Canadian consumer debt reached $2.4 trillion, according to Equifax

®

Canada’s most recent Market Pulse consumer credit trends and insights

report. Despite a sluggish mortgage market, non-mortgage debt showed

a seasonal rise in the second quarter of 2023, with credit card balances

reaching an all-time high of $107.4 billion. Against the backdrop of rising

interest rates, credit card spending growth showed signs of slowing.

“Canadians are demonstrating a shift in their spending habits due to the current

economic volatility,” explained Rebecca Oakes, Vice-President of Advanced Analytics

at Equifax Canada. “With various factors at play, individuals and households are

actively adapting their nancial strategies to navigate this dynamic landscape.”

Non-mortgage debt continued to grow in Q2 2023, largely due to substantial growth

in credit card balances and a notable increase in debt among subprime and deep

subprime consumers. While record-high credit card balances played a key role, the

average non-mortgage debt per credit-active consumer only saw a marginal uptick

to $21,131. This increase was masked by the inux of new credit users in Canada who

have much lower debt levels when they rst become credit active. The number of

credit active consumers with less than 24 months of credit activity went up by

37.1 per cent while their average non-mortgage debt went down by 10.2 per cent

when compared to Q2 2022. In contrast, consumers with a credit history exceeding

two years had an average non-mortgage debt of $22,710, up 1.9 per cent. Mortgage

debt showed a modest one per cent increase from Q1 to Q2 2023. Additionally, new

credit card originations surpassed 1.5 million in Q2 2023, with an average credit limit

near $6,000 for new cards, signaling evolving trends in consumer nance.

- 2 -

- 3 -

Demand for credit slowing as cost

of borrowing rises

Balance growth & rising borrowing costs showed signs of impacting demand for many

credit products in the second quarter. Minimum monthly payments for credit card

and unsecured line of credit increased 11.7 per cent and 18.3 per cent, respectively,

compared to last year. HELOC holders also saw their payments rise by over $200.

Consumers purchasing a new vehicle in 2023 are experiencing much higher monthly

payments. Average monthly payments on new car and used car loans are up by over

$100 when compared to 12 months ago.

“Consumers are becoming more prudent with their credit related decisions,” said Oakes.

“We’ve seen consumers shopping around more for the best mortgage deal at point

of renewal and some switching to alternative credit products which may be lower

rate to cover the costs of large purchases”

Credit card spending has been consistently growing since the end of 2021 and is

nally starting to slow, partly due to ination drops and partly due to rising nancial

pressure from high interest rate credit products. Average monthly credit card spend

per credit card consumer increased by 3.7 per cent in Q2 2023 as compared to

22.7 per cent in Q2 2022.

“The slowdown in credit card spend seems to be more prominent among mortgage

holders and higher-income segments,” said Oakes. “They may have more exibility

to scale back on discretionary spending to meet their increased credit payment

obligations. However, it’s a dierent story for lower-income households, who are

grappling with rising costs and may nd it challenging to curb their spending.

The divide becomes apparent when we consider savings — those with higher savings

can redirect funds to cover xed expenses like mortgages and auto loans while

tightening the reins on variable expenses like credit card spending. Meanwhile,

consumers with depleting savings are facing an uphill battle, resulting in a continued

uptick in credit card debt.”

Fewer consumers were able to pay their credit card balance in full each month

during the second quarter, with close to 500K more active credit card users not

paying their balances in full as of June 2023 when compared to 12 months ago.

Average monthly credit card spending rose 8.4 per cent for revolvers (those who

don’t pay o their balance in full each month) and 2.4 per cent for transactors

(those who do pay o their balance in full each month), while credit card payment

rates showed signs of decline. Average credit card balances per credit card

consumer have risen by 9 per cent, with the largest increase seen in lower credit

score segments, up 13.7 per cent year-over-year.

“Consumers are becoming more prudent

with their credit related decisions.”

Rebecca Oakes

Vice-President of Advanced Analytics,

Equifax Canada

- 4 -

New trend in delinquencies

Oakes also points to an intriguing trend as credit card debt continues to mount — the

frequency of missed credit card payments is not surging as rapidly as anticipated.

This trend can largely be attributed to a signicant inux of new credit card users,

especially those who are new to credit, which conceals the true extent of credit card

payment delinquencies. Despite a 19.8 per cent year-over-year increase in 90+ days

balance delinquencies for credit cards, it’s worth noting that they still stand 14.6 per cent

below Q2 2019 levels, indicating that missed payments are not escalating as swiftly

as expected.

Conversely, the auto loan sector tells a dierent story, with delinquencies surpassing

2019 levels, driven less by the inux of new credit users. While non-bank auto lenders

maintain relatively low delinquency rates, there is a noticeable uptick in arrears among

consumers with used cars. Additionally, nancial products with variable interest rates,

such as unsecured lines of credit and home equity lines of credit (HELOCs), are

experiencing a faster rise in delinquencies year-over-year. The 30+ days balance

delinquency rate for unsecured lines of credit signicantly exceeded Q2 2019 levels,

and early delinquencies in HELOCs are approaching pre-pandemic levels. Overall,

the evolving credit landscape reects a concerning increase in consumers missing

at least one payment as of Q2 2023 compared to Q2 2022, with a pronounced

concentration of arrears among accounts opened during the period of historically

low interest rates in 2020-2021. These credit users from that timeframe are grappling

with higher rates of missed payments.

- 5 -

Biggest impact of rates have been on

the mortgage market

The impact of recent interest rate hikes on the mortgage market is evident. An increase

of 475 basis points in interest rates over just 10 increments initially slowed mortgage

originations towards the end of 2022. However, in Q2 2023, there has been a resurgence

in new mortgages, driven by higher home sales. The brief dip in home prices has

rebounded, as seen in the increased average loan amount for new mortgages compared

to the previous quarter.

Interest rate hikes aren’t conned to new originations; they’re also aecting existing

mortgage holders. The burden of high monthly mortgage costs has made many

nancially vulnerable, leading to a rise in mortgage delinquencies, especially in

provinces like Ontario and B.C. In these regions, delinquencies have spiked by

86.9 per cent and 33.9 per cent year-over-year, respectively.

“Factors such as substantial house price increases, larger loan amounts, a higher

proportion of variable-rate mortgages, and the elevated cost of living have contributed

to the delinquency rise,” said Oakes. “Additionally, payment shocks for newly renewed

mortgages and upcoming renewals are poised to impact consumer nances, particularly

for those facing mortgage terms that extend beyond their expected retirement age,

leaving them with limited options for reducing monthly payment costs.”

Equifax oers a range of innovative solutions that can help clients make more informed

and condent credit risk decisions, and use predictive data to help retain mortgage

clients in the current economic climate.

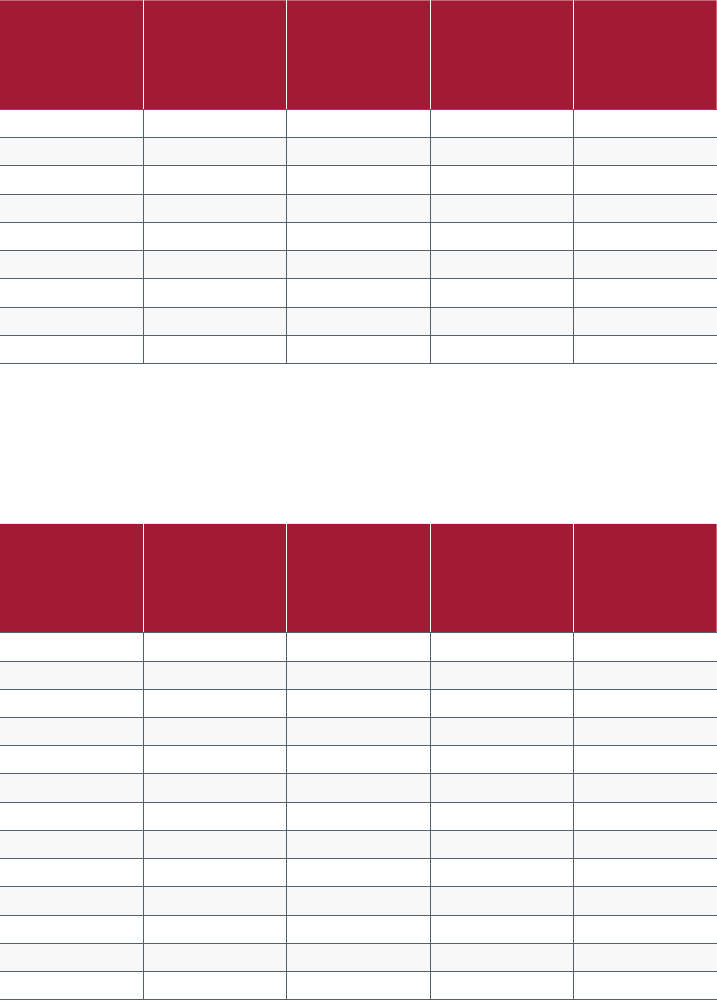

Age Group Analysis

Debt & Delinquency Rates (excluding mortgages)

Age Average Debt

(Q2 2023)

Average Debt

Change

Year-over-Year

(Q2 2023 vs.

Q2 2022)

Delinquency

Rate ($)

(Q2 2023)

Delinquency

Rate ($) Change

Year-over-Year

(Q2 2023 vs.

Q2 2022)

18-25 $7,820 -3.11% 1.64% 18.73%

26-35 $17,123 0.09% 1.64% 28.47%

36-45 $26,136 1.69% 1.28% 31.93%

46-55 $32,772 1.92% 0.95% 32.08%

56-65 $26,844 0.72% 0.85% 30.06%

65+ $14,313 -2.03% 0.95% 23.11%

Canada $21,131 0.01% 1.13% 29.45%

“Factors such as

substantial house

price increases,

larger loan amounts,

a higher proportion

of variable-rate

mortgages, and the

elevated cost of living

have contributed to

the delinquency rise.”

Rebecca Oakes

Vice-President of Advanced Analytics,

Equifax Canada

- 6 -

Major City Analysis

Debt & Delinquency Rates (excluding mortgages)

City Average Debt

(Q2 2023)

Average Debt

Change

Year-over-Year

(Q2 2023 vs.

Q2 2022)

Delinquency

Rate ($)

(Q2 2023)

Delinquency

Rate ($) Change

Year-over-Year

(Q2 2023 vs.

Q2 2022)

Calgary $24,143 -3.09% 1.31% 17.75%

Edmonton $23,732 -2.51% 1.65% 21.85%

Halifax $20,828 -0.77% 1.24% 30.41%

Montreal $16,442 0.12% 1.00% 32.76%

Ottawa $19,142 1.31% 1.04% 32.77%

Toronto $20,067 -1.4 4% 1.46% 40.04%

Vancouver $22,282 -2.10% 0.91% 39.39%

St. John’s $23,423 -1.07% 1.34% 24.56%

Fort McMurray $37, 5 49 -0.24% 1.94% 29.68%

Province Analysis

Debt & Delinquency Rates (excluding mortgages)

Province Average Debt

(Q2 2023)

Average Debt

Change

Year-over-Year

(Q2 2023 vs.

Q2 2022)

Delinquency

Rate ($)

(Q2 2023)

Delinquency

Rate ($) Change

Year-over-Year

(Q2 2023 vs.

Q2 2022)

Ontario $21,593 0.88% 1.14% 37.33%

Quebec $18,518 0.48% 0.78% 30.74%

Nova Scotia $20,613 -0.43% 1.43% 25.21%

New Brunswick $21,861 -0.12% 1.40% 15.75%

PEI $22,356 0.53% 0.98% 20.22%

Newfoundland $22,980 0.31% 1.39% 21.24%

Eastern Region $21,615 -0.12% 1.38% 20.84%

Alberta $24,439 -2.46% 1.48% 18.18%

Manitoba $17,0 47 0.54% 1.45% 25.91%

Saskatchewan $22,302 -1.24% 1.43% 13.35%

British Columbia $21,765 -0.80% 1.03% 34.16%

Western Region $22,293 -1.35% 1.28% 23.47%

Canada $21,131 0.01% 1.13% 29.45%

* Based on Equifax data for Q2 2023

How Equifax can help reduce risk and grow your business

We oer specialized products and solutions to help you gain insights on markets,

acquire more customers and process credit applications. Our unmatched data assets

and innovation help you nd the best customers and smartly grow your customer base.

Sign up to get the latest quarterly consumer trends and economic insights.

Contact your Equifax Account Representative to learn more

1.855.233.9226

solutions.ca@equifax.com

consumer.equifax.ca/business/contact-us/

Let’s stay connected

About Equifax

At Equifax (NYSE: EFX), we believe knowledge drives progress. As a global data, analytics,

and technology company, we play an essential role in the global economy by helping

nancial institutions, companies, employers, and government agencies make critical

decisions with greater condence. Our unique blend of dierentiated data, analytics,

and cloud technology drives insights to power decisions to move people forward.

Headquartered in Atlanta and supported by more than 13,000 employees worldwide,

Equifax operates or has investments in 24 countries in North America, Central and

South America, Europe, and the Asia Pacic region. For more information, visit Equifax.ca.

© Equifax Canada Co., 2023. All rights reserved. Equifax and the Equifax marks used herein are trademarks of Equifax Inc.

Other product and company names mentioned herein are the property of their respective owners.

This report is for informational purposes only and is not legal advice and should not be used, or interpreted, as legal advice.

The information is provided as is without any representation, warranty or guarantee of any kind, whether express or implied.

Equifax Canada will not under any circumstances be liable to you or to any other person for any loss or damage arising from,

connected with, or relating to the use of this information by you or any other person. Users of this information should consult

with their own lawyer for legal advice.