Consumer Financial

Protection Bureau

An ofcial publication of the U.S. government

WHAT YOU SHOULD KNOW ABOUT

Home Equity

Lines of Credit

(HELOC)

Borrowing from the

value of your home

How to use the booklet

When you and your lender discuss home equity

lines of credit, often referred to as HELOCs,

you receive a copy of this booklet. It helps you

explore and understand your options when

borrowing against the equity in your home.

You can nd more information from the

Consumer Financial Protection Bureau (CFPB)

about home loans at cfpb.gov/mortgages.

You’ll also nd other mortgage-related CFPB

resources, facts, and tools to help you take

control of your borrowing options.

About the CFPB

The CFPB is a 21st century agency that

implements and enforces federal consumer

nancial law and ensures that markets for

consumer nancial products are fair, transparent,

and competitive.

This pamphlet, titled What you should know about

home equity lines of credit, was created to comply with

federal law pursuant to 15 U.S.C. 1637a(e) and 12 CFR

1026.40(e).

How can this booklet help you?

This booklet can help you decide whether

home equity line of credit is the right choice

for you, and help you shop for the best

available option.

A home equity line of credit (HELOC) is

a loan that allows you to borrow, spend,

and repay as you go, using your home as

collateral.

Typically, you can borrow up to a

specied percentage of your equity.

Equity is the value of your home minus

the amount you owe on your mortgage.

Consider a HELOC if you are condent

you can keep up with the loan

payments. If you fall behind or can’t

repay the loan on schedule, you could

lose your home.

After you nish this booklet:

• You’ll understand the effect of borrowing

against your home

• You’ll think through your borrowing and

nancing options, besides a HELOC

• You’ll see how to shop for your best HELOC

offer

• You’ll see what to do if the economy or your

situation changes

2 HOME EQUITY LINES OF CREDIT COMPARE A HELOC TO OTHER MONEY SOURCES 3

Compare a HELOC to other

money sources

Before you decide to take out a HELOC, it might

make sense to consider other options that might

be available to you, like the ones below.

TIP

Renting your home out to other people may be

prohibited under the terms of your line of credit.

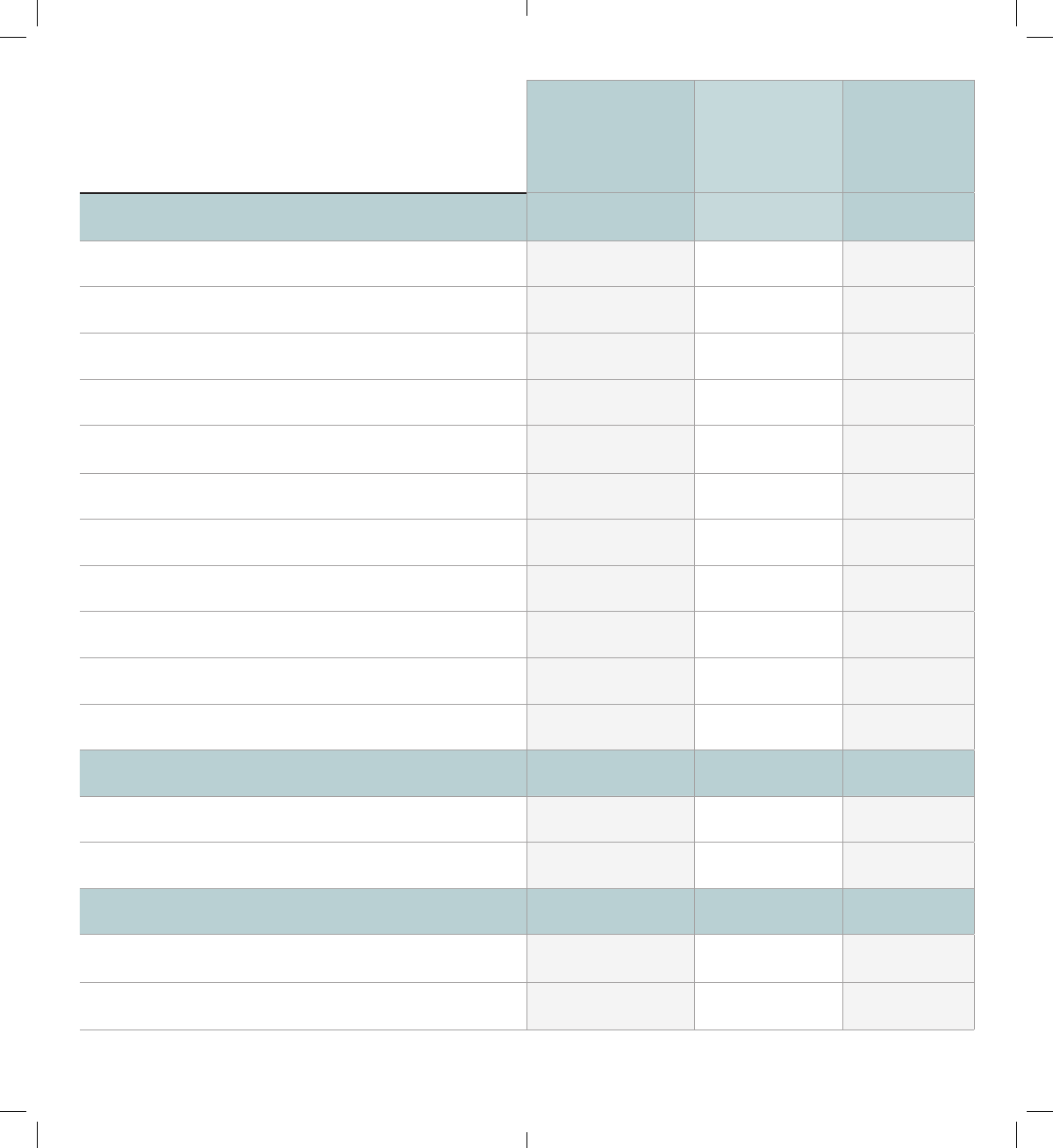

MONEY SOURCE

HOW MUCH CAN YOU

BORROW

VARIABLE

OR FIXED

RATE

IS YOUR

HOME AT

RISK?

TYPICAL

ADVANTAGES

TYPICAL

DISADVANTAGES

HELOC

You borrow against

the equity in your

home

Generally a

percentage of the

appraised value

of your home,

minus the amount

you owe on your

mortgage

Variable.

typically

Yes Continue

repaying and

borrowing for

several years

without additional

approvals or

paperwork

Repayment amount

varies; repayment is

often required when

you sell your home

SECOND

MORTGAGE OR

HOME EQUITY

LOAN

You borrow against

the equity in your

home

Generally a

percentage of the

appraised value

of your home,

minus the amount

you owe on your

mortgage

Fixed Yes Equal payments

that pay off the

entire loan

If you need more

money, you need to

apply for a new loan;

repayment is often

required when you

sell your home

CASH-OUT

REFINANCE

You replace your

existing mortgage

with a bigger

mortgage and take

the difference in cash

Generally a

percentage of the

appraised value

of your home; the

amount of your

existing loan plus

the amount you

want to cash out

Variable

or xed

Yes Continue to make

just one mortgage

payment

Closing costs are

generally higher;

it may take longer

to pay off your

mortgage; interest

rate may be higher

than your current

mortgage

PERSONAL LINE OF

CREDIT

You borrow based on

your credit, without

using your home as

collateral

Up to your

credit limit, as

determined by the

lender

Variable,

typically

No Continue repaying

and borrowing

for several years

without additional

approvals or

paperwork

Solid credit is

required; you may

need to pay the

entire amount due

once a year; higher

interest rate than a

loan that uses your

home as collateral

4 HOME EQUITY LINES OF CREDIT COMPARE A HELOC TO OTHER MONEY SOURCES 5

Compare a HELOC to

other money sources

MONEY SOURCE

HOW MUCH CAN YOU

BORROW

VARIABLE

OR FIXED

RATE

IS YOUR

HOME AT

RISK?

TYPICAL

ADVANTAGES

TYPICAL

DISADVANTAGES

RETIREMENT PLAN

LOAN

You borrow from your

retirement savings

in a 401(k) or similar

plan through your

current employer

Generally, up

to 50% of your

vested balance

or $50,000,

whichever is less

Fixed No Repay through

paycheck

deductions;

paperwork

required but no

credit check and

no impact on your

credit score

If you leave or lose

your job, repay the

whole amount at

that time or pay

taxes and penalties;

spouse may need to

consent

HOME EQUITY

CONVERSION

MORTGAGE (HECM)

You must be age 62

or older, and you

borrow against the

equity in your home

Depends on your

age, the interest

rate on your loan,

and the value of

your home

Fixed or

variable

Yes You don’t make

monthly loan

payments—

instead, you

typically repay the

loan when you

move out, or your

survivors repay it

after you die

The amount you owe

grows over time;

you might not have

any value left in your

home if you want to

leave it to your heirs

CREDIT CARD

You borrow money

from the credit card

company and repay

as you go

Up to the amount

of your credit limit,

as determined by

the credit card

company

Fixed or

variable

No No minimum

purchase;

consumer

protections in the

case of fraud or

lost or stolen card

Higher interest rate

than a loan that

uses your home as

collateral

FRIENDS AND

FAMILY

You borrow money

from someone you

are close to

Agreed on by

the borrower and

lender

Variable,

xed or

other

No Reduced waiting

time, fees, and

paperwork

compared to a

formal loan

Forgiven loans

and unreported or

forgiven interest can

complicate taxes,

especially for large

loans; can jeopardize

important personal

relationships if

something goes

wrong

6 HOME EQUITY LINES OF CREDIT HOW HELOCS WORK 7

How HELOCs work

PREPARE FOR UP-FRONT COSTS

Some lenders waive some or all of the up-front

costs for a HELOC. Others may charge fees. For

example, you might get charged:

• A fee for a property appraisal, which is a formal

estimate of the value of your home

• An application fee, which might not be

refunded if you are turned down

• Closing costs, including fees for attorneys,

title search, mortgage preparation and ling,

property and title insurance, and taxes

PULL MONEY FROM YOUR LINE OF CREDIT

Once approved for a HELOC, you can generally

spend up to your credit limit whenever you want.

When your line of credit is open for spending, you

are in the you are in the borrowing period, also

called the draw period. Typically, you use special

checks or a credit card to draw on your line. Some

plans require you to borrow a minimum amount

each time (for example, $300) or keep a minimum

amount outstanding. Some plans require you to

take an initial amount when the credit line is set up.

MAKE REPAYMENTS DURING THE “DRAW

PERIOD”

Some plans set a minimum monthly payment that

includes a portion of the principal (the amount you

borrow) plus accrued interest. The portion of your

payment that goes toward principal typically does

not repay the principal by the end of the term.

Other plans may allow payment of the interest only,

during the draw period, which means that you pay

nothing toward the principal.

If your plan has a variable interest rate, your

monthly payments may change even if you don’t

draw more money.

ENTER THE “REPAYMENT PERIOD”

Whatever your payment arrangements during the

draw period—whether you pay some, a little, or

none of the principal amount of the loan—when the

draw period ends you enter a repayment period.

Your lender may set a schedule so that you repay

the full amount, often over ten or 15 years.

Or, you may have to pay the entire balance owed,

all at once, which might be a large amount called

a balloon payment. You must be prepared to

make this balloon payment by renancing it with

the lender, getting a loan from another lender, or

some other means. If you are unable to pay the

balloon payment in full, you could lose your home.

RENEW OR CLOSE OUT THE LINE OF CREDIT

At the end of the repayment period, your lender

might encourage you to leave the line of credit

open. This way you don’t have to go through the

cost and expense of a new loan, if you expect to

borrow again. Be sure you understand if annual

maintenance fees or other fees apply, even if you

are not actively using the credit line.

TIP

If you sell your home, you are generally required

to pay off your HELOC in full immediately. If you

are likely to sell your home in the near future,

consider whether or not to pay the up-front costs

of setting up a line of credit.

8 HOME EQUITY LINES OF CREDIT GET THREE HELOC ESTIMATES 9

GET THREE HELOC ESTIMATES

Shopping around lets you compare costs and

features, so you can feel condent you’re making

the best choice for your situation. OFFER A OFFER B OFFER C

Initiating the HELOC

Credit limit

$

First transaction

$

Minimum transaction

$

Minimum balance

$

Fixed annual percentage rate

Variable annual percentage rate

» Index used and current value

» Amount of margin

» Frequency of rate adjustments

» Amount/length of discount rate (if any)

» Interest rate cap and oor

Length of plan

» Draw period

» Repayment period

Initial fees

» Appraisal fee

$

» Application fee

$

10 HOME EQUITY LINES OF CREDIT

My best HELOC offer is:

GET THREE HELOC ESTIMATES

Shopping around lets you compare costs and

features, so you can feel condent you’re making the

best choice for your situation. OFFER A OFFER B OFFER C

» Up-front charges, including points

$

» Early termination fee

$

» Closing costs

During the draw period

» Interest and principal payments

$

» Interest-only payments?

$

» Fully amortizing payments

$

» Annual fee (if applicable)

$

» Transaction fee (if applicable)

$

» Inactivity fee

$

» Prepayment and other penalty fees

$

During the repayment period

» Penalty for overpayments?

» Fully amortizing payment amount?

» Balloon repayment of full balance owed?

» Renewal available?

» Renancing of balance by lender?

» Conversion to xed-term loan?

12 HOME EQUITY LINES OF CREDIT HOW HELOCS WORK 13

How variable interest rates work

Home equity lines of credit typically involve

variable rather than xed interest rates.

A variable interest rate generally has two parts:

the index and the margin.

An index is a measure of interest rates generally

that reects trends in the overall economy

Different lenders use different indexes in their

loans. Common indexes include the U.S. prime

rate and the Constant Maturity Treasury (CMT)

rate. Talk with your lender to nd out more about

the index they use.

The margin is an extra percentage that the lender

adds to the index.

Lenders sometimes offer a temporarily discounted

interest rate for home equity lines—an introductory

or teaser rate that is unusually low for a short

period, such as six months.

Rights and responsibilities

Lenders are required to disclose the terms and

costs of their home equity lines of credit. They

need to tell you:

• Annual percentage rate (APR)

• Information about variable rates

• Payment terms

• Requirements on transactions, such as

minimum draw amounts and number of draws

allowed per year

• Annual fees

• Miscellaneous charges

You usually get these disclosures when

you receive a loan application, and you get

additional disclosures before the line of credit is

opened. In general, the lender cannot charge a

nonrefundable fee as part of your application until

three days after you have received the disclosures.

If the lender changes the terms before the loan is

made, you can decide not to go forward with it,

and the lender must return all fees. There is one

exception: the variable interest rate might change,

and in that case if you decide not to go ahead with

the loan, your fees are not refunded.

Lenders must give you a list of HUD-approved

housing counselors in your area. You can talk

to counselor about how HELOCs work and get

free or low-cost help with budgeting and money

management.

Right to cancel (also called right to rescind)

If you change your mind for any reason, under

federal law, you can cancel the credit line in the

rst three days. Notify the lender in writing within

the rst three days after the account was opened.

The lender must then cancel the loan and return

the fees you paid, including application and

appraisal fees.

TIP

Some HELOCs let you convert some of your

balance to a xed interest rate. The xed interest

rate is typically higher than the variable rate, but

it means more predictable payments.

14 HOME EQUITY LINES OF CREDIT HOW HELOCS WORK 15

If something changes during

the course of the loan

HELOCs generally permit the lender to freeze or

reduce your credit line if the value of your home

falls or if they see a change for the worse in your

nancial situation. If this happens, you can:

• Talk with your lender. Find out the reason

for the freeze or reduction. You might need

to check your credit reports for errors that

might have caused a downgrade in your

credit. Or, you might need to talk with your

lender about a new appraisal on your home

and make sure the lender agrees to accept a

new appraisal as valid.

• Shop for another line of credit. If another

lender offers you a line of credit, you may be

able to use that to pay off your original line

of credit. Application fees and other fees

may apply for the new loan.

WELL DONE!

For most people, a home is their most

valuable asset. A HELOC can help you

make the most of this asset, when you

understand the ins and outs and know

what to expect.

In this booklet:

ASK YOURSELF

Have I considered other sources of money

and loans, besides a HELOC?

Have I shopped around for HELOC features

and fees?

Am I comfortable with the worst-case

scenario, where I could lose my home?

ONLINE TOOLS

CFPB website

cfpb.gov

Answers to common questions

cfpb.gov/askcfpb

Tools and resources for home buyers

cfpb.gov/owning-a-home

Talk to a HUD-approved housing counselor

cfpb.gov/nd-a-housing-counselor

Submit a complaint

cfpb.gov/complaint

Last updated 08/22