BRAND NEW ENERGY.

SAME BIG HEART.

ANNUAL REPORT 2015

1635 West National Avenue • Milwaukee, Wisconsin 53204

414/383-1234 • 800/837-7833

badgermutual.com

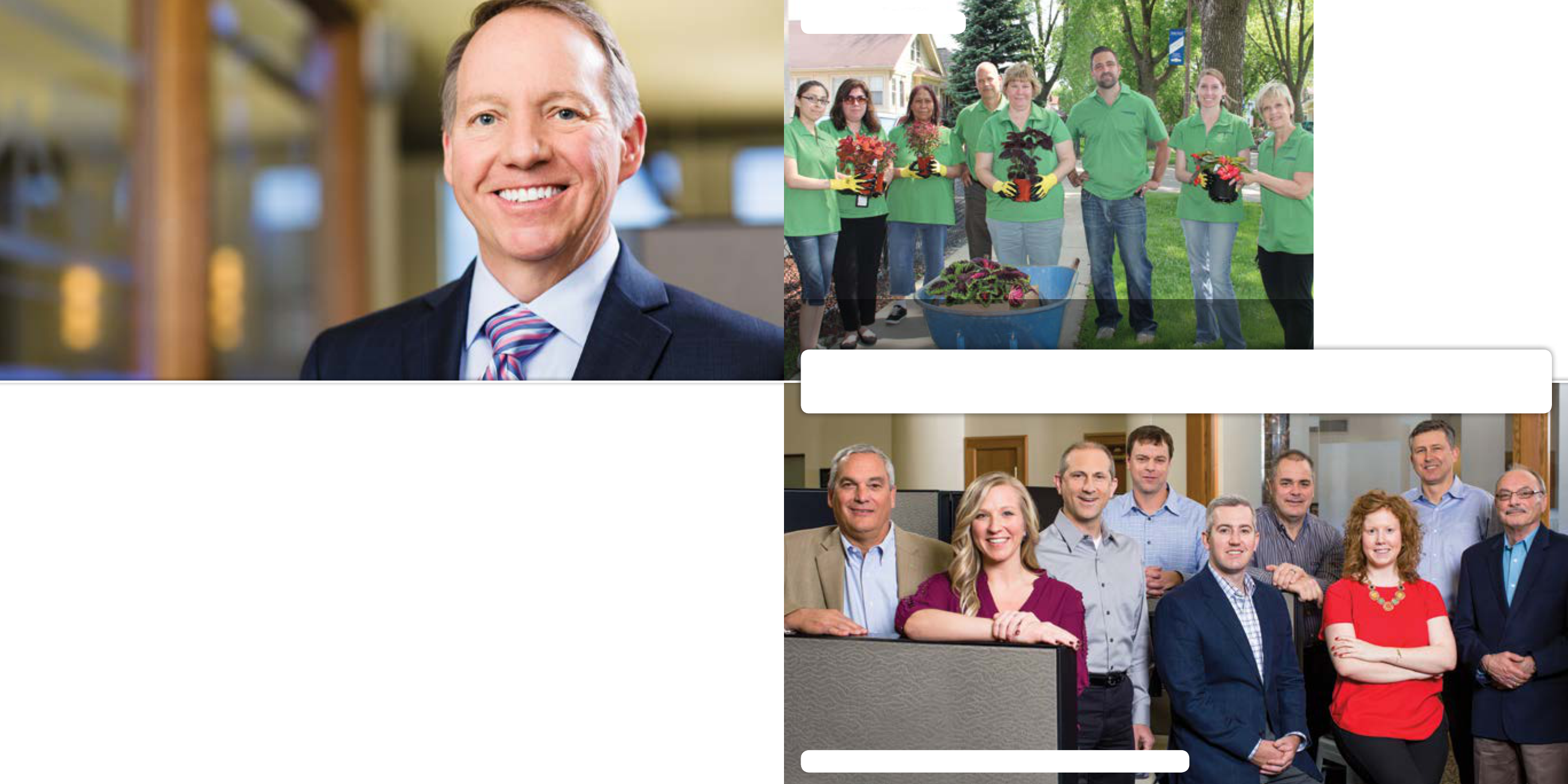

PRESIDENT/CEO

(31 years of service)

Since 1887, Badger Mutual has been providing quality

insurance and superior customer service. As a mutual

insurance company, we value the relationships we have

with our policyholders and agents.

Our employees possess qualities that make our agents

want to work with us. They genuinely care about our

agents, insureds, community, and each other. Our

employees’ hearts have always been big, demonstrated

by our longtime relationships with our independent

agency force, our insureds, and our community partners.

2015 was a year of re-energizing—we’re using this energy

to make the best decisions for our company, agents,

insureds, and employees. We launched a new logo and

tagline, continued hiring recent college graduates, began

the programming of a new technology system, and

introduced several new underwriting initiatives. There’s an

entirely new vigor and liveliness that streams through our

office. Our level of teamwork, accountability, dedication,

and enthusiasm is infectious—and why we’ve been able

to establish and genuinely enjoy the strong relationships

we have with everyone who does business with us.

From NOVICE TO SEASONED

GARDENERS

, employee

volunteers plant flowers on our

properties and TAKE A WEEKLY

TURN

picking up debris. I’ve seen

MANY CHANGES THROUGH

THE YEARS

and clearly we’re

ENERGIZED BY NEW

EMPLOYEES

who are eager to

learn, and

OLDER EMPLOYEES

WHO EMBRACE CHANGE

.

t

LAURA MICHNA

Assistant VP of Administration

(13 years of service)

COMMITTEE MEMBERS PICTURED (L-R): Guadalupe Magana, Daliborka Kojic, Patty Allender,

Chris Klemens, Diana Kirk, Andy Steeno, Julie Bender, Laura Michna

COMMITTEE MEMBERS NOT PICTURED: Cassandra Kirk, Pam Heidenreich, Anna Bruders, Mark Zierer

THE GREEN TEAM

INFORMATION TECHNOLOGY & MARKETING

BRAND NEW ENERGY.

DAVID M. KANE

I LOVE WORKING for Badger Mutual

thanks to my coworkers and our office

environment—and we have a BRAND

NEW HEALTH CLINIC here on-site.

t

GUADALUPE MAGANA, Accounts

(8 years of service)

To me, THE THEME means that we’ve

made several changes recently to make us a

BETTER COMPANY, which allows us to

better meet the needs of customers. We are

MOVING IN THE RIGHT DIRECTION.

t

JENNIFER ZUBEK, Receptionist

(15 years of service)

“BRAND NEW ENERGY, SAME BIG

HEART” says we’re a 125-year-old plus company

CONTINUING TO COMPETE for business

with all types of other carriers—we ADAPT to

what consumers and agents want and need.

t

CHRISTOPHER KLEMENS, Senior Claims Examiner

(5 years of service)

BOARD OF DIRECTORS

(L-R)

COMMERCIAL LINES

Thomas A. Kaupp, President

Image Makers Advertising, Inc.

Bartley L. Munson, Actuarial Consultant

Munson & Associates

Seated: Stuart H. Warrington

Retired Insurance Systems Executive

Vincent P. Lyles, President/CEO

Boys & Girls Clubs of Greater Milwaukee

John R. Linscott Jr., M.D.

Board Certified Family Medicine

David M. Kane, President/CEO

Badger Mutual Insurance Co.

D. Lisa Graff, Retired Corporate Counsel

Dematic Corp.

Steven C. Klima, CPA

Financial Consultant

David L. Springob, Retired Chairman/CEO

Catholic Family Life Insurance

Seated: Robert W. Smith, Retired Asst.

Corp. Controller, Johnson Controls, Inc.

Roy R. Bubeck, Retired Chairman/CEO

Badger Mutual Insurance Co.

Santino R. Cicero, Retired Senior VP

BMO Harris Bank

PERSONAL LINES

CLAIMS

CLAIMS

OFFICERS

(L-R)

Dan Nigro, Vice President IT/Marketing and Secretary

Laura Michna, Assistant Vice President Administration

Darrin Groendal, Vice President/Chief Financial Officer

David Kane, President/CEO

Karen Kirk, Vice President Human Resources

Kathy Bubeck, Vice President Claims

Brian Wiza, Vice President Underwriting

Top reasons consumers and businesses CHOOSE

BADGER MUTUAL

are our competitive rates

and overall customer SERVICE—including

direct communtication with a REAL PERSON

FROM THE FIRST CALL.

t

JAMES KAUFMAN, Retired VP of Administration

(20 years of service)

I am still impressed by the CLOSE-KNIT

FAMILY atmosphere at Badger Mutual. The theme

says we CARE FOR OUR CLIENTS THAT

SAME WAY—the way we always have—but with

NEW FACES AND POSITIVE CHANGES.

t

TYLER PROTZ, Account Underwriter

(1 year of service)

One of the top reasons our customers choose

Badger Mutual Insurance? They know that they’ll

get the coverage they need from a local company

that

GOES ABOVE AND BEYOND

STANDARD CUSTOMER SERVICE.

t

JEFF SLADKY, President/Owner,

Capital Insurance Agency of WI Inc

Brookfield, WI (since 1977)

Sean Costello, Regional Manager (IL, MI, IA, UT, ID, and WY)

Jim Serpe, President Serpe Insurance Agency (Chicago, IL)

Mike Haeger, Regional Manager (Milwaukee & Green Bay, WI and MN)

Brian MacGillis, President MacGillis Insurance Agency Inc. (Fredonia, WI)

Brian Baker, Owner Red Rock Insurance Agency (Las Vegas, NV)

Joe Eden, Partner Giese & Eden Insurance Group LLC (Flagstaff, AZ)

Jeff Limberg, Regional Manager (AZ and NV)

Bruce Barlow, President Barlow Insurance Agency (Bloomer, WI)

David Wade, Regional Manager (Northern Wisconsin)

BMI MEETS WEST/MIDWEST: PARTNERSHIPS PERFECTLY ALIGNED FOR PERSONAL CUSTOMER CARE

TOP REASONS CUSTOMERS CHOOSE BADGER MUTUALBRAND NEW ENERGY?

Badger Mutual is a ROCK-SOLID COMPANY—

with people who are there when you need them

most. Their reps are awesome and their

underwriters are a great bunch to work with as

well.

YOU CAN’T PUT A PRICE ON THE

COVERAGE OPTIONS AND PLANS THEY

GIVE TO ME AND MY AGENCY.

They are

loyal to their customers and agents, and they’re

not into ‘price gouging’ our clients. Thank you,

Badger Mutual, for all you do for the clients,

the agents, and our communities.

t

DAVID EILER, Owner, Eiler Insurance Agency LLC

Fairwater, WI (since 1998)

I have always thought of Badger Mutual as having

energy. And as for the BIG HEART—no question.

Having been with Badger Mutual for seven years,

I have always thought they have been very supportive

and willing to work with my agency. With very

competitive prices and quick responses on quotes,

I can get back to a potential customer and show

him our

DEDICATION TO CUSTOMER

SERVICE

. These are only a few of the many

ways that Badger Mutual Insurance continues to help

not only my agency, but all of Badger’s agencies.

t

MICHAEL ANDERSON, President, MEA Insurance Agency

Finland, MN (since 2008)

COST, EASE, SPEED, PEACE OF MIND

that everything is covered, and security of personal data.

t

STEVE LADD, President, Ladd Agency

Menomonee Falls, WI (since 1993)

It all STARTS WITH OUR AGENCY FORCE.

They are the frontline professionals who communicate

the BMI brand message: WE ARE A

FINANCIALLY SECURE INSURANCE

COMPANY WITH HOMETOWN VALUES.

t

BRIAN WIZA, Vice President Underwriting

(corporate, 13 years of service)

Badger Mutual is STEADFASTLY COMMITTED

TO THE INDEPENDENT AGENT

. At all levels,

executives and staff are approachable and

considerate. On those rare occasions when justified

change of direction is needed, Badger Mutual

communicates clearly with its agents, working in

true partnership.

IN AN INDUSTRY WHERE

COMPETITORS ARE GROWING EVER

MORE IMPERSONAL, BADGER MUTUAL

STANDS OUT FROM THE COMPETITION.

It is a privilege for us to represent Badger Mutual.

t

WES THEW, President, Flagstaff Insurance Inc

Flagstaff, AZ (since 2007)

Make-A-Wish has provided nearly 5,000

Wisconsin children and families with

life-threatening medical conditions the

gift of a wish. In the 2015 Walk & Run for

Wishes, our company raised over $11,500

to help grant wishes for two more

children—this brings our grand total

to 67 wishes granted!

The Sixteenth Street Community Health

Center offers quality healthcare and

health education to underserved patients

throughout Greater Milwaukee. In 2015,

we received the Community Impact

Award for our participation in the Girls

on the Run event which promotes

self-esteem and positive thinking.

United Way is a nonprofit organization

that unites partners from various

organizations to work toward common

goals to better the community. Our

employees donated $23,042.90 to

the United Way campaign in 2015—

the company matched that for a total

donation of $46,085.80.

At Badger Mutual, I see a company that

does more than make a donation. We’re

a CIVIC LEADER in Milwaukee,

dedicated to programs that benefit

the city. Our business is

EQUALLY

COMMITTED to doing what’s best

for the city—and those who trust us

with their property and security.

t

JOHN GAW, Claims Consultant

(6 years of service)

ACCOUNTING

Boys & Girls Clubs of Greater Milwaukee

is the largest youth-serving agency in

the city, promoting academic and career

success for every member. Each year, our

company wraps and donates Christmas

gifts for those in need. We collected

over 120 gifts in 2015—and Santa and

Mrs. Claus even made an appearance.

The United Community Center (UCC)

provides personal development pro-

grams to area residents of all races

and ages in education, cultural arts,

recreation, community development,

and health and human services. We

partner with UCC to honor outstanding

achievements by the community’s youth.

This Badger Mutual Insurance Women’s

Amateur Golf Tournament is one of

the largest in our area and benefits the

nonprofit social service agency My

Home, Your Home and the Sojourner

Family Peace Center, a nonprofit

provider of domestic violence

prevention.

Why did I choose to work at Badger Mutual?

The

CULTURE and atmosphere made it

a clear decision. HR made me feel very

comfortable, reassuring me that I would

be working with a GOOD-NATURED

COMPANY. Dedication to community

speaks to the COMPANY’S GOOD

WILL— that’s important for me.

t

DAN MCNEELY, Claims Examiner

(1 month of service)

ADMINISTRATIVE & HUMAN RESOURCES

STATEMENT OF FINANCIAL POSITION AS OF DECEMBER 31

Longtime and loyal customers and

businesses

CHOOSE US because

we have

COMPETITIVE RATES,

offer discounts, and we have a good

loss history. Staff is

EASY TO

CONTACT

, and changes and claims

are handled quickly. We are

USER-

FRIENDLY

so customers can pay

and review their accounts online.

t

RHONDA PARYS

Personal Lines Senior Account Underwriter

(19 years of service)

Premiums Written ................................................................... $98,626,959 .............$100,737,883

Change in Unearned Premiums ................................................. 270,968 ...................(398,066)

Reinsurance Ceded .................................................................... (7,671,944) ................ (7,740,968)

Premiums Earned .............................................................. $91,225,983 ............$92,598,849

Losses Incurred ........................................................................ $54,407,750 ..............$58,343,768

Loss Adjusting Expenses Incurred ........................................ 9,042,888 ................... 10,355,136

Underwriting Expenses Incurred .........................................26,059,628 .................26,262,332

Underwriting Gain (Loss) .....................................................$1,715,717 ........... ($2,362,387)

Net Investment Income ..............................................................$1,976,123 .................$4,356,074

Other Income ..................................................................................... 502,628 ...................... 545,664

Dividends to Policyholders ...........................................................(99,127) ...................... (53,925)

Federal Income Taxes ........................................................................ 54,535 ..........................54,014

Net Gain (Loss) .................................................................. $4,040,808 ................$2,431,412

Net Premium/Surplus Ratio .................................................................. 1.42 ................................1.50

Percentage Growth in Premiums Written ................................. -2.25% ..............................1.15%

STATEMENT OF INCOME 2015 2014

OPERATING RESULTS

Cash & Short-Term Securities ................$11,577,246 ..........$18,170,745

Bonds (Amortized Cost) ......................... 117,423,563 ........ 109,183,445

Stocks (Market Value) ..................................9,594,158 ............6,326,586

Mortgage Loans ............................................... 2,110,395 ............ 2,867,506

Real Estate ...........................................................7,151,449 .............. 7,636,174

Accrued Investment Income .........................701,010 ................876,985

Premium Balances ......................................14,806,743 ...........14,953,387

Company Owned

Life Insurance .................................................4,353,541 .............4,198,564

Deferred Taxes/

Federal Taxes Receivable ...................... 6,064,526 .............3,777,544

Loss Recoverable

from Reinsurers ..................................................48,482 ................103,409

Computer Hardware ........................................233,536 ................... 57,355

Total Assets .........................................$174,064,648 ..... $168,151,700

ASSETS 2015 2014

Reserves for Losses

& Adjusting Expenses ..........................$54,673,878 ........ $53,667,513

Reserve for Unearned Premiums .........41,906,528 ...........42,177,496

Reserve for General Expenses .............. 4,609,600 ............5,058,892

Reserve for Premiums

Paid in Advance .............................................1,316,207 .............. 1,280,199

Reinsurance Payable ........................................ 845,919 .............1,080,876

Reserve for Federal

Income Taxes ................................................................. 0 .................. 53,984

Reserve for Pension Benefits .................... 5,910,722 ............. 2,236,651

Reserve for Other Liabilities ........................646,669 ................690,247

Policyholder Surplus ....................................64,155,125 ..........61,905,842

Total Liabilities & Surplus ................$174,064,648 ..... $168,151,700

LIABILITIES & SURPLUS 2015 2014

SAME BIG HEART.

It seems like yesterday that I started working at

Badger Mutual Insurance Company. And it’s true—

time flies when you enjoy what you’re doing. A

special part of my journey has been the relationships

that I have made, which have made the past 29 years

of my career so incredibly rewarding.

RETIRED CHAIRMAN/CEO

Chairman/CEO 2012-2015 and President 1998-2012

(29 years of service)

To me,

OUR THEME means that while we continually

adapt to changes in our industry and society, the

COMPANY’S DEDICATION to its policyholders, agents,

community, and employees

REMAINS THE SAME.

t

DAVID WADE, Regional Manager (34 years of service)

ROY R. BUBECK