INT WORKING PAPER 06

Vice Presidency for Sectors and Knowledge

Integration and Trade Sector

2nd Quarter 2008

The Transportation Costs of Fresh Flowers:

A Comparison between Ecuador

and Major Exporting Countries

Henry Vega

The Transportation Costs of Fresh Flowers: A Comparison between Ecuador and

Major Exporting Countries

∗

Henry Vega, Ph.D. Candidate

Center for Transportation Policy, Operations, and Logistics,

School of Public Policy, George Mason University

†

Abstract

Exporting fresh flowers is one of very few successful efforts by producers in low-

income countries to compete in international markets of high-value agricultural goods.

While this success results from producers’ ability to take advantage of their geographic

location and access to low labor costs, it may not be sustainable in the long run due to

unreliable supply chains and high transportation costs. In this regard, it is important to

note that to date, there have not been many studies on the subject.

Using a case study approach of Ecuador’s supply chain, complemented by an

empirical analysis of microdata on exports from major fresh flower exporting countries to

the United States, this study confirms producers’ claims that time and transportation costs

vary widely across countries. The findings of this study indicate that in the Ecuadorian

case, time reliability of the supply chain is not the norm. For instance, a shipment of fresh

flowers, from the time of harvest on a farm located near Quito until the moment it arrives

to a U.S. retailer, can take from 44 ½ hours to almost 13 days. Furthermore, the results of

the study also show that depending on the time of the year, transportation costs can be 10

- 20 percent higher for Ecuador as compared to those of Colombia, or on average, about

$0.43 higher per kilogram.

While the sources of variations in transportation and time costs are beyond the

scope of this study, infrastructure and institutional constraints are widely recognized as

having a significant impact on the efficiency with which transportation systems operate.

These constraints are present in the case of Ecuador and include inadequacies in current

airport operations such as insufficient cargo facilities, runways that are too short to allow

large aircraft to take off with full loads, complex governance issues of economic rights in

air transportation, high costs of air navigation services, and the prevalence of unbalanced

trade flows with the United States.

Keywords:

Ecuador, air cargo, transportation costs, supply chain, floriculture

∗

Background paper for the IDB Report "Unclogging the Arteries. The Impact of Transport Costs on Latin American

and Caribbean Trade.” Inter-American Developing Bank and David Rockefeller Center for Latin American Studies.

Harvard University, 2008.

The author would like to thank Professor Kenneth Button and Professor David Hummels for the detailed and useful

comments that they provided. He is also indebted to Professor Naoru Koizumi and Dr. Ting Zhang for their advice on

several aspects of the statistical analysis. Finally, he gratefully acknowledges all the information provided by

Ecuador’s fresh flower industry experts, Alfonso Maldonado and Juan Abel Echeverría.

†

Mailing address: 4400 University Drive MS 3C6, Fairfax, VA 22030 U.S.A. E-mail: [email protected]

The views and opinions expressed in this publication are those of the authors and do not necessarily reflect the

official position of the Inter-American Development Bank.

Introduction

This study examines the legal commercial growth of flowers, an activity that has

evolved into a global industry since the turn of the last century.

1

Advances in genetics,

transportation, logistics, refrigeration, and telecommunications technologies have resulted in

the successful business of flower-growing in countries such as Colombia or Kenya and their

subsequent distribution and commercialization in distant markets such as the United States

and Russia. In this regard, innovations in the industry have translated into quality

predictability of some producers, which is no easy task to accomplish when doing business

with perishable goods.

2

Firms producing cut flowers range from very small to very large, vertically-integrated

operations. In addition, the flower industry’s value chain includes freight forwarders, export

and import agents, wholesalers or brokers, supermarkets, auction houses in the case of the

European market, and numerous retailers and providers of airfreight and trucking

transportation services. From a development perspective, the complexity of interactions

across value chain members and the lack of adequate transportation infrastructure are often

barriers to the entry of firms located in low-income countries. In Ecuador, for example, it took

about 20 years for new firms to learn from previous failed attempts.

Using Ecuador as a case study, this paper provides a qualitative description of the

value chain in the fresh-flower industry and a quantitative assessment of the magnitude of

transportation costs across a sample of major exporting countries. In the case of Ecuador, time

reliability of the supply chain is not the norm. For example, a shipment of fresh flowers, from

the time of harvest on a farm located near Quito until the moment it arrives to a U.S. retailer,

can take from 44 ½ hours to almost 13 days. In terms of cost, the results of this study confirm

what is commonly believed in the industry about the wide variation in international

transportation costs, even between neighboring countries. For example, depending on the

time of the year, they can be 10 - 20 percent higher for Ecuador as compared to those of

Colombia, or on average, about $0.43 higher per kilogram (kg).

3

It is also worth mentioning an

unexpected result of the analysis, which is that transportation costs are the lowest in February

1

Cut flowers are blossoms from flowering plants sold as stems, bunches, or arrangements (fresh, dried, or preserved). The main

types of cut flowers include carnations, roses, chrysanthemums, gladioli, tulips, orchids, lilies, alstroemeria, delphinium and

larkspur, gerbera daisies, iris, lisianthus, and snapdragons.

2

Good quality of fresh flowers is not only defined by type, size, color, absence of pests and diseases, and condition upon arrival,

but also by performance, or so-called vase or shelf life.

3

All denominations are in U.S. dollars unless otherwise stated.

even though this is the busiest month of the year as demand for transportation services

significantly rises due to the Valentine's Day holiday.

The paper covers a range of issues from the size and significance of the industry to the

regulatory framework surrounding the provision of air transportation services and is

organized as follows. The first section illustrates the importance of the industry using

Ecuador’s fresh-flower industry as a case study. The second section describes the main

characteristics of the value chain, and the third section identifies variations in airfreight costs

among major exporting countries. Finally, the study discusses institutional and regulatory

issues. Throughout the study, Colombia’s industry is used as a benchmark.

Floriculture a Global Industry

Estimates of the annual consumption of commercially grown flowers worldwide vary

by source and range from $40 - $60 billion. On the demand side, 80 percent of consumption is

accounted for by six countries, including Germany, the United States, the United Kingdom,

France, the Netherlands, and Switzerland.

4

While worldwide consumption has been on the

rise, at the same time, consumers have also become more sophisticated in demanding new

products. For example, the Russian market is well known for its preference for very large

flower buds. In addition, niche markets in former Soviet republics are becoming prime growth

prospects. To meet this growing and changing demand, production has continued to move

from countries that have traditionally been consumers and growers, such as The Netherlands,

to other relatively new producing countries. Data for 2004 data rank the Netherlands as the

leader with 62 percent of all value traded, followed by Colombia with 14 percent and Ecuador

with 7 percent (Hernandez et al, 2007).

5

The shift in production locations has mainly been driven by the existence of more

abundant labor and land elsewhere, and has been made possible by developments in air

transportation and refrigeration.

6

Thus, in the United States the business of growing flowers,

which began on the east coast and moved to western and southern states in the 1950s, has

4

The market share of world imports is as follows: Germany, 22 percent; United States, 15 percent; United Kingdom,

10 percent; France, 10 percent; the Netherlands, 9 percent; and Switzerland, 5 percent.

5

The total area dedicated to flower production worldwide has increased on a global basis. In 2001 it was estimated at

200,000 hectares (UNITC, 2001). In this regard, developing countries’ share of world exports increased from 21

percent in 1991 to 29 percent in 1998.

6

Air transportation made it possible in the United States to shift cut-flower production from the eastern states to the

western and southern states. Regularly scheduled commercial air flights eliminated eastern state growers’ ability to

charge a premium for freshness during the 1950s (Méndez, 1991).

2

since expanded to several low-income and least developed countries (LDCs).

7

The impact of

increased competition on prices has varied by region. While producers in South America have

benefited from flat prices in the U.S. market, by contrast, in Europe the impact of new African

suppliers has been reflected in a downward movement of prices. As a result, at the Dutch

Cooperative Auctions (VBN), while the import price of roses was $0.16 per stem in 1997, it fell

to $0.15 in 1998, $0.13 in 1999, and as low as $0.03 per unit in 2006. Differences among regions

are also apparent in labor productivity. Labor utilization varies from about six workers per

hectare in the Netherlands to 15 - 20 workers in South Africa, 25 - 30 in Kenya (Whitaker and

Kolavalli, 2006), and 10 - 13 in Ecuador (Expoflores, 2004).

In recent years, two developments have had a significant effect on the global market.

The first is increased competition in production and distribution. In this regard, established

producers such as Ecuador, Kenya, Malaysia, and Thailand have expressed concern about the

growth of the industry in China and India as China in particular is reportedly planning to

quadruple annual exports to $200 million or to more than a billion stems by 2010 (Bradsher,

2006).

8

On the distribution side, new flower centers have emerged in locations such as Dubai,

Tel Aviv, and Kunming, China. These centers are likely to affect overall efficiency and lower

transactions costs for distant producers, resulting in increased pressure on prices (as much as

80 percent of stems sold in the Dutch auctions are exported).

9

The second important development, to a large extent linked to increased competition,

is the considerable progress that has been made in consolidation and vertical integration. For

instance, in October 2006 the two largest Dutch cooperative auctions (FloraHolland and

Bloemenveiling Aalsmeer) announced their intention to merge. If the merger is authorized by

the Netherlands Competition Authority, the new entity would become the world’s largest

flower marketplace with combined sales of about $4.68 billion. Furthermore, in the United

States, large retailers such as Wal-Mart have increased the amount of purchases acquired

directly from growers under long-term contracts. A related development is that producers

7

Developing countries with well-established industries include Colombia, Kenya, Zimbabwe, Cote d’Ivoire,

Cameroon, the Dominican Republic, Jamaica, and Ecuador. Exports of cut flowers from LDCs increased from $18

million in 1995 to $45 million in 1999. LDC exporters include Zambia, Tanzania, Uganda, Malawi, Ethiopia, and

Rwanda. Exporters of foliage include Haiti, Madagascar ,and Malawi. Currently, LDC exporters have a larger

market share in the European Union than they do in the United States. For a study on the importance of LDCs to the

industry, see UNITC (2001).

8

China’s advantage may further increase due to abundant low-cost laborers who can clean the thorns of the roses

manually.

9

Chrysanthemums grown in Thailand, for instance, may travel to the Netherlands on their way to the Japanese

market. This uncovers what Jacques Teelen, FloraHolland CEO, calls a “disconnecting of the commerce and the

logistics” (Economist, 2007).

3

have also integrated. Dole Fresh Flowers, for example, has its own chartered daily

deliveries.

10

The U.S. Market

Consumption of fresh flowers per U.S. household amounted to $9.87 on average in

2006, with two-thirds supplied by imports, up from 50 percent in 1994. This growth rate

exceeds the demographic increase and consumption of other agricultural products (Malaga,

2005). Moreover, the effect of growth in consumption on prices has varied across flower

varieties. As seen in Table 1, in the case of roses, for instance, prices have remained steady

with a slight increase in 2004, up to about 40 cents per stem.

Table 1 – Average Unit Wholesale Prices by Flower Type (2000 – 2005)

Type 2000

2001

2002

2003

2004 2005

Chrysanthemums 0.31

1.30

1.31

1.30

1.33 1.40

Roses 0.37

0.37

0.37

0.38

0.40 0.39

Gerbera 0.31

0.31

0.30

0.30

0.31 0.31

Delphinium,

larkspur

0.25

0.24

0.23

0.24

0.25 0.24

Carnations 0.16

0.16

0.16

0.18

0.18 0.20

Source: Jerardo, (2006b).

In 2005 approximately 82 percent of imported fresh flowers came from countries in

the Western Hemisphere, with Colombia contributing 59 percent of the total, followed by

Ecuador with 18 percent. Roses from Central and South American countries made up about

half of all U.S. imports, which in 2005 totaled 1.35 billion stems (Jerardo, 2006a). Table 2

further illustrates the importance of the U.S. market for exports of flowers from the Western

Hemisphere.

Ecuador’s Fresh cut Flowers

Ecuadorian flowers, particularly roses, have been recognized as among the finest in

the world. The quality of Ecuadorian flowers is the result of a combination of production

10

Dole’s farms produce over 250 million stems and increasingly assemble value-added products such as ready-to-sell

bouquets. Its Miami operation is a 328,000-square-foot building located on 17 acres, which features research labs and

merchandise rooms to showcase about 820 flower varieties.

4

factors including ideal ecological zones (geographic advantage: altitude higher than 2,000

meters above sea level in the equatorial zone), relative proximity to the United States,

availability of rich volcanic soils, abundant labor, and inventive entrepreneurs who seek to

match flower, field, and market to maximize profits (Sawers, 2005). Notwithstanding its

success, the development of Ecuador’s floriculture industry has been a lengthy process

characterized by early failures and later successes. Ecuador first attempted to export fresh

flowers between 1963 and 1977, but export growth was limited by poor air transportation

links to the U.S. market, a lack of technical know-how, and an absence of related industries.

Table 2 – Value of U.S. Imports of Cut Flowers by Country in

$Million (2000 – 2005)

Country 2000

2001

2002

2003

2004 2005

Colombia 347.20

302.40

289.50

343.60

415.00 418.30

Ecuador 89.20

99.70

87.30

105.80

134.30 129.40

Netherlands 71.60

67.10

71.30

67.60

65.90 64.70

Costa Rica 19.40

14.70

15.20

17.10

18.80 23.50

New

Zealand

2.40

3.20

3.30

4.00

4.30 4.60

Guatemala 5.50

3.40

3.00

3.90

4.10 3.90

Brazil 0.10

0.10

0.70

2.00

2.30 2.90

Chile 2.90

3.40

2.90

2.30

2.00 2.60

Kenya 0.00

0.00

0.50

0.90

1.10 1.20

China 1.40

1.40

1.00

1.50

1.00 1.00

World 610.50

565.50

541.70

610.90

705.90 709.10

Source: U.S. Census Bureau Foreign Trade Division Foreign Trade Statistics Database

The industry was revitalized in 1983,

11

and in the two decades that followed, the area

of cultivated flowers grew to approximately 5,000 hectares according to Ecuador’s Association

of Producers and Exporters of Fresh-Cut Flowers (Expoflores).

12

Of this total, 60 percent were

roses. The industry is still relatively young, and as it has matured, only some degree of

consolidation has taken place. As shown in Table 3, between 1997 and 2003, the average farm

11

Before Ecuatoriana de Aviacion, Ecuador’s national carrier, scheduled a weekly flight in 1990, producers had to

wait for unoccupied cargo space on passenger planes to transport their products (Arbeláez et al, 2007).

12

Expoflores represents about 70 percent of producers.

5

size increased from 10.27 to 12.90 hectares. Given economies of scale, further consolidation of

the industry is expected in the future. In this regard, as average growers expand their

operations, they will likely be increasingly in a position to take advantage of cost efficiencies.

Another important development concerns the fact that producers have become more

automated and have developed a cost advantage relative to smaller producers. For example,

in Colombia 40 firms with a size larger than 50 hectares account for 50 percent of exports.

13

Furthermore, in the United States, large greenhouse growers can produce ornamental crops at

a per-square-foot cost that is 18 percent lower than growers half their size (Schumacher and

Marsh, 2003).

From an economic development standpoint and as shown in Table 3, the industry has,

in some cases, improved the socio-economic condition of impoverished rural Ecuadorian

communities by adding an average of more than 5,500 jobs a year over the last decade. In

total, it has generated more than 70,000 direct jobs to date.

14

Table 3 – Ecuador's Floriculture Industry Statistics

Year Area (hectares) Number of Farms Average Farm Size Direct Jobs

1997 2,250 219 10.27 25,320

1998 2,700 241 11.20 35,348

1999 2,803 271 10.34 35,715

2000 2,977 277 10.75 36,097

2001 3,208 282 11.38 36,457

2002 3,262 284 11.48 37,130

2003 3,263 253 12.90 39,153

2004 3,396 295 11.51 44,214

2005 3,417 305 11.20 58,259

2006 3,441 350 9.83 76,758

Source: Expoflores

13

According to Colombia’s Association of Flower Producers (Asocolflores), there are 60 medium firms with a size of

20-50 hectares representing 25 percent of exports and 200 small producers whose area is smaller than 20 hectares

representing an additional 25 percent of exports.

14

Expoflores has estimated that 700,000 people are employed in floriculture-related industries, including

agrochemicals, irrigation systems, air cargo transportation and logistics, packaging materials, and food services.

6

Furthermore, because of spatial concentration, in some counties, the industry is the

single largest employer (see Table 4). In this regard, about 66 percent of the cultivated area is

located in a single province, Pichincha, and about 22 percent in two adjacent provinces,

Cotopaxi and Imbabura.

15

Table 4 – Concentration of Flower Farms, Ecuador (2005)

Province Number of ha %

Pichincha 2,256 66

Cotopaxi 581 17

Imbabura 171 5

Guayas 164 5

Azuay 161 5

Other 83 2

Source: Expoflores

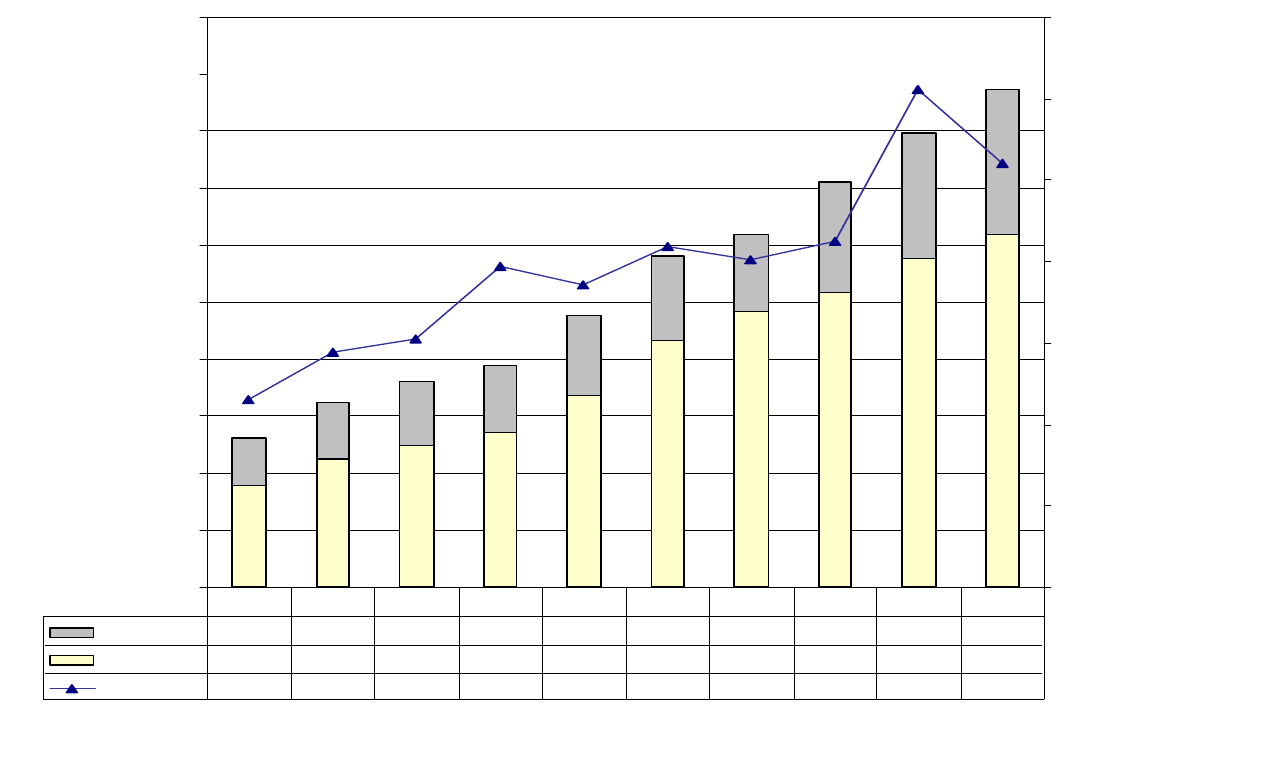

As for its significance in the larger economy, between 1997 and 2006 exports grew by

almost 26 percent a year from $131 million to $436 million. Fresh flower exports are now the

country’s third largest non-oil source of foreign currency. Only export revenue from bananas

and shrimp exceeds that of the fresh flower industry.

16

Figure 1 shows the growth of the

industry in volume and value.

As shown in Table 5, in 2006 by far the number one destination of Ecuador’s fresh

flower exports was the United States. Approximately 58 percent of value of exports, or 63

percent of volume, was destined for this country. Russia occupied the number two position

with a considerable smaller market share of 14 percent of value, or 12 percent of volume.

15

Similarly, in Colombia, 85 percent of firms are located in the Sabana de Bogotá.

16

According to Ecuador’s Export and Investment Promotion Corporation statistics, non-oil exports represented $5.18

billion in 2006.

7

8

Table 5 – Destination of Ecuador's Exports of Fresh Flowers (2006)

Destination Kg $ F.O.B.

1

$ F.O.B.

1

per

kg

% kg % F.O.B.

1

United States 65,606

254,041

3.87 63 58

Russia 12,535

59,094

4.71 12 14

Netherlands 11,014

48,115

4.37 11 11

Spain 1,863

10,940

5.87 2 3

Canada 2,483

10,803

4.35 2 2

Germany 1,752

9,021

5.15 2 2

Italia 1,537

7,960

5.18 1 2

Switzerland 1,267

6,188

4.88 1 1

Japan 517

5,283

10.23 0 1

Chile 808

3,215

3.98 1 1

Argentina 269

972

3.61 0 0

Other 4,513

20,211

4.48 4 5

Total 104,164

435,843

4.18 100 100

1

Free on board prices.

Source: Ecuador’s Central Bank

Production costs can be roughly broken down as follows: labor, around 60 percent;

packing material, 10 percent; chemical products, 9 percent; construction maintenance, 5

percent; consumption materials, 3 percent; energy and fuel, 1 percent; and cuttings, 12 percent.

These costs are doubled when adding expenses for marketing, finance, transportation, import

duties and overhead (Arbeláez et al, 2007). According to Asocolflores, one dollar’s worth of

exported flowers increases tenfold once it reaches the end consumer in the United States.

0

50,000

100,000

150,000

200,000

250,000

300,000

350,000

400,000

450,000

500,000

Year

Exports $

0

20,000

40,000

60,000

80,000

100,000

120,000

140,000

Exports kg

$ Other

41,369 50,009 56,376 59,246 69,660 74,440 66,751 97,167 109,674 126,691

$ Roses

89,641 111,953 124,023 135,405 168,391 215,886 241,987 257,651 288,233 309,151

Volume Kg

45,948 57,770 60,935 78,825 74,230 83,631 80,363 84,853 122,185 104,164

1997 1998 1999 2000 2001 2002 2003 2004 2005 2006

9

Figure 1 – Ecuador’s Export of Fresh Flowers (1997 – 2006)

Source: Ecuador’s Central Bank

Value Chain and Transportation Costs in the Industry

As approximately 15 percent of worldwide air cargo is made up of perishables,

17

the

importance of transporting perishable goods is growing. And as computers and other goods

typically moved by air are increasingly being transported by ship, perishables have

experienced an annual growth in volume over 7 percent. Measured as a share of new freight

tonne kilometer (FTK),

18

perishables are growing at 12 percent annually, a rate exceeded only

by that of capital equipment and intermediate materials and ahead of computers and apparel

(von Heereman, 2006). In some South American and African countries, air transportation of

perishables represents 80 - 90 percent of total exported airfreight. Notwithstanding these facts,

however, air transportation networks connecting countries in these regions are not well

developed. Countries lack either the infrastructure or the amenities, or both, to optimize time

and cost of the value chain. In fact, industry estimates suggest that up to 35 percent of total

production is lost after harvest due to mishandling and loss of quality in the form of vase

life.

19

In addition, in many instances due to seasonality and inaccuracy in harvest forecasting,

scheduling air services in advance can also be costly as producers contracting chartered

services have to bear the cost of both outbound and inbound flights.

From an efficiency point of view, an examination of the aspects of reducing

transportation costs and the loss of product quality is particularly relevant since producers

appear to be in the weakest position to profit. As Table 6 illustrates, while profit margins

differ by region, the producer’s share can be as low as 4 percent in the Netherlands, in the

United Kingdom, or in Germany, while the margin for the retailer can be as high as 42 percent

in the United Kingdom, or 36 percent in the United States.

17

High value-to-weight perishables include fresh flowers, seasonal fruits and vegetables, exotic fruits and vegetables,

and fresh fish and seafood.

18

One FTK is one metric tonne of revenue load carried one kilometer.

19

The post-harvest treatment of flowers involves a value chain in which the processes carried out by chain members

influences quality. After harvesting, in order to guarantee a vase life of about 7 days, all processes must occur in the

shortest possible time under controlled temperature and humidity until final purchase

10

Table 6 – Profit Margins on Sales of Perishables

Point of Sale Producer Forwarder Airline Wholesaler Retailer

United States 6% 25% 16% 17% 36%

Netherlands 4% 32% 14% 39% 11%

United

Kingdom

4% 30% 15% 19% 42%

Germany 4% 35% 13% 25% 23%

Switzerland 5% 34% 14% 23% 24%

Source: Von Heereman (2006)

From the producers’ perspective, factors with the potential to reduce transportation

and logistics costs include:

• increased competition among airlines resulting in reasonable airfreight rates

• stable rates

• overall increased reliability and minimizing transit time variability

• guaranteed customer service from air cargo agencies (freight forwarders)

• suitable equipment and facilities for handling perishables

• appropriate storage capacity at different times

• adequate interface across transportation modes

• transparent and low administrative costs: easy booking, billing, claims

Ecuador’s Value Chain Analysis

Value chains, also referred to as supply chains, are defined as institutional

arrangements linking producers, processors, marketers, and distributors – often separated by

time and space – that progressively add value to products as they go through the chain (see

Button, 2001; Nabi and Luthria, 2002). In complex supply chains, the competitiveness of a

sector depends on the existence of firms in related industries to provide support services,

capital goods, inputs, and information. Firms in the production stage are in charge of

processes usually involving research and development, technical know-how, infrastructure,

planting and growing, materials procurement, harvest and on-farm post-harvest treatment,

and packaging. On the logistics side, public entities and private firms often interact in the

provision of public infrastructure such as roads, telecommunications, electricity, airport

facilities, scheduled air services, freight forwarding and handling systems, cold storage,

11

refrigerated trucking, quality control, and customs clearance. Finally, firms on the marketing

side provide services involving information about supply and demand, advertising,

compliance with quality and environmental standards, and customer service.

A general overview of Ecuador’s fresh flower industry distribution supply chain is

presented here. One of the challenges of supply chain analysis is the difficulty in defining a

structure that is applicable to all firms. Thus, due to the heterogeneity of Ecuadorian

producers, some have relatively short distribution supply chains consisting of two or three,

while others have supply chain lengths that may include more than eight members. The

purpose here is therefore to identify members and to assess variations in time from the

moment flowers are harvested until they arrive in Miami. Figure 2 shows a short supply chain

that represents an ideal scenario, while Figure 3 illustrates a scenario closer to current

circumstances. A description of supply chain members follows.

Road Transportation Infrastructure

Ecuador’s public transportation infrastructure includes 43,197 km of roads, of which

6,467 km are paved (Ecuador, 2007). Since most farms are located within a few hours of two

major cities, the roads that connect farms to cargo agencies’ facilities are usually in good

condition.

Cargo Agencies

Neither Quito’s International Airport (UIO) nor Guayaquil’s International Airport

(GYE) has sophisticated refrigeration facilities for the storage of perishables. However, this

need has been met by numerous freight forwarders, also known as cargo agencies. There are

about 80 agencies that have refrigerated rooms and the capability of dispatching fleets of

trucks to transport semi-consolidated shipments to the airport.

12

Figure 2

Supply Chain of the Fresh Flower Industry with Reduced Number of Participants

PLANTACION

CAMION

AGEN

CAMION

FARMS

DOMESTIC

TRANSPORT

AIRCRAFT

DOMESTIC AIR CARGO

FACILITY AT ORIGIN AIRPORT

FOREIGN AIR CARGO FACILITY

AT DESTINATION AIRPORT

TRANSPORT IN

FOREIGN MARKET

RETAILER &

END CONSUMER

Source: Adapted from Expoflores (2007a)

Figure 3

Current Participants in Supply Chain of Ecuador’s Fresh F0ower Industry

PLANTACION

CAMION

AGEN

AVION

FARMS

TRANSPORT TO AIR CARGO

AGENCIES

AIRCRAFT

TEMPORARY

STORAGE

FOREIGN DESTINATION FACILITY / IES

TRANSPORT IN

FOREIGN MARKET

RETAILER &

END CONSUMER

CAMION

PALLETIZING

TRANSPORT

TO AIRPORT

Source: Adapted from Expoflores (2007a)

13

Cargo agents provide two main services: guaranteeing cargo space with airlines and

temporary storage. They may also act as an export agent in Ecuador and an import agent at

the destination port.

20

Regarding the handling of freight from Ecuador to the U.S., larger

agencies, such as Garcés & Garcés, offer their services for $25 per box, while smaller

competitors charge fees on average up to $60 per box. Table 7 below further highlights the

important factor of economies of scale as it relates to the fee structure.

Table 7

Selected Cargo Agencies’ Average Handling Fees per Box of Fresh Flowers,

Quito (2007)

Cargo Agency Number of

Employees

Weekly Boxes

to the United

States

Handling Fees per

Box

Garcés & Garcés Cargo Services 57 15,000

$25-$35

Fresh Logistics Carga 45 7,500

$30

Royal Cargo 60 3,500

$35

Panamerican Cargo 3 1,000

$40

Sierra Cargo 12 500

$50

Corporación Logística Integral 30 30

$60

Source: Expoflores Logistics Census

Palletization

As with most cargo, perishable products transported by air need to be placed on top

of pallets. This task is usually performed by the airline or by a contractor with the airline. Fees

vary depending on whether the customer is an airline or a cargo agent. According to

Expoflores (2007b), palletization fees range from $0.04 to $0.32 per box. As for the

palletization process, although efforts are made to keep the flowers refrigerated, it is not

uncommon to observe airlines palletizing cargo under open environment conditions due to

20

Some also offer transportation services to move the product from farms to their facilities, but most medium and large operations rely on

their own trucks for this task.

14

infrastructure constraints. In the context of this discussion, it is important to mention that

ideally, fresh flowers should be kept at temperatures below 3 degrees Celsius at all times.

Temperatures in Quito range between 9 and 20 Celsius. In Guayaquil, temperatures are on

average 10 degrees Celsius higher.

Airport Infrastructure

UIO, Quito’s international airport, is located inside the city limits at about 2,814

meters above sea level and is open between 5:45 a.m. and 1:00 a.m. everyday. However,

during the high season for perishables, in coordination with Ecuador’s General Civil Aviation

Directorate (DGAC), it operates 24 hours a day. The airport has a single runway, which is

3,120 meters long. A new Quito airport is scheduled to open in 2009 and is being built in a

valley 24 kilometers west of the city at 2,400 meters above sea level.

There are three major constraints affecting exports of perishables from Ecuador. First,

because of altitude constraints, only short-to-medium-range aircraft can land including A-340s,

MD-11s, B-737s, B-757s, A-310s, and A-320s. For the same reasons, aircraft cannot take off

fully loaded.

21

Second, there is only a limited size area for refrigerated storage, about 7,000

square meters. During high season, the area fills very rapidly, and it is not uncommon to see

boxes of flowers stored on the airport’s tarmac. Third, the fee structure at Ecuadorian airports

has a major impact on the cost of transporting perishable exports. As Table 8 illustrates, at

$2,221, UIO landing and other fees for an aircraft weighing 150 metric tons, are the highest in

Latin America. Airlines have objected to these fees because: (1) they are being used to finance

the construction of the new airport, and (2) air navigation fees collected by the DGAC at major

airports are used to cross-subsidize the provision of air navigation services at small and rural

airports. From an economic efficiency point of view, the rationale behind the first criticism

may not make much sense as the same airlines will likely benefit from improved air

navigation services and increased number of slots in the new airport; however, efforts to

cross-subsidize other airport operations with little or no regularly scheduled service is viewed

by critics as regressive. In any event, the airlines’ objections have had little or no impact on

how the DGAC sets its fees.

21

A Boeing 757 jumbo-jet, although suitable for operating out of UIO, is capable of transporting only up to 6,000 boxes when

taking off at an altitude of 600 meters or less.

15

Table 8 – Estimated Landing and Other Fees at Selected Airports (March 2007)

Country Airport

Code

Landing Fees Other Fees Total

Ecuador UIO 1,661

560

2,221

Ecuador GYE 952

305

1,257

Colombia BOG 1,075

84

1,159

Costa Rica SJO 60

427

487

Guatemala GUA 40

112

152

Source: International Air Transport Association (IATA), Ecuador.

Airlines

From the start of the growth of the industry, guaranteeing cargo space on passenger

flights has been a major problem. It was not until 1990 that the now defunct state-owned

carrier Ecuatoriana de Aviación dedicated aircraft exclusively for cargo. Today, only a

handful of carriers offer routes from Ecuador to the United States and Europe. Table 9 lists

currently scheduled passenger and cargo services. In recent years integrated cargo carriers

have become more important in Ecuador. An industry survey of airlines reveals that in 2005,

cargo-only carriers such as Lan Cargo, Martin Air, Arrow Air, Cargolux, Tampa Cargo, and

UPS together transported almost 79 percent of cargo out of Ecuador. In addition, the use of

chartered cargo aircraft has remained an option that is mainly taken advantage of during the

peak season.

U.S. International Airports

Miami International Airport (MIA) is the center of the U.S. flower distribution system.

Two thirds of the flowers consumed in the United States are received by MIA, followed by

New York International Airport (JFK), Los Angeles (LAX), and Dallas (DFW). In 2003 imports

of flowers through MIA were valued at $967 million. Approximately 130 importers manage

offices and cooling facilities of more than 130,000 square meters and employ about 6,100

workers. Between 35,000 and 70,000 boxes arrive at MIA everyday depending on the time of

the year (AFIF, 2007).

16

At MIA, flowers are kept in cooling facilities at all times. Inspection by the U.S.

Department of Agriculture’s Animal and Plant Health Inspection Service (APHIS), which

checks flowers for pests and diseases that may threaten U.S. agriculture, can take up to four

hours. Often the flowers are checked in electronically by U.S. Customs before landing, and

APHIS officers perform inspections 24 hours a day, seven days a week. Only 500 boxes per

day or 2 percent of shipments are found to be non-compliant under APHIS regulations.

22

Congestion delays at U.S. airports are a major concern as they are not uncommon

nowadays. In the context of this discussion, the time an aircraft spends taxiing on the runway

is very critical in affecting quality if the cargo hold is not air conditioned. For instance, it is

common practice for pilots of passenger planes to switch off an engine after landing with the

aim of saving fuel, thus leaving the cargo hold exposed to the outside temperature.

Table 9 – Scheduled Outbound Service, Quito International Airport (August 2007)

Airline Number of

Flights

Days /

week

Route Aircraft Type

Aircomet 1 1 UIO-GYE-MAD A-343 Passenger

Aircomet 1 2 UIO-GYE-MAD A-332 Passenger

American 2 7 UIO-MIA B-752 Passenger

Continental 1 7 UIO-IAH B-738 Passenger

Delta 1 7 UIO-ATL B-752 Passenger

Iberia 1 7 UIO-GYE-MAD A-343 Passenger

KLM 1 6 UIO-BON-AMS MD-11 Passenger

Lan Ecuador 1 7 UIO-JFK-MAD B-763 Passenger

Lan Ecuador 1 7 UIO-MIA B-763 Passenger

Lan Cargo 1 5 UIO-MIA

B-767 /

DC-10 Freighter

Arrow Air 1 1 UIO-GYE DC-10 Freighter

Martinair 1 2

UIO-GYE-MIA-

AMS

MD-11 Freighter

Martinair 1 1

UIO-GYE-SJU-

AMS MD-11 Freighter

UPS 1 1 UIO-GYE-MIA B-757 Freighter

UPS 1 1 UIO-GYE-MIA B-757 Freighter

Source: Quito International Airport.

Foreign Destination Activities: Marketing and Distribution

There are different channels through which flowers are marketed and distributed in

the United States. Once the flowers clear U.S. Customs and APHIS, there are two possible

marketing scenarios: (1) a traditional channel involving importer, wholesaler, retailer; or (2) a

22

If this occurs, the importer has three options: (1) return the shipment to the country of origin, (2) fumigate it, or (3) destroy it.

The first option is the most expensive; fumigating is the favored option depending on the price of the shipment. Destroying the

product is done when the costs of fumigation are too high with respect to the price of the shipment (Malaga, 2005).

17

channel characterized by vertical integration with several wholesalers associated with large

retailers such as Wal-Mart.

23

About 90 percent of flowers imported from Colombia are

marketed through alliances with vertically integrated import companies in the U.S.

(Hernandez et al, 2007). By contrast, only 30 percent of Ecuadorian exports are marketed this

way.

24

Under the first scenario, estimates for 2002 reveal that in addition to at least 130

importing firms in Miami, distribution channels for imported fresh flowers are made up of

about 1,000 wholesalers countrywide, 57,000 specialized retailers (florists), and 60,000 retail

chain stores. About 90 percent of flowers imported through Miami are sold outside the state

of Florida (Arbeláez et al, 2007). From Miami, shipments can reach any city in the continental

United States by truck in less than 5 days.

Retailers

Retailers are the final stop for the imported flowers before the product reaches the

end consumer. Retailers include traditional florist shops, online stores, supermarket chains,

roadside vendors, gas stations, drugstores, etc. Supermarkets account for almost 40 percent of

U.S. flower sales (Sawers, 2005), and their importance is continuously increasing as the

industry aims to spread sales evenly throughout the year. According to Miami (2004), five

holidays account for 95 percent of all purchases of fresh flowers as a percentage of retail

dollars. These holidays are: Valentine’s Day, 36 percent; Mother’s Day, 27.4 percent;

Christmas/Hanukkah, 15.1 percent; Easter/Passover (8.9 percent); and Thanksgiving Day, 7.4

percent.

Assessing the “Hidden Cost” of Time in the Value Chain

Given the lack of data on incremental value contributed by each member of the flower

supply chain, here an effort is made to complement the analysis by offering insight into the

variability in the length of time flowers remain with each member of the supply chain. With

the goal of obtaining as much consistency as possible in the data, a questionnaire was sent to

the individuals responsible for operations at major cargo agencies in Quito, and their

23

Other retailers, such as Equiflor, one of the five largest flower importers, either own or lease hundreds of hectares in several

countries, the purpose being to guarantee production and quality predictability throughout the year (Malaga, 2005).

24

Small firms in particular usually opt for alternative ways to distribute flowers in the United States, which involves the use of a

broker such as Armellini, a transportation company that acts as an intermediary between the producer and the retailer, without

ever taking possession of the cargo.

18

responses were used to fill in some of the blanks that emerged in the information found in

published sources.

Table 10 provides a summary of the amount of time that a shipment of flowers spends

under the control of different supply chain members. In terms of the variation in the time used

for each process, it is apparent that producers’ demand for reliability and adequate interface

with other modes has clearly not been met. From the moment of harvest until the time the

product arrives to the U.S. retailer, the trip can take anywhere from 44 ½ hours to almost 13

days. Assuming that roses can last up to 14 days in good condition if handled properly after

harvesting and a modest retail shelf life expectancy of seven days, it is reasonable to state that

from the seventh day in transit onwards, the cost of time increases as each additional travel

day lowers the quality and consequently the price of the product.

Table 10 – Potential to Affect Quality throughout the Supply Chain

Process Time Potential to affect

quality

Post-harvest on farm, Ecuador 4 - 8 hours

Medium

Storage on farm 12 - 72 hours

Low – Medium

Transportation to cargo agencies 1 - 6 hours

Medium

Storage at cargo agency 4 hours

Low

Palletizing, Quito 6 hours

Medium – High

Customs clearance, Quito 0.5 hours

Low

Loading to aircraft, Quito 1 - 2 hours

Medium – High

Flight UIO-MIA nonstop 4 hours

High

Customs clearance, Miami 4 - 12 hours

Low

Depalletizing, Miami 2 - 4 hours

High

Storage at cargo agency, Miami 4 - 72 hours

Low – Medium

Transportation to U.S. retailer 2 hours - 5 days

Medium

International Transportation Costs

A frequent claim of Ecuadorian fresh flower producers is that transportation costs are

higher in Ecuador than in other countries, which significantly reduces competitiveness. In this

regard, arguments supporting this contention are often anecdotal based on the “asking price”

rate a freight forwarder is most likely to quote. Compared with their Colombian counterparts,

producers assert that the freight rate from Ecuador is $1.60 per kg, while in Colombia it is

$0.96. By contrast, IATA statistics indicate a freight rate somewhere in the middle between

$1.31 and $1.38 per kg. Additional estimates suggest that transportation costs of Ecuadorian

19

flower exports account for as much as 25 percent of the wholesale unit price of a stem in the

United States and 33 percent in Europe. It is important to note that there is an important

caveat regarding these estimates as they do not take into account the evolution of the freight

rate through time or the effect of seasonality.

Using import data from the U.S. Bureau of Census, Foreign Trade Statistics, this

section discusses variations among airfreight rates of fresh flowers, specifically of roses, across

a sample of major exporting countries. This single product has been chosen to facilitate

comparisons. Moreover, roses are very representative because of their large share in the

market for imported fresh flowers.

Methodology and Data

When assessing transportation costs, due to the heterogeneity of supply chain lengths,

a common measurement approach is to estimate average freight rates at the country level.

However, when one of the trading partners is the United States, an indirect method, which

estimates average freight rates using data obtained from the free-alongside-shipping (FAS)

value and cost-insurance-freight (CIF) value of imports, can be used (Yeats, 1989; Cai et al,

2007).

Airfreight costs are defined by the U.S. Bureau of Census as “the aggregate cost of all

freight, insurance, and other charges, excluding U.S. import duties.” Yeats (1989) reports that

insurance is approximately equal to 10 percent of total import charges. Thus, airfreight costs

may be expressed as follows:

25

Airfreight costs = (CIF value – FAS value) × 0.90 (1)

FAS and CIF microdata are made available by the U.S. Census Bureau Foreign Trade

Division through monthly statistics published as U.S. Imports of Merchandise. Following Cai

et al (2007), the following two measures of freight rates are calculated: i) freight costs per kg of

cargo, and ii) freight costs per dollar of cargo’s FAS value.

Freight costs per kg = Freight costs × Shipping weight

-1

(2)

Freight costs per dollar = Freight costs × Export value

-1

(3)

25

The FAS value – also called the customs value – reflects the costs of obtaining merchandise and placing those products

alongside the vessel at the export port, while the CIF value represents the landed value of the merchandise at the first port of

arrival. The difference between the CIF and FAS values represents import charges, which include both freight costs and

insurance. A 2006 study by Micco and Serebresky finds that insurance fees make up about 15 percent of total air charges.

20

This calculation takes into account differences in quality and other aspects between

units of cargo under the same Harmonized System category within and across countries. The

empirical analysis is complemented by regression analysis of a fixed effects model using

cross-sectional panel data on freight costs, FAS value, and the shipping weight of rose exports

to the United States.

The purpose is twofold. First, a model is used to determine whether or not there are

significant differences between the shipping rates of the countries in the sample. This is done

using dummy variables to isolate for country-specific and time-specific effects. Shipping rates

are estimated in dollars per kilogram (FKG) using the values calculated with equation (2) and

as a percentage of dollar exported (FVAL) using the values calculated with equation (3). The

country of Colombia, the month of February, and the year 2000 are used as benchmarks.

FKG = β

i

COUNTRY

i

+… + β

i

COUNTRY

j

+ β

k

MONTH

1

+…+ β

l

MONTH

12

+

+ β

m

YEAR

1

+…+ β

n

YEAR

7

+ ε (4)

FVAL = β

i

COUNTRY

i

+… + β

i

COUNTRY

j

+ β

k

MONTH

1

+…+ β

l

MONTH

12

+

+ β

m

YEAR

1

+…+ β

n

YEAR

7

+ ε (5)

Second, a model is used to measure how freight costs (F), measured in logarithms,

relate to the country of origin, month, and year intercepts, after controlling for shipping

weight and FAS value. The country of origin dummy is intended to capture all fixed

conditions of a country such as distance and infrastructure.

26

Again, the country of Colombia,

the month of February, and the year 2000 are used as benchmarks. The estimations of the

model allow for synthesizing and averaging variations in freight rates, across countries and

through time. They also allow for interpreting them as percentages.

ln F

i

= β

i

COUNTRY

i

+… + β

i

COUNTRY

j

+ β

k

MONTH

1

+… + β

l

MONTH

12

+

+ β

m

YEAR

1

+…+ β

n

YEAR

7

+ β

o

ln WEIGHT

ij

+ β

p

ln FAS

j

+ ε (6)

The designated category among trade classifications for flowers in the U.S.

Harmonized System is 0603110060: “roses, fresh, suitable for bouquets or for ornamental

purposes, not elsewhere specified or included (NESOI).” This category includes all roses

26

This approach is adapted from Hummels (2001) whereby the total freight bill to the importer and commodity

intercepts are related to the weight and value of the shipment and the distance it travels. In this modified approach,

distance is dropped as its effect is constant and is already captured in the country dummy variable.

21

except for those with small blooms and spray roses. Roses from Central and South American

countries make up about half of all U.S. fresh flower imports. In 2005 approximately 82

percent of imported fresh flowers came from these countries, with Colombia making up 59

percent of the total, followed by Ecuador with 18 percent.

The sample of countries includes only those with regular monthly shipments to the

United States for at least five years during the seven year period from 2000 – 2006. The data

used correspond to imports into all ports.

27

As the two largest suppliers of imported roses to

the United States are Colombia and Ecuador, much of the analysis concentrates on

comparisons between these two countries.

Results

From 2000 to 2006, the results show that the value of rose exports has continued to

increase in a typically seasonal fashion, as is often observed in perishables markets. In Figure

4, it is observed that in the month of February, when supply and demand for roses experience

a considerable expansion, Colombian exports increased from $24.8 million in 2000 to $38.3

million in 2006. Similarly, Ecuadorian exports rose from $10.6 million in 2000 to $14.9 million

in 2006. In the seven-year period, roses exported from Colombia represented about $1.042

billion,

or about $149 million per year, while roses exported from Ecuador during the same

period accounted for about $450 million or $64 million per year.

27

Using more disaggregated data, freight rates can be estimated for each landing port; however, because the purpose

here is to identify the average freight rate, the U.S. aggregated data used will suffice.

22

Figure 4 – Monthly Export of Roses from Selected Countries,

$Thousands (2000-2006)

0

5,000

10,000

15,000

20,000

25,000

30,000

35,000

40,000

2000

2001

2002

2003

2004

2005

2006

Year

Thousands $

Colombia

Ecuador

Source: U.S. Census Bureau Foreign Trade Division Monthly Statistics

Measured in metric tons, volumes also vary throughout the year. Again, February

was the busiest month. Table 11 shows that in February 2006 Colombia exported 8,483 metric

tons but only 2,570 metric tons in June; it also indicates that Ecuador exported 3,519 metric

tons in February but only 1,249 metric tons in November.

Table 11

Export of Roses in Metric Tons from Selected Countries, Monthly Record Lows

and Highs (2000-2006)

Country Low/High

1

2000

2001

2002

2003

2004 2005 2006

Colombia Low 1,641

1,631

1,689

2,067

2,026 2,567 2,570

High 5,831

5,790

4,914

6,357

6,577 7,117 8,483

Ecuador Low 971

1,000

778

847

1,044 1,161 1,249

High 2,982

3,867

2,789

2,888

3,335 2,908 3,519

Guatemala Low 57

28

30

37

29 23 32

High 208

171

207

211

166 175 204

1

For all three countries, February is the month with the highest shipping weight. March, June, August, November,

and December are the months with the lowest shipping weight.

Source: U.S. Census Bureau Foreign Trade Division Monthly Statistics and author’s calculations.

23

In both cases, the exported weight in February is three to four times as much as the

amount exported in the month with the record low. In the case of Guatemala, as can be

observed in 2005, it is about eight times as much. Accordingly, providing appropriate storage

capacity at different times can be very costly.

Considering the effects of distance, it is logical that Ecuador’s transportation costs are

slightly higher than those of Colombia, but still not as high as those of the Netherlands. As

shown in Table 12, Ecuador’s rates in February 2007, expressed as a percentage of cargo value,

were much higher (12 percent) than those of Colombia and, unexpectedly, higher (10 percent)

than those of the Netherlands. Only Kenyan and Israeli exports were subject to higher freight

rates.

In 2006, which was the year with the highest rates, at $1.35 per kg, Ecuador’s average

freight rate for February was 50 percent higher than that of Colombia and 37 percent higher

six months later in August. However, February rates are still lower than the figure for August.

In previous years (not shown here) the effect of the Valentine’s season (“Valentine’s effect”)

on February’s freight rates was more obvious.

Table 12 – Transportation Costs of Roses from Selected Countries to

the United States

Country Distance to February 2006 August 2006

Main entry Shipments Freight Shipments Freight

U.S. airport Quantity Price

1

percent

cargo

Quantity Price

1

percent

cargo

(statute miles) (000 kg) ($/kg) $/kg

2

Value

3

(000 kg) ($/kg) $/kg

2

value

3

Colombia 1,506 8,483 4.51 0.898 20 2,836 4.10 0.895 22

Ecuador 1,787 3,519 4.23 1.350 32 1,278 3.74 1.227 33

Guatemala 1,017 204 4.19 0.468 11 40 4.51 0.866 19

Netherlands 4,120 63 4.49 0.984 22 n/a n/a n/a n/a

Kenya 7,947 33 3.46 2.746 79 3 3.53 3.030 86

Costa Rica 1,117 2 5.51 1.093 20 3 6.53 1.707 26

Israel 5,677 1 3.41 2.294 67 n/a n/a n/a n/a

1

Shipment prices equal to cargo FAS value divided by quantity. Data obtained from the U.S. Foreign Trade Statistics

2

Freight rates calculated based on the formula as shown in (1).

3

Calculated based on the previous two columns.

Source: U.S. Census Bureau Foreign Trade Division Monthly Statistics and Author’s Calculations.

24

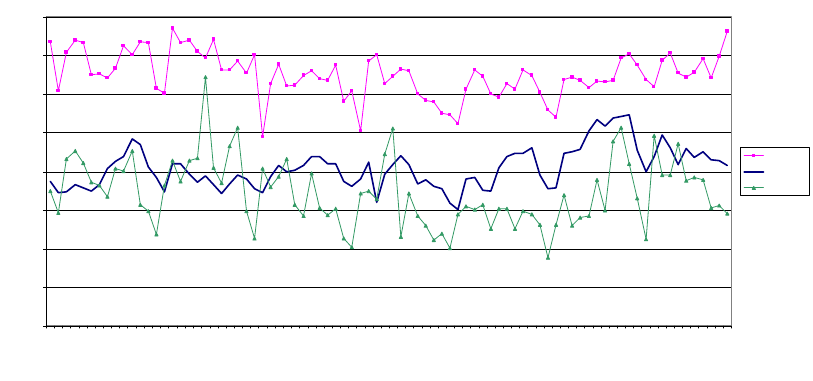

Overall, throughout the entire period covered in this study, Ecuador’s transportation

costs were higher than Colombia’s, both in terms of dollars per kg (Figure 5) and as a

percentage of shipment value (Figure 6). While it appears that these costs began to converge

towards the end of the year 2005, in 2006 the trend stopped when some of the highest

transportation costs were recorded.

Figure 5

Average Monthly Transportation Costs of Roses in $/kg, Selected Countries

(2000 – 2006)

0.00

0.20

0.40

0.60

0.80

1.00

1.20

1.40

2000

2001

2002

2003

2004

2005

2006

Ye ar

$/Kg

Ecuador

Colombia

Guatemala

Source: U.S. Census Bureau Foreign Trade Division Monthly Statistics and Author’s Calculations.

25

Figure 6 - Average Monthly Transportation Costs of Roses Measured as a

Percentage of Shipment Value, Selected Countries (2000 – 2006)

0

5

10

15

20

25

30

35

40

2000

2001

2002

2003

2004

2005

2006

Ye ar

% Cargo Value

Ecuador

Colombia

Guatemala

Source: U.S. Census Bureau Foreign Trade Division Monthly Statistics and Author’s Calculations.

Sorting Out Freight Rates Using Regression Analysis

The results of the estimation of variations in freight costs are presented here. Table 13

contains the coefficients related to different specifications of equations (4), (5), and (6).

Coefficients are within the expected values from the descriptive analysis performed earlier. To

control for serial autocorrelation, dummy variables for month and year were added. In

equation (6), the transformation of the variables to logarithms reduced multicollinearity

problems. In general and on average during the whole period studied, when compared to

Colombia’s transportation costs, it can be stated that airfreight rates for Ecuador were 43 cents

higher (Model I) per kg, and 15 points higher as a percentage of shipment value (Model II).

After controlling for shipping weight and value (Model III), the coefficient associated with the

dummy variable for Ecuador accounted for a 15 percent increase in airfreight transportation

costs. This result is in line with the descriptive statistics presented earlier.

26

Table 13 – Regression Results of the Estimation of Variation in Freight Costs

Dependent

Variable:

$ per kg

Dependent

Variable: percent

of Shipment Value

Dependent Variable: Log Freight

Costs

Independent

Variable

Model I Model II Model III

95% Conf. Interval

Colombia (dropped) (dropped) (dropped)

Costa Rica 0.05 1.60 -0.27*** -0.34 -0.20

Ecuador 0.43*** 15.23*** 0.15*** 0.10 0.20

Guatemala 0.04 -0.12 -0.16*** -0.22 -0.11

Israel 1.11*** 18.85*** 0.07* -0.01 0.14

Kenya 1.67*** 44.35*** 0.31*** 0.25 0.38

Netherlands 0.82*** 11.65*** 0.07** 0.00 0.14

South Africa 2.24*** 47.59*** 0.24*** 0.16 0.32

Year 2000 (dropped) (dropped) (dropped)

Year 2001 0.25** 7.90*** 0.03 -0.02 0.08

Year 2002 0.15 6.09** -0.04 -0.09 0.01

Year 2003 0.19* 4.42* -0.04 -0.09 0.01

Year 2004 0.07 2.31 -0.07** -0.12 -0.02

Year 2005 0.29** 3.53 -0.01 -0.07 0.04

Year 2006 0.52*** 12.34*** 0.04 -0.01 0.10

February (dropped) (dropped) (dropped)

January 0.34** 9.81*** 0.03 -0.04 0.09

March 0.57*** 12.27*** 0.06 -0.01 0.12

April 0.55*** 16.90*** 0.09*** 0.03 0.16

May 0.47*** 12.39*** 0.07** 0.00 0.13

June 0.75*** 16.14*** 0.10*** 0.04 0.17

July 0.49*** 11.97*** 0.06* -0.01 0.12

August 0.51*** 13.33*** 0.07** 0.00 0.13

September 0.54*** 13.94*** 0.07** 0.00 0.14

October 0.51*** 16.64*** 0.07** 0.00 0.14

November 0.59*** 13.82*** 0.08** 0.01 0.14

December 0.29** 8.24** -0.06* -0.13 0.01

Weight, log 0.50*** 0.33 0.67

Value, log 0.45*** 0.28 0.61

Adjusted R

2

0.815 0.814 0.998

Note: N = 527 for all regressions.

***

Significant at the 0.01 level.

**

Significant at the 0.05 level.

*

Significant at the 0.10 level.

27

Although Ecuadorian exports faced lower freight rates of about 30 cents per kg

(Model I) compared to those of the Netherlands, when the freight rate is calculated as a

percentage of the shipment value (Model II), transportation costs of Dutch roses are lower by

about 3.6 percent. Moreover, imports from other countries outside the Western Hemisphere

were subject to higher transportation costs, and as expected, due to their proximity to the

United States, imports from Guatemala and Costa Rica had lower transportation costs.

The coefficient associated with the dummy variable for the year 2006 was higher than

the coefficients associated with dummies for previous years in all model specifications. Of all

months, April and June were the two months associated with the largest increase of freight

rates when compared to the rates applied in February.

The “Valentine’s Effect”

The results of the analysis suggest, unexpectedly, that transportation costs are the

lowest in February. In theory, low transportation costs in February may be the result of

various factors. In this regard, exactly how relevant these factors are is an empirical question

that goes beyond the scope of this study. Nevertheless, from an empirical standpoint, the

following five factors merit special attention (Button, 2007):

(1) Economies of scale and density as more flowers are moved during February;

(2) Spare capacity in the air transportation fleet because of lower demand elsewhere

in the system or for additional empty capacity on particular aircraft;

(3) Lower demand for transportation of flowers, driving the price of competitive transport

down;

(4) More predictable demand in a particular time period resulting in low-cost forward

contracts for transportation services; i.e. less of a risk premium; and

(5) Higher demand for transportation services into the flower areas thus reducing the

overall cots of in-bound and out-bound movements of goods (flowers being the

outbound part).

Clearly, neither lower demand in February nor higher demand for inbound

transportation services are the case. Therefore, any one of the other three factors, or the

interaction of two or more of them, would likely be the driving force behind lower

transportation costs in February.

28

Alternatively, as pointed out by Hummels (2007), at least in the case of Ecuador which

presents only a low “Valentine’s effect” (Figure 5) on transportation costs measured in terms

of dollars per kilogram, but a very high effect when measured as a percentage of shipment

value (Figure 6), the source of the “Valentine’s effect” could be the peak in the price of roses in

February. That is, if the transportation cost per kilogram is constant, then a rise in the price of

roses due to the Valentine’s Day holiday is what causes the share of the transportation costs in

shipping value to fall. Therefore, it may be an increase in the price of roses, and not a fall in

the price of transportation costs, that causes the seasonal effect of February.

Challenges to Reducing Air Transportation Costs

Despite successful efforts to remove the most severe constraints on trade, such as

tariffs, recently it has become clear that there are other limitations to the free movement of

goods and factors of production, most notably, sub-optimally high transportation costs.

Indeed, for a variety of technical reasons and especially due to the development of

containerized freight systems and supply-side logistics, the global costs of moving many types

of cargo have fallen. However, both internal and external transportation costs have generally

remained high for low-income countries (Button, 2006). From an economic growth perspective,

the importance of reducing air transportation costs derives mainly from its increasing role in

the movement of perishable products and “exotics.” Up to 80 percent of air cargo exports

from South America (i.e., 340,000 tons to the United States and 150,000 tons to Europe in 2006)

and Africa (i.e., 310,000 tons to Europe) are perishables with extremely short shelf lives.

In light of these developments and the fiscal constraints of lower income countries,

decisions on infrastructure investments need to be carefully assessed from a public policy

perspective. By simply looking at the heterogeneity of airfreight rates for a single commodity,

roses grown in Central and South America, it is very difficult to explain what the sources of

inconsistency among airfreight rates are. Even though providing an explanation goes far

beyond the scope of this study, this section provides a contextual framework for a discussion

of air transportation costs in the fresh flower industry. Table 14 lists the elements of this

framework.

29

Table 14

Microeconomic and Macroeconomic Conditions Influencing Airfreight Rates

Microeconomic Conditions Macroeconomic Conditions

• Economies of scale

• Economies of speed

• Economies of density

• Economies of diversity

• Economies of experience

• The peak load problem

• Multilateral settings

• National aviation policy

• Lack of airport competition

• Increased safety and security

standards

• Bilateral trade relations

Microeconomic Conditions Affecting Transportation Costs

Due to a variety of economic factors, the direct impact of distance on the cost of travel

is often offset in transportation networks. For example, the importance of distance often

diminishes when airlines adopt a hub-and-spoke structure. Higher load factors, the use of

larger planes that cost less per-traveled-mile than smaller planes, and more frequent flights

that allow for increased aircraft utilization further reduce costs. A discussion of several

microeconomic factors affecting transportation costs follows.

Economies of Scale and Density

Air transportation is a network industry, and as such, is subject to network effects.

The presence of economies of scale on the supply side implies that an airline’s marginal costs

are increasingly lower as it fills to full capacity for a given origin-destination airport pair (i.e.,

the larger the quantities transported, the lower the unit cost). The presence of economies of

density on the demand-side also leads to lower marginal costs. Consequently, an airline’s total

costs associated with servicing an extra origin-destination airport pair will decrease with each

additional service. In developed markets, with a view to achieving economies of density in

air transportation, specialized air cargo carriers such as FedEx and UPS have adopted

complex hub and spoke networks. By contrast, due to geographic and infrastructure

constraints and the relatively small size of the market, air transportation networks have

remained underdeveloped in South America.

28

28

For a comprehensive review of issues surrounding air transportation networks see Ricover and Negre (2004).

30

Economies of Speed and Increased Diversity

In contrast to other modes of transportation, economies of speed in aviation allow for

aircraft to potentially be repositioned to almost anywhere in the world within hours. In an

industry with overcapacity and increased price competition, the diversity of aircraft that can

be chartered allows for the supply of air cargo services to be augmented almost instantly, once

a critical mass of cargo exists. Consequently, as the amount of cargo ready to fill a plane

increases, the types of aircraft that can be used also expands, and freight rates decrease due to

the spread of the aircraft’s fixed costs over a larger shipment.

Economies of Experience

Although in a high-information and low-transaction cost world, it is logical to expect

that all providers of transportation services would optimally have access to the same

technology and equal opportunity to bid for inputs, in reality, in the highly complex field of

international commerce and logistics, experience contributes to lower transaction costs.

Experience, for example, allows firms to more effectively organize work teams, establish

higher effort standards, and recruit, train, and retain more productive employees (Idson and

Oi, 1999). Specialized air cargo carriers are more likely to realize these economies through

investing in research, training of personnel in the handling of perishables, and developing

relationships with other agents such as freight forwarders and wholesalers. In this regard,

integrated cargo airlines, such as UPS or FedEx have the advantage of dedicated facilities and

personnel to address the complexities of dealing with perishable products.

29

The Peak Load Problem

While passenger business is generally bidirectional, cargo is not. Rather, freighter

routes are often imbalanced. This implies that when transporting goods from point A to point

B, the freight rate charged must also cover the return trip from B to A. While this issue may be

seen by the producer as discriminatory pricing, the transportation economics literature has

long reflected that price differences in the presence of peak loads do not imply discrimination

(Hirshleifer, 1958). When the demand for transportation services is unidirectional, freight

rates are simply higher as the shipper pays for foregone capacity on either the inbound or

outbound flight. When the trade imbalance is strongly positive (more exports than imports),

transportation costs for exports tend to be higher than for imports. As reflected in Table 15,

29

With the exception of UPS, major cargo carriers do not serve the Ecuadorian market.

31

compared to other countries exporting roses to the United States, Ecuador has the most

marked trade imbalance with the United States. Not surprisingly, Ecuador’s freight rates are

also higher.

Table 15 – Trade with the United States in Metric Tons (2006)

Trading Partner Exports Imports Flow Unbalance

Ecuador 54,017

10,972

0.66

Kenya 3,708

1,361

0.46

Colombia 131,231

58,288

0.38

Costa Rica 28,909

13,694

0.36

Guatemala 14,685

8,795

0.25

Israel 51,018

35,148

0.18

Netherlands 76,477

112,170

-0.19

South Africa 8,234

21,957

-0.45

Source: U.S. Census Bureau Foreign Trade Division Monthly Statistics and Author’s Calculations.

Macroeconomic Conditions Increasing Transportation Costs

The macroeconomic conditions affecting the flower industry’s transportation costs

relate to the institutions governing and regulating air transportation. Institutions are

important as they can be instrumental in either facilitating or hindering the efficient allocation

of resources (Coase, 1937), and their influence – in some cases – can even be superior to

market forces, at least in the short-run. The main governance and regulatory issues

surrounding the provision of air cargo services are described next.

Multilateral Settings

In 1944 the United Nations’ Convention on International Civil Aviation established

the International Civil Aviation Organization (ICAO) in an effort to reach a comprehensive

32

multilateral agreement on the exchange of economic rights and aviation safety. Due to a lack

of multilateral support at the time, today markets for air services are dependent on a series of

complex bilateral air service agreements. For instance, a commercial aircraft’s right to fly over

South America is potentially subject to compliance with 65 bilateral agreements and the

payment of "overfly" bills, as most countries charge fees for using their airspace.

In contrast to what has occurred in other regions of the world since 1978, only in

recent years has there been some movement towards the liberalization of aviation in South

America. In the Andean Community, in 1991 progress was made towards the establishment of

a common aviation policy for its four country members when an integration initiative was

launched. Based on the “open skies” principle, within the sub-region, airlines of the member

states are given free access. However, member states have not granted cabotage rights to a

third-country airline.

30

In another region of South America, progress towards extending

liberalization to the Southern Common Market (MERCOSUR) countries has been strongly

resisted by labor unions. Therefore, the restrictive policies of South American countries

contrasts with those of other developing countries such as India, which have unilaterally

declared open skies for all cargo and allow foreign airlines to serve domestic routes.

Ecuador’s Aviation Policy

The General Civil Aviation Directorate (DGAC), part of the armed forces until 2002, is

responsible for providing air navigation, aircraft safety and security, and management

services for all Ecuador’s airports. The only exceptions are Quito and Guayaquil where a

concessionaire is in charge of management. In the context of this discussion, it is also worth

mentioning that Quito’s air navigation fees are the highest in the region, which creates an

additional disincentive for airlines to serve this market. In addition and as mentioned earlier

in this paper, DGAC uses surplus revenues collected at self-sustaining airports to cross-

subsidize the construction and provision of air navigation services at smaller airports.

Overseeing the DGAC is the National Civil Aviation Council (CNAC), the regulatory

body in charge of defining policy for airport infrastructure and air navigation services.

Among its other responsibilities, CNAC authorizes new routes, negotiates international

services agreements, and determines fares. Generally, with respect to determining fares, in

Ecuador and in other Latin American countries there seems to be a strong interest in

30

Cabotage is defined as transportation services provided between two airports located in the same country irrespective of the

country in which the aircraft is registered.

33

protecting domestic carriers from increased competition based on the argument that it would

lead to “airline consolidation leaving small airlines having to face the reality of economies of

scale” (Drosdoff, 2001).

Lack of Airport Competition

Ecuador’s airports enjoy monopoly power as there is no competition between airports

for international traffic. Moreover, until 2002, airport facilities did not operate with

commercial criteria, but rather with the objective of providing the DGAC with a valuable

source of foreign revenue. And while some degree of competition could be achieved if

traveling time between the two major airports of Quito and Guayaquil were shortened, the

reality is that regional disagreements over a hundred years old have halted the construction of

a high-speed highway that could connect the two points in less than four hours.

Increased International Safety and Security Standards