STATEMENT OF ADDITIONAL INFORMATION (SAI)

SPONSORS

NAME OF MUTUAL FUND

Baroda BNP Paribas Mutual Fund

NAME OF THE ASSET MANAGEMENT COMPANY

Baroda BNP Paribas Asset Management India Private Limited

Corporate Identity Number (CIN): U65991MH2003PTC142972

NAME OF THE TRUSTEE COMPANY

Baroda BNP Paribas Trustee India Private Limited

Corporate Identity Number (CIN): U74120MH2011PTC225365

ADDRESSES OF THE ENTITIES

201(A), 2

nd

floor, A wing, Crescenzo, C-38 & 39, G-Block, Bandra Kurla Complex,

Mumbai 400 051, Maharashtra, India.

WEBSITE OF THE ENTITY

www.barodabnpparibasmf.in

This Statement of Additional Information (SAI) contains details of Baroda BNP Paribas

Mutual Fund, its constitution, and certain tax, legal and general information. It is

incorporated by reference (is legally a part of the Scheme Information Document).

This SAI is dated August 26, 2024.

Bank Of Baroda

Registered Office: Baroda House, P. B. No.

506, Mandvi, Baroda - 390006.

BNP Paribas Asset Management Asia

Limited

Suite 1701, 17/F, Lincoln House, Taikoo

Kong

Statement of Additional Information

2

TABLE OF CONTENTS

I. INFORMATION ABOUT SPONSOR, AMC AND TRUSTEE OF BARODA BNP PARIBAS MUTUAL FUND .............. 3

A. CONSTITUTION OF THE MUTUAL FUND ..................................................................................... 3

B. SPONSORS ...................................................................................................................... 4

C. THE TRUSTEE ................................................................................................................... 5

D. ASSET MANAGEMENT COMPANY .......................................................................................... 10

E. SERVICE PROVIDERS ......................................................................................................... 23

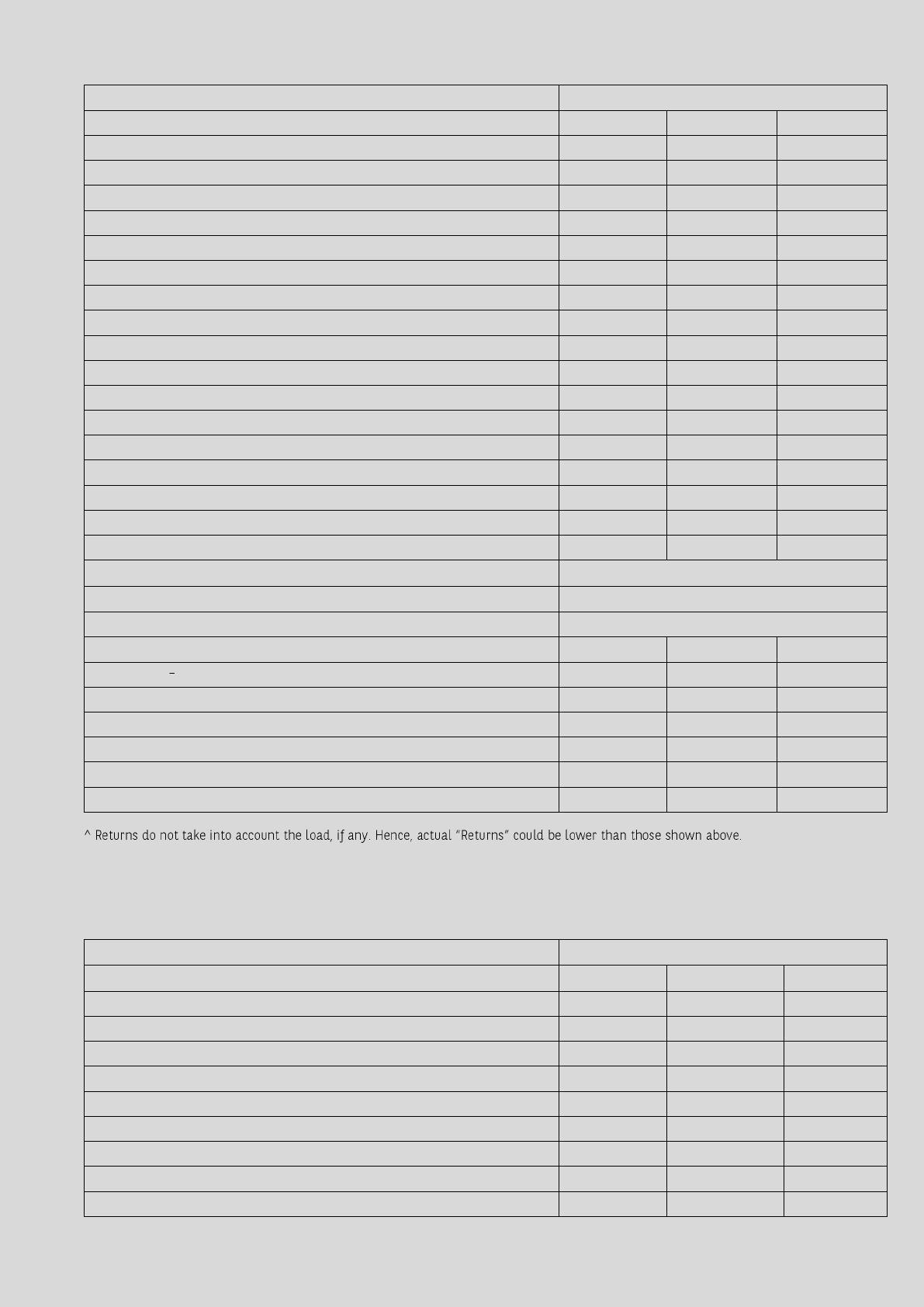

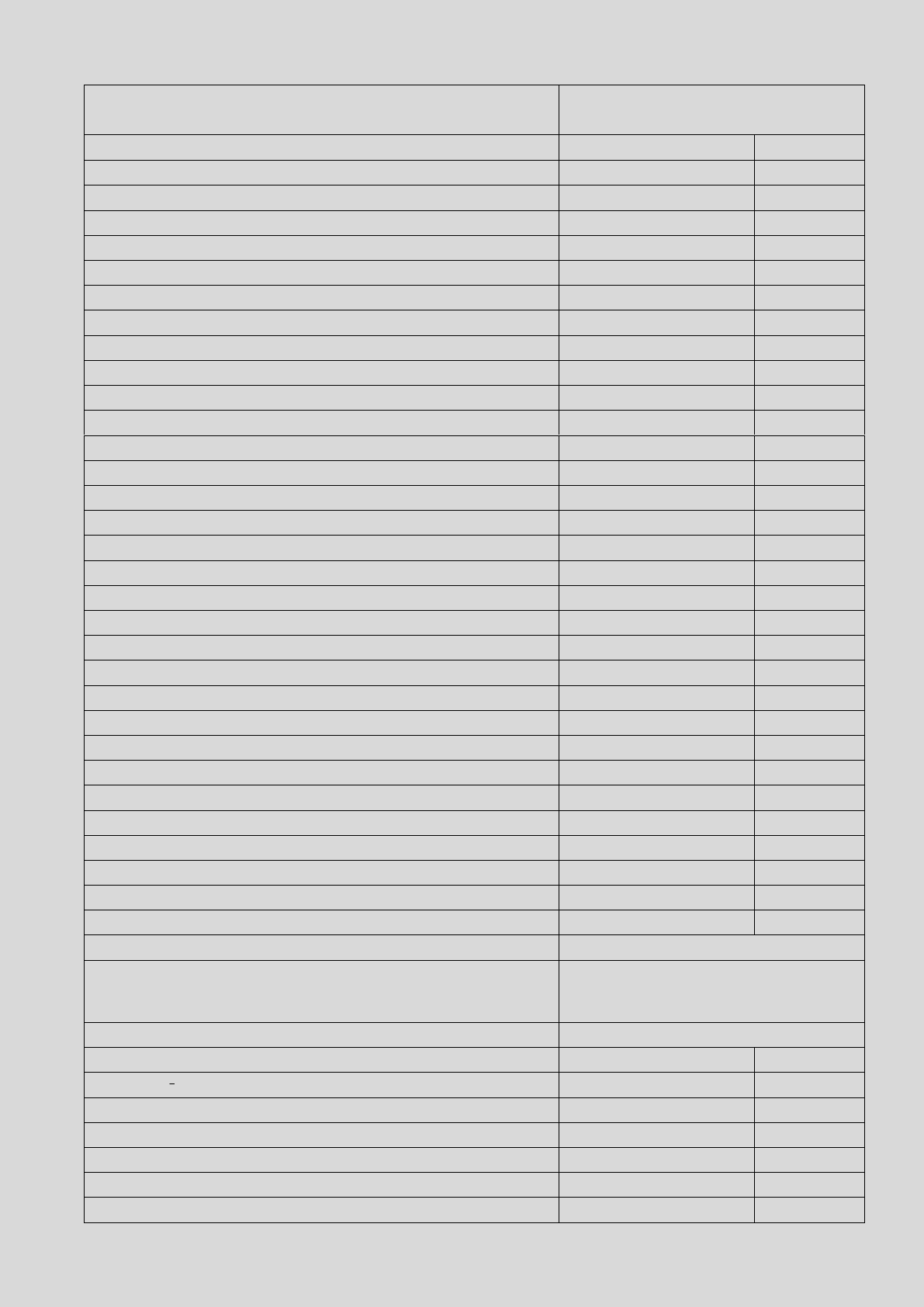

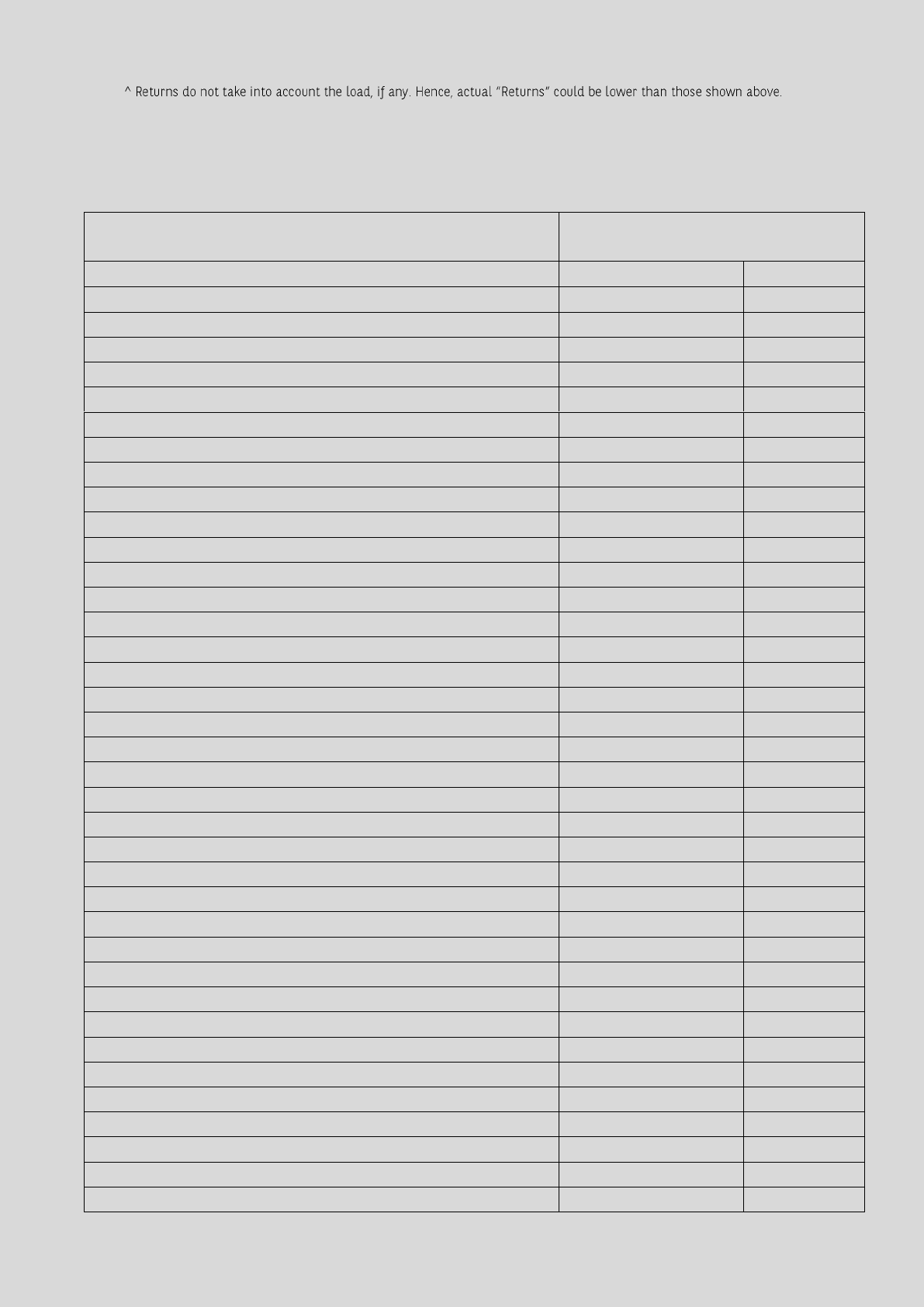

F. CONDENSED FINANCIAL INFORMATION ................................................................................... 24

II. HOW TO APPLY? .................................................................................................................................................. 58

III. RIGHTS OF UNITHOLDERS OF THE SCHEME .................................................................................................... 76

IV. INVESTMENT VALUATION NORMS FOR SECURITIES AND OTHER ASSETS ................................................... 77

V. TAX & LEGAL AND GENERAL INFORMATION ..................................................................................................... 92

A. TAXATION ON INVESTING IN MUTUAL FUNDS ....................................................................................................... 94

B. LEGAL INFORMATION ................................................................................................................................................ 113

C. GENERAL INFORMATION ............................................................................................................................................ 122

3

I. INFORMATION ABOUT SPONSOR, AMC AND TRUSTEE OF BARODA BNP PARIBAS MUTUAL

FUND

A. CONSTITUTION OF THE MUTUAL FUND

Baroda BNP Paribas Mutual Fund (erstwhile Baroda Mutual Fund) has been constituted as a trust in accordance

with the provisions of the Indian Trusts Act, 1882 (2 of 1882), by BNP Paribas Asset

Management Asia Limited AM s, and Baroda BNP Paribas Trustee India Private Limited

(erstwhile Baroda Trustee India Private Limited) as per the terms of the Trust

Deed dated October 30, 1992 as amended vide the Supplement to the Deed of Trust dated August 12, 2008,

Supplemental Deed dated July 30, 2012, the Deed of Variation dated September 27, 2018 and Deed of Variation

. This Trust

Deed has been registered under the Indian Registration Act, 1908 in supersession to the Trust Deed under Fortis

Mutual Fund. Baroda BNP Paribas Mutual Fund has been registered with SEBI under the same registration number

viz. SEBI Registration No. MF/018/94/2 on April 13, 2022.

HISTORICAL BACKGROUND OF BARODA MUTUAL FUND

A.

accordance with the provisions of the Indian Trusts Act, 1882 (2 of 1882) on 30th October 1992, originally with

Sponsor and the Board of Trustees to the Mutual Fund as the Trustee. The Trust

Deed has been registered under the Indian Registration Act, 1908. The Mutual Fund was registered with SEBI

on November 21, 1994 under Registration Code MF/018/94/2.

B. PGAM

AMC which was renamed as Baroda Pioneer Asset Management Company Ltd. effective

July 8, 2008 and PGAM became a co-sponsor of BOB Mutual Fund. The name of BOB Mutual Fund was

subsequently changed to Baroda Pioneer Mutual Fund, for which SEBI approval was received vide letter no.

IMD/RB/134922/08 dated August 12, 2008.

C. Effective November 1, 2017, PGAM was merged by way of incorporation, pursuant to Italian law, into its

UniCredit

obligations of PGAM were transferred to UniCredit by operation of law including, inter alia, those relating to

the ownership of 51% of the equity share capital of each of the AMC, investment manager to the Mutual Fund,

, trustee to the Mutual Fund.

D. On September 28, 2018, BOB acquired the entire shareholding of UniCredit in the AMC and Trustee and became

the sole Sponsor of the Mutual Fund. A Deed of Variation was executed on September 27, 2018 between BOB,

UniCredit and the Trustee to amend the Deed of Trust as amended from time to time, to reflect changes

relating to the change in Sponsor and other related changes. Subsequently, the name of the Mutual Fund was

/31324/1/2018

dated November 13, 2018.

E. On March 14, 2022, merged into Baroda BNP Paribas

Private Limited] (Baroda AMC and BBNPP AMC jointly

asset management company of Baroda BNP Paribas Mutual Fund (erstwhile Baroda Mutual Fund) (the

surviving mutual fund). BNP Paribas Trustee India Private Limited merged into Baroda BNP Paribas Trustee

BNP Paribas TC acting as the trustee company of Baroda BNP Paribas Mutual Fund. Further, there were change

of trusteeship of the schemes of BNP Pariba . SEBI has

-I DOF5/P/OW/2022/0000002171/1

dated January 17, 2022, SEBI/HO/IMD/IMD-I DOF5/P/OW/2022/0000002307/1 dated January 19, 2022,

SEBI/HO/IMD-II/DOF-10/P/OW/3575/1/2022 dated January 28, 2022 and SEBI/HO/IMD-II/DOF-

3/P/OW/3593/2022 dated January 28, 2022

HISTORICAL BACKGROUND OF BNP PARIBAS MUTUAL FUND

A. ABN AMRO Mutual Fund (subsequently BNP Paribas Mutual Fund) had been constituted as a trust in accordance

with the provisions of the Indian Trusts Act, 1882, by the original Sponsor, ABN AMRO Bank N.V., as per the

terms of the Trust Deed dated April 15, 2004. The Trust Deed had been registered under the Indian Registration

Act, 1908. The Mutual Fund had been registered with SEBI, vide. Registration No. MF/049/04/01 dated May 27,

2004.

B. Pursuant to an internal restructuring of ABN AMRO Group in 2005, ABN AMRO Asset Management (Asia) Limited

BNP Paribas Asset Management India Private Lim

4

letter no. IMD/SB/46021/05 dated August 4, 2005 and the transfer was made effective from October 31, 2005.

Accordingly, a Deed of Variation dated March 2, 2006 to the initial Deed of Trust was executed between ABN

AMRO Trustee (India) Private Limited, ABN AMRO Bank N.V. and ABN AMRO Asset Management (Asia) Limited.

C. Consequent to a global restructuring of ABN AMRO, ABN AMRO Asset Management became a part of Fortis

Investment Management with effect from April 1, 2008. SEBI vide its letter no. IMD/RB/139920/08 dated October

3, 2008 had conveyed its no-objection to the indirect change in control of ABN AMRO Asset Management (India)

Private Limited and ABN AMRO Trustee (India) Private Limited. Accordingly, ABN AMRO Mutual Fund had been

renamed to Fortis Mutual Fund with the same SEBI registration number being MF/049/04/01 with effect from

October 24, 2008. The AMC had been renamed to Fortis Investment Management (India) Pvt. Ltd. and Trustee

Company to Fortis Trustee (India) Pvt. Ltd. with effect from September 19, 2008.

D. Consequent to a global and internal restructuring of the Fortis group in the year 2009, the sponsor company is

known as BNP Paribas Asset Management Asia Limited with effect from January 19, 2010

E. 100% share capital of the sponsor, viz. BNP Paribas Asset Management Asia Limited is held by BNP Paribas

Asset Management Holding (erstwhile BNP Paribas Investment Partners SA). The ultimate parent company of

BNP Paribas Asset Management Holding is BNP Paribas SA which is a listed Bank located at Paris.

F. SEBI vide its letter no. OW/YE/23202/2010 dated October 12, 2010 has conveyed its no-objection to the indirect

(India) Private Limited. The Mutual Fund had been renamed to BNP Paribas Mutual Fund (effective October 20,

2010), the AMC to BNP Paribas Asset Management India Pvt. Ltd. (effective October 18, 2010) and the Trustee

Company to BNP Paribas Trustee India Pvt. Ltd. (effective October 22, 2010).

G. On March

Limited] (Baroda AMC and BBNPP AMC jointly referred to

management company of Baroda BNP Paribas Mutual Fund (erstwhile Baroda Mutual Fund) (the surviving

mutual fund). BNP Paribas Trustee India Private Limited merged into Baroda BNP Paribas Trustee India Private

L

TC acting as the trustee company of Baroda BNP Paribas Mutual Fund. Further, there were change of trusteeship

of the schemes of BNP Paribas Mutual Fun

objection via letter no. SEBI/HO/IMD/IMD-I DOF5/P/OW/2022/0000002171/1 dated January 17, 2022,

SEBI/HO/IMD/IMD-I DOF5/P/OW/2022/0000002307/1 dated January 19, 2022, SEBI/HO/IMD-II/DOF-

10/P/OW/3575/1/2022 dated January 28, 2022 and SEBI/HO/IMD-II/DOF-3/P/OW/3593/2022 dated January 28,

2022. Post completion of the transaction, registration certificate of BNP Paribas Mutual Fund was cancelled

w.e.f. April 13, 2022 by SEBI.

B. SPONSORS

BANK OF BARODA (THE CO-SPONSOR OF SURVIVING MF)

Bank of Baroda (BOB) is a body corporate under the Banking Companies (Acquisition and Transfer of Undertakings)

Act, 1970. BOB was founded in 1908 by Maharaja Sayajirao Gaekwad III and was nationalised in 1969. Presently,

BOB is an Indian state-owned entity in the banking and financial services sector. As on March 31, 2024, the

government owns 63.97% of its outstanding share capital. Its shares are listed on the Bombay Stock Exchange

Banking, Retail Banking and others. As on March 31, 2024, it had INR 13,26,957.84 crore and INR 10,90,505.80

crore in Global Deposits and Global Gross Advances respectively, with an Operating Profit of INR 30,965.23 Crore

and INR 15,85,797.09 crore worth of Total Assets. BOB has 8,243 branches in India, with over 74,000 employees.

Its international experience spans over 69 years, with 91 branches and offices (including branches of its

subsidiaries) across 17 countries. For more information, please see https://www.bankofbaroda.in/.

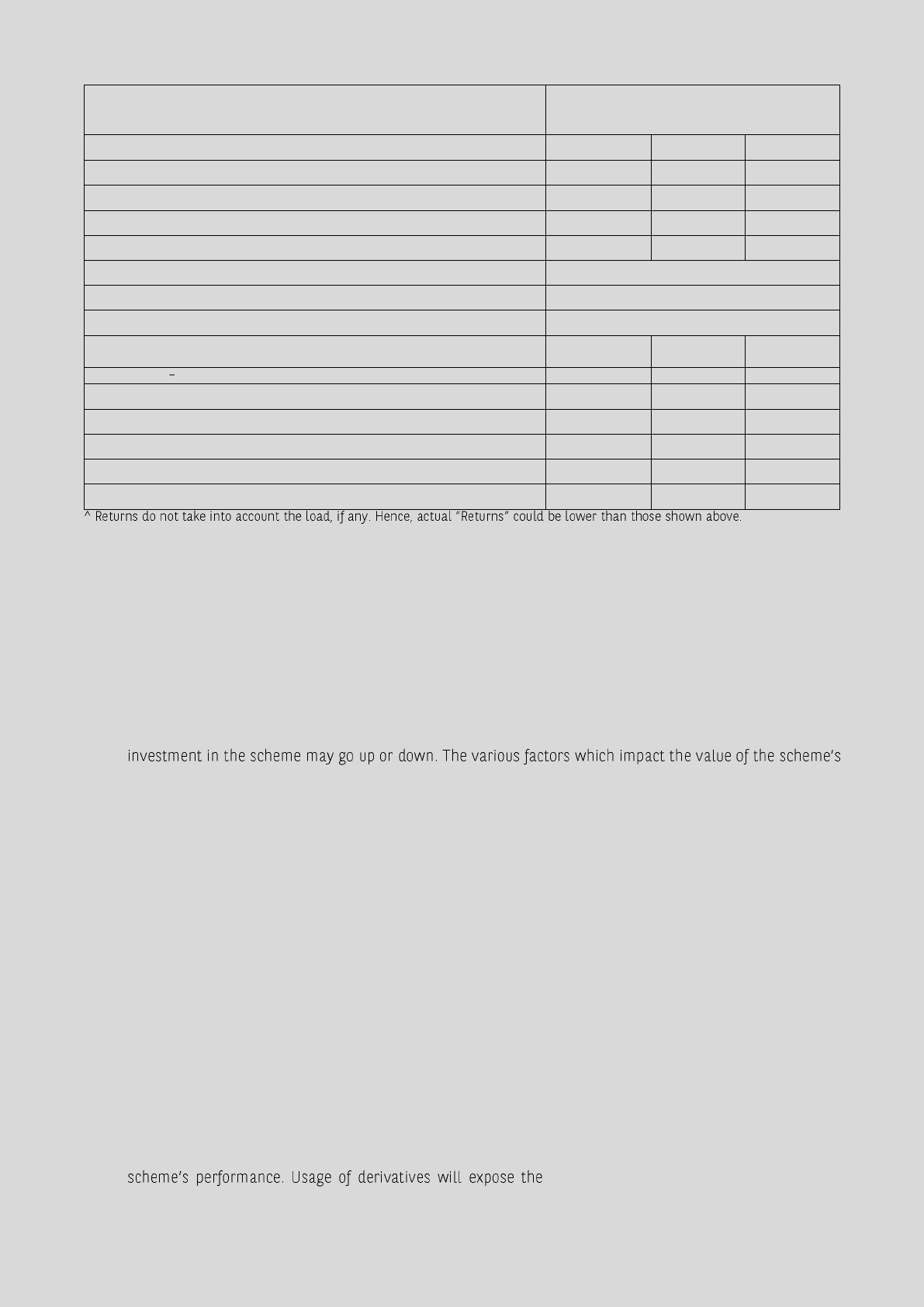

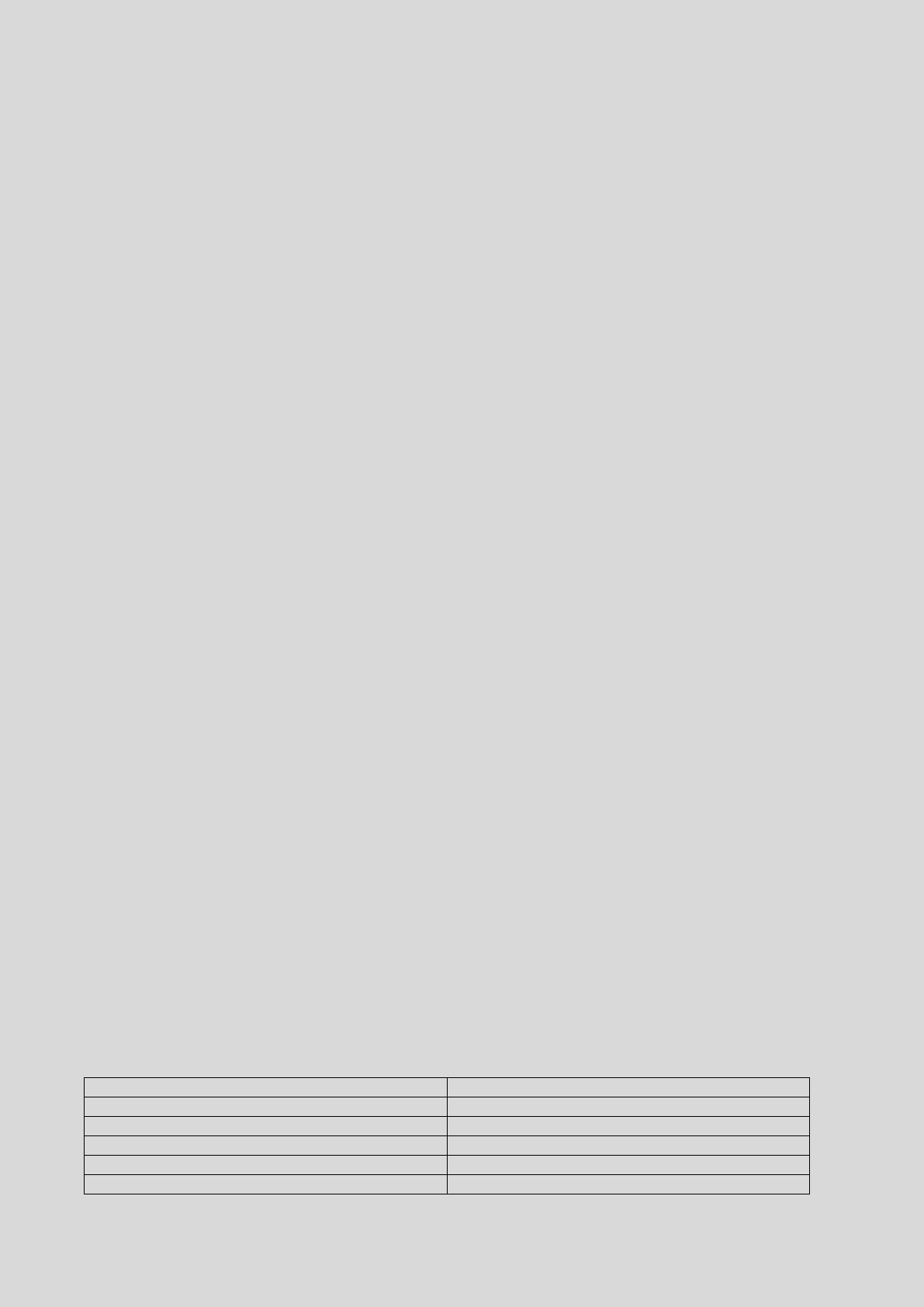

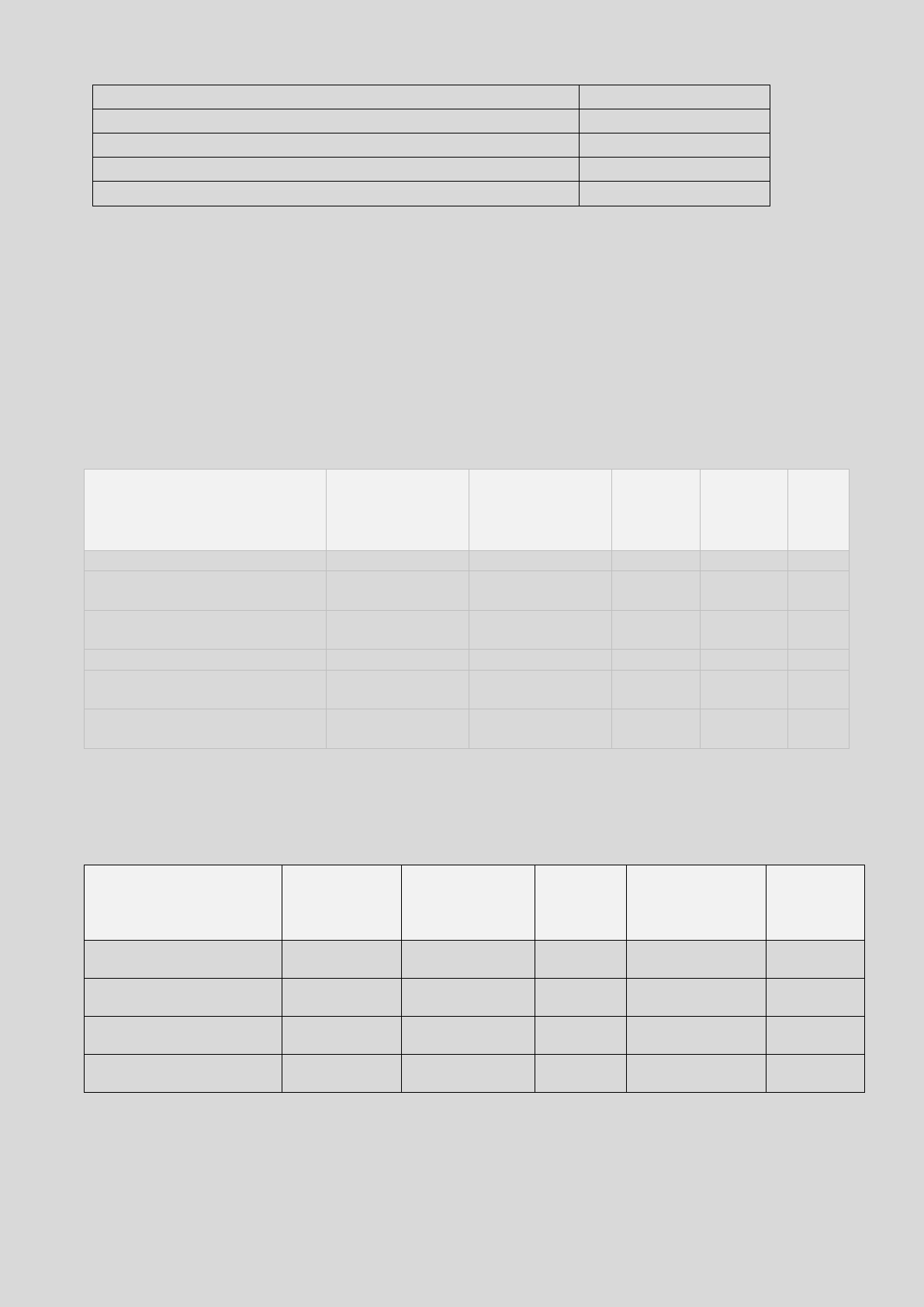

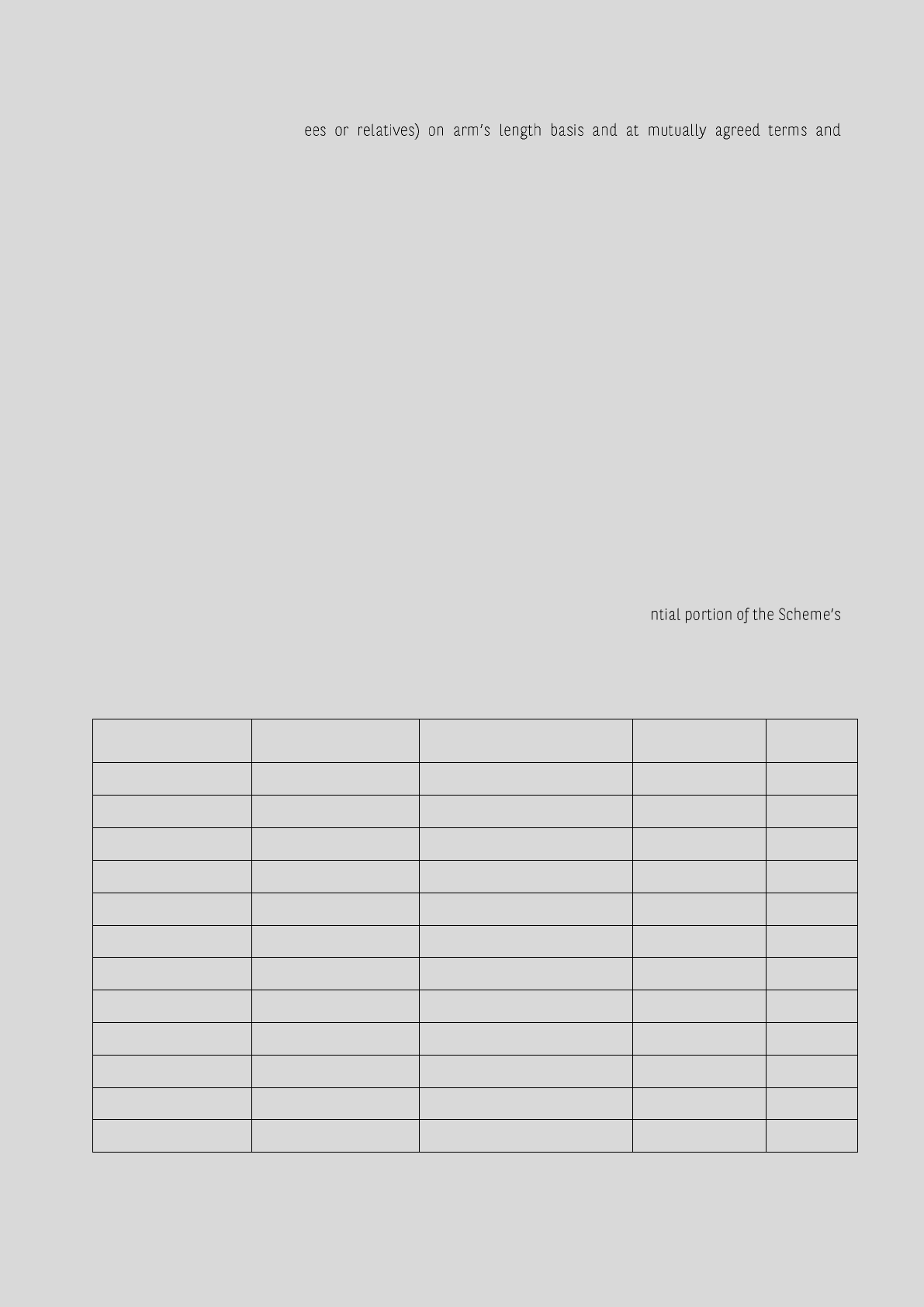

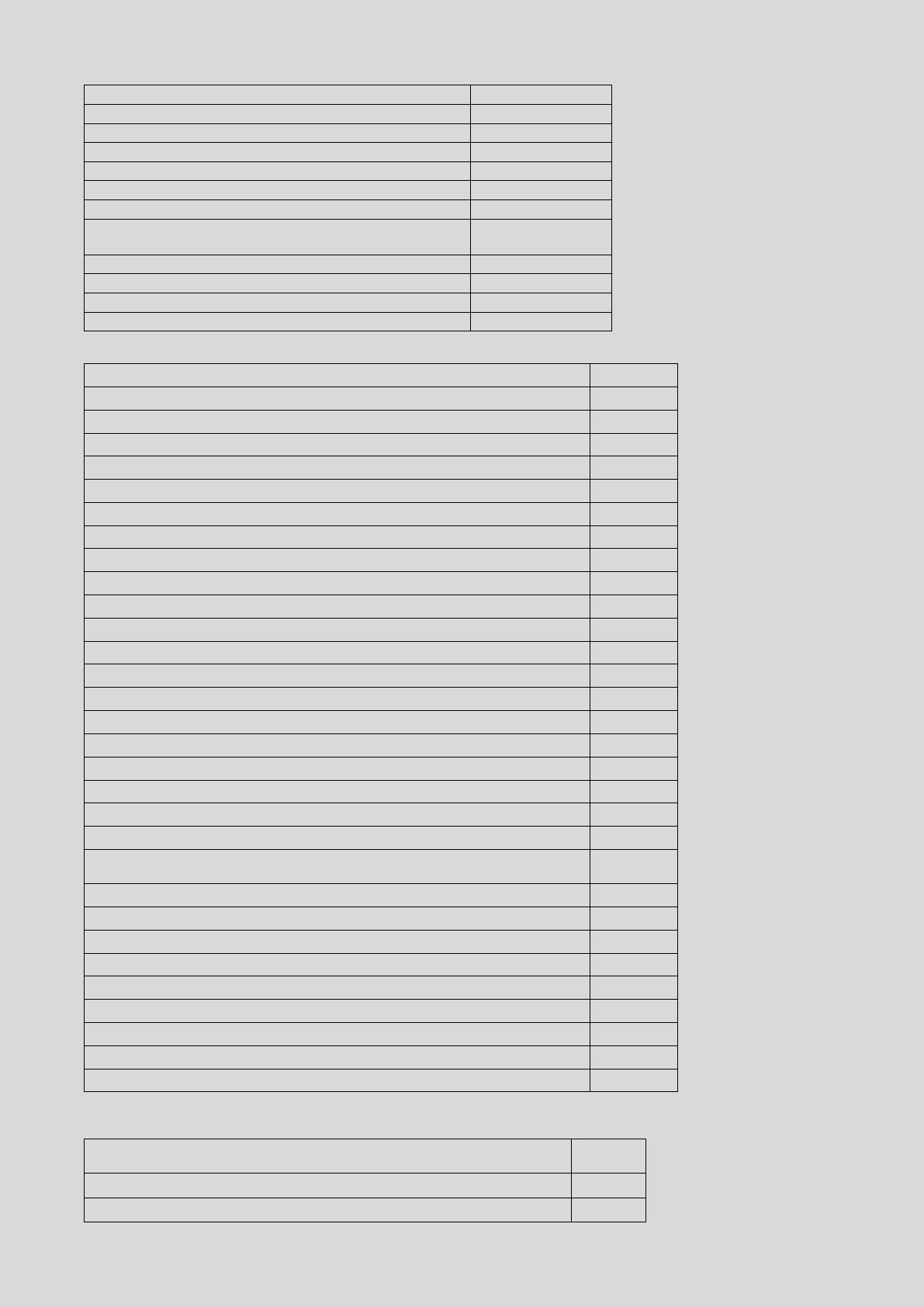

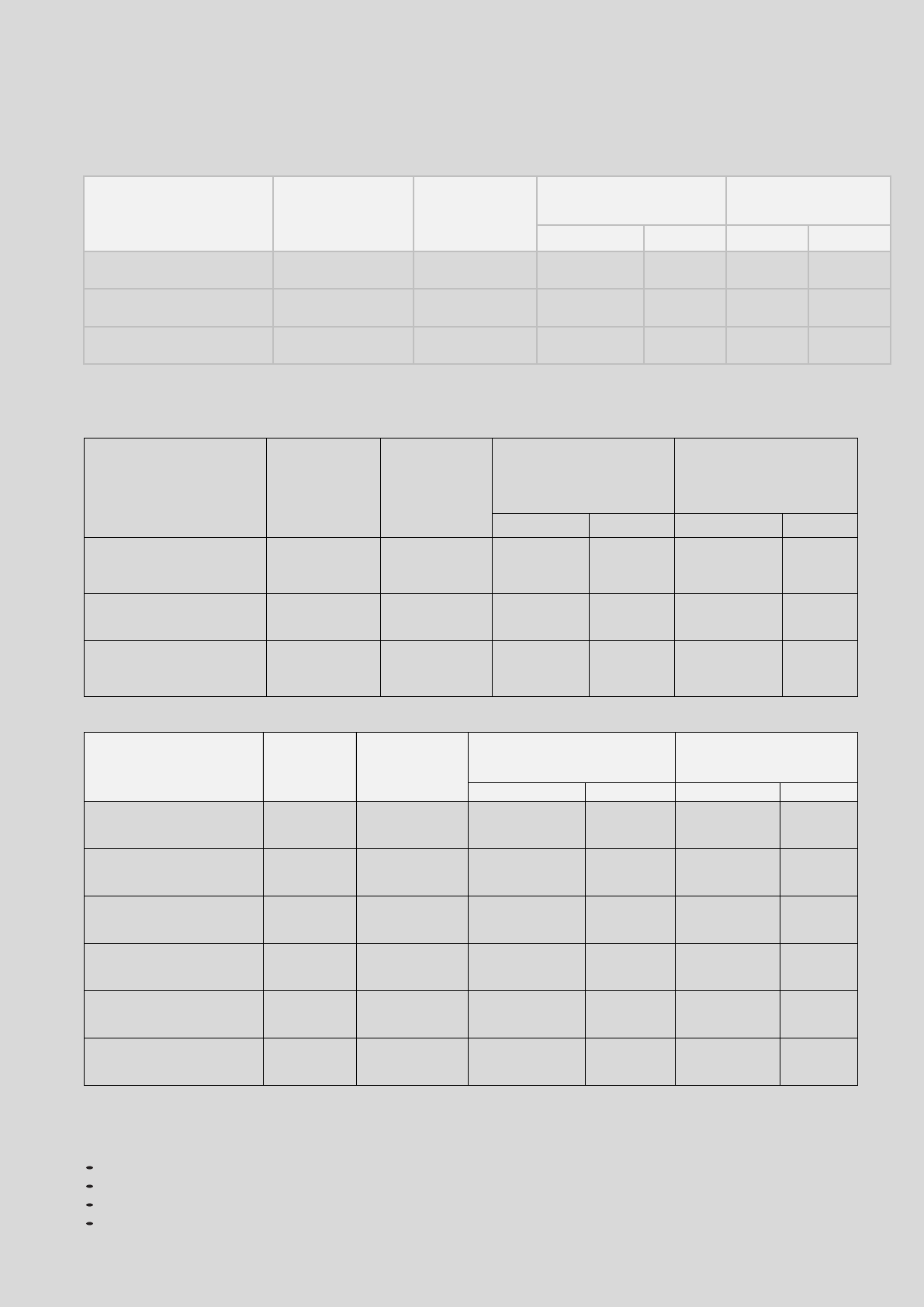

FINANCIAL PERFORMANCE FOR BANK OF BARODA (Rs. in crores)

Particulars

2023-2024

2022-2023

2021-2022

Net Worth

93,850. 76

76,591.07

61,521.92

Total Income

59,216.90

51,381.58

44,105.29

Profit/(Loss) after tax

17,788.78

14,109.62

7,272.28

Assets Under Management

NA

NA

N.A.

NA: Not Applicable

5

BNP PARIBAS ASSET MANAGEMENT ASIA LIMITED (THE CO-SPONSOR OF SURVIVING MF)

and is licensed with the Securities and Futures Commission to conduct Type 1 (dealing in securities), Type 4

(advising on securities), Type 5 (advising on futures contracts) and Type 9 (asset management) regulated activities

under the Securities and Futures Ordinance.

BNPP Asia specializes in the Asian markets for investment funds management /advisory and discretionary

mandates as a part of BNP Paribas Asset Management, the autonomous asset management business of the BNP

Paribas Group

For more information, please see https://www.bnpparibas-am.hk/

FINANCIAL PERFORMANCE FOR BNP PARIBAS ASSET MANAGEMENT ASIA LIMITED

Particulars

CY2024

CY2023

CY 2022

Net Worth (in millions of HKD)

386.58

540.20

237.35

Total Income (in millions of HKD)

229.50

251.79

327.97

Profit/(Loss) after tax (in millions of HKD)

(278.62)

232.85

41.86

Assets Under Management# (in Billion of HKD)

96.43

104.65

126.84

HKD: Hong Kong dollars; #as at 31-Dec

The Sponsor has entrusted a sum of Rs.10,00,000/- to the Trustee as the initial contribution towards the

corpus of the Mutual Fund

C. THE TRUSTEE

Baroda BNP Paribas Trustee India Private Limited (formerly Baroda Trustee India Private limited), through its

Board of Directors, shall discharge obligations as Trustee of Baroda BNP Paribas Mutual Fund. The Trustee ensures

that the transactions entered into by the AMC are in accordance with the SEBI Regulations and will also review

the activities carried on by the AMC. Pursuant to the no-objection certificate received from SEBI vide letter no.

OW/24482/2011 dated July 28, 2011, Baroda Trustee India Pvt. Ltd. (now known as Baroda BNP Paribas Trustee

India Private Limited), was incorporated on December 23, 2011. BNP Paribas Trustee India Private Limited merged

Private Limited], with Baroda BNP Paribas TC acting as the trustee company of Baroda BNP Paribas Mutual Fund.

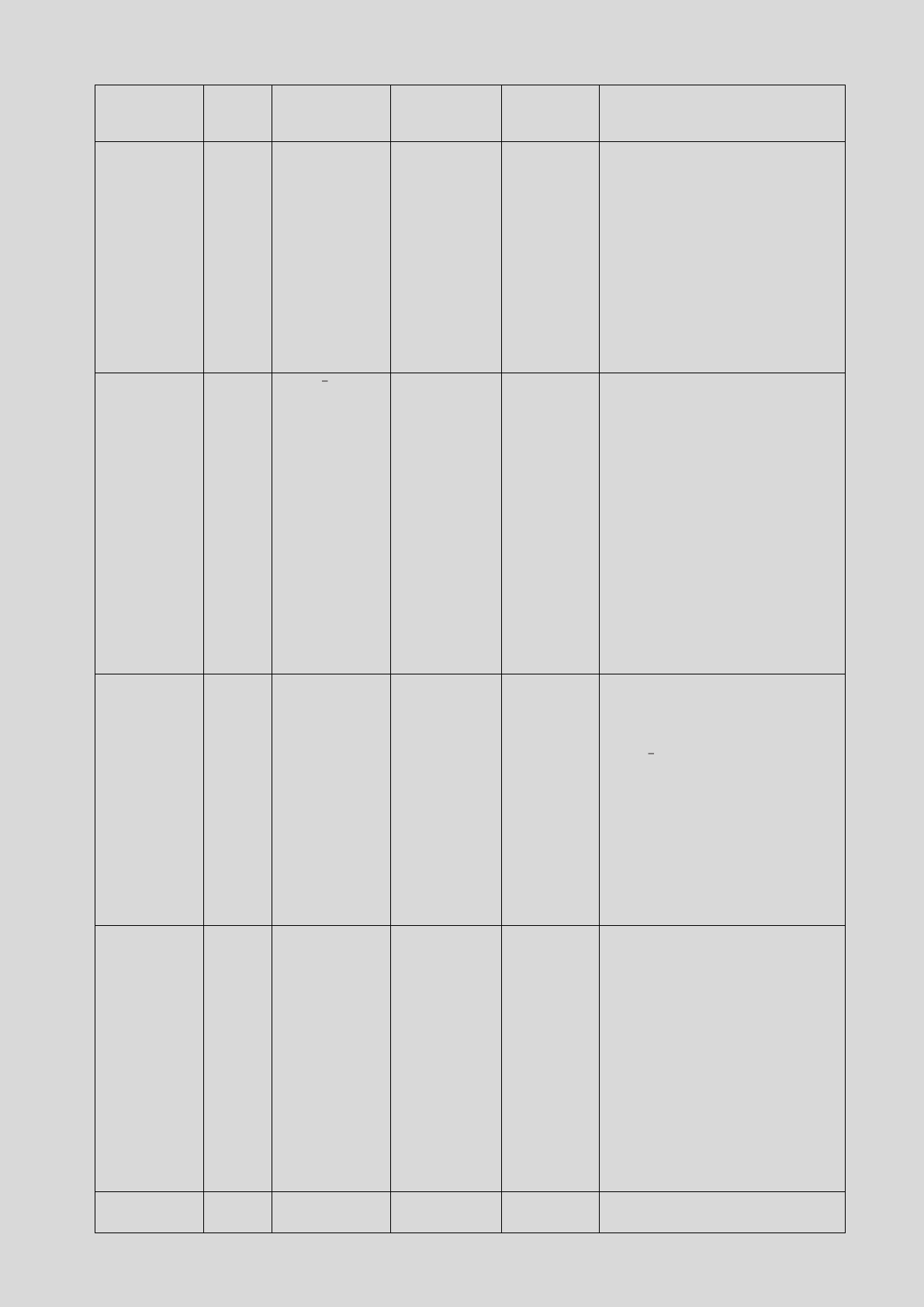

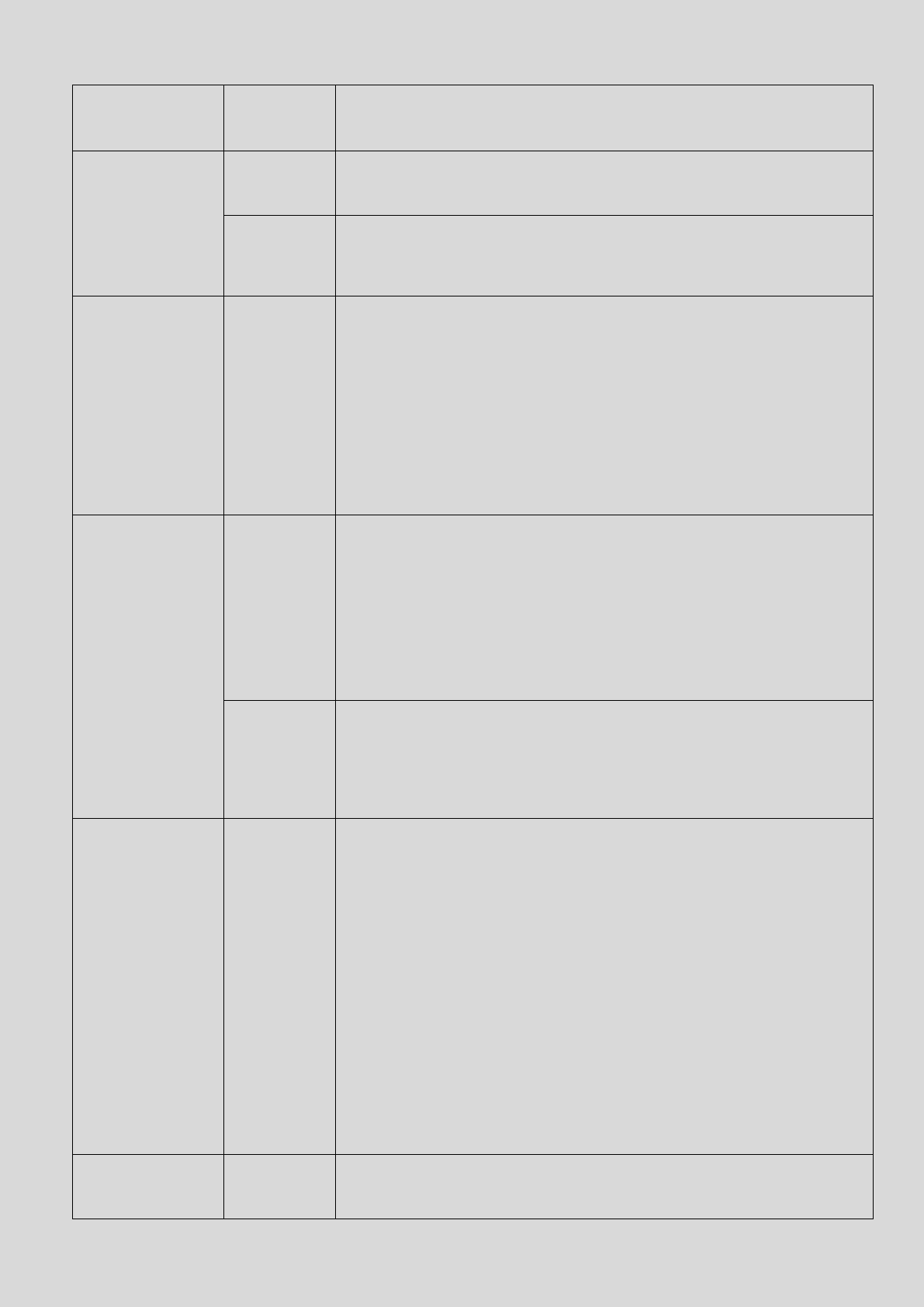

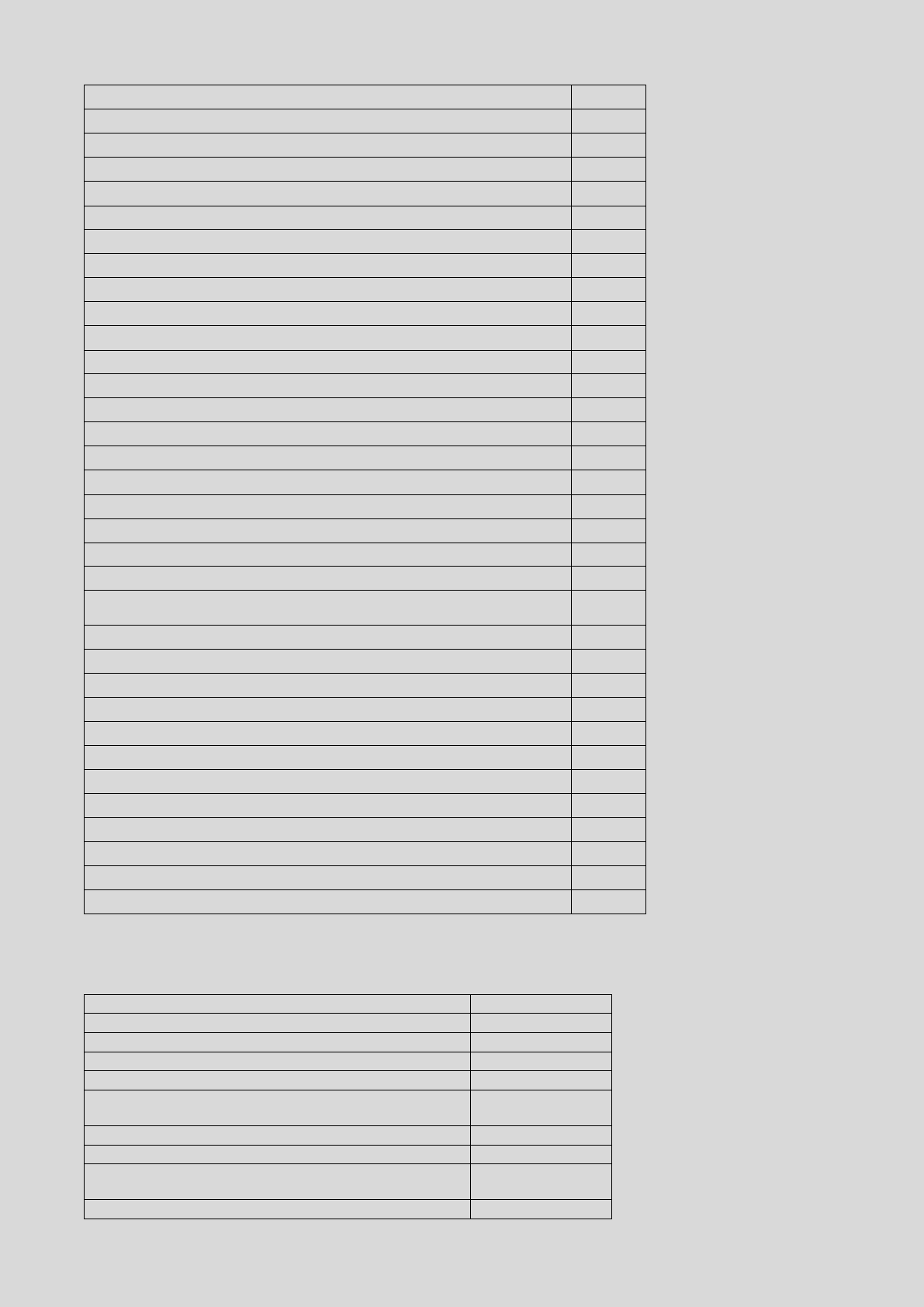

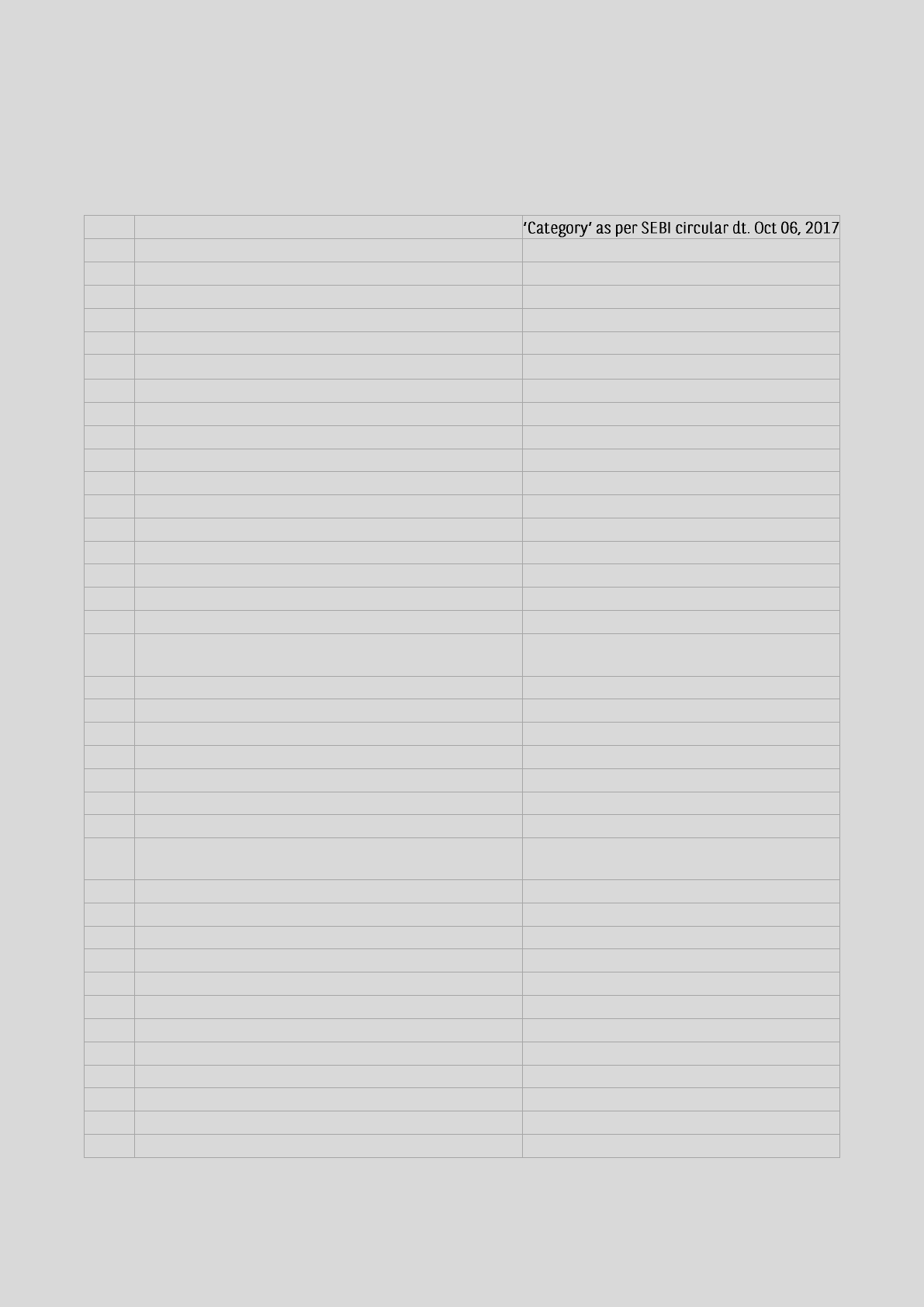

Details of Trustee Directors:

Name

Age

Educational

Qualifications

Brief Experience

Mr. Ashok

Jangid

(Independent

Director)

63 years

B.Com, LL.B, FCS,

Certified Corporate

Director

Mr. Jangid has professional experience of over 40 years in the

Corporate Governance and Board Member. From 1982 to 2013, he

worked in the Senior Management of SIEMENS India & Germany

for 27 years, Urban Infrastructure Venture Capital Ltd. (RELIANCE

MDAG), SUZLON ENERGY Ltd. and ESSAR Group. He has been a

Member of the Boards of Directors and Board Committees of over

40 companies. Since 2014 he has been independently working as

Corporate Advisor, Arbitrator and also a Director on Boards of

certain companies. He has been primarily engaged in advising /

supporting certain foreign and Indian companies on Companies

Act, M&A transactions, Corporate Governance, Board and

Committee structure, processes and policies, Legal, Compliance,

anti-bribery & corruption laws, setting up companies and

operations in India, JVs, Wind Energy Projects, pre IPO

preparations, buyback of shares, delisting, NCLT, etc. which

includes interacting with the Regulators, Government agencies

and Departments. He holds memberships of ICSI, Institute of

Directors (IoD), Indian Institute of Corporate Affairs (IICA MCA) and

Indo-German Chamber of Commerce.

Other Directorship

• EKA Corporate Advisors & Services Private Limited

• C3X Entertainment Private Limited

6

• Warner Ads Private Limited

Mr. Deepak

Narang

(Independent

Director)

69 years

M.Sc. (Physics),

CAIIB, CFA (Inter)

Mr. Deepak Narang has more than 44 years of experience in the

banking industry and was associated with United Bank of India as

an Executive Director during March 2012 to March 2015 (upto his

retirement from the bank). Mr. Narang also held charge of the bank

from February 2014 to December 2014. Mr. Narang has worked in

senior level positions across various capacities in the bank,

especially in the areas of credit sanctioning and recovery.

Mr. Punit

Saxena

(Independent

Director)

67 years

B.Sc. Engg,

in Business

Administration,

CAIIB, Master of

Valuation

Mr. Punit Saxena has a wide experience of over 40 years of which,

more than 14 years is at the CEO/MD level and more than 25 years

is at Board level positions. Mr. Saxena has been associated with

the Unit Trust of India (Mutual Fund) since 1989, in senior level

positions across various functions. Mr. Saxena has held the position

of Chief Executive Officer in UTI Infrastructure and Services Ltd.

since January 2004 till its merger with UTI Technology Services Ltd.

in May 2009. Since then , Mr. Saxena held the position of Managing

Director & Chief Executive Officer of UTI Infrastructure and

Technology Services Ltd., (a Government of India Company under

the Ministry of Finance through Specified Undertaking of Unit Trust

of India) upto June 2017. Mr. Saxena is an Independent Director in

Flair Writing Industries Ltd. where he is the Chairman of Audit

Committee, and Chairman of Stakeholders Relationship Committee

and a member of Risk Management Committee. He is also on the

Board of Chetna Education Limited, Mumbai where he is the

Chairman of the Audit Committee and Chairman of the Stake

Holders Relationship Committee, and a Member of Nomination and

remuneration Committee. On the social front, he is the Hon.

Chairman of Association of Members of G Block, BKC, Mumbai.

Other Directorship

• Flair Writing Industries Limited

• Chetna Education Limited

Mr. Inumella

Venkata

Lakshmi

Sridhar

(Associate

Director)

57 years

B.Com; ACA

Mr. I.V.L. Sridhar is a Bachelor in Commerce and a Chartered

Accountant with overall experience of more than 28 years in the

Banking Industry. Mr. Sridhar worked for Union Bank of India

(1995-2005) and Dena Bank (2005-2007) prior to joining Vijaya

Bank in 2007 and worked in various roles and functions which

include credit, accounts and taxation. Post merger of Vijaya Bank

with Bank of Baroda in 2019, he became an employee of Bank of

Baroda and handled various areas of work as Head-Financial

Accounting (IND-AS), worked in Compliance Function and was

Head of Subsidiaries & Joint Ventures. Presently, he is acting as

Secretary to the Board of Bank of Baroda.

Ms. Jyothi

Krishnan

(Associate

Director)

43 years

BCom; A.C.S and

B.G.L

Ms. Jyothi Krishnan has an overall experience of 20 years in the

financial services industry.

Her work experience is as follows:

1. February 25, 2021 till date - BNP Paribas Asset Management

Asia Limited - Head Compliance APAC (ex-Japan) - Member

of regional management team and supervising local

compliance across APAC jurisdiction

2. May 2013 to February 2021 - BNP Paribas Asset Management

India Private Limited - Head Compliance, Legal, and

Secretarial - To ensure compliance with various regulations,

internal guidelines and corporate secretarial matters.

3. March 2009 to May 2013 - IDFC Asset Management Co. Ltd

Compliance Officer - To ensure compliance with various

regulations issued by SEBI / RBI / PFRDA/ any other regulators.

4. April 2005 to March 2009 - ING Investment Management India

Private Limited Head - Compliance and Risk Management

7

To ensure compliance with various regulations issued by

SEBI/any other regulators and comply with global

policies/guidelines.

June 2003 to April 2005 - Standard Chartered Mutual Fund - Legal

& Compliance - To ensure compliance with various regulations

issued by SEBI / any other regulators and comply with global

policies / guidelines.

Mr. Ashutosh

Bishnoi

62 Years

MBA, B.Com

Mr. Ashutosh Bishnoi has over four decades of rich corporate

experience and expertise in Asset Management industry. His stints

included Mahindra Manulife Investment Management Private

Limited, Association of Mutual Funds in India, L&T Mutual Fund,

State Street, Orbis Capital Limited, etc. He is serving as a member

of the NISM Committees for Empanelment of Resource Person and

the NISM Committees for CPE Accreditation since 2010. He is also

the visiting faculty member at NISM since 2009 and Symbiosis

Institute of Business Management since 2011. He has also received

the Best Alumni Award in 2005 by Symbiosis Institute of Business

Management, Pune. He was the speaker at the Harvard India

stitute of Banking & Finance in 2004.

Directorship:

Multi-Act Trade & Investments Private Limited

Mafatlal Industries Limited

Under the SEBI Regulations, the Trustee has, inter alia, the following rights, duties and responsibilities:

1. The trustees and the asset management company shall with the prior approval of the Board enter into an

investment management agreement.

2. The investment management agreement shall contain such clauses as are mentioned in the Fourth Schedule

and such other clauses as are necessary for the purpose of making investments.

3. The trustees shall have a right to obtain from the asset management company such information as is

considered necessary by the trustees

4. The Trustee shall approve the policy for empanelment of brokers by the AMC and shall ensure that the AMC

has been diligent in empaneling the brokers, in monitoring securities transactions with brokers and avoiding

undue concentration of business with any broker.

5. The Trustee shall ensure that

a. the Asset Management Company has not given any undue or unfair advantage to any associates or dealt

with any of the associates of the Asset Management Company in any manner detrimental to interest of

the Unit holders;

b. the transactions entered into by the Asset Management Company are in accordance with the SEBI

Regulations and the scheme;

c. the Asset Management Company has been managing the Mutual Fund schemes independently of other

activities and have taken adequate steps to ensure that the interest of investors of one scheme are not

being compromised with those of any other scheme or of other activities of the Asset Management

Company; and

d. All the activities of the Asset Management Company are in accordance with the provisions of the SEBI

Regulations.

6. Where the Trustee have reason to believe that the conduct of business of the Mutual Fund is not in accordance

with the SEBI Regulations, it shall forthwith take such remedial steps as are necessary by them and shall

immediately inform SEBI of the violation and the action taken by them.

7. The Trustee shall take steps to ensure that the transactions of the Mutual Fund are in accordance with the

provisions of the Trust Deed and SEBI Regulations.

8. The Trustee shall ensure that the income calculated by the AMC under sub-regulation (25) of regulation 25 of

these regulations is in accordance with the SEBI Regulations and the Trust Deed.

9. The Trustee shall obtain the consent of the Unit holders;

a. whenever required to do so by SEBI in the interest of the Unit holders; or

b. whenever required to do so on the requisition made by three fourths of the Unit holders of any scheme;

or

c. when the majority of the trustees decide to wind up a scheme in terms of clause (a) of sub regulation (2)

of regulation 39 or prematurely redeem the units of a close ended scheme ..

8

10. The trustees shall ensure that no change in the fundamental attributes of any scheme, the fees and expenses

payable or any other change which would modify the scheme and affect the interest of the unit holders is

carried out by the asset management company, unless it complies with sub-regulation (26) of regulation 25 of

these regulations. 11. The Trustee shall quarterly review all transactions carried out between the Mutual Fund,

Asset Management Company and its associates.

12. Each Trustee shall file the details of his transactions of dealing in securities with the Mutual Fund within the

time and manner as may be specified by the Board from time to time .

13. The Trustee shall call for the details of transactions in securities by the key personnel of the asset management

company in his own name or on behalf of the asset management company and shall report to the SEBI, as and

when required.

14. The Trustee shall quarterly review the net worth of the Asset Management Company and in case of any

shortfall, ensure that the Asset Management Company make up for the shortfall as per clause (f) of sub-

regulation (1) Regulation 21 of SEBI Regulations on a continuous basis.

15. The Trustee shall periodically review all service contracts such as custody arrangements, transfer agency of

the securities and satisfy itself that such contracts are executed in the interest of the Unit holders.

16. The Trustee shall ensure that there is no conflict of interest between the manner of deployment of its net

worth by the Asset Management Company and the interest of the Unit holders.

17. The Trustee shall be accountable for, and be the custodian of, the funds and property of the respective schemes

and shall hold the same in trust for the benefit of the unit holders in accordance with SEBI Regulations and the

provisions of Trust Deed.

18. The Trustee shall periodically review the investor complaints received and the redressal of the same by the

Asset Management Company.

19. The Trustee shall furnish to the SEBI on a half yearly basis, -

a. report on the activities of the mutual fund;

b. a certificate stating that the trustees have satisfied themselves that there have been no instances of self

dealing or front running by any of the trustees, directors and key personnel of the asset management

company;

c. a certificate to the effect that the asset management company has been managing the schemes

independently of any other activities and in case any activities of the nature referred to in [clause (b)] of

regulation 24 have been undertaken by the asset management company and has taken adequate steps to

ensure that the interest of the unitholders are protected.

20. The independent trustees referred to in sub-regulation (5) of Regulation 16 shall give their comments on the

report received from the asset management company regarding the investments by the mutual fund in the

securities of group companies of the Sponsor.

21. The Sponsor or the Trustee shall be entitled by one or more Deed/s supplemental to the Trust Deed to amend,

modify, alter or add to the provisions of the Trust Deed in such manner and to such extent as they may consider

expedient for any purpose, provided that:

a. no such amendment, modification, alteration or addition shall be made without the approval of the

Unitholders and SEBI;

b. no such modification, alteration or addition shall impose upon any Unitholder any obligation to make any

further payment in respect of his Units or to accept any liability in respect thereof.

22. Where the SEBI Regulations provide for seeking the approval of the Unitholders for any purpose, the Trustee

may adopt any of the following procedures:

a. Seeking approval by Postal Ballot or

b. Approval of the Unitholders present and voting at a meeting to be specifically convened by the Trustee

for the purpose. For this purpose, the Trustees shall give 21 days notice to the Unitholders and the

Trustees may lay down guidelines for the actual conduct and accomplishment of the voting at the meeting

and announcement of the results or

Such other means as may be approved by SEBI23.

or institutions or financial intermediaries or any body corporate with which any of the directors of the Trustee

may be associated.

23. To ensure that no director of the Trustee participates in meetings of the Board of Directors of the Trustee or in

any decision making process for any investments in which he/she may be deemed to be interested.

24. To furnish to the Trustee, particulars of interest that each of the directors of the Trustee may have in any other

company or institution or financial intermediary or any corporate by virtue of his/her position as director,

partner or with which he/she may be associated in any other capacity.

25. The Trustee shall abide by the Code of Conduct as specified in PART-A of the Fifth Schedule to the SEBI

Regulations.

26. The Trustee shall exercise due diligence as under;

a. General Due Diligence:

i. The Trustee shall be discerning in the appointment of the Directors on the Board of the Asset Management

9

Company.

ii. Trustee shall review the desirability of continuance of the Asset Management Company if substantial

irregularities are observed in any of the schemes and shall not allow the Asset Management Company to

float new schemes.

iii. The Trustee shall ensure that the trust property is properly protected, held and administered by proper

persons and by a proper number of such persons.

iv. The Trustee shall ensure that all service providers are holding appropriate registrations from SEBI or

concerned regulatory authority.

v. The Trustees shall arrange for test checks of service contracts.

vi. Trustees shall immediately report to SEBI of any special developments in the Mutual Fund.

b. Specific Due Diligence:

The Trustee shall:

i. Obtain internal audit reports at regular intervals from independent auditors appointed by the Trustee.

ii. Obtain compliance certificates at regular intervals from the Asset Management Company.

iii. Hold meeting of Trustee more frequently.

iv. Consider the reports of the independent auditor and compliance reports of Asset Management Company at

the meetings of Trustee for appropriate action.

v. Maintain records of the decisions of the Trustee at their meetings and of the minutes of the meetings.

vi. Prescribe and adhere to a code of ethics by the Trustee, Asset Management Company and its personnel.

vii. Communicate in writing to the Asset Management Company of the deficiencies and checking on the

rectification of deficiencies.

viii. The trustees shall also exercise due diligence on such matters as may be specified by the Board from time

to time.

27. The Independent Directors of the Trustee or Asset Management Company shall pay specific attention to the

following, as may be applicable, namely:

a. The Investment Management Agreement and the compensation paid under the agreement.

b. Service contracts with associates whether the Asset Management Company has charged higher fees than

outside contractors for the same services.

c.

d. Securities transactions involving associates to the extent such transactions are permitted.

e. Selecting and nominating individuals to fill independent Directors vacancies.

f. Code of ethics must be designed to prevent fraudulent, deceptive or manipulative practices by insiders in

connection with personal securities transactions.

g. The reasonableness of fees paid to Sponsor, Asset Management Company and any others for services

provided.

h. Principal underwriting contracts and their renewals.

i. Any service contract with the associates of the Asset Management Company.

28. Notwithstanding anything contained in the SEBI Regulations 18 (1) to 18 (25), the Trustee shall not be held

liable for acts done in good faith if they have exercised adequate due diligence honestly.

The supervisory role of the Trustee will be discharged by reviewing the information and the operations of the

Mutual Fund based on the periodic reports submitted at the meetings of the Trustee and by reviewing the reports

submitted by the Internal Auditor. The Trustee will also conduct a detailed review of annual accounts of the

Scheme of the Mutual Fund. Presently the Board of Directors of Trustee is required to hold a meeting at least once

in two calendar months and at least six such meetings are required to be held every year. During the financial

year 2023-24, six Board Meetings had been held.

The Board of Directors of the Trustee has constituted an Audit Committee, comprising of 6 Directors of which 4 are

Independent Directors from the Board of Directors of the Trustee; pursuant to para 6.1 of SEBI Master circular

SEBI/HO/IMD/IMD-PoD-1/P/CIR/2024/90 dated June 27, 2024 Trustee may require or give verification of identity

or other details regarding any subscription or related information from / of the Unit holders as may be required

under any law, which may result in delay in dealing with the applications, Units, benefits, distribution, etc.

Trustee - Fees and Expenses

Pursuant to the Trust Deed constituting the Mutual Fund, the Trustee in addition to reimbursement of all costs,

charges and expenses incurred in or about the administration and execution of the Mutual Fund, is entitled to

receive a fee computed at a rate specified in the individual Scheme Information Document.

The Trustee may charge further fees as permitted from time to time under the Trust Deed and the SEBI Regulations.

All Administration and Operational expenses are borne by Asset Management Company.

10

II. ASSET MANAGEMENT COMPANY

Baroda BNP Paribas Asset Management India Private Limited is a private limited company incorporated under the

Companies Act, 1956, having its Registered Office at 201(A) 2nd Floor, A wing, Crescenzo, C-38 & 39, G Block,

Bandra-Kurla Complex, Mumbai, -400051 Maharashtra, India. 50.1% of the paid up equity share capital of the

AMC is held by Bank of Baroda and 49.9% of the paid up equity share capital of the AMC is held by BNP Paribas

Asset Management Asia Limited.

Baroda BNP Paribas Asset Management India Private Limited has been appointed as Asset Management Company

of Baroda BNP Paribas Mutual Fund by the Trustee vide Investment Management Agreement (IMA) dated March

14, 2022 executed between Baroda BNP Paribas Trustee India Private Limited (erstwhile Baroda Trustee India

Private Limited) and Baroda BNP Paribas Asset Management India Private Limited (erstwhile BNP Paribas Asset

Management India Private Limited).

Historical background and other business of AMC:

• Erstwhile ABN AMRO Asset Management (India) Limited was a company incorporated under the Companies

Act, 1956 on November 4, 2003. ABN AMRO Asset Management (India) Limited had been appointed as Asset

Management Company of ABN AMRO Mutual Fund (Now known as BNP Paribas Mutual Fund) by the Trustee

vide Investment Management Agreement (IMA) dated April 15, 2004 and executed between ABN AMRO Trustee

(India) Private Limited and ABN AMRO Asset Management (India) Limited. SEBI had approved ABN AMRO Asset

Management (India) Limited to act as the Asset Management Company (AMC) of the Mutual Fund vide its

letter No. IMD/YK/11091/2004 dated May 28, 2004.

• Due to changes in minority shareholding, the Company was converted into a Private Limited Company and

was named as ABN AMRO Asset Management (India) Private Limited vide fresh Incorporation Certificate dated

June 20, 2008. Consequent to the global restructuring of ABN AMRO, ABN AMRO Asset Management had become

a part of Fortis Investment Management resulting in indirect change in the control of AMC. Subsequently,

name of ABN AMRO Asset Management (India) Private Limited had been changed to Fortis Investment

Management (India) Private Limited vide fresh Incorporation Certificate dated September 19, 2008.

• Pursuant to global restructuring of Fortis group and indirect change in the control of AMC, name of Fortis

Investment Management (India) Private Limited changed to BNP Paribas Asset Management India Private

Limited vide fresh Incorporation Certificate dated October 18, 2010. SEBI vide its letter no. OW/YE/23202/2010

dated October 12, 2010 had conveyed its no objection to the indirect change in control of Fortis Investment

and the AMC was renamed as BNP Paribas Asset Management

India Pvt. Ltd..

•

Management India Private Limited (BNP AMC) with BNP AMC acting as the surviving AMC of Baroda BNP

Paribas Mutual Fund (the surviving mutual fund) and the AMC was renamed as Baroda BNP Paribas Asset

Management India Private Limited. SEBI issued its no objection vide letter SEBI/HO/IMD/IMD-I

DOF5/P/OW/2022/0000002171/1 dated January 17, 2022, SEBI/HO/IMD/IMD-I

DOF5/P/OW/2022/0000002307/1 dated January 19, 2022, SEBI/HO/IMD-II/DOF-10/P/OW/3575/1/2022 dated

January 28, 2022 and SEBI/HO/IMD-II/DOF-3/P/OW/3593/2022 dated January 28, 2022.

Other business of AMC

In accordance with the SEBI Regulation 24(b), an asset management company, subject to certain conditions, is also

permitted to undertake activities in the nature of portfolio management services, management and advisory services

to offshore funds, pension funds, provident funds, venture capital funds, management of insurance funds, financial

consultancy and exchange of research on commercial basis and such other activities as may be permitted by SEBI

from time to time..

• ABN AMRO Asset Management (India) Private Limited (subsequently BNP Paribas Asset Management India

Private Limited) had received an approval from SEBI vide its letter No. IMD/SP/67987 dated May 29, 2006 for

rendering services as Portfolio Manager under SEBI (Portfolio Managers) Rules and Regulations, 1993 under

Registration no. PM/INP000001728. The AMC commenced Portfolio Management Service (PMS) with effect from

September 26, 2006. Rendering the PMS is not in conflict of interest with the activities of the Mutual Fund.

• Subsequent to the indirect change in control of Fortis Investment Management (India) Private Limited, SEBI

granted fresh registration in the name of BNP Paribas Asset Management India Private Limited (now known

as Baroda BNP Paribas Asset Management India Private Limited) vide its letter No. IMD/DOF

1/MT/OW/25642/2010 dated October 28, 2010 for rendering services as Portfolio Manager under SEBI

(Portfolio Managers) Rules and Regulations, 1993 under Registration No. PM/INP000003716. As a pre-

condition to the amalgamation of Baroda Asset Management India Limited with BNP Paribas Asset

11

Management India Private Limited, RBI directed vide letter no. DoR.AUT.No.S3289/24.01.002/2021-22 dated

January 05, 2022 that the merged entity shall only service the existing PMS customers till maturity and not

acquire any fresh business under PMS related services till further directions from RBI. Subsequently, RBI vide

letter bearing no. DoR.AUT. No. S8094/24.01.2022/2022-23 dated March 20, 2023 accorded approval for

undertaking new PMS business through Baroda BNP Paribas Asset Management India Private Limited. The

SEBI certificate for PMS in the name of Baroda BNP Paribas Asset Management India Private Limited

(Registration No. PM/INP000003716) is dated March 21, 2023. Further, SEBI has extended its no objection to

render non-binding Investment Advisory Services to Category I and / or Category II Foreign Portfolio Investors

(FPIs) in accordance with Regulation 24 (b) of SEBI (Mutual Funds) Regulations vide its letter dated

IMD/DF3/OW/P/2019/13985/1 dated June 7, 2019 to the merged entity i.e. Baroda BNP Paribas Asset

Management India Private Limited vide its letter SEBI/HO/IMD-II/DOF-10/P/OW/3573/1/2022 dated January

28, 2022.

• Further, SEBI vide its letter no. SEBI/HO/IMD/IMD-RAC-3/P/OW/2023/42457/1 dated October 16, 2023 granted

no-objection to the AMC to set up a branch in GIFT city, Ahmedabad. The International Financial Services

Centres Authority (IFSCA, regulator at GIFT city) granted certificate of registration dated March 6, 2024 to AMC

under the category - Registered Fund Management Entity (Non-Retail). The AMC provides investment

management and advisory services to offshore funds of BNP Paribas group from GIFT city.

The AMC undertakes the above activities (other than the Mutual Fund activity), after satisfying itself that there is no

potential conflict of interest between the activities and by ensuring that conditions as prescribed under SEBI MF

Regulations are adhered to.

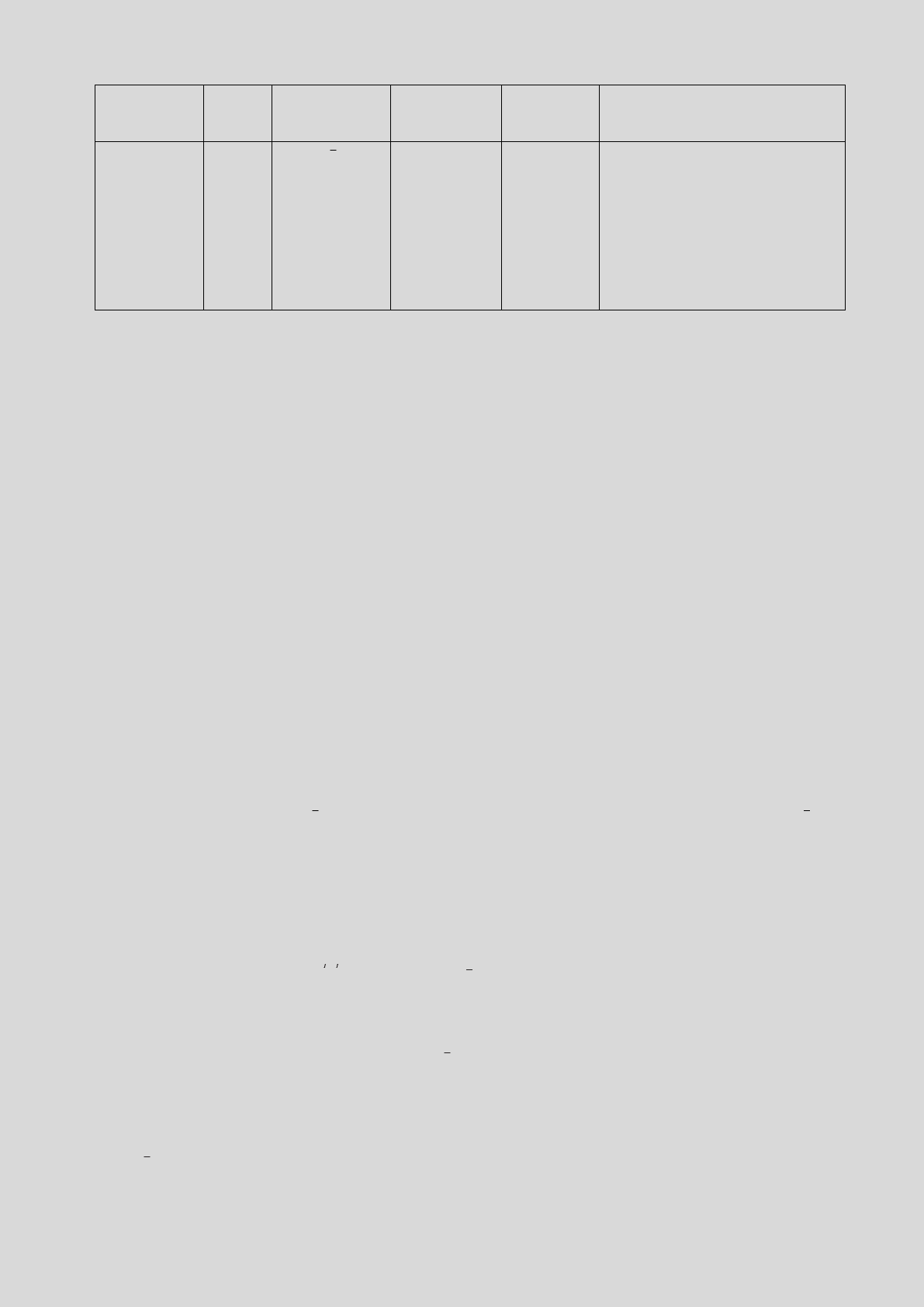

DETAILS OF AMC DIRECTORS

Name

Age

Educational

Qualification

Brief Experience

Mr. Sanjay

Sachdev

(Independent

Director)

61Years

Certificate in

Corporate

Governance -

Wharton School of

Management;

LL.B Government

Law College,

University Of

Bombay;

International

Management -

American Graduate

School of

International

Management

(Thunderbird),

Phoenix, AZ, USA

2018 Harvard ALI

Fellow

Fellow of the LIMRA

Life Insurance

Institute

Mr. Sanjay Sachdev is Managing Director of Freedom Financial

Services, a family office focused on Investing in Financial Services

businesses and Education. He is a Senior Advisor to First Trust

Portfolios, a Global Asset Manager and the largest manager of

active ETFs in the world helping them with their Asia expansion for

over 7 years and an Advisory Board member of Apis Partners, a

Private Equity Impact Fund Manager for over 8 years. He is also a

Board member of BNP- Baroda Asset Management India Private

Limited and associated as a Senior Advisor to Brandeis University

helping them with social impact investments in India. Sanjay has

over 28 years of experience in the global financial services industry

in various leadership positions helping multinational businesses

invest in India and S.E. Asia and establishing financial services

businesses. He is a Fellow of the Advanced Leadership Initiative at

Harvard University focused on finding solutions to global issues

that Impact society. He was the Founding Chairperson of the United

Way of Mumbai in India and has been focused on championing

gender equality and women's rights and education in India.

He was the Founding Chairperson of the United Way of Mumbai and

a Board Member and Global Chairperson of the Financial Planning

Standards Board, a non-profit that issues the Certified Financial

Planner (CFP) designation for wealth managers in 26 countries. He

was also the founding President of the US-India Investment Forum

and was ranked by The Week Magazine as one of the 50 emerging

leaders in India in 2004. Besides his time at Harvard as an ALI

Fellow in 2018, Sanjay holds a Certificate in Corporate Governance

- Wharton School of Management, a MBA from the American

Graduate School of International Management (Thunderbird),

Phoenix, AZ, USA and a Degree in Law and Business from the

University of Bombay.

Ms. Aparna

Sharma

(Independent

Director)

49

Years

Bachelor of Arts

(History, Political

Science and

Economics) -

Maharani Laxmibai

College, Bhopal;

Ms. Aparna Sharma made her foray into the Corporate world

through NOCILI and moved into different roles in the HR function in

organisations like Monsanto, Novartis, UCB, Deutsche Bank, Lafarge

& Greaves Cotton. In her diverse roles, Aparna has successfully

been a learning partner, mentor and coach to leaders, leadership

12

• Post Graduate in

Personnel

Management &

Industrial Relations

- Tata Institute of

Social Sciences

(TISS), Mumbai

teams and organisations to build competencies, learning abilities

and nimbleness for achieving purposeful performance.

With over 28 years of experience in HR across different verticals,

she is currently contributing as a Board Mentor with various Boards

and as an advisor to various corporates in areas such as Strategic

Leadership, Planning, Organization Behaviour and Strategy for

Board Room Effectiveness, Organization Culture & Development,

Leadership Relationships, Temperamental Traits and Derailment

Factors within Boards, etc.

Beyond her corporate role as an HR Leader, Aparna also dons the

hat of HR contributor through her associations with the Indian

Society of Training & Development (ISTD), All India Management

Association (AIMA), National Institute of Personnel Management

(NIPM), National HRD Network and Sumedhas, where she actively

participates in disseminating her acquired knowledge and build the

HR fraternity by creating future leaders.

Aparna is also a celebrated author of 2 best-selling books -

Bytes -

foreword by Padma Bhushan Padma Shri Dr. Devi Shetty.

Other Directorships

Unitop Chemicals Private Limited

Rossari Biotech Limited

Fabtech Technologies Private Limited

Mr. Nagesh

Alai

(Independent

Director)

65

Years

Mr. Nagesh Alai is a Co-Founder of an AI technology enterprise

solutions start-up. He has been an Independent Director in

marquee brands like Morgan Stanley, Vodafone group companies,

FCB companies in India and abroad. Currently, Mr. Alai serves on

the board of Baroda BNP Paribas AMC as an Independent Director.

Mr. Alai has had an extensive professional work experience across

various functions namely management, strategy, finance, tax, legal,

corporate law, corporate governance, mergers and acquisitions and

human resources and has held top positions of responsibilities in

India and abroad.

His professional journey began with finance, tax and management

advisory practice. After a near decade in consultancy, he migrated

to the corporate world, beginning with a stint of over 8 years in the

pharma companies between 1983 and 1990 in MNCs like Boots

Pharmaceuticals (now Abbott) and John Wyeth (now Pfizer). In

1990, Mr. Alai moved on to FCB Ulka Advertising Pvt Ltd (a top four

advertising communications group in India), a wholly owned

subsidiary of the NYSE quoted Interpublic Group of Companies,

headquartered in New York, responsible for various functions like

finance, law, management, business, mergers and acquisitions, HR,

IT, etc, in India and across Asia and Pacific regions. Between 1990,

when he joined FCB, and 2016, when he superannuated, Mr. Alai

has held leadership positions such as CFO, Company Secretary,

General Counsel, Executive Director, CFO Asia Pacific and Africa and

Group Chairman.

His extensive experience and expertise have seen Mr. Alai playing

active leadership roles in industry bodies through his long career

including helming the apex Advertising Industry Association (AAAI)

as its President between 2010 - 2012 and the regional advertising

industry body, Confederation of Asian Advertising Agencies

Association as its Chairman between 2015 - 2017. Mr. Alai has been

active in self-regulation in advertising and has served on the apex

watch dog, Consumer Complaints Council of ASCI. Mr. Alai has been

on various committees of industry bodies like CII etc. and has been

and continues to be a guest columnist in business and general

13

magazines, covering topical business, economic, finance and social

issues.

Mr. Alai is also on the advisory Board of pan-India NGOs in the

skilling and livelihood space and is an independent Director on the

board of few corporates. He has also served on the Boards of other

NGOs in the geriatrics and elder care space. Mr. Alai is a guest

faculty at different management colleges including his alma mater,

teaching Finance, Financial Markets and Corporate Finance,

Leadership and Success Metrics. He is an active mentor to start ups

and businesses.

He is an avid art connoisseur/collector, voracious reader, high

altitude trekker, a marathoner and a motivational mentor.

Other Directorships

Wild Dreams Properties Private Limited

Mr. Vincent

Trouillard-

Perrot

(Associate

Director)

57

Years

Graduated of INSEEC

business school

(Paris Bachelor)

MBA in CECI

(International

commerce) and ITM

in Paris (Dealing

room specialization),

both in Paris

(France)

INSEEC Paris

Business school

Mr. Trouillard-Perrot spent all his career at BNP Paribas Group in

vast areas of business and responsibilities in Paris and in many

regions of the globe especially in Asia and in the Nordic countries.

After experiences in CIB, General Inspection and Private Banking,

Mr. Trouillard-Perrot joined the Asset Management business line

in 2003 as President and CEO of BNPPAM Japan based in Tokyo.

Then he was appointed CEO Asia and head of the regional APAC hub

based in Hong Kong. He then joined Alfred Group (a subsidiary of

BNPPAM) covering the Nordic and Baltic countries based in

Stockholm. In 2018, he was appointed back to the head office of

BNPPAM based in Paris, to oversee a wide number of countries

where BNPPAM has its operations, from Latam, Asia, EMEA and the

Nordic countries. Since 2020, he has the overall responsibility of

supervising and developing the strategic participations and Joint-

Ventures of BNPP Asset Management. With over 30 years of rich

and diverse experience in financial industry, especially in Wealth

Management for over 20 years (in Private Banking and Asset

Management), he has accumulated a successful and relevant

experience in dealing with many commercial and regulatory

environments, as a leader and as a Board member

Other Directorships

HFT IM China

(Norway)

NPP ABC WMC (China)

Mr. David

Vaillant

(Associate

Director)

48

Years

Harvard University,

Fintech Program

Master in Economic

Analysis and Policy

(applied

mathematics),

EHESS, Ecole

Normale Supérieure

Master in Political

Sciences and Public

Affairs, Science Po

Paris

Admitted to the Paris

Bar, Law, Paris Bar

School - EFB

Master in Corporate

Law, Université

Panthéon Assas

(Paris II)

Mr. David Vaillant oversees finance, strategy and participations,

inclusive of our joint ventures in Asia and Latin America. He serves

as the Deputy CEO for BNPP AM Europe and sits on the Executive

Committee of BNPP AM. In addition to these roles, Mr. Vaillant is

Chairman of the Board of Gambit Financial Solutions-a Fintech

specialized in digital investment platform and of IWC (International

Woodland Company), a leading provider of investment solutions in

forestry and agricultural land. He also holds the position of Director

at Aquis Exchange PLC and chairs the supervisory board of Aquis

Exchange Europe, a technology-led exchange group, listed on AIM.

Mr. Vaillant is a member of the IAPB International Advisory Panel

on Biodiversity Credits. Prior to his current engagements, Mr.

Banking / FIC division as the Head of Banking for EMEA.

transformational transactions (notably the acquisition of Fortis)

and has been a significant contributor to the BNP Paribas franchise

across Europe and emerging markets. Having initiated his

14

Master in Business

Law, Université René

Descartes (Paris V)

Master in

Communications/

Intellectual Property

law, Université

Panthéon Sorbonne

(Paris I)

Master in

Management,

Community of

European

Management

Schools (Rotterdam

University, Bocconi,

London School of

Economics, etc.)

Master in

Management, HEC

professional journey at Skadden as a lawyer, he later transitioned

to the French central bank (Banque de France). Mr. Vaillant has

taught finance, law and economics in various institutions and

presently lectures on Sustainable Finance at HEC Paris Business

in management from HEC Paris, a Master in Political Sciences and

Public Affairs from Sciences Po, a Master in Analysis and Policy in

Economics (applied mathematics) from EHESS / Ecole Normale

Supérieure, as well as fintech studies at Harvard, a Master in

Communications/Intellectual Property law from Paris I Sorbonne

University and a Master in Business Law from Paris II Assas

University.

Mr.Vaillant is a member of the Paris Bar.

Other Directorships

Europe

International Woodland Company Holding A/S

Gambit Financial Solutions

Mr. Sanjay

Kumar

Grover

55

years

Master in Economics,

CAIIB

Mr. Sanjay Grover, a seasoned banker and treasurer, is a senior

executive in Bank of Baroda. His area of expertise is Treasury

Operations where he has spent most of his career and gained skills

and expertise in the domain in true holistic sense. Presently, as

Chief General Manager, he is heading Treasury and Global Markets

in Bank of Baroda.

Mr Grover is associated with Bank of Baroda since 1993 in different

positions. He has completed two sought after stints of overseas

posting. One as Treasury Dealer in Dubai, UAE and second as

prestigious position of Chief Executive (European Operations) and

Managing Director & CEO of Bank of Baroda (UK) Limited.Mr Grover

Indian Institute of Bankers. He has successfully participated in

Leadership Development Program of IIM-B which is an initiative of

Bank Board Bureau in collaboration with IBA and supported by

Department of Financial Service, Ministry of Finance (GoI). Mr.

Grover has participated in numerous seminars, workshops and

training programs in India and overseas throughout his career.

Other Directorship:

FIMMDA

Ms. Shinjini

Kumar

57

Years

Master of Arts

Ms. Kumar has over three decades of work experience in senior

positions across various organizations including Reserve Bank of

India, Bank of America Merrill Lynch, PricewaterhouseCoopers

Private Limited, Paytm Payments Bank and Citibank India.

She is the co-founder and Director of Five Salts Private Limited and

Seven Salts Private Limited, building a woman-first fintech

platform offering personal finance products. Ms Kumar has degrees

in English Literature, journalism and Public Policy and is on various

Boards and the Executive Council of CGAP.

Other Directorship:

Seven Salts Financial Services Private Limited

Five Salts Private Limited

Nium Forex India Private Limited

The duties & obligations of the AMC shall, as specified in the SEBI Regulations and the Investment

Management Agreement, will be as follows:

1. Be responsible for formulating and floating one or more Schemes for the Mutual Fund after approval of the

15

same by the Trustee and SEBI, and managing the funds mobilised under various Schemes, in accordance with

the provisions of the Trust Deed, investment guidelines, if any, laid down by the Trustee from time to time,

the SEBI Regulations, the Scheme Information Document, the investment objectives of each Scheme and the

IMA. Further the AMC shall exercise due diligence and care in managing and/ or taking all its investment

decisions with respect to the funds mobilised under various Schemes as would be exercised by other persons

engaged in the same business.

The Asset Management Company shall obtain prior in principle approval from the recognized stock

exchange(s) where units are proposed to be listed in case of Close ended / interval income schemes (other

than an equity linked savings scheme).

2. Provide or cause to be provided to the Trustee, reports on its performance of duties, as the Trustee may

reasonably require, from time to time.

3. Ensure that adequate instructions are issued to and duly complied with by the custodian, stock brokers, agents

(including registrars and share transfer agents) for discharging its duties under the SEBI Regulations and / or

the IMA.

4. The Asset Management Company shall take all reasonable steps and exercise due diligence to ensure that the

investment of funds pertaining to any scheme is not contrary to the provisions of the SEBI Regulations and

the Trust Deed.

5. Provide information to SEBI and the Unitholders as required under the SEBI Regulations or as otherwise

required by SEBI.

6. The Asset Management Company shall exercise due diligence and care in all its investment decisions as would

be exercised by other persons engaged in the same business.

7.

body corporate with which it may be associated.

8. The Asset Management Company shall be responsible for the acts of commission or omission by its employees

or the persons whose services have been procured by the Asset Management Company.

9. The Asset Management Company shall submit to the Trustees quarterly reports of each year on its activities

and the compliance with the SEBI Regulations.

10. Ensure that it does not give any undue or unfair advantage to any associates or deals with any of the associates

of the AMC in any manner detrimental to the interest of the Unitholders.

11.

may be required under any law or by the Trustee, such books, records and statements expressed in such

currencies as may be necessary to give a proper and complete record of all transactions carried out by the

AMC for or on behalf of the Mutual Fund and such other books, records and statements as may be required

by any law or the Trustee and shall permit the employees, authorised agents and auditors of the Trustee, to

inspect such books, records, and statements at all reasonable times and on request of the Trustee, furnish

true copies thereof.

12. The Asset Management Company shall not take up any activity that is in contravention of the SEBI Regulations.

13. The Asset Management Company shall not acquire any of the assets out of the scheme property which involves

the assumption of any liability which is unlimited or which may result in encumbrance of the scheme property

in any way.

14. The Trustees at the request of the Asset Management Company may terminate the assignment of the Asset

Management Company at any time:

Provided that such termination shall become effective only after the Trustees have accepted the termination

of assignment and communicated their decision in writing to Asset Management Company.

15. Notwithstanding anything contained in any contract or agreement or termination, the Asset Management

Company or its directors or other officers shall not be absolved of liability to the mutual fund for their acts of

commission or omission, while holding such position or office.

16. The Chief Executive Officer (whatever his designation may be) of the Asset Management Company shall ensure

that the mutual fund complies with all the provisions of SEBI Regulations and the guidelines or circulars issued

in relation thereto from time to time and that the investments made by the fund managers are in the interest

of the unit holders and shall also be responsible for the overall risk management function of the mutual fund.

17. The Asset Management shall not through any broker associated with the Sponsor, purchase or sell securities,

which is average of 5% or more of the aggregate purchases and sale of securities made by the mutual fund in

all its schemes:

Provided that for the purpose of the above, the aggregate purchase and sale of securities shall exclude sale

and distribution of units issued by the mutual fund:

Provided further that the aforesaid limit of 5% shall apply for a block of any 3 months.

The Asset Management Company shall not purchase or sell securities through any broker [other than a broker

referred to in clause (a) of sub-regulation 7 of Regulation 25 of SEBI Regulations] which is average of 5% or

more of the aggregate purchases and sale of securities made by the mutual fund in all its schemes, unless the

Asset Management Company has recorded in writing the justification for exceeding the limit of 5% and reports

16

of all such investments are sent to the Trustees on a quarterly basis:

Provided further that the aforesaid limit shall apply for a block of 3 months.

18. The Asset Management Company shall not utilize the services of the Sponsor or any of its associates,

employees or their relatives, for the purpose of any securities transaction and distribution and sale of

securities:

Provided that the Asset Management Company may utilize such services if disclosure to the effect is made to

the unit holders and the brokerage or commission paid is also disclosed in the half yearly accounts of the

mutual fund:

Provided further that the mutual funds shall disclose at the time of declaring half yearly and yearly results:

a. any underwriting obligations undertaken by the schemes of the mutual fund with respect to issue of

securities associate companies,

b. devolvement, if any,

c. subscription by the schemes in the issues lead managed by associate companies,

d. subscription to any issue of equity or debt on private placement basis where the sponsor or its associate

companies have acted as arranger or manager.

19. The Asset Management Company shall file with the Trustees the details of transactions in securities by the

key personnel of the Asset Management Company in their own name or on behalf of the Asset Management

Company and shall report to the SEBI, as when required by SEBI.

20. In case the Asset Management Company enters into any securities transactions with any of its associates a

report to that effect shall be sent to the Trustee at its next meeting.

21. In case any company has invested more than 5% of the net asset value of a scheme, the investment made by

that scheme or by any other scheme of the same mutual fund in that company or its subsidiaries shall be

brought to the notice of the trustees by the Asset Management Company and be disclosed in the half yearly

& annual accounts of the respective schemes with justification for such investment provided the latter

investment has been made within 1 year of the date of the former investment calculated on either side.

22. The Asset Management Company shall file with the Trustees and the SEBI

a. detailed bio data of all its directors along with their interest in other companies within 15 days of their

appointment;

b. any change in the interests of directors every 6 months;

c. a quarterly report to the Trustees giving details and adequate justification about the purchase and sale of

the securities of the group companies of the sponsor or the Asset Management Company, as the case may

be, by the mutual fund during the said quarter.

23. Each director of the Asset Management Company shall file the details of his transactions of dealing in

securities with the Trustees in a quarterly basis in accordance with guidelines issued by the SEBI.

24. The Asset Management Company shall not appoint any person as key personnel who has been found guilty of

any economic offence or involved in violation of securities laws.

25. The Asset Management Company shall appoint registrars and share transfer agents who are registered with

the SEBI:

Provided if the work relating to the transfer if units are processed in house, the charges at competitive market

rates may be debited to the scheme and for rates higher than the competitive market rates, prior approval of

the Trustees shall be obtained and reasons for charging higher rates shall be disclosed in the annual accounts.

26. Suspension or restriction of repurchase / redemption facility under any scheme of the Mutual Fund shall be

made applicable only after the approval from the Board of Directors of the Asset Management Company and

the Trustees. The approval from the AMC Board and the Trustees giving details of circumstances and

justification for the proposed action shall also be informed to SEBI in advance.

27. Chief Executive Officer (whatever be the designation) shall also ensure that the Asset Management Company

has adequate systems in place to ensure that the Code of Conduct for Fund Managers and Dealers specified

in PART - B of the Fifth Schedule of these regulations are adhered to in letter and spirit. Any breach of the said

Code of Conduct shall be brought to the attention of the Board of Directors of the Asset Management Company

and Trustees. The Dealers (whatever be the designation) shall ensure that orders are executed on the best

available terms, taking into account the relevant market at the time for transactions of the kind and size

concerned to achieve the objectives of the scheme and in the best interest of all the unit holders.

28. The Fund Managers (whatever the designation may be) shall ensure that the funds of the Scheme(s) are

invested to achieve the objectives of the scheme and in the interest of the unit holders.

29. The Fund Managers (whatever be the designation) shall abide by the Code of Conduct for Fund Managers and

Dealers specified in PART - B of the Fifth Schedule of Securities and Exchange Board of India (Mutual Funds)

Regulations, 1996 and submit a quarterly self-certification to the Trustees that they have complied with the

said code of conduct or list exceptions, if any

30. The Dealers (whatever be the designation) shall abide by the Code of Conduct for Fund Managers and Dealers

specified in PART - B of the Fifth Schedule of the Securities and Exchange Board of India (Mutual Funds)

Regulations, 1996 and submit a quarterly self-certification to the Trustees that they have complied with the

17

said code of conduct or list exceptions, if any.

31. The asset management company shall abide by the Code of Conduct as specified in [PART-A of] the Fifth

Schedule.

32. The Asset Management Company shall not invest in any of its scheme, unless full disclosure of its intention

to invest has been made in the offer documents.

Provided that an asset management company shall not be entitled to charge any fee on its investment in that

scheme.

33. The Asset Management Company shall not carry out its operations including trading desk, unit holder servicing

and investment operations outside the territory of India.

34. The Asset Management Company shall compute and carry out valuation of investments made by its scheme(s)

in accordance with the investment valuation norms specified in Eighth Schedule of SEBI Regulations, and shall

publish the same.

35. The Asset Management Company and the sponsor of the mutual fund shall be liable to compensate the

affected investors and/or the scheme for any unfair treatment to any investor as a result of inappropriate

valuation.

36. The Asset Management Company shall report and disclose all the transactions in debt and money market

securities, including inter scheme transfers, as may be specified by SEBI from time to time.

37. The board of directors of the asset management company shall exercise due diligence as follows:

a. The board of directors of the asset management company shall ensure before the launch of any scheme that

the asset management company has-

(i) systems in place for its back office, dealing room and accounting;

(ii) appointed all key personnel including fund manager(s) for the scheme(s) and submitted their bio-data

which shall contain the educational qualifications and past experience in the securities market with the

Trustees, within fifteen days of their appointment;

(iii) appointed auditors to audit its accounts;

(iv) appointed a compliance officer who shall be responsible for monitoring the compliance of the Act, rules and

regulations, notifications, guidelines, instructions, etc., issued by the Board or the Central Government and

for redressal of investors grievances;

(v) appointed a registrar to an issue and share transfer agent registered under the Securities and Exchange

Board of India (Registrars to an Issue and Share Transfer Agents) Regulations, 1993 and laid down

parameters for their supervision;

(vi) prepared a compliance manual and designed internal control mechanisms including internal audit systems;

(vii) specified norms for empanelment of brokers and marketing agents;

(viii) obtained, wherever required under these regulations, prior in principle approval from the recognized stock

exchange(s) where units are proposed to be listed.

b. The board of directors of the asset management company shall ensure that

(i) the asset management company has been diligent in empanelling the brokers, in monitoring securities

transactions with brokers and avoiding undue concentration of business with specific brokers;

(ii) the AMC has not given any undue or unfair advantage to any associate or dealt with any of the associate of

the asset management company in any manner detrimental to interest of the unit holders;

(iii) the transactions entered into by the asset management company are in accordance with these regulations

and the respective schemes;

(iv) the transactions of the mutual fund are in accordance with the provisions of the trust deed;

(v) the networth of the asset management company are reviewed on a quarterly basis to ensure compliance

with the threshold provided in clause (f) of sub-regulation (1) of regulation 21 on a continuous basis;

(vi) all service contracts including custody arrangements of the assets and transfer agency of the securities are

executed in the interest of the unit holders;

(vii) there is no conflict of interest between the manner of deployment of the networth of the asset management

company and the interest of the unit holders;

(viii) the investor complaints received are periodically reviewed and redressed;

(ix) all service providers are holding appropriate registrations with the Board or with the concerned regulatory

authority;

(x) any special developments in the mutual fund are immediately reported to the trustees;

(xi) there has been exercise of due diligence on the reports submitted by the asset management company to

the trustees;

(xii) there has been exercise of due diligence on such matters as may be specified by the Board from time to

time.

38. The compliance officer appointed under sub-clause (iv) of clause (a) of sub-regulation (22) shall independently

and immediately report to the Board any non-compliance observed by him.

18

39. The AMC shall constitute a Unit Holder Protection Committee in the form and manner and with a mandate

as may be specified by SEBI.

40. The AMC shall be responsible for calculation of any income due to be paid to Baroda BNP Paribas Mutual Fund

and also any income received in the mutual fund, for the unit holders of any scheme of the mutual fund, in

accordance with these regulations and the trust deed.

41. The AMC shall ensure that no change in the fundamental attributes of any scheme or the trust, fees and

expenses payable or any other change which would modify the scheme and affect the interest of unit holders,

shall be carried out unless,

(i) a written communication about the proposed change is sent to each unit holder and an advertisement is

issued in one English daily newspaper having nationwide circulation as well as in a newspaper published in

the language of region where the Head Office of the mutual fund is situated; and

(ii) the unit holders are given an option to exit at the prevailing Net Asset Value without any exit load.

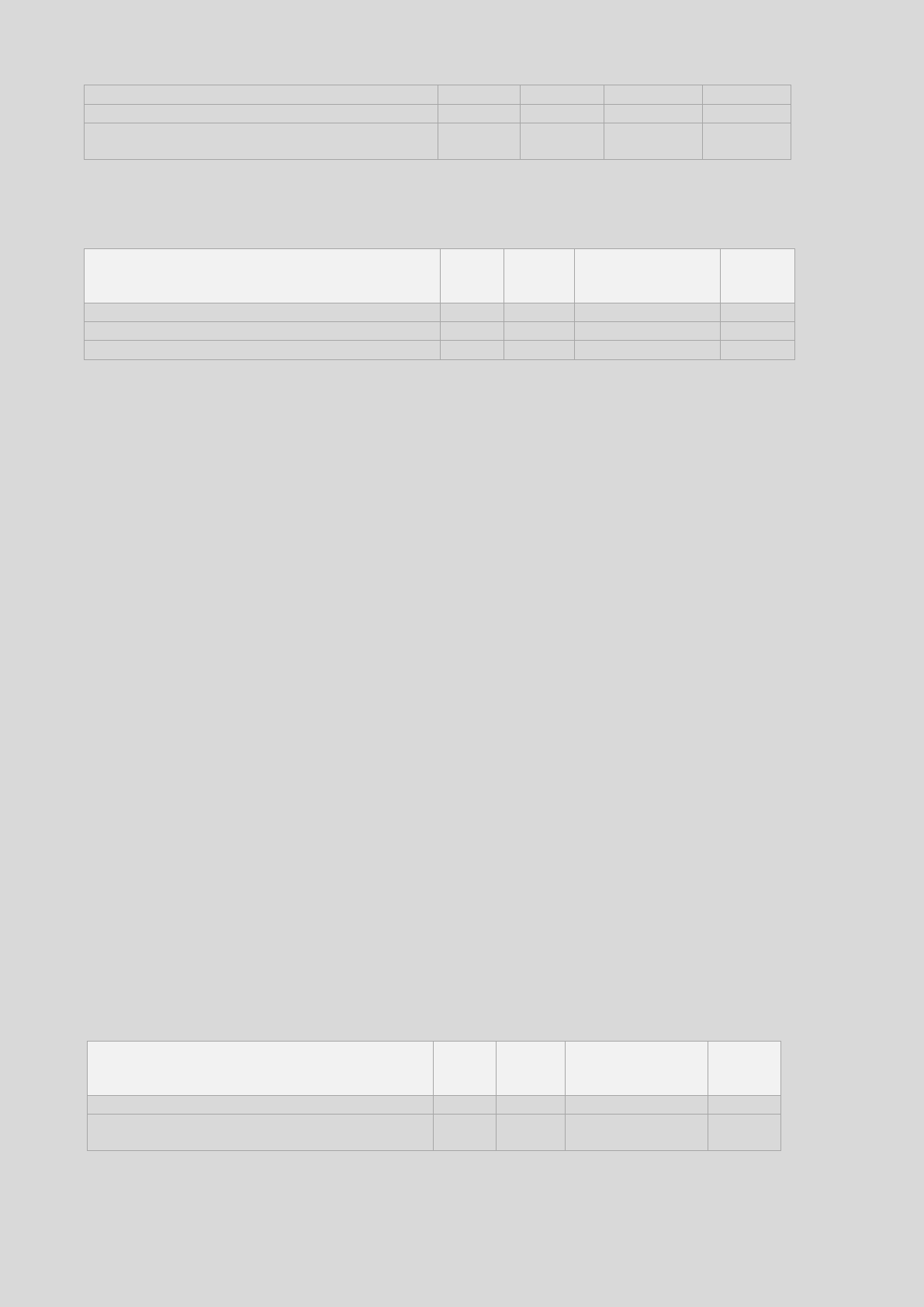

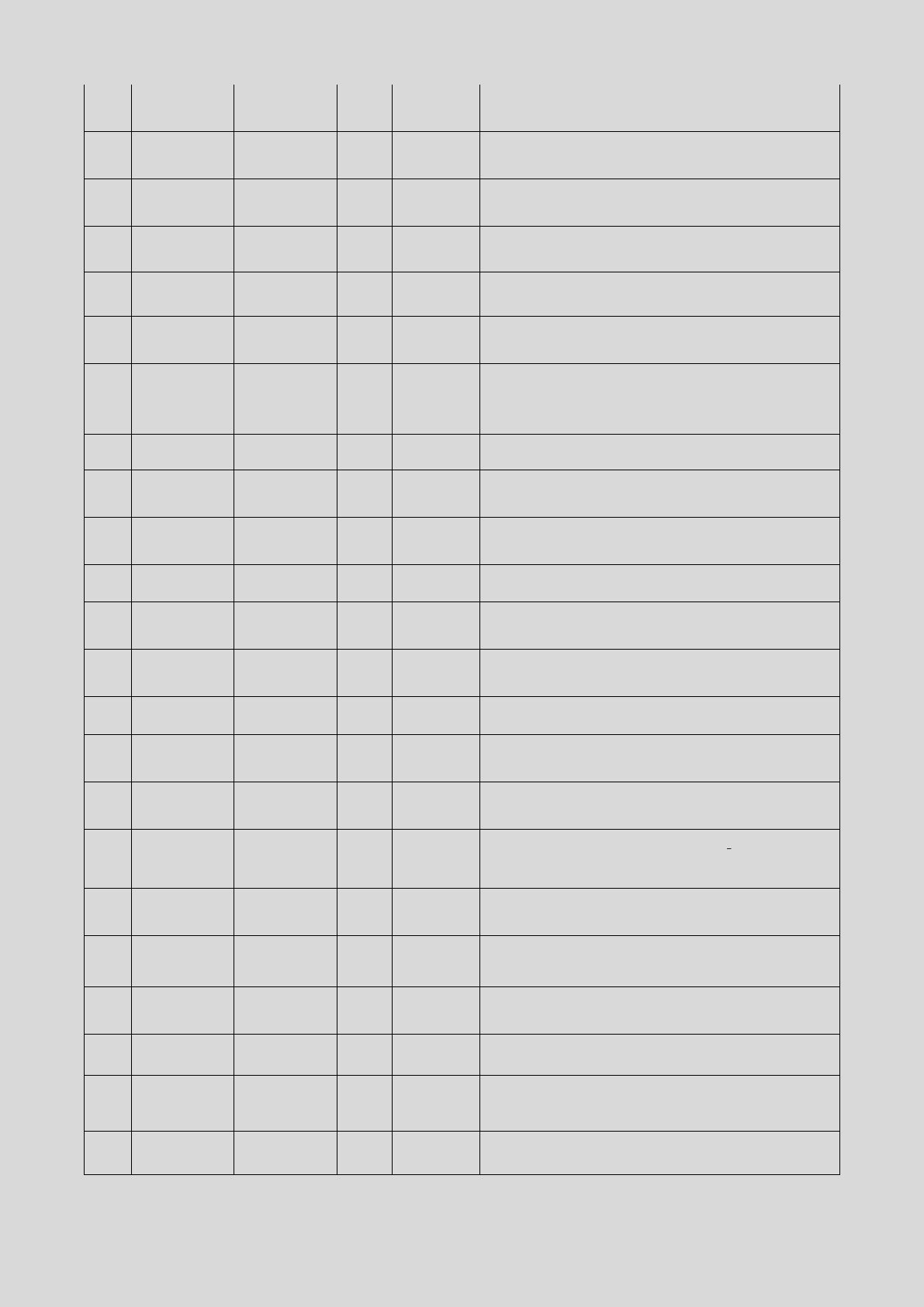

Information on Key Personnel of the AMC

Name

Age

Designation

Educational

Qualification

Total No. of

years of

Experience

Nature of past experience

including assignments held

during the last 10 years

Mr. Suresh

Soni

54

years

[Chief Executive

Officer (CEO)]

B.Sc.

ACA, Grad CWA

28 Years

Mr. Soni is a seasoned Asset

management professional with rich

experience of over 28 years. His

experience spans across investment

and business management. He has

varied experience of working with

start-ups as well as global giants

and across retail as well as

institutional clients. Mr. Soni is the

CEO of Baroda Asset Management

India Limited as CEO from August 03,

2021. In his prior roles, he has also

worked at Deutsche Asset

Management, leading it to become

the most successful foreign bank

promoted asset manager in the

country. He was also CEO at

Edelweiss Alternative Asset

Advisors, one of the largest

alternative asset managers in the

country.

Mr. Vivek

Kudal

40

years

(Chief

Operating

Officer & Chief

Financial

Officer)

C.A.

B.Com

18 Years

Mr. Kudal has over 18 years of

experience in operations, finance

and technology related areas. His

previous stint was with BNP Paribas

Asset Management (BNPP AMC),

KPMG, BDO Consulting. His

responsibilities include managing

the Operations, Fund Accountancy,

Technology and Administration

functions. Mr. Kudal is instrumental

in driving operational excellence at

AMC. With a career reflecting strong

leadership skills and a team-based

management style, he is aptly

positioned to transform strategy

and process-orientation into

success.

Mr. Sanjay

Chawla

58

years

[Chief

Investment

Officer Equity

Chief

Investment

Officer Equity

(CIO-Equity)]

MMS-BITS,

Pilani

34 Years

Mr. Chawla has over 34 years of

experience in fund management,

equity research and Management

Consultancy. He is designated as

Chief Investment Officer - Equity

with Baroda BNP Paribas Asset

Management India Private Limited.

19

Name

Age

Designation

Educational

Qualification

Total No. of

years of

Experience

Nature of past experience

including assignments held

during the last 10 years

In his previous assignment, he has

worked with Baroda Asset

Management India Limited as Chief

Investment officer, Birla SunLife

AMC as Sr. Fund Manager-Equity,

managing various schemes with

different strategies. Mr. Chawla has

also worked as Head of Research

with SBI Capital Markets and in

various capacities in the equity

research space in Motilal Oswal

Securities, IDBI Capital Markets,

SMIFS Securities, IIT Invest Trust &

Lloyds Securities. He is the fund

manager for certain schemes of the

Mutual Fund.

Mr. Prashant

Pimple

47

Years

Chief

Investment

Officer -Fixed

Income

BCom,

MMS (Fin),

ACTM

25 Years

Mr. Prashant Pimple has an

overall experience of 25 years. He

is designated as Chief Investment

Officer Fixed Income of Baroda

BNP Paribas Asset Management

India Private Limited. His previous

stint was with JM Financial AMC as

CIO Fixed Income. Prior to that,

he has also worked with Nippon

AMC.

Mr. Jitendra

Sriram

52

years

(Senior Fund

Manager -

Equity)

M.B.A

(Finance)

B.E. (Electrical

& Electronics

Engineering)

27 Years

Mr. Jitendra Sriram has an overall

experience of 27 years. His last stint

was with Prabhudas Lilladher

Portfolio Management Services as

Senior Vice President Equity Fund

Manager. Prior to that, he has

worked with various companies viz.,

Max Life Insurance Company Private

Limited, HSBC Securities & Capital

Markets (India) Private Limited,

HSBC Asset Management (India)

Private Limited.

Ms. Nisha

Sanjeev

43

years

Head

Compliance,

Legal &

Secretarial

CS,

LLB,

M. Com

18 years

Ms. Nisha has over 18 years of

experience in compliance, legal and

secretarial functions within the

mutual fund industry. In her

previous assignment, she was

associated with ITI Mutual Fund as

Compliance Officer. Prior to that, she

was also associated with HSBC

Mutual Fund and DSP Mutual Fund,