2024

PROXY STATEMENT

Annual Meeting of Shareholders

May 7, 2024, at 10:00 a.m.

Eastern Daylight Time

Flywheel Digital

1801 Porter Street, Suite 300

Baltimore, MD 21230

2 2024 Proxy Statement

A Letter from Omnicom’s Lead Independent Director

To My Fellow Shareholders:

It is a great honor to be writing my rst letter to you as Omnicom’s Lead Independent Director, a roleI assumed on January1,

2024.I want to thank my predecessor and colleague on the Board, Len Coleman, for his tremendous leadership in the position

over the past eightyears, and for his continued support and guidance during our transition of responsibilities. AsI reect on

Omnicom’s accomplishments throughout 2023,I am incredibly proud of our successful execution of strategic business priorities,

our commitment to growing and supporting Omnicom’s best-in-class talent, and our Board’s continued growth as a diverse, skilled,

and engaged group of directors.

In my new independent leadership position,I am committed to ongoing collaboration with my fellow Board members and

Omnicom’s management team to realize our core objective of generating long-term value for our shareholders. Direct shareholder

engagement and the feedback we receive from those engagements remain critical components of the process our Board and

management undertake to achieve that objective, andI have enjoyed engaging and look forward to continuing to engage in

constructive dialogue with shareholders in my new role.I also look forward to continuing our long-standing practice of actively

obtaining feedback on key focus areas for the Board and management, including those discussed below, in the coming year.

Execution on Strategic Initiatives. Our leadership team delivered strong operational and nancial performance in 2023, while

navigating a complex economic environment, by continuing to expand our capabilities and drive areas of growth through

investment. For example, on January2, 2024, we closed the acquisition of Flywheel Digital, which signicantly broadens our

capabilities in e-commerce, retail media and high-growth digital areas, as we continue to deliver superior results for our clients and

outpace our competition. In addition to executing key strategic acquisitions during the year, we established rst-mover technology

partnerships with leading generative articial intelligence (AI) companies, such as Microsoft, Adobe, AWS, and Getty Images. We are

also thoughtfully integrating AI into our market-leading technology platform, Omni, and leveraging AI to enhance user experiences

as we build, expand, and improve our client offerings, all while carefully considering and evaluating the associated risks.

Ongoing Board Refreshment. We have evolved our Board in recentyears through a deliberate and ongoing refreshment process,

which incorporates fresh perspectives and prioritizes a mix of skills, experience, and diversity to provide effective oversight of the

Company’s strategy. Seven of our 11 nominees this year are women, four are Black, and two are Hispanic/Latinx. Additionally, all

independent Board leadership positions are currently held by gender or ethnically diverse directors. On January1, 2024, Cassandra

Santos joined our Board, bringing signicant expertise in technology, cybersecurity, digital transformation, and AI to the Board and

strengthening our collective skillset.

Promoting a Diverse, Equitable, and Inclusive Workplace. Talent remains a core differentiator for Omnicom, and we seek to cultivate

a diverse workforce at all levels that drives creativity and innovation for our clients. We consistently ground our work in data-driven

results, and in 2023 we saw meaningful progress against our ve workforce Key Performance Indicators (KPIs). We also raised the

bar for ourselves and for our industry by introducing two new goals to advance DE&I, aimed at expanding BIPOC representation

across our workforce and increasing the number of women in leadership positions. In 2024, we are launching our OPEN 3.0 Initiative,

which will further guide and strengthen our efforts to operationalize DE&I across our business. As part of this broader vision,

Omnicom launched our rst-ever Global Steering Committee to develop globally inclusive and culturally relevant strategies for our

clients and communities. Additional information can be found in our second annual standalone DE&I report.

Advancing Environmental Sustainability and Responsible Practices. We continue to make signicant progress against our

environmental sustainability priorities, which are overseen by the Governance Committee. We recently set ambitious goals to reduce

our Scope 1, 2, and 3 global emissions by 46.2% by 2030, which is aligned with our corporate strategy to consolidate oces and

optimize the use and eciency of our spaces. Our near-term emissions-reduction target was validated by the Science Based Targets

initiative (SBTi) in early 2023. In addition, through our work as a founding member of Global Ad Net Zero, we play a leading role in

efforts to reduce carbon emissions from advertising operations and nd innovative ways to strengthen our sustainability initiatives. Our

environmental sustainability initiatives and progress against key goals are reected in our most recent Corporate Responsibility report.

On behalf of the full Board of Directors, thank you for your investment in Omnicom and consideration of the important matters

set forth in our Proxy Statement. It was a successful 2023 for our Company, andI look forward to working with the Board and

management this year in my new role, as Omnicom continues to provide world-class services to our clients and deliver value for our

shareholders, people, and communities.

Mary C. Choksi

Lead Independent Director

www.omnicomgroup.com 3

NOTICE OF 2024 ANNUAL MEETING OF

SHAREHOLDERS

Subject:

1. Elect the directors named in the Proxy Statement accompanying this notice to Omnicom

Group Inc.’s (the “Company,” “we,” “us” or “our”) Board of Directors (the “Board”) to serve until the

Company’s 2025 Annual Meeting of Shareholders or until the election and qualication of their

respective successors.

2. Vote on an advisory resolution to approve executive compensation.

3. Ratify the appointment of KPMG LLP as our independent auditors for the scal year ending

December31, 2024.

The Board unanimously recommends that you vote:

� FOReach of the director nominees;

� FORthe advisory resolution to approve executive compensation; and

� FORthe ratication of the appointment of KPMG LLP as our independent auditors.

Shareholders will also transact any other business that is properly presented at the meeting.

Atthis time, we know of no other matters that will be presented.

In accordance with the rules promulgated by the U.S.Securities and Exchange Commission,

we sent a Notice of Internet Availability of Proxy Materials on or about March28, 2024, and

provided access to our proxy materials on the Internet, beginning on March28, 2024, to the

holders of record and benecial owners of shares of our common stock as of the close of business

on the record date.

Please sign and return your proxy card or vote by telephone or Internet (instructions are on your

proxy card), so that your shares will be represented at the 2024 Annual Meeting of Shareholders,

whether or not you plan to attend. If you do attend, you will be asked to present valid photo

identication, such as a driver’s license or passport, before being admitted. Cameras, recording

devices and other electronic devices will not be permitted.

Additional information about the meeting is included below in the Proxy Statement in the section

entitled “Information About Voting and the Meeting.”

Meeting Date:

Tuesday, May7, 2024

Time:

10:00a.m. Eastern

Daylight Time

Place:

FlywheelDigital

1801PorterStreet

Suite300

Baltimore,MD21230

Record Date:

March18, 2024

Louis F. Januzzi

Secretary

NewYork, NewYork

March 28, 2024

4 2024 Proxy Statement

PROXY SUMMARY

This summary highlights selected information about the items to be voted on at the 2024 Annual Meeting of Shareholders

(or “2024 Annual Meeting”). This summary does not contain all of the information that you should consider in deciding how

to vote. You should read the entire Proxy Statement carefully before voting.

Meeting Agenda and Voting Recommendations

ITEM1: Election of Directors

The Board recommends a voteFOReach of the director nominees.

� We have conducted a comprehensive evaluation of director skill sets to enable each director’s

unique qualications and attributes to collectively support the oversight of Omnicom’s

management.

� Each of our directors is elected annually by a majority of votes cast.

� 10 of Omnicom’s 11 director nominees are independent, and each of the Audit, Compensation,

Governance and Finance Committees is comprised solely of independent directors.

� Diversity is a core value across our organization. A majority of our director nominees are

women, four are Black and two are Hispanic/Latinx. The Audit, Compensation and Finance

Committees are all Chaired by directors who are women, and the Chair of the Governance

Committee is Black.

See page13

for further

information

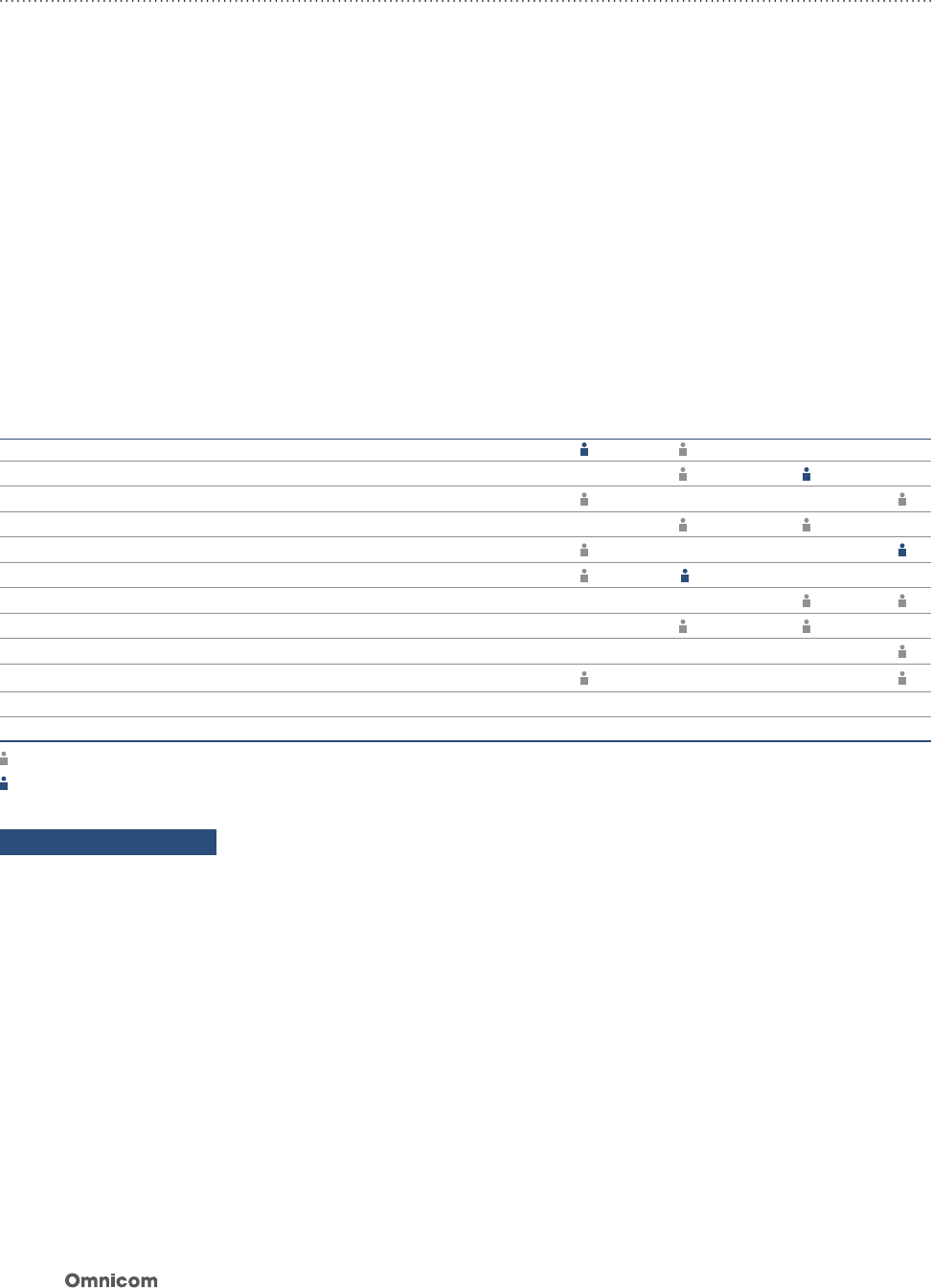

DIRECTOR NOMINEES

Name and Age Principal Occupation

Director

Since

Omnicom

Committees

Other Current Public

Company Boards

Mary C. Choksi, (I), 73

Lead Independent Director

Former Founding Partner and

Senior Managing Director, Strategic

Investment Group

2011

A (Chair)

C

� White Mountains Insurance

Group, Ltd.

Leonard S. Coleman, Jr. (I), 75 Former President, National League of

Professional Baseball Clubs

1993

C

G (Chair)

� Hess Corporation

Mark D. Gerstein, (I), 64 Former Partner, Latham & Watkins LLP 2022

A

F

Ronnie S. Hawkins, (I), 55 Partner, Global Infrastructure

Partners

2018

C

G

Deborah J. Kissire, (I), 66 Former Vice Chair and Regional

Managing Partner, EY

2016

A

F (Chair)

� Cable One, Inc.

� Axalta Coating SystemsLtd.

� Celanese Corporation

Gracia C. Martore, (I), 72 Former President and Chief

Executive Officer, TEGNA Inc.

2017

A

C (Chair)

� WestRock Company

� United Rentals, Inc.

Patricia Salas Pineda, (I), 72 Former Group Vice President of

Hispanic Business Strategy, Toyota

Motor North America

2022

G

F

� Frontier Group Holdings, Inc.

� PortlandGeneralElectric

Linda Johnson Rice, (I), 66 Chief Executive Officer, Johnson

Publishing Company

2000 C

G

� Enova International, Inc.

Cassandra Santos, (I), 54 Former Chief Information Officer,

Asurion

2024 F

Valerie M. Williams, (I), 67 Former Southwest Assurance

Managing Partner, EY

2016 A

F

� Devon Energy Corporation

� DTE Energy Co.

John D. Wren, 71 Chairman and Chief Executive

Officer, Omnicom

1993

(I): Independent A: Audit C: Compensation F: Finance G: Governance

PROXY SUMMARY

www.omnicomgroup.com 5

Board Nominees Snapshot

Independence Gender Diversity

10 of 11

Director nominees

are independent

91%

7 of 11

Dire

ctor nominees

are

women

64%

Committee Chair Diversity Ethnic Diversity

4 of 4

100%

All four committee

chairs are women or

diverse

6 of 11

Four director nominees

are Black

and two

are

Hispanic/Latinx

55%

Current Tenure of 2024 Nominees

10-15

Years

> 15

Years

5-9

Years

0-4

Years

1

3

4

3

New Director Refreshment

3 of 10

Independent director

s

have been added sinc

e

2022

30%

Experience and Skills

Our director nominees are accomplished leaders who bring a mix of e xperiences and skills to the Board.

Our Board has identied skill categories fundamental to its ability to effectively oversee Omnicom’s

strategy and management, and undertakes a comprehensive evaluation so that these skills are well

represented on the Board.

One new director joined the Board on January 1, 2024 as part of our continued refreshment process

to bring fresh perspectives to the Board. Our new director also brings relevant technology, cybersecurity,

digital transformation and AI expertise, which strengthens our Board’s ability to effectively oversee

management’s execution against business strategy.

See pages 14 and 15 for further information.

6 2024 Proxy Statement

PROXY SUMMARY

GOVERNANCE HIGHLIGHTS

The Board has adopted, and periodically reviews, policies and procedures to guide it in its oversight responsibilities.

These policies and procedures provide a framework for the proper operation of our Company and align with

shareholders’ interests.

Shareholder Rights Independent Oversight Good Governance

Annual election of all directors

Majority voting standard in

uncontested elections

Proxy access rights consistent

with overwhelming market

practice

Right to call a special meeting of

the Board with 10% ownership

threshold

Longstanding shareholder

engagement program and history

of responsiveness to shareholder

feedback

Engaged Lead Independent

Director with clear and robust

responsibilities, which were

further expanded in 2023

New Lead Independent Director

appointed effective January 1,

2024

All directors are independent

except the Chairman, who also

serves as CEO

Executive sessions of our

independent non-management

directors are conducted on a

regular basis

All Board committees are

comprised solely of independent

directors

Comprehensive oversight of

strategy and risk, including

oversight of environmental, social

and governance (“ESG”) strategy

and risk

Annual Board and committee

evaluations and skill set

assessment

Strong equity ownership

requirement for executives and

directors (3x to 6x base salary

for executives; 5x annual cash

retainer for directors)

Robust processes for condential

and anonymous submission by

employees of concerns regarding

accounting or auditing matters,

as well as potential violations of

our Code of Business Conduct

or Code of Ethics for Senior

Financial Ocers

Direct and ongoing engagement

with auditors, counsel and

advisors

SHAREHOLDER ENGAGEMENT

Ongoing shareholder engagement is a priority for our Board and management team. In the fall of 2023, we reached out

to shareholders holding 70% of our outstanding shares with an invitation to engage. We spoke to every shareholder that

accepted our invitation, which represented an aggregate of 22% of our outstanding shares. As in prioryears, our Lead

Independent Director was an active participant in select shareholder meetings. Broad topics discussed included:

� Company strategy and performance

� Board composition, refreshment and leadership

� Lead Independent Director succession process

� Management succession planning

� Executive compensation program

� Diversity, Equity and Inclusion (“DE&I”) efforts across the organization

� Environmental sustainability initiatives

� Human capital management initiatives

� Governance practices

PROXY SUMMARY

www.omnicomgroup.com 7

We have made a number of changes in recentyears in response to the feedback we have received from our ongoing

shareholder engagement efforts, which management regularly reviews with the Board, including:

Topics discussed with

shareholders

Board and management actions in response to feedback

Board Leadership – A

large majority of our

shareholders indicated they

are supportive of the Board’s

thoughtful approach to its

leadership structure given

our strong Lead Independent

Director role, the critical

nature of our C hairman’s

relationships with clients and

key management around

the world in our professional

services business, and the

complex nature of our rapidly

changing industry.

� The role and responsibilities of our Lead Independent Director are robust and

clearly dened, and the Board further strengthened the Lead Independent Director

role in 2023 by enhancing existing responsibilities and codifying additional

responsibilities.

� Mr. Coleman stepped down from the Lead Independent Director role at the end of

2023, and the Board appointed Ms. Choksi as our new Lead Independent Director

effective January 1, 2024.

� Our Lead Independent Director is elected by the independent directors annually.

� The Board continues to evaluate its leadership structure on an ongoing basis to

enable its structure to be in the best interest of shareholders.

Board Refreshment –

Shareholders are pleased

with the level of progress we

have shown to meaningfully

refresh and further diversify

our Board.

� The Board has implemented a thoughtful approach to ongoing refreshment, bringing

fresh perspectives and relevant skill sets to the Board.

� Seven of our 10 independent director nominees have been appointed since 2016,

including one appointed effective January 1, 2024 and two appointed in 2022.

� The Board anticipates continued Board refreshment on an ongoing basis.

Director Skill Sets –

Shareholders support the

diverse aggregation of skills

represented by the members

of our Board and appreciate

the deliberate director skill set

analysis undertaken by the

Board to inform the director

recruitment process.

� The Board continues its search for qualied director candidates, with periodic

assistance from a third-party search rm.

� The current mix of director skills provides effective oversight of management, with

those skill categories aligning with the Company’s top priorities and critical areas

of oversight that shareholders expect to see represented on the Board, namely

Technology, Talent Management, Finance& Accounting, and Risk Management&

Controls being highly represented.

� The appointment of Cassandra Santos, effective January 1, 2024, brings fresh

perspectives and complementary skills to the Board’s overall mix, including the

highest level of technology, cybersecurity, digital transformation and AI expertise.

� The Board periodically conducts a deliberate director skill set analysis and identies

certain director skill categories that it intends to prioritize with respect to prospective

director candidates, taking into account input received from shareholders.

PROXY SUMMARY

8 2024 Proxy Statement

Topics discussed with

shareholders

Board and management actions in response to feedback

Executive Compensation –

Shareholder response to

our executive compensation

program, which aims to

achieve optimal pay and

performance alignment

and motivate executives in

key focus areas, has been

overwhelmingly positive.

� The Compensation Committee weighs (i) internal Omnicom performancemetrics

at 40%, (ii) peer metrics at 40% and (iii) qualitative metrics at 20% to achieve

alignment between Company performance and pay outcomes. The Compensation

Committee realigned qualitative factors to align with our strategic priorities as a

business, including adding factors that focus on human capital management and

employee training initiatives and removing the COVID-19 responserelated measures.

These actions took into account feedback received during our shareholder outreach

process.

DE&I and Corporate

Responsibility – Shareholders

appreciate the importance we

place on DE&I and corporate

responsibility, including

steps taken to move towards

achieving systemic equity

throughout Omnicom, and

enhancements made to

our diversity and corporate

responsibility disclosures.

� We provided diversity disclosures for our U.S.workforce in 2023, publishing our

second annual standalone DE&I Report, and plan to continue providing relevant

disclosure going forward.

� We are progressing against key performance indicators (KPIs) measuring

advancement under OPEN 2.0, a plan comprised of eight Action Items that builds on

the DE&I progress that we have made thus far to achieve our ultimate goal: systemic

equity throughout Omnicom.

� We publish our Equal Employment Opportunity Employer Information Report

(“EEO-1 Report”) on our website, and plan to continue providing relevant disclosure

going forward.

� We incorporated reporting informed by the Sustainability Accounting Standards Board’s

guidance for the Advertising and Marketing industry into our reporting efforts in 2023,

and plan to continue providing relevant disclosure on our reporting efforts going

forward.

� After committing to establish goals using the Science Based Targets Initiative (SBTi)

methodology in 2021, Omnicom’s near-term Scope 1, 2 and 3 emissions reduction

target was validated by the SBTi in 2023, which reviews participating companies on

their emissions goals and evaluates whether they are in line with the goals of the

Paris Agreement (as interpreted by the particular SBTi methodology).

� Omnicom does not make political contributions at the holding company level, and we

disclosed that Omnicom and its agencies made no U.S. political contributions in 2021,

2022, and 2023.

� We annually disclose payments to U.S. trade associations that received more

than $50,000 in Omnicom dues or contributions, and the amount of such dues or

contributions that those trade associations used for lobbying or political activity

payments.

PROXY SUMMARY

www.omnicomgroup.com 9

We appreciate the insights and perspectives of our shareholders, which were discussed among the full Board.

ITEM 2: Advisory Resolution to Approve Executive Compensation

The Board recommends a voteFORthis voting item.

� We closely tie pay to current and long-term Company performance;

� We maintain a high degree of variable “at-risk” compensation;

� We establish challenging quantitative performance metrics that align with our business

strategy, which determine 80% of our 2023 Annual Incentive Award;

� We determine 20% of our 2023 Annual Incentive Award by assessing certain qualitative

performance metrics, including DE&I, environmental sustainability, human capital

management and employee training initiatives, and corporate responsibility and integrity;

and

� We sustain competitive compensation levels.

See page 42

for further

information

10 2024 Proxy Statement

PROXY SUMMARY

EXECUTIVE COMPENSATION HIGHLIGHTS

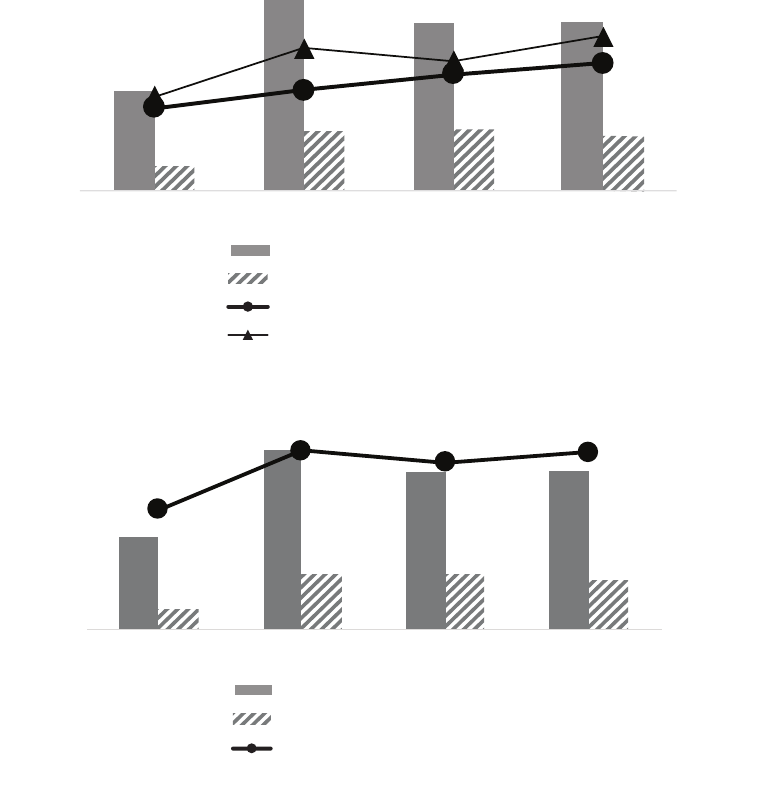

2023 Performance Overview and Highlights

Omnicom nished 2023 on a strong note. Our full year revenue was $14,692.2 million, with organic growth of 4.1%;

operating income was $2,104.7 million and adjusted operating income was $2,231.9 million; operating margin was 14.3%

and adjusted operating margin was 15.2%; and diluted EPS was $6.91 and adjusted diluted EPS was $7.41. We generated

approximately $1.4 billion in net cash provided by operating activities, an increase of 53.4% compared to the full year 2022,

and approximately $1.9 billion in free cash ow, an increase of 6.5% compared to the full year 2022. We returned $1.1 billion

to shareholders through dividends and share repurchases and ended the year with $4.4 billion in cash and cash equivalents.

See Annex A for the denitions of adjusted operating income, adjusted operating margin, adjusted diluted EPS and free

cash ow, which are non-GAAP measures, and a reconciliation of each non-GAAP measure to the most directly comparable

GAAP measure. Our return on equity was 40.5% in 2023, while our return on invested capital was 25.8%. As we move into

2024, Omnicom’s liquidity and balance sheet remain strong and continue to support our primary uses of cash — dividends,

acquisitions and share repurchases. Throughout the year, we continued to invest in areas that will shape the future of our

industry through acquisitions and internal investments and partnerships.

In determining the Annual Incentive Award for performance in 2023, the Compensation Committee considered Company

(i.e., internal) nancial performance (weighted at 40%), our performance as compared with the performance of our peer

group (weighted at 40%) and certain qualitative metrics (weighted at 20%) in order to increase alignment between Company

performance and pay outcome. In assessing qualitative metrics, the Compensation Committee’s intent is to promote

accountability for progress on our DE&I initiatives, environmental sustainability, human capital management and employee

training initiatives, and corporate responsibility and integrity.

The chart below outlines the metrics used in determining our Annual Incentive Award for 2023, which were the same as

those metrics to determine the 2022 Annual Incentive Award, with the exception of the removal of the response to COVID-19

challenges from the qualitative performance metric. The program is discussed in greater detail below in the section entitled

“Calculation of Annual Incentive Award” on page 57.

Metrics to calculate 2023 Annual

Incentive Award

40% Peer Metrics (performance vs. peers):

� Return on equity, organic growth, adjusted

operating margin, organic growth plus

adjusted operating margin

40% Performance Metrics (performance vs.

internal OMC targets):

� Adjusted diluted EPS growth, adjusted

EBITA margin, organic growth

20% Qualitative Metrics:

� DE&I; environmental sustainability; human

capital management and employee training;

and corporate responsibility and integrity

PROXY SUMMARY

www.omnicomgroup.com 11

Compensation Best Practices

Emphasis on performance-based compensation

Executive and director stock ownership guidelines (6x base salary for Chairman and CEO and for President and COO;

3x base salary for CFO; 5x annual cash retainer for directors)

Policy adopting equity grant best practices

New compensation recovery (i.e., clawback) policy in compliance with U.S. Securities and Exchange Commission (“SEC”)

and New York Stock Exchange (“NYSE”) rules

Policy prohibiting hedging of Company equity securities

Policy prohibiting pledging and margin transactions

ITEM 3: Ratify the appointment of KPMG LLP as our independent

auditors for the scal year ending December 31, 2024

The Board recommends a voteFORthis voting item.

See page 77

for further

information

12 2024 Proxy Statement

TABLE OF CONTENTS

Notice of 2024 Annual Meeting of Shareholders 3

Proxy Summary 4

Proxy Statement 13

ITEM 1

Election of Directors

13

Omnicom Board of Directors 13

Board’s Role and Responsibilities 28

Diversity, Equity and Inclusion 30

Shareholder Engagement and Responsiveness 33

Board Leadership Structure 34

Board Policies and Processes 38

Directors’ Compensation for Fiscal Year 2023 40

ITEM 2

Advisory Resolution to Approve

Executive Compensation 42

Executive Compensation 43

Executive Summary 44

Compensation Committee Report 51

Compensation Discussion & Analysis 52

Summary Compensation Table for 2023 66

Grants of Plan-Based Awards in 2023 67

Outstanding Equity Awards at 2023 Year-End 68

Option Exercises and Stock Vested in 2023 69

Nonqualied Deferred Compensation in 2023 69

Potential Payments Upon Termination of

Employment or Change in Control 69

Pay Ratio Disclosure 73

Pay Versus Performance Table 74

ITEM 3

Ratification of the Appointment of

Independent Auditors 77

Fees Paid to Independent Auditors 77

Audit Committee Report 78

Stock Ownership Information 79

Security Ownership of Certain Benecial Owners

and Management 79

Delinquent Section 16(a) Reports 80

Equity Compensation Plans 81

Information About Voting and the Meeting 82

Record Date Shares Outstanding 82

Quorum; Required Vote; Effect of Abstentions

and Broker Non-Votes 82

Voting Prior to the Meeting 82

Voting at the Meeting 83

“Default” Voting 83

Right to Revoke 83

Tabulation of Votes 83

Additional Information 84

Expense of Solicitation 84

Incorporation by Reference 84

Availability of Certain Documents 84

Delivery of Documents to Shareholders Sharing

an Address 84

Forward- Looking Statements 85

Shareholder Proposals and Director

Nominations for the 2025 Annual Meeting 86

Annex A 87

Non-GAAP Financial Information 87

www.omnicomgroup.com 13

PROXY STATEMENT

ITEM 1 —ELECTION OF DIRECTORS

Omnicom Board of Directors

The Board of Directors (the “Board”) of Omnicom Group Inc., a New York corporation (“Omnicom,” the “Company,” “we,” “us”

or “our”), currently consists of 11 directors: 10 independent directors and John D. Wren, our Chairman and Chief Executive

Ocer. Each director stands for election annually and is elected by a majority of votes cast (in an uncontested election). Our

Board values the views of our investors regarding board composition and, in response to investor input, has made board

refreshment a priority.

� Our Board succession planning process has resulted in seven of our 10 independent director nominees joining the Board

since 2016, bringing important and complementary skills to the Board’s overall composition.

Cassandra Santos, the former Chief Information Ocer at Asurion, joined our Board and Finance Committee on

January1,2024.

Patricia Salas Pineda, the former Group Vice President of Hispanic Business Strategy for Toyota Motor North

America, Inc., joined our Board and Governance Committee in February2022 and was appointed to the Finance

Committee in May 2023.

Mark D.Gerstein, a former Partner at Latham& Watkins LLP, joined our Board and Finance Committee in May 2022

and was appointed to the Audit Committee in May 2023.

Four additional independent directors have joined our Board since 2016, reecting robust Board refreshment and

contributing new director skills and perspectives to our Board.

� The Board anticipates appointing additional independent directors on an ongoing basis.

As we continue our ongoing Board refreshment, we remain focused on ensuring a smooth transition and onboarding

process for new directors.

DIRECTOR TENURE

A balanced mix of fresh perspectives and institutional knowledge enables strong Board oversight of management. The 2024

director tenure chart below illustrates this balance and reects the meaningful board refreshment that has been underway

over the last severalyears.

Current Tenure of 2024 Nominees

0-4

Years

3

3

> 15 Y

ears

10-15 Years

1

4

5-9 Years

ITEM 1 — ELECTION OF DIRECTORS

14 2024 Proxy Statement

QUALIFICATIONS OF THE MEMBERS OF THE BOARD

In determining the nominees for the Board, our Governance Committee considers the criteria outlined in our Corporate

Governance Guidelines, including a nominee’s independence, his or her background, skills and experience in relation to other

members of the Board, and his or her ability to commit the time and focus required to discharge Board duties. In addition,

our Governance Committee considers the composition of the Board as a whole and diversity in its broadest sense, including

diversity of gender, race/ethnicity, viewpoints, ages, and professional and life experiences. The Governance Committee

considers a broad spectrum of skills and experience to promote a strong and effective Board and nominees are neither

chosen nor excluded solely or largely based on any one factor.

Our Board seeks to align our directors’ collective expertise with those areas most important to strong oversight of management

at Omnicom. Accordingly, we periodically evaluate Board composition to help inform Board succession planning efforts,

maintain close alignment between Board skills and Omnicom’s long-term strategy, and promote Board effectiveness. We have

implemented a rigorous skills analysis for each of our directors and have found that those skill categories with the highest

aggregate level of director experience, namely Technology, Talent Management, Finance& Accounting, and Risk Management&

Controls, align with the areas most critical to Board oversight at Omnicom. The chart below outlines the skill and experience

categories our Board periodically evaluates, as well as the importance of each category to overall Board effectiveness.

Strategic

Planning

Our Board’s ability to effectively review and assess the long-term strategic

priorities developed by management, as well as management’s execution against those

priorities, is fundamental to our capacity to grow, innovate and create shareholder value.

Finance &

Accounting

Financial and accounting expertise is essential to promoting the integrity of our internal

controls, critically evaluating our performance, and providing insight and counsel with

respect to our nancial reporting, capital structure and approach to capital allocation.

Industry

Experience

Directors with experience relevant to our industry are well-suited to help guide the

Company in key areas of our business such as advertising, customer relationship

management, media buying, public relations and healthcare, and to assess growth

opportunities, whether organic or through acquisitions.

Risk

Management &

Controls

Robust risk management is a foundational component of strong Board oversight, and

we believe that the Board must include directors who possess a sophisticated ability to

understand, measure and mitigate risk.

Talent

Management

Our ability to attract and retain the most talented professionals is fundamental to the

success of a professional services business such as ours, and the Board’s oversight

function is particularly critical with respect to succession planning for our senior leadership

team, and human capital management and DE&I.

Technology

Technological experience enables our directors to provide important insight regarding

cybersecurity, data privacy and other matters related to our information security and

technology systems, as we navigate a time of rapid technological advancement industry

wide.

CEO

Experience

We believe that experience serving as a CEO enables directors to contribute deep insight

into business strategy and operations, positioning the Board to serve as a valuable thought

leader and challenge key assumptions while overseeing management.

Legal /

Regulatory

Our Board must be able to effectively evaluate Omnicom’s legal risks and obligations,

as well as the complex, multinational regulatory environments in which our businesses

operate, to help protect Omnicom’s reputational integrity and promote long-term success.

International

Business

Because of Omnicom’s global scale, it is key for our directors to bring experience in

international markets and business operations, so that our Board is well-positioned to

oversee global strategies and evaluate opportunities for growth outside of the U.S.

Public

Company Board

Experience

Through their experience serving on the boards of other large publicly traded companies,

directors bring a valuable understanding of board functions and effective independent

oversight.

ITEM 1 — ELECTION OF DIRECTORS

www.omnicomgroup.com 15

In addition to possessing the skills discussed above, each of our directors must also demonstrate sound judgment,

integrity of thought, ethical behavior, critical insight into Omnicom’s businesses, the ability to ask challenging questions of

management, and a healthy respect for their fellow Board members.

2024 DIRECTOR NOMINEES: 11 TOTAL

Independence: 10 of our director

nominees are independent

91 %

Director Independence

Diversity:sevenofourdirectornominees

are women, four are Black and two are

Hispanic/Latinx

82 %

Women & Diverse Directors

Women

Hispanic/LatinxBlack

ITEM 1 — ELECTION OF DIRECTORS

16 2024 Proxy Statement

2024 DIRECTOR NOMINEES

The current11 members of the Board have been nominated to continue to serve as directors for another year. All

of the director nominees have been recommended for election to the Board by our Governance Committee and approved

and nominated for election by the Board. We periodically engage a third-party search rm to assist with the evaluation of

director candidates.

The Board has no reason to believe that any of the nominees would be unable or unwilling to serve if elected. If a nominee

becomes unable or unwilling to accept nomination or election, the Board may, prior to the meeting, select a substitute

nominee or undertake to locate another director after the meeting. If you have submitted a proxy and a substitute nominee

is selected, your shares will be voted for the substitute nominee.

The Board UNANIMOUSLY recommends that shareholders vote FOR all nominees.

John D. Wren

Age 71

Director since

1993

PROFESSIONAL EXPERIENCE:

Mr. Wren is Chairman and Chief Executive Ocer of Omnicom. He was named Chief Executive Ocer

in 1997 and elected Chairman in 2018. Mr. Wren also served as President of Omnicom for twenty-two

years, having been appointed to that role in 1996. Under his direction, Omnicom has become a premier

global provider of marketing communications services and has achieved status as a world-class

company with one of the best corporate and divisional management leadership teams in our industry.

Mr. Wren was part of the team that created Omnicom in 1986, and was appointed Chief Executive Ocer

of Omnicom’s DAS Group of Companies division in 1990.

KEY SKILLS AND QUALIFICATIONS:

Through the positions he has held at Omnicom and its networks, Mr. Wren possesses a combination

of broad strategic vision and extensive industry knowledge that is fundamental to the Board’s oversight

role and uniquely positions him to serve as Chairman. Mr. Wren’s comprehension of Omnicom, its

businesses, its clients and its people is invaluable to the Board’s mix of skills and enables him to provide

critical insights to the Board. Mr. Wren has designed and implemented a signicant organizational

realignment of Omnicom’s businesses and management, and his leadership in the boardroom greatly

enhances the Board’s ability to oversee the development of strategy and guide Omnicom’s future

success in an industry that is experiencing rapid change, disruption and market-wide technological

advancements. As the former Chief Executive Ocer of Omnicom’s DAS Group of Companies division,

Mr. Wren has tremendous advertising, marketing and corporate communications experience. Under

his leadership, the DAS Group of Companies grew to become Omnicom’s largest operating group,

comprised of companies in a wide array of communication disciplines ranging from public relations

to branding. Mr. Wren’s deep understanding of our industry gained through his extensive experience,

long-term relationships he has developed with key clients, and his relationships with key management

around the world contribute to robust Board discussions on a variety of topics central to Omnicom’s

success, including identifying competitive advantages, retaining top talent and navigating relationships

with our most important clients. Mr. Wren is also a member of the International Business Council of the

World Economic Forum, and as such, he has direct exposure to the dynamic issues facing a myriad of

international companies. This exposure is a valuable asset to Omnicom and enhances the Board’s ability

to judiciously oversee management of Omnicom’s own complex global businesses.

ITEM 1 — ELECTION OF DIRECTORS

www.omnicomgroup.com 17

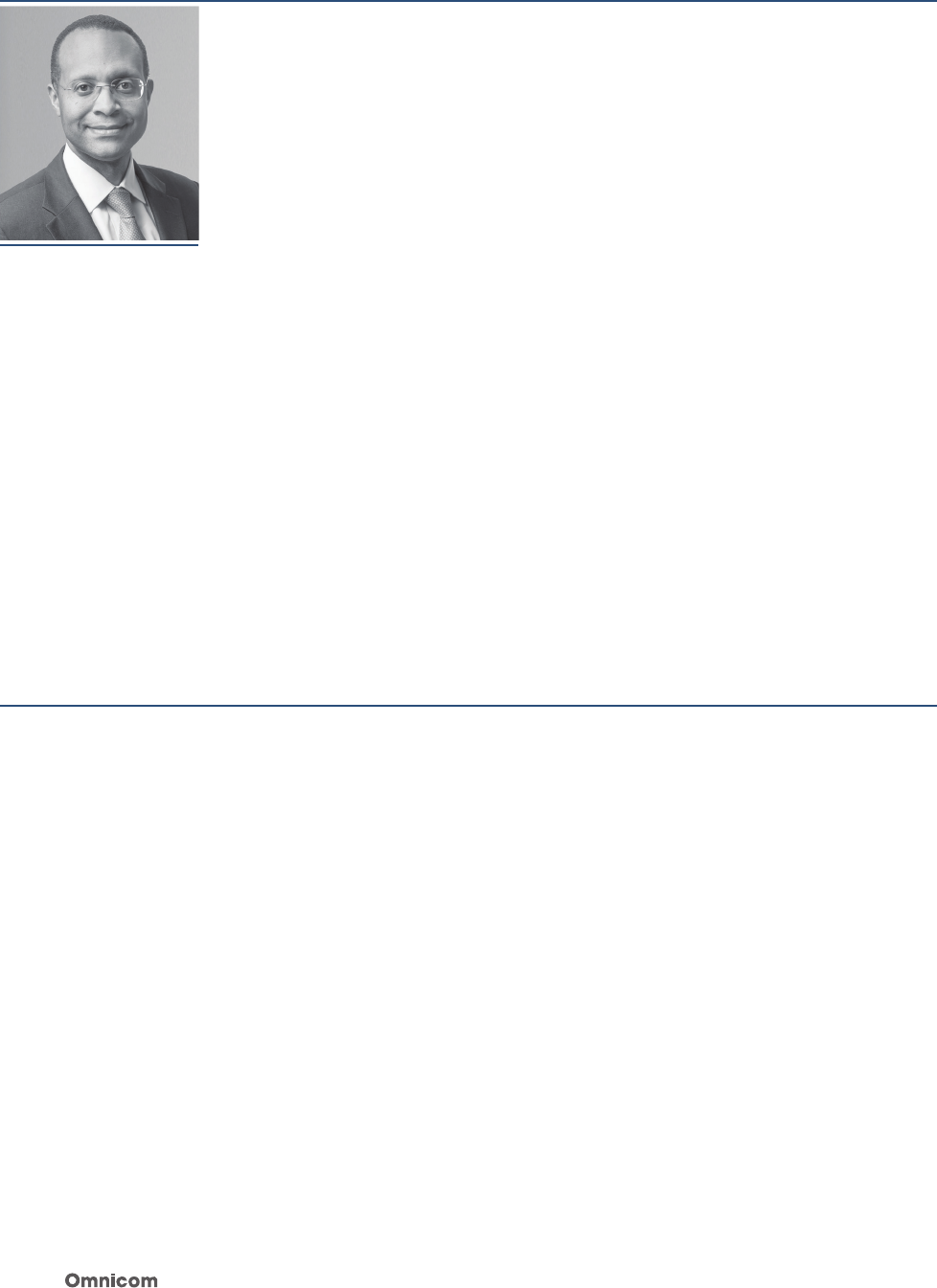

Mary C. Choksi

Age 73

Director since

2011

Lead Independent

Director,

Chair of the Audit Committee

and Member of the

Compensation Committee

PROFESSIONAL EXPERIENCE:

From 1987 to 2017, Ms. Choksi was a founding partner and Senior Managing Director of Strategic

Investment Group, an investment management enterprise that designs and implements global investment

strategies for large institutional and individual investors. In addition, Ms. Choksi is a T rustee of a number

of funds in the Franklin Templeton Funds family. Ms. Choksi was also a founder and, until May 2011, a

Managing Director of Emerging Markets Management LLC, which manages portfolios of emerging market

equity securities, primarily for institutional investors. Prior to 1987, Ms. Choksi worked in the Pension

Investment Division of the World Bank.

OTHER PUBLIC COMPANY BOARDS:

Ms. Choksi is a director and Chair of the Finance Committee of White Mountains Insurance Group, Ltd.,

a company whose principal businesses are conducted through its insurance subsidiaries and other

aliates. Ms. Choksi also served as a director of Avis Budget Group during the last ve years.

KEY SKILLS AND QUALIFICATIONS:

With her extensive investment management experience, Ms. Choksi brings to the Board a sophisticated

comprehension of the nancial matters inherent to running a global business enterprise. It is central

to Omnicom’s growth and successful nancial performance that the Board’s knowledge base includes

Ms. Choksi’s understanding of the utilization of assets to generate growth. Ms. Choksi was a founding

partner and Senior Managing Director of the investment management enterprise Strategic Investment

Group and a founder, and, until May 2011, a Managing Director of Emerging Markets Management,

which manages portfolios of emerging markets securities, primarily for institutional investors. As such,

Ms. Choksi has the highest level of experience managing assets, evaluating investment risk, developing

investment strategies and determining the optimal use of corporate assets. Ms. Choksi also has

considerable experience as a member of the board, and nance and audit committees of other public

companies. The breadth of Ms. Choksi’s professional experience and her extensive board experience are

valuable components of our overall mix of director skills. Together with Ms. Choksi’s Omnicom board

tenure and Audit Committee leadership, this experience signicantly contributes to her Lead Independent

Director role and enhances Omnicom’s shareholder engagement initiative in which Ms. Choksi directly

participates. In addition, Ms. Choksi’s career includes 10 years of experience at the World Bank, primarily

working in the Bank’s development arm focusing on projects in South and Southeast Asia. Through this

role, Ms. Choksi acquired a keen appreciation of the many challenges facing a multinational institution

as it navigates foreign markets and hones its global investment strategies. Collectively, Ms. Choksi’s

experience and learning also greatly enhance the function of Omnicom’s Audit Committee on which

Ms. Choksi serves as Chair.

ITEM 1 — ELECTION OF DIRECTORS

18 2024 Proxy Statement

Leonard S.

Coleman, Jr.

Age 75

Director since

1993

Chair of the

Governance Committee

and Member of the

Compensation Committee

PROFESSIONAL EXPERIENCE:

Mr. Coleman was Senior Advisor, Major League Baseball, from 1999 through 2005. Previously, he

was Chairman of Arena Co., a subsidiary of Yankees/Nets, until September 2002. Before that, he was

President of The National League of Professional Baseball Clubs from 1994 to 1999, having previously

served since 1992 as Executive Director, Market Development of Major League Baseball. Additionally,

Mr. Coleman was previously a municipal nance banker for Kidder, Peabody & Company. Prior to joining

Kidder, Mr. Coleman served as Commissioner of both the New Jersey Department of Community Affairs

and Department of Energy, and Chairman of the Hackensack Meadowlands Development Commission

and the New Jersey Housing and Mortgage Finance Agency. Mr. Coleman was also the Vice Chairman

of the State Commission on Ethical Standards and a member of the Economic Development Authority,

Urban Enterprise Zone Authority, Urban Development Authority, State Planning Commission and New

Jersey Public Television Commission. He has also served as President of the Greater Newark Urban

Coalition and worked in a management consulting capacity throughout Africa.

OTHER PUBLIC COMPANY BOARDS:

Mr. Coleman is a director and member of the Corporate Governance and Nominating and Environmental

Health and Safety Committees of Hess Corporation, an energy company engaged in the exploration and

production of crude oil and natural gas. Mr. Coleman also served as a director of Electronic Arts Inc.,

Santander Consumer USA Holdings Inc. and Avis Budget Group during the last ve years.

KEY SKILLS AND QUALIFICATIONS:

Mr. Coleman brings a diverse array of senior-level business experience to the Board , enhancing the

effectiveness of its independent oversight of management. The experience acquired throughout

Mr. Coleman’s career includes more than a decade of senior management experience in Major League

Baseball, including as President of the National League. Mr. Coleman’s qualications also include service

on the boards of several large public companies, providing him with a sophisticated understanding of

the operational and nancial aspects of businesses, both domestic and international. The breadth of

Mr. Coleman’s leadership experience, coupled with his extensive public company board experience,

provides him with the skills and judgment that make him an effective Chair of the Governance

Committee . Further, Mr. Coleman has extensive government and nance experience, having served as

Commissioner of the New Jersey Department of Community Affairs where his responsibilities included

overseeing all local and county budgets. As Commissioner of New Jersey’s Department of Energy, he

developed the energy policy for the state. In addition, Mr. Coleman was Chairman of the Hackensack

Meadowlands Development Commission developing zoning regulations for the area and also lived

overseas for several years serving as a management consultant. Collectively, these roles have imbued

Mr. Coleman with a keen sense of managing risks in a variety of capacities and sectors, which is a critical

skill for service as a director.

ITEM 1 — ELECTION OF DIRECTORS

www.omnicomgroup.com 19

Mark D. Gerstein

Age 64

Director since

2022

Member of the

Audit and Finance

Committees

PROFESSIONAL EXPERIENCE:

Mr. Gerstein served as a partner at Latham & Watkins LLP from 1996 until December 31, 2022, holding

leadership positions, including global chair of the Mergers & Acquisitions group, where he helped build

the Latham & Watkins M&A Practice into a U.S. and global leader for public company transactions. He

has counselled the directors and ocers of Fortune 500 companies and other public companies on

corporate governance (including ESG matters), investor relations, crise s management, domestic and

cross-border mergers and acquisitions, and other strategic and capital markets matters. From 1984

to 1996, Mr. Gerstein was a corporate partner at Katten Muchin Rosenman, an AmLaw 100 law rm,

advising directors and owners of private and public companies on a variety of corporate matters. Since

April 2023, Mr. Gerstein has served as a Senior Advisor to PJT Partners, a global, advisory-focused,

investment bank. In addition, Mr. Gerstein was Chair and is currently a Board member of Youth Guidance,

which works with children in urban public schools in Chicago and nationally. Mr. Gerstein also serves as

Co-Chair of the University of Michigan’s Dean’s Advisory Council at the School of Literature, Science and

the Arts.

KEY SKILLS AND QUALIFICATIONS:

Having served as a partner in the Mergers & Acquisitions group at Latham & Watkins, a leading global

law rm, from 1996 until 2022, Mr. Gerstein brings the highest level of legal expertise and judgment

to the Board. Mr. Gerstein possesses a deep understanding of the intricacies of corporate law and a

tremendous knowledge of corporate governance best practices, both of which are key components of

the Board’s overall mix of skill sets. Through his many years of experience advising public companies

on a wide array of domestic and cross-border mergers and acquisitions, Mr. Gerstein has developed a

formidable ability to support and oversee management’s execution on transactional opportunities for

driving strategic growth. While serving more than a decade as a global Chair of Latham’s M&A practice,

Mr. Gerstein played a key role in building the rm’s M&A practice into a U.S. and global leader, evidencing

the value of his contribution to the Board’s collective oversight of management’s strategies for amplifying

Omnicom’s business. In his role as a senior law rm partner, Mr. Gerstein has provided critical guidance

to many company boards regarding crisis management situations, an important facet of the Board’s

aggregation of skills. Mr. Gerstein also has extensive experience advising clients on investor relations

and engagement, including on capital allocation and ESG matters, which contributes signicantly to the

Board’s support and oversight of management’s robust shareholder engagement efforts. With these

many years of experience counselling the directors and ocers of Fortune 500 companies and other

public companies on a broad spectrum of legal and regulatory matters, Mr. Gerstein also possesses

a sophisticated ability to gauge the legal and regulatory risks navigated by senior leadership of public

companies such as Omnicom. Mr. Gerstein’s extensive mergers and acquisitions and capital allocation

experience is not only a tremendous asset for the Board, but is also particularly valuable to his service as

a member of the Company’s Finance Committee.

ITEM 1 — ELECTION OF DIRECTORS

20 2024 Proxy Statement

Ronnie S. Hawkins

Age 55

Director since

2018

Member of the Compensation

and Governance Committees

PROFESSIONAL EXPERIENCE:

Mr. Hawkins is a Partner of Global Infrastructure Partners, and has been with such company since

April 2018. Global Infrastructure Partners is an infrastructure-focused private equity rm with over

$100 billion of assets under management. In this role, Mr. Hawkins focuses on international investments .

Until April 2018, Mr. Hawkins was a Managing Director, Head of International Investments and member

of the Investment Committee of EIG Global Energy Partners, which he joined in 2014. From 2009 to

2013, Mr. Hawkins was an Executive Vice President of General Electric where he led GE Energy’s Global

Business Development activities and served as Chair of the GE Energy Investment Committee. Prior

to that, Mr. Hawkins spent 19 years as a senior member of the investment banking departments at

Citigroup and Credit Suisse, completing corporate advisory assignments in over 50 countries, including

mergers, acquisitions, divestitures and restructurings. Mr. Hawkins has also led numerous corporate

nancings for large companies including equity, debt and structured nancings.

KEY SKILLS AND QUALIFICATIONS:

Mr. Hawkins has extensive strategic planning and corporate advisory experience developed over

many years as an investment banker, corporate executive and most recently as a Partner of Global

Infrastructure Partners. With a focus on investments outside of the U.S., Mr. Hawkins possesses an

in-depth understanding of the complex regulations governing international business operations and

contributes the highest level of international experience to the Board’s mix of skill sets. Mr. Hawkins

also served as a senior executive at General Electric for several years where he managed acquisitions,

divestitures and joint ventures while leading GE Energy’s Global Business Development activities. Having

structured and overseen a great number of business transactions encompassing varied and complex

business strategies, Mr. Hawkins has honed an acute understanding of strategic planning, business

operations and the role of management. This background and knowledge serves as a key component of

the Board’s effective oversight of Omnicom and its management. Having held several senior positions

at Citigroup and Credit Suisse leading corporate nancings and advising public companies on large

transactions, Mr. Hawkins brings valuable investment banking expertise to the Board . Through his

considerable experience advising corporate clients, Mr. Hawkins has developed an expert knowledge of

corporate compliance best practices which is additive to his service on the Governance Committee and

strengthens its oversight of related risks. The experience gained through advising clients on mergers,

acquisitions and other strategic corporate transactions provides Mr. Hawkins with a sophisticated ability

to evaluate businesses and discern opportunities for growth that greatly enhances the collective skills of

the Board .

ITEM 1 — ELECTION OF DIRECTORS

www.omnicomgroup.com 21

Deborah J. Kissire

Age 66

Director since

2016

Chair of the Finance

Committee and Member of

the Audit Committee

PROFESSIONAL EXPERIENCE:

Ms. Kissire held multiple senior leadership positions at EY during her career from 1979 to 2015, serving

most recently as Vice Chair and Regional Managing Partner, member of the Americas Executive Board

and member of the Global Practice Group. Other positions held include the U.S. Vice Chair of Sales and

Business Development and National Director of Retail and Consumer Products Tax Services. Throughout

her career at EY, Ms. Kissire’s leadership skills and vision were leveraged for strategic rm initiatives and

programs .

OTHER PUBLIC COMPANY BOARDS:

Ms. Kissire is a director and Chair of the Audit Committee of Cable One, Inc., a company that provides

customers with cable television, high-speed Internet and telephone services, and a director, Chair of the

Nominating and Corporate Governance Committee and member of the Compensation Committee of

Axalta Coating Systems Ltd., a manufacturer of liquid and powder coatings. Ms. Kissire also serves as

a director, Chair of the Audit Committee and member of the Environmental, Health, Safety, Quality and

Public Policy Committee of Celanese Corporation, a global chemical and specialty materials company

that engineers and manufactures a wide variety of products.

KEY SKILLS AND QUALIFICATIONS:

Ms. Kissire brings several key skills to the Board’s overall mix of knowledge and experience. Throughout

a career of 36 years at EY, an internationally recognized accounting rm, Ms. Kissire distinguished herself

in a variety of roles. She gained extensive experience serving in senior positions at EY and developed a

sophisticated ability to gauge risk in nancial, accounting and tax matters. Under Ms. Kissire’s leadership,

the size of EY’s Mid-Atlantic practice more than doubled. Through her experience and leadership

capabilities, Ms. Kissire has proven herself to possess not only an in-depth understanding of the global

nancial and taxation regulations facing a business such as Omnicom, but also a keen understanding

of how to effectively grow a complex business. Ms. Kissire’s strategic vision and signicant nancial

expertise are a tremendous asset to Omnicom’s Finance Committee, of which she is the Chair. Among

her leadership roles at EY, Ms. Kissire served as an executive advisor for the rm’s offering in Cyber

Economic Security, giving her a unique perspective on digital vulnerabilities and methods of preventing

and mitigating cyber-attacks. Taken together, these skills comprise an important component of the

Board’s aggregation of skill sets and make Ms. Kissire an extremely effective member of the Board and

Audit Committee and Chair of the Finance Committee. Further, Ms. Kissire also serves as a director

of other public company boards, including serving as Chair of audit and nominating and corporate

governance committees.

ITEM 1 — ELECTION OF DIRECTORS

22 2024 Proxy Statement

Gracia C. Martore

Age 72

Director since

2017

Chair of the Compensation

Committee and Member of

the Audit Committee

PROFESSIONAL EXPERIENCE:

Ms. Martore is the former President and Chief Executive Ocer of TEGNA Inc., one of the nation’s largest

local media companies formerly known as Gannett Co., Inc., a position she held from October 2011 to

June 2017. Ms. Martore held various leadership roles over her 32-year career at TEGNA, including as

President and Chief Operating Ocer from 2010 to 2011, Executive Vice President and Chief Financial

Ocer from 2005 to 2010 and Senior Vice President and Chief Financial Ocer from 2003 to 2005. Prior

to TEGNA, Ms. Martore worked for 12 years in the banking industry. Ms. Martore is also a member of the

board of directors of FM Global and is Chair of The Associated Press.

OTHER PUBLIC COMPANY BOARDS:

Ms. Martore is a director and member of the Audit and Finance Committees of WestRock Company, a

multinational provider of paper and packaging solutions for the consumer and corrugated packaging

markets, and a director, Chair of the Compensation Committee and member of the Audit Committee of

United Rentals, Inc., the world’s largest equipment rental company.

KEY SKILLS AND QUALIFICATIONS:

Having served as President and Chief Executive Ocer of TEGNA , Ms. Martore brings strong leadership

skills, broad strategic vision, nancial expertise and proven business acumen to the Board. Ms. Martore’s

successful navigation of TEGNA’s strategy through a period of signicant technological disruption within

its industry strengthens the collective oversight function of the Board as it assesses risk and evaluates

strategies regarding technological advances implemented by our agencies. Under her leadership, TEGNA

doubled its broadcast portfolio and acquired full ownership of Cars.com. Ms. Martore’s experience

running TEGNA adds to the Board the highest level of industry experience and a keen understanding

of the media buying perspective, which is a crucial component of Omnicom’s businesses. Ms. Martore

also led the separation of TEGNA into two separate publicly traded companies. The strategic vision

evidenced by Ms. Martore’s successes in transforming TEGNA and generating value for shareholders

is a critical skill for the Board’s overall mix of skill sets. Prior to serving as President and Chief Executive

Ocer, Ms. Martore served in a variety of leadership roles at TEGNA, including Treasurer, Executive

Vice President, Chief Operating Ocer and Chief Financial Ocer. Ms. Martore’s experience in these

varied roles brings signicant operational, nancial, accounting, and risk management skills to the Board

that are directly leveraged through her service as Chair of the Compensation Committee and a member

of the Audit Committee. In addition, Ms. Martore’s extensive business and nancial expertise enhance

the Board’s overall ability to guide business development strategy and oversee management of nancial

and operational matters. Ms. Martore’s leadership positions at TEGNA, coupled with her service as Chair

and member of other public company compensation committees, contributes signicantly to her role

as Chair of Omnicom’s Compensation Committee and better enables the Board to perform its function

of overseeing executive compensation and retention. Ms. Martore also brings to the Board considerable

experience serving on the boards and committees of other public companies.

ITEM 1 — ELECTION OF DIRECTORS

www.omnicomgroup.com 23

Patricia

Salas Pineda

Age 72

Director since

2022

Member of the

Governance and Finance

Committees

PROFESSIONAL EXPERIENCE:

Ms. Pineda served as Group Vice President of Hispanic Business Strategy for Toyota Motor North

America, Inc. from 2013 to October 2016. Prior to that, Ms. Pineda was Group Vice President of National

Philanthropy for nine years. During her time at Toyota Motor North America, which she joined in 2004,

Ms. Pineda also served as General Counsel and Group Vice President of Administration, Corporate

Advertising, Corporate Communications and Diversity. Before that, Ms. Pineda was General Counsel,

Vice President of Human Resources, Government and Environmental Affairs, and Corporate Secretary of

New United Motor Manufacturing, Inc., where she had worked since 1984. Ms. Pineda is also currently

a member of the board of directors of the Latino Corporate Directors Association and a member of the

Board of Trustees of Earthjustice.

OTHER PUBLIC COMPANY BOARDS:

Ms. Pineda is a director and member of the Compensation and Nominating and Governance Committees

of Frontier Group Holdings, Inc., the parent company of Frontier Airlines, and a director and member of

the Compensation, Culture and Talent, and Finance Committees of Portland General Electric, a utility

company. Ms. Pineda also served as a director of Levi Strauss & Company during the last ve years.

KEY SKILLS AND QUALIFICATIONS:

With many years of executive leadership experience working in C-Suite roles at Toyota Motor North

America, including that of Group Vice President of Hispanic Business Strategy, Ms. Pineda contributes

broad strategic vision, sophisticated leadership ability and strong business development acuity to the

Board, strengthening its collective oversight of Omnicom’s management. During her distinguished career

at Toyota Motor North America, Ms. Pineda also served as Group Vice President of Administration,

Corporate Advertising, Corporate Communications and Diversity, roles through which she honed many

relevant skills, including a deep understanding of operational matters, valuable industry knowledge

and a keen sense of the DE&I landscape, each of which is an important aspect of the Board’s oversight

mandate. In addition, Ms. Pineda served as Toyota Motor North America’s General Counsel, in which

role she developed the highest level of legal and regulatory expertise. This legal and regulatory

expertise is fundamental to the Board’s mix of skills, and greatly contributes to the Board’s ability to

oversee management of Omnicom’s legal and regulatory risks. Prior to joining Toyota Motor North

America, Ms. Pineda served as General Counsel, Vice President of Human Resources, Government and

Environmental Affairs, and Corporate Secretary of New United Motor Manufacturing, experience which

brings signicant corporate governance, environmental sustainability and human capital management

know-how to Omnicom’s Board. The strength of judgment derived from having served in her General

Counsel roles, coupled with Ms. Pineda’s facility for understanding complex legal, regulatory and

compliance issues, considerably adds to her service as a member of Omnicom’s Governance Committee.

In the aggregate, Ms. Pineda’s professional experience enhances the Board’s ability to oversee

management’s execution against strategic priorities for long-term shareholder value creation. In addition,

Ms. Pineda has extensive experience serving on the boards of other public companies.

ITEM 1 — ELECTION OF DIRECTORS

24 2024 Proxy Statement

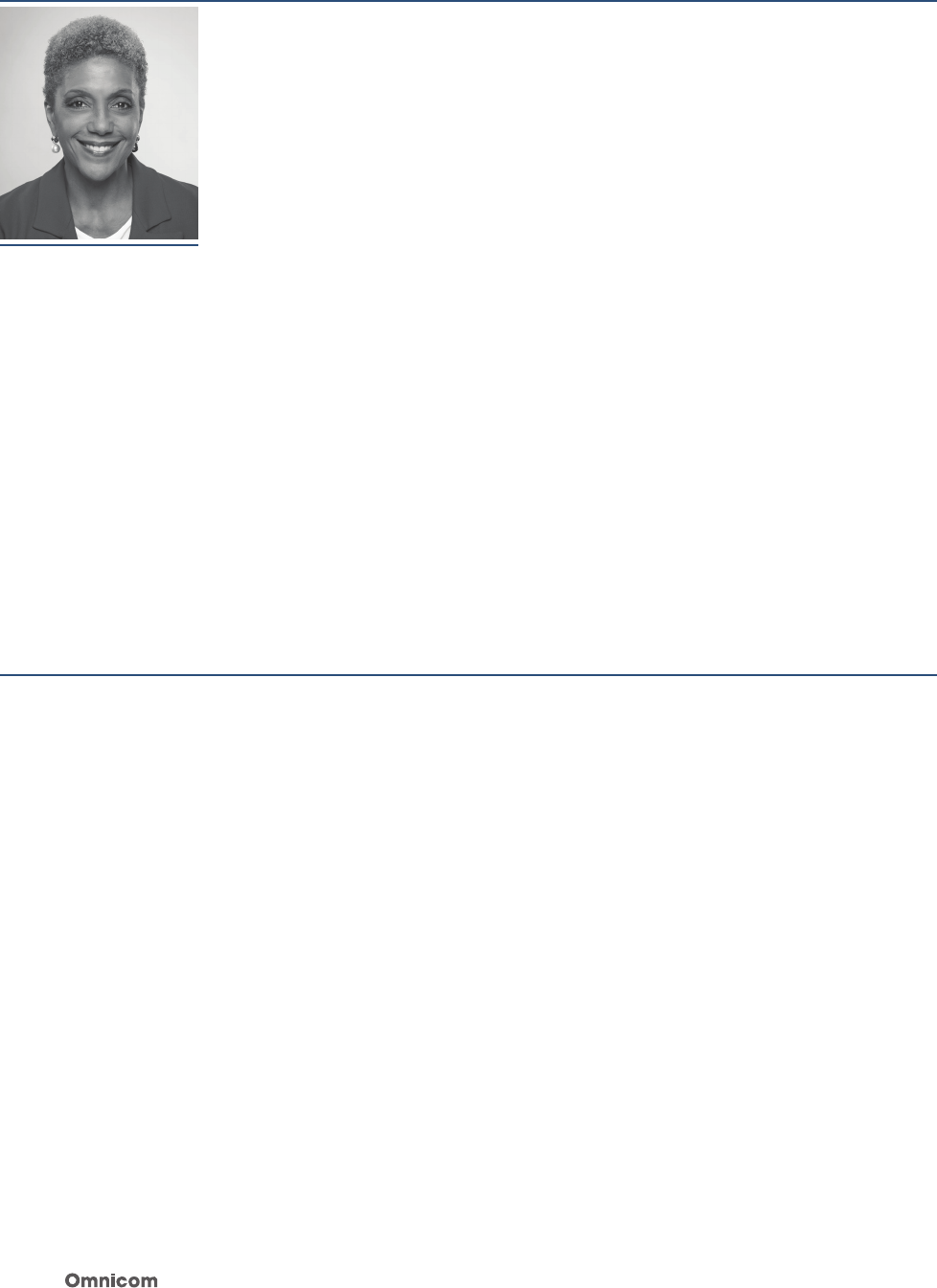

Linda

Johnson Rice

Age 66

Director since

2000

Member of the

Compensation and Governance

Committees

PROFESSIONAL EXPERIENCE:

Ms. Rice is Chief Executive Ocer of Johnson Publishing Company, formerly the parent company for

EBONY and Jet magazines and Fashion Fair Cosmetics. Ms. Rice is the former Chairman Emeritus of

Ebony Media Holdings, the parent company for the Ebony and Jet brands, and the former Chairman

Emeritus of Ebony Media Operations, for which she also served as Chief Executive Ocer from 2017 until

2019. Ms. Rice joined Johnson Publishing Company in 1980, was elected President and Chief Operating

Ocer in 1987 and served as Chairman and Chief Executive Ocer from 2008 to 2019. Johnson

Publishing Company led a voluntary petition for bankruptcy under Chapter 7 of the U.S. Bankruptcy

Code on April 9, 2019.

OTHER PUBLIC COMPANY BOARDS:

Ms. Rice is a director and Chair of the Nominating and Corporate Governance Committee of Enova

International, Inc., a provider of online nancial services to non-prime consumers and small businesses.

Ms. Rice also served as a director of Grubhub Inc. and Tesla, Inc. during the last ve years.

KEY SKILLS AND QUALIFICATIONS:

Ms. Rice’s deep understanding of media, advertising and brand management and substantial knowledge

of consumer businesses developed during her tenure as President and Chief Operating Ocer of

Johnson Publishing Company brings to the Board valuable insight into Omnicom’s businesses

and the concerns of its clients, a matter of paramount importance to Omnicom’s global business

growth. Ms. Rice’s industry expertise is a key Board skill that allows her to contribute a sophisticated

oversight capability with respect to the complex business strategies driving Omnicom’s success and

underpinning its commitment to long-term shareholder value creation. The experience and knowledge

base Ms. Rice developed through her leadership role as Chief Executive Ocer of Johnson Publishing

Company, in which she oversaw the organization’s largest and most critical business relationships,

serves as a valuable component of the Board’s overall mix of business expertise, particularly in light

of the importance of client relationships to Omnicom’s continued success. Ms. Rice also has very

broad experience through having served for more than 25 years on the boards, audit committees,

compensation committees and nominating and governance committees of several other large public

companies in a variety of industries. The breadth of this board experience adds to the strength of

Omnicom’s Board and contributes to the oversight function of its Compensation and Governance

Committees on which Ms. Rice serves.

ITEM 1 — ELECTION OF DIRECTORS

www.omnicomgroup.com 25

Cassandra Santos

Age 54

Director since

2024

Member of the

Finance Committee

PROFESSIONAL EXPERIENCE:

Ms. Santos served as the Chief Information Ocer of Asurion from 2021 to February 2024, where she

led a division driving global tech and procurement strategy to develop and support innovative tech

products for business growth. Prior to Asurion, Ms. Santos held various technology leadership roles in

the nance industry, including, from 2019 to 2021, serving as the Head of Business Process Innovation

at AllianceBernstein, and, from 2014 to 2019, as the Chief Information Ocer of General Atlantic. Prior

to that, Ms. Santos served as a strategic consultant at McKinsey & Company and its private investment

subsidiary MIO Partners, advising world class companies on technology innovation and strategy.

Ms. Santos serves as the Board Chair of the Greater Nashville Technology Council, as a director of

Horizon Blue Cross Blue Shield of New Jersey, and as a member of the Nashville Electric Service Board.

In addition, Ms. Santos serves or has served on the advisory boards of Zoom, Amazon Web Services,

Moveworks, Box, Agio, Masergy, Appirio and Computer Design and Integration. Ms. Santos started

her career at NASA, supporting over 20 space shuttle missions, including the rst MIR docking and the

Hubble Telescope repair missions.

KEY SKILLS AND QUALIFICATIONS:

Having served in various technology leadership positions and on the advisory boards of several

leading technology companies, Ms. Santos contributes the highest level of technology expertise to

our Board’s collective mix of skill sets. Through her senior technology positions, including her most

recent role as Chief Information Ocer at Asurion, Ms. Santos has developed and continues to hone

a deep understanding of the shifting technology landscape and rapidly evolving challenges, risks and

opportunities central to a company’s technology business strategy. Under her leadership, Asurion

signicantly reduced supply chain losses, increased tech cost eciency, and pioneered the use of

AI, including implementation of a new AI-powered call center platform. The breadth of Ms. Santos’s

professional experience as a strategic leader in technology innovation and information technology

enables her to bring to the Board a broad strategic vision encompassing a wide technology spectrum.

Her signicant technology background and proven business acumen serve as important components

of our Board’s collective function of overseeing management’s strategic priorities, particularly in the

areas of technology, data privacy and cybersecurity. With extensive private equity and M&A experience

derived from having developed M&A strategy for the AllianceBernstein executive team and having led

the global technology team at General Atlantic, Ms. Santos brings a sophisticated understanding of

M&A strategy and technology businesses to the Board. This technology-focused M&A experience is

particularly valuable to her service on the Finance Committee as it oversees executive management’s

execution against strategic acquisition priorities in key high-growth areas such as e-commerce and

digital technologies.

ITEM 1 — ELECTION OF DIRECTORS

26 2024 Proxy Statement

Valerie M. Williams

Age 67

Director since

2016

Member of the Audit and

Finance Committees

PROFESSIONAL EXPERIENCE:

Ms. Williams is a former Southwest Assurance Managing Partner for EY, a position she held from 2006

to 2016. She joined EY in 1981 and has over 35 years of audit and public accounting experience, serving

numerous global and multi-location companies in various industries. Ms. Williams held several senior

leadership positions at EY and served on multiple strategic committees, including the rm’s Partner

Advisory Council, Inclusiveness Council, Audit Innovation Taskforce and the Diversity Taskforce. In

addition, Ms. Williams serves as Trustee of a number of funds in the Franklin Templeton Funds family.

OTHER PUBLIC COMPANY BOARDS:

Ms. Williams is a director, Chair of the Audit Committee and member of the Reserves Committee of

Devon Energy Corporation, a leading oil and gas producer in the U.S., and a director, Chair of the Audit

Committee and member of the Corporate Governance Committee of DTE Energy Co., a diversied energy

company involved in the development and management of energy-related businesses and services. In

addition, Ms. Williams served as a director of WPX Energy, Inc., from 2018 until its merger with Devon

Energy Corporation in January 2021.

KEY SKILLS AND QUALIFICATIONS:

Ms. Williams has extensive audit practice experience gained over the course of her career and through

this experience has developed risk management skills that are a key component of the Board’s oversight

role. The signicant nancial reporting expertise developed by Ms. Williams through 35 years of audit

and public accounting experience serving numerous global and multi-location companies in various

industries is a valuable contribution to the Board’s overall mix of skill sets and is particularly additive

to Ms. Williams’s service as a member of the Audit Committee. Ms. Williams distinguished herself in

various senior roles throughout her career at EY, and successfully grew a large audit practice group

through expert oversight of operations and strategy development. These achievements underscore the

business expertise and leadership skills that Ms. Williams possesses and that better enable the Board

to effectively oversee the growth of Omnicom’s businesses. Omnicom is a global business, and through

her experience representing international businesses, Ms. Williams contributes signicantly to the

Board’s oversight of Omnicom’s multinational strategies for growth. Ms. Williams also served on several

important committees at EY, including the Inclusiveness Council and the Diversity Taskforce, and brings

to the Board strategic DE&I knowledge . Further, Ms. Williams has signicant experience serving on other

public company boards and audit committees.

ITEM 1 — ELECTION OF DIRECTORS

www.omnicomgroup.com 27

DIRECTOR INDEPENDENCE

Our non-management directors are Mary C. Choksi, Leonard S. Coleman, Jr., Mark D. Gerstein, Ronnie S. Hawkins,

DeborahJ. Kissire, Gracia C. Martore, Patricia Salas Pineda, Linda Johnson Rice, Cassandra Santos and Valerie M. Williams.

Our Board has determined that all of our non-management directors are “independent” within the meaning of the NYSE

rules, as well as under our Corporate Governance Guidelines. Our Corporate Governance Guidelines are posted on our

website at http://www.omnicomgroup.com. In determining that each of our non-management directors is independent,

the Board took into consideration the answers to annual questionnaires completed by each of the directors, which covered

any transactions with director-aliated entities. The Board also considered that Omnicom and its subsidiaries occasionally

and in the ordinary course of business, sell products and services to, and/or purchase products and services from, entities

(including charitable foundations) with which certain directors are aliated. The Board determined that these transactions

were not material to Omnicom or the entity and that none of our directors had a material interest in the transactions

with these entities. The Board therefore determined that none of these relationships impaired the independence of any

non-management director. John D. Wren, our Chairman and Chief Executive Ocer, is not independent due to his position as

an executive ocer.

SHAREHOLDER NOMINATION PROCESS

Nominations for directors at our 2025 Annual Meeting of Shareholders may be made only by the Board, or by a shareholder

entitled to do so pursuant to the Amended and Restated By-laws of the Company (“By-laws”), not later than the deadlines set

forth on page 86 in the section entitled “Shareholder Proposals and Director Nominations for the 2025 Annual Meeting.”

Our By-laws provide that shareholders may present director nominations directly at the annual meeting (and not for

inclusion in our proxy statement) by satisfying certain advance notice requirements, and providing information as to such

nominee and submitting shareholder as specied in our By-laws. Our By-laws also permit a shareholder or group of up to

20 shareholders owning 3% or more of the Company’s common stock continuously for at least threeyears to nominate

and include in the Company’s proxy statement director candidates constituting up to 20% of the Board, but no less than

two, to be considered for election by the holders of the Company’s common stock; provided that the shareholder (or group)