Introduction

Courier (Informal) Entry Clearance

What can be imported by Courier (Informal) mode

Documentation required

Customs process

Taxes and fees

Operational ow

Formal Import to Brazil Entry Clearance

What can be imported by Formal Import to Brazil mode

Documentation required

Customs process

Taxes and fees

DHL Customs Services

Documentation

WayBill

Commercial Invoice

Packing List

Online Solutions

DHL Import Online Express

DHL ProView

Check List

Prohibited/Restricted Items

Incoterms

Quick Guide

INDEX

2

In Brazil, import rules and regulations aren’t always

easy to navigate. For example, all commercial

shipments (those intended for resale), regardless

of value, must be imported as formal shipments.

This is contrary to many other countries where the

declared value, quantity and in some cases the

weight determine whether the shipment is courier

(informal) entry or formal import entry.

Therefore, having prior knowledge of the import

process is key to ensuring that the shipment gets

All shipments arriving in Brazil are thoroughly

inspected by the Federal Customs Service, so the

shipment mode you choose will directly impact

clearance time. With DHL Express, you can import

your shipments via courier (informal) or formal

modes. DHL will happily advise you on the best

mode for your shipment.

Note: All formal imports are serviced by the Formal Import to Brazil solution.

Need to choose

the right import mode

for your shipment?

We’re here to help.

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

3

» Import clearance for shipments with a CIP/CIF value up

to US$3,000³ — not for resale:

Documentation required

»

Important:

» Commercial Invoice or Pro Forma

Customs process

»

can help with the entire Customs process

»

Taxes and fees

»

»

»

1 Will be dutiable.

2 A legal entity is allowed to make the foreign exchange closing to pay the exporter.

3 CIP/CIF = cost of goods + international freight + international insurance.

WHAT CAN BE IMPORTED VIA COURIER (INFORMAL) ENTRY

1,2

Did you know that in Brazil, you are able to utilize the courier (informal) entry clearance mode for personal

shipments? See details below:

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

4

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

Here is a quick guide to

understanding the steps involved

in importing via Courier mode:

IMPORTANT: It is necessary to

have at hand the valid Tax ID

number (CNPJ) of the importer.

1

NOTE: Brazilian Customs does not accept

DHL Express’s Tax ID number (CNPJ) in

the WayBill.

OPERATIONAL FLOW

1 Along with Federal Customs Service.

* The shipment is subject to Customs examination an

1

4

2

3

out all required Commercial Invoice

information.

After all taxes are assessed, shipment

Sender contacts DHL Express to

schedule a pickup.

Shipment is loaded and bound

for importation into Brazil via

Courier mode.

5

» Materials for resale or with foreign exchange cover,

regardless of declared value;

» Shipping for any purpose that has a greater value than

US$ 3000

1

;

» Donations (only for organizations registered with the

government);

» Materials that require an import license, such as alcoholic

beverages and tobacco;

» Unaccompanied luggage

2

.

The complete list is on Siscomex in the Mercosur Common

Nomenclature (NCM).

Documentation required

3

» WayBill must have the consignee’s CNPJ*/TAX ID;

» Commercial invoice and packing list: original copy signed

in blue ink;

» Prior import license: should be approved before the date of

This license is only necessary if required by the NCM;

» Valid CNPJ/TAX ID: the document must be duly registered

by Federal Customs Service.

Duties and taxes

»

Some states in Brazil offer tax incentives in accordance

with the nature of the company;

»

» ICMS: average of 18%;

» IPI (manufactured products): based on the goods’ tax

» COFINS;

» PIS;

» Storage rate (By Infraero);

» SISCOMEX rate (will be collected by Customs for each

record of Import Declaration).

Customs services

»

Formal clearance service.

1 CIP/CIF = cost of goods + international freight + international insurance.

2 The luggage will be cleared by the importer at the Airport (entry by Guarulhos airport or

Viracopos airport) being delivered later in any part of Brazil, after the customs clearance.

3 Fines may be applied by the Federal Customs Service for noncompliant documents.

* CNPJ - Cadastro Nacional da Pessoa Juridica (Brazil corporate TAX ID)

WHAT CAN BE IMPORTED VIA FORMAL IMPORT TO BRAZIL?

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

6

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

companies and commercial establishments importing to

Brazil, such as the tax exemption and tax credit for the

ICMS (State tax).

In order for the importer (legal entity) to take advantage

company will be required to pay taxes applied in the State

of São Paulo.

A new express service is performed directly* from the

country of origin to the airports of Manaus, Belo Horizonte,

Porto Alegre, Curitiba, Rio de Janeiro and São Paulo, and

after the arrival of the clearance. Give the documentation to

your reliable broker or hire DHL as your broker.

destination without passing through São Paulo.

»

(see available targets on map below);

»

— all you need is a dedicated Import account

and the required documentation;

»

Global Network — serving 220 countries;

»

— table in Reais (R$) by 0.5 kg to 0.5 kg and

no minimum fee.

FORMAL IMPORT TO BRAZIL MODE IS EXCLUSIVE TO THE CITIES OF MANAUS, BELO HORIZONTE,

PORTO ALEGRE, CURITIBA, RIO DE JANEIRO AND SÃO PAULO

* For some destinations the shipment may be transferred rather than being sent directly. Consult your sales

representative to learn more about using this service.

7

» Advisory services for documentation;

» Guarantee of compliance with laws;

» Clearance for formal shipments;

»

» Extensive delivery network, covering the entire country;

» Complete information throughout all stages of the customs

process;

» Portfolio of optional products to meet the diverse needs of

your company.

» Shortest time between shipment arrival and its clearance

through Customs. DHL’s unique clearance-in-the-air

technology allows us to initiate the clearance process with

Customs before the shipment arrives in Brazil;

» DHL has an experienced team of in-house Customs

Brazilian Customs authorities;

» DHL Express maintains strong, professional relationships

with the Brazilian Customs authority. This ensures that

your shipments are cleared with minimal delays.

Additional information can be found at www.dhl.com

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

8

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

Applies to Formal Import to Brazil and Courier Mode

The WayBill is the contract of transport issued by the company carrier

transportation as well as the obligation of delivery of goods to the legal

recipient at the preset destination.

» Complete all sender and recipient data in full;

»

» Declare the value of the goods in the country as “Declared Value”;

» If the importer is responsible for shipping, must have the account

number on WB;

» For all import shipments, DHL Express automatically insures the

shipment, If you aren’t interested in insuring your shipment, please

contact your Sales Executive.

(Check Online Solutions). These tools are easy-to-use, help avoid

errors, and save time.

* DHL Express does not validate the FORMAL IMPORT information on the Commercial Invoice, only on the WayBill.

WAYBILL (WB)

9

Applies to Formal Import to Brazil and Courier Mode

ownership of goods to a buyer. All shipments that are dutiable

in the country of destination must be accompanied by a

commercial invoice or Pro Forma.

All commercial invoices must meet the following information

prerequisites:

» Tax ID for impor ter;

» Full description and Harmonized System Code (HS);

the Mercosur Common Nomenclature number (NCM).

» Merchandise unit cost, quantity and currency;

» Applicable INCOTERM used (DDP/DDU/EXW);

» Must have the exporter logotype.

DHL Express does not produce Commercial

Invoices.

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

COMMERCIAL INVOICE OR PRO FORMA

10

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

The Packing List contains an itemized and detailed list of goods. It is

intended to complement the Commercial invoice and assist Customs in the

identification and monitoring of goods.

»

» Describe all the shipments, including separate entries detailing exactly

what’s in each box and the weight of each;

» The document is indispensable for consignments sent as Formal

Import to Brazil.

PACKING LIST

Packing List

Date: 16/05/2014

Invoice #: 010/09

Customer ID:

To:

Salesperson Job Shipping

Method

Shipping

Terr

Delivery

Date

Payment

Terms

Due Date

DHL

6717953071

Quantity Description Package N.W (kg) G.W (Kg) Measurement Serial

20 Cover Cartons 0.190 0.268 26.5 x 20 x 18

CBM

1546972

20 Cover Cartons 0.190 0.268 26.5 x 20 x 18

CBM

1546973

TOTAL 1 Cartons 0.380 0.535 26.5 x 20 x 18

CBM

Box 01

Net Weight: 0.380

11

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

Online Shipping is the ideal solution for

preparing export shipments. It allows you to

create waybills, schedule pickups, store data

in submissions, track shipping in real time,

and more — all from your computer.

Click here to learn more about Online

Shipping and MyDHL.

With DHL ProView, you can have real time

visibility of your shipments and then you, or

collected or delivered. The application allows

users to track shipments by account number

or delivery status, in real time, and keeps you

and your clients constantly updated.

Click here to view the DHL ProView User’s

Guide.

DHL WEB SHIPPING

DHL PROVIEW

12

» Do you have consignee’s Tax ID number?

» Do you have the right commodity HS code?

» Does the shipment require Formal entry process? (see

reference table);

» Include “FORMAL IMPORT” in the “Goods Description”

» Is the value and currency declared marked correctly?

To expedite the process, it is recommended to use values

expressed in USD;

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

IMPORT

LEGAL ENTITY

NOT

ALLOWED

COURIER

MODE

FORMAL IMPORT MODE

BOOKS, NEWSPAPERS AND

MAGAZINES

DOCUMENTS

PURCHASES UP TO US $3000 WITH

COMMERCIAL DISPOSAL

PUCHASES/GIFTS BELOW US $3000

(NO COMMERCIAL DISPOSAL)

UNACCOMPANIED BAGGAGE

SAMPLES (BELOW TO US $3000)

PRODUCT FOR RESALE (ANY VALUE)

DONATIONS

PRODUCT THAT REQUIRES IMPORT

LICENSE

USED PRODUCT

ALCOHOLIC BEVERAGES AND

TOBACCO

MONEY

13

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

PROHIBITED RESTRICTED (Consult DHL before)

Animals Antiques

and art works

Cash, debit

card,

checks and

vouchers

Narcotics

(Illegal drugs)

Pirated or

products

Firearms

(or any part

of) and

ammunition

Ivory Precious

material

and jewelry

Gambling-

related

paraphernalia

Pornography Human parts,

including

ashes

Personal

correspondence

and postal

envelopes

Asbestos Dangerous

or fuel

materials

Medical

samples

Goods

used or

reconditioned

Any property is prohibited by law, by international regulation or by any Government or national State where you go or have to pass through to get to its destination.

Batteries

Semi-

precious

material

COURIER MODE

Plants and

derivatives

Terms, limits and conditions established by IRS Bulletin No. 1,073, October 1, 2010, regulating the customs clearance of impor t

and export consignments transported by business express, international express transport.

Alcoholic

beverages

Tobacco

14

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

FORMAL IMPORT TO BRAZIL

PROHIBITED RESTRICTED (Consult DHL before)

Animals Antiques

and art works

Cash, debit

card,

checks and

vouchers

Narcotics

(Illegal drugs)

Pirated or

products

Firearms

(or any part

of) and

ammunition

Ivory Precious

material

and jewelry

Gambling-

related

paraphernalia

Pornography Human parts,

including

ashes

Personal

correspondence

and postal

envelopes

Asbestos Dangerous

or fuel

materials

Medical

samples

Used or

reconditioned

goods

Batteries Plants and

derivatives

Alcoholic

beverages

Tobacco

Products of

vegetable

origin

Semi-

precious

material

Any property is prohibited by law, by international regulation or by any Government or national State where you go or have to pass through to get to its destination.

Terms, limits and conditions established by IRS Bulletin No. 1,073, October 1, 2010, regulating the customs clearance of impor t

and export consignments transported by business express, international express transport.

15

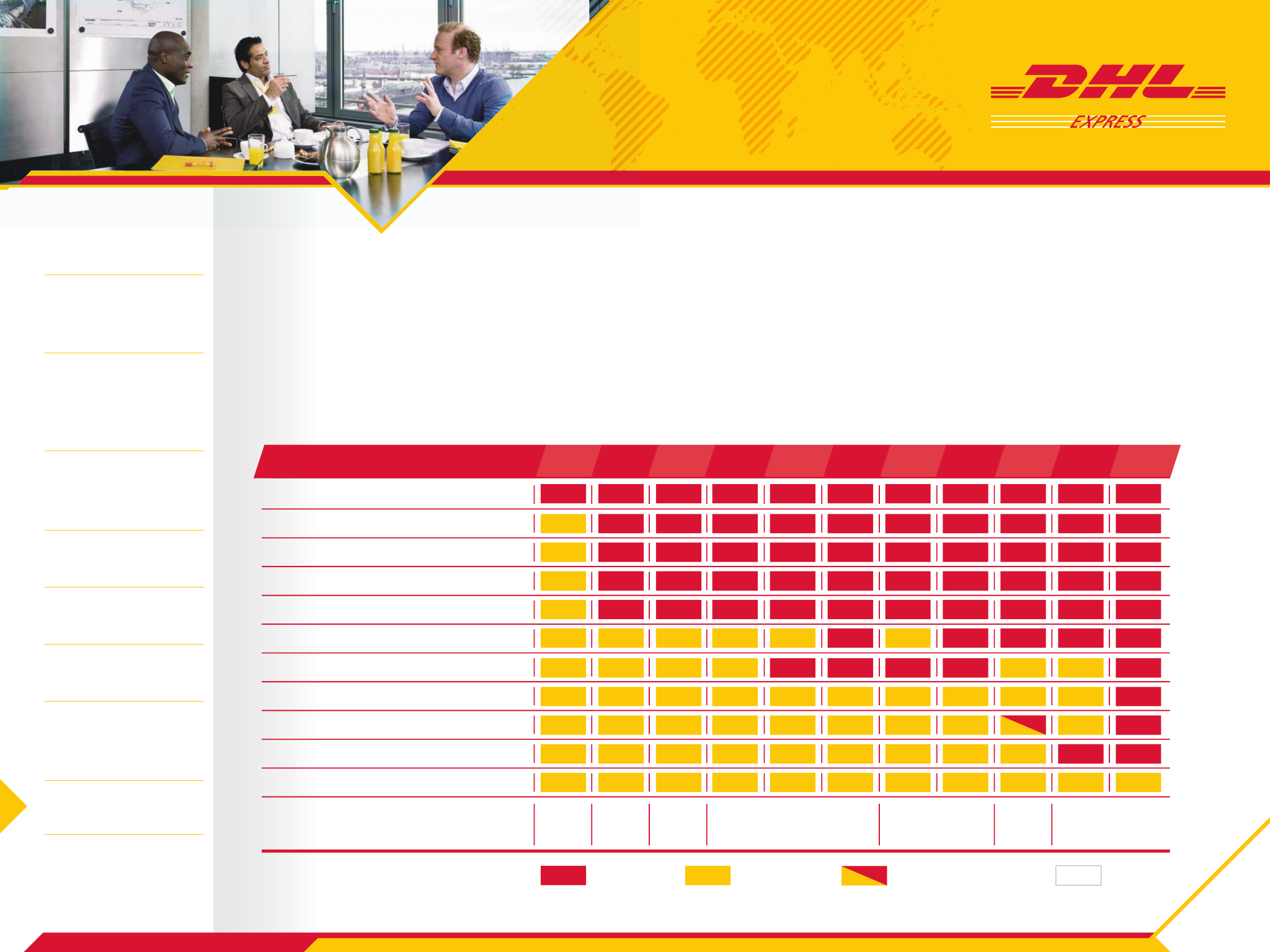

By offering Door-To-Door Express service, DHL Express

operates with only three Incoterms. Here are some situational

examples that determine whether the place of origin/seller

or the destination/buyer pays all transport costs:

» — All the costs are paid at the destination

by the buyer.

»

— All transport costs are paid by the origin/seller. Taxes

and duties are paid by the destination/buyer.

» — All transport charges,

taxes, and duties are paid by the origin/seller. This service

is only available for imports by a courier.

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

COSTS EXW FCA FAS FOB CFR CIF CPT CIP DAT DAP DDP

PACKAGING AND MARKING

LOADING

DOMESTIC TRANSPORT (EXPORTER’S COUNTRY)

DOMESTIC TRANSPORT AT DESTINATION

UNLOADING AT DESTINATION

TRANSFER OF RISKS

(FROM SELLER TO BUYER)

AT THE PLACE

DESIGNATED AT

ORIGIN

UPON DELIVERY

TO THE

TRANSPORTER

NAMED BY THE

BUYER

ALONGSIDE

SHIP, ON THE

QUAY AT

THE PORT OF

SHIPMENT

ON THE QUAY

AT THE PORT

OF DESTINATION

DDP (DELIVERED DUTY PAID) –

AVAILABLE ONLY FOR COURIER

SHIPMENTS. TRANSPORT FEES

AND TAXES BORNE BY THE

CONSIGNOR.

UPON CROSSING THE SHIP’S RAILS AT THE

PORT OF SHIPMENT

UPON DELIVERY TO THE

SUPPLIER CONTRATED BY

THE SELLER

EXPORT CUSTOMS CLEARANCE (DEPARTURE)

IMPORT CUSTOMS CLEARANCE (ARRIVAL)

TRANSPORT AT TERMINAL (DEPARTURE)

TRANSPORT AT TERMINAL (ARRIVAL)

PRINCIPAL TRAVEL INSURANCE

PRINCIPAL TRAVEL TRANSPORT

SELLER BUYER

o

o

o

o

o

OPTIONAL

o

o

o

o

o

SELLER / BUYER

Incoterms/2010

16

» Import clearance for shipments with a

CIP/CIF up to US$3,000

1

– not for resale

2

1 CIP/CIF = cost of goods + international freight + international insurance

2 Does not include items for personal use or unaccompanied luggage

» Items for personal use

» Unaccompanied luggage

»

Materials for resale or with foreign exchange

cover, regardless of declared value

» Items with declared customs value over

US$3,000

» Donations (only for organizations registered

with the government)

»

Materials that require an import license, such

as alcoholic beverages and tobacco

» Import duty: 60% of the shipment’s value

» ICMS tax: (a state value-added tax on

services and circulation of goods) average

of 18%

» Import duty: based on the goods’ tax

» ICMS: average of 18%

» IPI (manufactured products): based on the

» COFINS: 7.65% of the declared value

» PIS: 1.65% of the declared value

» EXW (Ex Works) — All costs are paid by

the destination/buyer.

» DAP/DDU (Delivered At Place/Delivered

Duty Unpaid) — All transport costs are paid

by the origin/seller. Taxes and duties are

paid by the destination/buyer.

» DDP (Delivered Duty Paid) — All transport

charges, taxes, and duties are paid by the

origin/seller. This service is only available

for imports by a courier.

» EXW (Ex Works) — All costs are paid by

the destination/buyer.

» DAP/DDU (Delivered At Place/Delivered

Duty Unpaid) — All transport costs are paid

by the origin/seller. Taxes and duties are

paid by the destination/buyer.

» WayBill (must have the consignee’s CNPJ/

TAX ID)

» Commercial Invoice

3 Other documents may be required

» WayBill must have the consignee’s CNPJ/

TAX ID

» Commercial Invoice and packing list:

original copy signed in blue ink

» Prior import license: should be approved

before the date of shipment to the

»

Valid CPF/CNPJ TAX ID: the document

must be duly registered by Federal Customs

Service

» Main requirement: importer registration with

the Federal Customs Service (RADAR)

» Formal clearance service

» Bonded storage

» It is not necessary to hire a customs broker

as DHL Express will handle the customs

clearance

» DHL Express provides customs clearance

services to conduct the process

DHL IMPORT EXPRESS ONLINE enables communication between importers and exporters,

wherever you are, directly through the Internet. With DHL Import Express Online you can:

DHL Web Shipping helps you prepare and manage express international and domestic

shipments—all directly from the Internet. With DHL Web Shipping you can:

» Complete waybills electronically, securely,

and easily

» Control shipments electronically

» Gain full visibility of your shipments

» Schedule pickups and organize imports

»

» Print labels

» Schedule pickups

» Store contact details

» Track your shipments

INFORMAL ENTRY FORMAL ENTRY INFORMAL ENTRY FORMAL ENTRY

What can be imported Taxes and Fees

Incoterms

Documents Required

3

Customs Services

Customs Clearance

Online Solutions

Introduction

Courier (Informal)

Entry Clearance

Formal Import

to Brazil Entry

Clearance

DHL Customs

Services

Documentation

Online Solutions

Check List

Prohibited/

Restricted Items

Incoterms

Quick Guide

17

www.dhl.com.br

Call DHL Express

São Paulo: +55 11 3618 3200

Other locations: 0800 771 3451