A common EU approach to

liability rules and

insurance for connected

and autonomous vehicles

European Added Value

Assessment

Accompanying the

European Parliament's

legislative own-initiative

report (Rapporteur: Mady

Delvaux)

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 1

The European added value of a common EU approach to

liability rules and insurance for connected and autonomous

vehicles

Study

In accordance with Article 225 of the Treaty on the Functioning of the European Union, the

European Parliament has a right to request that the European Commission take legislative action.

The Conference of Presidents of the European Parliament therefore authorised its Committee on

Legal Affairs (JURI) to draft a legislative initiative report on the civil law rules on robotics.

1

All European Parliament legislative initiative reports (INI) must automatically be accompanied

by a detailed European added value assessment (EAVA). Accordingly, the JURI Committee asked

the Directorate-General for Parliamentary Research Services (EPRS) to prepare an EAVA to

support the legislative initiative report on civil law rules on robotics prepared by Mady Delvaux.

The purpose of the European added value assessment is to support a legislative initiative of the

European Parliament by providing a scientifically based evaluation and assessment of the

potential added value of taking legislative action at EU level. In accordance with Article 10 of the

Interinstitutional Agreement on Better Law-Making,

2

the European Commission should respond

to a request for proposals for Union acts made by the European Parliament by adopting a specific

communication. If the Commission decides not to submit a proposal, it should inform the

European Parliament of its detailed reasons, including a response to the analysis on the potential

European added value of the measure requested.

Abstract

The findings of this European added value assessment (EAVA) suggest that it is necessary to

revise the current legislative EU framework for liability rules and insurance for connected and

autonomous vehicles. Not only would revision ensure legal coherence and better safeguarding

of consumers rights but it would also be likely to generate economic added value. It is argued

that accelerating the adoption curve of driverless or autonomous vehicles (AVs) by five years has

the economic potential to generate European added value worth approximately €148 billion.

1

Report with recommendations to the Commission Civil Law Rules on Robotics, 2015/2103(INL), European

Parliament, Rapporteur: Mady Delvaux (S&D, Luxembourg).

2

Interinstitutional Agreement between the European Parliament, the Council of the European

Union and the European Commission on Better Law-Making, OJ L 123, 12.5.2016, pp. 1-14.

European Added Value Assessment

PE 615.635 2

This analysis has been drawn up by the European Added Value Unit within the European

Parliamentary Research Service (EPRS). It builds on two expert research studies carried out by

the Utrecht Centre for Accountability and Liability Law and RAND Europe for the European

Added Value Unit of the European Parliament's DG EPRS. The two expert research papers are

presented in full in Annex I and Annex II

Annex I

Legal analysis of the EU common approach on the liability rules and insurance related to

connected and autonomous vehicles , by Dr E.F.D. Engelhard and R.W. de Bruin, LL.M., within

the Utrecht Centre for Accountability and Liability Law

Annex II

Socio-economic analysis of the EU common approach on the liability rules and insurance

related to connected and autonomous vehicles by Charlene Rohr and Fay Dunkerley at RAND

Europe and by Professor David Howarth from the University of Cambridge.

AUTHOR

Tatjana Evas

European Parliamentary Research Service, Impact Assessment and European Added Value

Directorate, European Added Value Unit

European Parliament

B-1047 Brussels

To contact the unit, please e-mail EPRS-EuropeanAdded[email protected]

LINGUISTIC VERSIONS

Original: EN

Manuscript completed in February 2018.

© European Union, 2018.

This document is available on the internet at:

http://www.europarl.europa.eu/thinktank/en/home.html

DISCLAIMER

This document is prepared for, and addressed to, the Members and staff of the European

Parliament as background material to assist them in their parliamentary work. The content of the

document is the sole responsibility of its author(s) and any opinions expressed herein should not

be taken to represent an official position of the Parliament.

Reproduction and translation for non-commercial purposes are authorised, provided the source

is acknowledged and the publisher is given prior notice and sent a copy.

PE 615.635

ISBN 978-92-846-2550-5

DOI: 10.2861/282501

QA-04-18-027-EN-N

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 3

Table of contents

Executive summary ....................................................................................................................... 5

1. Introduction ................................................................................................................................ 7

1.1. Background ....................................................................................................................... 7

1.2. Methodology and scope of the European added value assessment .......................... 8

2. EU law and policy context ........................................................................................ 11

2.1. Applicable EU law .......................................................................................................... 11

2.2. EU programming documents relating to AVs ............................................................ 12

2.3. Position of the European Parliament ........................................................................... 13

2.3.1 Results of the European Parliament's public consultation ........................... 14

2.4. Position of the European Commission ........................................................................ 16

2.4.1 Review of existing legislation ........................................................................... 16

2.4.2 Studies on AVs.................................................................................................... 18

3. Limitations of and gaps in the current framework ............................................. 20

3.1. Existing risks: shift in liability ...................................................................................... 22

3.1.1 Product Liability Directive and Motor Insurance Directive ............................ 22

3.2. New risks not explicitly addressed by current EU legislation on motor vehicles . 24

3.3. Procedure and standards for establishing liability .................................................... 27

4. EU policy response to current gaps and limitations............................................ 27

4.1. Need to take action or intervene at EU level .............................................................. 28

4.2. Subsidiarity and proportionality .................................................................................. 29

4.3. Policy options and their impact .................................................................................... 29

5. European added value .............................................................................................. 32

5.1 Economic analysis .......................................................................................................... 32

5.2. Comparative legal analysis ........................................................................................... 33

5.3. Comparative assessment of policy options and European added value ................ 35

6. Conclusions ................................................................................................................ 37

European Added Value Assessment

PE 615.635 4

List of tables

Table 1 – Methodology for measuring European added value ......................................................... 10

Table 2 – Main EU legal and policy instruments on civil liability relating to motor vehicles ...... 11

Table 3 – Main activities of the European Commission in relation to the deployment of AVs .... 16

Table 4 – Main studies related to liability issues for AVs by the European Commission ............. 19

Table 5 – Main risks in the current system versus those in a mobility system based on AVs ...... 21

Table 6 – Summary of the main gaps under the current PLD regulation that could potentially

have a negative effect on consumers in the light of the introduction of AVs ................ 23

Table 7 – Summary of the main gaps under current MID and national traffic liability rules ..... 24

Table 8 – Policy option 1: baseline scenario ......................................................................................... 30

Table 9 – Policy option 2: reform of Product Liability Directive ....................................................... 30

Table 10 – Policy option 3: reform of the Motor Insurance Directive ............................................... 31

Table 11 – Policy option 4: new legislation and no fault insurance .................................................. 31

Table 12 – Summary of cost-benefit analysis of scenarios for the EU (€ billion in 2015 prices) ... 33

Table 13 – Summary: potential European added value ..................................................................... 35

Table 14 – Comparative policy options – European added value assessment ................................ 36

Table 15 – Summary of impacts by stakeholder group included in the CBA ............................... 162

Table 16 – Proportion of new cars and all cars that are FAVs, by scenario (%) ............................ 166

Table 17 – Summary CBA impacts of scenarios for the EU (€bn in 2015 prices) .......................... 169

Table 18 – Assessment of legislative policy options ......................................................................... 173

List of figures

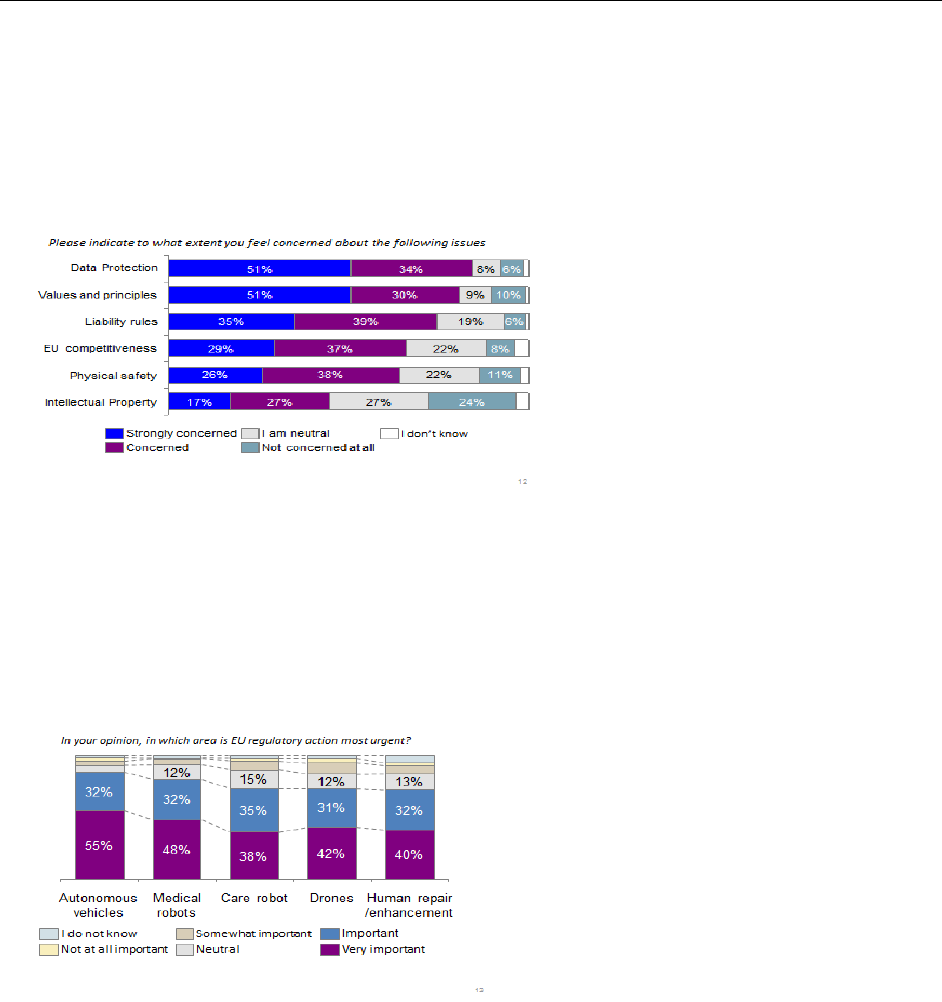

Figure 1 – Stakeholders' concerns about liability issues .................................................................... 15

Figure 2 – Stakeholders' opinions on most urgent regulatory action ............................................... 15

Figure 3 – Overview of stakeholders' replies to Question 33 ............................................................ 17

Figure 4 – Overview of stakeholders' replies to Question 34 ............................................................ 17

Figure 5 – Baseline market penetration rates for FAVS ................................................................... 160

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 5

Executive summary

Two key trends are shaping the future of personal mobility: first, a shift from human (driver-

driven) to machine (driverless-supercomputer driven) control of vehicles and second, a shift from

individual to shared ownership of vehicles. This European added value assessment (EAVA)

focuses on the first trend, the shift from driver-driven to autonomous personal mobility, and

more specifically on the regulation of civil liability for autonomous vehicles (AVs) at EU level.

The main objective of this EAVA is to assess whether regulatory action on civil liability for AVs

is justified at EU level and, if so, what would be the expected benefits and costs of such

intervention. The analysis of European added value is informed by two expert studies specifically

commissioned by the EPRS: 'Socio-economic analysis of the EU common approach on liability

rules and insurance related to connected and autonomous vehicles' and 'Legal analysis of the EU

common approach on the liability rules and insurance related to connected and autonomous

vehicles'; it also draws on the results of the European Parliament's public consultation on robotics

and artificial intelligence and on publicly available statistical data and publications.

Accelerating the adoption curve for driverless or autonomous vehicles (AVs) by five years has

the economic potential to generate European added value worth approximately €148 billion. It

is therefore in the interest of the public regulator to ensure that the regulatory framework

facilitates the adoption of AVs, thus helping to generate economic value. The expert national

committees of Member States, high level expert groups set up by the European Commission, and

recently adopted European Parliament resolutions have all underlined that the liability issues

related to the adoption and use of AVs need to be clarified.

The appropriation of risks in relation to the use of motor vehicles is currently regulated by two

main EU legislative acts governing liability rules: the Motor Insurance Directive (2009/103/EC)

and the Product Liability Directive (85/374/EEC). The current EU system of appropriation of

risks related to motor vehicles generally works well and, as a comparative legal analysis suggests,

would in principle be able to deal with the introduction of AVs to the market. However, the

application of the existing rules to AVs will likely shift the existing balance in liability

distribution between consumers and producers, further accentuate existing gaps, and could

potentially contribute to legal and administrative costs in connection with uncertainties.

If the current EU framework is not adjusted, in addition to existing gaps in the current EU legal

framework, the introduction of AVs will contribute to the emergence of new gaps and legal grey

areas. This is because the current legal framework was not developed to deal with the liability

issues of AVs, which are technologically complex and stand distinctly apart from the motor

vehicles currently on the roads. Four main categories of risk relating to the liability issues raised

by AVs are likely to emerge or become significantly more prominent with the mass roll-out and

use of AVs. The new risks include: risks relating to the failure of operating software enabling an

AV to function, risks relating to network failures, risks related to hacking and cybercrime, and

risks/external factors relating to programming choices. These four issues are not at all or not

sufficiently addressed under the current Product Liability Directive - Motor Insurance Directive

framework.

If the above issues are not specifically addressed by the legislator, the current regulatory

framework will result in many uncertainties, in particular relation to the new groups of risk

identified above. In this context, it is likely that the cost of scientifically unknown risks will be

European Added Value Assessment

PE 615.635 6

borne by the injured parties and consumers will find it increasingly difficult to claim damages.

This could ultimately lead to reduced consumer confidence in AVs and, consequently, to

slower uptake of AVs in the market.

An analysis of the gaps and limitations of the existing EU regulatory framework suggests that EU

policy needs to respond by regulating liability issues relating to the roll-out and introduction

of AVs. EU action should address three main sets of issues: first, the limitations and gaps relating

to the current framework, specifically the shift in liability between parties; second, the need to

adjust the current framework or introduce new rules to cover new risks; and third, the need to

adjust or introduce new procedural rules allowing liability to be established for damages

involving or caused by AVs.

Four policy options to address the current shortcoming of the EU liability framework are

compared and analysed: the status quo (Option 1); reform of the Product Liability Directive

(Option 2); or Motor Insurance Directive (Option 3); and the introduction of new EU legislation

and setting up of a no-fault insurance framework for damages resulting from AVs (Option 4). A

comparative assessment is made of these policy options applying seven qualitative criteria: legal

certainty, potential litigation burden, impact on innovation, impact on level of consumer

protection, political acceptance, degree of regulatory intervention needed, and degree of

dependence on soft law. On this basis it is argued that Option 4 (new EU legislation and

insurance framework) is preferable as it has the greatest potential of the four policy options to

address three sets of outstanding issues and gaps identified through comparative legal analysis.

Revision of the existing regulation and/or the introduction of additional regulation on the

allocation of risks related to AVs has the economic potential to generate European added value

that could be lost if the no-action option is chosen. The European added value generated from

the roll-out of AVs would be generated mainly by legislative measures facilitating their earlier

adoption. Further added value from EU action could be generated at the mass AV adoption stage

by measures aimed at reducing transaction and litigation costs arising from regulatory

divergences between differing jurisdictions and measures to boost consumer trust in the new

technologies.

Coordinated action at EU level has the potential to contribute further to European added value

by reducing the transaction costs resulting from the fragmentation of national legal systems

and minimising litigation costs. Insufficient coordination among several jurisdictions on the

adoption of regulatory rules enabling the testing, licensing and operation of autonomous

technologies and vehicles could ultimately lead to unnecessary barriers to the development and

deployment of new technological solutions. Clear rules at EU level would meanwhile contribute

to legal certainty and would help to avoid transaction costs arising from divergent national legal

rules.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 7

1. Introduction

1.1. Background

Driverless or autonomous vehicles (AVs) promise to bring substantial economic and societal

benefits. It is widely assumed that driverless cars would have the potential, for example, to save

human lives, minimise the financial cost of car accidents, improve urban mobility, decrease

congestion and negative environmental impacts, provide more inclusive forms of mobility for the

elderly and people with special needs, and increase productivity.

3

According to World Economic

Forum estimates there is substantial economic value at stake for the industry (US$ 0.67 trillion)

and society (US$ 3.1 trillion) as a result of digital transformation in the automotive industry

already in the period between 2016 to 2025.

4

Connected and autonomous vehicles are significant sector of the EU economy. In 2016 the EU-

28 accounted for 21 % of global passenger car production

5

with 12.6 million people employed in

the automotive industry.

6

It is forecasted that by the year 2050, this sector of the industry will

contribute €17 trillion to the European economy

7

and as of 2020 (the year AVs are expected to be

introduced) add 0.15 % to Europe's annual gross domestic product (GDP) growth rate.

8

However, motor vehicles, and road mobility more generally, also create risks and thus require

public coordination, supervision and enforcement. The motor vehicles and road transport sector

is a densely regulated area.

9

At international level: the United Nations 1968 Vienna Convention

on Road Traffic regulates standard traffic rules; while the 1958 and 1998 Agreements of the United

Nations Economic Commission for Europe regulate technical requirements and type-approval

for motor vehicles.

10

The European Union also has a wide range of competences relating to the

production and use of motor vehicles. As a result there is a large number of EU regulatory acts

in the wide spectrum of policy areas relating to motor vehicles, including civil law (e.g. liability,

insurance, data protection, licensing and type approval); public law (e.g. traffic regulations and

safety) and norms and standards (e.g. consumer protection, and technical and environmental

standards).

11

The future of personal mobility is in the process of major qualitative change. This change is

deemed by experts to be akin to the shift from horse to automobile as a means of transportation

or the introduction of the railway. AVs are not yet another product improvement in a traditional

automotive industry. They are ushering in a disruptive technology that has the potential to

3

For an overview and analysis see, for example, Autonomous Vehicle Implementation Predictions,

Implications for Transport Planning, Victoria Transport Institute, 26 January 2018; and 'Autonomous

Vehicles: Are You Ready for the New Ride?', MIT Technology Review Insights, 9 November 2017.

4

Digital transformation: Reinventing the wheel: digital transformations in the automotive industry, World

Economic Forum, 2016.

5

2016 Production Statistics, International Organization of Motor Vehicle Manufacturers, see also Key

Figures, European Automobile Manufacturers Association.

6

See footnote above; also information provided by the European Commission.

7

F. Ranft, Freeing the Road: Shaping the future for autonomous vehicles, London, 2016.

8

Ibid.

9

For a regulatory overview of the main legislation at international and EU level see S. Pillath, Automated

vehicles in the EU, EPRS, European Parliament, January 2016.

10

Ibid.

11

There are more than 1800 EU regulatory acts relating to 'motor vehicles'.

European Added Value Assessment

PE 615.635 8

change what is now our conventional understanding of mobility, ownership and security. In this

context there is increasing evidence and growing numbers of calls from various stakeholders

arguing that the current regulatory framework, developed when the roll-out of autonomous

vehicles was, if anything, a very indistinct reality, is inadequate when faced with the current

state of innovation and digitalisation in the automotive industry.

This explains why now at all levels of governance – national, EU and international – there are

intensive discussions on the need and urgency to revise the current law and policy to enable the

testing of AVs and their introduction to the market. Indeed, AVs are already being widely tested

on public roads around the globe and according to the most recent estimates driverless, fully

autonomous vehicles will be on the market by 2020.

12

The representatives of the automotive

industry consider that the countdown to the mass production of autonomous cars has already

started and has come much sooner than most experts expected. This earlier than expected roll-

out of driverless vehicles is possible, inter alia, due to the cooperation between connected

industries, know-how and substantial financial investment in this type of technology.

13

Two key trends are shaping the future of personal mobility: first, a shift from human (driver-

driven) to machine (driverless-supercomputer driven) control of a vehicle and, second, a shift

from individual to shared ownership of vehicles.

14

1.2. Methodology and scope of the European added value

assessment

This European added value assessment (EAVA) focuses on the first trend, a shift from driver-

driven to autonomous personal mobility and, more specifically, on the regulation of the civil

liability of motor vehicles at EU level. According to a 2015 study published by the Organisation

for European Cooperation and Development (OECD) 'liability remains an important barrier for

the manufacturers and designers of autonomous vehicles'.

15

A similar conclusion is also reached

by the UK's Department for Transport, which finds it necessary to 'provide additional clarity and

certainty in legislation, to provide a sound basis upon which to allocate criminal and civil

liability'.

16

The consideration of issues relating to liability has also been on the agenda of all major

EU expert group discussions facilitated by the European Commission (i.e. GEAR 2030) and road

maps of Member States.

Against this backdrop, the main objective of this EAVA is to assess whether regulatory action

on the civil liability of AVs is justified at EU level; and if so what would be the expected

benefits as well as costs of such intervention. European added value is assessed both

quantitatively (economic analysis) and qualitatively (comparative legal analysis). The former is

based on the economic analysis of the possible added value of legislative developments in the EU

12

See for example also Uber/Volvo framework agreement to introduce robot taxis as early as 2019. Volvo

Group media statement from ‘Volvo Cars to supply tens of thousands of autonomous drive compatible cars

to Uber’, 20 November 2017.

13

J. Becker, 'BMW's driverless cars: A quantum leap to Level 5', 2025 AD, November 2017; see also

'Chipmaker Nvidia's CEO sees fully autonomous cars within 4 years', Reuters, October 2017.

14

Deloitte, The future of mobility, January 2017.

15

Automated and Autonomous Driving, Regulation under uncertainty, OECD, 2015, p.6.

16

The pathway to driverless cars: summary report and action plan, UK Department for Transport, 2015,

p. 10.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 9

liability framework on earlier deployment of AVs. A cost-benefit analysis (CBA) is applied to

explore the scale of social and economic benefits of a faster roll out and take-up of AVs in the

EU.

17

European added value is thus measured and quantified in terms of socio-economic costs

and benefits relating to a possible earlier than anticipated baseline roll-out of AVs.

This quantification approach and methodology is based on an assumption that AVs will bring

substantial economic and social benefits for the EU's legal and private persons and that therefore

their earlier roll-out in the EU would be advantageous. The quantitative analysis contributes to

the understanding of the scope of possible socio-economic gains for the EU related to earlier roll-

out of AVs as well as the influence of developments in EU liability legislation on the earlier

deployment of AVs. This analysis also informs a policy debate on the possible impact of EU

regulatory intervention on the industry's willingness to introduce AVs to the EU market. This

economic quantification however does not fully measure or quantify other aspects relating to

possible costs and benefits and wider possible impacts of the revision of EU civil liability rules in

relation to AVs. For example, the possible impact of the revision of the EU civil liability

framework on the coherence of the EU legal system, the achievement of the EU's objectives, and

the protection of fundamental free movement rights and fundamental freedoms are not (or not

fully) measured by the CBA.

To account for these limitations of the quantitative approach, the economic analysis is

supplemented by a qualitative assessment. The qualitative assessment approaches the question

of European added value from a broader policy perspective. It focuses not only on the

prerequisites of earlier deployment of AVs but also on the necessity and impact of possible EU

legislative intervention for the legal certainty and coherence of the EU's legal system, the scope

of legal protection provided by EU law, and efficiency of the EU rules.

The qualitative assessment is twofold. First, a comparative legal analysis is conducted to identify

legal gaps and shortcomings of the existing EU liability framework as applied to AVs. A

detailed inventory of applicable EU rules is necessary to understand whether and how the scope

of legal protection would change as a result of the roll-out of AVs; whether the current EU system

of rules will allow for efficient resolution of possible disputes, and how the coherence and

consistency of the EU legal system would be affected. Second, based on the review of gaps and

shortcomings, four policy options are suggested. The potential European added value of the four

policy options suggested is then measured and assessed on the basis of seven qualitative criteria;

these aim to measure the effectiveness, efficiency, coherence and political feasibility of

possible regulatory intervention. Effectiveness is measured in terms of the ability of the policy

intervention to address current legislative gaps and uncertainties; efficiency is measured in terms

of ease of applicability of the policy by stakeholders; coherence is measured as the ability of the

adopted rules to facilitate national and cross-border claims settlement and resolution of conflict

of law issues; finally, political feasibility is measured in terms of the legal procedure and the scope

of regulatory change needed.

17

For a detailed description of the methodology, method and model for quantification applied please see

Annex II (RAND study).

European Added Value Assessment

PE 615.635 10

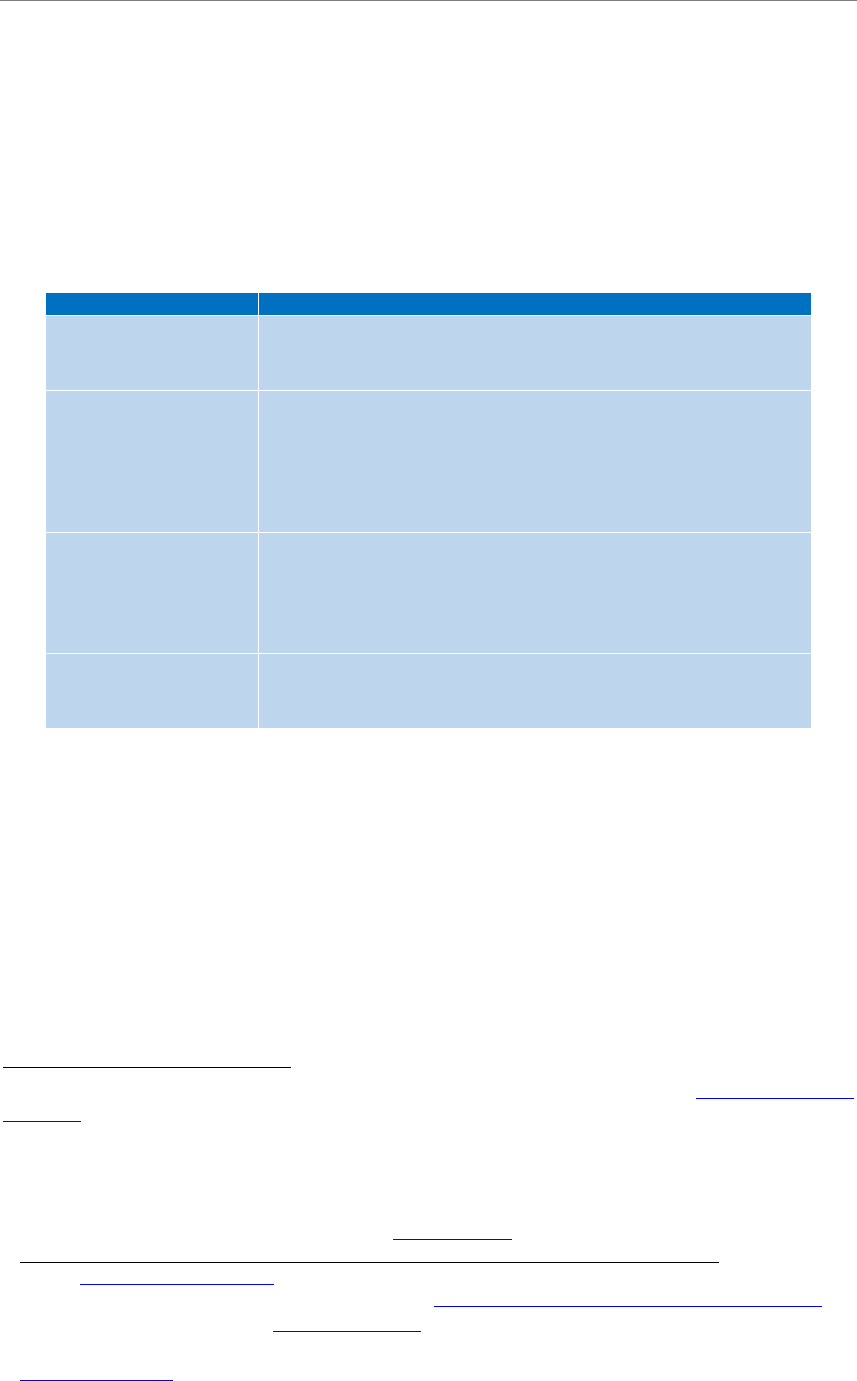

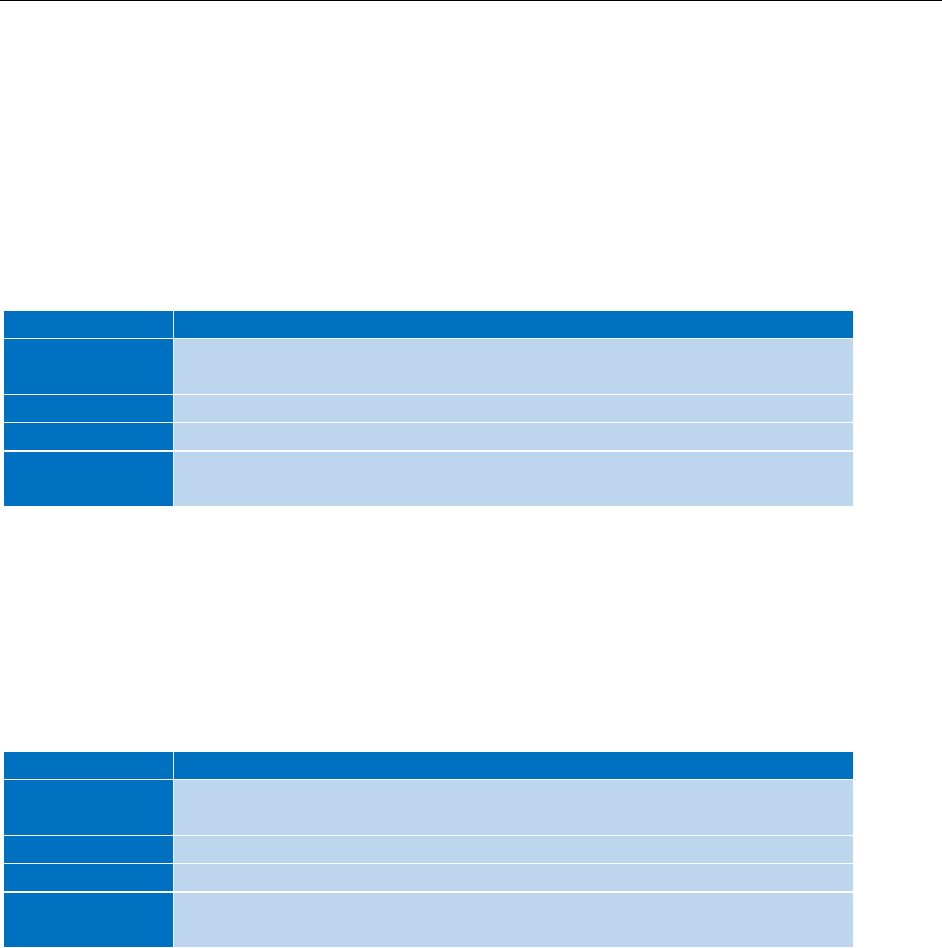

Table 1 – Methodology for measuring European added value

18

Scope

Method

Outcome

Quantitative

analysis

Economic analysis of

the possible EU added

value of legislative

changes to the EU

liability framework of

earlier deployment of

AVs

Cost-benefit analysis

Expert interviews with

stakeholders to verify

assumptions for the

quantification

Monetised

estimate of

European added

value in terms of

earlier deployment

of AVs

Qualitative

analysis

Legal analysis of gaps

and shortcomings of the

Product Liability

Directive and Motor

Insurance Directive

Comparative legal

analysis of selected

national traffic

regulation rules

Legal analysis of EU

and national rules on

cybersecurity, hacking

and data protection

Legal analysis of application

of EU law

Comparative legal analysis

of national regulation of

liability issues in Germany,

Sweden, the UK, the

Netherlands and Belgium

European added value is

measured by the ability of

the EU legislative

intervention to contribute to

the reduction of inefficiency,

ineffectiveness and

incoherencies of the current

legislative framework

European Parliament public

consultation on Robotics

and AI

Qualitative

assessment of

potential European

added value

measured against

seven qualitative

criteria

Limitations

Issues of criminal liability or other adjunct areas of law, including for

example a detailed analysis of data protection and privacy, are excluded.

A comprehensive comparative analysis of all EU Member State legislation

and policy is beyond the scope of the present analysis.

Source: Information compiled by the author.

This EAVA does not cover issues of criminal liability or other related areas of law, nor does it

provide for example a detailed analysis of data protection and privacy. It focuses primarily on

EU-level regulation and thus comprehensive comparative analysis of Member State legislation

and policy is beyond its scope.

The EAVA is structured as follows: after this introduction, Section 2 outlines the current EU

regulatory framework for civil liability and explains how this framework could be applied to

AVs. Section 3 presents an analysis of the gaps and limitations of the current framework as

applied to the AVs. Building on this analysis, Section 4 focuses on possible EU policy responses

and discusses what action could be taken at EU level to address the current gaps. Finally,

Section 5 brings all the analysis together by providing an assessment of the European added value

of taking action at EU level.

18

A quantitative analysis and expert interviews were conducted by RAND Europe Consultancy

(Cambridge) at the request of the EPRS. The full study is available in Annex II. The comparative legal

analysis was conducted by Utrecht University at the request of the EPRS and it is available in Annex I. The

European Parliament's public consultation on robotics was requested by the Legal Affairs Committee and

conducted by the EPRS European Added Value Unit.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 11

The analysis of European added value is informed by the two expert studies specifically

commissioned by the EPRS: 'Socio-economic analysis of the EU common approach on liability

rules and insurance related to connected and autonomous vehicles' and 'Legal analysis of the EU

common approach on the liability rules and insurance related to connected and autonomous

vehicles', results of the European Parliament public consultation on robotics and artificial

intelligence, and also publicly available statistical data and publications.

2. EU law and policy context

2.1. Applicable EU law

The appropriation of risks in relation to the use of motor vehicles is currently regulated through

two main EU legislative acts governing liability: the Motor Insurance Directive (2009/103/EC)

and the Product Liability Directive (85/374/EEC). This system is based on the highly harmonised

EU framework for liability of a producer of a defective product and very limited EU framework

(mainly establishing third-party liability insurance cover and procedure for claims resolution) on

civil liability for victims of road traffic accidents. When it comes to the substantive rules relating

to road traffic accidents, national rules on liability and the calculation of damages for victims

apply.

Table 2 – Main EU legal and policy instruments on civil liability relating to motor vehicles

EU law

Product Liability Directive (PLD) 85/374/EEC

19

Motor Insurance Directive (MID) 2009/103/EC

20

EU policy instruments

2017 European Parliament resolution on civil law rules on robotics

21

2016 Declaration of Amsterdam – Cooperation in the field of connected and

automated driving

22

2017 Letter of Intent on the testing and large scale demonstration of Connected

and Automated Driving

23

Other action at EU level

2017 European Commission public consultation on PLD

2017 European Commission public consultation on MID

24

Source: Information compiled by the author.

19

Council Directive 85/374/EEC of 25 July 1985 on the approximation of the laws, regulations and

administrative provisions of the Member States concerning liability for defective products, OJ L 210,

7.8.1985.

20

Directive 2009/103/EC of the European Parliament and of the Council of 16 September 2009 relating to

insurance against civil liability in respect of the use of motor vehicles, and the enforcement of the obligation

to insure against such liability (Text with EEA relevance), OJ L 263, 7.10.2009.

21

Resolution of 16 February 2017 on civil law rules on robotics, European Parliament.

22

Declaration of Amsterdam – Cooperation in the field of connected and automated driving, 15-16 April

2016.

23

Letter of intent on the testing and large scale demonstrations of connected and automated driving (CAD),

23 March 2017.

24

REFIT review of the Motor Insurance Directive; Public consultation on REFIT review of Directive

2009/103/EC on motor insurance.

European Added Value Assessment

PE 615.635 12

The Product Liability Directive (PLD) establishes a harmonised EU framework for the liability

regime for producers that, inter alia, is applicable to car manufacturers.

25

The PLD, as interpreted

by the Court of Justice of the European Union, sets out rules relating to the liability of producers

and the rights of consumers. This framework is based on a no-fault liability regime.

26

This means

that the producer of a defective product must compensate for personal injuries and damage to

private property irrespective of the negligence of an individual. The rights of consumers to claim

damages under the provisions of the PLD cannot be limited by the contractual clauses included

by the producer.

27

The PLD however provides a limited list of derogations in Article 7 that waives

liability of the producer. National rules on civil liability still apply, for example on the

determination on non-material damages or definition of causality.

The Motor Insurance Directive (MID) provides a less harmonised framework for motor vehicles.

The substantive rules on liability for damages resulting from motor vehicle accidents are not

harmonised at EU level and thus individually regulated by the Member States. The various

Member States have adopted differing liability systems, for example, the Netherlands has a semi-

strict liability system, France has very strict liability system (no fault regime), and the United

Kingdom system has a 'no strict liability' regime based on negligence rules. The MID prescribes

only minimum third party liability insurance cover in EU Member States.

These two legislative acts cover very different areas, provide different degrees of harmonisation

on civil liability rules and also have different purposes. Indeed the purpose of the PLD, which

applies to all EU products, is to facilitate competition and the free movement of goods within the

internal market and protect consumer against damage caused by a defective product. The

purpose of the MID, meanwhile, is to facilitate the free movement of people through EU by

providing a mechanism for the protection of road traffic accident victims.

2.2. EU programming documents relating to AVs

The digitalisation of transport was one of the key priorities of the Estonia and Netherlands

Council presidencies in 2017. Most recently, on 5 December 2017, the Council adopted

conclusions calling on the Commission 'to work together with Member States and stakeholders,

including at international level, to analyse the liability regime in the context of the digitalisation

of transport, addressing especially data quality, data integrity and traffic of connected and

automated vehicles, vessels and drones'.

28

The 2016 Declaration of Amsterdam on cooperation in the field of connected and automated

driving and the 2017 Letter of intent on the testing and large scale demonstration of connected

and automated driving,

29

signed at EU Member State ministerial level, call for closer cooperation

25

For a review of the application in the Member States, see the Fourth report on the application of Council

Directive 85/374/EEC of 25 July 1985 on the approximation of the laws, regulations and administrative

provisions of the Member States concerning liability for defective products amended by Directive

1999/34/EC of the European Parliament and of the Council of 10 May 1999.

26

Article 1, PLD.

27

Preamble and Article 13, PLD.

28

Council conclusions of 5 December 2017 on the digitalisation of transport.

29

Letter of intent on the testing and large scale demonstrations of connected and automated driving (CAD),

March 2017.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 13

and exchange of information among Member States on actions leading to the testing and

deployment of AVs.

Moreover, in 2017 the European Parliament adopted a resolution on civil law aspects of robotics

and artificial intelligence (AI).

30

The European Commission's 2015 digital single market

strategy,

31

its 2016 communication on digitising European industry,

32

and its 2017 communication

on building a European data economy,

33

all address, in a more general context, the liability issues

relating to new technologies, the internet of things, and autonomous systems.

2.3. Position of the European Parliament

In the light of the rapid developments in the area of robotics and artificial intelligence, the

European Parliament Committee on Legal Affairs (JURI) set up a working group in 2015 on legal

questions relating to the development of robotics.

34

The aim set out in the working group mission

statement was 'to reflect on legal issues and especially to pave the way to the drafting of civil law

rules in connection with robotics and artificial intelligence'. The working group engaged

intensively with the topic of robotics and AI, consulted with experts and various stakeholders,

35

and as a final outcome drafted a report on civil law rules on robotics.

36

This latter provided a basis

for the European Parliament resolution adopted in February 2017 outlining its main framework

and vision on the topic of robotics and AI.

37

The resolution devotes considerable attention to issues of liability that, according to the EP,

should be analysed and addressed at Union level.

38

In the introduction and general principles

section Parliament calls for the development of civil liability rules that reflect European and

universal values,

39

discusses in detail challenges arising from the general liability issues

associated with autonomous robots and AI, questions the sufficiency of the current liability

framework, and underlines the limits in the substantive (i.e. persons that can be held liable) and

material scope (i.e. only damages resulting from manufacturing defect) of the current legislative

framework. The resolution calls on the European Commission to submit a proposal for a directive

on civil law rules on robotics on the basis of Article 114 of the Treaty on the Functioning of the

European Union (TFEU). More specifically, as regards liability issues, the Commission is urged

to submit a legislative proposal, accompanied by non-legislative instruments, to address legal

issues relating to the development and use of robotics and artificial intelligence, including AVs.

40

30

Resolution of 16 February 2017 on civil law rules on robotics, European Parliament.

31

Communication on a digital single market strategy for Europe, COM(2015) 192, European Commission,

2015; see also the communication on the mid-term review of the digital single market strategy,

COM(2017) 228, European Commission, May 2017.

32

, Communication on digitising European industry reaping the full benefits of a digital single market,

COM(2016) 180, European Commission, April 2016.

33

Communication on building a European data economy, COM(2017) 9, January 2017.

34

The minutes of the working group on robotics and artificial intelligence meetings are available here:

http://www.europarl.europa.eu/committees/en/juri/subject-files.html?id=20150504CDT00301

35

See the proceedings of the working group.

36

Draft report with recommendations to the Commission on Civil Law Rules on Robotics, Rapporteur: Mady

Delvaux.

37

Resolution of 16 February 2017 on civil law rules on robotics, 2015/2103 (INL), European Parliament.

38

Resolution 2015/2103, Liability, para. 49.

39

Resolution 2015/2103, General Principles, Sections U and Y.

40

Resolution 2015/2103, Liability, para. 51.

European Added Value Assessment

PE 615.635 14

In developing a legislative instrument on civil liability and carrying out an impact assessment,

the Commission is called upon to consider the following elements:

- Limitations to liability. The type or the extent of the damages that may be recovered

and the forms of compensation offered to the aggravated party should not be restricted

or limited solely on the basis that the damage is caused by a non-human agent (para 52).

- System for determination of liability. In-depth analysis is necessary to determine

whether the EU should adopt the strict liability (no-fault) or the 'risk management'

approach (paras 53-55). Whatever system is preferred, 'liability should be proportional to

the actual level of instructions given to the robot and of its degree of autonomy' (para 56).

- Obligatory insurance scheme and guarantee fund. The European Parliament stresses

that compulsory insurance for robotics is a possible solution to the allocation of

responsibility for damages caused by autonomous robots (paras 57, 59a). This insurance

system could be supplemented by a guarantee fund to ensure compensation in cases of

damage caused by unidentified or uninsured subjects (paras 58, 59b-e).

The European Parliament has been working continuously on the issue of robotics and artificial

intelligence. Together with the adoption of the resolution, in February 2017 the European

Parliament's Legal Affairs Committee launched a public consultation on robotics and artificial

intelligence.

41

The aim of the consultation was to invite and involve all stakeholders, including

private individuals, to express their views on the subject. Following the results of the public

consultation, at the request of the Legal Affairs Committee, the European Parliamentary Research

Service is preparing an in-depth study on the cost of non-Europe for robotics and artificial

intelligence.

42

Robotics and AI will also be one of the topics debated during European Youth

Event in Strasbourg in spring 2018.

43

2.3.1 Results of the European Parliament's public consultation

The 2017 public consultation on the civil law rules on robotics covered, among other topics, issues

relating to the liability of autonomous vehicles. The main objective of the consultation was to

obtain views from wide a range of stakeholders on developments in the area of robotics and AI

in order to define further possible measures, both legislative and non-legislative.

44

The results of the consultation showed that 74 % of respondents, in the context of robotics and

AI, felt concerned about liability issues. As the graph below indicates, in fact, liability was among

the top three concerns related to robotics and AI as indicated by the respondents.

One of the elements that emerged was the preference, among stakeholders, for action at EU level

as opposed to national level. Indeed, of those favouring a regulatory approach, an overwhelming

majority preferred action at EU or international level rather than action at Member State level.

The arguments supporting regulatory action at this wider level were, among others, the need to

protect EU values (especially data protection, privacy and ethics), to ensure the EU's global

competitiveness, to secure EU primacy as a standard setter in international fora, to avoid a 'race

to the bottom', and to promote fair competition within the internal market. Compared with the

41

The public consultation was prepared and scientifically coordinated by Tatjana Evas, European Added

Value Unit, EPRS, European Parliament.

42

The Cost of Non-Europe on Robotics and Artificial intelligence report will be published in 2018-2019.

43

European Youth Event, European Parliament.

44

The consultation was open from February to June 2017 and received almost 300 replies (259 from private

individuals, 37 companies, and 2 from public authorities or international organisations). An overview of the

aims and the results of the public consultation are available on the European Parliament website.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 15

national level, respondents also considered the EU as more efficient, not only in legislating but

also in ensuring better enforcement of adopted regulation.

Figure 1 – Stakeholders' concerns about liability issues

Source: Data compiled by the author.

The stakeholders were asked which policy area would require, in their opinion, the most urgent

regulatory action, should EU action be considered. 87 % of respondents indicated that action in

the area of autonomous vehicles was a top regulatory priority.

Figure 2 – Stakeholders' opinions on most urgent regulatory action

Source: Data compiled by the author.

In conclusion, the European Parliament position on the liability issue, supported by the results of

the public consultation, suggests that liability issue should be addressed by at EU level as a matter

of priority. The current regulatory framework, as defined by PLD and MID, seems insufficient

and requires a review in terms of both substantive and material scope. This is why in its resolution

the European Parliament invited the European Commission to conduct an in-depth analysis of

possible policy options at EU level to address liability issues.

European Added Value Assessment

PE 615.635 16

2.4. Position of the European Commission

The European Commission (EC) is managing a wide range of initiatives, funding programmes

and expert groups on automated driving, coordinated by different directorates general (DGs).

45

The activities of the Commission relating to the deployment of AVs can be broadly summarised

as follows:

Table 3 – Main activities of the European Commission in relation to the deployment of AVs

46

1. Programming

documents

2016 European strategy on C-ITS, a milestone towards

cooperative, connected and automated driving

47

2. Review of existing

legislation

REFIT review of Directive 2009/103/EC relating to motor

insurance third party liability

48

including a public

consultation

Evaluation of Directive 85/374/EEC concerning liability for

defective products

49

including a public consultation

3. Studies/initiatives

related to the future

deployment of AVs

GEAR 2030 High Level Group (which concluded its activities

in October 2017)

C-ITS Platform Phase I and Phase II

C-ROADS

4. Funding

programmes

Horizon 2020 – dedicated calls to tender on automated road

transport and internet of things

Source: Information compiled by the author.

2.4.1 Review of existing legislation

In 2017 the European Commission started the evaluation of the PLD and the REFIT of the MID.

50

According to the 2017 inception impact assessment of the MID, the evaluation pillar of the

REFIT will focus, among other things, on the 'suitability of the directive in the light of

technological developments (electric bicycles, Segways, semi-automated and automated vehicles)

and on whether the liability system it provides will suit future needs'.

51

In the context of the public

consultation carried out from July to October 2017,

52

questions 33 and 34 (Q33 and Q34) were

particularly relevant in relation to liability issues linked to the deployment of AVs.

45

For an up-to-date overview of European Commission initiatives see for instance the Automated Driving

Roadmap, European Technology Platform, 2017.

46

This table only presents measures and activities that cover or mention the issue of liability or regulatory

cooperation among Member States. Projects and activities relating, for example, to road safety, technical

standards or the environment are not included.

47

Communication on A European strategy on cooperative intelligent transport systems, a milestone towards

cooperative, connected and automated mobility, COM(2016)766, November 2016.

48

REFIT review of Directive 2009/103/EC relating to motor insurance third party liability.

49

See the Roadmap for evaluation.

50

REFIT is shorthand for the European Commission's Regulatory Fitness and Performance Programme.

51

Inception Impact Assessment, Ares(2017)3714481, REFIT review of Directive 2009/103/EC relating to

motor insurance third party liability.

52

Public consultation on the REFIT review of Directive 2009/103/EC on motor insurance.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 17

'Question 33: Should autonomous vehicles continue be insured for liability to victims of accidents

the same way as vehicles with drivers?

Question 34: Should MID be clarified in any way to reflect the development of autonomous

vehicles? If so, please substantiate your answer and explain how.'

At the time of writing, in January 2018, the results of the public consultation, in the form of the

analytical report, have yet to be published. However an analysis of the replies submitted,

available on the web page of the consultation, reveals that 73 % of the respondents who answered

Q33

53

considered that AVs should continue to be insured for liability to victims in the same way

as vehicles with drivers. Considering however, that only 14.5 % of all respondents answered this

optional question, it could be argued that respondents found it difficult to answer.

Figure 3 – Overview of stakeholders' replies to Question 33

Source: Data compiled by the author.

The replies to Q34, which asks more specifically whether and how MID should be clarified to

reflect the development of autonomous vehicles, leave respondents even more divided.

Figure 4 – Overview of stakeholders' replies to Question 34

Source: Data compiled by the author.

The results of the public consultation seem to suggest that further in-depth analysis on the topic

is necessary. It remains to be seen how the European Commission will interpret the results of the

public consultation and whether or not it will suggest any reviews of the MID in relation to AVs.

53

There were 504 answers to Q 33 out of a total of 3 478 replies submitted to the consultation.

Yes

No

Other answers

367

57

80

Q 33: Should autonomous vehicles continue be insured for liability to victims

of accidents the same way as vehicles with drivers?

Yes

No

Other answer

80

96

170

Q 34: Should the MID be clarified in any way to reflect the development

of autonomous vehicles? If so, please substantiate your answer and

explain how.

European Added Value Assessment

PE 615.635 18

In parallel to the REFIT of the MID, the European Commission is also conducting an evaluation

of the PLD.

54

According to the roadmap, one of the purposes of the evaluation is to 'assess the

coherence of the directive with other relevant EU actions and whether it still corresponds to the

stakeholders' need and has EU added value. The evaluation will also assess if the directive is fit-

for-purpose vis-à-vis the new technological developments such as the internet of things and

autonomous systems'.

55

The roadmap specifically refers, inter alia, to the 2017 European

Parliament resolution on civil law aspects of robotics and AI as one of the grounds for carrying

out the evaluation. In providing justification for the evaluation, the roadmap states the following

as regarding liability in context of new technological developments:

'Recently, liability issues are progressively being investigated notably within the

framework of the digital single market strategy (DSM). In the context of preparing the

free flow of data initiative, a key issue is to reflect whether Directive 85/374/EEC is fit

for purpose vis-à-vis new technological developments (i.e. software, Cloud, internet of

things (IoT), advanced robots and automated systems) and whether it covers cases of

malfunctioning apps and non-embedded software. Furthermore, issues have been raised

on whether the unintended, autonomous behaviour of an advanced robot could be

considered a defect and how should strict liability for damages be allocated between the

different participants in the internet of things or, in more general terms, in case of

connected objects relying on each other.'

56

As part of the evaluation process, at the beginning of 2017, the European Commission also

organised a public consultation.

57

The brief summary of the consultation results suggests that,

even now, with autonomous vehicles not yet en masse on public roads, 58 % of consumers and

45 % of producers consider that for products like autonomous vehicles the application of the

directive might be problematic or uncertain. It is interesting to note, however, that only 25 % of

producers consider that the directive needs to be adapted for innovative products such as

autonomous vehicles. This is in contrast to 54 % of consumers and 40 % of other respondents

(including public authorities and civil society) who consider adoption of the directive to be

necessary.

58

2.4.2 Studies on AVs

The European Commission has arranged a large number of initiatives and expert groups in

relation to the automotive sector and AVs, covering a wide range of topics connected with the

testing and roll-out of AVs. The main positions and conclusions arising from these AV-related

studies AVs, as specifically related to liability issues, are summarised in the table below:

54

2017 evaluation of the Directive 85/374/EEC concerning liability for defective products.

55

Roadmap for the 2017 evaluation of the Directive 85/374/EEC concerning liability for defective products.

56

Ibid.

57

The Public consultation on the rules on liability of the producer for damage caused by a defective product.

58

Brief factual summary on the results of the public consultation on the rules on producer liability for

damage caused by a defective product. The summary does not specifically mention autonomous vehicles

but refers for instance to 'products where software and applications from different sources can be installed

after purchase, products performing automated tasks based on algorithms, data analytics, self-learning

algorithms or products purchased as a bundle with related services'.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 19

Table 4 – Main studies related to liability issues for AVs by the European Commission

Year

Document

Main Conclusions

2017

GEAR 2030 HLG

Final Report

18/10/2017

'Regarding compensation of victims, GEAR 2030 HLG is of the

opinion that motor insurance and product liability directives are

sufficient at this stage, at least for systems expected by 2020.'

'There are diverging views as to whether it is necessary, or even

desirable, to harmonise more the different national liability regimes.'

'Therefore the European Commission will monitor the need to revise

the MID and PLD (e.g. definition of product/service, definition of

defect) as well as the need for additional EU legal instruments with

the future development of technologies.'

2016

GEAR 2030 HLG

Roadmap

For the current state of development of connected and autonomous

vehicles, the existing legal framework on liability and risk

appropriation is sufficient.

59

However, with increasing connectivity and automation of vehicles a

complete revision or shift in liability rules between the parties

involved (i.e. driver, manufacturer, software provider, etc.) might be

necessary.

60

2015

Business

Innovation

Observatory/

Study by PwC

commissioned by

DG GROW

'with the technology for assisted and autonomous driving

developing rapidly, uncertainty on liability is a growing concern.

[...] Without clarity, insurance companies will not know where they

can rightfully claim the damages and companies will not be able to

assess their liability.'

61

'By quickly developing a harmonised European legal framework

that addresses concerns on liability and self-driving functionality,

especially for semi-autonomous and fully autonomous vehicles,

Europe can gain a competitive edge over other regions where such

a framework is not yet in place (e.g. the USA).'

62

2015

C-ITS Final

Report

63

As long as the driver remains in the control of the vehicle no changes

concerning liability are necessary.

64

However, considering the 'trends towards higher levels of

connectivity and automation, where information provided via C-ITS

may trigger subsequent action from the vehicle', the final C-ITS

report recommended re-evaluating the question of liability for these

cases in the second phase of the C-ITS platform.

Source: Information compiled by the author

The dominant view taken by the expert studies commissioned by the European Commission from

2015 to the present day is that the current regulatory framework will suffice at least until 2020

when mass roll-out of AVs is expected. Future technological developments might require

59

'It is anticipated that at least in the short run the legal position for liability in relation to features on vehicles

which incorporate higher levels of automation would not be significantly different to those presently

assisting the driver. In case of accident, each of the parties involved (manufacturer, driver, etc.) may be

found to be civilly (or in some cases criminally) liable to a greater or lesser extent depending on the exact

circumstances of the situation.' GEAR 2030 Discussion Paper, Roadmap on Highly Automated Vehicles, p.8.

60

Ibid.

61

Internet of Things, Connected Cars, Case study 43, European Commission, Business Innovation

Observatory, 2015, p. 11.

62

Internet of Things, Connected Cars, p. 14.

63

C-ITS stands for Cooperative Intelligent Transport Systems. On the platform see information provided on

the Commission website.

64

Internet of Things, Connected Cars, p. 13., 'the driver always remains in control of the vehicle, and

therefore there are no changes concerning liability compared to the current situation and the current

amendment to the Vienna Convention (Amendment Article 8, paragraph 5) will be sufficient'.

European Added Value Assessment

PE 615.635 20

adjustments to the current system but this is as yet uncertain and thus would not require

regulatory intervention at this stage. In this context, the scope and options for future possible

adjustments have not yet been fully analysed in depth by the Commission. As the October 2017

GEAR 2030 report suggests, the Commission will monitor developments relating to the

application of MID and PLD to the roll-out of AVs to the market and leave resolution of the

possible problems and disputes to the courts and other bodies on a case by case basis.

This position stands in contrast to the position of the European Parliament, which is calling for a

pro-active in-depth analysis of the possible regulatory response before mass roll-out of AVs. The

results of the European Parliament public consultation, especially relating to the PLD suggests

that consumers also feel a need for adjustments to the current system. It remains to be seen what

action the European Commission will take on the liability issues associated with AVs in the light

of the results of the ongoing REFIT of the MID and evaluation of the PLD.

3. Limitations of and gaps in the current framework

This section describes in more detail the limitations of and gaps in the current EU legislative

framework that could potentially have a significant impact when AVs take to public roads en

masse.

The current EU system of appropriation of risks related to motor vehicles generally works well.

Based on the review of the PLD and MID

65

as well as the public consultations carried out by the

European Commission, the majority of stakeholders believe that the current EU liability

framework provides a working system that ensures an appropriate balance of interests and

responsibilities of all parties involved.

66

The results of the European Commission's 2017 public

consultation on the PLD indicate that 82.5 % of respondents representing organisations believe

that the PLD provides for a fair balance between the interests of producers and those of the

consumers.

67

Private individuals and other respondents seem however to be less confident, as in

total (all replies considered) only 68 % believe that the directive provides for a fair balance

between the interests of producers and those of consumers.

68

Respondents also consider that the,

roll-out and in particular the mass penetration of AVs into the market would likely have a

significant effect on the existing system of appropriation of risks relating to motor vehicles.

The current liability system is based on the understanding that there are two main types of risk

relating to the operation of motor vehicles: first, the failure of the hardware, i.e. it is the product

that triggers product liability, and second, the action of (and/or damage to) a driver, which

triggers liability under national traffic laws and is also covered by the MID. Table 5 below

summarises the new types of risk that could be generated by the introduction of AVs to the

market. Considering the nature of AVs as products characterised by increased complexity of

65

Directive 2009/103/EC of the European Parliament and of the Council of 16 September 2009 relating to

insurance against civil liability in respect of the use of motor vehicles, and the enforcement of the obligation

to insure against such liability.

66

See the European Commission's 2017 public consultation on the REFIT review of Directive 2009/103/EC

on motor insurance; and the summary of the European Commission's 2017 public consultation on the rules

on liability of the producer for damage caused by a defective product.

67

See replies to question 13, European Commission, Brief factual summary on the results of the public

consultation on the rules on producer liability for damage caused by a defective product, p. 24.

68

Ibid, p. 3.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 21

hardware and software as well as crucial reliance on connectivity and networks, at least six main

risks affecting liability can be identified. The existing risks, i.e. failure of hardware and liability

based on personal conduct of a driver will be substantially impacted. This could potentially lead

to a shift in risk distribution between for example consumer and producer. The new risks that

would emerge with the roll-out of AVs are currently not specifically covered by the EU liability

framework.

69

Thus, the current set of rules would have to be interpreted in such a way as to

account for the 'new risks'. This legal ambiguity could lead to increase in litigation and possible

divergent interpretation in various Member States. Finally, the current rules of evidence, i.e. the

rules establishing fault and therefore liability would need to be adjusted, possibly through the

introduction of legislation on detection technology, i.e. event data recorders.

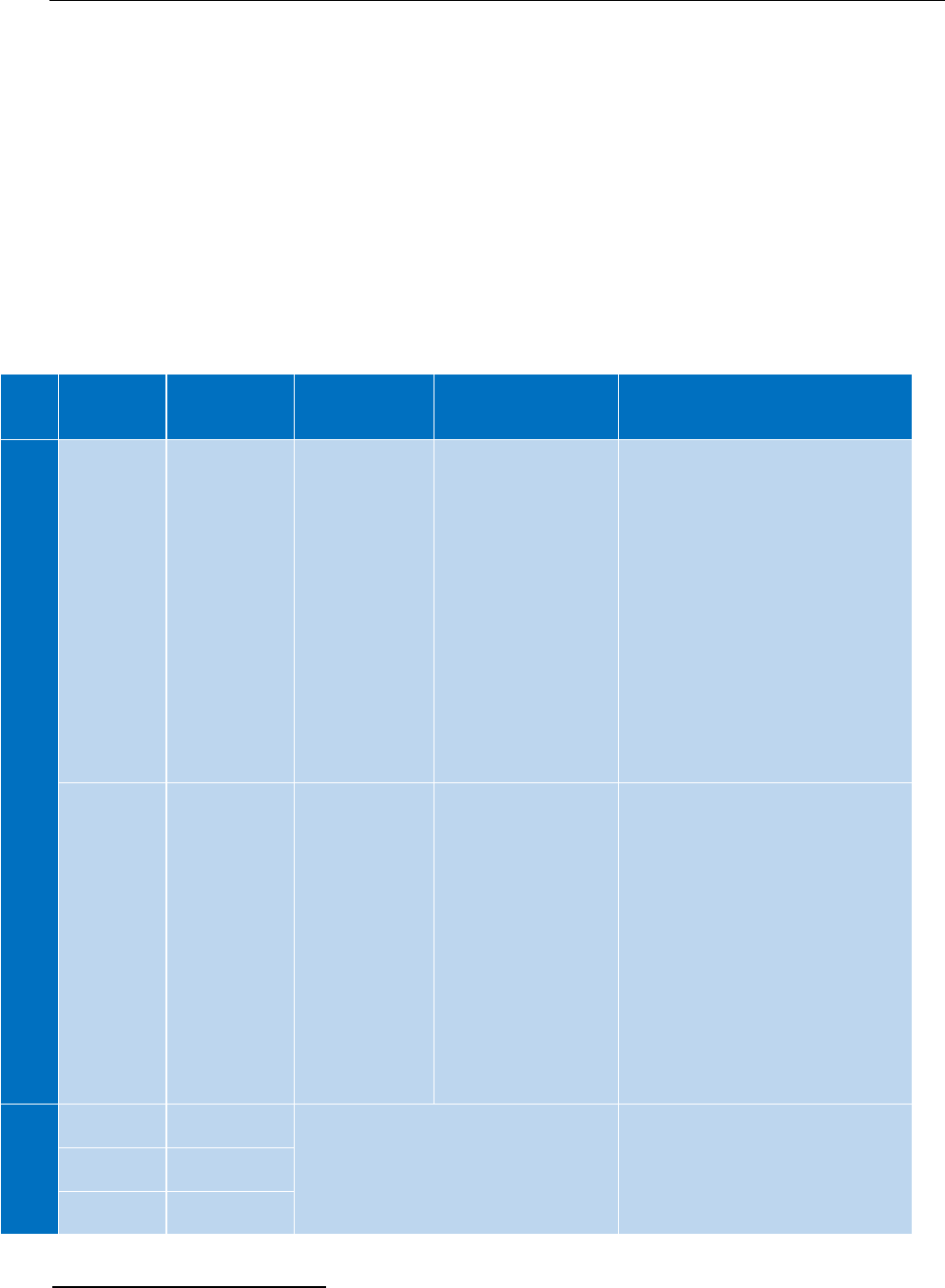

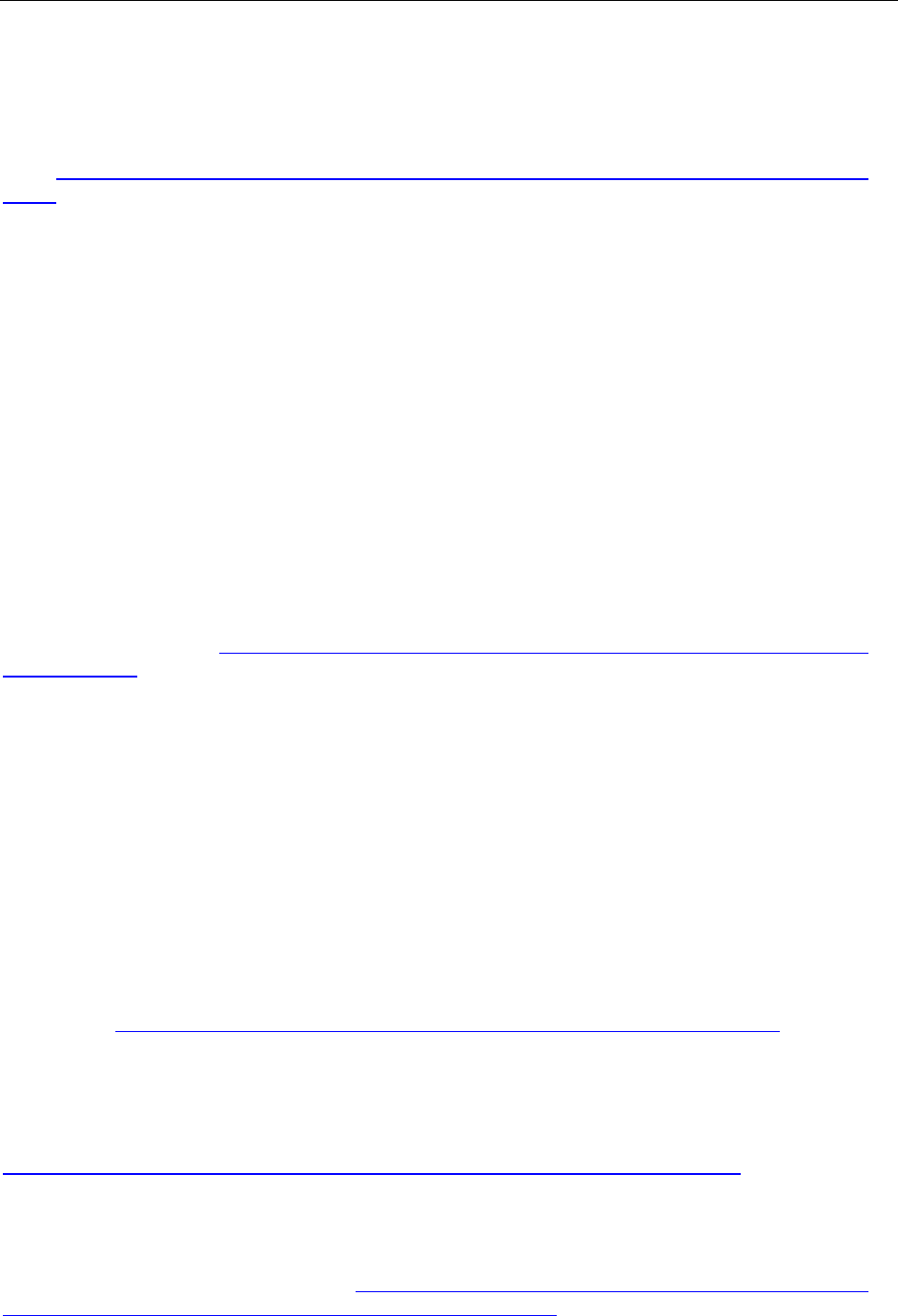

Table 5 – Main risks in the current system versus those in a mobility system based on AVs

Current

system of

mobility

System of

mobility

based on AVs

Current

legislative

coverage

Existing gaps and

limitations

Main impacts relating to the use of

AVs

Existing risks

Hardware

failure

Hardware

failure (but

with

additional

components,

such as

sensor

failure)

PLD

Concept and scope

of defectiveness

Scope of available

defences

If driver or

operator suffers

damage him or

herself as a result

of a sensor being

faulty because of

'wear and tear'

there is no

protection under

the PLD or the

MID.

If current rules remain there will

be de facto a major shift in liability

transfer, and thus the current

balance will be upset, most likely

to the disadvantage of the

consumer.

It will create legal uncertainty and

potential increased litigation.

Action of a

driver

Action of a

driver

MID

National traffic

rules

Insured risk of

motor liability

insurance is

assessed differently

within the EU.

Member States with

a risk-based

liability regime

exclude or limit the

protection of the

owner/ possessor/

keeper of vehicles,

if they suffer

damage

themselves.

Liability based on the personal

fault of the driver will decrease

while liability based on the failure

of the technology will increase

New risks

Software

failure

Issues/risks that currently are not

explicitly or sufficiently clearly

regulated by EU law

New risks are currently not (or not

fully) covered by existing EU

legislation. If these are not

addressed it will lead to increased

legal uncertainty (divergent

Network

failure

Hacking/

cybercrime

69

Though some risks, for example those relating to data protection, are covered by EU legislation, see

discussion below in Section 3.2.

European Added Value Assessment

PE 615.635 22

Programming

choice

externality

interpretations of current rules in

various jurisdictions).

Higher volume and costs of

litigation

Procedural rules

Evidence

Evidence

National traffic liability rules/ MID

Claimants will potentially

increasingly encounter problems

with delivering proof of defects,

where without in-built associated

detection technology (such as an

event data recorder) it may be

difficult to prove the defect.

Source: Information compiled by the author.

3.1. Existing risks: shift in liability

The roll-out of autonomous vehicles calls for a fitness check of the current regulatory framework

on liability in order to understand (i) how risks would be allocated among the parties involved

and (ii) whether current balance between the parties would be preserved. The key question is

whether the process of digitalisation in the automotive industry, in particularly the roll-out and

the mass adoption of AVs, would impact the current balance between parties in risk

appropriation. If roll-out of AVs would result in liability transfer between the parties, the

question is whether and to what extent an adjustment and/or introduction of a new regulation

would be necessary. AVs require special regulatory attention and a review of the current

framework not only because of their significant economic and societal value but also because AVs

are a disruptive technology that have the potential to change what is now our conventional

understandings of a product, mobility, ownership and security. In other words, roll-out and mass

adoption of AVs are not another upgrade or improvement of the traditional product of the

automotive industry, a vehicle, but rather a qualitatively new product. This new product is

technologically sophisticated with many components, software, hardware and algorithms where,

among other things, the line between product and service becomes increasingly blurred.

3.1.1 Product Liability Directive and Motor Insurance Directive

70

The PLD is generally a fair instrument for balancing the distribution of risks between producers

and consumers of products. However, if applied to the mobility system based on AVs, existing

gaps and limitations could potentially limit the scope and effectiveness of the PLD and affect the

existing balance between the parties.

71

The three main groups of issues are the following:

First, the PLD has limited substantive scope and covers only liability of producers for

defective products. The concept of 'defectiveness' is narrowly defined and difficult to

establish for technically complex products such as AVs. As it stands now, damage arising

for example from a vehicle's wear and tear, bad repair, the way vehicle has been used,

the road situation, or weather conditions will be not covered by the PLD. Developers,

producers, component makers, importers, distributors, and car-dealers could rely on a

number of defences provided by the PLD to minimise liability, which in relation to highly

technological products, could provide a wide safety net for producers to the

disadvantage of consumers. For this reason, several parties (including rental companies

70

For a comprehensive, detailed overview of the gaps in and limitations of the current framework see the

study by Engelhard and Bruin in Annex I.

71

Ibid.

EU Common Approach on the liability rules and insurance related to the Connected and Autonomous Vehicles

PE 615.635 23

and other service providers, pure developers of the operating technology and testing

companies) will not incur risk-based liability for defectiveness, but only fault-based

liability. The definition of product also remains an open question, more specifically

whether software is a product or not.

Second, the cost of scientifically unknown risks will be shouldered by the injured

party.

Third, the high-tech nature of AVs combined with the broad provisions of the PLD on

defences, in particular in relation to the concept of 'reasonableness' may overburden

national courts. National courts interpreting and applying the PLD to disputes involving

AVs will be called upon to settle very complex technological issues.

Table 6 – Summary of the main gaps under the current PLD regulation that could potentially

have a negative effect on consumers in the light of the introduction of AVs

72

- [substantive scope] Several parties responsible for the design and/or manufacture of autonomous

vehicles are not covered by the risk-based liability imposed by the PLD.

- [material scope]

o The consumer must show that the product was defective at the moment a vehicle left the

factory, this is technically difficult and also involves a normative judgement on the

required safety standard for the new technology.

o Producers have a wide margin of possibilities to shift costs of scientifically unknown risks

through 'compliance risk' and 'development risk' defences to the consumer.

o The PLD does not cover damage to the autonomous vehicle itself and it is limited with

regard to property damage.

o The PLD does not cover damages resulting from 'wear and tear' or other parties'

interventions or failure of telecom networks.

Source: Information compiled by the author.