lnstitute for Fiscal Studies

Quantitative easing,

monetary policy

im

plementation and

the public finances

IFS Report R223

Paul Tucker

IFS Green Budget 2022

1

7. Quantitative easing,

monetary policy

implementation and the

public finances

Paul Tucker (Harvard Kennedy School)

1

,

2

Key findings

1. Now that interest rates are rising, the interaction of quantitative easing (QE) with

the Bank of England’s current methods for implementing monetary policy will

add to strains on the public finances. These could, and arguably should, have been

avoided by prompt, forward-looking action from around 2019 when the materiality of

the risk became apparent (Section 7.2 of main text). As of now, however, there are no

easy options.

2. The crux is that QE creates money that goes onto banks’ balances (reserves) at the

Bank of England, and those reserves are being fully remunerated at the central bank’s

policy rate (Bank Rate). Given the outstanding stock of QE (£838 billion), that has

effectively shifted a large fraction of UK government debt from fixed-rate

borrowing (where debt-servicing costs are ‘locked in’) to floating-rate borrowing

1

Sir Paul Tucker is a research fellow at the Harvard Kennedy School’s Mossavar-Rahmani Center for Business and

Government; is author of Global Discord (Princeton University Press, November 2022) and Unelected Power

(Princeton University Press, 2018); is President of the National Institute of Economic and Social Research; and is a

former central banker who, among other things, worked at various times on monetary policy, monetary operations,

government debt management and prudential policy.

2

With special thanks to Ben Zaranko (IFS) for active assistance and comments. Thanks also to Carl Emmerson and

Paul Johnson (both IFS), who usefully pressed the importance of clarifying various things for readers outside the

monetary policy community; to Steve Cecchetti for comments on an early draft; to my former central banking

colleagues Peter Andrews and Roger Clews, with whom I worked on debt management strategy and reforming

debt-management operations during the mid 1990s, and on overhauling the Bank of England’s monetary operations

then and, again, in the mid 2000s; to David Aikman, Paul Mizen and John Vickers for exchanges on the section on

banks; to Stefanie Stantcheva, Jeremy Stein and Larry Summers for exchanges on public-finance economics; and

to Charlie Bean and Mervyn King for going through a near-final draft.

The Institute for Fiscal Studies, October 2022

Quantitative easing, monetary policy implementation and the public finances

2

(where debt-servicing costs rise and fall with Bank Rate). Increases in Bank Rate

therefore lead immediately to higher debt-servicing costs for the government,

leaving the British state with a large risk exposure to rising interest rates. That

exposure is not technically necessary to operate monetary policy effectively, so the

predicament was not unavoidable.

3. Stepping back, it is a long-standing principle of the UK’s macro-finance framework that

government debt management should not impair the effectiveness of the Bank of

England’s monetary policy. It would be sensible to add a new precept: that when, in

terms of the objectives for monetary-system stability, the Bank of England is indifferent

between options for how to implement its monetary policy decisions, it should opt for

methods that interfere least with government choices about the structure of the

public debt.

4. That high-level principle points towards the Bank reforming the way it operates

its system of reserves. In particular, change would be warranted for how the regime

operates in circumstances where, because the Bank is conducting QE, the banks

cannot choose the level of reserves each wants to hold, but the extra reserves do not

squeeze out their investing in other assets. Under those conditions, the principle

implies that the Bank should not remunerate the totality of reserves at Bank Rate but

only an amount necessary to establish its policy rate in the money markets. In other

words, taken on its own, the principle supports the Bank moving to a system of

tiered remuneration for reserves balances, combining no (or low) remuneration for

some large portion of reserves with a so-called corridor system acting on marginal

reserves to establish the Bank’s policy rate in the money markets (explained in

Sections 7.4 and 7.5).

5. Such a change would have considerable benefits for the public purse. Given the Bank

currently holds around £800 billion of gilts, Britain’s debt-servicing costs are highly

sensitive to even small changes in the path of Bank Rate (Section 7.3). Taking

current (6 October) market expectations for a substantial rise in Bank Rate

together with the Bank’s current published plans for unwinding QE, the implied

savings would be between around £30 billion and £45 billion over each of the

next two financial years. These are big numbers, and would of course be even bigger

if the Bank does not actively unwind QE via asset sales but lets it roll off as bonds

mature.

6. Assuming the Bank does go ahead with asset sales, the projected savings from

moving to a tiered-reserves regime amount to approximately 1.6% of GDP in

2023–24 and 1.2% in 2024–25 (using Chapter 2’s Citi forecasts). They would,

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

3

therefore, reduce prospective annual debt-servicing costs from around 3.9% to around

2.3% of forecast GDP in the first year, and from around 2.7% to 1.5% in the second

(using Chapter 3’s IFS forecasts). Put another way, if not implemented, the forgone

annual saving of (on average) £37 billion over the next few years would be equivalent

to around 9% of recent annual spending on health, education and defence.

7. What might seem at first sight like an obvious easy-win reform needs, however,

to be balanced against a number of other important considerations. They concern

the effects of bank taxes on allocative efficiency, and on credit conditions (Section 7.6);

and, separately, central bank credibility (Section 7.7).

8. The first and second of those arise because the counterpart to the state’s debt-

interest savings would be lower interest payments from the Bank to the banking

industry on its reserves balances. This could be regarded as a tax on banking and

one, moreover, that might depart from standard public-finance-economics prescriptions

on the tax system not distorting incentives and being stable over time. The broad point

– and the key high-level trade-off – is that in deciding whether to ask the Bank to

consider moving to a tiered-reserves system, the government would have to balance,

on the one hand, suboptimal taxes being imposed today (to avoid the higher borrowing

brought about by a suboptimal debt structure) and, on the other hand, accepting higher

borrowing today (to avoid imposing inefficient taxes) and accepting the prospect of

having in the future to impose higher taxes (on incomes and consumption) and/or cut

the provision of public services. Broadly, this pitches microeconomic considerations

against macroeconomic ones.

9. The standard prescription would be to accept the latter course: do not introduce

inefficient taxes when better solutions can be applied over time to the macro problem.

The better choice might, however, be affected by whether, in current and prospective

circumstances, government might have to pay a default-risk premium on bond-market

borrowing unless it cuts the near-term deficit; and by whether more broad-based tax

increases and/or cuts in public services are politically infeasible or socially undesirable.

10. There is also a question of whether a tiered-reserves scheme is best regarded as

introducing a tax on banking intermediation or, alternatively, as withdrawing a

transfer to banks’ equity holders and managers; crudely, a distinction between

banking and bankers. If competitive conditions in banking are such that, as Bank

Rate rises, the benefits of fully remunerated reserves would be passed on to neither

depositors nor borrowers, but instead would go straight into banks’ profits, then

perhaps full remuneration of reserves is better regarded as a transfer. But even if UK

banking were uncompetitive (on which we do not take a view), it does not follow that

The Institute for Fiscal Studies, October 2022

Quantitative easing, monetary policy implementation and the public finances

4

there would be no (or only small) pass-through of higher Bank Rate to banks’

customers.

11. Quite apart from government needing to weigh allocative efficiency in the economy

against its debt burden, the Bank of England would separately need to form its

own view on whether withdrawing a flow of income from reserves would hurt the

resilience of the banking system; and also whether the macroeconomic effects

of any tightening in loan conditions could be offset by monetary policy.

12. In addition, the authorities would need to weigh some political economy risks.

One is the possibility that unremunerated reserves would make QE an attractive

source of funding for government, which might warrant higher hurdles in the

way of routine monetary financing. Another is that changes in the reserves regime

might dent perceptions that the Bank’s operating framework will be stable over time, so

any new regime needs to be designed to work well in many different states of the

world.

13. Given the need to balance many different considerations, and given the Bank has

private information on the state and choices of the banks, this chapter falls short of

recommending that the reserves regime be changed right now. But nor does it rule out

early reforms. It is clear, moreover, that, unless the Treasury objects on tax-

efficiency grounds, the Bank should set out how it will operate a reformed

system in future. The prospect of the current predicament recurring is not

hypothetical. Given many current estimates of the equilibrium global real rate of

interest are close to zero, the lower bound for the UK’s Bank Rate is likely to bite, and

so QE be deployed, much more frequently than when the UK’s current monetary policy

regime was established.

14. Finally, the broad principle discussed above – that the Bank should, where consistent

with its mandate, adopt methods of monetary policy implementation that interfere least

with public debt management – might be thought also to have some bearing on

how the Monetary Policy Committee (MPC) chooses to tighten monetary

conditions to get control of inflation. Specifically, if the authorities believe gilt yields

currently incorporate a default-risk premium but that it will unwind, it might be argued

that, on debt-management grounds, the MPC should defer selling gilts (quantitative

tightening, or QT) in order to avoid the state paying the risk premium for the residual

term of the sold bonds, instead relying entirely on raising Bank Rate to deliver its price

stability objective. We believe, however, that the better conclusion is that if the

authorities did want to avoid locking in such costs, any adjustment in the pattern

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

5

of government funding should come in the maturity structure of new issuance

by the UK’s Debt Management Office.

15. That being so, it is important that the significance of this chapter’s central dilemma –

between the debt burden and allocative efficiency – would be reduced by early QT

sales, since they would shrink the quantum of reserves held by banks with the Bank

(whether or not the reserves scheme is reformed).

16. In conclusion, if, as argued here, the Bank’s monetary techniques have distorted the

British state’s debt structure in unfortunate ways, it matters that the simplest remedy

might introduce tax-induced distortions to the allocation of resources. Balancing those

conflicting considerations in current circumstances is a weighty matter for

government. This chapter aims to frame the debate. If, having balanced the different

considerations, the government were to ask the Bank to consider whether reforms

could be introduced without compromising monetary policy, we believe the Bank would

need carefully to analyse, and consult on, the implications for price and financial

stability. But subject to the government exercising a veto on inefficient-tax grounds, we

are not ruling out reforms to the reserves regime for periods when QE is being

deployed.

7.1 Introduction

There has been growing concern about the effect on the public finances of the government

having effectively borrowed at a floating rate of interest, which will increase, possibly sharply,

as the Bank of England tries to bring inflation under control. Higher debt-servicing costs would

increase government borrowing, and would imply, eventually, some combination of higher taxes

and lower spending on public services and other things. This predicament is a complicated

product of low equilibrium market interest rates, the authorities’ resorting to quantitative easing

(QE) as a substitute for interest rate cuts at the zero lower bound, and central banks paying

interest on banks’ reserves. That cocktail of technicalities needs some slow-motion unpacking in

order to expose the nature of the problem and the pros and cons of various possible solutions.

This chapter aims to do that.

To begin with a sweeping summary, we can say the following. When a central bank purchases

government bonds, it leaves the size of the state’s consolidated balance sheet (see annex for

definitions) unchanged, but alters the composition of its liabilities. When the central bank pays

interest on the money it created to buy those bonds, it changes the profile of interest payments

on the state’s consolidated debt, which might turn out to be costly, cheap or neither. There are

The Institute for Fiscal Studies, October 2022

Quantitative easing, monetary policy implementation and the public finances

6

good reasons to think that UK government debt-servicing costs will be much higher than they

otherwise could have been, plausibly running into many tens of billions of pounds.

3

While this

has become more obvious since the Bank of England’s policy rate started rising, the risk existed

even during the period when QE was running a profit (because the policy rate was very close to

zero). Proposals for reform have included the Bank of England stopping paying interest on

banks’ reserves, and government partially hedging the exposure. In order to explain what is

going on, it is necessary to look at the mechanics and economics of how QE interacts with

public debt management, the economics of various options for attenuating the link, and some of

the background political economy dilemmas.

From a macroeconomic-policy perspective, a lesson that emerges for the future is that when a

central bank’s monetary policy significantly employs QE, it should not remunerate all the

reserves held by the private sector but only whatever fraction of reserves needs to be

remunerated to establish its policy rate in the short-term money markets. Even if there were

reasons to hold back from immediate reform, this implies reforming the Bank’s operating regime

after the current stock of QE has unwound but before QE is employed again. But a series of

microeconomic policy considerations, belonging more to the Treasury than the Bank, also need

to be weighed. So the issue is not straightforward, but it is big – because the implications for

government borrowing are big.

The chapter begins with how the risk exposure in the public finances has arisen and in what

circumstances it matters (Section 7.2), followed by a range of estimates of the exposure’s

quantitative significance (Section 7.3). It goes on to explain why central banks moved to paying

interest on reserves (Section 7.4), and whether the current set-up is the only one that can

reconcile quantitative easing with control over short-term interest rates (to jump ahead: no). It

then outlines, for purposes of exposition rather than recommendation, how monetary policy

might operate if interest were not paid on the bulk of reserves (Section 7.5). Having explained

the obvious attractions of reforming the Bank’s reserves regime, the chapter turns to

microeconomic considerations, setting out some that would need to be carefully weighed against

any more macro benefits to the public purse. These concern the effect of taxing banking on the

efficient allocation of resources, and on pass-through to customer loan and deposit rates (Section

7.6); and, separately, central bank credibility (Section 7.7). Before concluding, two alternative

strategies are briefly noted: hedging part of the exposure, and the Bank relying on selling off its

gilt portfolio, rather than increasing its policy rate, when it wishes to tighten monetary

3

This risk exposure was highlighted in evidence to the House of Lords Economic Affairs Committee hearings on

QE by Philip Aldrick and by Paul Tucker on 2 February 2021, and was picked up in the evidence of Charles

Goodhart and Adair Turner on 16 March 2021 (https://committees.parliament.uk/work/993/quantitative-

easing/publications/oral-evidence/). It is discussed in paragraph 141 of the committee’s report

(https://committees.parliament.uk/publications/6725/documents/71894/default/) and, later, in the July 2021 fiscal

risks report of the Office for Budget Responsibility (2021b).

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

7

conditions (Section 7.8). After recapping how its main findings relate to public risk management

and accountability, the chapter draws to a close by suggesting a new principle to help guide the

interaction of monetary policy and public debt management.

7.2 Central banking and the public finances:

qualitative analysis

Central banks’ financial operations affect their countries’ public finances in a very direct way. A

central bank is a machine for issuing the money that is the final settlement asset in a monetary

economy – known to economists as base money (see annex). It alters the amount of this money

circulating in the economy via financial operations of various kinds. Those operations change

the structure and/or size of the state’s consolidated balance sheet.

If a central bank buys only government paper, the structure of the state’s consolidated liabilities

is altered, but its size is left unchanged because one organ of the state (the central bank) has

bought the liabilities of another (central government). Monetary liabilities are substituted for

government’s longer-term debt obligations. If, by contrast, the central bank purchases private

sector paper or lends secured or unsecured to the private sector, the size of the state’s

consolidated balance sheet increases, with monetary liabilities being added to the government’s

outstanding debt, and in addition the risk structure of the state’s consolidated asset portfolio

shifts.

4

In each case, it matters whether the central bank pays any interest on its monetary liabilities, and

at what rate of interest. For around 20 years (as explained in Section 7.4), the main central banks

have paid interest at or close to their policy rate on reserves balances held by banks; the Bank of

England pays its policy rate, known as Bank Rate (defined in the annex, and shown for the

period since Bank of England independence in Figure 7.1). In consequence, when the central

bank purchases government bonds – via what is known as quantitative easing or QE – there is an

effect on the public finances. Whatever its utility for monetary policy (not discussed here), the

combination of QE and interest-on-reserves is roughly equivalent, for the public finances, to the

Treasury department entering into a debt swap with the private sector via which fixed-rate

government debt is swapped for floating-rate obligations. This means that rather than locking in

the rate of interest it pays to borrow, the state pays a rate of interest that is reset each time –

4

Some of the Bank of England’s recent facilities have done this; notably, the Term Funding Scheme (TFS), under

which there is currently nearly £200 billion of loans (with an original term of four years) outstanding. The TFS

does inject additional reserves. But because TFS loans are charged Bank Rate (plus a premium), the interest-rate

structure of the state’s consolidated debt is not affected. (The state does take credit risk under this and various other

schemes and facilities introduced during COVID and in response to the energy price shock.)

The Institute for Fiscal Studies, October 2022

Quantitative easing, monetary policy implementation and the public finances

8

roughly every six weeks – the Bank of England decides its policy rate, and so goes up or down

when Bank Rate goes up or down.

For the UK, so long as the state’s sovereign creditworthiness is not in question, the implications

for the public finances of long-lived QE are most easily examined in terms of the state’s

expected and realised debt-servicing costs (i.e. ex ante and ex post) rather than any volatility in

the mark-to-market value of the QE gilt portfolio.

5

The state is not liquidity constrained – not

least because the Bank can create money provided it maintains credibility for low and stable

inflation – so the state can finance itself through any nasty volatility in the value of its asset

portfolio.

6

Until and unless QE is unwound by selling bonds (Section 7.8), the state’s notional

mark-to-market gains and losses are typically not realised because, ordinarily, government does

not trade in its own debt or buy back bonds before maturity.

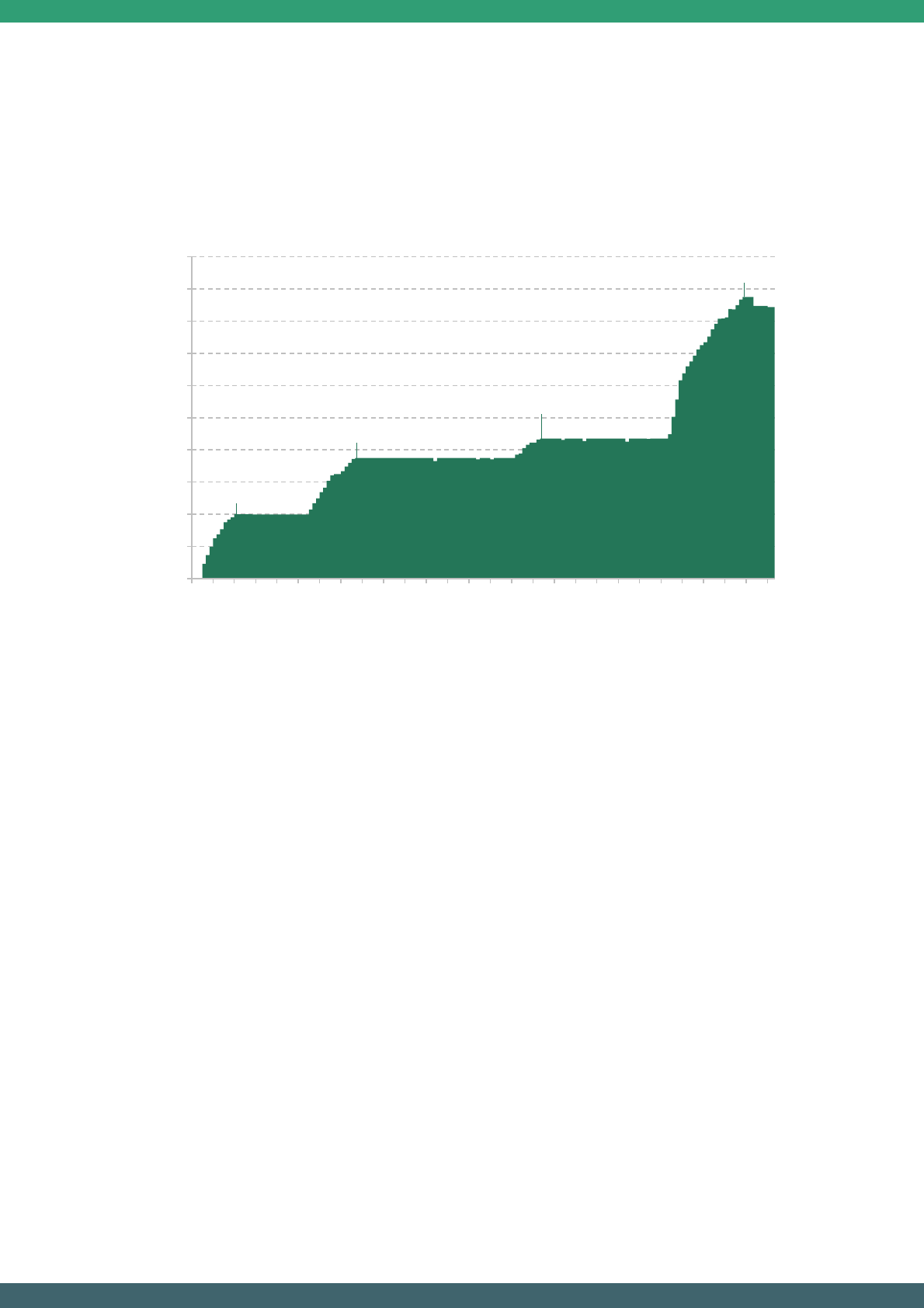

Figure 7.1. Bank Rate since Bank of England independence

8

7

6

5

Per cent

4

3

2

1

0

May 97

May 98

May 99

May 00

May 01

May 02

May 03

May 04

May 05

May 06

May 07

May 08

May 09

May 10

May 11

May 12

May 13

May 14

May 15

May 16

May 17

May 18

May 19

May 20

May 21

May 22

Source: Bank of England.

5

Had QE been short-lived, with all bonds sold before they matured, that would not be so. Instead, any capital losses

on its succeeding in helping to revive the economy would, in those circumstances, have had to be weighed in the

balance against the broader welfare benefits (including via higher taxes and lower welfare spending) of the

economic recovery that was driving up yields. It remains the case that the Bank enjoying a cash-flow profit (loss)

in the first years of a gilt holding is something neither to celebrate nor bemoan as it might be offset over the

remaining period of the holding. It is the profit/loss up to the point of maturity or sale that matters to evaluating the

effects on the public finances (see Section 7.3).

6

The conditions under which this can be consistent with maintaining central bank independence, and so anchored

inflation expectations, lie beyond the scope of this chapter.

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

9

While this can be obscured by the complex arrangements between the Bank and HM

Government (HMG) for conducting QE – involving an Asset Purchase Facility (APF) booked to

a special purpose vehicle, an indemnity and other things (Box 7.1) – what matters to taxpayers is

the position where Bank–HMG transfers are netted out, leaving only the state’s net transactions

with the market. By introducing a couple of simplifications, this becomes clear. If we assume

that the Bank holds the gilts it buys until maturity and that it buys new gilts at the yield at which

they were issued into the market (a reasonable approximation for 2020–21),

7

the financial effect

of QE on the state’s ex post debt-servicing costs – positive or negative – is simply equal to the

Bank’s cumulative profit or loss from buying and holding a long-term bond and financing it by

borrowing at Bank Rate. If, therefore, over the life of the bond, Bank Rate averages the yield at

which the bond was issued (and purchased), QE does not materially affect the public finances. If

Bank Rate is on average higher than that yield, the Bank makes a loss, which it passes on to the

Treasury, and so the state would have financed itself more cheaply if the Bank had not bought

the bond. Conversely, the state saves money if Bank Rate averages below the yield on the bond.

8

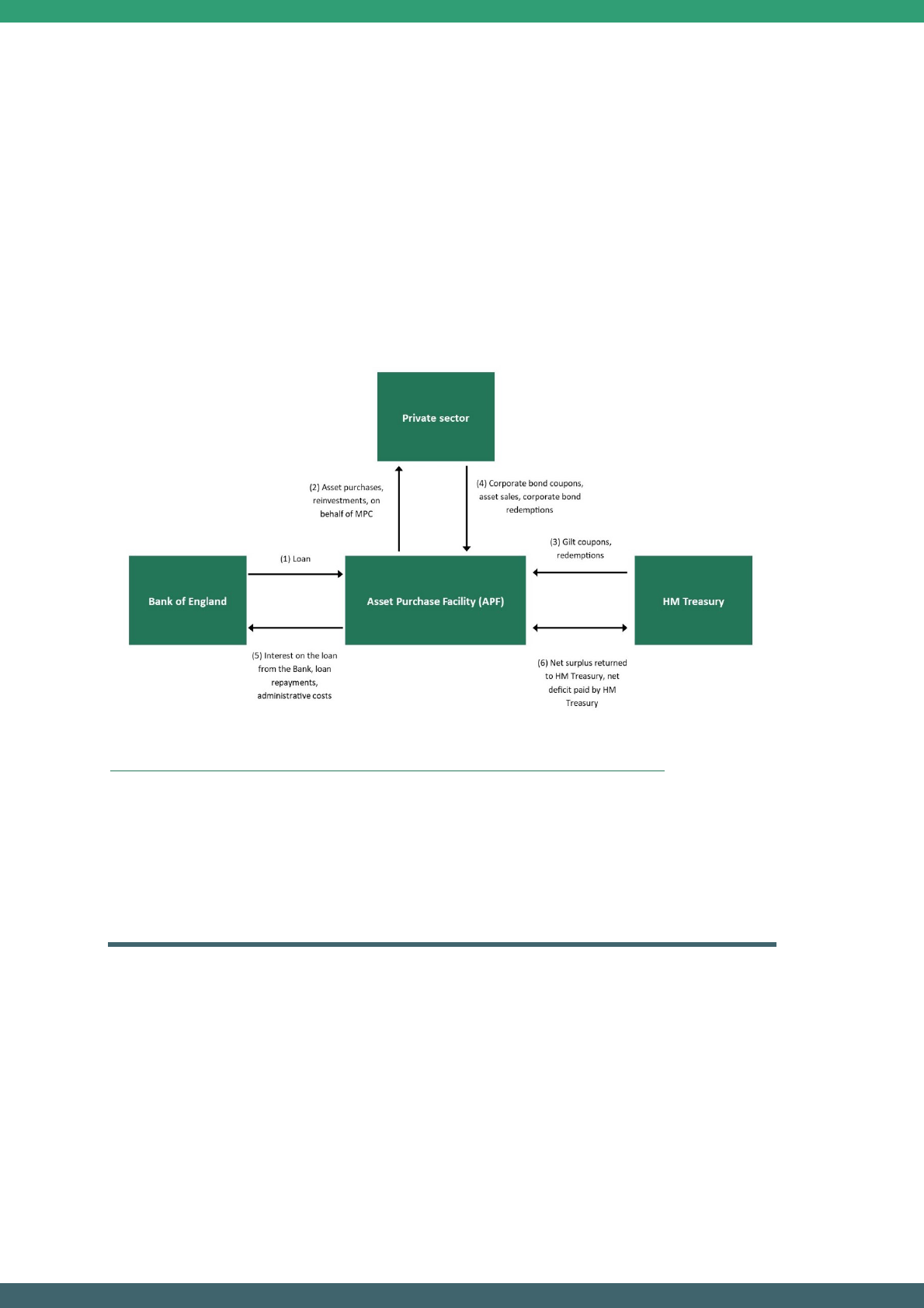

Box 7.1. The Asset Purchase Facility vehicle

The Bank of England implements QE via a special purpose vehicle called the Bank of England Asset

Purchase Facility Fund Limited (APFF Ltd). The company is a fully-owned subsidiary of the Bank.

When the vehicle purchases gilts, it finances the purchases by borrowing from the Bank’s Banking

Department, which charges a rate of interest set at Bank Rate. The reserves created are liabilities of

Banking Department. So in double-entry bookkeeping terms, Banking Department’s liabilities increase

by the amount of reserves created and held by banks, and its assets increase by a loan to APFF Ltd of

exactly that amount. Both liabilities and assets pay Bank Rate, so Banking Department has no interest-

rate exposure.

Meanwhile, APFF Ltd has a debt liability to Banking Department costing Bank Rate, and assets

comprising the gilts bought as part of the QE operations. The APFF Ltd therefore has an exposure to

interest rate risk: it has borrowed at a floating rate, and invested in a portfolio of fixed-rate securities.

The Treasury indemnifies APFF Ltd against any losses incurred via that exposure, and it receives any

running profits (when Bank Rate is lower than the average yield on the APF portfolio).

a

It was initially

envisaged that there would be a settlement of any profits or losses at the end of the QE scheme. But in

7

This effectively assumes (a) that there are no transaction costs in HM Treasury issuing into the primary market and

the Bank buying shortly afterwards in the secondary market and (b) that the price has not moved in the time

between the two transactions. During QE’s initial phase, during 2009–10, the Bank was not especially buying new

gilts, so any capital gain or loss on holding to maturity matters too.

8

That does not imply, however, that in such circumstances all issuance should be at short maturities in order to save

the term premium. See main text below.

The Institute for Fiscal Studies, October 2022

10

Quantitative easing, monetary policy implementation and the public finances

late 2012 it was announced that quarterly cash settlements would be introduced as QE was not winding

up on anything like the timescale envisaged.

b

Securities bought and held by the vehicle are, for accounting purposes, marked to market (MTM). Any

MTM gains or losses are offset by changes in the accounting value of amounts due to or from the

Treasury under the HMT Indemnity since that too is valued on an MTM basis (note 8 to BEAPFF

2020–21 accounts).

Figure 7.2. Cash flows to and from the Asset Purchase Facility

Source: Adapted from Bank of England, Cash transfers between BEAPFF and HMT,

https://www.bankofengland.co.uk/-/media/boe/files/markets/asset-purchase-facility/cash-transfers.pdf.

a

The indemnity is best thought of as an instrument of political economy designed to make clear up front to everyone,

including parliament and the public, that any Bank losses would fall on the Treasury. In fact, under the UK system,

that would have been so anyway, but might not have been widely understood.

b

Confirmed on page 4 of the BEAPFF Annual Report and Accounts for 2020–21. Quarterly cash settlement mirrors

long-standing arrangements for the Bank’s Issue Department (to which pound-note liabilities are booked). The Bank

was split into Issue Department and Banking Department in 1844 by legislation introduced by Prime Minister Peel.

The risk exposure

As the above makes clear, since QE combined with remunerated reserves shifts the state’s

consolidated liability structure, it obviously alters its exposure to risk, where risk is conceived of

as uncertainty about the path and the net present value of the state’s debt-servicing costs. The

incremental risk exposure is greater the larger the stock of QE, and risks are more likely to

crystallise the longer the exposure lasts. In fact, of course, QE has ended up being very much

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

11

larger and much longer-lasting than envisaged back in 2009–10. The stock of QE rose from

£200 billion at end-2010 to £435 billion at end-2019 and £875 billion at end-2021 (Figure 7.3).

9

Figure 7.3. Cumulative gilt purchases via the Bank of England Asset Purchase Facility

£200bn

£375bn

£435bn

£875bn

0

100

200

300

400

500

600

700

800

900

1,000

£ billion

2009 Jan

2009 Jul

2010 Jan

2010 Jul

2011 Jan

2011 Jul

2012 Jan

2012 Jul

2013 Jan

2013 Jul

2014 Jan

2014 Jul

2015 Jan

2015 Jul

2016 Jan

2016 Jul

2017 Jan

2017 Jul

2018 Jan

2018 Jul

2019 Jan

2019 Jul

2020 Jan

2020 Jul

2021 Jan

2021 Jul

2022 Jan

2022 Jul

Note: Figures show purchases of gilts only and exclude approximately £20 billion of corporate bonds

purchased by the APF.

Source: Office for National Statistics series FZIU (BoE: Asset Purchase Facility: total gilt purchases: £m

CPNSA).

It is natural to think of the risk exposure in terms of the uncertainty that arises from the structure

of the state’s debt stock veering away from what analysis had suggested would be sensible

absent QE. Had fiscal stimulus, not monetary stimulus, been the favoured instrument for

promoting economic recovery from the middle of the 2010s, the annual deficits would have been

larger but the structure of the state’s debt would presumably have been broadly unchanged

(given a stable debt-management strategy for many years).

Government’s choice of debt structure in normal conditions should be based on analyses of the

pattern of shocks – their type and possible scale – that might plausibly hit the economy. That

entails assessing the prospective effects on tax revenues and spending of a wide range of shocks,

taking account of whether different types of gilt issuance provide insurance to the private sector

9

These numbers are for QE via the purchase of gilts. The Bank’s operations to buy corporate securities raise

different issues, and are not considered here.

The Institute for Fiscal Studies, October 2022

12

Quantitative easing, monetary policy implementation and the public finances

and so dampen or amplify the transmission of shocks. Given the shocks might be nominal (e.g.

to the credibility of the monetary regime) or real, and that those real shocks might be to demand

(e.g. to consumer tastes) or supply (e.g. to technology), and sourced either domestically or

externally (notably, an energy price shock), the standard choice – certainly in the UK – is to

issue both nominal bonds and inflation-indexed bonds spread across the maturity spectrum.

10

More plainly, it makes sense to avoid effectively betting, via a lopsided debt structure, on certain

types of shock never occurring.

That, in its direct effects, is what swapping the debt into floating-rate nominal liabilities amounts

to for the public finances. The Bank of England’s QE operations purchased only nominal bonds,

not inflation-indexed bonds.

11

From the perspective of debt management, those purchases

accordingly undid HMG’s favoured duration choices for nominal issuance, while leaving the

nominal/indexed split of the public debt unchanged. This meant, among other things, that in the

face of a positive shock to domestically generated inflation that monetary policy did not pre-

emptively offset, debt-servicing costs would be hit by both a permanent increase in the cost of

servicing inflation-indexed bonds, and a temporary increase in the Bank Rate paid on reserves

when monetary policymakers caught up (a risk that is crystallising currently). We assume here

that the authorities were right to exclude inflation-indexed bonds from QE as that left the British

state with its (deliberate) exposure to rises in inflation, and so left intact the incentives for the

Treasury to favour low and stable inflation, and thus to maintain a strong, independent central

10

Even with a positive term premium (see annex), it is prudent to spread issuance across the maturity spectrum, as

bunched short-term issuance exposes the state to rollover risk (adverse price terms, or even quantity rationing) if

circumstances deteriorate; the UK has typically chosen to issue a higher proportion of its debt at long maturities

than its peers. The richest versions of such ‘optimal’ debt-portfolio studies seek to take into account the effect of

different types of shock not only on debt-servicing costs but also on government tax receipts and spending, so it is

correlations and covariances that matter. That is because the social policy objective (for a credibly solvent state) is

typically taken to be tax smoothing, on the grounds that ex ante uncertainty about future taxes (and so ex post

volatility in actual taxes) will impede economic actors’ planning and, thus, social welfare, other things being equal.

Analytically, this would suggest various types of state-contingent debt, including GDP-linked bonds (as proposed

by Robert Shiller (e.g. Shiller, 2018)). Absent that, and given that unconditional forecasts of the incidence of

different types of shock are highly uncertain, the robust conclusion is often taken to be a debt structure that mixes

nominal and inflation-indexed bonds issued at a wide range of maturities (see, for example, Barro (1997) and

Chrystal, Haldane and Proudman (1999)).

11

By contrast, the US Federal Reserve did buy inflation-indexed bonds in its QE operations. The effect, ex post, has

been to spare the US the cost of compensating holders for the recent much-higher-than-expected inflation out-turns

(assuming the Fed holds the indexed bonds until maturity), but with elected politicians left with blunted incentives

to press the Fed to stick to a policy of low inflation (in particular, low domestically generated inflation).

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

13

bank that can control domestically generated inflation (see Section 7.7).

12

The QE-induced risk

exposure that matters, therefore, concerns only the state’s consolidated nominal debt.

When does the risk exposure matter?

Whether the risk exposure matters, however, turns on more than probabilities, as a risk could

crystallise but be immaterial in its effects. Here things are a bit more subtle. Qualitatively, the

exposure does not greatly matter ex ante if the plausible possible paths for Bank Rate all average

around the plausible range for yields on medium-to-longer-term gilts, or ex post if Bank Rate is

not on average materially higher than the yields at which gilts were issued before being bought

by the Bank. As explained above, if those conditions are met then temporary divergences of

Bank Rate away from its expected path are not going to make much difference to the state’s

funding costs relative to the counterfactual of government financing itself in the market

(provided, as already stated, that fiscal credibility is solid).

In the ordinary course of things (assuming fiscal credibility), long-term bond yields would

reflect the expected path of the short rate, plus a so-called term premium to compensate investors

for locking up their funds (and assuming market-risk exposure if they might sell before

maturity).

13

When the expected path of policy rates is low (and the supply of long-maturity gilts

does not stretch demand), that term premium might be compressed because more asset managers

will try to enhance the returns on their investment portfolio by earning the illiquidity premium

(one of many manifestations of the proverbial search for yield).

That means that one reasonable indicator of the materiality of the risk exposure, ex ante, is

whether or not the long-term forward rate of interest (see annex) is roughly – in a plausible range

for – what people think will be the steady-state nominal rate of interest (roughly, Bank Rate).

Figure 7.4 shows the evolution over time of the 10-, 20- and 30-year forward rates for the 12-

month nominal rate of interest. It shows that in 2009 and 2010 when QE began, the long-run

forward rate was still around 5%, which is broadly consistent with inflation averaging 2% and

the real return on (roughly) risk-free assets averaging 2–3% over the long run. As such, the risk

12

The effect on the cost of servicing indexed bonds is permanent, because payments are indexed to changes in the

price level. That aside, the analysis differs where headline inflation rises due to an adverse shock to the terms of

trade (import prices rising relative to export prices), such as a sharp rise in world energy prices for countries that

import all or most of their energy. In those circumstances, one would not expect the monetary policy of a credible

central bank to have to become tight so as to restrain aggregate demand, and so the double whammy of higher

floating-rate interest payments and higher inflation-indexed payments is avoided. There is a double whammy,

however, if the cost shock (pushing up the price level) feeds through to expectations of future inflation, but that

should incentivise politicians to maintain a central bank resolutely focused, at all times, on maintaining anchored

medium-to-long-term inflation expectations. Talk a few years ago, in various industrialised countries, of running

the economy ‘hot’ might have obscured that vital incentive and interest.

13

Where fiscal credibility is absent or impaired, a further risk premium will be charged for the possibility either of

legal default or, for a country with its own currency, of government overriding central bank independence so as to

monetise its debts. That is mainly ignored here, but is touched upon in Section 7.8 (on quantitative tightening).

The Institute for Fiscal Studies, October 2022

2005

2006

2007

2008

2009

2010

2011

2012

2013

2014

2015

2016

2017

2018

2019

2020

2021

2022

14

Quantitative easing, monetary policy implementation and the public finances

exposure initially opened up by QE was not obviously material on this count, since borrowing at

a fixed long-term rate could be expected to be around the average of Bank Rate over the life of a

long-term bond.

14

Figure 7.4. Nominal 10-, 20- and 30-year forward rates, January 2005 to present

0

1

2

3

4

5

6

Per cent

10-year 20-year 30-year

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Jan

Note: Data run to 6 October 2022. Shaded areas indicate periods when the Bank of England was

undertaking quantitative easing and purchasing gilts via the Asset Purchase Facility. Data for 30-year

forward rates unavailable prior to 2016.

Source: Bank of England.

By mid-to-late 2019 – notably, before the 2020 COVID-19 pandemic began – long forward rates

were unusually low: the 20-year forward rate was between 1% and 2%, and the 30-year between

0% and 1%. Subject to one caveat, this implies that, ex ante, it would have been much cheaper to

fund the government by issuing long-term bonds to the market, thereby locking in the unusually

low long forward rates, than by borrowing at a floating rate from the Bank of England. That is

because Bank Rate would have been expected to be higher over the life of the bond than the long

forward rate. The caveat is that that inference would not hold for anyone who, at the time, had an

extraordinarily pessimistic view of the outlook for growth (and, therefore, the return on capital),

14

This reflects what is known as the Fisher equation (after Irving Fisher) that the nominal interest rate is equal to the

sum of the real interest rate plus (expected) inflation. The real interest rate is itself the sum of the risk-free real rate

plus various risk premia.

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

15

and/or thought inflation would systematically undershoot the prevailing 2% target. There is no

evidence (we know of) that the authorities held either view, let alone both.

15

Figure 7.5. Nominal 10-, 20- and 30-year forward rates, 1 September 2022 to present

6

Per cent

5

4

3

2

1

0

10-year 20-year 30-year

MPC

decision

Fiscal

event

BoE MMLR

operations

announced

1 Sep 2022

3 Sep 2022

5 Sep 2022

7 Sep 2022

9 Sep 2022

11 Sep 2022

13 Sep 2022

15 Sep 2022

17 Sep 2022

19 Sep 2022

21 Sep 2022

23 Sep 2022

25 Sep 2022

27 Sep 2022

29 Sep 2022

1 Oct 2022

3 Oct 2022

5 Oct 2022

Note: Data run to 6 October 2022. Vertical lines indicate the MPC’s 21 September announcement, the

Chancellor’s 23 September fiscal event, and the start, on 28 September, of the Bank of England’s market-

maker-of-last-resort (MMLR) temporary gilt purchases.

Source: Bank of England.

There is also another contrast between the 2009–10 and 2020–21 episodes of QE. During the

former, in the aftermath of the financial crisis, there was slack in the economy, and thus no

meaningful prospect of domestically generated inflation requiring a period of tight monetary

policy. In consequence, the Monetary Policy Committee (MPC) was in a position to

accommodate various cost shocks that hit the UK during 2010–11. In the later period, by

contrast, it was harder to be so confident about domestically generated inflation pressures

remaining muted given persistent additions to monetary stimulus and, following COVID, a large

number of people withdrawing from the workforce (reducing the economy’s productive

capacity) – even before Russia’s war on Ukraine and the various resulting cost shocks. As it

15

Recently, the Bank of England has estimated that the equilibrium world real rate of interest is around zero (Bailey,

2022; Cesa-Bianchi, Harrison and Sajedi, 2022). If that is correct, with an inflation target of 2%, a long nominal

forward rate significantly below 2% points towards the cheapest expected funding coming via long-term fixed-rate

bonds, other things being equal. Research papers estimating a low R* include Rachel and Summers (2019).

The Institute for Fiscal Studies, October 2022

16

Quantitative easing, monetary policy implementation and the public finances

turned out, that risk seems to have crystallised, implying a period of tight monetary policy

during which Bank Rate will be above its expected long-run average. In other words, the public-

finance risk exposure created by floating-rate funding through 2020 and 2021 was exacerbated

by a non-negligible chance of an inflationary shock. The point is not that this should certainly

have been the expected outcome, but that it was a meaningful possibility – the risks to inflation

were regarded by some as plainly to the upside – raising the stakes of adding to QE.

Summing up, it is reasonable to conclude that by the autumn of 2019 it was clear there was

meaningful risk to the public finances from the combination of QE and paying interest on banks’

reserves.

7.3 Quantifying the opportunity costs and

risk exposure

Materiality in the probability of a risk crystallising and materiality in the costs of its crystallising

are obviously not the same thing. This section aims to put some numbers around the opportunity

costs and continuing risk exposure by looking at, in turn, the what-if of QE having stopped

before 2020, the sensitivity of funding costs to the path of Bank Rate, and the savings available

if interest was no longer paid on banks’ reserves.

Opportunity costs from funding via QE over 2020–21

An obvious place to begin, given the previous subsection, is to put some numbers on the savings

that might have been secured had the Bank not added to its QE after 2019, when it became clear

long-run forward rates of interest were unusually low. This involves assuming, counterfactually,

that throughout 2020 and 2021 the government borrowed in fixed-income markets (without any

fixed-to-floating debt swap) to fund the fiscal assistance provided to the country during the

pandemic, and that the Bank chose not to buy-and-hold more gilts.

The Bank of England bought £440 billion of gilts during that period.

16

To simplify things, one

plausible benchmark is to assume that, instead of QE, the government funded in the market at

the average yield over that period at the average duration of the conventional part of debt

portfolio (ignoring QE), which was approximately 12 years.

17

Assuming no effect on borrowing

16

Purchases of fixed-rate corporate bonds are ignored here because BEAPFF’s holdings are only around £20 billion

(a large number in normal circumstances but small in the current context).

17

This is the average modified duration (see annex) on the government’s (net) outstanding conventional gilts over

2020 and 2021. The average maturity of the government’s (net) outstanding conventional gilts over the same

period was around 14 years. Source: Debt Management Office Quarterly Bulletins (various).

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

17

costs (see below), the interest rate incurred would have been approximately 0.7%.

18

In fact, a

respectable case could have been made for the government lengthening the duration of issuance

during this period to take advantage of the unusually low long-maturity forward rates, but that is

ignored here.

19

In the short run, funding via gilt issuance would have been more expensive than funding via QE

at Bank Rate, which averaged 0.17% over the period from 1 January 2020 to 31 December 2021.

But things were set to turn round once Bank Rate was returning back to something like neutral.

Taking the Bank’s recent estimate of the steady-state equilibrium nominal rate of interest of 2%

(and assuming no change in the outstanding amount of QE),

20

the annual savings would in

steady state have been roughly 1.3% (on the £440 billion of gilts), or £6 billion per year.

21

If,

instead, the equilibrium nominal rate were, say, 3% (roughly the 20-year nominal forward rate in

late August 2022, so before the recent fiscal-event shock), the steady-state savings would have

been nearly double: roughly 2.3%, or £10 billion per year. Using 2021–22 numbers for national

income, those steady-state savings would be around 0.2–0.4% of GDP per year, or 0.5–1.0% of

total government spending. If instead the equilibrium were 4.4% (the 20-year nominal forward

rate at the time of writing, 6 October – see Figure 7.5), the steady-state savings would rise to

3.7%, £16 billion per year, equivalent to 0.7% and 1.5% of 2021–22 GDP and total government

spending, respectively.

Those numbers assumed that if HMG had funded itself in the markets during 2020 and 2021,

that would not have affected yields. But long-maturity nominal forward rates were so low then

that the supply effect on yields would have had to have been in the order of 1–2 percentage

points for the implied steady-state saving to be wiped out. At the least, it can be argued that,

monetary policy considerations aside (see Assessment subsection below), government could

usefully have tested the waters rather than relying on Bank purchases.

22

18

This is the average (implied) yield on a 12-year zero coupon bond over 2020 and 2021, where 12 years is the

average duration of the nominal gilt portfolio over that period. The equivalent figure for a 14-year zero coupon

bond over the same period (14 years being the average maturity) is 0.8%.

19

A similar point was made in the 2020 IFS Green Budget (Emmerson, Miles and Stockton, 2020).

20

Bailey (2022) and Cesa-Bianchi, Harrison and Sajedi (2022) estimate the equilibrium world real interest rate at

0%, so a local inflation target of 2% implies an equilibrium nominal rate of 2%.

21

That calculation is for the longer-run annual savings from locking in very low long-maturity yields during 2020

and 2021. Of course, the shorter-run annual savings would have been even greater, being the difference between

paying approximately 0.7% on £440 billion of borrowing and paying a Bank Rate expected by markets (on 6

October) to average 5.6% over 2023–24 and 2024–25. The counterfactual below (not remunerating reserves) is

similar, but moves to paying zero on almost the totality of reserves (rather than just £440 billion).

22

Once monetary policy considerations are admitted, either the MPC would have had to have a change of heart about

QE or HMT exercised its right to veto further QE (unless, say, the reserves regime were reformed), putting

perceptions of independence in jeopardy. But that does not invalidate the utility of the thought experiment.

The Institute for Fiscal Studies, October 2022

18

Quantitative easing, monetary policy implementation and the public finances

Forward-looking risk analysis: the Office for Budget Responsibility’s

reports

That was backward-looking: assuming different policy choices on QE had been made over

recent years. Taking recent policy towards QE and reserves as given, the Office for Budget

Responsibility (OBR) has published two reports containing forward-looking analyses of the risk

to the public finances from the UK state’s de facto fixed-to-floating debt swap.

23

They approach

this by observing that the Bank’s operations have considerably shortened the average duration of

the debt stock. They calculate the reduction in the mean duration; and also, given that the mean

is lengthened by a few very-long-maturity bonds, in the median duration, which serves, OBR

points out, as ‘a direct measure of the time it takes for half of the full effect of a rise in rates to

feed through to interest payments’. In March 2021, the OBR reported that whereas the median

maturity of the government’s total gilt liabilities excluding the Bank’s APF was around 11 years,

it fell to 4 years if the APF was included. This meant that (as of March 2021) 59% of the

government’s debt liabilities would respond to changes in interest rates over the (five-year)

forecast period, compared with 44% in early 2009 (prior to QE). Relatedly, a 1 percentage point

increase in short rates was estimated to increase debt interest spending in the final year of the

forecast by three times as much as in December 2012: some 0.45% of national income

(equivalent to more than £11 billion in today’s terms), versus 0.16%.

24

The OBR has also explored the effect on debt-servicing costs of scenarios where the long-run

equilibrium real rate of interest (known as R*) rises with and without an equivalent increase in

the underlying rate of economic growth. Inflation is assumed to be at target, because the Bank is

assumed to anticipate the shocks. Obviously, the debt-to-GDP ratio rises when the equilibrium

real interest rate rises without a corresponding increase in growth. In its July 2022 analysis, the

OBR found that a permanent 1 percentage point increase in gilt yields without any change in

economic growth would, over a 50-year horizon, increase the ratio of debt to GDP by around 60

percentage points (from around 265% to around 325% of GDP).

25

These are important, useful thought experiments, but they do not exhaust the range of scenarios

where a reduction in the effective duration of the state’s consolidated debt proves costly. In part,

this is because the reduction in the debt stock’s median duration is not an adequate summary

statistic for the changes brought about by QE to the state’s debt structure. In principle, a

borrower could have a median debt duration of three years without having any debt that repriced

23

See box 4.1 of Office for Budget Responsibility (2021a) and paragraph 4.59 of Office for Budget Responsibility

(2022b).

24

See box 4.1 and supplementary expenditure table 3.21 of Office for Budget Responsibility (2021a) and box 3.3 of

Office for Budget Responsibility (2020).

25

See chart 4.17 and paragraph 4.59 of Office for Budget Responsibility (2022b).

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

19

every month, and so without being sensitive to sharp but temporary shifts in the monetary policy

rate.

Figure 7.6. Overnight Index Swaps forward curve (short end)

6

Per cent

5

4

3

2

1

0

6 October

9 September

2 4 6 8 10 12 14 16 18 20 22 24 26 28 30 32 34 36 38 40 42 44 46 48 50 52 54 56 58

Maturity (months)

Source: Bank of England.

Figure 7.7. Overnight Index Swaps forward curve

6

5

9 September

6 October

Per cent

4

3

2

1

0

0.5

1.5

2.5

3.5

4.5

5.5

6.5

7.5

8.5

9.5

10.5

11.5

12.5

13.5

14.5

15.5

16.5

17.5

18.5

19.5

20.5

21.5

22.5

23.5

24.5

Maturity (years)

Source: Bank of England.

The Institute for Fiscal Studies, October 2022

20

Quantitative easing, monetary policy implementation and the public finances

In terms of illustrating the state’s risk exposure via scenario analysis, the point is that a

permanent shift in the long-run equilibrium real rate of interest without higher growth does not

exhaust the set of unpleasant scenarios. Another important scenario, as suggested in the previous

section, was, hypothetically, of a temporary sharp increase in Bank Rate in order to bring

domestically generated inflation back under control or to re-anchor medium-term inflation

expectations. Given the British state’s floating-rate debt, a temporary monetary policy shock of

that kind would, while it lasted, increase debt-servicing costs while temporarily pushing GDP

below the path that would have been sustainable in the absence of the inflationary shock. A

variant of that shock has, of course, occurred – initially as underlying inflationary pressures

became apparent to financial-market participants, and intensifying after the fiscal event of 23

September. Taking the current (6 October) market-implied path for Bank Rate (shown in Figures

7.6 and 7.7) and the Bank’s announced plans for unwinding QE,

26

the cost of servicing the QE-

related debt (at Bank Rate) would be £90 billion between now (October 2022) and March 2025

(£42 billion and £33 billion in each of the next two financial years).

27,28

We return to this below.

These figures are sensitive to the future path of Bank Rate. To underline the sensitivities: given

the Bank’s announced plans for selling off part of its £800 billion plus QE gilt portfolio, every 1

basis point increase (decrease) in Bank Rate would increase (decrease) cumulative debt-

servicing costs over the coming two financial years by around £130 million. Put more

dramatically, that means an increase of more than £13 billion over 2023–24 and 2024–25 if the

path of Bank Rate were 1 percentage point higher than currently expected over that period; £6.5

billion (the average over the two years) is around 0.2% of GDP.

The broad point here is the need to find a way of analysing risks without the Bank assuming the

state’s fiscal position is definitely sound, and likewise without the OBR assuming the Bank’s

credibility suffers no hits. Navigating this is obviously not easy, but the prevalence of floating-

rate debt increases its importance.

26

Again, the reserves counterpart to the TFS assets are ignored here because both the reserves and the TFS loans are

priced to Bank Rate.

27

On 9 September, two weeks before the fiscal event, that number would have been £67 billion, comprising

£31 billion and £22 billion for, respectively, the next two financial years. Some City and think-tank economists

forecast a lower path for Bank Rate (under the Citi forecasts used elsewhere in this IFS Green Budget, for instance,

the figure would be £65 billion, with £32 billion and £18 billion in the next two financial years), but it is standard

to use the market curve, since that reflects a pooling of diverse views.

28

If, instead of assuming that the stock of reserves falls in line with the Bank’s published plans for unwinding QE,

we assume that the stock of reserves remains as it is now, this figure would rise to £111 billion (with £49 billion

and £46 billion in the next two financial years). If we assume that maturing bonds held in the APF are not

reinvested, but that the Bank does not undertake any active asset sales, it would be £105 billion (£47 billion and

£42 billion).

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

21

Counterfactual-regime analysis: not remunerating (most) reserves

An alternative forward-looking approach is to calculate what might be saved if the Bank’s

regime for implementing monetary policy were configured differently. Two London-based think

tanks – the National Institute of Economic and Social Research (NIESR) and the New Economic

Foundation (NEF) – have done this, with somewhat different counterfactuals. They each

quantify fiscal savings from the state adopting their respectively favoured reform proposals, and

thus provide illustrations of some crystallisations of the state’s risk exposure by estimating

losses in the absence of those reforms. In other respects the two studies differ. The NIESR

proposal is discussed below (Section 7.8). Here we discuss the simplest counterfactual, which is

to assume that interest is not paid on banks’ reserves (and for the moment abstract from

behavioural effects).

29

Of course, so long as Bank Rate was held at 0.1%, the quantitative effect would have been

small: on average under £2 billion per year (less than 0.1% of GDP) between 2009 when QE

began and 2 August 2018 when Bank Rate was raised to 0.75%.

30

It remained low – slightly

over £2 billion, again just under 0.1% of GDP per annum – from then until May 2022 when

Bank Rate was raised to 1%. The numbers were, however, set to become meaningful as Bank

Rate returned to something like normal.

That point was raised by various commentators and former policymakers in evidence to the

House of Lords Economic Affairs Committee during 2021. It gained wider publicity only when,

in mid 2022, the think tank New Economics Foundation (NEF) proposed dropping interest on

reserves (Van Lerven and Caddick, 2022). Taking account of Bank of England statements about

the prospective unwinding of QE and without taking into account any fiscal costs elsewhere

(say, lower corporation tax revenues) due to the de facto tax on banking intermediation (Section

7.6), they calculated a gross saving of roughly £57 billion over the three years to March 2025:

roughly £19 billion per annum, or around 0.8% of national income and 1.8% of total government

spending (for 2021–22).

31

Without implying any endorsement, the arithmetic was correct: there

29

As connoisseurs will recognise, strictly it is the total stock of reserves that matters here, not merely the part

corresponding to the QE gilt purchases (£838 billion as at 5 October 2022). The total stock of reserves as at 5

October was around £947 billion. Not using this bigger number (generating still bigger savings) is equivalent to

assuming that roughly £100 billion of reserves go into the corridor regime for ‘marginal’ reserves described in

Section 7.4. There is no suggestion that, if it were to adopt tiered-reserves, the Bank should leave exactly

£100 billion in the corridor. The calculation in the main text serves merely to illustrate the (large) sums involved.

30

Source: IFS calculations using ONS series FZIQ (BoE: Asset Purchase Facility: total asset purchases) and

historical Bank Rate.

31

In a variant, NEF assume £337 billion – approximately 40% of the stock of reserves – continued to be remunerated

at the policy rate, in which case the estimated saving is around £22 billion cumulatively over three years.

The Institute for Fiscal Studies, October 2022

22

Quantitative easing, monetary policy implementation and the public finances

would be a very large gross saving from borrowing at a rate of 0% rather than at the path of

Bank Rate, unless it were negative for a long period.

Given that, even before the recent fiscal event, the (market-implied) expected path of Bank Rate

was steeper than when the NEF published in mid June, the expected savings today would be

greater. After the fiscal event, the NEF proposal would now save (almost all of) the £90 billion

of interest payments on reserves implied by the market curve for the coming two-and-a-half

years (see above).

32

Of course, there are questions about how a measure along the lines proposed by NEF would

affect aggregate welfare given the possible effects on banking, but that (discussed in Section 7.6)

is separable from the narrow funding arithmetic.

Assessment of the significance of the public-finance risk exposure

The purpose of this section, and the previous one, has been to assess whether the risk to the

public finances from de facto floating-rate funding is sufficiently significant to make debate

about regime reform worthwhile. That depends on the probability of the risk exposure

crystallising in an adverse way, and also on the scale of the hit to the public finances if it does

crystallise. Both legs of the question can now be answered in the affirmative: the exposure does

matter.

While, as reflected in the OBR’s scenario analysis, permanent adverse shocks to the

government’s financing costs matter most, temporary sharp adverse shocks can be meaningful

too. The various benchmarks and counterfactuals explored in this section all generate large

numbers. Funding in the market rather than via QE during 2020–21 might eventually have saved

around £6 billion per year for a few decades (even before September 2022’s fiscal-event shock).

Funding via QE but not paying interest on any reserves would, if feasible, have saved around

£2 billion per year to date, but the implied saving is about to become much larger: potentially

more than £30 billion in each of the next two financial years. The underlying point of the OBR

risk analysis was that Bank Rate might rise more than expected: that risk has crystallised through

a combination of external and internal shocks to headline inflation and to inflationary pressures.

To put those numbers in context, in the decade or so since the 2007–09 financial crisis, debt-

servicing costs have averaged 1.9% of GDP, equivalent to £45 billion in 2021–22 terms.

Looking backwards, the potentially available (but forgone) savings from not remunerating

32

As per footnote 28, this figure would be greater if the stock of reserves remains as it is now, or if the Bank of

England does not undertake any active asset sales.

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

23

reserves since QE began would have been small: less than 0.1% of GDP, or less than 5% of

average debt-servicing costs since the financial crisis. Even with remunerated reserves, funding

via gilt issuance would have in fact been more expensive than funding via QE at Bank Rate over

2020 and 2021. But looking ahead, the potential savings under both counterfactuals are much

bigger because Bank Rate is expected to rise.

Depending on what one assumes about the equilibrium nominal rate of interest, the plausible

forgone annual savings in steady state, relative to QE-with-remunerated-reserves, from locking

in £440 billion of fixed-rate borrowing in the market during 2020 and 2021 range between 0.2%

and 0.7% of GDP per year. That is between 13% and 36% of average debt-servicing costs, or

between 1.6% and 4.5% of annual spending on defence, the health service and education

33

combined.

The potentially available short-run savings if (the bulk of) reserves were no longer remunerated

are greater still: perhaps between 1.2% and 1.6% of GDP over the coming two financial years

(based, again, on 6 October market expectations). That is equivalent to 63–84% of average debt-

servicing costs (obviously big); or 7.6–10.5% of annual spending on defence, health and

education. This would reduce prospective annual debt-servicing costs (as per the forecast in

Chapter 3 of this IFS Green Budget) from around 3.9% to around 2.3% of GDP in 2023–24, and

from around 2.7% to 1.5% of GDP in 2024–25.

In reality, then, these numbers are big enough to affect political choices on spending and

taxation. That might work through the government’s fiscal objectives (or ‘rules’). While the new

government’s fiscal framework is not yet wholly clear, the previous framework included a

provision that non-investment spending (including interest on debt) minus taxes and other

current receipts should be in balance (or surplus) by year three, so that central government is

borrowing only for investment by then.

34

A sharp hit to debt-servicing costs for a number of

years could make that objective (or anything like it) harder to achieve without unpalatable

choices.

Summing up, one question posed by this analysis is whether the QE undertaken during 2020 and

2021 was the only reasonable course for the Bank. Some analysts (including this author) have

argued that the interventions in the gilt market in the spring of 2020 would better have been cast

as emergency and so temporary MMLR operations to bring order to a destabilised market and

33

In 2021–22, total government spending amounted to £1,058 billion or 44.5% of GDP. Combined spending on

health, defence and education amounted to £366 billion, or 15.4% of GDP. Between 2008–09 and 2021–22,

spending on these items averaged 14.2% of GDP; between 1997–98 and 2007–08, 12.3%. Source: IFS TaxLab.

34

Under the fiscal regime prevailing until recently, the other rule was: for public sector net debt to be falling as a

percentage of GDP by the third year of the forecast. (See, for example, paragraph 4.3 of Office for Budget

Responsibility (2022a).) The new government has reiterated this but for the ‘medium term’ (perhaps implying the

horizon might be extended to, say, five years).

The Institute for Fiscal Studies, October 2022

24

Quantitative easing, monetary policy implementation and the public finances

provide emergency funding for government. Had that course been taken, the purchases would

have been unwound later in the year, once markets had stabilised, leaving HMG able to fund

itself in the market. The broader economic rescue would have been entirely fiscal not monetary,

with the Bank playing its part by continuing to keep its policy rate low. In other words, if one

thinks the 2020–21 QE was unnecessary to achieve the inflation target, there was a very large

opportunity cost to the public finances that cannot easily be explained away.

Those are bygones. QE having in fact continued up to and into 2022,

35

the current question is

whether anything can be done now to reduce the public finances’ continuing risk exposure.

Since the only way to have wholly eliminated the exposure was (and is) not to pay interest on

reserves, it matters why central banks moved to paying interest on reserves, whether those

reasons apply during prolonged QE, and what the effects might be of suspending interest on

reserves. The next sections address those questions.

7.4 Central banking reserves policy

Central bank money takes two forms: paper notes, and banks’ deposit balances with the central

bank. Historically, interest was paid on neither. It cannot feasibly be paid on physical notes.

36

For nearly two decades, the main central banks have paid interest on banks’ balances (reserves).

Two questions arise: what are banks’ reserves, and why did central banks shift to paying interest

on them?

Since the 18

th

century, the monetary systems of the advanced economies (and later others) have

had a stable structure. Households, businesses, charities and others all bank with small or large

banks. Small banks have often banked with large banks. Large banks bank with the central bank.

When the central bank buys government bonds from, say, a pension fund, the pension fund’s

deposit balance with its bank increases, and if that bank banks directly with the central bank,

then its balance with the central bank increases. Subsequently, if the pension fund buys assets

from, say, an insurance company, and that insurance company banks with a different bank, the

reserves balance at the central bank is transferred from the pension fund’s bank to the insurance

company’s bank. While the reserves balance of each bank changes (one goes down, the other

up), the aggregate quantity of reserves (central bank money) does not change.

The last point is very important. While individual banks can seek to shed or accumulate reserves,

by buying or selling assets, the banking system as a whole cannot affect the quantity of

35

The reinvestment of maturing proceeds ceased in March 2022. Incremental net purchases ceased in December

2021.

36

Some academics, including Willem Buiter and Charles Goodhart, have articulated schemes for doing so.

The Institute for Fiscal Studies, October 2022

IFS Green Budget 2022

25

aggregate reserves. Only transactions with the central bank can affect the aggregate quantity of

reserves (plus pound notes).

37

Why pay interest on reserves?

Historically, central banks did not pay interest on reserves, the Bank of England being no

exception. This meant that individual banks wanted to minimise their reserves balances, so that

they could instead hold an asset that provided them with a return. When the central bank injected

more money into the economy, banks’ (and others’) demand for government bonds would rise,

pushing up the price of those bonds and so reducing the yield on them. In other words, so long as

demand for reserves had not changed, injecting more money led to lower market interest rates,

i.e. easier monetary policy.

Some central banks set minimum reserve requirements, often determined by the size or growth

in a bank’s own monetary liabilities (most obviously, current-account balances held by

households and firms). From the early 1980s, the Bank of England did not set reserve

requirements. Instead, the main clearing banks chose what (non-zero) balance they aimed to hold

each day at the Bank. Those target balances were very low. This meant that, in order to avoid

banks continually going into overdraft, the Bank had to ensure each day that its aggregate supply

of reserves met demand, but no more. One result was hyperactivity in the Bank’s monetary

operations (open-market operations), and another was persistent volatility in the overnight rate

of interest in the money markets. Since the former was avoidable and the latter undesirable, the

Bank implemented a major overhaul of its money market operational framework in 2005–06,

before the global financial crisis (Tucker, 2004; Clews, 2005).

The new system – known as ‘voluntary reserves averaging’ – allowed almost any bank to bank

with the Bank, and had each bank set itself a target level of reserves to hold on average over the

month between one Monetary Policy Committee meeting and the next (the ‘monetary

maintenance period’). Since the Bank wanted the reserves banks each to hold a healthy balance

that minimised the prospect of overdrafts, it offered to pay the MPC’s policy rate (Bank Rate) on

balances close to each bank’s target, with standing deposit and lending facilities paying and

charging rates of interest close to Bank Rate.

38

Since this entailed remunerating reserves, the

37

It is, therefore, a mistake to suggest that central banks paying interest is as natural as commercial banks doing so;

for example, the BBC’s More or Less radio programme saying that ‘the Bank of England was paying a little bit of

interest on [reserves], because, well, that’s how bank accounts work, even when they’re bank accounts at the Bank

of England.’ (26 June 2022, https://www.bbc.co.uk/programmes/m0018gql). It is a mistake because whereas

numerous private banks compete to attract customer deposits, there is only one central bank and the reserve banks

(in aggregate) have no choice over whether to hold the reserves it creates. They can seek only to pass the parcel.

38

Each bank then chose a target level for average reserves taking account of the need to cope with payments shocks

and the expected policy rate.

The Institute for Fiscal Studies, October 2022

26

Quantitative easing, monetary policy implementation and the public finances

Treasury was consulted on whether it objected to the proposed reforms, and did not do so (see

Section 7.7 on how this fits with Bank of England independence).

In other words, the Bank of England’s decision to pay interest on reserves was taken in the

context of reforms to its operating system in normal circumstances, and was nothing to do with

the introduction of QE. By contrast, the US Federal Reserve (the Fed) did move to paying

interest on reserves in the context of its QE purchases after the 2008–09 financial system

collapse. In both cases (and elsewhere), since QE was not expected to persist for many years and

because long-maturity forward rates remained quite high, the possibility of the serious public

finance implications explored here was remote.

Setting interest rates under QE

The Fed moved to remunerating reserves because it faced a problem of how to establish its

policy rate of interest in the market once it was conducting QE on a significant scale. The

challenge arises because QE injects a quantity of reserves into the market far beyond the banking