____________________

____________________

V. Lending — HOPA

Homeowners Protection Act

Introduction

The Homeowners Protection Act of 1998 (the Act) was signed

into law on July 29, 1998, and became effective on July 29,

1999. The Act was amended on December 27, 2000, to pro-

vide technical corrections and clarification. The Act, also

known as the “PMI Cancellation Act,” addresses homeowners’

difficulties in canceling private mortgage insurance (PMI)

1

coverage. It establishes provisions for canceling and terminat-

ing PMI, establishes disclosure and notification requirements,

and requires the return of unearned premiums.

PMI is insurance that protects lenders from the risk of default

and foreclosure. PMI allows prospective buyers who cannot,

or choose not to, provide significant down payments to obtain

mortgage financing at affordable rates. It is used extensively to

facilitate “high-ratio” loans (generally, loans in which the loan

to value (LTV) ratio exceeds 80 percent). With PMI, the lend-

er can recover costs associated with the resale of foreclosed

property, and accrued interest payments or fixed costs, such as

taxes or insurance policies, paid prior to resale.

Excessive PMI coverage provides little extra protection for a

lender and does not benefit the borrower. In some instances,

homeowners have experienced problems in canceling PMI. At

other times, lenders may have agreed to terminate coverage

when the borrower’s equity reached 20 percent, but the poli-

cies and procedures used for canceling or terminating PMI

coverage varied widely among lenders. Prior to the Act,

homeowners had limited recourse when lenders refused to

cancel their PMI coverage. Even homeowners in the few states

that had laws pertaining to PMI cancellation or termination

noted difficulties in canceling or terminating their PMI poli-

cies. The Act now protects homeowners by prohibiting life of

loan PMI coverage for borrower-paid PMI products and estab-

lishing uniform procedures for the cancellation and termina-

tion of PMI policies.

Regulation Overview

Scope and Effective Date

The Act applies primarily to “residential mortgage transac-

tions,” defined as mortgage loan transactions consummated on

The Act does not apply to mortgage insurance made available under the

National Housing Act, title 38 of the United States Code, or title V of the

Housing Act of 1949. This includes mortgage insurance on loans made the

Federal Housing Administration and guarantees on mortgage loans made

by the Veterans Administration.

or after July 29, 1999, to finance the acquisition, initial con-

struction, or refinancing

2

of a single-family dwelling that

serves as a borrower’s principal residence.

3

The Act also in-

cludes provisions for annual written disclosures for “residen-

tial mortgages,” defined as mortgages, loans or other evidenc-

es of a security interest created for a single-family dwelling

that is the principal residence of the borrower (12 USC

§4901(14) and (15)). A condominium, townhouse, coopera-

tive, or mobile home is considered to be a single-family dwell-

ing covered by the Act.

The Act’s requirements vary depending on whether a mort-

gage is:

• A “residential mortgage” or a “residential mortgage trans-

action”;

• Defined as high risk (either by the lender in the case of

non-conforming loans, or Fannie Mae and Freddie Mac in

the case of conforming loans);

• Financed under a fixed or an adjustable rate; or

• Covered by borrower-paid private mortgage insurance

(BPMI) or lender-paid private mortgage insurance

(LPMI).

4

Cancellation and Termination of PMI for Non High

Risk Residential Mortgage Transactions

Borrower Requested Cancellation

A borrower may initiate cancellation of PMI coverage by

submitting a written request to the servicer. The servicer must

take action to cancel PMI when the cancellation date occurs,

which is when the principal balance of the loan reaches (based

on actual payments) or is first scheduled to reach 80 percent of

the “original value,”

5

irrespective of the outstanding balance,

2 For purposes to these procedures, “refinancing” means the refinancing of

loans any portion of which was to provide financing for the acquisition or

initial construction of a single-family dwelling that serves as a borrower’s

principal residence. See 15 USC §1601 et seq. and 12 CFR §1026.20.

3 For purposes of these procedures, junior mortgages that provide financing

for the acquisition, initial construction or refinancing of a single-family

dwelling that serves as a borrower’s principal residence are covered.

4 All sections of these procedures and Handbook apply to BPMI. For LPMI,

relevant sections begin under that heading and follow thereafter.

5 “Original value” is defined as the lesser of the sales price of the secured

property as reflected in the purchase contract or, the appraised value at the

time of loan consummation. In the case of a refinancing, the term means

the appraised value relied upon by the lender to approve the refinance

transaction.

FDIC Consumer Compliance Examination Manual — September 2015 V–5.1

1

____________________

V. Lending — HOPA

based upon the initial amortization schedule (in the case of a If PMI is terminated, the servicer may not require further

fixed rate loan) or amortization schedule then in effect (in the payments or premiums of PMI more than 30 days after the

case of an adjustable rate loan

6

), or any date thereafter that:

termination date or the date following the termination date on

• the borrower submits a written cancellation request;

• the borrower has a good payment history;

7

• the borrower is current;

8

and

• the borrower satisfies any requirement of the mortgage

holder for: (i) evidence of a type established in advance

that the value of the property has not declined below the

original value; and (ii) certification that the borrower’s

equity in the property is not subject to a subordinate lien

(12 USC §4902(a)(4)).

Once PMI is canceled, the servicer may not require further

PMI payments or premiums more than 30 days after the later

of: (i) the date on which the written request was received or

(ii) the date on which the borrower satisfied the evidence and

certification requirements of the mortgage holder described

previously (12 USC §4902(e)(1)).

Automatic Termination

The Act requires a servicer to automatically terminate PMI for

residential mortgage transactions on the date that:

• the principal balance of the mortgage is first scheduled to

reach 78 percent of the original value of the secured prop-

erty (based solely on the initial amortization schedule in

the case of a fixed rate loan or on the amortization sched-

ule then in effect in the case of an adjustable rate loan, ir-

respective of the outstanding balance), if the borrower is

current; or

• if the borrower is not current on that date, on the first day

of the first month following the date that the borrower be-

comes current (12 USC §4902(b)).

6 The Act includes as an adjustable rate mortgage, a balloon loan that “con-

tains a conditional right to refinance or modify the unamortized principal at

the maturity date.” Therefore, if a balloon loan contains a conditional right

to refinance, the initial disclosure for an adjustable rate mortgage would be

used even if the interest rate is fixed.

7 A borrower has a good payment history if the borrower: (1) has not made a

payment that was 60 days or more past due within the first 12 months of

the last 2 years prior to the later of the cancellation date, or the date that the

borrower requests cancellation; or (2) has not made a payment that was 30

days or more past due within the 12 months prior to the later of the cancel-

lation date or the date that the borrower requests cancellation.

8 The Act does not define current.

which the borrower becomes current on the payments, which-

ever is sooner (12 USC §4902(e)(2)).

There is no provision in the automatic termination section of

the Act, as there is with the borrower-requested PMI cancella-

tion section, that protects the lender against declines in proper-

ty value or subordinate liens. The automatic termination provi-

sions make no reference to good payment history (as pre-

scribed in the borrower-requested provisions), but state only

that the borrower must be current on mortgage payments (12

USC §4902(b)).

Final Termination

If PMI coverage on a residential mortgage transaction was not

canceled at the borrower’s request or by the automatic termi-

nation provision, the servicer must terminate PMI coverage by

the first day of the month immediately following the date that

is the midpoint of the loan’s amortization period if, on that

date, the borrower is current on the payments required by the

terms of the mortgage (12 USC §4902(c)). (If the borrower is

not current on that date, PMI should be terminated when the

borrower does become current.)

The midpoint of the amortization period is halfway through

the period between the first day of the amortization period

established at consummation and ending when the mortgage is

scheduled to be amortized. The servicer may not require fur-

ther payments or premiums of PMI more than 30 days after

PMI is terminated (12 USC §4902(e)(3)).

Loan Modifications

If a borrower and mortgage holder agree to modify the terms

and conditions of a loan pursuant to a residential mortgage

transaction, the cancellation, termination or final termination

dates shall be recalculated to reflect the modification (12 USC

§4902(d)).

Exclusions

The Act’s cancellation and termination provisions do not ap-

ply to residential mortgage transactions for which Lender Paid

Mortgage Insurance (LPMI) is required (12 USC §4905(b)).

Return of Unearned Premiums

The servicer must return all unearned PMI premiums to the

borrower within 45 days after cancellation or termination of

V–5.2 FDIC Consumer Compliance Examination Manual — September 2015

____________________

V. Lending — HOPA

PMI coverage. Within 30 days after notification by the ser-

vicer of cancellation or termination of PMI coverage, a mort-

gage insurer must return to the servicer any amount of un-

earned premiums it is holding to permit the servicer to return

such premiums to the borrower (12 USC §4902(f)).

Accrued Obligations for Premium Payments

The cancellation or termination of PMI does not affect the

rights of any lender, servicer or mortgage insurer to enforce

any obligation of a borrower for payments of premiums that

accrued before the cancellation or termination occurred (12

USC §4902 (h)).

Exceptions to Cancellation and Termination Provi-

sions for High Risk Residential Mortgage Transac-

tions

The borrower-requested cancellation at 80 percent LTV and

the automatic termination at 78 percent LTV requirements of

the Act do not apply to “high risk” loans. However, high-risk

loans are subject to final termination and are divided into two

categories - conforming (Fannie Mae/Freddie Mac-defined

high risk loans) and non-conforming (lender-defined high risk

loans) (12 USC §4902(g)(1)).

Conforming Loans (Fannie Mae/Freddie Mac-Defined

High Risk Loans)

Conforming loans are those loans with an original principal

balance not exceeding Freddie Mac’s and Fannie

Mae’s conforming loan limits.

9

Fannie Mae and Freddie Mac

are authorized under the Act to establish a category of residen-

tial mortgage transactions that are not subject to the Act’s re-

quirements for borrower-requested cancellation or automatic

termination, because of the high risk associated with them.

10

They are however, subject to the final termination provision of

the Act. As such, PMI on a conforming high risk loan must be

terminated by the first day of the month following the date that

is the midpoint of the loan’s initial amortization schedule (in

the case of a fixed rate loan) or amortization schedule then in

effect (in the case of an adjustable rate loan) if, on that date,

the borrower is current on the loan (12 USC § 4902(g)). (If the

borrower is not current on that date, PMI should be terminated

when the borrower does become current.)

This limit was $417,000 in 2015; however, it is reviewed annually and has

differing tiers based on geography and number of units.

10 Fannie Mae and Freddie Mac have not defined high-risk loans as of the

date of this publication.

Non-Conforming Loans (Lender-Defined High Risk

Loans)

Non-conforming loans are those residential mortgage transac-

tions that have an original principal balance exceeding Freddie

Mac’s and Fannie Mae’s conforming loan limits. Lender-

defined high-risk loans are not subject to the Act’s require-

ments for borrower-requested cancellation or automatic termi-

nation. However, if a residential mortgage transaction is a

lender-defined high risk loan, PMI must be terminated on the

date on which the principal balance of the mortgage, based

solely on the initial amortization schedule (in the case of a

fixed rate loan) or the amortization schedule then in effect (in

the case of an adjustable rate loan) for that mortgage and irre-

spective of the outstanding balance for that mortgage on that

date, is first scheduled to reach 77 percent of the original value

of the property securing the loan.

Like conforming loans that are determined to be high risk by

Freddie Mac and Fannie Mae, a residential mortgage transac-

tion that is a lender-defined high-risk loan is subject to the

final termination provision of the Act.

Notices

The lender must provide written initial disclosures at con-

summation for all high-risk residential mortgage transactions

(as defined by the lender or Fannie Mae or Freddie Mac), that

in no case will PMI be required beyond the midpoint of the

amortization period of the loan, if the loan is current. More

specific notice as to the 77 percent LTV termination standards

for lender defined high-risk loans is not required under the

Act.

Basic Disclosure and Notice Requirements Applica-

ble to Residential Mortgage Transactions and Resi-

dential Mortgages

The Act requires the lender in a residential mortgage transac-

tion to provide to the borrower, at the time of consummation,

certain disclosures that describe the borrower’s rights for PMI

cancellation and termination. A borrower may not be charged

for any disclosure required by the Act. Initial disclosures vary,

based upon whether the transaction is a fixed rate mortgage,

adjustable rate mortgage, or high-risk loan. The Act also re-

quires that the borrower be provided with certain annual and

other notices concerning PMI cancellation and termination.

Residential mortgages are subject to certain annual disclosure

requirements.

FDIC Consumer Compliance Examination Manual — September 2015

V–5.3

9

V. Lending — HOPA

Initial Disclosures for Fixed Rate Residential Mortgage

Transactions

When PMI is required for non high risk fixed rate mortgages,

the lender must provide to the borrower at the time the transac-

tion is consummated: (i) a written initial amortization sched-

ule, and (ii) a written notice that discloses:

• The borrower’s right to request cancellation of PMI, and,

based on the initial amortization schedule, the date the

loan balance is scheduled to reach 80 percent of the origi-

nal value of the property;

• The borrower’s right to request cancellation on an earlier

date, if actual payments bring the loan balance to 80 per-

cent of the original value of the property sooner than the

date based on the initial amortization schedule;

• That PMI will automatically terminate when the LTV ratio

reaches 78 percent of the original value of the property

and the specific date that is projected to occur (based on

the initial amortization schedule); and,

• The Act provides for exemptions to the cancellation and

automatic termination provisions for high risk mortgages

and whether these exemptions apply to the borrower’s

loan (12 USC §4903(a)(1)(A)).

Initial Disclosures for Adjustable Rate Residential Mort-

gage Transactions

When PMI is required for non high-risk adjustable rate mort-

gages, the lender must provide to the borrower at the time the

transaction is consummated a written notice that discloses:

• The borrower’s right to request cancellation of PMI on (i)

the date the loan balance is first scheduled to reach 80 per-

cent of the original value of the property based on the

amortization schedule then in effect or (ii) the date the

balance actually reaches 80 percent of the original value of

the property based on actual payments. The notice must

also state that the servicer will notify the borrower when

either (i) or (ii) occurs;

• That PMI will automatically terminate when the loan bal-

ance is first scheduled to reach 78 percent of the original

value of the property based on the amortization schedule

then in effect. The notice must also state that the borrower

will be notified when PMI is terminated (or that termina-

tion will occur when the borrower becomes current on

payments); and,

• That there are exemptions to the cancellation and automat-

ic termination provisions for high-risk mortgages and

whether such exemptions apply to the borrower’s loan (12

USC §4903(a)(1)(B)).

Initial Disclosures for High Risk Residential Mortgage

Transactions

When PMI is required for high risk residential mortgage trans-

actions, the lender must provide to the borrower a written no-

tice stating that PMI will not be required beyond the date that

is the midpoint of the loan’s amortization period if, on that

date, the borrower is current on the payments as required by

the terms of the loan. The lender must provide this notice at

consummation. The lender need not provide disclosure of the

termination at 77 percent LTV for lender defined high-risk

mortgages (12 USC §4903(a)(2)).

Annual Disclosures for Residential Mortgage Transactions

For all residential mortgage transactions, including high risk

mortgages for which PMI is required, the servicer must pro-

vide the borrower with an annual written statement that sets

forth the rights of the borrower to PMI cancellation and termi-

nation and the address and telephone number that the borrower

may use to contact the servicer to determine whether the bor-

rower may cancel PMI (12 USC §4903(a)(3)).

Disclosures for Existing Residential Mortgages

When PMI was required for a residential mortgage consum-

mated before July 29, 1999, the servicer must provide to the

borrower an annual written statement that:

• States that PMI may be canceled with the consent of the

lender or in accordance with state law; and

• Provides the servicer’s address and telephone number, so

that the borrower may contact the servicer to determine

whether the borrower may cancel PMI (12 USC

§4903(b)).

V–5.4 FDIC Consumer Compliance Examination Manual — September 2015

____________________

V. Lending — HOPA

Notification Upon Cancellation or Termination of

PMI Relating to Residential Mortgage Transactions

General

The servicer must, not later than 30 days after PMI relating to

a residential mortgage transaction is canceled or terminated,

notify the borrower in writing that:

11

• PMI has terminated and the borrower no longer has PMI;

and

• No further premiums, payments or other fees are due or

payable by the borrower in connection with PMI (12 USC

§4904(a)).

Notice of Grounds/Timing

If a servicer determines that a borrower in a residential mort-

gage transaction does not qualify for PMI cancellation or au-

tomatic termination, the servicer must provide the borrower

with a written notice of the grounds relied on for that determi-

nation. If an appraisal was used in making the determination,

the servicer must give the appraisal results to the borrower. If

a borrower does not qualify for cancellation, the notice must

be provided not later than 30 days following the later of: (i)

the date the borrower’s request for cancellation is received; or

(ii) the date on which the borrower satisfies any evidence and

certification requirements of the mortgage holder. If the bor-

rower does not meet the requirements for automatic termina-

tion, the notice must be provided not later than 30 days follow-

ing the scheduled termination date (12 USC §4904(b)).

Disclosure Requirements for Lender-Paid Mortgage

Insurance

Definitions

Borrower paid mortgage insurance (BPMI) means PMI is

required for a residential mortgage transaction, the payments

for which are made by the borrower.

Lender paid mortgage insurance (LPMI) means PMI that is

required for a residential mortgage transaction, the payments

for which are made by a person other than the borrower.

11 For adjustable rate mortgages, the initial notice to borrowers must state that

the servicer will notify the borrower when the cancellation and automatic

termination dates are reached (12 USC §4903(a)(1)(B). Servicers should

take care that the appropriate notices are made to borrowers when those

dates are reached.

Loan commitment means a prospective lender’s written con-

firmation of its approval, including any applicable closing

conditions, of the application of a prospective borrower for a

residential mortgage loan (12 USC 4905(a)).

Initial Notice

In the case of LPMI required for a residential mortgage trans-

action, the Act requires that the lender provide a written notice

to the borrower not later than the date on which a

loan commitment is made. The written notice must advise the

borrower of the differences between LPMI and BPMI by noti-

fying the borrower that LPMI:

• Differs from BPMI because it cannot be canceled by the

borrower or automatically terminated as provided under

the Act;

• Usually results in a mortgage having a higher interest rate

than it would in the case of BPMI; and,

• Terminates only when the mortgage is refinanced (as that

term is defined in the Truth in Lending Act, 15 U.S..C.

§1601 et seq., and Regulation Z, 12 CFR §1026.20), paid

off, or otherwise terminated.

The notice must also provide:

• That LPMI and BPMI have both benefits and disad-

vantages;

• A generic analysis of the costs and benefits of a mortgage

in the case of LPMI versus BPMI over a ten-year period,

assuming prevailing interest and property appreciation

rates; and,

• That LPMI may be tax-deductible for federal income tax-

es, if the borrower itemizes expenses for that purpose (12

USC §4905(c)(1)).

Notice at Termination Date

Not later than 30 days after the termination date that would

apply in the case of BPMI, the servicer shall provide to the

borrower a written notice indicating that the borrower may

wish to review financing options that could eliminate the re-

quirement for LPMI in connection with the mortgage

(12 USC §4905(c)(2)).

Fees for Disclosures

As stated previously, no fee or other cost may be imposed on a

borrower for the disclosures or notifications required to be

FDIC Consumer Compliance Examination Manual — September 2015

V–5.5

V. Lending — HOPA

given to a borrower by lenders or servicers under the Act (12

USC §4906).

Civil Liability

Liability Dependent upon Type of Action

Servicers, lenders and mortgage insurers that violate the Act

are liable to borrowers as follows:

• Individual Action

° In the case of individual borrowers:

— Actual damages (including interest accruing on such

damages);

— Statutory damages not to exceed $2,000;

— Costs of the action, and

— Reasonable attorney fees.

• Class Action

° In the case of a class action suit against a defendant that

is subject to section 10 of the Act, (i.e., regulated by the

federal banking agencies, NCUA or the Farm Credit

Administration):

— Such statutory damages as the court may allow up to

the lesser of $500,000 or 1 percent of the liable par-

ty’s net worth;

— Costs of the action; and

— Reasonable attorney fees.

° In the case of a class action suit against a defendant that

is not subject to section 10 of the Act, (i.e., not regulated

by the federal banking agencies, NCUA, or the Farm

Credit Administration):

— Actual damages (including interest accruing on such

damages);

— Statutory damages up to $1,000 per class member but

not to exceed the lesser of $500,000; or 1 percent of

the liable party’s gross revenues;

— Costs of the action; and

— Reasonable attorney fees (12 USC §4907(a)).

Statute of Limitations

A borrower must bring an action under the Act within two

years after the borrower discovers the violation (12 USC

§4907(b)).

Mortgage Servicer Liability Limitation

A servicer shall not be liable for its failure to comply with the

requirements of the Act if the servicer’s failure to comply is

due to the mortgage insurer’s or lender’s failure to comply

with the Act (12 USC §4907(c)).

Enforcement

The Act directs the federal banking agencies to enforce the

Act under 12 USC §1818 or any other authority conferred

upon the agencies by law. Under the Act the agencies shall:

• Notify applicable lenders or servicers of any failure to

comply with the Act;

• Require the lender or servicer, as applicable, to correct the

borrower’s account to reflect the date on which PMI

should have been canceled or terminated under the Act;

and,

• Require the lender or servicer, as applicable, to return

unearned PMI premiums to a borrower who paid premi-

ums after the date on which the borrower’s obligation to

pay PMI premiums ceased under the Act (12 USC §4909).

Examination Objectives

The objectives of the examination are:

1. To determine the financial institution’s compliance with

the Homeowners Protection Act of 1998 (HOPA), as

amended.

2. To assess the quality of the financial institution’s policies

and procedures for implementing the HOPA.

3. To determine the reliance that can be placed on the finan-

cial institution’s internal controls and procedures for

monitoring the institution’s compliance with the HOPA.

4. To initiate corrective action when violations of HOPA are

identified, or when policies or internal controls are defi-

cient.

V–5.6 FDIC Consumer Compliance Examination Manual — September 2015

____________________

V. Lending — HOPA

Examination Procedures

12

1. Through discussions with management and review of

available information, determine if the institution’s inter-

nal controls are adequate to ensure compliance with the

HOPA. Consider the following:

a. Organization charts;

b. Process flowcharts;

c. Policies and procedures;

d. Loan documentation;

e. Checklists;

f. Training; and,

g. Computer program documentation.

2. Review any compliance audit material, including work

papers and reports, to determine whether:

a. The institution’s procedures address all applicable pro-

visions of HOPA;

b. Steps are taken to follow-up on previously identified de-

ficiencies;

c. The procedures used include samples covering all prod-

uct types and decision centers;

d. The compliance audit work performed is accurate;

e. Significant deficiencies and their causes are included in

reports to management and/or to the Board of Directors;

f. Corrective action is taken in a timely and appropriate

manner; and

g. The frequency of compliance review is appropriate.

3. Obtain a sample of recent residential mortgage transac-

tions, including those serviced by the bank and conducted

electronically, if applicable. Complete the Homeowners

Protection Act worksheet (page V-5.8). Also, obtain a

copy of the bank’s disclosure and notification forms and

policies and procedures to complete the worksheet. As ap-

plicable, the forms should include:

a. Initial disclosures for: (i) fixed rate mortgages; (ii) ad-

justable rate mortgages; (iii) high risk loans; and (iv)

lender-paid mortgage insurance.

12

These reflect the interagency examination procedures in their entirety.

b. Annual notices for: (i) fixed and adjustable rate mort-

gages and high-risk loans and (ii) existing residential

mortgages.

c. Notices of: (i) cancellation; (ii) termination; (iii)

grounds for not canceling PMI; (iv) grounds for not

terminating PMI; (v) cancellation date for adjustable

rate mortgages; and (vi) termination date for lender paid

mortgage insurance.

4. Using the above sample and bank policies and procedures,

determine that borrowers are not charged for any required

disclosures or notifications (12 USC §4906).

5. Obtain and review a sample of recent written requests

from borrowers to cancel their private mortgage insurance

(PMI) on “non-high risk” residential mortgage transac-

tions. Verify that the insurance was canceled on either: (a)

the date on which the principal balance of the loan was

first scheduled to reach 80 percent of the original value of

the property based on the initial amortization schedule (in

the case of a fixed rate loan) or the amortization schedule

then in effect (in the case of an adjustable rate loan); or (b)

the date on which the principal balance of the loan actual-

ly reached 80 percent of the original value of the property

based on actual payments, in accordance with the applica-

ble provisions in 12 USC §4902(a) of HOPA (i.e., good

payment history, current payments and, if required by the

lender, evidence that the value of the mortgaged property

did not decline, and certification that the borrower’s equity

was unencumbered by a subordinate lien) (12 USC

§4902(a)).

6. Obtain and review a sample of “non-high risk” PMI resi-

dential mortgage transactions where the borrower did not

request cancellation. Select loans from the sample that

have reached a 78 percent or lower LTV ratio based on the

original value of the property and that are current. Verify

that PMI was terminated, based on the initial amortization

schedule (in the case of a fixed rate loan) or the amortiza-

tion schedule then in effect (in the case of an adjustable

rate loan) on the date that the principal balance of the loan

was first scheduled to reach 78 percent of the original val-

ue of the mortgaged property (if the borrower was current)

or on the first day of the first month after the date that the

borrower became current (12 USC §4902(b)).

7. Obtain a sample of PMI-covered residential mortgage

transactions (including high risk loans, if any) that are at

or beyond the midpoint of their amortization period. De-

termine whether PMI was terminated by the first day of

the following month if the loan was current. If the loan

was not current at the midpoint, determine that PMI was

FDIC Consumer Compliance Examination Manual — September 2015

V–5.7

V. Lending — HOPA

terminated by the first day of the month following the day

the loan became current. If, at the time of the examination,

a loan at the midpoint is not current, determine whether

the financial institution is monitoring the loan and has sys-

tems in place to ensure that PMI is terminated when the

borrower becomes current (12 USC §4902(c) and 12 USC

§4902(g)(2)).

8. Obtain a sample of any lender defined “high risk” PMI

residential mortgage transactions that have a 77 percent or

lower LTV based on the original value of the property.

Verify that PMI was canceled, based on the initial amorti-

zation schedule (in the case of a fixed rate loan) or the

amortization schedule then in effect (in the case of an ad-

justable rate loan), on the date that the principal balance of

the loan was scheduled to reach 77 percent of the original

value of the mortgaged property (12 USC

§4902(g)(1)(B)).

9. Obtain a sample of loans that have had PMI canceled or

terminated (the samples obtained above can be used). For

PMI loans canceled upon the borrowers’ requests, deter-

mine that the financial institution did not require any PMI

payment(s) beyond 30 days of the borrower satisfying the

evidence and certification requirements to cancel PMI (12

USC §4902(e)(1)). For the PMI loans that received auto-

matic termination or final termination, determine that the

financial institution did not require any PMI payment(s)

beyond 30 days of termination (12 USC §4902(e)(2) and

12 USC §4902(e)(3)).

10. Using the samples in steps 5, 6, and 7, determine if the

financial institution returned unearned premiums, if any,

to the borrower within 45 days after cancellation or termi-

nation (12 USC §4902(f)(1)).

Conclusions

11. Summarize all violations and internal deficiencies.

12. If the violation(s) or internal deficiencies noted above

represent(s) a pattern or practice, determine the root cause

by identifying weaknesses in internal controls, compliance

review, training, management oversight, or other factors.

13. Identify action needed to correct violations and weakness-

es in the institution’s compliance system, as appropriate.

14. Discuss findings with the institution’s management and

obtain a commitment for corrective action.

15. Determine if enforcement action is appropriate. If so, con-

tact appropriate agency personnel for guidance. Section

10(c) of the Act contains a provision requiring restitution

of unearned PMI premiums.

References

12 USC §§4901 – 4910 (2001)

[not found in FDIC Laws, Regulations and Related Acts]

V–5.8 FDIC Consumer Compliance Examination Manual — September 2015

V. Lending — HOPA

Job Aids

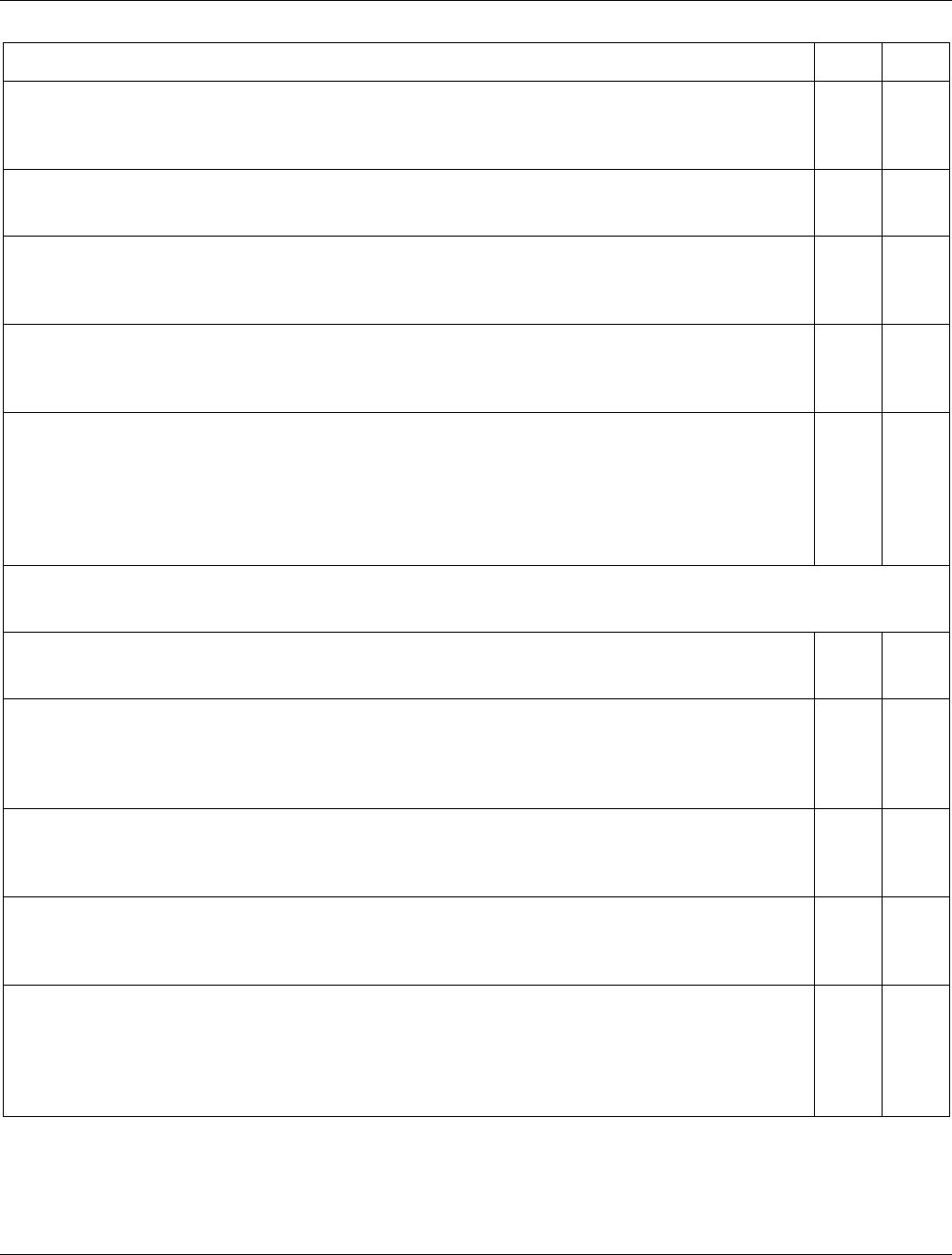

Homeowners Protection Act Worksheet

Use this worksheet to perform transactional testing. Answer the following questions with a “Yes” (Y) or a “No” (N) answer. Every

“No” answer indicates a violation of law or an internal deficiency and must be explained fully in the work papers.

Homeowner Protection Act Worksheet

Yes

No

1. Does the lender provide written initial disclosures at consummation for fixed rate residential

mortgage transactions that include:

a. A written amortization schedule? (12 USC §4903(a)(1)(A)(i))

b. A notice that the borrower may submit a written request to cancel PMI as of the date that, based on

the initial amortization schedule, the principal balance is first scheduled to reach 80 percent of the

original value of the mortgaged property, irrespective of the outstanding balance of the mortgage, or

based on actual payments, when the principal balance reaches 80 percent of the original value of the

mortgaged property (or any later date) and the borrower has a good payment history, is current on

payments, and has satisfied the lender’s requirements that the value of the mortgaged property has

not declined and is unencumbered by subordinate liens? (12 USC §4903(a)(1)(A)(ii)(I) and (II))

c. The specific date, based on the initial amortization schedule, the loan balance is scheduled to reach

80 percent of the original value of the mortgaged property? (12 USC §4903(a)(1)(A)(ii)(I))

d. A notice that PMI will automatically terminate on the date that, based on the amortization schedule

and irrespective of the outstanding balance of the mortgage, the principal balance is first scheduled to

reach 78 percent of the original value of the mortgaged property if the loan is current or on the first

day of the first month after the date that the loan becomes current? (12 USC §4903(a)(1)(A)(ii)(III))

e. The specific date the loan balance is scheduled to reach 78 percent LTV? (12 USC

§4903(a)(1)(A)(ii)(III))

f. Notice that exemptions to the right to cancel and automatic termination exist for high-risk loans and

whether such exemptions apply? (12 USC §4903(a)(1)(A)(ii)(IV))

2. Does the lender provide written initial disclosures at consummation for adjustable rate residential

mortgage transactions that include a notice that:

a. The borrower may submit a written request to cancel PMI as of the date that, based on the

amortization schedule then in effect and irrespective of the outstanding balance of the mortgage, the

principal balance is first scheduled to reach 80 percent of the original value of the mortgaged

property or based on actual payments, when the principal balance actually reaches 80 percent of the

original value of the mortgaged property (or any later date), and the borrower has a good payment

history, the loan is current, and the borrower has satisfied the lender requirements that the value of

the mortgaged property has not declined and is unencumbered by subordinate liens? (12 USC

§4903(a)(1)(B)(i))

b. The servicer will notify the borrower when the cancellation date is reached, i.e., when the loan

balance represents 80 percent of the original value of the mortgaged property? (12 USC

§4903(a)(1)(B)(i))

c. PMI will automatically terminate when the loan balance is first scheduled to reach 78 percent of the

original value of the mortgaged property irrespective of the outstanding balance of the mortgage if

the loan is current, or on the first day of the first month after the date that the loan becomes current?

(12 USC §4903(a)(1)(B)(ii))

FDIC Consumer Compliance Examination Manual — September 2015 V–5.9

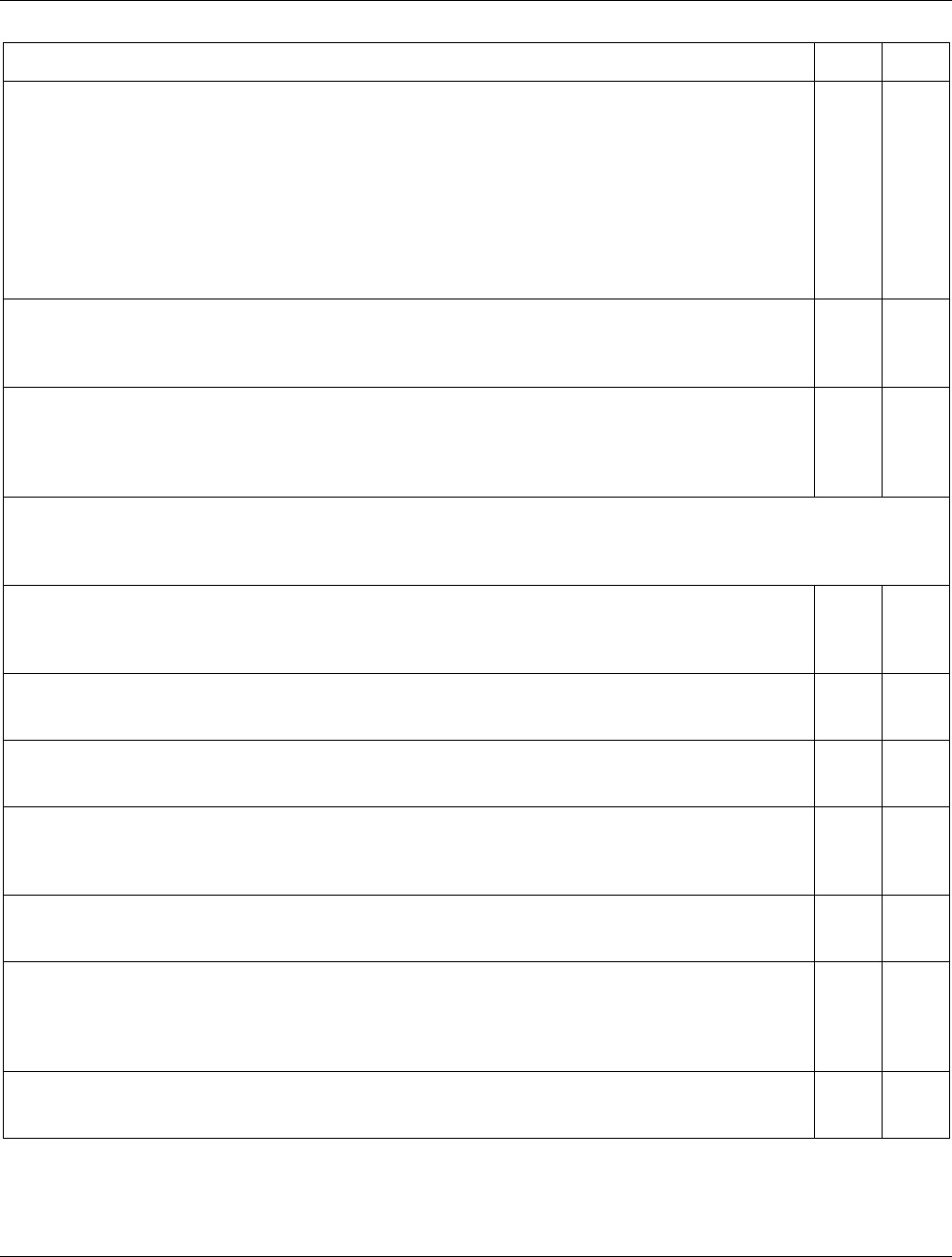

V. Lending — HOPA

Yes

No

d. On the termination date the borrower will be notified of the termination or the fact that PMI will be

terminated on the first day of the first month after the date that the loan becomes current? (12 USC

§4903(a)(1)(B)(ii))

e. Exemptions to the right to cancel and automatic termination exist for high-risk loans and whether

such exemptions apply? (12 USC §4903(a)(1)(B)(iii))

3. Does the lender have established standards regarding the type of evidence it requires borrowers to provide

to demonstrate that the value of the mortgage property has not declined and are they provided when a

request for cancellation occurs? (12 USC §4902(a)(4)(A))

4. Does the lender provide written initial disclosures at consummation for high risk residential mortgage

transactions (as defined by the lender or Fannie Mae or Freddie Mac), that PMI will not be required

beyond the midpoint of the amortization period of the loan, if the loan is current? (12 USC §4903(a)(2))

5. If the financial institution acts as servicer for residential mortgage transactions, does it provide an annual

written statement to the borrowers explaining their rights to cancel or terminate PMI and an address and

telephone number to contact the servicer to determine whether they may cancel PMI? (12 USC

§4903(a)(3))

Note: This disclosure may be included on RESPA’s annual escrow account disclosure or IRS interest

payment disclosures.

6. If the financial institution acts as servicer, does it provide an annual written statement to each

borrower who entered into a residential mortgage prior to July 29, 1999, that includes:

a. A statement that PMI may, under certain circumstances, be canceled by the borrower with the

consent of the lender or in accordance with applicable state law? (12 USC §4903(b)(1))

b. An address and telephone number that the borrower may use to contact the servicer to determine

whether the borrower may cancel the PMI? (12 USC §4903(b)(2))

Note: This disclosure may be included on RESPA’s annual escrow account disclosure or IRS interest

payment disclosure.

7. If the financial institution acts as servicer for residential mortgage transactions, does it provide borrowers

with written notices within 30 days after the date of cancellation or termination of PMI that the borrower

no longer has PMI and that no further PMI payments or related fees are due? (12 USC §4904(a))

8. If the financial institution services residential mortgage transactions, does it return all unearned PMI

premiums to the borrower within 45 days of either termination upon the borrower’s request or automatic

termination under the HOPA? (12 USC §4902(f))

9. If the financial institution acts as servicer for residential mortgage transactions, does it provide borrowers

with written notices of the grounds it relied on (including the results of any appraisal) to deny a

borrower’s request for PMI cancellation, no later than 30 days after the date the request is received, or the

date on which the borrower satisfies any evidence and certification requirements established by the lender,

whichever is later? (12 USC §4904(b)(1) and 12 USC §4904(b)(2)(A))

V–5.10 FDIC Consumer Compliance Examination Manual — September 2015

V. Lending — HOPA

Yes

No

10. If the financial institution acts as servicer for residential mortgage transactions, does it provide borrowers

with written notices of the grounds it relied on (including the results of any appraisal) for refusing to

automatically terminate PMI not later than 30 days after the scheduled termination date? (12 USC

§4904(b)(2)(B))

Note: The scheduled termination date is reached when, based on the initial amortization schedule (in the

case of a fixed rate loan) or the amortization schedule then in effect (in the case of an adjustable rate

loan), the principal balance of the loan is first scheduled to reach 78 percent of the original value of the

mortgaged property, if the borrower is current on that date or the first day of the first month after the date

that the borrower becomes current.

11. If the financial institution acts as a servicer for adjustable rate residential mortgage transactions, does the

financial institution notify borrowers that the cancellation date has been reached? (12 USC

§4903(a)(1)(B)(i))

12. If the financial institution acts as a servicer for adjustable rate residential mortgage transactions, does the

financial institution notify the borrowers on the termination date that PMI has been canceled or that it will

be cancelled on the first day of the first month after the date that the loan becomes current? (12 USC

§4903(a)(1)(B)(ii))

13. If the financial institution requires “Lender Paid Mortgage Insurance” (LPMI) for residential

mortgage transactions, does it provide a written notice to a prospective borrower on or before the

loan commitment date that includes:

a. A statement that LPMI differs from borrower paid mortgage insurance (BPMI) in that the borrower

may not cancel LPMI, while BPMI is subject to cancellation and automatic termination under the

HOPA? (12 USC §4905(c)(1)(A))

b. A statement that LPMI usually results in a mortgage with a higher interest rate than BPMI? (12 USC

§4905(c)(1)(B)(i))

c. A statement that LPMI only terminates when the transaction is refinanced, paid off, or otherwise

terminated? (12 USC §4905(c)(1)(B)(ii))

d. A statement that LPMI and BPMI both have benefits and disadvantages and a generic analysis

reflecting the differing costs and benefits of each over a 10-year period, assuming prevailing interest

and property appreciation rates? (12 USC §4905(c)(1)(C))

e. A statement that LPMI may be tax-deductible for federal income taxes if the borrower itemizes

expenses for that purpose? (12 USC §4905(c)(1)(D))

14. If the lender requires LPMI for residential mortgage transactions, and the financial institution acts as

servicer, does it notify the borrower in writing within 30 days of the termination date that would have

applied if it were a BPMI transaction, that the borrower may wish to review financing options that could

eliminate the requirement for PMI? (12 USC §4905(c)(2))

15. Does the financial institution prohibit borrower paid fees for the disclosures and notifications required

under the HOPA? (12 USC §4906)

FDIC Consumer Compliance Examination Manual — September 2015 V–5.11