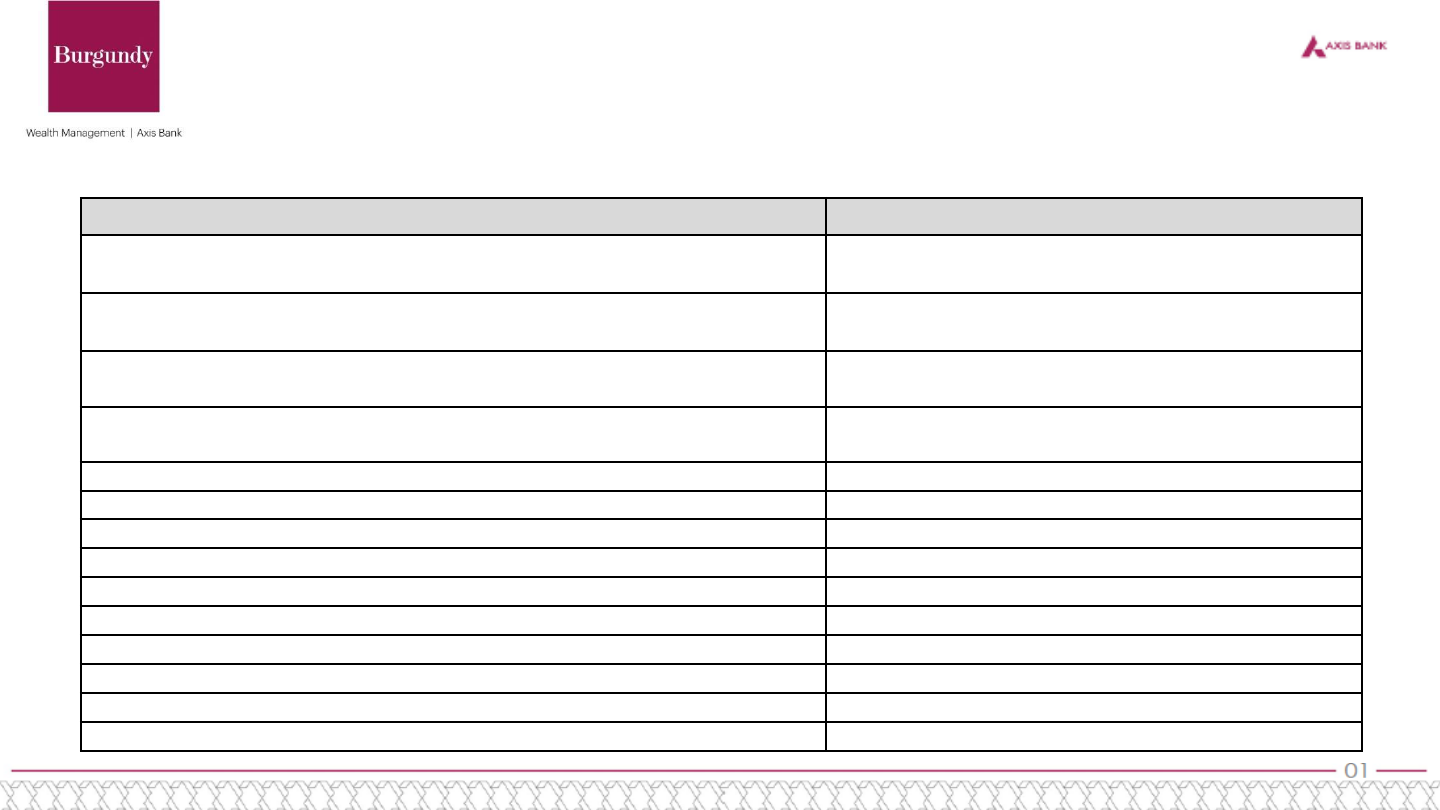

FEES & CHARGES

BASIC ACCOUNT CHARGES

Features Charges Applicable

Initial Funding

Rs. 5 Lakhs*

NA

Average Quarterly Balance Required (AQB)**

Rs. 10 Lakhs*

NA

Total Relationship Value**

Rs. 30 Lakhs*

NA

Total Relationship Value with Demat Holdings

Rs.1 Cr

NA

Account Service Fee NIL

Primary Debit Card: Type Burgundy Debit Card

Primary Card: Issuance Fees NIL

Primary Card: Annual Fees NIL

Joint Debit Card: Type Burgundy Debit Card

Joint Card: Issuance Fees NIL

Joint Card: Annual Fees NIL

My Design Card Issuance Charges may vary as per image selected

Chequebook Issuance^ Unlimited, Free

NetSecure with 1 Touch Issuance fee

Rs.1000

TRANSACTION CHARGES

Features Limits/ Charges Applicable

Daily ATM Withdrawal Limit Rs. 3 lakhs

Daily POS transaction Limit Rs. 6 lakhs

ECS/NACH Transaction Fees Rs.25 per transaction with a cap of Rs.100 a month

Monthly Cash Transaction^

No. of transactions / Limits (Metro/Urban/Semi-Urban/Rural)

10 free transactions or Rs.15 lakhs, whichever is breached earlier

Charges beyond free limit Rs. 5 per Rs.1,000 or Rs.150, whichever is higher

Monthly Cash Transaction: (Non-Home Branch)^

(Metro/Urban/Semi-Urban/Rural)

NA

Outstation Cheque Collection Fees^ NIL

RTGS (Branch)^ NIL

RTGS (Online) NIL

NEFT Transaction Limits Unlimited, Free

NEFT (Branch)^ NIL

NEFT(Online) NIL

IMPS Fees^ NIL

Speed Clearing NIL

Axis Bank ATM: No. of Free Transactions^ Unlimited

Axis Bank ATM Transaction Fee beyond limits NIL

Non-Axis Bank ATM: No of Free Transactions^ Unlimited

Non-Axis ATM: Cash Withdrawal (financial transaction) fees beyond limits NIL

Non-Axis ATM: Balance Enquiry (non financial transaction) fees beyond limits NIL

International Cash Withdrawal fees (ATM) NIL

International Balance Enquiry fees (ATM) NIL

Surcharge on Railway Tickets purchased with Debit Card 2.5% of the sale amount (Min Rs. 10) + Rs.30 per transaction

Cross Currency Mark-up on International Debit Card Transactions 3.5%

TRANSACTION FAILURE CHARGES

Features Charges Applicable

Outward Cheque Return

1st Return – Rs 50

2nd Return onwards – Rs 100

Inward Cheque Return (Financial Reasons) Rs.500 per cheque

Inward Cheque Return (Non-Financial Reasons)^ NIL

Outstation Cheque Return Rs.150 per cheque

ECS Debit Failure Rs. 500 per instance

Standing Instruction/Auto Debit return (Insufficient Funds)^ NIL

Standing Instruction Failure Charges for RD/MF^

SIP Bounce^

NIL

DEMAT CHARGES

Features Charges Applicable

Demat Account AMC NIL for life

Account Opening Fee for Axis Direct (Online Trading Account) NIL

Features Charges Applicable

Card Replacement Fee NIL

Additional Chequebook Fee NIL

Duplicate PIN (Branch mode only)^ NIL

Duplicate Passbook^ NIL

Physical Statement Fee at Branch for Prior Quarters^ NIL

Stop Payment Instructions: Cheque^ NIL

Stop Payment Instructions: ECS NIL

DD/PO Issuance^ NIL

DD/PO Cancellation^ NIL

DD/PO Duplicate^ NIL

DD/PO Revalidation^ NIL

Additional DD/PO Fee NIL

Value Added SMS Alerts^ NIL

Address Confirmation^ NIL

Photo Attestation^ NIL

Signature Verification^ NIL

Balance Certificate^ NIL

Locker fees*

60% discount on small & medium size lockers and 30%

discount on large & extra large size lockers for lifetime

NetSecure with 1 Touch -Replacement fee Rs.800

CONVENIENCE CHARGES

*Applicable for eligible customers only

FOREIGN CURRENCY CHARGES

Features Charges Applicable

Foreign Currency Outward Remit by Wire/TT/Swift Rs.100

Foreign Currency Outward Remit by DD Rs.500

Foreign Currency Inward Remittance Fee (wire) NIL

Foreign Currency deposit at Branches Rs.100 per instance

Foreign Currency Instrument Collection Fees

Cheque Collection Charges – Rs.750

Courier & Handling Charges – Rs.50

Correspondent/Drawee Bank Charges:-

Cash Letter Scheme (CLS) – NIL

Final Credit Scheme (FCS) - $40

Direct Credit Scheme (DCS) – On Actuals, as charged by

Correspondent/Drawee Bank

Please Click Here for Fees and Charges of Burgundy Multi-Currency Forex Card

Taxes will be charged additionally as applicable

TERMS & CONDITIONS

*In case of a salaried customer, one should be receiving a net salary credit in excess of Rs. 3 lakhs every month in Axis Bank Salary Account

**Customers who do not qualify for the AQB/TRV criteria will be converted to normal Savings Account with due notice. Fees and charges will

apply accordingly. For more details on TRV refer to https://www.axisbank.com/burgundy

#*Charges are levied if account is closed between 14 days and 1 year. No charges would be levied if account is closed within 14 days of account

opening or after 1 year.

^Mentioned charges will be applicable in case Burgundy eligibility criteria is not met w.e.f. 1

st

July 2021. Please click on the link below:

https://campaign.axisbank.com/disclaimer/Revision-of-Fees-and-Charges-for-Burgundy-accounts.html

Revision in Savings Account tariff structure for Burgundy Accounts is being revised effective 1st July, 2022. Please click on the link below

https://www.axisbank.com/docs/default-source/default-document-library/tariff-structure-wef-01072022.pdf

Eligibility for Burgundy Savings Account Tariff will be calculated as on 25

th

of every month. Click here for details.

For Burgundy eligibility criteria, please click on the link below:

https://www.axisbank.com/docs/default-source/default-document-library/burgundy-eligibility-criteria.pdf?sfvrsn=7e2b455_2

Applicable w.e.f. Jan 2022