September 30, 2022

UNCLASSIFIED

UNCLASSIFIED

FY 2022 USSOCOM Financial

Statement Reporting Package

Table of Contents

United States Special Operations Command Financial Statements and Notes as of

September 30, 2022 and 2021…...……...………………………………………………

1

Department of Defense Office of the Inspector General Transmittal of Independent

Auditor’s Reports…………………………………………………………………….......

63

Grant Thornton Audit Reports……………………………………………………….......

66

Management Response to the Fiscal Year 2022 United States Special Operations

Command Financial Statement Audit Report……………………………………….......

111

UNCLASSIFIED

UNCLASSIFIED

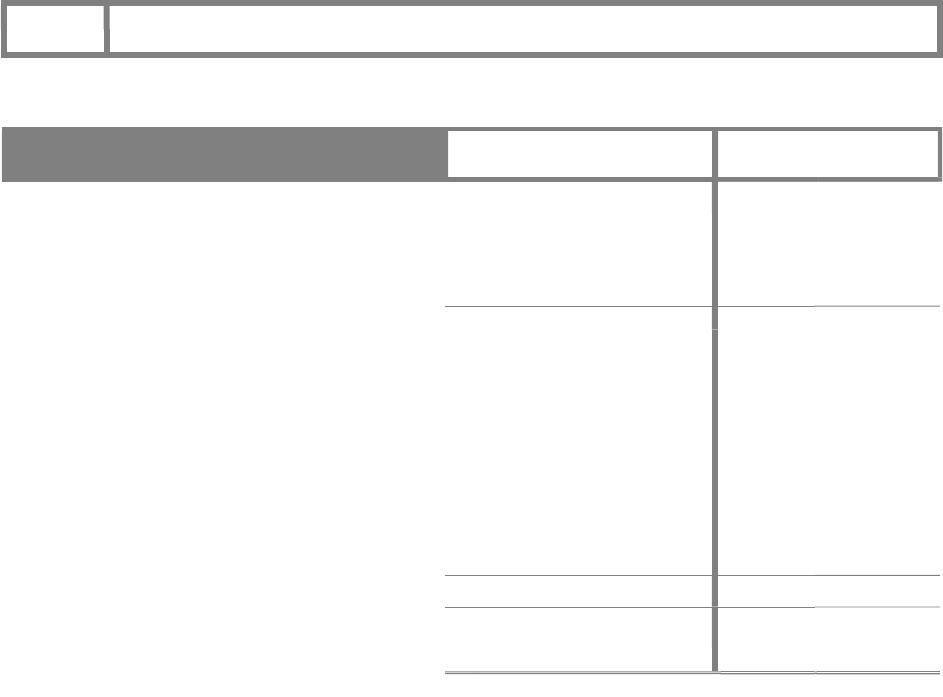

The accompanying notes are an integral part of these statements.

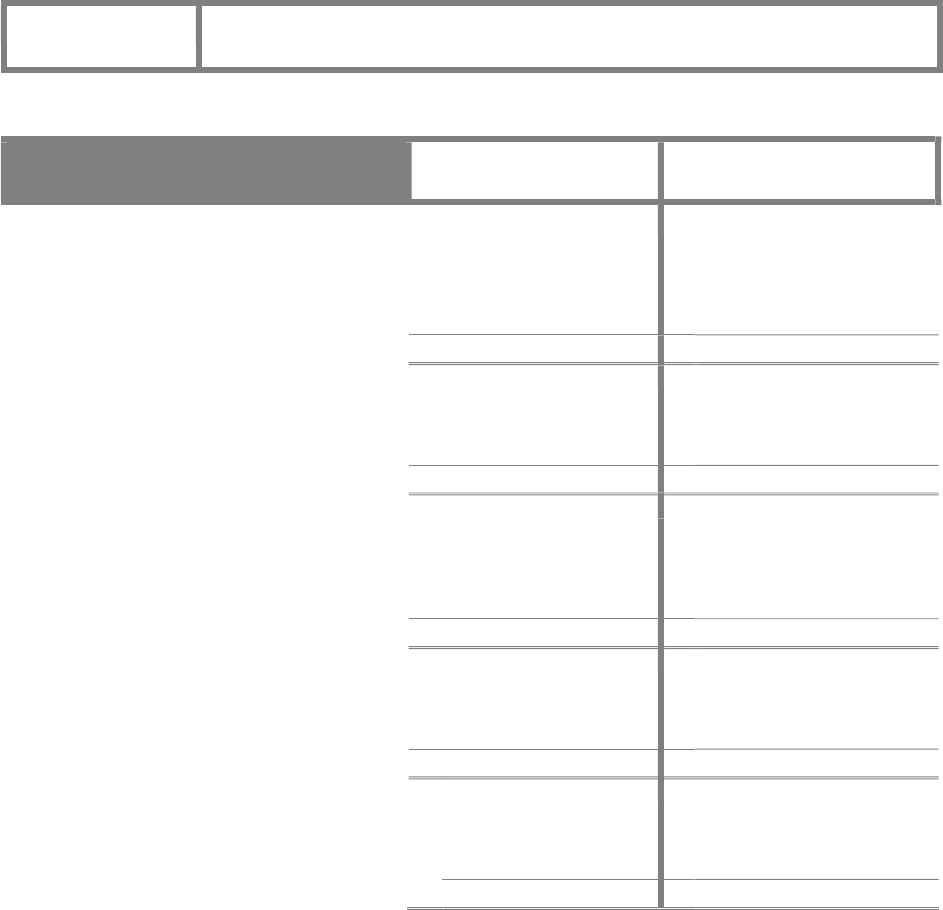

($ in Thousands)

Department of Defense

Other Defense Activities - Tier 2 - US Special Operations Command

CONSOLIDATED BALANCE SHEET - UNAUDITED

As of September 30, 2022 and 2021

Intragovernmental:

Fund Balance with Treasury (Note 3)

Accounts Receivable, Net (Note 6)

Other Assets (Note 10)

Total Intragovernmental

Other Than Intragovernmental:

Accounts Receivable, Net (Note 6)

Inventory and Related Property, Net (Note 8)

General Property, Plant and Equipment, Net (Note 9)

Advances and Prepayments (Note 10)

Total Other Than Intragovernmental

Total Assets

Stewardship PP&E (Note 9)

Liabilities (Note 11)

Intragovernmental:

Accounts Payable

Advances from Others and Deferred Revenue (Note 15)

Other Liabilities (Notes 13 and 15)

Total Intragovernmental

Other Than Intragovernmental:

Accounts Payable

Federal Employee and Veteran Benefits

Payable (Note 13)

Advances from Others and Deferred Revenue (Note 15)

Other Liabilities (Notes 15, 16 and 17)

Total Other Than Intragovernmental

Total Liabilities

Commitments and Contingencies (Note 17)

Net Position:

Unexpended Appropriations - Funds Other than

Dedicated Collections

Total Unexpended Appropriations (Consolidated)

Cumulative Results of Operations - Funds Other than

Dedicated Collections

Total Cumulative Results of Operations (Consolidated)

Total Net Position

Total Liabilities and Net Position

2022 Consolidated 2021 Consolidated

11,917,505

11,382,429

49,338 19,203

45

45

11,966,888

11,401,677

1,888

2,364

2,524,723

2,509,937

3,270,150

3,576,635

123,253

360,001

5,920,014

6,448,937

17,886,902

17,850,614

48,507 113,099

7,677

16,298

4,086

5,262

60,270 134,659

737,928

1,513,611

66,614

64,181

(3,064) (1,427)

40,306

48,613

841,784

1,624,978

902,054 1,759,637

11,412,380

10,237,420

11,412,380

10,237,420

5,572,468

5,853,554

5,572,468

5,853,554

16,984,848

16,090,974

17,886,902

17,850,611

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

$

UNCLASSIFIED

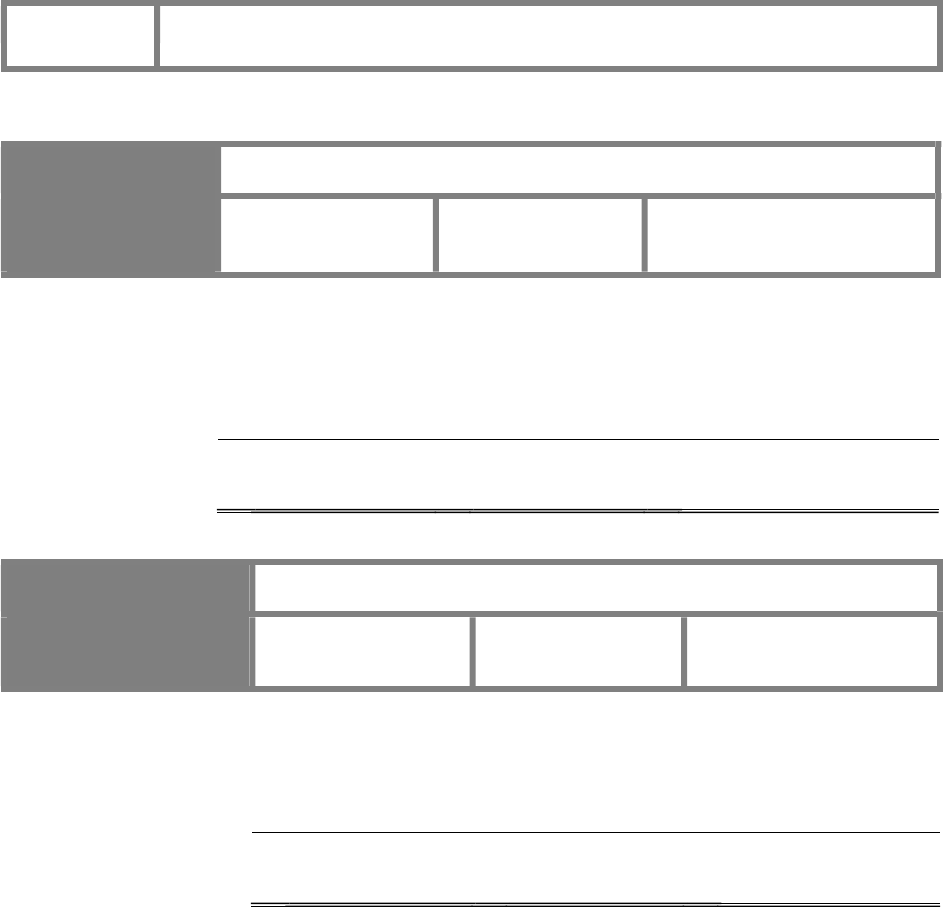

UNCLASSIFIED

1

Department of Defense

The accompanying notes are an integral part of these statements.

($ in Thousands)

Other Defense Activities - Tier 2 - US Special Operations Command

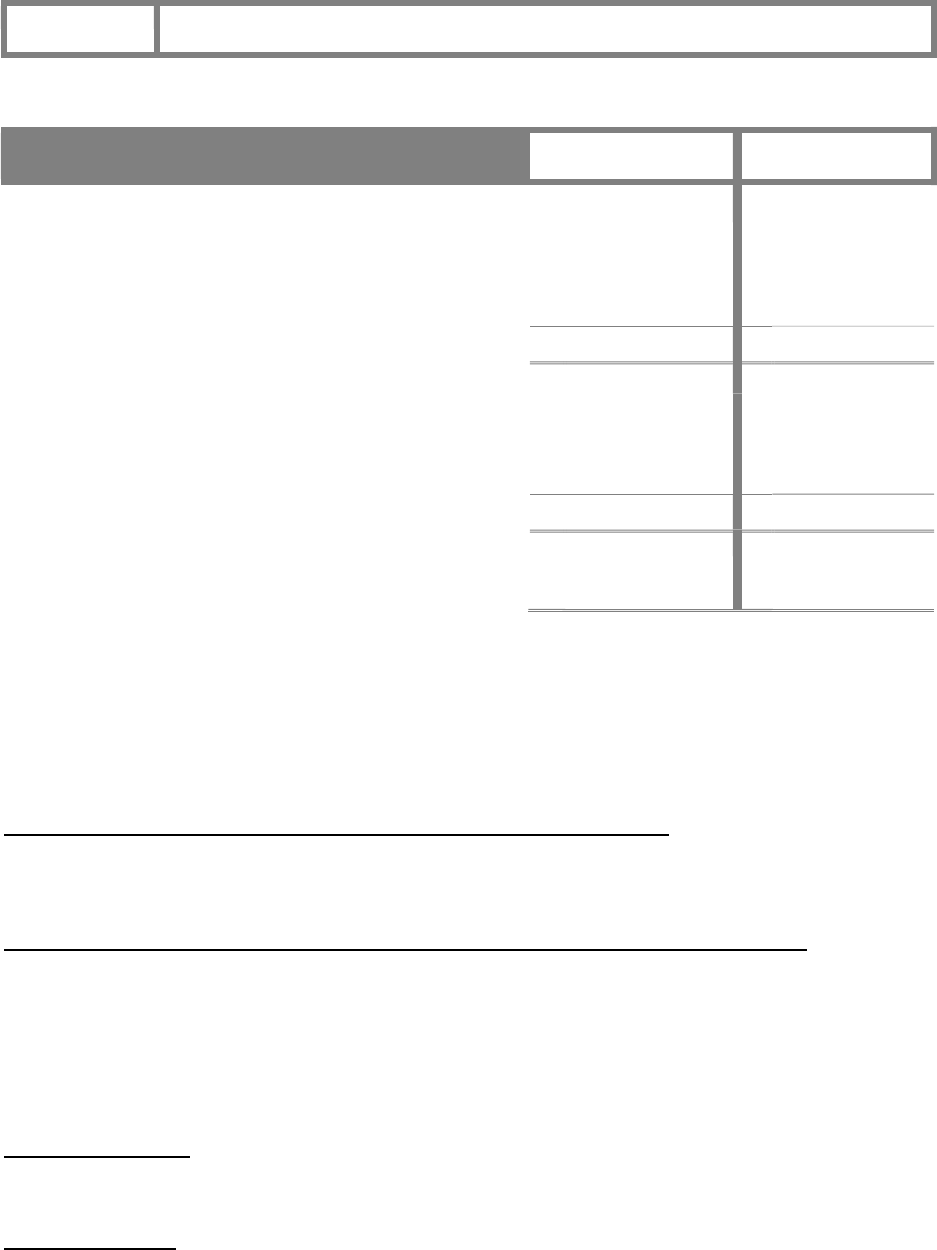

CONSOLIDATED STATEMENT OF CHANGES IN NET POSITION - UNAUDITED

For the periods ended September 30, 2022 and 2021

UNEXPENDED APPROPRIATIONS

Beginning Balances (Includes Funds from Dedicated

Collections - See Note 18)

Prior Period Adjustments:

Beginning Balances, as adjusted

Appropriations received

Appropriations transferred in/out

Other adjustments (+/-)

Appropriations used

Net Change in Unexpended Appropriations (Includes

Funds from Dedicated Collections - See Note 18)

Total Unexpended Appropriations, Ending Balance (Includes

Funds from Dedicated Collections - See Note 18)

CUMULATIVE RESULTS OF OPERATIONS

Beginning Balances

Prior Period Adjustments:

Beginning Balances, as adjusted (Includes Funds

from Dedicated Collections - See Note 18)

Other adjustments (+/-)

Appropriations used

Non-exchange revenue (Note 20)

Transfers in/out without reimbursement

Imputed financing

Other

Net Cost of Operations (+/-) (Includes Funds from

Dedicated Collections - See Note 18)

Net Change in Cumulative Results of Operations

Cumulative Results of Operations, Ending (Includes

Funds from Dedicated Collections - See Note 18)

Net Position

2022 Consolidated 2021 Consolidated

10,237,420

10,49

5,034

10,237,420

10,495,034

13,232,204

13,079,599

38,972

7,829

(261,582) (274,029)

(11,834,634) (13,071,013)

1,174,960

(257,614)

11,412,380

10,237,420

5,853,554

5,735,119

5,853,554

5,735,119

(2,928) (28)

11,834,634

13,071,013

2

2

(582,259) (269,270)

18,845

18,001

49,075

209

11,598,455

12,701,492

(281,086)

118,435

5,572,468

5,853,554

16,984,848

16,090,974

$

$

$

$

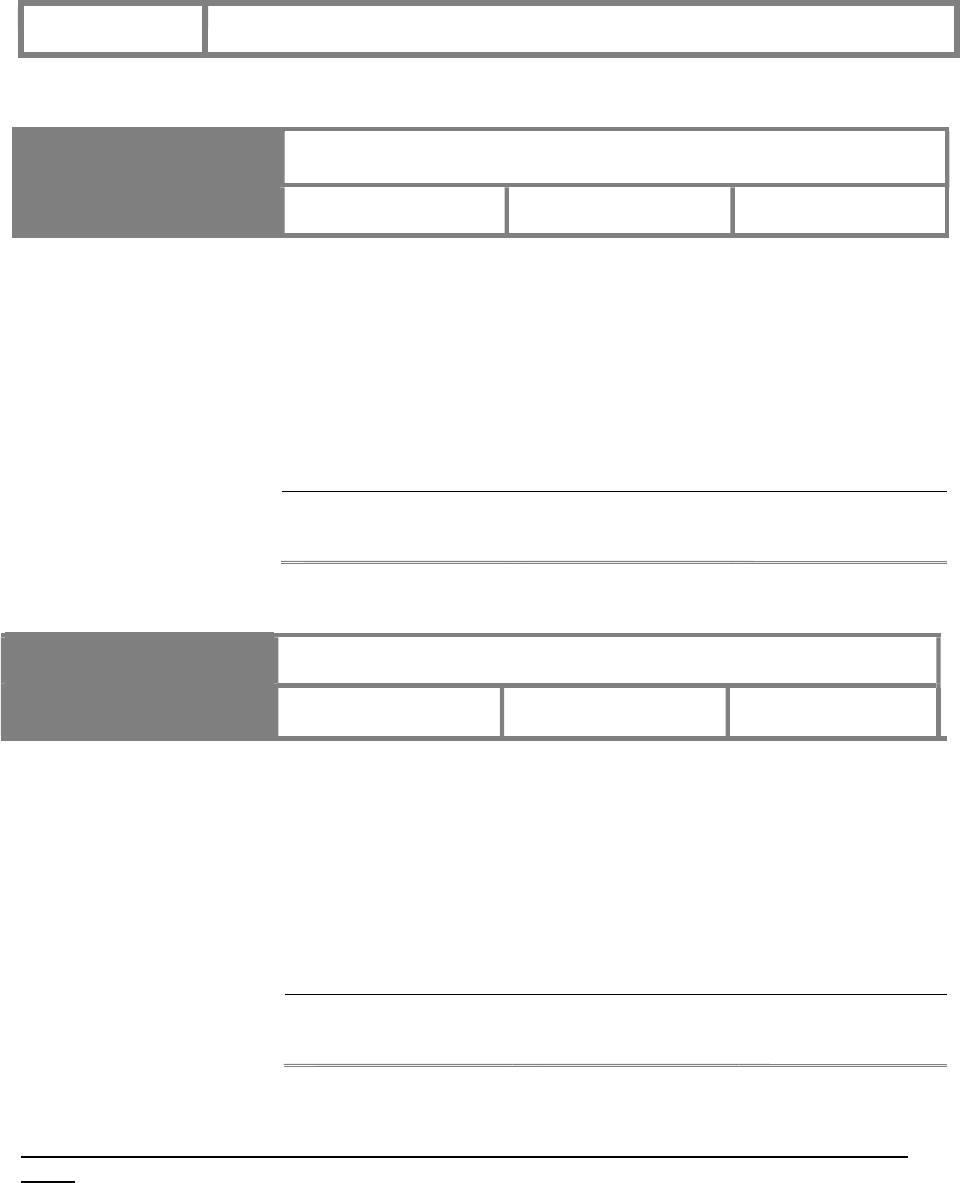

UNCLASSIFIED

UNCLASSIFIED

2

Department of Defense

The accompanying notes are an integral part of these statements.

($ in Thousands)

Other Defense Activities - Tier 2 - US Special Operations Command

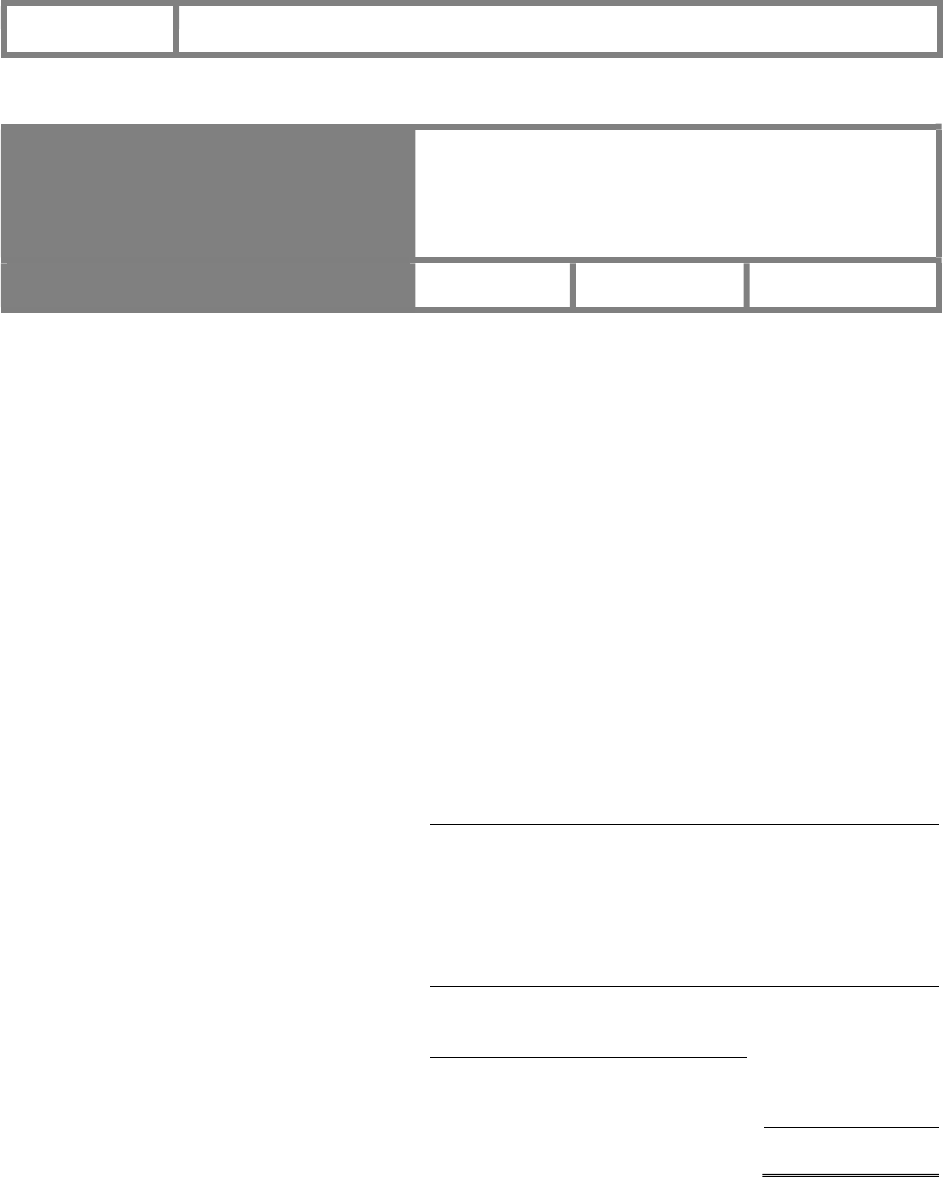

COMBINED STATEMENT OF BUDGETARY RESOURCES - UNAUDITED

For the periods ended September 30, 2022 and 2021

Budgetary Resources:

1071 Unobligated balance from prior year budget authority,

net (discretionary and mandatory) (Note 21)

1290 Appropriations (discretionary and mandatory)

1890 Spending Authority from offsetting collections

(discretionary and mandatory)

1910 Total Budgetary Resources

Status of Budgetary Resources:

2190 New obligations and upward adjustments (total)

Unobligated balance, end of year:

2204 Apportioned, unexpired accounts

2404 Unapportioned, unexpired accounts

2412 Unexpired unobligated balance, end of year

2413 Expired unobligated balance, end of year

2490 Unobligated balance, end of year (total)

2500 Total Budgetary Resources

Outlays, Net:

4190 Outlays, net (total) (discretionary and mandatory)

4210 Agency Outlays, net (discretionary and mandatory)

2022 Combined 2021 Combined

2,328,572

2,143,392

13,272,676

13,046,095

609,461

518,337

16,210,709

15,707,824

14,237,543

13,890,155

1,439,730

1,185,417

12

257,057

1,439,742

1,442,474

533,423

375,195

1,973,165

1,817,669

16,210,708

15,707,824

12,471,589

13,302,857

12,471,589

13,302,857

$

$

$

$

$

$

$

$

$

$

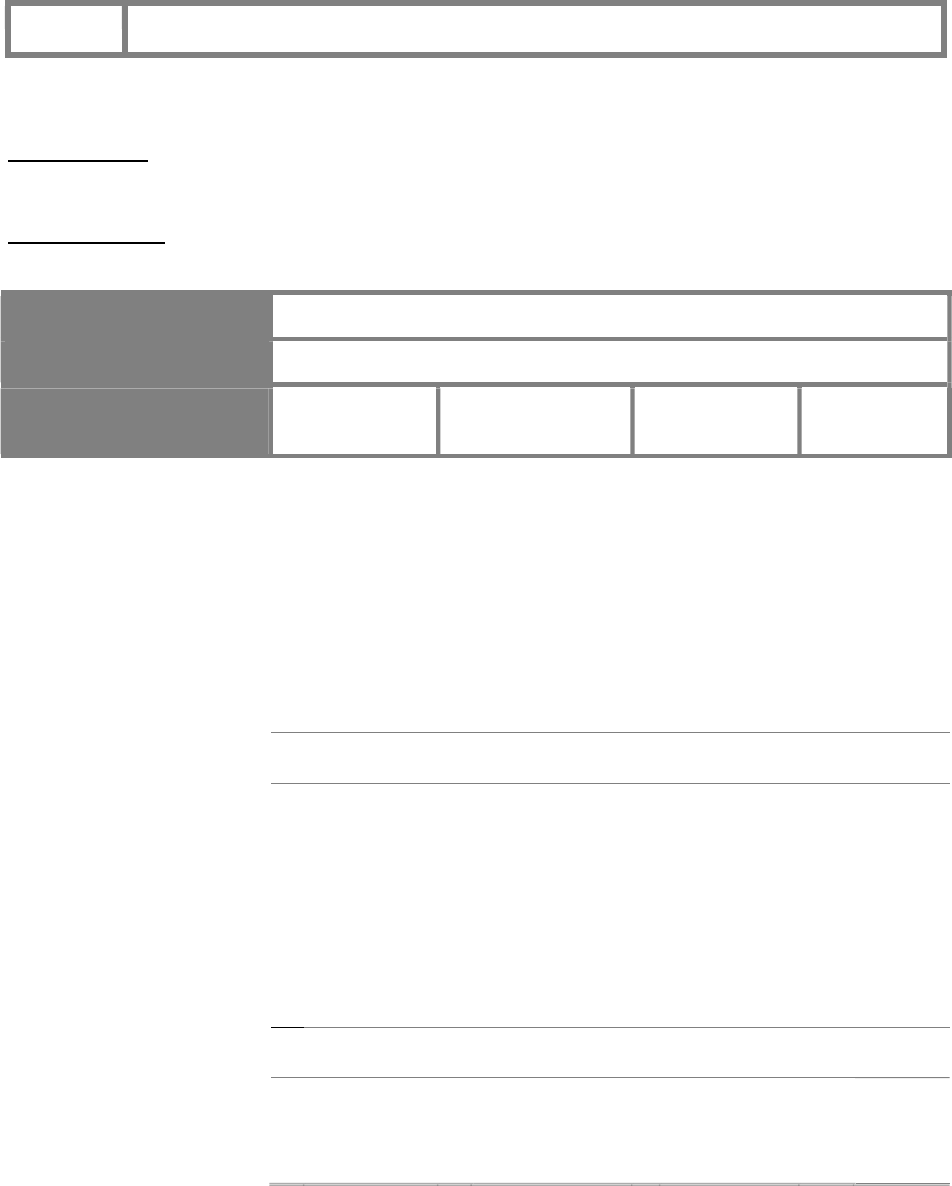

UNCLASSIFIED

UNCLASSIFIED

3

The accompanying notes are an integral part of these statements.

Department of Defense

Other Defense Activities - Tier 2 - US Special Operations Command

CONSOLIDATED STATEMENT OF NET COST - UNAUDITED

For the periods ended September 30, 2022 and 2021

Program Costs (Note 19)

Gross Costs

Operations, Readiness & Support

Procurement

Research, Development, Test & Evaluation

Family Housing & Military Construction

. (Less: Earned Revenue)

Net Cost before Losses/(Gains) from Actuarial Assumption Changes

for Military Retirement Benefits

Net Program Costs Including Assumption Changes

Net Cost of Operations

2022 Consolidated 2021 Consolidated

11,986,766

13,072,581

8,516,033

9,209,366

2,717,388

2,983,299

757,130

801,166

(3,786)

78,750

(388,311) (371,089)

11,598,455

12,701,492

11,598,455 12,701,492

11,598,455 12,701,492

$

$

$

$

UNCLASSIFIED

UNCLASSIFIED

4

Note 1. Summary of Significant Accounting Policies - Unaudited

1.A. Reporting Entity

The United States Special Operations Command (USSOCOM) is comprised of the following Components

and Sub-Unified Commands, whose responsibilities are to ensure their Special Operations Forces (SOF)

are highly trained, equipped and rapidly deployable to support national security interests around the world:

U.S. Army Special Operations Command (USASOC)

The USASOC is located at Ft. Bragg, North Carolina. The mission of USASOC is to organize, train, educate,

man, equip, fund, administer, mobilize, deploy, and sustain Army SOF to successfully conduct worldwide

special operations, across the range of military operations, in support of regional combatant commanders,

American ambassadors and other agencies as directed.

Naval Special Warfare Command (NAVSPECWARCOM or NSWC)

The NAVSPECWARCOM is located at Naval Amphibious Base, Coronado, California. NSWC provides

vision, leadership, doctrinal guidance, resources, and oversight to ensure component maritime SOF are

ready to meet the operational requirements of Combatant Commanders.

Air Force Special Operations Command (AFSOC)

The AFSOC is located at Hurlburt Field, Florida. The AFSOC is America’s specialized air power, a step

ahead in a changing world, delivering special operations combat power anytime, anywhere.

Marine Corps Forces Special Operations Command (MARSOC)

The MARSOC is located at Camp Lejeune, North Carolina. The MARSOC, as the U.S. Marine Corps

component of USSOCOM, trains, organizes, equips, and when directed by the Commander of USSOCOM,

deploys task organized, scalable, and responsive U.S. Marine Corps SOF worldwide in support of

Combatant Commanders and other agencies.

Joint Special Operations Command (JSOC)

The JSOC is a Sub-Unified Command of USSOCOM. The JSOC is a joint headquarters designed to study

special operations requirements and techniques, ensure interoperability and equipment standardization,

plan and conduct joint special operations exercises and training, and develop joint special operations

tactics.

Per 10 United States Code (USC) 165, “the Secretary of a military department is responsible for the

administration and support of forces assigned by him to a Combatant Command” (i.e., USSOCOM).

Combatant Command Support Agents (CCSAs) provides administrative support to the Combatant

Command headquarters, and the subordinate unified command headquarters. Components processes,

controls, and systems, including accounting systems are aligned with their “parent” Service (Army, Navy,

Air Force, Marine Corps); USSOCOM Headquarters element and Sub-Unified Commands’ processes and

controls are aligned with their CCSAs.

USSOCOM, through additional Sub-Unified Commands or Theatre Special Operation Commands

(TSOCs), supports the Geographic Combatant Commands (GCCs). The TSOCs are responsible for

planning special operations throughout their assigned areas of responsibility, planning, and conducting

peacetime joint training exercises, and orchestrating command and control of peacetime and wartime

special operations:

UNCLASSIFIED

UNCLASSIFIED

5

Theater Special Operations Command - Africa (SOCAFRICA)

The SOCAFRICA is a Sub-Unified Command of USSOCOM under operational control of United States

Africa Command (USAFRICOM), with headquarters in Kelley Barracks, Stuttgart-Mohringen, Germany.

The SOCAFRICA’s primary responsibility is to exercise operational control over theater-assigned or

allocated Air Force, Army, Marine, or Navy SOF conducting operations, exercises, and theater security

cooperation in the USAFRICOM area of responsibility.

Theater Special Operations Command - Central (SOCCENT)

The SOCCENT, in partnership with interagency and international partners, supports the United States

Central Command’s (CENTCOM) and USSOCOM’s objectives by employing special operations to deter

and degrade malign actors, influence relevant populations, and enhance regional partners to protect U.S.

national interests and maintain regional stability. When directed, SOCCENT employs special operations

forces for contingency and crisis response.

Theater Special Operations Command - Europe (SOCEUR)

The SOCEUR employs SOF across the United States European Command (USEUCOM) area of

responsibility to enable deterrence, strengthen European security collective capabilities and interoperability,

and counter transnational threats to protect U.S. personnel and interests.

Theater Special Operations Command - Korea (SOCKOR)

The SOCKOR plans and conducts special operations in support of the Commander of United States

Forces/United Nations Commander/Combined Forces Commander in armistice, crisis, and war. The

SOCKOR is a functional Component Command of United States Forces Korea, tasked to plan and conduct

special operations in the Korean theater of operations. The SOCKOR continues to be the only TSOC in

which U.S. and host nation SOF are institutionally organized for combined operations. SOCKOR and

Republic of Korea (ROK) Army Special Warfare Command (SWC) regularly train in their combined roles,

while SOCKOR’s Special Forces detachment acts as the liaison between ROK Special Forces and the U.S.

Special Forces.

Theater Special Operations Command - North (SOCNORTH)

The SOCNORTH, in partnership with the interagency and regional SOF, synchronizes operations against

terrorist networks and their acquisition or use of weapons of mass destruction, and when directed, employs

fully capable SOF to defend the homeland in depth and respond to crisis. The SOCNORTH is responsive,

capable, and postured to provide scalable SOF options to contribute to the defense of the homeland with

emphasis on counterterrorism, counter weapons of mass destruction-terrorism, and counter transnational

organized crime in Mexico.

Theater Special Operations Command - Pacific (SOCPAC)

The SOCPAC is a Sub-Unified Command of USSOCOM under the operational control of U.S. Indo-Pacific

Command (USINDOPACOM) and serves as the functional component for all special operations missions

deployed throughout the Indo-Asia-Pacific region. The SOCPAC coordinates, plans, and directs all special

operations in the Pacific theater supporting Commander, USINDOPACOM objectives of deterring

aggression, responding quickly to crisis, and defeating threats to the United States and its interests.

UNCLASSIFIED

UNCLASSIFIED

6

Theater Special Operations Command - South (SOCSOUTH)

The SOCSOUTH is a Sub-Unified Command of USSOCOM under the operational control of U.S. Southern

Command. The SOCSOUTH is a joint Special Operations headquarters that plans and executes special

operations in Central and South America and the Caribbean.

USSOCOM is a component reporting entity of the DoD, which is a component reporting entity and

consolidation entity of the Government-wide reporting process. For this reason, some of the assets and

liabilities reported by USSOCOM may be eliminated for the Government-wide reporting because they are

offset by assets and liabilities of another U.S. Government entity. These financial statements should be

read with the realization they are for a component of the U.S. Government.

1.B. Mission of the Reporting Entity

USSOCOM synchronizes the planning of Special Operations and provides SOF to support persistent,

networked and distributed GCCs operations to protect and advance our Nation’s interests. Each service

branch has a Special Operations Command that is unique and capable of running its own operations, but

when the different SOF need to work together for an operation, USSOCOM becomes the Joint Command

of the operation.

To achieve this mission, SOF Commanders and staff must plan and lead a full range of lethal and non-

lethal special operations missions in complex and ambiguous environments. Additionally, USSOCOM

accomplishes these missions using four service component Commands, seven TSOCs, and JSOC. SOF

personnel serve as key members of Joint, Interagency, and international teams and must be prepared to

employ all assigned authorities and apply all available elements of power to accomplish the assigned

missions. This mission makes it a unique Unified Combatant Command.

1.C. Basis of Presentation

These financial statements have been prepared to report the financial position, financial condition, and

results of operations of USSOCOM, as required by the Chief Financial Officers Act of 1990, expanded by

the Government Management Reform Act of 1994, Office of the Secretary of Defense (OSD),

Memorandum, “Internal Reporting for USSOCOM Financial Statements”, Department of Defense (DoD)

Financial Statement Audit Guide, and other appropriate legislation. The accompanying financial statements

account for all resources for which USSOCOM is responsible unless otherwise noted. Accounting standards

require all reporting entities to disclose that accounting standards allow certain presentations and

disclosures to be modified, if needed, to prevent the disclosure of classified information.

To the extent possible, the financial statements have been prepared from the accounting records of

USSOCOM using financial data obtained from the military department financial systems, Army, Navy and

Air Force, and related non-financial system data and in accordance with U.S. Generally Accepted

Accounting Principles (GAAP) for federal entities as prescribed by the Federal Accounting Standards

Advisory Board (FASAB), the Office of Management and Budget (OMB) Circular No. A-136, “Financial

Reporting Requirements”, and DoD Financial Management Regulation (FMR). USSOCOM is unable to fully

comply with all elements of GAAP and the OMB Circular No. A-136, due to limitations of financial and

nonfinancial management processes and systems that support the financial statements. USSOCOM

derives reported values and information for major asset and liability categories largely from nonfinancial

systems, such as inventory and logistic systems. These systems were designed to support reporting

requirements for maintaining accountability over assets and reporting the status of federal appropriations

rather than preparing financial statements in accordance with GAAP. USSOCOM continues to implement

process and system improvements addressing these limitations. USSOCOM’s continued effort towards full

compliance with GAAP for the accrual method of accounting is encumbered by system limitations.

USSOCOM is unable to meet all full accrual accounting requirements. This is primarily because legacy

accounting systems were not designed to collect and record financial information on the full accrual

accounting basis but were designed to record information on a budgetary basis.

UNCLASSIFIED

UNCLASSIFIED

7

1.D. Basis of Accounting

USSOCOM does not have a single accounting system. Therefore, USSOCOM financial statements and

supporting trial balances are compiled from the underlying financial data and trial balances of USSOCOM

components and TSOCs. USSOCOM Service Components’ processes, controls, and systems, including

accounting systems are aligned with their "parent" Service. USSOCOM Headquarters element and Sub-

Unified Commands’ processes and controls are aligned with their CCSA. The underlying data is largely

derived from budgetary transactions (obligations, disbursements, and collections), from nonfinancial feeder

systems, and accruals made for major items such as payroll expenses and accounts payable.

USSOCOM presents the Balance Sheet, Statement of Net Cost, and Statement of Changes in Net Position

on a consolidated basis, less eliminations, with the exception of revenue eliminations due to system

limitations. The financial transactions are recorded on a proprietary accrual and a budgetary basis of

accounting, except for issues noted for the Standard Operation and Maintenance Army Research and

Development System (SOMARDS) and the Standard Financial System (STANFINS). Under the accrual

basis, revenues are recognized when earned and expenses are recognized when incurred, without regard

to the timing of receipt or payment of cash. Whereas under the budgetary basis, generally the legal

commitment or obligation of funds is recognized in advance of the proprietary accruals and in compliance

with legal requirements and controls over the use of Federal funds.

USSOCOM is continuing to evaluate the effects that will result from fully adopting recent accounting

standards and other authoritative guidance issued by FASAB. The guidance listed below has the potential

to affect the financial statements; however, USSOCOM is currently unable to determine the full impact.

1) SFFAS 48: Opening Balances for Inventory, Operating Materials and Supplies, and Stockpile Materials:

Issued on January 27, 2016; Effective for periods beginning after September 30, 2016. USSOCOM

plans to utilize deemed cost to value beginning balances for inventory and related property (I&RP), as

permitted by SFFAS 48. USSOCOM has valued some of its I&RP using deemed cost methodologies,

as described in SFFAS 48. However, systems required to account for historical cost for I&RP in

accordance with SFFAS 3: Accounting for Inventory and Related Property, are not yet fully

implemented. Therefore, USSOCOM is not making an unreserved assertion with respect to this line

item.

2) SFFAS 50: Establishing Opening Balances for General Property, Plant, and Equipment: Amending

SFFAS 6, 10, and 23, and rescinding SFFAS 35: Issued on August 4, 2016. Effective Date: For periods

beginning after September 30, 2016.

USSOCOM plans to utilize deemed cost to value beginning balances for general property, plant, and

equipment (General PP&E), as permitted by SFFAS 50. USSOCOM has valued some of its General

PP&E using deemed cost methodologies as described in SFFAS 50. However, systems required to

account for historical cost for General PP&E in accordance with SFFAS 6: Accounting for Property,

Plant and Equipment, are not yet fully implemented. Therefore, USSOCOM is not making an

unreserved assertion with respect to this line item.

3) SFFAS 53: Budget and Accrual Reconciliation: Amending SFFAS 7 and 24, and Rescinding SFFAS

22: Issued October 27, 2017; Effective for periods beginning after September 30, 2018.

4) SFFAS 54: Leases: An Amendment to SFFAS 5, Accounting for Liabilities of the Federal Government,

and SFFAS 6, Accounting for Property, Plant, and Equipment: Issued Date: April 17, 2018. The

requirements of SFFAS 54 were deferred to reporting periods beginning after September 30, 2023,

under SFFAS 58, Deferral of the Effective Date of SFFAS 54, Leases: Issued June 19, 2020. Early

adoption is not permitted.

The DoD is continuing the actions required to bring its financial and nonfinancial feeder systems and

processes into compliance with GAAP. One such action is the ongoing revision of accounting systems to

record transactions based on the U.S. Standard General Ledger (USSGL). Until all USSOCOM financial

UNCLASSIFIED

UNCLASSIFIED

8

and non-financial feeder systems and processes are GAAP compliant and can collect and report financial

information as required, some of USSOCOM’s financial data will be derived from budgetary transactions or

data from nonfinancial feeder systems.

1.E. Accounting for Intragovernmental and Intergovernmental Activities

Intragovernmental Activities: Treasury Financial Manual (TFM), Volume I, Part 2, Chapter 4700 Agency

Reporting Requirements for the Financial Report of the United States Government, provides guidance for

reporting and reconciling intragovernmental balances. Accounting standards require an entity to eliminate

intragovernmental activity and balances from consolidated financial statements to prevent overstatement

caused by the inclusion of business activity between entity components. Intragovernmental cost and

exchange revenue represent transactions made between two reporting entities within the federal

government. Cost and earned revenue with the public represent exchange transactions made between the

reporting entity and a non-federal entity. USSOCOM cannot accurately identify intragovernmental

transactions by customer because the underlying accounting systems do not track buyer and seller data at

the transaction level. Generally, at the DoD level, seller entities within the DoD provide summary seller-side

balances for revenue, accounts receivable, and unearned revenue to the buyer-side internal accounting

offices. In most cases, the buyer-side records are adjusted to agree with DoD seller-side balances and are

then eliminated. USSOCOM, by way of the DoD, is implementing replacement systems and a standard

financial information structure incorporating the necessary elements to enable USSOCOM to correctly

report, reconcile, and eliminate intragovernmental balances.

While USSOCOM is unable to fully reconcile intragovernmental transactions with all federal agencies,

USSOCOM can reconcile balances pertaining to benefit program transactions with the Office of Personnel

Management (OPM). USSOCOM is taking actions to fully reconcile intragovernmental transactions with all

Federal agencies.

Intergovernmental Activities: Goods and services are received from other federal agencies at no cost or at

a cost less than the full cost to the providing federal entity. Consistent with accounting standards, certain

costs of the providing entity that are not fully reimbursed by USSOCOM are recognized as imputed cost in

the Statement of Net Cost and are offset by imputed financing in the Statement of Changes in Net Position.

Imputed financing represents the cost paid on behalf of USSOCOM by another federal entity. In accordance

with SFFAS 55: Amending Inter-entity Cost Provisions, USSOCOM recognizes the general nature of

imputed costs only for business-type activities and other costs specifically required by OMB, including

employee pension, post-retirement health, and life insurance benefits. Unreimbursed costs of goods and

services other than those identified above are not included in USSOCOM’s financial statements.

The DoD’s proportionate share of public debt and related expenses of the Federal Government is not

included. The Federal Government does not apportion debt and its related costs to federal agencies. The

DoD’s financial statements do not report any public debt, interest, or source of public financing, whether

from issuance of debt or tax revenues.

For additional information, see Note 19, Disclosures Related to the Statement of Net Cost.

1.F. Non-Entity Assets

USSOCOM classifies assets as either entity or non-entity. Non-entity assets are not available for use in

USSOCOM’s normal operations. USSOCOM has stewardship accountability and reporting responsibility

for non-entity assets. An example of a non-entity asset is non-federal accounts receivable.

For additional information, see Note 2, Non-Entity Assets.

1.G. Fund Balance with Treasury (FBwT)

The FBwT represents the aggregate amount of USSOCOM’s available budget spending authority available

to pay current liabilities and finance future authorized purchases. USSOCOM’s monetary financial

UNCLASSIFIED

UNCLASSIFIED

9

resources of collections and disbursements are maintained in the Department of the Treasury (Treasury)

accounts. The disbursing offices of Defense Finance and Accounting Service (DFAS), the Military

Departments, U.S. Army Corps of Engineers (USACE), and Department of State's financial service centers

currently process the majority of USSOCOM's cash collections, disbursements, and adjustments

worldwide. Monthly, each disbursing station reports to the U.S. Treasury on checks issued, electronic fund

transfers, interagency transfers, and deposits. The model of using DoD’s disbursing systems instead of

Treasury’s system is recognized by Treasury as Non-Treasury Disbursing Office (NTDO). DoD is actively

migrating NTDO transactions to TDO under the TDO Enterprise Strategy effort. TDO is DoD’s target end

state of executing payments and collections directly between DoD and Treasury using Treasury’s systems

and Treasury as the Service Provider. This posture will allow DoD to achieve FBwT accountability and

traceability through daily reconciliation and reporting directly with Treasury.

In addition, DFAS and the USACE Finance Center submit reports to U.S. Treasury by appropriation on

interagency transfers, collections received, and disbursements issued. Treasury records these transactions

to the applicable FBwT account.

Fund Balance with Treasury and the accompanying liability for deposit funds are not reported by individual

Other Defense Organizations General Fund but are reported in the Defense-wide General Fund. As such,

USSOCOM does not report deposit fund balances on its financial statements.

For additional information, see Note 3, Fund Balance with Treasury.

1.H. Cash and Other Monetary Assets

USSOCOM does not have any cash reported on the financial statements.

1.I. Investments and Related Interest

USSOCOM does not invest in Securities.

1.J. Accounts Receivable

Accounts receivable from other federal entities or the public include accounts receivable, claims receivable,

and refunds receivable. Allowances for uncollectible accounts due from the public are based upon factors

such as aging of accounts receivable, debtor’s ability to pay, and payment history.

For additional information, see Note 6, Accounts Receivable, Net.

1.K. Loans Receivable, Net and Loan Guarantee Liabilities

For additional information, see Note 7, Loans Receivable, Net and Loan Guarantee Liabilities.

1.L. Inventories and Related Property

USSOCOM currently does not have any inventory but does have related property.

Related property includes Operating Materials and Supplies (OM&S). OM&S, including munitions not held

for sale, are valued using various valuation methods. During prior years, USSOCOM inappropriately used

the Purchase Method of Accounting for OM&S and expensed all OM&S when procured. During Fiscal Year

(FY) 2021, USSOCOM commenced the adoption of the Consumption Method of Accounting for OM&S.

These efforts are still applicable for FY 2022.

For additional information, see Note 8, Inventory and Related Property, Net

1.M. General Property, Plant and Equipment (GPP&E)

UNCLASSIFIED

UNCLASSIFIED

10

USSOCOM generally records General PP&E at the estimated historical cost. When applicable, USSOCOM

will continue to adopt SFFAS 50, which permits alternative methods in establishing opening balances

effective for periods beginning after September 30, 2016.

USSOCOM’s General PP&E is comprised of General Equipment (GE) and Construction-In-Progress (CIP).

Except for real property (RP) CIP, USSOCOM does not report any RP.

General PP&E assets are capitalized at historical acquisition cost when an asset has a useful life of two or

more years and when the acquisition cost equals or exceeds USSOCOM’s capitalization threshold.

USSOCOM capitalizes improvements to existing General PP&E assets if the improvements equal or

exceed the capitalization threshold and extend the useful life or increase the size, efficiency, or capacity of

the asset. USSOCOM depreciates all GE on a straight-line basis. USSOCOM does not meet the recognition

criteria to report RP (building, structures, and land) as described in the OUSD (Comptroller (C))

Memorandum, dated September 30, 2015, Accounting Policy Update for Financial Statement Reporting for

Real Property Assets. Therefore, all completed USSOCOM-funded RP CIP projects are transferred and

financially reported by the military departments/components. When it is in the best interest of the

government, USSOCOM provides government property to contractors to complete contract work.

USSOCOM either owns or leases such property, or it is purchased directly by the contractor for the

government based on contract terms. When the value of contractor-procured General PP&E exceeds

USSOCOM’s capitalization threshold, as required by federal accounting standards, USSOCOM reports on

its Balance Sheet.

For additional information, see Note 9, General PP&E, Net.

1.N. Other Assets

USSOCOM conducts business with commercial contractors under two primary types of contracts: fixed

price and cost reimbursable. USSOCOM may provide financing payments to contractors to alleviate the

potential financial burden from long-term contracts. Contract financing payments are defined in the Federal

Acquisition Regulation (FAR), Part 32, as authorized disbursements to a contractor prior to acceptance of

supplies or services by the Government. Contract financing payment clauses are incorporated in the

contract terms and conditions and may include advance payments, performance-based payments,

commercial advances and interim payments, progress payments based on cost, and interim payments

under certain cost-reimbursement contracts.

The Defense Federal Acquisition Regulation Supplement (DFARS) authorizes progress payments based

on a percentage or stage of completion only for construction of RP, shipbuilding, and ship conversion,

alteration, or repair. Progress payments based on percentage or stage of completion are reported as CIP.

Contract financing payments do not include invoice payments, payments for partial deliveries, lease and

rental payments, or progress payments based on a percentage or stage of completion.

For additional information, see Note 10, Other Assets.

1.O. Leases

Lease payments for the rental of equipment and operating facilities are classified as either capital or

operating leases. USSOCOM reports operating leases only; USSOCOM does not hold any capital leases

and is not a lessor in any lease arrangement. An operating lease does not substantially transfer all the

benefits and risk of ownership to USSOCOM. Payments for operating leases are expensed on a straight-

line basis over the lease term.

For additional information, see Note 16, Leases.

UNCLASSIFIED

UNCLASSIFIED

11

1.P. Liabilities

Liabilities represent the probable future outflow or other sacrifice of resources because of past transactions

or events. However, no liability can be paid by USSOCOM absent proper budget authority. Liabilities

covered by budgetary resources are appropriated funds for which funding is otherwise available to pay

amounts due. Budgetary resources include new budget authority, unobligated balances of budgetary

resources at the beginning of the year or net transfers of prior year balances during the year, spending

authority from offsetting collections, and recoveries of unexpired budget authority through downward

adjustments of prior year obligations. Liabilities are classified as not covered by budgetary resources when

congressional action is needed before they can be paid.

For additional information, see Note 11, Liabilities Not Covered by Budgetary Resources.

1.Q. Environmental and Disposal Liabilities

USSOCOM does not report any Environmental Liabilities.

1.R. Other Liabilities

Other liabilities include:

1) Accrued payroll consists of estimates for salaries, wages, and other compensation earned by

employees but not disbursed as of September 30, 2022, and September 30, 2021.

2) Earned annual and other vested compensatory leave is accrued as it is earned and reported on the

Balance Sheet. The liability is reduced as leave is taken. Each year, the balances in the accrued leave

accounts are adjusted to reflect the liability at current pay rates and leave balances. Sick leave and

other types of non-vested leave are expensed when used.

3) SFFAS 51, Insurance Programs, established accounting and financial reporting standards for insurance

programs. OPM administers insurance benefit programs available for coverage to USSOCOM’s Civilian

employees. The programs are available to Civilian employees, but employees do not have to

participate. These programs include life, health, and long-term care insurance.

The life insurance program, Federal Employee Group Life Insurance (FEGLI) plan is a term life

insurance benefit with varying amounts of coverage selected by the employee. The Federal Employees

Health Benefits (FEHB) program is comprised of different types of health plans that are available to

Federal employees for individual and family coverage for healthcare. Those employees meeting the

criteria for coverage under FEHB may also enroll in the Federal Employees Dental and Vision Insurance

Program (FEDVIP). FEDVIP allows for employees to have dental insurance and vision insurance to be

purchased on a group basis.

The Federal Long Term Care Insurance Program (FLTCIP) provides long term care insurance to help

pay for costs of care when enrollees need help with activities they perform every day, or have a severe

cognitive impairment, such as Alzheimer’s disease. To meet the eligibility requirements for FLTCIP,

employees must be eligible to participate in FEHB. However, employees do not have to be enrolled in

FEHB.

OPM, as the administrating agency, establishes the types of insurance plans, options for coverage, the

premium amounts to be paid by the employees and the amount and timing of the benefit received.

USSOCOM has no role in negotiating these insurance contracts and incurs no liabilities directly to the

insurance companies. Employee payroll withholding related to the insurance and employee matches

are submitted to OPM.

For additional information, see Note 15, Other Liabilities.

UNCLASSIFIED

UNCLASSIFIED

12

4) Custodial Liabilities represents liabilities for collections reported as non-exchange revenues where

USSOCOM is acting on behalf of another federal entity.

For additional information, see Note 13, Federal Employee and Veteran Benefits Payable and Note 15,

Other Liabilities.

1.S. Commitments and Contingencies

USSOCOM recognizes contingent liabilities on the Consolidated Balance Sheet for those legal actions

where management considers an adverse decision to be probable and the loss amount is reasonably

estimable. These legal actions are estimated and disclosed in Note 17, Commitments and Contingencies.

However, there are cases where amounts have not been accrued or disclosed because the likelihood of an

adverse decision is considered remote, or the amount of potential loss cannot be estimated.

Financial statement reporting is limited to disclosure when conditions for liability recognition do not exist but

there is at least a reasonable possibility of incurring a loss or additional losses. USSOCOM’s risk of loss

and resultant contingent liabilities arise mostly from pending or threatened litigation or claims and

assessments due to contract disputes.

USSOCOM does not have environmental contingencies.

For additional information, see Note 17, Commitments and Contingencies.

1.T. Federal Employee and Veteran Benefits

USSOCOM does not pay military payroll. Therefore, USSOCOM does not report any military retirement

and other federal employment benefits because such liabilities/costs are recorded on the financials

statements of the individual services.

1.U. Revenues and Other Financing Sources

USSOCOM receives congressional appropriations as financing sources for general funds. USSOCOM uses

these appropriations and funds to execute its missions, and subsequently reports on resource usage.

General funds are used for collections not earmarked by law for specific purposes, the proceeds of general

borrowing, and the expenditure of these moneys. DoD general fund appropriations cover costs including

personnel, operations and maintenance, research and development, procurement, and military

construction.

These funds either expire annually or some on a multi-year basis. When authorized by legislation, these

appropriations are supplemented by revenues generated by services provided. USSOCOM recognizes

revenue because of costs incurred for goods and services provided to other federal agencies and the public.

Full-cost pricing is USSOCOM’s standard policy for services provided as required by OMB Circular A-25:

User Charges. USSOCOM recognizes revenue when earned, within the constraints of its current system

capabilities, with the exception of activity recorded within SOMARDS.

In accordance with SFFAS 7, Accounting for Revenue and Other Financing Sources and Concepts

for Reconciling Budgetary and Financial Accounting, USSOCOM recognizes non-exchange revenue

when there is a specifically identifiable, legally enforceable claim to the cash or other assets of another

party that will not directly receive value in return.

1.V. Recognition of Expenses

DoD policy requires the recognition of operating expenses in the period incurred. Estimates are made for

major items such as payroll expenses and accounts payable.

UNCLASSIFIED

UNCLASSIFIED

13

In the case of OM&S, operating expenses are generally recognized when the items are purchased, but

recorded as assets later, in accordance with the consumption method. USSOCOM has been working to

input OM&S into the accountable property system of record (APSR), Defense Property Accountability

System (DPAS), and is continuing the analysis to refine the Consumption Method of Accounting.

1.W. Budgetary Resources

The purpose of federal budgetary accounting is to control, monitor, and report on funds made available to

federal agencies by law and help ensure compliance with the law.

The following budgetary terms are commonly used:

Appropriation is a provision of law (not necessarily in an appropriations act) authorizing the expenditure of

funds for a given purpose. Usually, but not always, an appropriation provides budget authority.

Budgetary resources are amounts available to incur obligations each year. Budgetary resources consist of

new budget authority and unobligated balances of budget authority provided in previous years.

Obligation is a binding agreement that will result in outlays, immediately or in the future. Budgetary

resources must be available before obligations can be incurred legally.

Offsetting Collections are payments to the Government that, by law, are credited directly to expenditure

accounts and deducted from gross budget authority and outlays of the expenditure account, rather than

added to receipts. Usually, offsetting collections are authorized to be spent for the purposes of the account

without further action by Congress. They usually result from business-like transactions with the public,

including payments from the public in exchange for goods and services, reimbursements for damages, and

gifts or donations of money to the Government and from intragovernmental transactions with other

Government accounts. The authority to spend collections is a form of budget authority.

Offsetting receipts are payments to the Government that are credited to offsetting receipt accounts and

deducted from gross budget authority and outlays, rather than added to receipts. Usually, they are deducted

at the level of the agency and sub function, but in some cases, they are deducted at the level of the

Government as a whole. They are not authorized to be credited to expenditure accounts. The legislation

that authorizes the offsetting receipts may earmark them for a specific purpose and either appropriate them

for expenditures for that purpose or require them to be appropriated in annual appropriations acts before

they can be spent. Like offsetting collections, they usually result from business-like transactions with the

public, including payments from the public in exchange for goods and services, reimbursements for

damages, and gifts or donations of money to the Government, and from intragovernmental transactions

with other Government accounts.

Outlays are the liquidation of an obligation that generally takes the form of an electronic funds transfer.

Outlays are reported both gross and net of offsetting collections and they are the measure of Government

spending.

1.X. Treaties for Use of Foreign Bases

USSOCOM does not report any treaties for use of foreign bases.

1.Y. Use of Estimates

USSOCOM’s management makes assumptions and reasonable estimates in the preparations of financial

statements based on current conditions, which may affect the reported amounts. Actual results could differ

materially from the estimated amounts. Significant estimates include such items as year-end accruals of

accounts payable.

UNCLASSIFIED

UNCLASSIFIED

14

1.Z. Parent-Child Reporting

USSOCOM receives it’s funding from OSD. USSOCOM is also party to allocation transfers with other DoD

entities as a receiving (child) entity. An allocation transfer is an entity’s legal delegation of authority to

obligate budget authority and outlay funds on its behalf. A separate fund account (allocation account) is

created in the U.S. Treasury as a subset of the parent fund account for tracking and reporting purposes. All

allocation transfers of balances are credited to this account; and subsequent obligations and outlays

incurred by the child entity are charged to this allocation account as they execute the delegated activity on

behalf of the parent entity. Generally, all financial activity related to allocation transfers (e.g., budget

authority, obligations, outlays) is reported in the financial statements of the parent entity.

As of September 30, 2022, and 2021, USSOCOM received allocation transfers from the following agencies:

Defense Acquisitions University (DAU), Defense Threat Reduction Agency (DTRA) and Defense Security

Cooperation Agency (DSCA).

1.AA. Transactions with Foreign Governments and International Organizations

USSOCOM does not report any transactions with Foreign Governments and International Organizations.

1.AB. Fiduciary Activities

USSOCOM does not report any fiduciary activities.

1.AC. Tax Exempt Status

As an agency of the federal government, USSOCOM is exempt from all income taxes imposed by any

governing body whether it is a federal, state, commonwealth, local, or foreign government.

1.AD. Standardized Balance Sheet, the Statement of Changes in Net Position and Related Footnotes

– Comparative Year Presentation

The format of the Balance Sheet has changed to reflect more detail for certain line items, as required for

all significant reporting entities by OMB Circular A-136. This change does not affect totals for assets,

liabilities, or net position and is intended to allow readers of this Report to see how the amounts shown on

the DoD-wide Balance Sheet are reflected on the Government-wide Balance Sheet, thereby supporting the

preparation and audit of the Financial Report of the United States Government. The presentation of the

fiscal year 2021 Balance Sheet and the related footnotes was modified to be consistent with the fiscal year

2022 presentation. The mapping of USSGL accounts, in combination with their attributes, to particular

Balance Sheet lines and footnotes is directed by the guidance published periodically under TFM, USSGL

Bulletins, Section V. The footnotes affected by the modified presentation are Note 6, Accounts Receivable,

Net; Note 10, Other Assets; Note 15, Other Liabilities; and Note 24, Reconciliation of Net Cost to Net

Outlays.

UNCLASSIFIED

UNCLASSIFIED

15

Note 2. Non-Entity Assets - Unaudited

Table 2. Non-Entity Assets

As of September 30 2022

2021

(Amounts in thousands)

1. Non-Federal Assets

A. Accounts Receivable

2

3

B. Total Non-Federal Assets $

2

$

3

2. Total Non-Entity Assets

$

2

$

3

3. Total Entity Assets

$

17,886,900

$

17,850,611

4. Total Assets

$

17,886,902

$

17,850,614

SFFAS 1: Accounting for Selected Assets and Liabilities, states assets available to an entity to use in its

operations are entity assets, while those assets not available to an entity but held by the entity are non-

entity assets. While both entity and non-entity assets are to be reported on the financial statements, the

standards require segregation of these asset types. In addition, a liability must be recognized in an amount

equal to non-entity assets (See Note 15, Other Liabilities). Based on this guidance, USSOCOM has

stewardship accountability and reporting responsibility for nonentity assets.

Non-federal Assets - Accounts Receivable (Public)

The primary component of nonentity accounts receivable is the public receivable data call adjustment. The

balance reports the interest, penalties, and fines as of September 30, 2022 and September 30, 2021. Each

quarter, a manual input of Treasury Report on Receivables (TROR) informs the entry through a journal

voucher into the Defense Departmental Reporting System (DDRS) to ensure the ending balance of the trial

balance reconciles to the source system. Generally, USSOCOM cannot use these proceeds and must remit

them to the U.S. Treasury unless permitted by law.

UNCLASSIFIED

UNCLASSIFIED

16

Note 3. Fund Balance with Treasury - Unaudited

Table 3. Status of Fund Balance with Treasury

As of September 30 2022 2021

(Amounts in thousands)

1. Unobligated Balance:

A. Available $

1,439,730 $ 1,185,417

B. Unavailable 533,436 632,252

Total Unobligated Balance

$

1,973,166

$ 1,817,669

2. Obligated Balance not yet

Disbursed

$

10,738,536 $ 10,064,798

3. Non-FBwT Budgetary Accounts:

A. Unfilled Customer Orders without

Advance

(742,437)

(466,294)

B. Receivables and Other (51,760)

(33,744)

Total Non-FBwT Budgetary Accounts

$

(794,197)

$ (500,038)

5. Total FBwT

$

11,917,505 $ 11,382,429

Treasury records cash receipts and disbursements on USSOCOM’s behalf; funds are available only for the

purposes for which the funds were appropriated. USSOCOM FBwT consists of appropriation accounts.

The Status of FBwT reflects the reconciliation between the budgetary resources supporting FBwT (largely

consisting of Unobligated Balance and Obligated Balance Not Yet Disbursed) and those resources provided

by other means. The Total FBwT reported on the Balance Sheet reflects the budgetary authority remaining

for disbursements against current or future obligations.

Unobligated Balance is classified as available or unavailable and represents the cumulative amount of

budgetary authority set aside to cover future obligations. The available balance consists primarily of the

unexpired, unobligated balance that has been apportioned and available for new obligations. The

unavailable balance consists primarily of unobligated appropriation from prior years (expired) that are no

longer available for new obligations.

Due to Coronavirus Aid, Relief and Economic Security (CARES) Act appropriations received during FY

2020, USSOCOM reported additional FBwT over prior years. See Note 29, COVID-19 Activity.

Obligated Balance not yet disbursed represents funds obligated for goods and services but not paid.

Based on Table 3 above, Non-FBwT Budgetary Accounts, such as unfilled customer orders and other

receivables, create budget authority and unobligated balances, but do not record to FBwT as there has

been no receipt of cash or direct budget authority, such as appropriations.

UNCLASSIFIED

UNCLASSIFIED

17

Unfilled Customer Orders Without Advance and Reimbursements is a receivable providing budgetary

resources when recorded. FBwT is only increased when reimbursements are collected, not when orders

are accepted or have been earned.

Total FBwT does not include funds held because of allocation transfers received from other federal

agencies. USSOCOM received allocation transfers from other federal agencies for execution on their behalf

in the amount of $33 million in FY 2022, and $36 million in FY 2021.

Material discrepancies exist between FBwT as reflected in USSOCOM general ledger and the balance per

U.S. Treasury records. FBwT reported in the financial statements has been adjusted to reflect USSOCOM’s

balance as reported by Treasury. The difference between FBwT in USSOCOM’s general ledgers and FBwT

reflected in Treasury accounts is attributable to transactions that have not been posted to the individual

detailed accounts in USSOCOM’s general ledger, because of timing differences or the inability to obtain

valid accounting information prior to the issuance of the financial statements. USSOCOM continues to work

with its service provider to determine the accurate total undistributed amount. When research is completed,

these transactions will be recorded in the appropriate individual detailed accounts in USSOCOM’s general

ledger accounts.

UNCLASSIFIED

UNCLASSIFIED

18

Note 4. Cash and Other Monetary Assets - Unaudited

For more information, see, Note 1.H, Cash and Other Monetary Assets.

UNCLASSIFIED

UNCLASSIFIED

19

Note 5.

Investments and Related

Interest

-

Unaudited

For more information, see, Note 1.I., Investments and Related Interest.

UNCLASSIFIED

UNCLASSIFIED

20

Note 6. Accounts Receivable, Net - Unaudited

Table 6. Accounts Receivable, Net

As of September 30

2022

Gross Amount Due

Allowance For

Estimated

Uncollectibles

Accounts Receivable, Net

(Amounts in

thousands)

1.Intragovernmental

Receivables

$ 49,338

$ 0

$ 49,338

2. Non

-

Federal

Receivables

(From the Public)

$ 2,330

$ (442) $ 1,888

3. Total Accounts

Receivable

$ 51,668 $ ( 442) $ 51,226

As of September 30

2021

Gross Amount Due

Allowance For

Estimated

Uncollectibles

Accounts Receivable, Net

(Amounts in thousands)

1.Intragovernmental

Receivables

$ 19,203

0

$ 19,203

2. Non-Federal

Receivables (From

the Public)

$ 2,694

$ (330) $ 2,364

3. Total Accounts

Receivable

$ 21,896 $ ( 330) $ 21,567

Gross receivables, including federal receivables, must be reduced to net realizable value by an allowance

for doubtful accounts in accordance with SFFAS 1 and Technical Bulletin 2020-1, Loss Allowance for

Intragovernmental Receivables. Loss allowance recognition for intragovernmental receivables does not

alter the statutory requirements for the debtor agency to make the payment or for the collecting agency to

seek and obtain payment. USSOCOM has opted not to include federal receivables in the calculation for the

allowance. Historically, USSOCOM’s federal aged receivables have been immaterial and have not been

delinquent greater than two years. Additionally, per SFFAS 1, Losses on receivables should be recognized

when it is more likely than not that the receivables will not be totally collected. USSOCOM’s federal

receivables have shown to be more likely to be collected timely.

Accounts receivable represents USSOCOM’s claim for payment from other entities. Claims with other

federal agencies are resolved in accordance with the business rules published in Appendix 5 of Treasury

Financial Manual, Volume I, Part 2; Chapter 4700. USSOCOM uses historical public accounts receivable

UNCLASSIFIED

UNCLASSIFIED

21

data to compute the allowance for doubtful accounts. Amounts with an age greater than two years are

considered doubtful for collection; these amounts are used in the allowance calculation.

USSOCOM does not currently have any cases that have generated an order for criminal restitution.

Presentational Changes

As of September 30, 2022, ‘Other assets’ of approximately $45 thousand have been reclassified from the

Accounts Receivable balance sheet line to Other Assets, in accordance with the TFM, Bulletin No. 2022-

12. For more information, see Note 1.AD., Standardized Balance Sheet, the Statement of Changes in Net

Position and Related Footnotes – Comparative Year Presentation.

UNCLASSIFIED

UNCLASSIFIED

22

Note 7. Loans Receivable, Net and Loan Guarantee Liabilities - Unaudited

For more information, see Note 1.K., Loans Receivable, Net and Loan Guarantee Liabilities.

UNCLASSIFIED

UNCLASSIFIED

23

Note 8. Inventory and Related Property, Net - Unaudited

Table 8A. Inventory and Related Property

As of September 30

2022

2021

(Amounts in thousands)

1. Operating Materiel & Supplies,

Net

2,524,723

2,509,937

2

.

Total Inventory and Related

Property, Net

$

2,524,723

$

2,509,937

USSOCOM does not have seized property, forfeited property, foreclosed property, and Goods held under

price support and stabilization programs.

See Table 8C., OM&S Categories for further information.

UNCLASSIFIED

UNCLASSIFIED

24

Table 8C. OM&S Categories

As of September 30

2022

OM&S,

Gross Value

Revaluation

Allowance

OM&S, Net

Valuation

Method

(Amounts in thousands)

A. Held for Use $

2,301,487

$

0

$

2,301,487

Note1

B. Held in Reserve for

Future Use

151,127

0

151,127

Note1

C. Held for Repair

72,109

0

72,109

Note1

D. Excess, Obsolete,

and Unserviceable

6,571

(6,571)

0

NRV

E. Total

$

2,531,294

$

(6,571)

$

2,524,723

As of September 30

2021

OM&S,

Gross Value

Revaluation

Allowance

OM&S, Net

Valuation

Method

(Amounts in thousands)

A. Held for Use $ 2,340,486

$

0

$

2,340,486

Note1

B. Held in Reserve for

Future Use 121,368

0

121,368

Note1

C. Held for Repair 48,083

0

48,083

Note1

D. Excess, Obsolete,

and Unserviceable 1,582

(1,582)

0

NRV

E. Total

$ 2,511,519

$

(1,582)

$

2,509,937

Legend for Valuation Methods:

Note 1: Moving Average Cost, Historical Cost, and Replacement Price

NRV = Net Realizable Value

UNCLASSIFIED

UNCLASSIFIED

25

USSOCOM’s Related Property is comprised of two OM&S asset categories: munitions and Uninstalled

Aircraft Engines (UAE). USSOCOM is reporting fixed wing UAE procured with Major Force Program (MFP)-

11 funds. These assets are valued at historical cost (HC).

USSOCOM is reporting all munitions procured with MFP-11 funds. Further, with Navy concurrence,

USSOCOM reports all munitions assets at the Naval Satellite Operations Center (NAVSOC). Navy

transferred ownership of any Navy-procured MFP-2 funded munitions to USSOCOM for financial reporting.

This is consistent with the GPP&E assets currently reported for NAVSOC. These are valued by Moving

Average Cost (MAC). All remaining munitions are currently valued at Replacement Price using current

catalog pricing. USSOCOM recognizes the latter is not in compliance with SFFAS 3 in this regard and

continues to work towards developing processes to implement MAC under the Consumption Method of

Accounting.

The values of each OM&S category were determined according to asset condition codes per the DoD

4000.25-2-M, Military Transaction Reporting and Accounting Procedures. Net realizable value is the

estimated amount that can be recovered from selling or disposing of an item less the estimated costs of

completion, holding and disposal. The “net realizable value” for materials classified as Excess, Obsolete,

and Unserviceable is zero. As a result, this balance has been written down to zero with the use of the OM&S

allowance account.

Underlying economic event details pertaining to OM&S have been largely unavailable. This is primarily due

to OM&S tracking issues, and system limitations; As of FY 2022, USSOCOM can report OM&S based on

the underlying activities: acquisitions, purchases, disposals gains, or losses for the current OM&S categories:

UAE and Munitions.

Currently, USSOCOM is unaware of any restrictions on the use of OM&S.

USSOCOM is in the process of applying deemed costs methods, in accordance with SFFAS 48 and/or

SFFAS 3, to establish opening balances for OM&S. USSOCOM is currently not making its unreserved

assertion to the completeness, valuation and accuracy of the OM&S beginning balances as of September

30, 2022, and 2021. See above, for additional information related to valuation methods. USSOCOM’s

systems, and the controls related to them, are not effective to support the fair presentation of the recorded

balances in accordance with GAAP.

Both UAE and munitions are aligned to OM&S categories based on Federal Supply Condition Codes as

noted in the respective material management system.

UNCLASSIFIED

UNCLASSIFIED

26

Note 9. General PP&E, Net - Unaudited

Table 9A. Major General PP&E Asset Classes

As of September 30

2022

Depreciation/

Amortization

Method

Service

Life

Acquisition

Value

(Accumulated

Depreciation/

Amortization)

Net Book

Value

(Amounts in thousands)

1. Major Asset Classes

A. General Equipment S/L Various

4,778,255

(2,846,725)

1,931,530

B. Construction-in-

Progress N/A N/A

1,338,620

N/A

1,338,620

C. Total General PP&E

$

6,116,876

$

(2,846,725)

$

3,270,150

As of September 30

2021

Depreciation/

Amortization

Method

Service

Life

Acquisition

Value

(Accumulated

Depreciation/

Amortization)

Net Book

Value

(Amounts in thousands)

1. Major Asset Classes

A. General Equipment S/L Various

4,741,378

(2,612,370)

2,129,008

B. Construction-in-

Progress N/A N/A

1,447,627

N/A

1,447,627

C. Total General PP&E

$

6,189,005

$

(2,612,370)

$

3,576,635

Legend for Valuation Methods:

S/L = Straight Line N/A = Not Applicable

USSOCOM’s current capitalization threshold is $250 thousand. USSOCOM financially reports all capital

GPP&E assets procured with MFP-11 funds for all Components/TSOCs; Plus NSWC, with Navy

concurrence, which includes MFP-2 funded assets. There are no restrictions on the use or convertibility of

GPP&E.

USSOCOM does not have acquisition values or acquisition dates for a portion of the GPP&E population and

uses deemed cost methodologies to provide GPP&E values for financial statement reporting purposes.

USSOCOM does have acquisition values and dates for GPP&E acquired after May 1, 2018.

Within FY 2022 and FY 2021, accounting adjustments were made to the USSOCOM’s GE assets to ensure

accuracy of values based on ongoing audit remediation efforts. These accounting adjustments were

recognized in gain/loss accounts when auditable data was not available to support restatement of prior period

financial statements.

UNCLASSIFIED

UNCLASSIFIED

27

Throughout FY 2021, USSOCOM worked to continually improve its GE financial reporting process and

data. These efforts continued throughout FY 2022.

Table 9B. Heritage Assets

For the Period Ended

September 30

2022

(physical count)

Categories:

Beginning

Balance

Additions (Deletions)

Ending

Balance

Museum Collection Items

(Objects, Not Including

Fine Art) 8,174

0

(8)

8,166

Museum Collection Items

(Objects, Fine Art) 785

0

(11)

774

For the Period Ended

September 30

2021

(physical counts)

Categories:

Beginning

Balance

Additions (Deletions)

Ending

Balance

Museum Collection Items

(Objects, Not Including

Fine Art) 8,175

3

(4)

8,174

Museum Collection Items

(Objects, Fine Art) 801

0

(16)

785

Heritage Assets

USSOCOM’s policy focuses on the preservation of its heritage assets, which are items of historical, cultural,

educational, or artistic importance. Heritage assets consist of museum collections. The heritage assets do

not relate to USSOCOM mission and are not reported on the financial statements.

Museum Collection Items

Museum collection items are items that have historical or natural significance; cultural, educational, or

artistic (including fine art, items such as portraits and artist depictions or historical value); or significant

technical or architectural characteristics.

The three additional artifacts reflected during FY 2021 were found during routine inventory. Museum

collection deletions mostly consist of 16 commercially produced lithograph prints (e.g., Jim Dietz, etc.) of

various historical subjects that are not SOF specific removed from US Army Center of Military History

database (AHCAS) as not being considered artifacts or artwork. They are retained by the Museum on local

unit property books, to be used for office/area decoration on hand receipts. Additionally, four line items were

removed from AHCAS as being incomplete, empty, or items already deaccessioned but not removed from

AHCAS; the deletions are correcting errors found in the database.

UNCLASSIFIED

UNCLASSIFIED

28

Stewardship Land

USSOCOM does not have any stewardship land.

Table 9D. General PP&E, Net ‒ Summary of Activity

For the period ended September 30

2022

2021

(Amounts in thousands)

1. General PP&E, Net beginning of year $

3,576,635

$

3,829,014

2. Capitalized acquisitions

560,112

492,188

3. Dispositions

(15,487)

(17,961)

4. Transfers in/(out) without reimbursement

(582,308)

(269,314)

5. Revaluations (+/-)

(34,447)

(428,530)

6. Depreciation expense

(234,355)

(28,762)

7. General PP&E, Net end of year $

3,270,150

$

3,576,635

UNCLASSIFIED

UNCLASSIFIED

29

Note 10. Other Assets - Unaudited

Table 10. Other Assets

As of September 30

2022

2021

(Amounts in thousands)

1. Intragovernmental

A. Other Assets 45

45

B. Total Intragovernmental $ 45

$

45

2.

Other than Intragovernmental

A. Outstanding Contract Financing

Payments $ 115,375

$

353,120

B. Advances and Prepayments 7,878

6,881

C. Subtotal 123,253

360,001

D. Less: “Outstanding Contract Financing

Payments” and “Advance and

Prepayments” totaled and presented on

the Balance Sheet as “Advances and

Prepayments” (123,253)

(360,001)

3. Total Other Assets

$ 45

$

45

Outstanding Contract Financing Payments, a separate classification of advances and prepayments,

includes contract financing payments made in contemplation of the future performance of services, receipt

of goods, incurrence of expenditures or receipt of other assets.

Contract terms and conditions for certain types of contract financing payments convey certain rights to

USSOCOM protecting the contract work from state or local taxation, liens or attachment by the contractors’

creditors, transfer of property, or disposition in bankruptcy. However, these rights should not be

misconstrued to mean that ownership of the contractor’s work has transferred to USSOCOM. USSOCOM

does not have the right to take the work, except as provided in contract clauses related to termination or

acceptance. USSOCOM is not obligated to make payment to the contractor until delivery and acceptance.

Outstanding Contract Financing Payments are estimated future payments to contractors upon delivery and

government acceptance.

Advances and Prepayments are made in contemplation of the future performance of services, receipt of

goods, incurrence of expenditures, or receipt of other assets, excluding those made as Outstanding

Contract Financing Payments.

Presentational Changes

For more information, see Note 1.AD, Standardized Balance Sheet, the Statement of Changes in Net

Position and Related Footnotes – Comparative Year Presentation and Note 6, Accounts Receivable.

UNCLASSIFIED

UNCLASSIFIED

30

Note 11. Liabilities Not Covered by Budgetary Resources - Unaudited

Table 11. Liabilities Not Covered by Budgetary Resources

As of September 30

2022

2021

(Amounts in thousands)

1. Intragovernmental Liabilities

A. Accounts payable $ 640

$

640

B. Total Intragovernmental Liabilities

$ 640

$

640

2. Other than Intragovernmental Liabilities

A. Accounts payable $ 161,281

$

165,125

B. Federal employee and veteran benefits

payable 63,908

62,915

C. Other liabilities 200

0

D

.

Total Other than Intragovernmental

Liabilities

$ 225,389

$

228,040

3. Total Liabilities Not Covered by

Budgetary Resources

$ 226,029

$

228,680

4. Total Liabilities Covered by Budgetary

Resources

$ 676,024

$

1,530,957

5. Total Liabilities

$ 902,054

$

1,759,637

Liabilities Not Covered by Budgetary Resources require future congressional action whereas liabilities

covered by budgetary resources reflect prior congressional action. USSOCOM fully expects to receive the

necessary resources to cover these liabilities in future years. See Note 13, Federal Employee and Veteran

Benefits Payable, for additional information related to 2.B., Federal employee, and veteran benefits

payable, in the table above.

Non-federal accounts payable not covered by budgetary resources represent amounts that are related to

canceled appropriations. Non-federal other liabilities are related legal contingencies. These amounts will

require resources that are funded from future-year appropriations. For additional information, see Note 17,

Commitments and Contingencies.

Intragovernmental Accounts Payable primarily represent liabilities in canceled appropriations, which, if paid,

will be disbursed using current year funds.

For additional information related to Other than Intragovernmental Other Liabilities, see Note 17,

Commitments and Contingencies.

Federal Employee and Veteran Benefits Payable consists of benefits that will be paid in the future. For

additional information, see Note 13, Federal Employee and Veteran Benefits Payable.

UNCLASSIFIED

UNCLASSIFIED

31

Note 12.

Debt

-

Unaudited

USSOCOM does not have Federal Debt and Interest Payable.

UNCLASSIFIED

UNCLASSIFIED

32

Note 13. Federal Employee and Veteran Benefits Payable - Unaudited

Table 13A. Federal Employee and Veteran Benefits Liability

As of September 30

2022

Liabilities

(Assets Available to Pay

Benefits)

Unfunded Liabilities

(Amounts in thousands)

1. Federal Employee and

Veteran Benefits Payable

(presented separately on

the Balance Sheet)

66,614

(2,706)

63,908

2. Other benefit-related

payables included in

Intragovernmental Other

Liabilities on the Balance

Sheet

4,440

(4,440)

0

3. Total Federal Employee

and Veteran Benefits

Payable

$

71,054

$

(7,146)

$

63,908

As of September 30

2021

Liabilities

(Assets Available to

Pay Benefits)

Unfunded Liabilities

(Amounts in thousands)

1. Federal Employee and

Veteran Benefits Payable

(presented separately on

the Balance Sheet) 64,181 (1,266) 62,915

2. Other benefit-related

payables included in

Intragovernmental Other

Liabilities on the Balance

Sheet 5,582 (5,582) 0

3. Total Federal Employee

and Veteran Benefits

Payable

$ 69,763 $ (6,848) $ 62,915

Other Benefit-Related Payables Included in Intragovernmental Other Liabilities on the Balance

Sheet

Other Benefit-Related Payables included in Intragovernmental Other Liabilities on the Balance Sheet

includes Employer Contributions and Payroll Taxes Payable. It represents the employer portion of payroll

UNCLASSIFIED

UNCLASSIFIED

33

taxes and benefit contributions for health benefits, retirement, life insurance and voluntary separation

incentive payments.

Other Benefits

Other Benefits includes Accrued Unfunded Annual Leave liabilities and are related to unfunded employee

leave. These amounts will require resources that are funded from future-year appropriations. Unfunded

civilian leave is funded as leave is taken. As of September 30, 2022, there was $63.9 million of accrued

unfunded annual leave.

Reconciliation of Beginning and Ending Liability Balances for Military Retirement and Other Federal

Employee Benefits

For additional information, see Note 1.T., Federal Employee and Veteran Benefits.

UNCLASSIFIED

UNCLASSIFIED

34

Note 14. Environmental and Disposal Liabilities - Unaudited

For more additional information, see Note 1.S., Commitments and Contingencies.

UNCLASSIFIED

UNCLASSIFIED

35

Note 15.

Other Liabilities

-

Unaudited

Table 15A. Other Liabilities

As of September 30

2022

Current

Liability

Non-Current

Liability

Total

(Amounts in thousands)

1. Intragovernmental

A. Liabilities for non-entity

assets

10

(8)

2

B. Other liabilities

(356)

0

(356)

C. Subtotal

(346)

(8)

(354)

D. Other Liabilities reported on

Note 13, Federal Employee

and Veteran Benefits

Payable

4,440

0

4,440

E. Total Intragovernmental $

4,094

$

(8)

$

4,086

2.

Other than

Intragovernmental

A. Accrued funded payroll and

leave $

33,680

$

0

$

33,680

B. Withholdings payable

203

0

203

C. Contract holdbacks

5,864

0

5,864

D. Contingent liabilities

0

200

200

E

. Other liabilities with related

budgetary obligations

359

0

359

F. Total Other than

Intragovernmental $

40,106

$

200

$

40,306

3. Total Other Liabilities

$

44,200

$

191

$

44,391

UNCLASSIFIED

UNCLASSIFIED

36

As of September 30

2021

Current

Liability

Non-Current

Liability

Total

(Amounts in thousands)

1. Intragovernmental

A. Liabilities for non-entity assets

9

(6)

3

B. Other liabilities

(323)

0

(323)

C. Subtotal

(314)

(6)