SEPTEMBER 2022

ELECTRIC BUSES

IN MAHARASHTRA

LESSONS FROM INTERVIEWS AND

RECOMMENDATIONS FOR FUTURE

ROLLOUT IN INDIA

By Anuj Dhole and Pramoda Gode

ACKNOWLEDGMENTS

The authors thank all interviewees from the transit authorities, private bus operators,

and manufacturers for their time and for sharing details about their experiences

operating electric buses. This work would not have been impossible without them:

» Dr. Chetana Kerure, Sunil Burse, Dattatray Zende, Shantaram Waghere, Prashant

Kolekar, Somnath Waghole, and Deepak Walunjkar of Pune Mahanagar Parivahan

Mahamandal Limited

» Chandrakant Birajdar, Victor Nagaokar, Sopan Bagade, and Pravin Shetty of

Brihanmumbai Electric Supply and Transport Undertaking

» Vivek Achalkar, Tushar Garud, Santosh Pashte, Santosh Patil, and Ravindra Bagul of

Navi Mumbai Municipal Transport

» Prashant Javale of Tata Motors

» Shiv Kumar Tiwari, Shekhar Sharma, and Vijay Kumar of Evey Trans Pvt. Ltd.

» Louis Fernandez, Shahbaz Khan, and Satish Ugale of Hansa City Bus Services Pvt. Ltd.

» Vaibhav Wakode of Maharashtra State Road Transport Corporation

» T Ravi of Telangana State Road Transport Corporation

The authors also thank NITI Aayog for support and the following reviewers for

providing critical feedback and relevant case studies: Oscar Delgado, Ray Minjares,

Carlos Bueno, and Amit Bhatt (all of the ICCT); Ravi Gadepalli and Lalit Kumar (UITP

India); Dr. Indradip Mitra, Sahana L and Tuan Nguyen Anh (GIZ); Prashanth Bachu

(independent consultant); Dario Hidalgo (WRI); and Megha Kumar.

This publication is part of the NDC Transport Initiative for Asia (NDC-TIA). NDC-TIA is part

of the

International Climate Initiative (IKI). IKI is working under the leadership of the Federal

Ministry for Economic Aairs and Climate Action, in close cooperation with its founder, the

Federal Ministry of Environment and the Federal Foreign Oce. For more visit:

https://www.ndctransportinitiativeforasia.org.

I

NTERN ATIONAL

CLIMATE INITIATIVE

International Council on Clean Transportation

1500 K Street NW, Suite 650

Washington, DC 20005

communications@theicct.org | www.theicct.org | @TheICCT

© 2022 International Council on Clean Transportation

Please share your valuable insights

about NDC-TIA knowledge product(s)

by taking this short survey:

https://tinyurl.com/ndctia-survey

i ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

ABOUT THIS REPORT

Vehicle emissions are a concern worldwide, and heavy-duty vehicles are responsible

for a disproportionate amount of these emissions in India. As a result, over the past

decade, many bus transit authorities in India have shifted from diesel to compressed

natural gas as fuel, as this reduces both tailpipe pollution and operating costs. But now

electric buses are increasingly in focus, as they are even cheaper to operate and have

the advantage of zero tailpipe emissions. Although only three new electric buses were

registered in India in 2015, that grew to 1,176 new electric buses registered in the year

2021 alone. Additionally, there was a recent aggregated tender for 5,450 electric buses

for five cities, and a separate 3,000 electric bus order by Mumbai.

Despite the momentum, there are certain challenges with electric buses, including

higher upfront costs and longer refueling time than conventional combustion engine

buses. To address these issues, innovative procurement models and schedules that

accommodate the longer refueling time are already being developed and used. Indeed,

some transit authorities in India have been operating electric buses for a few years now,

and their experiences can provide crucial lessons for future electric bus rollout in peer

transit authorities.

This report captures experiences from three Indian cities that adopted electric buses

early: Mumbai, Pune, and Navi Mumbai. These cities represent about 42% of the electric

buses already operating in India and they obtained these using both outright purchase

and gross cost contract models. We interviewed 21 representatives from the transit

authorities and their private bus operators, and this report identifies key experiences

and lessons from the rollouts. Based on these and by drawing from international

best practices, we also make specific recommendations for the future. This report is

supplemented by a blog series at theicct.org that touches on a variety of the anecdotes

from this research.

ii ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

TABLE OF CONTENTS

Introduction ................................................................................................................................ 1

Methodology ............................................................................................................................. 3

City selection .............................................................................................................................................3

Interviews ....................................................................................................................................................4

Electric bus procurement stories of the three cities ........................................................5

Mumbai ......................................................................................................................................................... 5

Pune ...............................................................................................................................................................9

Navi Mumbai ..............................................................................................................................................12

Summary of select experiences in the three cities .......................................................... 14

Procurement ............................................................................................................................................. 14

Personnel and training ..........................................................................................................................17

Data collection and application ....................................................................................................... 19

Bus operations ....................................................................................................................................... 20

Way forward: The unifying piece of electric bus deployment .......................................23

Appendix A. Details of interviews ......................................................................................24

Appendix B. Procurement details .......................................................................................25

iii ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

ABBREVIATIONS

BEST Brihanmumbai Electric Supply and Transport Undertaking

CNG compressed natural gas

CPI Consumer Price Index

FAME Faster Adoption and Manufacturing of (Hybrid &) Electric vehicles in India

GCC gross cost contract

ICE internal combustion engine

KPI key performance indicator

kWh kilowatt hour

BMC Brihanmumbai Municipal Corporation

DHI Department of Heavy Industries

NMMT Navi Mumbai Municipal Transport

OEM original equipment manufacturer

PMPML Pune Mahanagar Parivahan Mahamandal Ltd.

WPI Wholesale Price Index

Also

Standard buses have lengths ranging from 10 to 12 meters

Midi buses have lengths ranging from 8 to 10 meters

Mini buses have lengths of less than 8 meters

1 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

INTRODUCTION

The number of electric buses registered in India rose from just three in 2015 to 3,130 as

of June 2022.

1

The total number of registered buses in India also grew by about 38%

from 2009 to 2019, and most of these were diesel buses.

2

Still, the share of electric

buses in annual new bus registrations in India surpassed that of compressed natural

gas (CNG) buses for the first time in 2021 (Figure 1). About 68% of all the electric buses

ever registered through December 2021 were incentivized under the two phases of the

national-level Faster Adoption and Manufacturing of (hybrid &) Electric vehicles in India

(FAME) scheme, which was launched by the Department of Heavy Industries (DHI).

3

10.7%

9.6%

79.5%

0%

10%

20%

30%

40%

50%

60%

70%

80%

90%

100%

2015 2016 2017 2018 2019 2020 2021

Share of total registrations each calendar year

Electric CNG Diesel

Figure 1. Annual registration of buses in India by fuel type.

Note: Data retrieved from Vahan Sewa Dashboard of the Ministry of Road Transport and Highways,

Government of India; 80 electric buses operating in Hyderabad and Indore were added separately.

Given the increasing popularity, this qualitative study focuses on the experience of

early adopters of electric buses in India. There is a learning curve for transit authorities

when transitioning to a new bus technology and the lessons learned by early adopters

can help other transit authorities planning electric bus deployment to set realistic

expectations, have more confidence, and avoid or mitigate some of the impediments

experienced by others.

1 Vahan Sewa Dashboard, Ministry of Road Transport & Highways, Government of India, “Battery Operated

Medium and Heavy Passenger Vehicles,” accessed June 27, 2022, https://vahan.parivahan.gov.in/

vahan4dashboard/. Eighty electric buses operating in Hyderabad and Indore were added separately.

2 Transport Research Wing, Ministry of Road Transport & Highways, Government of India, Road Transport Year

Book (2017–18 & 2018–19), (2021, p. 52), https://morth.nic.in/sites/default/files/RTYB-2017-18-2018-19.pdf

3 Press Information Bureau, Ministry of Heavy Industries & Public Enterprises, Government of India, “Electric

Vehicle Operational in Medium and Heavy Passenger Vehicle Category Register an Increase,” August 5, 2021,

https://pib.gov.in/PressReleasePage.aspx?PRID=1742666; Ministry of Heavy Industries, Ministry of Heavy

Industries & Public Enterprises, Government of India, “Year-End-Review of Ministry of Heavy Industries – 2021,”

December 22, 2021, https://pib.gov.in/newsite/erelcontent.aspx?relid=228991

2 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

In particular, electric buses require special considerations for charging infrastructure,

route planning, scheduling, operation, maintenance, and re-skilling of the workforce.

At the same time, they oer multiple benefits such as zero tailpipe emissions, less

maintenance overall, lower fuel cost, less heat in the driver’s cabin, less noise, and many

report a better driving experience.

India’s stage-carriage fleet has 3.2 lakh

(320,000) buses that are operated by

public and private operators.

4

There

is a big opportunity to electrify these

because of their recurrent nature of

operations, in other words, they operate

on specified routes and schedules each

day. India is rapidly deploying battery-

electric buses and recently floated its

largest-ever aggregated tender for 5,450

electric buses for five cities. The tender

included buses divided into five lots

based on their size, the presence (or not)

of air conditioning (AC), and deck height.

The original equipment manufacturers

(OEMs) who are awarded the order were

required to be a part of an agreement

with the transit authorities to provide

service throughout the lifetime of the

buses. Additionally, the FAME incentive

for eligible buses was expected to be

calculated based on the lowest quoted

rate for each of the lot. The lowest

quoted rates for the electric buses in the tendering process were 36% to 48% cheaper

than the operating costs for comparable diesel buses.

5

Electric buses have already

been found to have at least 12% lower total cost of ownership than diesel buses at a

high daily utilization of 200 km.

6

“ We have maintenance sta working in three shifts of

8 hours each. Thus, we have people working around the

clock on maintenance activities of ICE buses. Interestingly,

the operator has only seven technicians for maintaining

about 100 electric buses, mostly working at night.”

— DEEPAK WALUNJKAR, DEPOT MANAGER, PMPML

4 Amit Bhatt and Shilpa Kharwal, “Don’t miss the bus,” Deccan Herald, June 12,, 2020, https://www.deccanherald.

com/opinion/in-perspective/dont-miss-the-bus-848580.html

5 Amber Banerjee, “World’s Largest Electric Bus Tender for 5,450 Buses: How CESL Orchestrated This Deal,”

The Times of India, May 24, 2022, https://timesofindia.indiatimes.com/auto/worlds-largest-electric-bus-tender-

for-5450-buses-how-cesl-orchestrated-this-deal/articleshow/91760385.cms

6 Parveen Kumar and Chaitanya Kanuri, “Total Cost of Ownership of Electric Vehicles: Implications for Policy

and Purchase Decisions,” WRI India, October 6, 2020, https://wri-india.org/blog/total-cost-ownership-electric-

vehicles-implications-policy-and-purchase-decisions

3 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

METHODOLOGY

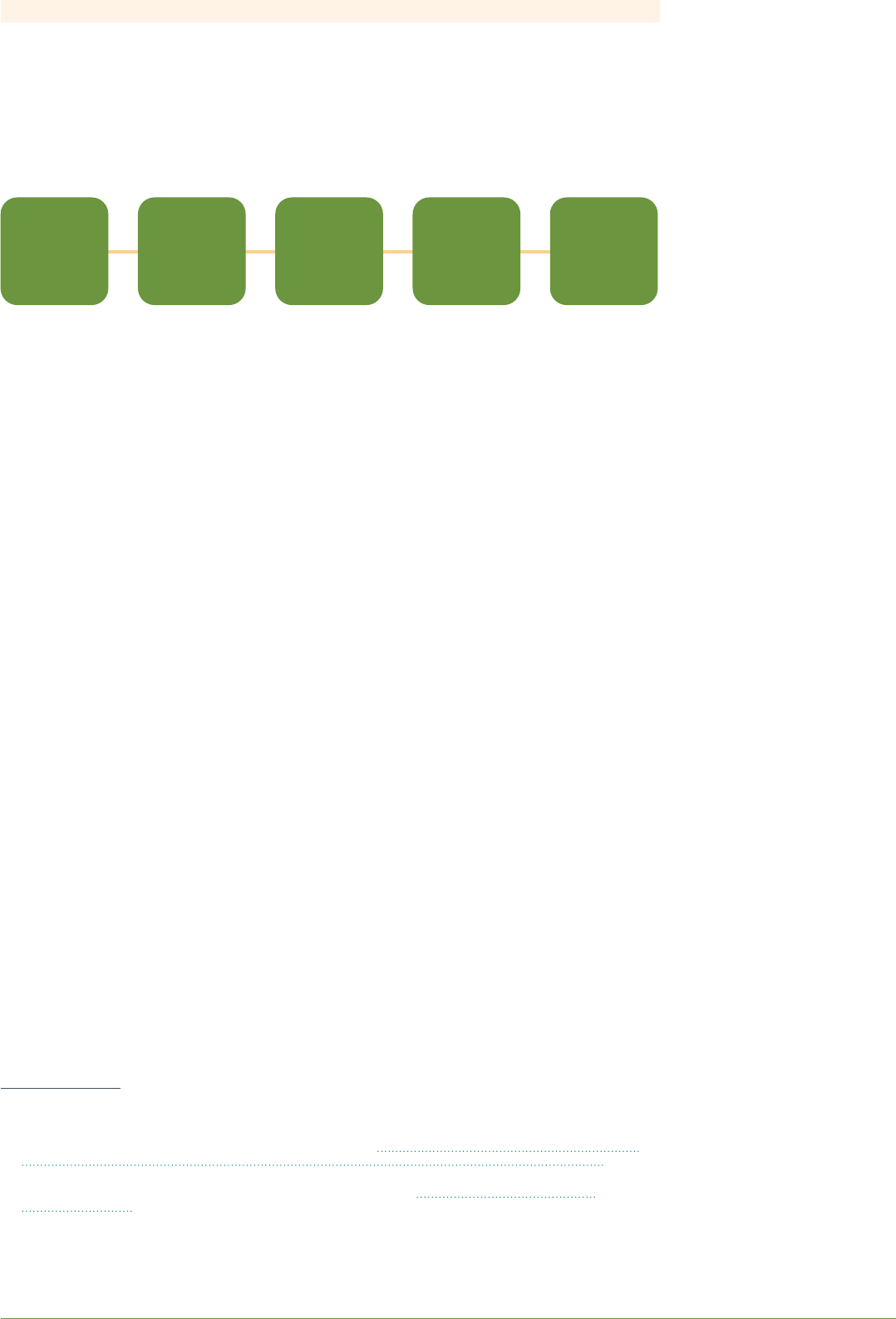

The steps we took to gather and analyze data for this report are illustrated in Figure 2

and each is described in more detail below.

City

selection

Identifying

interviewees

Identifying

relevant

topics for

interviews

Interviews Analysis

Figure 2. Research methodology.

CITY SELECTION

India’s electric bus fleet is concentrated in urban areas. Only 27% of the electric buses

deployed under FAME I are being used for intercity operations, and only 7% of the

5,595 electric buses were sanctioned for intercity operations under FAME II.

7

The Maharashtra State Electric Vehicle Policy 2021 set a

goal of 25% electrification of public bus fleets in five cities

by 2025, and 15% electrification of the state transport

corporation’s fleet.

Maharashtra is in the national spotlight because of its success in procuring a large

number of electric buses. Notably, the Maharashtra State Electric Vehicle Policy

2021 set a target of 15% bus fleet electrification for the Maharashtra State Road

Transport Corporation and 25% public bus fleet electrification by 2025 in five urban

agglomerations: Greater Mumbai, Pune, Nagpur, Nashik, and Aurangabad. As the first

serious mover in this space, the electric bus rollout experiences in Maharashtra can

oer lessons for others.

Maharashtra accounted for about 42% of the electric buses operational in India as of

February 2022, and the overwhelming majority of these, approximately 99%, have been

registered in Mumbai, Pune, or Navi Mumbai.

8

We chose these three cities because they

have fairly extensive experience with electric bus operations and each of them adds

unique value to this study. Mumbai’s oldest public electric buses were commissioned in

2017, while those of Navi-Mumbai and Pune were commissioned in 2018. Additionally:

» Mumbai has more than 4 years of operational experience and has been through

four rounds of electric bus procurements, one round of outright purchase and three

rounds under a gross cost contract (GCC) model.

9

7 Press Information Bureau, “Electric Vehicle Operational in Medium and Heavy Passenger Vehicle Category

Register an Increase”; Department of Heavy Industries, Ministry of Heavy Industries & Public Enterprises,

Government of India. Sanction of Electric Buses Under Phase-II of Faster Adoption and Manufacturing of

Electric Vehicles in India Scheme (FAME India Scheme), 2019, https://heavyindustries.gov.in/writereaddata/

fame/famepressrelease/1-E__didm_WriteReadData_userfiles_Press%20Release%20for%20Buses.pdf

8 Vahan Sewa Dashboard, Ministry of Road Transport & Highways, Government of India, “Battery Operated

Medium and Heavy Passenger Vehicles,” accessed February 7, 2022, https://vahan.parivahan.gov.in/

vahan4dashboard/. Eighty electric buses operating in Hyderabad and Indore added separately.

9 A gross cost contract is a procurement model in which a transit authority hires a bus fleet from a private bus

operator for an agreed-upon period and terms in a contract. The operator is responsible for the operation

and maintenance of the buses according to the schedule set by the transit authority. In exchange, the transit

authorities pay an agreed-upon fixed amount per unit distance operated (contract cost). In a dry lease, the

operator provides buses without drivers and in a wet lease the operator also provides drivers.

4 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

» Pune (Pune Metropolitan Region) was the first city in India to procure electric

buses without the FAME I incentive (150 buses). Pune also built two depots

exclusively for electric buses and has recently commissioned six new depots

exclusively for electric buses.

10

» Navi Mumbai is one of the few cities in India that procured electric buses under

outright purchase using the FAME I incentive (30 buses). Navi Mumbai’s transit

authority also represents the experience of a smaller transit authority.

Table 1 is a snapshot of the present bus fleets and charging infrastructure in the three

cities in this study and their electric bus procurement plans.

Table 1. Bus fleet details and plans for Mumbai, Pune, and Navi Mumbai.

Mumbai Pune Navi Mumbai

Number of buses per million population 250.7

a

228.3

b

483.9

c

Total number of buses 3,460 1,895 600

Number of electric buses in operation 386 220 180

Work order placed for electric buses 3,000 430 None

Number of electric buses planned 900 double decker 300 (7 meters long) 1 double decker

Current level of fleet electrification 11% 12% 30%

Plans for full electric operation by year 2027 25% by 2025

d

—

Types of chargers used 150 kW, 200 kW, and 240 kW 80 kW and 150 kW 120 kW and 240 kW

a. We estimated the population of Mumbai to be 13.8 million in 2021, based on an assumed 10.7% growth since 2011 and the 12.5 million population

reported in the 2011 census. The population growth rate assumption for all three cities is taken from the estimated population growth in

Maharashtra as per “Population projections for India and States 2011 – 2036,” (July 2020), National Commission on Population. Available at

https://main.mohfw.gov.in/sites/default/files/Population%20Projection%20Report%202011-2036%20-%20upload_compressed_0.pdf

b. Estimated population of the Pune Metropolitan Region in 2021 was 8.3 million, based on 10.7% growth since 2011 and the reported population of 7.5

million in the 2011 census.

c. Estimated population of Navi Mumbai in 2021 was 1.24 million, based on 10.7% growth since 2011 and the reported population of 1.12 million in the

2011 census.

d. As per the Maharashtra Electric Vehicle Policy 2021, MSEVP-2021/CR 25/TC 4, accessed May 6, 2022, https://maitri.mahaonline.gov.in/PDF/

EV%20Policy%20GR%202021.pdf

INTERVIEWS

We conducted interviews from August 2021 to March 2022 with 21 individuals who

can be grouped into three broad categories: technical decision-makers such as chief

engineers, executive engineers, and junior engineers; managers of depots, operations

managers, and trac managers; and others, including private bus operators, drivers,

bus maintenance sta, and site supervisors.

The technical decision-makers and managers in transit authorities work closely with

the higher-level decision-makers such as the chairman, managing director, and

general manager. Technical decision-makers are concerned with things related to bus

specifications and fueling infrastructure, while managers look after decisions related

to operations at the fleet and depot levels, such as route planning, schedules, revenue,

and sta. Personnel in the others category work on the ground.

Our objective with the interviews was to record experiences through a semi-structured

discussion rather than a fixed question-and-answer format. This was so the interviewees

would not feel restricted, and we identified high-level topics for discussion for each

interviewee in advance. Please see Appendix A for more details of these topics.

10 Dheeraj Bengrut, “PMPML to Construct 6 Mega Charging Stations for E-buses,” Hindustan Times, December 2,

2021, https://www.hindustantimes.com/cities/pune-news/pmpml-to-construct-6-mega-charging-stations-for-

ebuses-101638385281562.html

5 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

ELECTRIC BUS PROCUREMENT STORIES OF

THE THREE CITIES

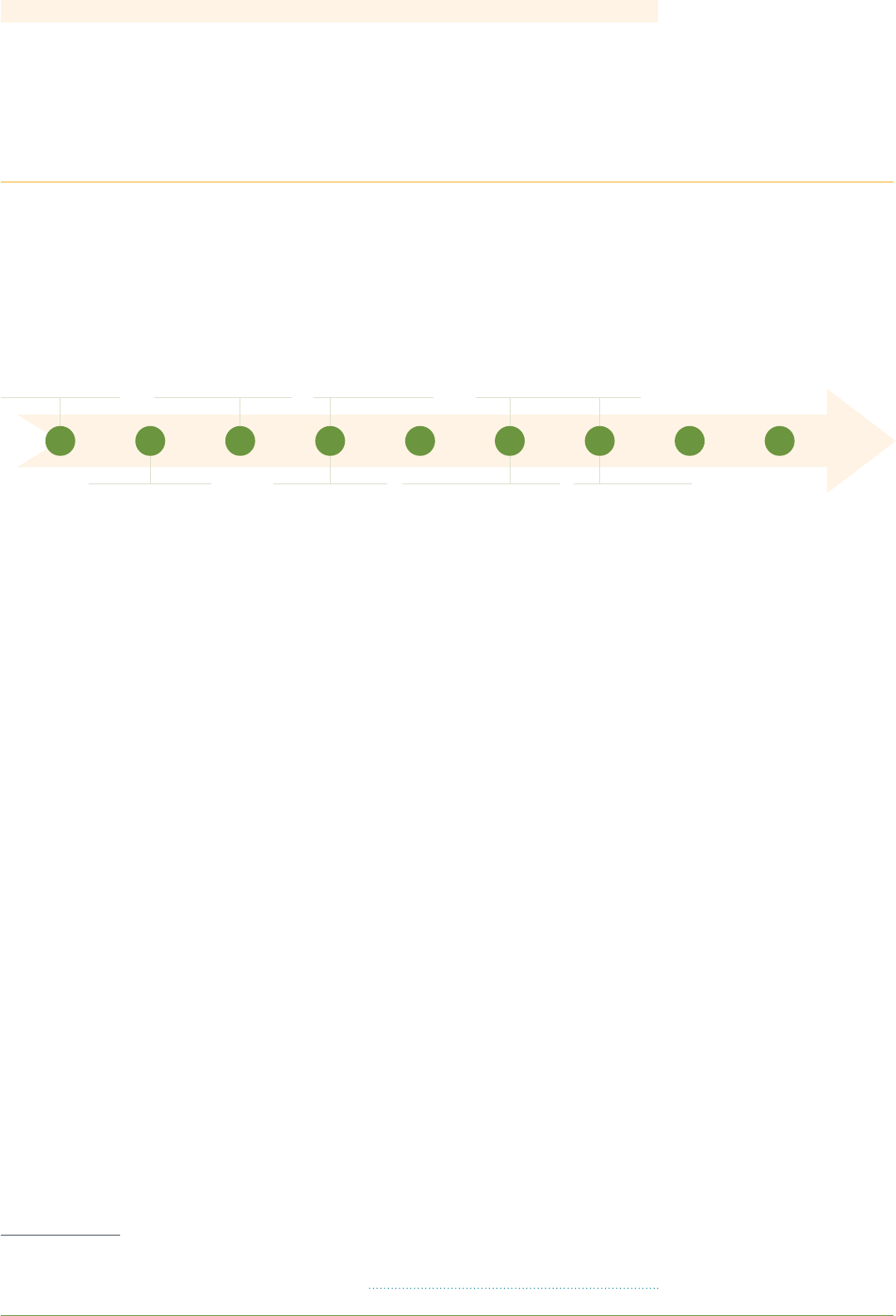

MUMBAI

2016

Tender for

retrofitting ICE

buses. Ultimately

canceled because

of unviable cost.

2018

BEST gets 25

hybrid buses from

the Mumbai

Metropolitan Region

Development

Authority

(AC, standard)

2019

BEST places an

order for 340

electric buses on

GCC, subsidized

under FAME II.

(AC, standard

and midi)

2021 / 2022

BEST publishes a tender

for 200 double-decker

electric buses on

GCC. Eventually places

an order for 900

double-decker electric

buses, funded by

state budget.

(AC, double-decker)

LOOKING AHEAD

BEST set to transition

to 50% electric bus

operations by 2023 and

to 100% electric bus

operations by 2028.

2022

BEST publishes a

tender for 2,100

electric buses.

Procurement is

in progress.

(AC, standard)

2021

BEST publishes a

tender to procure

1,900 buses on GCC.

Ultimately canceledfor

administrative reasons.

(AC, standard

and midi)

2019

BEST gets 40

electric buses on

GCC, subsidized

under FAME I.

(AC, midi)

2017

BEST purchases

6 electric buses,

funded by

municipal budget

(non-AC, midi)

Figure 3. Timeline of electric bus procurements in Mumbai.

The Brihanmumbai Municipal Corporation (BMC) is the governing body of India’s

financial capital, Mumbai. BMC covers an area of 437.7 sq. km and had an estimated

population of 13.8 million in 2021.

11

Brihanmumbai Electric Supply and Transport

Undertaking (BEST) has been responsible for providing public bus services in Mumbai

and the neighboring cities since 1926.

12

BEST has a fleet of 3,460 buses, including the

iconic double-decker buses.

“ Hybrid buses did not show promise. They have an internal

combustion engine as well as a battery. They did not

show enough tangible benefits in terms of emissions,

operations, and maintenance costs. Thus, we decided to

go for battery electric buses only.”

—CHANDRAKANT BIRAJDAR, EXECUTIVE ENGINEER, BEST

BMC’s working group for alleviating air pollution oered ₹ 100 crores (₹ 1 billion) to

BEST for purchasing new buses in 2015, out of which they allotted ₹ 10 crores (₹ 100

million) for purchasing fully electric buses. According to BEST, electric buses made

domestically were not available at that time. During that same time, though, Kirtaney

Pandit Information Technologies (KPIT) and the Central Institute of Road Transport

(CIRT) had plans to retrofit internal combustion engine (ICE) buses to electric, and

BEST oered some of their buses for that. BEST also published a tender for retrofitting

11 Assumes a 10.7% growth rate since 2011. The population of Mumbai was reported to be 12.5 million in the

2011 census.

12 “Organization Information,” BEST, accessed August 8, 2022, https://www.bestundertaking.com/in/page.asp?i=1

6 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

its ICE buses to electric in 2016, but it

received very high bids of ₹ 2.5 crores

(₹ 25 million) per bus, and this was

considered financially unviable.

At the same time, Tata’s hybrid buses

were available, and the Mumbai

Metropolitan Region Development

Authority was procuring 25 of them.

The FAME scheme was also being

formulated, and it provided an incentive

for both hybrid and electric buses.

BEST tested a hybrid bus and an

imported electric bus from two dierent

manufacturers, and this experience

convinced them to opt for electric

buses only. Some more details of the

electric bus procurements in Mumbai

are available in Appendix B.

Pre-FAME I and FAME I bus procurement

Testing of electric buses began in

Himachal Pradesh in 2016.

13

After that,

BEST issued a tender for the outright

purchase of electric buses using the ₹ 10

crores (₹ 100 million) fund allotted by BMC, and it was won by Olectra Greentech Pvt

Ltd (previously known as Goldstone Infratech). The company delivered six non-AC midi

electric buses in 2017.

Subsequently, FAME I oered an upfront purchase incentive of 60% of the bus cost to

the transit authority, up to a maximum of ₹ 1 crore (₹ 10 million) if the OEM of the electric

bus being purchased achieved 15% localization and a maximum of ₹ 1.5 crores (₹ 15

million) in cases where the OEM achieved 35% localization.

14

DHI invited an expression of

interest in October 2017 from cities that wanted to procure electric buses under FAME I.

15

BEST submitted a proposal for 100 electric buses and out of that 80 buses were allotted

in two phases of 40 buses each. BEST began procurement of electric buses on GCC.

Evey Trans Pvt. Ltd., a subsidiary of Olectra Greentech Pvt. Ltd., won the first tender and

the other tender was won by Volvo Eicher Commercial Vehicles (VECV).

BEST was looking for joint ownership of electric buses to safeguard its investment

and ensure accountability from the OEM and the private bus operator. However, BEST

settled for an equivalent bank guarantee from the private bus operator instead of joint

ownership. A bank guarantee is a form of security provided by a lessee (in this case,

the private bus operator) for the contractual obligations toward a lessor (here the

transit authority). The lessor can access the funds in the bank guarantee to cover losses

if the lessee fails to deliver the required services in case of bankruptcy or other reasons.

13 PTI, “Himachal Pradesh to Start Battery-Operated Electric Buses,” The Economic Times, August 3, 2016,

https://economictimes.indiatimes.com/news/politics-and-nation/himachal-pradesh-to-start-battery-operated-

electric-buses/articleshow/53514988.cms?from=mdr

14 Abhay Khairnar, “Pune Smart City Pitches for 60 Electric Buses Under the National Electric Mobility Mission

Plan 2020,” Hindustan Times, November 29, 2017, https://www.hindustantimes.com/pune-news/pune-

smart-city-pitches-for-60-electric-buses-under-the-national-electric-mobility-mission-plan-2020/story-

THjn8Qx3mPb1DPbCHjubON.html

15 Department of Heavy Industries, Ministry of Heavy Industries & Public Enterprises, Government of India,

Expression of interest inviting proposals for availing incentives under FAME India scheme of Government

of India from State Government departments/ undertakings/ municipal corporations for million plus cities,

October 31, 2017, https://heavyindustries.gov.in/writereaddata/UploadFile/EoI636662994025953960.pdf

7 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

According to BEST, three supply options were provided in the tender document and

this was to encourage maximum participation and to get the most competitive rates for

the two procurements under FAME I. These were:

» Option 1 – Range of 80 km on a single charge

» Option 2 – Range of 170 km to 200 km on a single charge

» Option 3 – Range of 50 km with battery swapping

BEST received the lowest bid for the second option. Meanwhile, DHI added two

conditions to avail incentives under the FAME I scheme. The first was benchmark prices.

Cities across India received varying bids for their tenders under FAME I. For example,

bid prices for outright purchase of midi AC electric buses varied from ₹ 7.7 million to

₹ 9.9 million per bus.

16

As a result, DHI declared benchmark prices and decided to use

them to calculate the maximum incentive. The benchmark prices were based on the

lowest bid received in each bus category, and the categories were formed based on bus

length, seating capacity, battery capacity, and floor height.

17

The second condition was

joint ownership. Due to the large subsidy provided for the electric buses, DHI added the

clause of joint ownership of buses between the transit authority and the OEM or private

bus operator, which BEST had already tried to include in its contract.

18

As a result of the above changes by DHI, interviewees shared that the subsidy for Evey

Trans Pvt. Ltd. was reduced by about ₹ 24 lakh (₹ 2.4 million) per bus, but they decided

to move ahead with the order and delivered the 40 midi non-AC electric buses. Also,

per interviewees, VECV suered a significant setback as their subsidy was reduced

by about ₹ 55 lakh (₹ 5.5 million) per bus.

19

This made it economically unviable for

them, and the contract was canceled. As a result, BEST only procured 40 out of the 80

electric buses approved under the FAME I scheme.

Notably, BEST had previously relied upon outright purchase of buses, and GCC was a

shift in its procurement model. According to BEST, this change came after studying

multiple tenders published by transit authorities across the country.

Procurement under FAME II

DHI launched the FAME II scheme in March 2019 and issued an invitation for expression

of interest for availing incentive for electric buses in June 2019.

20

DHI mandated the

GCC procurement model and declared ₹ 35 lakh (₹ 3.5 million), ₹ 45 lakh (₹ 4.5 million),

and ₹ 55 lakh (₹ 5.5 million) as maximum incentives for mini, midi, and standard buses,

respectively.

21

BEST submitted a proposal for 1,000 electric buses, out of which 300

were allotted.

22

DHI also re-allotted the 40 electric buses from FAME I to make up for

the canceled contract. So, under FAME II, BEST procured 340 AC electric buses (200

midi buses and 140 standard buses) from Tata Motors in 2019, and this brought its total

fleet of electric buses to 386.

16 Ravi Gadepalli et al., Fiscal Incentives to Scale Up Adoption of Electric Buses in Indian Cities, (UITP and Shakti

Sustainable Foundation, 2019), https://shaktifoundation.in/wp-content/uploads/2020/01/Fiscal-Incentives-to-

scale-up-electric-buses.pdf

17 Cabell Hodge et al., Surat Municipal Corporation Bus Electrification Assessment, (National Renewable Energy

Laboratory/TP-5400-73600, 2019), https://doi.org/10.2172/1515398

18 During FAME I, OEMs also played the role of private bus operators because there were no private bus

operators willing to operate electric buses in India.

19 The reduction in subsidy amounts has not been verified.

20 Department of Heavy Industries, Ministry of Heavy Industries & Public Enterprises, Government of India,

Publication of notification in Gazette of India (extraordinary) regarding Phase-II of FAME India scheme

(1(1)2019-AEI), (2019), https://heavyindustries.gov.in/writereaddata/fame/famedepository/2-notification.pdf

21 Department of Heavy Industries, Ministry of Heavy Industries & Public Enterprises, Government of India,

Expression of Interest Inviting Proposals for availing incentives under FAME India Scheme Phase II For

Deployment of Electric Buses on Operational Cost Model basis, (2019), https://heavyindustries.gov.in/

writereaddata/fame/famedepository/13-E__didm_WriteReadData_userfiles_Final%20EOI%2004%20June%20

2019%20Published.pdf

22 Department of Heavy Industries, Sanction of electric buses under Phase-II of Faster Adoption and

Manufacturing of Electric Vehicles.

8 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

Procurement of 3,000 electric buses in 2022

BEST scrapped 1,235 ICE buses between 2020 and 2022 and is planning to scrap

200 more ICE buses by 2023. The initial plan was to replace them with CNG buses,

but BEST has decided to procure electric buses, instead. This is for two reasons.

First, procuring CNG buses would postpone complete fleet electrification by at least

a decade. Second, BEST had a positive experience with the performance of their 386

electric buses.

BEST published a tender in September 2021 for 1,900 AC electric buses (1,400

standard buses, 400 midi buses, and 100 mini buses). However, it was canceled in

February 2022 due to administrative issues.

23

BEST published a fresh tender in April

2022 for procuring between 1,400 and 2,100 electric buses and the process is still

ongoing as of August 2022.

24

Additionally, with state government funding, BEST has placed an order for 900 double-

decker electric buses which will be delivered by 2023.

25

Seven hundred of these buses

will be delivered by Causis E-Mobility and 200 will be delivered by Switch Mobility

(Ashok Leyland).

26

Charging infrastructure

For 340 electric buses, BEST’s private bus operator has installed 53 Tellus Power Green

chargers with 200 kW capacity and 19 Exicom chargers with 240 kW capacity. The rest

of the 46 electric buses are charged using 26 BYD chargers with 150 kW capacity.

Plans for expansion of the electric bus fleet

The Mumbai municipal commissioner announced that BEST would transition to 50%

electric operation by 2023, and the Maharashtra state environment minister announced

that BEST would fully transition to electric operation by 2028.

27

This is a more

ambitious timeline than the Maharashtra State EV Policy.

23 Although this tender was eventually canceled, we have included the lessons learned from it in this report.

24 Manthank Mehta, “Mumbai: BEST Places Order for 2,100 Electric Buses,” The Times of India, May 23, 2022,

https://timesofindia.indiatimes.com/city/mumbai/mumbai-best-places-order-for-2100-electric-buses/

articleshow/91749157.cms; Carrie Hampel, “2,100 Olectra Electric Buses Headed for Mumbai,” Electrive.com,

May 24, 2022, https://www.electrive.com/2022/05/24/2100-olectra-electric-buses-headed-for-mumbai/

25 Somit Sen, “BEST to Get 900 AC Electric Double-Decker Buses for Mumbai,” The Times of India, January 26,

2022, https://timesofindia.indiatimes.com/city/mumbai/best-to-get-900-ac-electric-double-decker-buses-for-

mumbai/articleshow/89133180.cms

26 Vinod Shah, Causis E-Mobility Plans to Revolutionise Green Public Transport in India,” Urban Transport News,

February 28, 2022, https://urbantransportnews.com/news/causis-e-mobility-wants-to-revolutionise-green-

public-transport-in-india; “Switch Mobility Mulls ‘Green’ Plant to Make E-buses,” The Hindu, June 14, 2022,

https://www.thehindu.com/business/switch-mobility-mulls-green-plant-to-make-e-buses/article65526651.ece

27 PTI, “BEST’s Entire Fleet Will Have Electric Buses by 2028: Aaditya Thackeray,” The Economic Times, October

4, 2021, https://economictimes.indiatimes.com/industry/renewables/bests-entire-fleet-will-have-electric-

buses-by-2028-aaditya-thackeray/articleshow/86760923.cms; Purva Chitnis, “Commuters, Come Back:

Mumbai’s Iconic BEST Double Decker Bus Returning in Electric, AC Avatar,” The Print, February 6, 2022,

https://theprint.in/india/commuters-come-back-mumbais-iconic-best-double-decker-bus-returning-in-

electric-ac-avatar/821556/

9 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

PUNE

2019

Procurement of 150

electric buses on GCC,

subsidized through

municipal budgets.

(AC, midi and standard,

BRT compliant)

LOOKING AHEAD

PMPML is required to

electrify 25% of its fleet

by mid-2025 under the

Maharashtra State

Electric Vehicle Policy.

2022

PMPML is in the

process of procuring

300 electric buses

on GCC.

(AC, mini)

2021

PMPML places a

work order for 150

electric buses on

GCC, subsidized

under FAME II.

(AC, standard,

BRT compliant)

2021

PMPML places a work

order for 350 electric

buses, subsidized by

municipal budgets.

(AC, standard,

BRT compliant)

Figure 4. Timeline of electric bus procurements in Pune.

The twin cities of Pune and Pimpri-Chinchwad are a part of the Pune Metropolitan

Region. Pune Mahanagar Parivahan Mahamandal Ltd. (PMPML) has provided the public

bus transport service in the Pune Metropolitan Region (hereafter referred to simply as

Pune) since 2007.

28

PMPML has a fleet of 1,895 buses that serve a population estimated

to be 8.3 million in 2021, spread out across 7,257 sq. km.

29

PMPML scrapped all of its

diesel buses and decided to operate only CNG and electric buses; currently 88% of

PMPML’s fleet is CNG buses and 12% is electric.

30

Pune was considering procurement of electric buses in 2017 using Smart City funds.

31

According to PMPML, some experts were skeptical about electric vehicle technology,

and they predicted prohibitive operating costs. But PMPML conducted several

meetings with the OEMs to understand the market and ensure that the technology was

mature enough. PMPML was also following the electric bus experiences in Himachal

Pradesh and Mumbai. Eventually, they were convinced that the technology was

suciently mature to serve their operational requirements.

Additionally, PMPML’s erstwhile chairman and managing director favored electric

bus procurement. The board of directors approved the chairman’s proposal for

procurement of 150 electric buses on GCC in 2018. It was then presented to the two

municipal corporations of Pune and Pimpri Chinchwad, and the matter was debated in

the standing committee meetings. PMPML organized a question-and-answer session to

convince all stakeholders and ensure their support. After deliberation, both municipal

corporations unanimously accepted the proposal. They decided to grant a lump sum

28 “History,” Pune Mahanagar Parivahan Mahamandal Ltd., accessed August 8, 2022,

https://www.pmpml.org/en/about-us/history/

29 Estimated population of Pune Metropolitan Region in 2021 is based on a 10.7% growth since 2011. The

population of Pune Metropolitan Region was reported to be 7.5 million in the 2011 census.

Pune Metropolitan Region Development Authority, Government of Maharashtra. “Background: Pune

Metropolitan Region,” accessed February 9, 2022, http://www.pmrda.gov.in/pmrda_background

30 FE Bureau, “Pune Scraps Diesel Buses in its Public Transport Fleet,” Financial Express, April 15, 2022,

https://www.financialexpress.com/express-mobility/vehicles/buses/pune-scraps-diesel-buses-in-its-public-

transport-fleet/2493172/; The calculation is based on the bus age data provided by PMPML as of February

14, 2022, adding the 70 electric buses inducted in March 2022 and deducting 380 diesel buses scrapped in

early April 2022.

31 Pune was selected as a Smart City under the National Smart Cities Mission by the Ministry of Housing and

Urban Aairs, Government of India. Under this program, cities were allotted funds for promoting sustainable

development; Abhay Khairnar, “Pune Smart City Pitches.”

10 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

incentive of ₹ 50 lakh (₹ 5 million) per bus to the OEM

for the

first procurement, which consisted of 25 midi AC electric

buses and 125 bus rapid transit (BRT) compliant standard

AC electric buses.

32

Some more details of the electric bus

procurements in Pune are available in Appendix B.

First procurement

Because people at PMPML did not have the necessary

expertise in drafting electric bus specifications, they reached

out to CIRT and jointly drafted a request for proposal with

them.

33

According to PMPML, some special conditions and

specifications in the request for proposal were:

1. Range of 225 km on a single charge, with a provision

to accommodate one opportunity charging event

during the day lasting 30 minutes.

2. Minimum of 225 assured kilometers per day.

3. BRT-compliant standard buses with a floor height

of 900 mm.

4. Air suspension for better comfort.

5. Monocoque body because of the longevity and

durability it oers. (AC is also more eective in

a bus with a monocoque body because it

prevents air leakage. A typical bus body built in

the transit authority’s workshop is dierent

because it is composed of numerous joints, nuts,

and bolts that start rattling with use and require

frequent maintenance.)

During the pre-bid meeting, manufacturers requested

that PMPML reduce the required range to 125 km on a

single charge and allow opportunity charging for the rest of the 100 km. To keep the

procurement process competitive, PMPML agreed to this request. However, PMPML

ultimately only received one bid during the first round of the bidding process, from Evey

Trans Pvt. Ltd. To invite other manufacturers to participate and support competition,

PMPML extended the deadline of the bidding process twice, but to no fruition. Ultimately,

PMPML went ahead with the procurement process with Evey Trans Pvt. Ltd.

PMPML conducted an elaborate proof of concept before procurement with an electric

bus from Evey Trans Pvt. Ltd. (manufactured by Olectra Greentech Pvt. Ltd.). PMPML

operated the bus on a variety of routes, both congested and non-congested, and over

a variety of terrains, including hilly areas, for 7 days. This testing also mimicked actual

operating conditions: daily operation for 18 hours in two shifts with AC switched on,

three tons of sandbags loaded in the bus, and halts and door operation at each of the

bus stops. The bus achieved a 150 km range in the first shift and a 100 km range in

the second shift after a 30-minute opportunity charge using a 150 kW fast charger.

PMPML was satisfied with the performance and went ahead with the procurement on

a GCC model using the incentive provided by the municipal corporations.

32 The municipal corporation of Pune paid 60% of the incentive and the municipal corporation of Pimpri-

Chinchwad paid 40% of it. Only OEMs or consortiums in which OEMs were lead members were invited to

participate in the tendering process.

33 Central Institute of Road Transport (CIRT) is a joint initiative of the Ministry of Shipping and Transport and

the Association of State Road Transport Undertakings, itself an association of transit authorities in India. CIRT

provides training, consultancy, and automobile component testing services to the transit authorities. See

http://www.cirtindia.com/About_History.html

11 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

Later, PMPML also issued a work order

to Evey Trans Pvt. Ltd. for 125 standard

BRT-compliant AC electric buses with

similar specifications. The contract

cost included buses, their maintenance,

charging infrastructure, and driver;

meanwhile, the cost of conductors and

the electricity for bus charging were to

be paid by PMPML. The buses are being

operated by Evey Trans Pvt. Ltd.

Second procurement

PMPML has issued a work order for an

additional 500 electric buses. Of these,

150 are under the FAME II scheme

and 350 are being supported through

municipal budgets; this support is in the

form of upfront purchase incentives for

the private bus operators, similar to the

first procurement. Seventy out of the

500 electric buses were delivered as of

March 2022 and rest were expected to

be delivered by mid-2022.

34

Charging infrastructure

PMPML’s private bus operator has installed 42 BYD chargers with 80 kW capacity and

two Delta chargers with 150 kW capacity at Bhekrainagar depot for the 90 electric

buses stationed in that depot.

Plans for expansion of the electric bus fleet

Recall that Pune is one of the five cities in Maharashtra that is required to electrify at

least 25% of its fleet by 2025, as per the Maharashtra State EV Policy 2021. The total

tally of electric buses in Pune, after the expected delivery of the remaining 430 electric

buses mentioned above, would be 650, and the total fleet size would be 2,325 if no

buses are added or scrapped. That means that 28% of PMPML’s fleet would be electric

and Pune will have achieved the target of at least 25% electrification. Further, PMPML

tested 7-meter long electric buses in July 2022 and plans to procure 300 such buses by

the end of this year.

35

PMPML is also planning to add double-decker electric buses in

the future.

36

34 Joy Sengupta, “Pune: PMPML to Get 500 E-buses by May,” The Times of India, January 8, 2022, https://

timesofindia.indiatimes.com/city/pune/pmpml-to-get-500-e-buses-by-may/articleshow/88766031.cms

35 Joy Sengupta, “Pune Mahanagar Parivahan Mahamandal Limited Starts Trial Run of 7m-long E-bus,” The Times

of India, July 5, 2022, https://timesofindia.indiatimes.com/city/pune/pune-mahanagar-parivahan-mahamandal-

limited-starts-trial-run-of-7m-long-e-bus/articleshow/92663939.cms

36 TNN, “Double-decker Buses May Run Again in Pune, as EVs,” The Times of India, February 4, 2022,

https://timesofindia.indiatimes.com/city/pune/double-decker-buses-may-run-again-in-pune-as-evs/

articleshow/89334573.cms

12 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

NAVI MUMBAI

2019

Navi Mumbai purchases

30 electric buses and a

10-year maintenance

contract, subsidized

under FAME I.

(AC, midi)

LOOKING AHEAD

Navi Mumbai is in the

process of procuring a

double-decker electric bus.

Already more than 50% of

itsfleet is electrified.

2021

Navi Mumbai

procures 150

electric buses on

GCC, subsidized

under FAME II.

(AC, standard)

Figure 5. Timeline of electric bus procurements in Navi Mumbai.

Navi Mumbai has three administrative jurisdictions, and they are governed

by Navi Mumbai Municipal Corporation, the City and Industrial Corporation

of Maharashtra Ltd., and Panvel Municipal Corporation. Navi Mumbai also

spans two districts, Thane, and Raigad. The total area of Navi Mumbai is

around 344 sq. km.

37

The estimated population of Navi Mumbai in 2021 was

about 1.24 million.

38

Navi Mumbai Municipal Transport (NMMT) provides

public bus transport services to Navi Mumbai and connects the city to the

Mumbai Metropolitan Region. NMMT has a total fleet of around 600 buses.

Some more details of the electric bus procurements in Navi Mumbai are

available in Appendix B.

Procurement under FAME I

NMMT procured its first set of electric buses on an outright purchase model

by availing the incentive under the FAME I scheme at ₹ 1.28 crore (12.8

million) per bus (this was dierent from the GCC model used by BEST).

39

Navi Mumbai submitted a proposal for the outright purchase of 55 midi

electric buses and DHI allotted the city 30 midi electric buses. NMMT

published the tender for these buses in August 2018. According to NMMT,

only two major specifications were included in the request for proposal, and

this was to encourage maximum participation in the bidding process:

1. Range of 120 km on a single charge.

2. Minimum seating capacity of 34, including driver.

Out of many bidders, JBM Auto won the contract. As NMMT owns the buses, it

must also maintain the buses. Thus, NMMT also purchased a 10-year comprehensive

maintenance contract (CMC) from JBM Auto at ₹ 7.05 per km, and it includes regular

37 City & Industrial Development Corporation of Maharashtra Limited. Navi Mumbai: The periphery, December 19,

2017, https://cidco.maharashtra.gov.in/

38 Estimated population of Navi Mumbai in 2021 is based on a 10.7% growth since 2011. The population of Navi

Mumbai was reported to be 1.12 million in the 2011 census. Navi Mumbai Municipal Corporation, Environmental

Status Report of Navi Mumbai Municipal Corporation 2018-19, accessed February 9, 2022, https://www.nmmc.

gov.in/navimumbai/assets/251/2020/02/mediafiles/ESR_2018-19_English.pdf

39 George Mendonca, “NMMT Gets Nod to Buy 30 Electric Buses, 18 Charging Stns at Rs 42cr,” The Times of

India, August 10, 2018, https://timesofindia.indiatimes.com/city/navi-mumbai/nmmt-gets-nod-to-buy-30-

electric-buses-18-charging-stns-at-rs-42cr/articleshow/65358693.cms

13 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

bus maintenance, spare parts, labor cost, accidental damage insurance, and battery

maintenance. In this way, NMMT was able to manage the technology and maintenance-

related risks even in an outright purchase; this is otherwise an advantage of a GCC

procurement model.

Procurement under FAME II

DHI initially allotted 100 electric buses to NMMT under FAME II, and then later on,

allotted an additional 50 electric buses.

40

NMMT thus procured 150 electric buses

under the scheme: 105 standard and 45 midi AC electric buses. These buses were

procured on a GCC model as it was a requirement to qualify for the incentive under

the FAME II scheme. NMMT increased the range requirement for this procurement and

added a few more specifications to suit the GCC procurement, as shown in Table 2.

Table 2. Technical specifications for NMMT’s second electric bus procurement

Midi buses Standard buses

Range (km) 160 200

Assured kilometers per day 199 223

Opportunity charging time (minutes/day) 75 90

Preferred seating capacity More than 31 More than 37

Expected minimum daily operation in two shifts (km) 220 260

The second order was also won by JBM Auto, and it delivered the 150 electric buses by

October 2021.

Charging infrastructure

NMMT had planned to set up 15 chargers in a depot and three chargers at terminals at

the cost of ₹ 3.5 crore (₹ 35 million) for 30 electric buses in 2019.

41

In interviews, NMMT

explained that 26 chargers had been installed so far: 20 Exicom chargers with 120 kW

capacity, and two Exicom chargers and four Delta chargers with 240 kW capacity.

Plans for expansion of the electric bus fleet

NMMT has started procurement of one double-decker AC electric bus on an

outright purchase model. The tender includes one electric bus, the charger, and a

comprehensive maintenance contract for 12 years. NMMT is expecting a range of 120

km on a single charge, a minimum seating capacity of 65, and an energy eciency

of less than 1.4 kWh/km. Interestingly, NMMT prefers outright purchase over GCC

because the capital cost of the electric bus is paid from the municipal budget; the

transit authority has to bear only the costs of operation and maintenance. On the other

hand, in a GCC, the contract cost is inclusive of the bus cost, and that would therefore

increase NMMT’s expenses. According to NMMT, the maintenance of electric buses can

be streamlined by purchasing a comprehensive maintenance contract, as it did during

its first electric bus purchase.

40 Department of Heavy Industries, Sanction of electric buses under Phase-II of Faster Adoption and

Manufacturing of Electric Vehicles.

41 Local Press Co., “NMMT Takes Delivery of First Electric Bus, 30 Such Buses to Start Plying in Navi Mumbai

Soon,” August 27, 2019, https://localpress.co.in/mumbai/nmmt-takes-delivery-of-first-electric-bus-30-such-

buses-to-start-plying-in-navi-mumbai-soon/

14 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

SUMMARY OF SELECT EXPERIENCES IN THE

THREE CITIES

This section presents the lessons learned through the interviews in the three cities.

We divided them into four categories—procurement, personnel and training,

data collection and application, and bus operations—and have included our

recommendations at the end of each category.

PROCUREMENT

Technical evaluation before bus procurement

“ We chose to complete the proof of concept and technical

assessment of the electric buses before opening bids. That

way, we ensured that the electric buses were technically fit

for our operational requirements”

—SUNIL BURSE, CHIEF MECHANICAL ENGINEER, PMPML

In its tendering process, PMPML decided to open the technical bids before opening the

financial bids. This meant that preference was given to the performance and technical

specifications of the buses over price, and prevented a process that would only select

the lowest bidder. PMPML relied upon the expertise of CIRT to draft the specifications

for the electric buses and to make sure that the products oered by the bidders

fulfilled them. The chief mechanical engineer of PMPML stressed the benefits of this

approach and suggested that transit authorities procuring electric buses for the first

time should conduct a pilot for a minimum of 15 days to ensure that the buses meet

their range requirements.

Prior to awarding a contract, NMMT also conducted a detailed inspection to verify bus

range, battery capacity, bus quality, and workmanship.

Terms of bus procurement

The benefits of procuring buses on GCC for the transit authorities are well known, and

it has been the most popular model for electric bus procurement. Only 320 electric

buses have been outright purchased as of March 2021, and that is only 10% of the

electric buses operating in India today.

42

GCC is attractive in part because it separates

the costs and risks associated with bus operations and maintenance from scheduling

and revenue. Additionally, the transit authorities we studied have used some strategies

to reduce the contract cost and enable a smoother and faster rollout of buses:

1. Contract length: The contracts for BEST’s procurements in 2018 and 2019 were

10 years. However, they subsequently realized that the private bus operators

expect to replace the battery in 6 years, and thus a 12-year contract would

enable full use of two battery cycles and BEST would get the most competitive

rate. BEST has since included a provision to extend the 12-year contract further

by 3 years, depending on the condition of the electric buses at the end of 12

years. NMMT’s recent electric bus contract length is also 12 years. PMPML’s

contracts are 10 years, with a provision for a 2-year extension.

42 Number of buses purchased outright referred from: Anumita Roychowdhury and Sayan Roy, Electric Bus

Towards Zero Emission Commuting, (Centre for Science and Environment: New Delhi, 2021), https://www.

cseindia.org/electric-bus-10969

15 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

2. The cost of electricity: This is a key dierentiator between the three transit

authorities we studied. BEST has included the cost of electricity in the contract

cost from the private bus operator, while PMPML and NMMT pay for the

electricity required for bus charging separately. BEST has used a formula to

revise the contract cost to account for the changes in the electricity tari since

its first electric bus procurement. For the latest procurement, BEST adjusted the

formula to account for the real-world eciency of the electric buses to oset

the actual electricity cost to the private bus operator, as detailed in the section

on Data collection and application, below.

PMPML pays the private bus operator for the electricity consumed by bus charging

and each charger has a separate electricity meter. PMPML keeps track of the number

of units of electricity consumed per kilometer operated at the end of each month

at the fleet level (energy eciency in kWh/km). If the number of units consumed

is higher than 1.3 kWh/km (1.4 kWh/km in the latest tender) for standard AC buses

and 1 kWh/km for midi AC buses, the private bus operator is expected to pay for the

excess electricity.

Similarly, NMMT pays for the cost of electricity subject to the maximum energy

eciency of 1.4 kWh/km for standard AC buses and 1.2 kWh/km for midi AC buses.

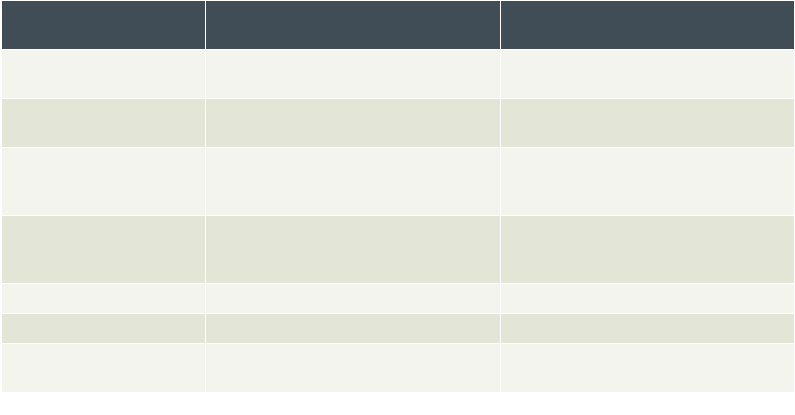

Table 3. Terms for payment of electricity consumed for charging of electric buses in the three

transit authorities

PMPML NMMT BEST

Midi AC buses Up to 1 kWh/km Up to 1.2 kWh/km

Does not pay

separately for

electricity

Standard AC buses

Up to 1.3 kWh/km for

first tender

Up to 1.4 kWh/km for

latest tender

Up to 1.4 kWh/km

3. Depot development: The general practice has been that the transit authority

provides land, upstream electrical infrastructure, and developed depots

(which includes basic infrastructure like an oce building, bus shelters, paving,

and electrical connection), and the operator is responsible for purchasing,

installing, and maintaining the chargers. However, PMPML has identified depot

development as one of the potential risks for delay in bus rollout. Delays can

happen because of interdependence between government departments and

agencies and if there is a lack of coordination between them. Hence, PMPML has

transferred the responsibility of depot development to the operators in its latest

procurement; it still provides the land and upstream infrastructure.

4. Opportunity charging: BEST tried to operate its electric buses without

providing opportunity charging in its FAME I procurement, but that meant

the private bus operator had to deploy about 8% more electric buses than the

number contracted, and this eventually led to a higher cost for BEST. Therefore,

in the 2021 procurement, BEST provided an opportunity-charging window. See

the section on Bus operations, below, for more details.

5. Fleet availability: The transit authorities mostly expect 100% fleet availability

in their contracts for electric buses and penalize private bus operators if

availability falls below 100%. However, BEST reduced its fleet availability

requirement to 95% for peak hours in its latest procurement, and this gives the

private bus operator some additional time to charge and maintain the buses.

16 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

“ We have learned from our past tenders that it is important

to minimize the financial risk perceived by the private bus

operators to get the most competitive rates”

—CHANDRAKANT BIRAJDAR, EXECUTIVE ENGINEER, BEST

6. Other price revision criteria: The private bus operator can be expected to

factor in the increasing operating cost over the contract period upfront if the

transit authority does not enable regular escalation of the contract cost. BEST,

which uses a formula to calculate regular price increases, updated the formula in

its latest contracts to oset the increasing operational cost for the private bus

operator more realistically by accounting for the following:

» Change in electricity tari. The contract cost is revised in accordance with

the ratio of actual change in the electricity tari to the bus energy eciency

in km per kWh, and this adjustment is made as and when the electricity tari

changes. BEST calculated the real-world energy eciency of the electric

buses they are already operating to use more realistic values of the energy

eciency in the tender. More details are in the section on Data collection and

application, below.

» Change in labor cost. Adjustment is equal to the product of the quoted

contract cost and 20% of the relative change in the minimum wages for

skilled laborers (drivers) as issued by the Government of Maharashtra from

the second year onward. This was 15% in the previous contracts and this

adjustment is made once every two months.

» Change in the cost of spare parts and other consumables required for bus

maintenance. Adjustment is equal to the product of the quoted contract cost

and 5% of the relative change in the Consumer Price Index (CPI) from the

third year onward. This adjustment is made every 2 months.

C

r

= C

q

+

(

E

T

r

– T

p

)

+

(

Cq ×

CPI

base

CPI

month

– CPI

base

× 0.2

)

×

(

C

q

×

MW

base

MW

month

– MW

base

× 0.05

)

C

r

Revised contract cost (₹/km)

C

q

Quoted contract cost when the bid was submitted (₹/km)

T

r

Revised electricity tari (₹/kWh)

T

p

Previous electricity tari (₹/kWh)

E Energy eciency (km/kWh) based on the bus type

CPI

month

Revised consumer price index in that month

CPI

base

Consumer price index when the bid was submitted

MW

month

Minimum wages as published by the Government of Maharashtra

NMMT has a formula similar to that of BEST and it is based on the model concession

agreement published by DHI for procurement of electric buses under FAME II.

43

The

provision in the tender was to revise the contract cost every 6 months, and sooner if

the electricity tari varies by 10% and/or CPI and Wholesale Price Index (WPI) vary by

more than 2%.

43 NITI Aayog, Government of India, Public Private Partnership in Operation and Maintenance of Electric

Buses in Cities (OPEX Model). Model Concession Agreement. (2021). https://www.niti.gov.in/sites/default/

files/2020-02/ModelAgreement-Operation-and-Maintenance-of-E-Buses.pdf

17 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

PMPML provides a fixed 1% escalation annually in the contract cost from the third

year onward.

7. Disputes and contract closure: Transit authorities define key performance

indicators (KPIs) in the contracts to monitor and manage the quality of service

provided by private operators. KPIs of concern might include trip delay, trip

cancellation, breakdowns, deviation from agreed-upon bus specifications, and

violations of trac rules. Transit authorities impose penalties in the case of any

such infractions by private bus operators.

Ocials from BEST said they were too risk-averse in the FAME I and FAME II tenders

and heavily accounted for the risk of default by the operator, with a cap on total

penalties for infractions in a month at 10% of the monthly bill and a fixed bank

guarantee for 5 years. But in retrospect, BEST stated that it might not have been the

best option for them because when operators bid for a tender, they quote a rate that

would cover their costs even in the case of such a penalty. BEST has since reduced

the cap on the penalty for infractions to 5% of the total monthly bill payable to the

operator and incorporated a bank guarantee that reduces by 20% annually, to account

for the services provided against the disbursed incentive and depreciating assets.

44

RECOMMENDATION: WELL-DESIGNED TENDERS AND CONTRACTS CAN REDUCE COSTS,

RISK, AND THE POTENTIAL FOR DELAYS IN ROLLOUT.

»

Minimize the financial risk to the private bus

operator. Including comprehensive cost revision

provisions in the contracts recognizes and osets

operational cost increases for the private bus

operator over the contract tenure. If this is not

done by the transit authority, the operator will

factor in these risks upfront and contract costs will

be higher.

» Align contracts with battery lifetimes. The

operational life of electric buses is dependent

on the life of the battery and the motor, both of

which are replaceable. In Santiago, Chile, battery

life is assumed to be 7 years, and thus the electric

bus contract tenure is 7 years, with a provision for

another 7-year extension.

44

Provisions that allow

for an extension of the contract also motivate

operators to maintain service quality.

» Identify and transfer responsibilities that are

better served by the private bus operators.

Activities like depot development and installation

of downstream electrical infrastructure can be

handled eciently by private bus operators.

Transferring responsibility for paying for the

electricity to the private bus operators can

also save on administrative costs for the transit

authorities. In the case of outright purchase, the

transit authority can purchase a comprehensive

maintenance contract to ensure adequate support

from the OEM over the lifetime of the bus.

PERSONNEL AND TRAINING

Personnel requirement

PMPML appoints one timekeeper per shift per depot to document the electricity

consumption for charging electric buses and other details mentioned in the section on

Data collection and application, below. Each charger has a separate electricity meter,

and the timekeeper records the unit reading before and after the charging event, along

with the start and end time. The timekeeper also records the odometer reading of the

bus at each charging event in a standard sheet (see Table 4, below) and communicates

these details to PMPML’s central oce. Three timekeepers per depot per day are

required for monitoring electricity consumption and this becomes four timekeepers if a

reliever is also appointed for cases of absenteeism.

44 Red Metropolitana de movilidad, “Tender Process for Public Transport Operation [Webinar],” accessed August

8, 2022, https://www.dtpm.cl/descargas/licitacion20/Tender%20Process%20for%20PT%20Operation_ENG.pdf

18 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

Bus drivers are usually in high demand and private bus

operators said they typically maintain a daily driver-to-

bus ratio of 2.5:1 (for two shifts), including additional

drivers to account for absenteeism.

Training requirements and priority

The focus of the transit authorities is on building the

capacity of their electrical department, as it will play

a crucial role in ensuring energy security in the future.

However, many interviewees did not feel a pressing

need for electric bus-specific training for their sta,

as most of the responsibilities for charging and

maintenance are handled by the private bus operators.

Some transit authorities feel the need to protect

themselves by relying on high penalties when

negotiating contracts with the operator. This is due to

a lack of experience and expertise regarding electric

buses, and they hope this will change as they get more

experience and training.

According to the private bus operators, driver training

is the most essential part of their hiring process. The

drivers are given safety training and are trained to

read and interpret the information that is specific to

electric buses, such as the state of charge and the error

codes on the dashboard that are displayed in cases of

malfunction. Drivers are also taught best practices to

achieve maximum eciency from the battery and to

leverage regenerative braking in electric buses. NMMT

follows this kind of approach in training its drivers, and

even organizes refresher courses for them regularly.

Range anxiety

Some depot managers and drivers stated that range anxiety remains a concern, but

they think it is getting better with time as drivers gain confidence in electric buses.

According to a depot manager at PMPML, the display that shows the remaining range

is helpful because it helps drivers make better decisions before starting the trip.

However, they have experienced hesitancy among drivers to drive the bus at a lower

state of charge and have considered displaying reference charts inside electric buses

that show the battery percentage required to complete one trip on various routes, to

guide drivers. However, it became unnecessary as drivers became more confident with

experience. We also observed a dierence in perception of the actual range of the

electric buses amongst the sta working in the transit agencies.

A driver from NMMT said that their electric buses automatically disable AC when

the state of charge drops below 20%. This extends the bus’s range, helps the driver

overcome range anxiety, and makes breakdown due to insucient charge unlikely.

19 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

RECOMMENDATION: RESKILL AND UPSKILL THE EMPLOYEES OF TRANSIT AUTHORITIES

»

Transit authorities should provide training and

regular refresher courses for their planners,

decision-makers, and other sta, even if most

of the responsibility of the technology is on the

private bus operator.

» Transit authorities might opt for outright purchase

of some electric buses in the future to avoid

complete dependence on hired fleets and to utilize

their permanent employees who will likely remain

with them for several years. Such employees

should be trained in electric bus operations before

completing the transition to electric.

» Range anxiety is interfering with bus planning in

some transit authorities. This aects scheduling

and route planning and may lead to the

underutilization of buses. Training and evidence-

based planning can alleviate this concern.

DATA COLLECTION AND APPLICATION

Traditionally, transit authorities collect and store operational data from their bus fleets.

Some key performance indicators (KPIs) tracked include the scheduled and operated

kilometers, fuel consumption, revenue collection, material use, and breakdowns. In the

case of electric buses, transit authorities keep a record of some additional data points,

especially at the charger level. Table 4 is representative of data typically recorded by

transit authorities.

Table 4. Format of the data traditionally collected by the transit authorities.

Duty supervisor name: Shift: Date:

Bus

Number

Odometer

reading

Driver

name /

Number

Charger

Number

Start

Time End Time

Start

SOC End SOC

Meter

reading

before

Meter

reading

after

No. Of units

consumed

Transit authorities do not typically have access to any information on battery health

or energy eciency from the on-board diagnostics of the electric buses. Some of the

interviewees were skeptical as to whether they would ever have access to such data,

as the OEMs consider it proprietary. They also reported that the private bus operators

do not share the monthly operational and performance reports as agreed to in the

contracts, let alone the real-time performance data.

Note, though, that BEST uses real-world electric bus energy eciency to calculate

the contract cost escalation in its latest tender. It calculates the real-world energy

eciency by taking the ratio of the number of units consumed for bus charging to the

number of operated kilometers at the depot and fleet levels. The energy eciency is

based on assumptions in their previous contracts and is shown in Table 5, along with

the revised values.

Table 5. The energy eciency numbers used by BEST to calculate electricity consumption in two

of its contracts.

Bus type

Energy eciency assumed for

FAME II contract

(kWh/km)

a

Revised energy eciency

(kWh/km) for 2021

procurement

6 to 8 meter AC (mini bus) — 0.66

9 meter AC 0.94 1.05

12 meter AC 1.18 1.33

a

BEST represents energy eciency in kilometers traveled per unit of electricity (km/kWh). We have

converted it to kWh/km for clarity.

20 ICCT REPORT | ELECTRIC BUSES IN MAHARASHTRA

RECOMMENDATION: MONITORING AND EVALUATION IS A MUST

»

Mandate data sharing by the private bus

operator on bus technology and operations

in the contracts, especially regarding energy

eciency, battery health, and maintenance cost.

This improves transparency and informs the true

cost of operating electric buses. Sharing this

information between transit authorities can help

identify potential outliers and improve critical

assumptions related to battery such as battery

life and battery replacement cycles, both of which

aect the cost of the electric buses directly or

indirectly.

» Transit authorities can monitor and estimate

the energy eciency and the state of health of

the battery using telematics devices (real-world

performance monitoring). Many ICE bus contracts

already require that buses fit the Recommendatory

Urban Bus Specifications II (UBS II), and the

specifications for the Intelligent Transport System

in UBS II include support for Vehicle Health

Monitoring and Diagnostics (VHMD).

45

VHMD

can report the health of the power train (engine

for ICE buses), electrical system, electronics,

safety features, and transmission. Similar VHMD

mandates can be standardized for and applied to

electric buses, as well. The true costs of electric

bus operation can inform future tenders and can

be leveraged to reduce the financial risk on the

private bus operator as well as to negotiate better

rates on future buses for the transit authorities.

» Transit authorities can include a clause for a penalty

on the private bus operators in case they fail to

share data.

BUS OPERATIONS

Charging and scheduling

45

BEST did not modify its existing ICE bus schedules to suit electric buses for its FAME

I and FAME II procurements. Their strategy was to operate the maximum number of

buses during morning and evening peak hours and about 80% of the buses during

o-peak hours; the hope was to leverage this downtime to charge the buses. But this

time was not sucient for charging the buses to meet the operational requirements

and the private bus operator had to deploy about 8% extra electric buses and keep on

exchanging the charged buses with the discharged ones. Additionally, BEST realized

that the additional buses deployed by the private bus operator were not eligible for

the FAME II subsidy because they were over and above the number of electric buses

sanctioned to them. Thus, this cost was eventually factored into BEST’s contract cost.

As a result, in its latest procurement, BEST allowed opportunity charging for 45 to 60

minutes per day. Additionally, BEST reduced the required bus availability from 100% to

95% on weekdays and even lower on weekends, so that the private bus operator gets

an opportunity to charge and maintain the electric buses. In its latest procurement,

BEST procured electric buses with ranges varying from 160 km to 200 km. To manage

charger use, the plan is to allot bus routes so that some of the buses with larger battery

capacity will require minimum opportunity charging time during the day.

NMMT and PMPML had already provided an opportunity-charging window in their

GCC contracts and the time varied from 45 minutes to 90 minutes. Both authorities

informed us about changes in schedules to accommodate electric buses. NMMT has

now adopted the Ahmedabad pattern where crew change takes place at the depot at

the end of the shift; they previously followed the London pattern, with crew change

at the terminal. This change was necessary because electric buses have to come back

to the depot for charging, and that incurs additional dead kilometers between the