Importers designate the preliminary Periodic Monthly Statement print

date for importer statements.

Filers designate preliminary Periodic Monthly Statement print dates for

filer statements.

CBP will route the preliminary Periodic Monthly Statement (new

application identifier ‘MS’) to the filer on the date selected.

The payment type indicator value (record identifier ‘B’ of the ‘MS’

application identifier) indicates the statement type:

6 - Broker/Filer Periodic Monthly Statement

7 - Importer Periodic Monthly Statement

8 - Importer Combined Periodic Monthly Statement

Whenever all the Periodic Daily Statements show zero money due for a

Periodic Monthly Statement Number, a Preliminary Monthly Statement

will not be generated to the filer. The filer will not see this data in their

ACE portal information. ACE only records receivables for Periodic

Monthly Statement generation.

Filers are able to designate whether their Periodic Monthly Statements are to be

consolidated to include all ports (national level) or generated for each port (port level).

The port level is the default selection. The national level statement is for filers only.

Topic: Periodic Monthly Statement

11

February 2012

Step 9) Optional: Remove entry summaries before final Periodic Monthly

Statement

Follows the same process as Step 7.

Step 10) Process payment using ACH Credit / ACH Debit

Using ACH Credit involves the following:

Users must initiate a Periodic Monthly Statement payment with

their bank.

ACH Credit Users with $0 Periodic Monthly Statements should

send an ACH $0 payment transaction to CBP referencing the

specific PMS number of the $0 statements for closing the Periodic

Monthly Statements. The PMS numbers can be provided by their

client representative.

The receivables created for the entry summaries are marked

“paid” in the sub-ledger.

The Periodic Monthly Statement is marked “paid.”

Using ACH Debit involves the following:

On the 15

th

working day of the month, CBP initiates collection. No

action is required by the ACH Debit user.

A separate debit authorization for each daily statement listed on the

Preliminary Periodic Monthly Statement will be sent to the client’s

bank for processing on the 15

th

work day of the month.

The $0 Periodic Monthly Statements for ACH Debit Users will be

automatically closed from the $0 debit authorization actions sent on

the Periodic Daily Statements.

The receivables created for the entry summaries are marked “paid” in

the sub-ledger.

The Periodic Monthly Statement is marked “paid.”

Step 11) Produce final Periodic Monthly Statement

Final Periodic Monthly Statements are generated after the payment has

been processed.

After the payment is processed during the ACS end-of-day cycle, the

final Periodic Monthly Statement (new application identifier ‘MS’) is

routed to the filer.

Topic: Periodic Monthly Statement

12

February 2012

The payment type indicator value (record identifier ‘B’ of the ‘MS’

application identifier) indicates the statement type:

6 – Broker/Filer Periodic Monthly Statement

7 – Importer Periodic Monthly Statement

8 – Importer Combined Periodic Monthly Statement

Whenever all the Periodic Daily Statements show zero money due for a

Periodic Monthly Statement number, a final monthly statement will not

be generated to the filer.

Participation in Periodic Monthly Statement

Importers have two options to participate in Periodic Monthly Statement.

Importers can establish their own ACE Portal account and not only participate in

Periodic Monthly Statement processing, but also have direct access to the ACE

portal which includes having an ability to better manage their CBP account and

customize their own reports.

An alternative for participation is to have the importer participate as a Non-Portal

Account through their broker, who is an ACE Portal Account. To encourage

maximum participation in Periodic Monthly Statement, CBP created non-portal

accounts for importers not seeking the benefits of having an ACE portal account,

but wishing to participate in Periodic Monthly Statement.

Importers who have their customs duties and fees paid by their broker (a)

via their own ACH account or (b) via their broker’s ACH account can

participate in Periodic Monthly Statement as non-portal accounts. For

their non-portal accounts, brokers continue to flag entry summaries for a

statement and effect payment as they do today. Brokers are able to place

eligible entry summaries for activated non-portal accounts on a broker or

importer statement.

For further details, please see the Federal Register Notice (FRN), 70 FR

61466, published on October 24, 2005, announcing the establishment of

non-portal accounts, as well as any other applicable FRNs, at the

following link: www.cbp.gov/modernization.

Procedures to Apply for Participation

The following diagram outlines the procedures to follow to apply for participation in

Periodic Monthly Statement.

Topic: Periodic Monthly Statement

13

February 2012

Confirmation from CBP

Importers will only be able to view Periodic Monthly Statements for those IR number(s)

that are part of their Account List and which have been approved for Periodic Monthly

Statement. An importer will know that their IR numbers have been activated for

Periodic Monthly Statement by one of the following ways:

1. The account may receive an e-mail message from CBP Revenue Division

and/or their CBP Account Manager;

2. The account may be notified by their customs broker if they were the party who

submitted the Periodic Monthly Statement participation request to CBP; and/or,

3. ACE Portal accounts can run report AR006 in the ACE Secure Data Portal

Reports Tool to determine if the IR number(s) has been activated for Periodic

Monthly Statement. If no data appears for the IR number(s), no entry

summaries were flagged or the IR number(s) has not been flagged for Periodic

Monthly Statement during the date range specified for that IR number.

NO

E-mail should state the following:

• Importer’s interest in participating in Periodic

Monthly Statement as a non-portal account;

• List of IR#s being requested for Periodic

Monthly Statement activation.

Scanned image of the CBP Form 5106 with

“Periodic Monthly Statement Activation” written on

top is to be included. Please include no more than

five CBP Forms 5106 on a single email.

Subject of e-mail should be “Activation Request.”

Carbon copy should be sent to importer’s CBP

Account Manager, if applicable.

E-mail should state the following:

• Importer is an ACE Portal Account;

• Importer’s interest in participating in Periodic

Monthly Statement; and

• List of IR#s being requested for Periodic

Monthly Statement activation.

• ACE ID from Top Account and ACE IDs

associated with IR#s being requested.

Subject of e-mail should be “Activation Request.”

Carbon copy should be sent to importer’s CBP

Account Manager, if applicable.

Importer or broker e-mails

CBP Revenue Division at

Is the importer an ACE Portal Account?

YES

Topic: Periodic Monthly Statement

14

February 2012

If confirmation from CBP is not received within 10 business days,

resubmit application.

Additional ACE Resources

For additional assistance, take the Periodic Payments web-based training (WBT).

The URL for the ACE Online Training

Center and the required user name

and password are:

http://nemo.cbp.gov/ace_online

Do you need additional assistance with Periodic Monthly

Statement? Please contact your CBP Client Representative or e-

mail [email protected]

. If you are a trade caller or if

you are calling outside the United States, you may also contact the

Technology Service Desk at 1-866-530-4172.