GORANSON AND ASSOCIATES, INC.

G

AMAZON WATCH

FINANCIAL STATEMENTS

FOR THE YEAR ENDED

DECEMBER 31, 2013

TABLE OF CONTENTS

Page

Independent Auditor’s Report 1 - 2

Financial Statements:

Statement of Financial Position 3

Statement of Activities 4

Statement of Functional Expenses 5

Statement of Cash Flows 6

Notes to Financial Statements 7 - 12

GORANSON AND ASSOCIATES, INC.

446 BEAVER STREET, SANTA ROSA, CA 95404 PHONE: 707/542-1256 FAX: 707/575-0609 GORANSONCPA.COM

G

INDEPENDENT AUDITOR’S REPORT

To the Board of Directors

Amazon Watch

Oakland, California

We have audited the accompanying statement of financial position of Amazon Watch (a California

nonprofit public benefit corporation) as of December 31, 2013, and the related statement of

activities, functional expenses, and cash flows for the year then ended, and the related notes to the

financial statements. Our responsibility is to express an opinion on these financial statements

based on our audit. The prior year summarized comparative information has been derived from

Amazon Watch’s 2012 financial statements and, in our report dated August 15, 2013; we expressed

an unqualified opinion on those financial statements.

Management’s Responsibility for the Financial Statements

Management is responsible for the preparation and fair presentation of these financial statements

in accordance with accounting principles generally accepted in the United States of America; this

includes the design, implementation, and maintenance of internal control relevant to the

preparation and fair presentation of financial statements that are free from material misstatement,

whether due to fraud or error.

Auditor’s Responsibility

Our responsibility is to express an opinion on these financial statements based on our audit. We

conducted our audit in accordance with auditing standards generally accepted in the United

States of America. Those standards require that we plan and perform the audit to obtain

reasonable assurance about whether the financial statements are free of material misstatement.

An audit involves performing procedures to obtain audit evidence about the amounts and

disclosures in the financial statements. The procedures selected depend on the auditor’s

judgment, including the assessment of risks of material misstatement of the financial statements,

whether due to fraud or error. In making those risk assessments, the auditor considers internal

control relevant to the entity’s preparation and fair presentation of the financial statements in order

to design auditor procedures that are appropriate in the circumstances, but not for the purpose of

expressing an opinion on the effectiveness of the entity’s internal control. Accordingly, we express

no such opinion. An audit also includes evaluating the appropriateness of accounting policies

used and the reasonableness of significant accounting estimates made by management, as well

as evaluating the overall presentation of the financial statements.

GORANSON AND ASSOCIATES, INC.

G

We believe that the audit evidence we have obtained is sufficient and appropriate to provide a

basis for our audit opinion.

Opinion

In our opinion, the financial statements referred to above present fairly, in all material respects, the

financial position of Amazon Watch as of December 31, 2013, and the changes in its net assets and

its cash flows for the year then ended in conformity with accounting principles generally accepted

in the United States of America.

Goranson and Associates, Inc.

September 5, 2014

Santa Rosa, California

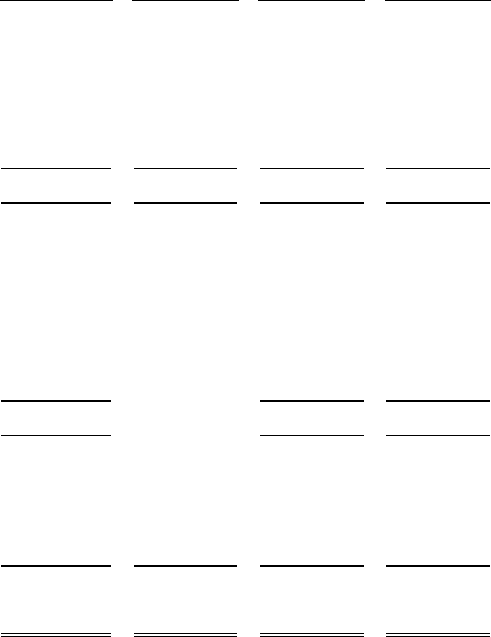

- 3 -

AMAZON WATCH

STATEMENT OF FINANCIAL POSITION

DECEMBER 31, 2013

(With summarized comparative totals for December 31, 2012)

2013 2012

ASSETS

Current assets:

Cash and cash equivalents 342,611$ 79,271$

Grants receivable 212,566 171,296

Prepaid expense

- 1,089

Total current assets

555,177 251,656

Fixed assets:

Equipment 60,782 60,782

Less accumulated depreciation

(59,066) (55,119)

Total fixed assets

1,716 5,663

Other assets:

Investments

11,579 19,519

Total assets

568,472$ 276,838$

LIABILITIES AND NET ASSETS

Current liabilities:

Accounts payable and credit cards 27,172$ 22,954$

Vacation and wages payable

29,522 -

56,694 22,954

Net Assets:

Unrestricted 91,925 (7,530)

Temporarily restricted

419,853 261,414

Total net assets

511,778 253,884

Total liabilities and net assets

568,472$ 276,838$

The accompanying notes are an integral part of these financial statements

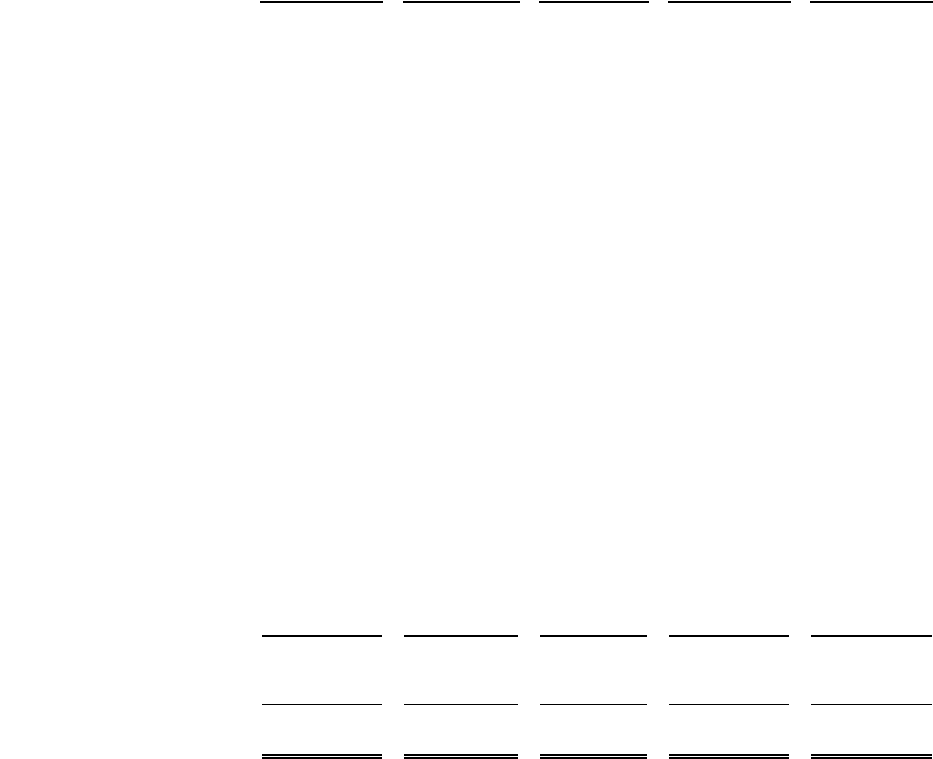

- 4 -

AMAZON WATCH

STATEMENT OF ACTIVITIES

FOR THE YEAR ENDED DECEMBER 31, 2013

(With summarized comparative totals for the year ended December 31, 2012)

Temporarily 2013 2012

Unrestricted Restricted Total Total

SUPPORT AND REVENUE:

Grants and contributions 1,037,872$ 670,793$ 1,708,665$ 1,477,560$

Unrealized Gain (loss) 1,108 - 1,108 (1,108)

Other income 2,404 - 2,404 8,716

Net assets released from restriction

512,354 (512,354) - -

Total support and revenue

1,553,738 158,439 1,712,177 1,485,168

EXPENSES:

Campaigns and capacity building

grants to partners 1,151,945 1,151,945 1,478,280

Management and general 110,081 110,081 112,120

Fund development

192,258 192,258 251,464

Total expenses

1,454,284 1,454,284 1,841,864

CHANGE IN NET ASSETS 99,455 158,439 257,893 (356,695)

NET ASSETS, BEGINNING

(7,530) 261,414 253,884 610,579

NET ASSETS, ENDING

91,925$ 419,853$ 511,777$ 253,884$

The accompanying notes are an integral part of these financial statements

- 5 -

AMAZON WATCH

STATEMENT OF FUNCTIONAL EXPENSES

FOR THE YEAR ENDED DECEMBER 31, 2013

(With summarized comparative totals for the year ended December 31, 2012)

Campaigns

and Grants to 2013 2012

Partners Administration Fundraising Total Total

Salaries and wages 553,914$ 30,947$ 113,277$ 698,138$ 617,565$

Payroll tax expense 44,551 2,530 9,167 56,248 54,021

Employee benefits 57,378 3,260 11,840 72,478 72,347

Grants awarded 176,354 - 174 176,528 296,258

Travel 67,720 2,076 4,870 74,666 177,902

Professional services 92,051 42,279 14,489 148,819 301,803

Occupancy 57,432 10,583 68,015 92,070

Fundraising 325 - 13,928 14,253 34,522

Publicity 21,151 1,313 461 22,925 90,984

Conferences and meetings 3,916 3,219 165 7,300 6,150

Telecommunications 21,246 3,525 1,956 26,727 18,898

Insurance 15,361 2,862 1,104 19,327 7,664

Finance charges 14,998 2,319 7,068 24,385 16,672

Supplies and equipment 5,853 659 968 7,480 14,991

Postage 438 - 1,786 2,224 4,017

Outside services 3,813 828 394 5,035 3,732

Printing and copying 7,053 1,065 7,894 16,012 13,855

Other operating expense

5,208 2,095 2,474 9,777 13,251

Subtotal 1,148,762 109,560 192,015 1,450,337 1,836,702

Depreciation

3,183 521 243 3,947 5,162

Total expenses

1,151,945$ 110,081$ 192,258$ 1,454,284$ 1,841,864$

The accompanying notes are an integral part of these financial statements

- 6 -

AMAZON WATCH

STATEMENT OF CASH FLOWS

FOR THE YEAR ENDED DECEMBER 31, 2013

(With summarized comparative totals for the year ended December 31, 2012)

2013 2012

CASH FLOWS FROM OPERATING ACTIVITIES:

Change in net assets 257,893$ (356,695)$

Adjustments to reconcile change in net

assets to cash from operations

Depreciation 3,947 5,162

Unrealized gains 1,108 1,108

(Increase) decrease in:

Grants receivable (41,270) 362,940

Prepaid expenses 1,089 -

Increase (decrease) in:

Accounts payable 4,219 3,642

Vacation and wages payble

29,522 -

Net cash provided by operating activities

226,986 16,157

CASH FLOWS FROM INVESTING ACTIVITIES:

(Increase) decrease in investments 6,832 (1,695)

Purchase of property and equipment

- -

Net cash provided (used) by investing activities

6,832 (1,695)

CASH FLOWS FROM FINANCING ACTIVITIES:

Draw on line of credit

- (50,303)

NET DECREASE IN CASH 263,340 (35,841)

CASH, beginning of year

79,271 115,112

CASH, end of year

342,611$ 79,271$

The accompanying notes are an integral part of these financial statements

- 7 -

AMAZON WATCH

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2013

NOTE 1 ORGANIZATION

Amazon Watch was created in 1997 as a Montana nonprofit corporation and incorporated in the

state of California April 2000. Amazon Watch works to protect the rainforest and advance the rights

of indigenous peoples in the Amazon Basin. We partner with indigenous and environmental

organizations in the Amazon in campaigns for corporate accountability, sustainability, human

rights, and the protection of ecological systems. Primary support comes from private funding.

Our Strategies and Programs:

In the Amazon region of Brazil, Colombia, Ecuador, and Peru, Amazon Watch is working directly

with indigenous communities to build local capacity and advance the long-term protection of their

lands. In partnership with communities, non-governmental organizations, concerned shareholders

and citizens, we utilize the following strategies:

Campaign to persuade decision-makers in corporations, international financial institutions and

governments to honor the rights of indigenous peoples over “development” decisions in their

territories and to rectify past harms, for example in areas devastated by past and current oil

drilling. Through media exposure, legal action and shareholder campaigns we promote corporate

social and environmental accountability.

Strengthen capacity in indigenous communities and partner organizations in the Amazon to better

advocate for own their rights at local, national and international forums. Through training in legal

rights, advocacy, media and technology as well as the donation of equipment, we help our

indigenous partners protect their rainforest homelands, assert their collective voice and advance

their rights.

Seek permanent protection for threatened areas and vulnerable indigenous populations in the

Amazon rainforest. In partnership with ally organizations in South America, we champion

ecologically sound alternatives and solutions to industrial and fossil-fuel intensive economic

development.

Educate corporate executives, shareholders, public officials and the general public using media

coverage, websites, publications and documentary films. By building awareness and promoting

green economic alternatives to the current export-oriented development model, we are helping to

bring about a shift within key institutions and society.

- 8 -

AMAZON WATCH

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2013

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES

Basis of Presentation – Amazon Watch reports information regarding its financial position and

activities on an accrual basis according to three classes of net assets: unrestricted, temporarily

restricted, and permanently restricted.

Unrestricted Net Assets

– Net assets that are not subject to donor-imposed restrictions. These

also may be designated for specific purposes by action of the Board of Directors.

Temporarily Restricted Net Assets

– Net assets that are subject to donor-imposed stipulations

that may be fulfilled by actions of Amazon Watch to meet the stipulations or that become

unrestricted at the date specified by the donor.

Permanently Restricted Net Assets

– Net assets subject to donor-imposed stipulations that they

be retained and invested permanently by Amazon Watch to use all or part of the investment

return on these net assets for specified or unspecified purposes.

Net assets released from restriction – Temporarily restricted net assets are “released” to

unrestricted net assets when the donor-stipulated purpose has been fulfilled and/or the stipulated

time period has elapsed.

Other Basis of Presentation Policies – Revenues or support are reported as increases in

unrestricted net assets unless subject to donor-imposed restrictions. If temporary restrictions are

fulfilled in the same time period the revenue or support is received, Amazon Watch reports the

revenue or support as unrestricted. Expenses are reported as decreases in unrestricted net assets.

Gains and losses on investments and other assets or liabilities are reported as increases or

decreases in unrestricted net assets unless restricted by explicit donor stipulation or by law.

Cash and Cash Equivalents - Cash equivalents consist primarily of money market accounts and

other investments with an original maturity of 90 days or less.

Grants Receivable - Grants receivable consist of grants awarded, but not yet received as of

December 31, 2013. Management believes receivables at December 31, 2013 will be fully

collected. Accordingly, no allowance for doubtful receivables is recorded.

- 9 -

AMAZON WATCH

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2013

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued

Fixed Assets - Fixed assets are carried at cost or at estimated fair market value at date of donation.

Depreciation is calculated using the straight-line method over the useful life of the asset, usually

five to ten years depending upon the asset.

Investments- Investments are stated at fair value. Unrealized and realized gains and losses are

reported on the statement of activities. Interest income is included as an increase in unrestricted

net assets in the accompanying statement of activities as its use is unrestricted.

Income Taxes - Amazon Watch is exempt from Federal and State Income taxes under Internal

Revenue Code Section 501(c)(3) and California Franchise Tax Board Code Section 23701d.

Therefore, no provision for income taxes has been made in the accompanying financial

statements. In addition, the Internal Revenue Service has determined Amazon Watch is not a

“private foundation” within the meaning of Section 509(a) of the Internal Revenue Code.

Management of Amazon Watch considers the likelihood of changes by taxing authorities in its filed

tax returns and recognizes a liability for or discloses potential significant changes if management

believes it is more likely than not for a change to occur, including changes to Amazon Watch’s

status as a not-for-profit entity. Management believes Amazon Watch met the requirements to

maintain its tax-exempt status and has not income subject to unrelated business income tax;

therefore no provision for income taxes has been provided in these financial statements. Amazon

Watch’s tax returns for the past three years are subject to examination by tax authorities, and may

change upon examination.

Donated Services and Items - Many people have contributed significant amounts of time and

inventory to the activities of Amazon Watch without compensation. The financial statements do not

reflect the value of those contributed services because, although clearly substantial, detailed

information is not maintained to determine an appropriate basis for valuation.

Estimates - The preparation of financial statements in conformity with generally accepted

accounting principles requires management to make estimates and assumptions that affect

certain reported amounts and disclosures. Accordingly, actual results could differ from these

estimates.

- 10 -

AMAZON WATCH

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2013

NOTE 2 SUMMARY OF SIGNIFICANT ACCOUNTING POLICIES, continued

Summarized Financial Information – The financial statements include certain prior year

summarized comparative information in total but not by net asset class. Such information does

not include sufficient detail to constitute a presentation in conformity with accounting principles

generally accepted in the United States of America. Accordingly such information should be read

in conjunction with Amazon Watch’s financial statements for the year ended December 31, 2012,

from which the summarized information was derived.

NOTE 3 GRANTS RECEIVABLE

Grants receivable consist of the following at December 31, 2013:

Campaigns support 102,383$

General program support 110,183

212,566$

NOTE 4 FAIR VALUE MEASUREMENTS AND INVESTMENTS

Fair Value Measurements - Generally accepted accounting principles provide guidance on how fair

value should be determined when financial statement elements are required to be measured at fair

value. Valuation techniques are ranked in three levels depending on the degree of objectivity of the

inputs used with each level:

Level 1 Inputs

– quoted prices in active markets for identical assets

Level 2 Inputs

– quotes prices in active or inactive markets for the same or similar assets

Level 3 Inputs

– estimates using the best information available when there is little or no market

The following table sets forth, by level within the fair value hierarchy, the Agency’s assets measured

at fair value on a recurring basis at December 31, 2013.

Level 1

Common stock $ 11,579

- 11 -

AMAZON WATCH

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2013

NOTE 5 REVOLVING LINE OF CREDIT

Amazon Watch has a $100,000 revolving line of credit secured by the assets of the organization

renewed August 20, 2013. Bank advances on the credit line are payable on demand and carry

an interest rate of 3.25 percent above the prime rate, with a 7.5 percent floor. There is no

balance carried at December 31, 2013.

NOTE 6 TEMPORARILY RESTRICTED NET ASSETS

Temporarily restricted net assets are monies awarded with either program or time restrictions for

future or multi-year programs. Temporarily restricted net assets at December 31, 2013 are for the

following purposes:

Re-granting 132,253$

Peru 14,000

Ecuador 82,500

Brazil 20,000

General support 38,000

Campaigns support 133,100

419,853$

NOTE 7 LEASE COMMITMENTS

Amazon Watch leases its offices in Oakland under a five year lease dated January 1, 2013 and

expiring December 31, 2017. Amazon Watch also leases office space in Washington D.C. on a

month-to-month basis. Total rent expense for the year ended December 31, 2013 is $68,015.

Future lease payments are as follows on December 31:

2014 $ 93,756

2015 104,288

2016 107,417

2017 110,639

- 12 -

AMAZON WATCH

NOTES TO FINANCIAL STATEMENTS

DECEMBER 31, 2013

NOTE 8 RETIREMENT PLAN

Amazon Watch provides a SIMPLE IRA plan qualified under Section 408(p) of the Internal Revenue

Code (IRS). Employees may make contributions to the plan up to the maximum amount allowed

by the IRS if they wish. Amazon Watch contributed $5,863 in matching funds, as required by the

plan for the year ended December 31, 2013.

NOTE 9 SUBSEQUENT EVENTS

Amazon Watch has evaluated subsequent events through September 5, 2014, which is the date the

financial statements were available to be issued, and determined that there were no events

occurring subsequent to December 31, 2013.