T

his is your annual Flex Benefits Open Enrollment quick reference guide. It contains information and links

you should review to select your flexible benefits for the 2024 benefit plan year, which runs from January

1 to December 31, 2024. This year, the online Open Enrollment period runs November 1 through 15, 2023.

Your benefits choices take eect January 1, 2024. For complete information, consult the 2024 Flexible Benefits

Enrollment and Reference Guide on the Lehigh Benefits website, available Wednesday, November 1.

Open Enrollment

Quick Reference Guide

November 2023

WHAT’S NEW? ENROLLING IS EASY

Medical Plan Benefit Comparison.........2

Understanding Coverage Language........3

2024 Medical Prices.........3

Davis Vision Program.........4

Express Scripts Prescription Program.........4

Coordination of Benefits/Spousal Surcharge....4

Concordia Flex Dental Program.........5

2024 Dental Prices.........5

Note About International Travel.......5

Need Help?......6

Virtual Vendor Visits......6

Notice of Privacy Practices......6

Frequently Asked Questions......7

Alight Services......8

New Life/Disability Insurance Provider.....8

Important Notice for Employees Turning 65.....8

CONTENTS

Changes For 2024

• Medical Plan Premiums – Employee premiums for

all three medical plan options will increase by 7%.

Premium contributions, including both employee

and university shares, are listed on page 3.

• Dental Plan Premiums - Premiums will increase

5% in 2024. This is the first increase in dental plan

premiums since 2018.

• Eective January 1, 2024, Reliance Matrix will

be the university’s Life and Disability Insurance

vendor. More information about this change is

available on page 8.

• Spousal Surcharge Waiver Form – If you are

covering a spouse/partner on your medical plan,

you must complete a 2024 Spousal Surcharge

Waiver form. This form must be completed every

year that you cover a spouse/partner. See page 4

for details.

Enroll on the Web

• Log in to “Connect Lehigh” from the upper left corner of

the Inside Lehigh homepage.

• Navigate to the Employee Links tile.

• Select “Human Resources.”

• Select “Lehigh Benefits.”

• Select the button under the words “Enroll Now!” that

reads “Click Here to View Your Benefits.”

Or Use The App

• Download the Benefitfocus app from The App Store or

the Google Play Store.

• Log in by using the ID “lehighbenefits” on the initial

screen, then sign in with your Lehigh ID and password.

You’ll be asked to confirm your dependents and answer a few

questions before you begin enrollment. You can review your

current elections, use the comparison shopping tool to view

estimated out of pocket costs, change your elections, update

your beneficiary information and more.

ARE YOU

Turning 65 and eligible for Medicare this year?

AND

Considering the High Deductible Plan with HSA?

See page 8 for very important information

about Health Savings Accounts

IMPORTANT REMINDER

FSAs and employee contributions to HSAs DO NOT

automatically roll forward from the previous year.

If you want a healthcare or dependent care Flexible

Spending Account (FSA) or plan to make employee

contributions to a Health Savings Account (HSA) in 2024,

you must make these elections during Open Enrollment.

Flex Benefits Updates for 2024

Open Enrollment 2024 Quick Reference Guide

page 2

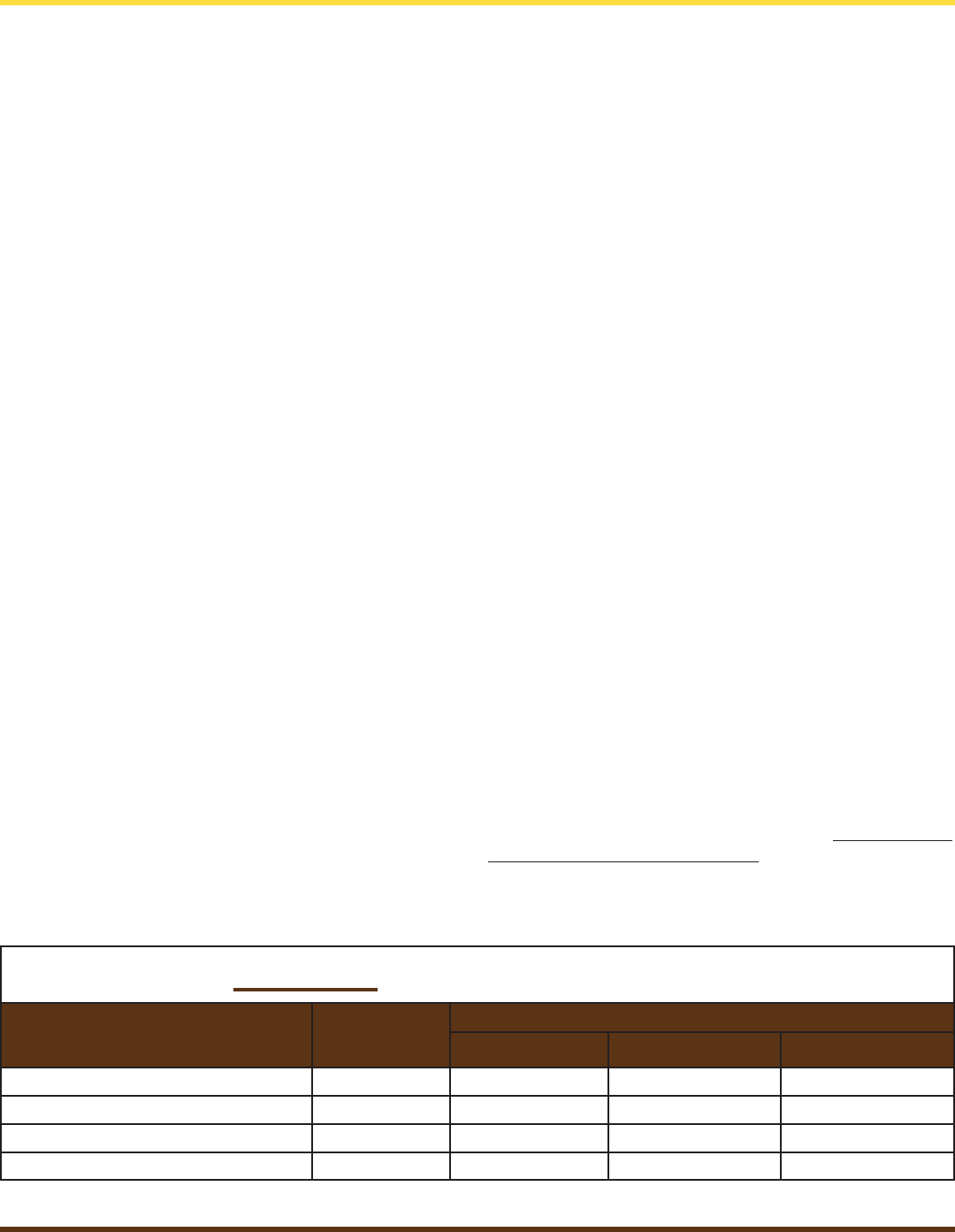

Summary of Medical Plan Options

PPO HDHP Keystone HMO***

Network

National National 21 County/Lehigh Valley

In-network Out-of-network In-network Out-of-network In-network

Annual Deductible

Individual

$300 $500 $1,750 $2,500 $0

Family

$900 $500 /person $3,500* $5,000* $0

Coinsurance

20% 40% 20% 40% N/A

Out-of-Pocket Maximum for all medical and prescription drug charges

Individual

$5,000 No limit $5,000 No limit $4,000

Family

$10,000 No limit $10,000 No limit $8,000

Physician Services

Oce Visit $30 copay/visit 40% coinsurance 20% coinsurance 40% coinsurance $30 copay/visit

Specialist Visit

$50 copay/visit 40% coinsurance 20% coinsurance 40% coinsurance $50 copay/visit

Preventive Care

(Administered in

accordance with

Preventive Health

Guidelines & PA state

mandates)

No charge Mandated screenings

and immunizations:

40% coinsurance;

Routine physical

exams: Not covered

No charge Mandated screenings

and immunizations: 40%

coinsurance; Routine

physical exams: Not

covered

No charge

Hospital Services

Inpatient Coverage

20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance $250/admission

Outpatient Hospital

20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance $100 copay/outpatient surgery

Emergency Room

$150 copay/service, waived if admitted 20% coinsurance

after deductible

$150 copay/visit, waived if

admitted

Urgent Care

$50 copay/

service

40% coinsurance 20% coinsurance 40% coinsurance $50 copay/ service

Maternity Services

Prenatal/

Postpartum Care

20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance No charge

Hospital

20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance $250/admission

Mental Health **

Inpatient

20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance $250/admission

Outpatient

$30 copay/visit 40% coinsurance 20% coinsurance 40% coinsurance $30 copay/visit

Substance Abuse **

Inpatient

20% coinsurance 40% coinsurance 20% coinsurance 40% coinsurance $250/admission

Outpatient

$30 copay/visit 40% coinsurance 20% coinsurance 40% coinsurance $30 copay/visit

Prescription Drugs

Generic

10% coinsurance

Coinsurance plus

amount over Express

Scripts allowable

amount

10% coinsurance

after deductible

is met

Coinsurance plus

amount over Express

Scripts allowable amount

after deductible

10% coinsurance

Brand Forumulary

20% coinsurance

Coinsurance plus

amount over Express

Scripts allowable

amount

20% coinsurance

after deductible

is met

Coinsurance plus

amount over Express

Scripts allowable amount

after deductible

20% coinsurance

Brand Non-Forumulary

30% coinsurance

Coinsurance plus

amount over Express

Scripts allowable

amount

30% coinsurance

after deductible

is met

Coinsurance plus

amount over Express

Scripts allowable amount

after deductible

30% coinsurance

*For all coverage levels other than employee only, the entire family deductible must be met before the HDHP plan starts paying medical and pharmacy

benefits to anyone in the plan. Medical and pharmacy expenses count toward the deductible.

** Managed Behavioral (Mental) Health services are administered by Capital Blue Cross for all of the medical plans. To search for providers of managed

behavioral health please go to My Care finder at https://www.capbluecross.com/wps/portal/cap/home/find/my-care-finder. Preauthorization is required in

all plans.

***Care from out-of-network providers is not covered, other than in an emergency, as determined by Capital Blue Cross.

See the Summary of Benefits and Coverage and Plan Design Details sections of the 2024 Enrollment and Reference Guide to learn more about specific

coverages and limits as well as preauthorization information.

Open Enrollment 2024 Quick Reference Guide

page 3

The following are definitions of terms used in the description of medical coverage. Understanding these terms will make it

easier for you to compare the benefits provided under each of the plans.

Allowed Charge: That portion of a charge that the plan

determines is reasonable for covered services that

have been provided to the patient. Also known as the

“allowance.” Amounts in excess of the allowed charge are

not paid by the plan. If the services were provided by a

participating provider, the amount in excess of the allowed

charge is waived by the provider. If the services were pro-

vided by a non-participating provider, the patient may be

responsible for paying the additional amount (see “Balance

Billing”).

Balance Billing: Occurs when a provider of services or

supplies declines to accept the payment level determined

by a medical plan as payment in full. The provider then bills

the insured for the amount of the charge that exceeds plan

payment plus deductible, coin surance, and/or copayment.

Coinsurance [Cl]: The portion of a covered charge that is

paid by both the insured and the plan. It is the sharing of

charges as defined by the plan. Typically these amounts

are expressed in terms of the “percentage paid by the plan

versus percentage paid by the insured,” such as 80 percent

by the plan and 20 percent by you; 70 percent by the plan

and 30 percent by you; or 50 percent by the plan and 50

percent by you. Coinsurance amounts may aect out-of-

pocket maximums.

Copayment [CP]: A flat dollar amount paid to the provider

by the insured for a covered service or supply at the time it

is received. An example would be paying the physician $30

at the time of an oce visit. Copayments do not aect the

deductible and coinsur ance maximum, but do contribute

to the out-of-pocket maximum that includes applicable

physician copayments.

Covered Charge: An allowed charge for service that the

plan is designed to accept and for which the plan will pay, if

all other con ditions (like deductibles and coinsurance) have

been met. Charges that are not covered (like Balance Billing)

do not aect deducti bles, coinsurance, or out-of-pocket

maximums.

Deductible [D]: The total amount of covered charges that

the insured must pay in full during the plan year before any

payment is made by the plan.

Out-of-Pocket Maximum: The maximum amount that would

be paid by the insured for covered charges during a plan

year, usual ly a combination of deductible, coinsurance, and

copayments. The amount does not include plan charges

for services that are not covered, and charges that are in

excess of plan allowable charges (see “Balance Billing”).

Preventive Care: Any covered medical service or supply

that is received in the absence of symptoms or a diagnosed

medical condi tion. Preventive care includes preventive

health services like physical examinations, certain

immunizations, and screening tests. Preventive care can

also provide specific programs of education, exercise, or

behavior modification that seek to manage disease or

change lifestyle: programs for diabetes management,

smoking cessation, childbirth preparation and the like.

Medical plans clearly define the types of services, supplies,

and programs they oer as preventive benefits and they

provide them based upon protocols established in the

medical community with regard to factors like frequency,

patient age, and suitability. The Patient Protec tion and

Aordable Care Act also requires particular preventive

services for particular individuals to be covered at no cost,

provided the covered services are received from a network

provider. These services can be reviewed at healthcare.gov/

coverage/preventive-care-benefits.

Understanding Medical Coverage Plan Language

2024 Monthly Medical Insurance Prices

University

Contribution

Employee Premiums

HDHP Plan PPO Keystone HMO

Individual $678 $41 $274 $132

Employee + Spouse/Partner $1,396 $156 $678 $371

Employee + Child(ren) $1,270 $132 $603 $326

Employee + Family $2,016 $229 $983 $537

Open Enrollment 2024 Quick Reference Guide

page 4

Vision and Prescription Drug Plan Information

Service/Product

Your

In-Network Cost

Out-of-Network

Reimbursement

to You

Eye Exam $0 $32

Eyeglass Lenses

Standard Single vision $0 $25

Bifocal $0 $36

Trifocal $0 $46

Post Cataract $0 up to $72

Non-standard (i.e. no

line bifocals, tints,

coatings)

Fixed Costs

No Additional

Benefit

Frames

$0 for Davis fashion

selection frames at all

providers. Amount over

$110 for non-Davis frames

at Visionworks, less 20%

overage discount. Amount

over $60 at other providers.

$30

Contact Lenses

Prescription and

Fitting

$0

Daily Wear: $20

Extended Wear: $30

Contact Lenses Amount over $75, less 15%

discount on overage

Specialty: $48

Disposable: $75

Medically Necessary

Contacts (w/prior

approval)

$0 up to $225

1-877-923-2847 (prior to initial enrollment)

1-800-999-5431 (once enrolled) or www.davisvision.com

Davis Vision Program

Express Scripts Prescription Drug Benefit

Lehigh’s prescription drug program is based on a three -tiered formulary that determines the amount of coverage you will receive for

your drugs. Below are the coverage levels for each tier.

Coordination of Benefits/

Spousal Surcharge

If you have dependents covered by

Lehigh’s medical insurance plan, you will be

asked to complete a Coordination of Benefits

questionnaire. You will receive the form from

Capital BlueCross. This form will ask you if your

dependents’ other parent also has coverage for

them on a plan from his or her employer. It also

asks if your adult children (under age 26) have

coverage with their employers.

In general, all participants receive primary

coverage from the medical plan that covers

them as an employee, and dependent children

receive primary coverage from the parent

whose birthday comes first in the calendar year.

Secondary coverage comes from the medical

plan of the other employer, or the other parent,

respectively.

If you choose to have your spouse or partner

covered by Lehigh’s medical insurance plan,

you will be charged a $100/month surcharge

until you complete a Spousal Surcharge Waiver

request and HR approves it.

The waiver request form is provided during

the online enrollment process. Failure to submit

the waiver request during Open Enrollment will

result in the monthly surcharge beginning on

January 1. If you provide the form later and it is

approved, the surcharge will stop; however, you

will not receive a refund for prior months.

Retail Mail Order

Generic 10% ($25 maximum) per 30-day supply 10% ($62.50 maximum) per 90-day

supply

Formulary Brand Name 20% ($50 maximum) per 30-day supply 20% ($125 maximum) per 90-day

supply

Non-Formulary Brand Name 30% ($100 maximum) per 30-day supply 30% ($250 maximum) per 90-day

supply

If you have questions about whether your prescriptions are considered “formulary” or “non-formulary,” contact Express

Scripts at 1-866-383-7420 or www.express-scripts.com.

Open Enrollment 2024 Quick Reference Guide

page 5

Dental Benefit Summary

Diagnostic and Preventive Service Benefits - Paid at 100%

of MAC*. Does not count against maximum annual benefits

of $1,000 per person

Semi-annual cleaning, polishing and examination

Annual bitewing X-rays

Complete X-ray series (every five years)

Fluoride treatment (under age 19)

Sealant: Under age 16. One sealant per permanent first and

second molars in three years.

Emergency treatment: Palliative (to alleviate pain), not restorative

Basic Service Benefits - Paid at 80% of MAC*

Inpatient consultation

Anesthetics: Novocain, IV sedation, general

Basic restoration: Amalgam and composite fillings

Non-surgical periodontics

Endodontics

Oral surgery

Simple extraction

Repair of crowns, inlays, onlays, bridges and dentures

Major Service Benefits - Paid at 50% of MAC*

Surgical periodontics

Inlays, onlays and crowns

Prosthetics: Dentures and bridges; no implants

Orthodontics (under age 19) - Paid at 50% of MAC*

Orthodontic lifetime benefit maximum of $1,000 per person

*MAC: Maximum Allowable Charge - The negotiated

charge the plan pays to providers.

The Preventive Incentive

To encourage good oral health and help save

you money, United Concordia Dental’s plan covers

Class I diagnostic and preventive procedures

in full. Annual preventive care for each person

covered under the plan includes:

• Two cleanings

• Two exams

• One set of X-rays.

In addition, the coverage of these costs does

not count toward your annual maximum. For more

information on The Preventive Incentive, contact

United Concordia Dental customer service at

1-800-332-0366.

To view a list of participating dentists, visit

United Concordia’s website at

www.ucci.com/, select “Find a Dentist,”

and select “Advantage Plus” to find

participating dentists in Pennsylvania,

and “National Fee-For-Service” to find

dentists in all other states.

2024 Monthly Dental Prices

United Concordia Dental

Employee Only $37.02

Employee + One $74.06

Employee + Two or More $95.74

A Note About International Travel

All three of Lehigh’s medical coverage plans are administered by Capital BlueCross, which is a member of the

BlueCross BlueShield Association.

That aliation makes the BlueCross BlueShield Global Core program available to employees and dependents

covered under any Lehigh medical plan. BlueCross BlueShield Global Core provides access to an international network

of traditional inpatient, outpatient, and professional healthcare providers, as well as participating hospitals, around the

world.

If you plan to travel outside the US, you can find information about the program and its services - including the process

for locating a doctor or hospital - by calling 1-800-810-BLUE. Outside the US, call collect at 1-804-673-1177. You can also

visit the Global Core website at https://www.bcbsglobalcore.com.

If you are traveling on university business outside the US, you can also use the International SOS program travel

services assistance plan that can help with medical, personal, travel and security assistance in times of need.

International SOS is not medical insurance, but is another source of support. Learn more about International SOS and

other university travel insurance issues by calling the Oce of International Aairs (610-758-4977) or Risk Management

(610-758-3899).

Open Enrollment 2024 Quick Reference Guide

page 6

Need Help?

Need an answer to a benefit coverage question? Here’s a list of resources to get your questions answered. Clip and save

this list for future reference. This list is also available at: https://hr.lehigh.edu/resources.

Provider Phone Web Address

AFLAC 800-433-3036 www.aflacgroupinsurance.com

Alight (expert medical opinion) 888-361-3944 mymedicalally.alight.com

BenefitsVIP Service Center (general Lehigh

benefits questions)

866-293-9736 email: solutions@benefitsvip.com

Capital BlueCross and

Keystone Health Plan

800-216-9741 www.capbluecross.com

Capital BlueCross Managed Behavioral

Health (mental health benefits)

866-322-1657 www.capbluecross.com

Capital Blue Virtual Care (telehealth) 855-818-3627

https://www.capbluecross.com/wps/portal/

cap/home/explore/resource/virtual-care

Davis Vision

800-999-5431 or

877-923-2847

www.davisvision.com

control code: 5167

Express Scripts 866-383-7420 www.express-scripts.com

Health Advocate

Advocacy Services

866-695-8622

email: [email protected]

web: https://members.healthadvocate.com/

Home/Index

Health Equity (HSA administration) 866-346-5800 www.healthequity.com

Health Advocate

Employee Assistance Program (EAP)

866-799-2728 healthadvocate.com/members

United Concordia Dental 800-332-0366 www.ucci.com

Wageworks/Health Equity

(FSA administration)

855-774-7441 or

877-924-3967

https://www.wageworks.com/

Virtual Visits by Capital BlueCross

A representative from Capital BlueCross will be available

virtually during Open Enrollment on

the dates below.

Take some time to visit with Capital and ask questions

about how Lehigh’s benefit plans work. Human

Resources representatives will also be

available.

Wednesday, November 1, 12:00 - 1:00 p.m.

Tuesday, November 7, 12:00 - 1:00 p.m.

Registration for individual appointment slots is

available via Page Up.

Notice of Privacy Practices

Lehigh University has a Benefit Plans

Notice of Privacy Practices. You have a right

to receive a paper copy of this Notice of

Privacy Regulations at any time. To obtain a

paper copy of this notice, send your written

request to:

Lehigh University Human Resources

306 South New Street, Suite 437

Bethlehem, PA 18015

If you would like to have a more detailed

explanation of these rights or if you would

like to exercise one or more of these rights,

contact the Director of Benefits at the

above address or call 610-758-3900.

Open Enrollment 2024 Quick Reference Guide

page 7

Frequently Asked Questions

Q: What is the last date to file Capital BlueCross claims for

the HDHP or PPO medical plans?

A: Claims must be filed within twelve (12) months of the date

of service for any of the Capital BlueCross medical plans.

Q: How often may I change from one health insurance

plan to another within our medical plans?

A: The only time you can change to another plan is during

the annual open enrollment period, held this year from

November 1-15. If you are dissatisfied with your current

coverage, please contact Human Resources. It is important

to tell us about any problems you encounter.

Q: I am expecting a baby/adopting a child soon. When and

how should I add my new child to my coverage?

A: Adding a child to your family is a Qualifying Life Event. As

a result, you have thirty-one (31) days from the date of birth

or adoption placement to add a child (under the age of 26)

to your insurance. You should add your child as soon as

possible during that timeframe.

Remember: Open Enrollment insurance elections are for

the 2024 plan year. Therefore, if you need to add a child

to your insurance coverage for the remainder of 2023,

you need to provide the appropriate information and

documentation outside of the Open Enrollment process.

To do so, log into Lehigh Benefits and select “Life Event” in

the “Manage Account” section on the left side of the screen

before beginning Open Enrollment. You will be prompted

to provide information and documentation on your new

dependent.

Completing the Life Event section triggers the system to add

your child to your insurance for the remainder of 2023. You

may continue on to select your 2024 benefits through the

Open Enrollment process. If your new child is not yet listed

as a dependent, you’ll need to add them when prompted.

Q: I am getting married soon. Can I add my new spouse

and/or stepchild(ren) to my coverage or do I have to wait

until there is an open enrollment period?

A: The instructions in the question above regarding

adding a new child also apply in this situation. You have

thirty-one (31) days from the date of your marriage to add

your spouse and/or stepchild(ren) to your health and/or

dental coverage, purchase dependent life insurance, and/

or increase your supplemental life insurance. After thirty-one

days, you must wait for the next open enrollment period. If

your spouse has access to health insurance through his or

her employer, keep the spousal surcharge in mind when

considering adding him or her to your medical plan. See the

full Flexible Benefits Enrollment and Reference Guide online

on the Lehigh Benefits website.

Q: My child just turned age 26 and has no health

insurance plan. Can he or she stay on my medical plan?

A: No. Your dependent or adult children can only remain

covered under a university medical, dental, life insurance,

or FSA program until the end of the month in which they

reach age 26. He or she will be oered COBRA continuation

medical and dental coverage at that time. He or she can

also visit www.healthcare.gov to see options for purchasing

individual medical insurance. If your child is disabled, special

rules may apply. Please contact HR for more information.

Q: I am helping my 25-year old pay for major dental

work. Can I be reimbursed through my Flexible Spending

Account (FSA)?

A: Yes. Qualifying medical expenses incurred by your adult

child (under 26 years old) are eligible for reimbursement

through your FSA. The same requirements apply.

Q: What is the dierence between “pre-tax” and “post-

tax” long-term disability (LTD) plans?

A: If you purchase LTD coverage on a pre-tax basis, this

means you pay federal income tax on the benefit if you

become disabled, but you pay no federal income tax on the

premium. If you choose the post-tax option, you pay federal

income tax on the premium, but no federal income tax on

the benefit (the income you would receive if you became

disabled).

Q: I enrolled my non-working spouse/partner on my

insurance plan. How can I avoid being charged a

surcharge?

A: The Spouse/Partner Surcharge of $100 per month is

assessed when an employee’s spouse/partner has access

to medical insurance via an employer or former employer

but still chooses to be enrolled in Lehigh’s plan as primary

coverage. If your spouse/partner does not have such

access, you must complete the online Spouse/Partner

Surcharge Waiver Request form to avoid being charged.

If you do not complete the spousal surcharge waiver

request by November 30, 2023, you may be charged the

surcharge starting in January 2024. You will continue

to be charged $100 monthly if you do not submit a waiver

request that is then approved by HR. Please note that if your

waiver request is accepted, the surcharge will stop, but prior

months’ charges will not be refunded.

Q: How do I access Managed Behavioral Health (Mental

Health) benefits under my medical plan?

A: Your first step should always be to contact the proper

service provider by phone. Capital BlueCross provides

managed behavioral health benefits for all three medical

plans. You can call 866-322-1657.

Open Enrollment 2024 Quick Reference Guide

page 8

More About Your Benefits

Fact: Once you are enrolled in any part of

Medicare, you will not be eligible to contribute

to (or receive contributions from Lehigh into)

an HSA in the months following your Medicare

eective date.

Fact: If you are receiving Social Security

payments prior to age 65, you will automatically

be enrolled in Medicare when you turn 65.

Fact: If you do not stop contributing to your

HSA after enrolling or being automatically

enrolled in Medicare, you will be subject to

taxes and penalties from the IRS.

What This Means for Your HSA: You can be

Medicare eligible and still contribute to your HSA

beyond age 65, as long as you have postponed

applying for Social Security payments and

Medicare benefits.

The Bottom Line: Because Lehigh’s HDHP

medical plan automatically includes the HSA,

if you are Medicare eligible you should assess

your current situation and consider your medical

plan decision very carefully.

For more information, download this sheet

from Health Equity: https://hr.lehigh.edu/sites/

hr.lehigh.edu/files/medicare.pdf

The WageWorks HealthCare Card is a debit card that you

can use at the point of sale to access your healthcare FSA

funds when paying for allowable charges. Once the year

turns over from 2023 to 2024, you will only be able to use

the card to pay for 2024 expenses. You will need to file

for reimbursement of 2023 expenses via the WageWorks

website or app no later than March 31, 2024.

Important Reminder for Healthcare FSA Users

Contributing to an HSA after age 65

As you approach Medicare eligibility, be aware of

these important facts.

Avoid IRS Taxes and Penalties!

Lehigh Life/Disability Provider

Change in 2024

Eective January 1, 2024, Reliance Matrix will be the

university’s new life and disability insurance provider.

Reliance Matrix was selected after careful consideration

in response to increasing premiums and decreasing

client satisfaction with Lehigh’s current vendor, Lincoln

Financial Group.

Reliance Matrix will be administering life insurance

coverage, short term disability and long term disability

claims. They oer an attentive and responsive claims

team alongside an intuitive online claims administration

option for employees.

Lehigh HR will provide contact information and details

about Reliant Matrix’s claims process in December.

Alight

Alight (formerly ConsumerMedical), a free

expert medical opinion service, is a benefit for Lehigh

faculty and sta. Alight services include:

• Find the best doctors and hospitals in their area and

insurance network

• Verify any doctor’s credentials, skills, and experience

treating their condition

• Get a second opinion from top specialists, either

in person or virtually

• Connect with experts in their diagnosis from leading

medical institutions

For more information, visit https://hr.lehigh.edu/alight-

expert-medical-opinion-service.