1

FOS_en_Premium_T&C_07/22

REVOLUT PREMIUM ACCOUNT

CONDITIONS FOR BENEFICIARIES

INTRODUCTION

Revolut Bank UAB, as the issuer of the Premium current account, has arranged with us the following

collective agreement relating to insurance benefits (hereinafter referred to as "collective insurance

agreement") that account holders and other beneficiaries can benefit from.

Based on the collective insurance agreement, the account holders are permitted to make a claim directly to

us but do not have any rights directly with us in relation to the collective insurance agreement.

These conditions for beneficiaries are not part of an individual insurance policy, but give a description of the

different benefits that are available as part of the collective insurance agreement. In these conditions for

beneficiaries, information is provided about the benefits, different limitations and exclusions, as well as the

obligations of the account holders and other beneficiaries under the collective insurance agreement. The

collective insurance agreement benefits are only available for account holders when they subscribe to a

Premium current account and will end the moment the Premium current account is downgraded or closed,

either by Revolut Bank UAB or by the account holder.

It is important for the account holder and other beneficiaries to read these conditions for beneficiaries

carefully.

In accordance with the Revolut Plus, Premium and Metal Terms you confirm that you understand English

and you agree that the claims related to the benefits you have under the collective insurance agreement of

Revolut will be handled in English. Alternatively, your claims will be handled in local language if the official

language of your country of residence is English, German, French, Italian, Spanish, Dutch, Polish, Greek,

Slovenian, Hungarian or Romanian.

Revolut Bank UAB will inform the account holder of any substantial change in the collective insurance

agreement or if this collective insurance agreement is ending or will not be continuing under the same terms

and conditions. The collective insurance agreement can end, be changed or can be terminated by us or

Revolut Bank UAB without the approval of the account holder.

2

FOS_en_Premium_T&C_07/22

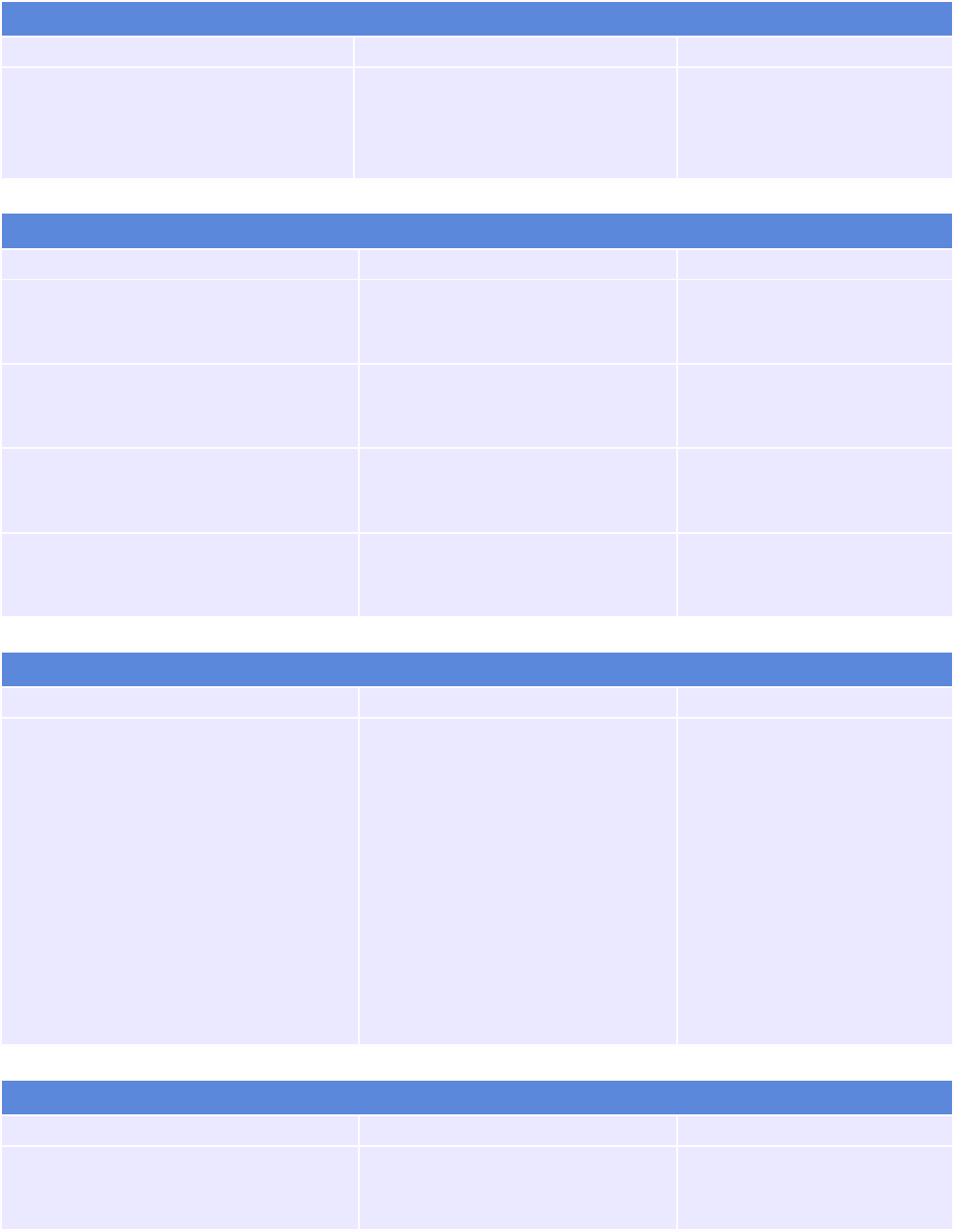

BENEFITS SUMMARY

TRIP CANCELLATION

Benefit Covered up to Deductible

Reimbursement of non-refundable

trip costs, cancellations fees, and

rebooking fees in case of a trip

cancellation

€ 5,000 per beneficiary € 50 per beneficiary

TRIP INTERRUPTION

Benefit Covered up to Deductible

Reimbursement of unused non-

refundable trip costs in case of a trip

interruption

€ 5,000 per beneficiary € 50 per beneficiary

Reimbursement of the additional

transportation costs to return to your

country of residence early

An economy class ticket None

Reimbursement of the additional

costs to enable you to continue your

onward journey

An economy class ticket None

Reimbursement of the cost of

necessary additional

accommodation

Up to € 1,000 in total for all

beneficiaries (up to € 200 per

night for a maximum of 5 nights)

None

TRAVEL DELAY

Benefit Covered up to Deductible

Reimbursement of additional

expenses incurred as a result of a

transportation delay or missed

departure during a trip

Minimum required delay length is 4

hours

If you have receipts - € 500 per

beneficiary

(€ 100 limit for the first complete

4 hours and € 100 limit for each

complete hour after this)

If you do not have receipts or

have not incurred expenses -

€ 350 per beneficiary

(€70 limit for the first complete 4

hours and € 70 limit for each

complete hour after this)

None

BAGGAGE

Benefit Covered up to Deductible

Baggage damage, loss or theft

Up to € 1,000 per beneficiary

(but no more than € 150 if

receipts cannot be provided),

€ 50

3

FOS_en_Premium_T&C_07/22

including up to € 250 for high

value items

BAGGAGE DELAY

Benefit Covered up to Deductible

Reimbursement for essential items in

case of a delay in luggage arrival at

the trip destination

Minimum required delay length is

4 hours

If you have receipts - € 400 per

beneficiary

If you do not have receipts - € 200

per beneficiary (outbound

journey only)

None

LOSS OF TRAVEL DOCUMENTS

Benefit Covered up to Deductible

Reimbursement for the cost of an

emergency passport or visa and

associated expenses in case your

travel documents are lost, stolen or

damaged on your trip

€ 500

None

The remaining value of each unused

year in the lost, stolen or damaged

passport

Actual costs None

EMERGENCY MEDICAL/DENTAL BENEFITS ABROAD

Benefit Covered up to Deductible

Medical expenses € 10,000,000 € 50

Emergency dental expenses € 300 € 50

EMERGENCY TRANSPORTATION

Benefit Covered up to Deductible

Medical repatriation Actual cost None

Search and rescue € 2,000 None

Transportation of remains Actual cost None

Return of dependents Actual cost None

Transport to bedside Actual cost None

SPORTS COVERAGE

Benefit Covered up to Deductible

Missed activity € 200 None

Sporting equipment € 1,500 None

Sporting equipment rental € 300 None

Search and rescue € 3,000 None

4

FOS_en_Premium_T&C_07/22

TRAVEL SERVICES DURING YOUR TRIP

Benefit Covered up to Deductible

Assistance in finding a doctor or

medical facility

information only None

The above is only a brief description of the benefits available under these conditions for beneficiaries. Terms,

conditions, and exclusions apply to all benefits. Please carefully review these conditions for beneficiaries for

complete details. The definitions of the terms in the Definitions section of the conditions for beneficiaries will

also apply to those terms when used in this Benefits Summary. If not otherwise specified, the benefit limits

shown above are per beneficiary.

NOTE: Some specific events, benefits and/or exclusions cannot be applied in certain countries for

legal or regulatory reasons. Please refer to each benefit section and the General Exclusions for full

details of where these restrictions apply.

5

FOS_en_Premium_T&C_07/22

GENERAL INFORMATION

WHO WE ARE

We are a Dutch branch of AWP P&C S.A., which has its registered office in Saint-Ouen, France. We also

operate under the trading name Allianz Assistance.

Our business address is: Our postal address is:

Poeldijkstraat 4 PO Box 9444

1059 VM Amsterdam 1006 AK Amsterdam

The Netherlands The Netherlands

AWP P&C S.A. – Dutch Branch, trading as Allianz Assistance and/or Allianz Travel, is an insurer licensed to

act in all EEA countries and operating in freedom of services, with corporate identification No 33094603, and

registered at the Dutch Authority for the Financial Markets (AFM) No 12000535

AWP P&C S.A., which has its registered office in 7 rue Dora Maar, Saint-Ouen, France, is authorized by

L’Autorité de Contrôle Prudentiel et de Résolution (ACPR) 4 Place de Budapest CS 92459, Paris Cedex 09,

France.

ABOUT THESE CONDITIONS FOR BENEFICIARIES

These conditions for beneficiaries are not a contract of insurance but summarise the Travel Insurance Policy

which is held by Revolut Bank UAB for the benefit of (and in trust for) their account holders. The account

holder's children (including the stepchildren, foster children, adopted children or children currently in the

adoption process) are also considered to be beneficiaries when they travel with the account holder.

It is important to note that the account holder and other beneficiaries do not have an insurance policy

directly with us. Whilst the conditions for beneficiaries wording summarises the benefits available to account

holders and other beneficiaries under the Travel Insurance Policy held by Revolut Bank UAB, it does not give

them direct rights under the policy held by Revolut Bank UAB.

Please read these conditions for beneficiaries carefully. You will notice that some words are italicised. These

words are defined in the “Definitions” section. Words that are capitalised refer to the document and

coverage names found in the conditions for beneficiaries wording. Headings are provided for convenience

only and do not affect your benefits in any way.

WHAT THE CONDITIONS FOR BENEFICIARIES INCLUDES AND WHOM IT COVERS

The benefits are only for the sudden and unexpected specific situations, events, and losses included in these

conditions for beneficiaries, and only under the conditions described. Please review these conditions for

beneficiaries carefully.

These conditions for beneficiaries consist of three parts:

1. The conditions for beneficiaries wording document.

2. The Insurance Product Information Document (IPID).

3. Statement of insurance.

6

FOS_en_Premium_T&C_07/22

NOTE: Not every loss is covered, even if it is due to something sudden, unexpected, or out of your control.

Only those losses meeting the conditions described in these conditions for beneficiaries document may be

covered and any payment for a reimbursement claim will be made to the account holder only. Please refer

to the General Exclusions section of this document for exclusions applicable to all coverages under these

conditions for beneficiaries.

CANCELLATION RIGHTS

Your satisfaction is our priority but we understand that these conditions for beneficiaries may not meet the

needs of all beneficiaries. The account holder is free to cancel the cover under these conditions for

beneficiaries at any time by closing their Premium current account or changing it to another account type.

Doing so will cancel the cover immediately for all beneficiaries.

DEDUCTIBLES

Under some sections of these conditions for beneficiaries, you will have to pay a deductible. This means that

the account holder will be responsible for paying the first part of the claim for each beneficiary, for each

section, for each claim incident. The amount you have to pay is called the deductible. The Benefits Summary

shows where it applies and, where possible, we will deduct the sum from any claims payment due to the

account holder.

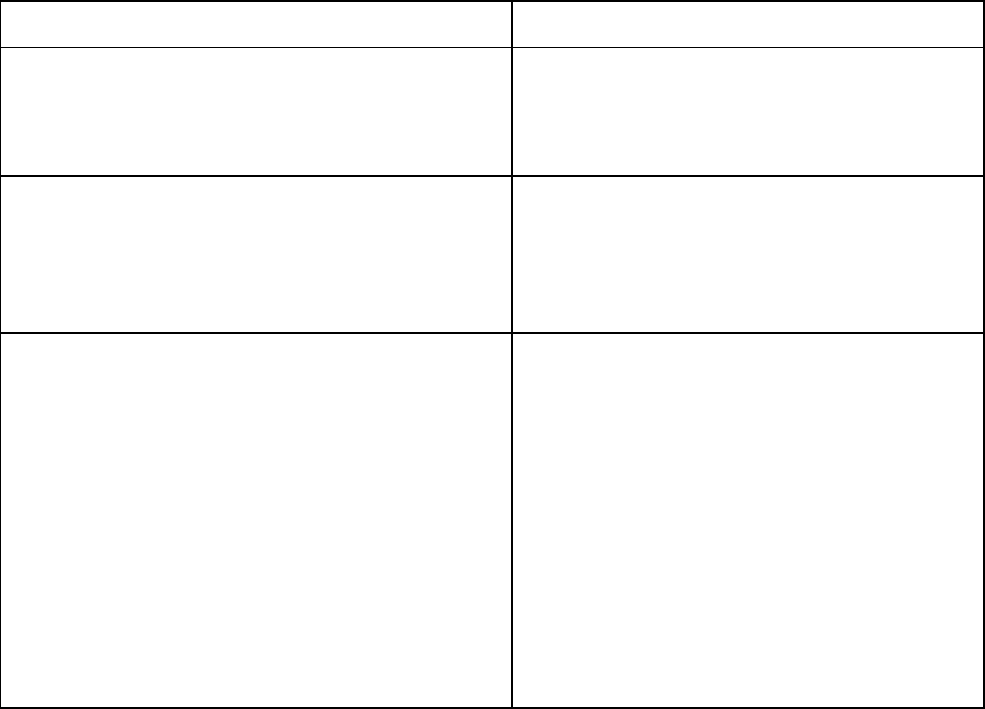

IMPORTANT CONTACT DETAILS

COUNTRY EMAIL ADDRESS TRAVEL EMAIL ADDRESS MEDICAL TELEPHONE

NUMBER

Austria claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+4312530572

Belgium claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+3222904549

Bulgaria claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+35924923861

Croatia claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+390200689772

Cyprus claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+35722000355

Czech

Republic

claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+420225985719

Denmark claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+4532700379

Estonia claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+3726093040

Finland claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+358942722104

France claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+33170391163

Germany claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+498942729981

Greece medical@allianz-assistance.gr medical@allianz-assistance.gr +302111988851

Hungary claims.at@allianz.com assistance.at@allianz.com +3612344901

Iceland claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+3544160123

Ireland claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+35315267980

Italy claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+390230329329

Latvia claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+37167873417

Lichtenstein claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+41432101104

Lithuania claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+37166004952

Luxembourg claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+35220204220

Malta claims.awpeuro[email protected]

contact.awpeurope@allianz.com

+390200689738

Netherlands claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+31107994319

7

FOS_en_Premium_T&C_07/22

Norway claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+46850520021

Poland claims.awpeurope@allianz.com

pms@mondial-assistance.pl +48222630096

Portugal claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+351211452610

Romania claims.awpeurope@allianz.com

assistance.at@allianz.com +40312296341

Slovakia claims.awpeurop[email protected]

contact.awpeurope@allianz.com

+421233325518

Slovenia claims.at@allianz.com assistance.at@allianz.com +38617775925

Spain claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+34919153157

Sweden claims.awpeurope@allianz.com

contact.awpeurope@allianz.com

+46850511150

APPLICABLE LAW

The governing law of these conditions for beneficiaries is the Lithuanian law.

COMPLAINTS

We aim to provide you with a first class service. However, there may be times when you feel we have not

done so. If this is the case, please tell us about it so that we can do our best to solve the problem. If you make

a complaint, your legal rights will not be affected. In the first instance, please contact us as specified above.

Please supply us with your name, address and claim number, and enclose copies of relevant

correspondence, as this will help us to deal with your complaint, in the shortest possible time.

If you are not satisfied with our final response, you can refer the matter to the Ombudsman of your country

of residence for independent arbitration.

COUNTRY POSTAL ADDRESS EMAIL

ADDRESS/WEBSITE

TELEPHONE

NUMBER/FAX

Austria Beschwerdestelle über

Versicherungsunternehmen im

Bundesministerium für Arbeit,

Soziales, Gesundheit und

Konsumentenschutz gem. $33

VAG Abteilung III/3,

Stubenring 1,

1010 Wien

E-Mail:

versicherungsbeschwerde

@sozialministerium.at

Tel: +43 1 71100 –

862501

Belgium Ombudsman van de

Verzekeringen, de Meeûssquare

35, 1000 Brussel

Email:

info@ombudsman.as

Tel: +32 (2) 547 58 71

Fax: +32 (2) 547 59 75

Bulgaria Financial Supervision

Commission

Budapeshta str.16

1000 Sofia

E-mail: delovod[email protected]

Website: www.fsc.bg

+359 2 9404 999

Croatia Croatian Financial Services

Supervisory Agency (HANFA)

Miramarska 24b

Zagreb

HR – 10000

Croatia

E-mail: p[email protected]

Website: www.hanfa.hr/

+385 1 6173 200

Cyprus Financial Ombudsman of the

Republic of Cyprus.

E-mail:

complaints@financialombu

Tel: +357 2284 8900

8

FOS_en_Premium_T&C_07/22

PO Box 25735

1311 Nicosia

Cyprus

dsman.gov.cy.

Website:

www.financialombudsman.

gov.cy.

Fax: +357 22660584,

+357 22660118

Czech Republic Czech National Bank

Consumer Protection

Department

Na Príkope 28

115 03 Prague 1

Czech Republic

E-mail:

spotrebit[email protected]

Website:

www.ombudsmancap.cz

Tel: 22 441 4359/2887

Fax: 22 441 2261

Denmark Ankenævnet for Forsikring

Østergade 18, 2

1100 København K

Denmark

E-mail:

ankeforsikring@ankeforsikr

ing.dk

Website:

www.ankeforsikring.dk/en

glish

+45 33 15 89 00

Estonia Tarbijakaitse ja Tehnilise

Järelevalve Amet

Aadress: Endla 10a

10122 Tallinn

E-mail:

avaldus@komisjon.ee

Website: www.tarbijakaits

eamet.ee

+372 667 2000

Finland FINE - Insurance and Financial

advice

Porkkalankatu 1

00180 Helsinki

E-mail: i[email protected]

Website: www.fine.fi

+358 (0) 9 6850 120

France La Médiation de l’Assurance

TSA 50110

75441 Paris Cedex 09

www.mediation-

assurance.org

Germany Bundesanstalt für

Finanzdienstleistungsaufsicht

(BaFin)

Graurheindorfer Straße 108

D – 53117 Bonn

www.bafin.de

Greece Hellenic Consumers Ombudsman

144 Alexandras Avenue

114 71, Athens

Greece

E-mail:

grammateia@synigoroskat

analoti.gr

Website:

http://www.synigoroskatan

aloti.gr/

Tel: +30 210 646 0862

Fax: +30 210 646 0414

Hungary Financial Consumer Protection

Centre

Hungarian National Bank

BKKP Postafiók: 777

1534 Budapest

Hungary

E-mail:

ugyfelszolga[email protected]

Website:

www.mnb.hu

+368 020 3776

9

FOS_en_Premium_T&C_07/22

Iceland Umboðsmanns fjármálaþjónustu

til óháðrar umfjöllunar

Höfðatún 2,

105 Reykjavík

Iceland

E-mail:

Website:

https://en.fme.is/supervisio

n/consumeraffairs/the-

insurancecomplaints-

committee/

Tel: + 354 520 3700

Fax: +354 520 3727

Ireland

Financial Services and Pensions

Ombudsman for independent

arbitration

3rd Floor, Lincoln House

Lincoln Place

Dublin 2

D02 VH29

E

-

mail:

+353 1 567 7000

Italy Institute for Insurance

Supervision (IVASS)

Via del Quirinale 21

00187 Rome

Italy

E-mail: i[email protected]

Website: www.ivass.it

800 486661 (from

Italy)

+(39) 06 42021 095

(from outside Italy)

Fax: +(39) 06 42133

745 or +(39) 06 42133

353

Latvia Latvijas Apdrošinātāju

asociācijas ombudu

zvērinātu advokāti Kristīnu

Pētersoni

Lomonosova iela 9- 10

LV-1019

Rīga

E-mail: office@laa.lv

Website:

https://www.laa.lv/klientie

m/ombuds/

+371 67 360 898 or

+371 67 360 838

Liechtenstein Bundesanstalt für

Finanzdienstleistungsaufsicht

(BaFin)

Graurheindorfer Straße 108

D – 53117 Bonn

www.bafin.de

Lithuania Finansinių paslaugų ir rinkų

priežiūros departamentas

Žalgirio g. 90

LT-09303Vilnius

Lietuva

E-mail: [email protected]

Website:

https://www.lb.lt/lt/vartoto

ju-ir-finansu-rinkos-dalyviu-

gincai

Tel: +370 800 50 500

Luxembourg Aufsichtsbehörde ACA

12 rue Erasme

L – 1468 Luxembourg

E-mail: med[email protected]

Within Belgium:

Tel.: 44 21 44 44 1

Fax: 44 02 89

Malta Arbiter

for Financial Services

1st Floor

St Calcedonius Square

Floriana FRN 1530

financialarbiter.org.mt

or

complaint.i[email protected]

From within Malta:

8007 2366

From abroad: +356

7921 9961

10

FOS_en_Premium_T&C_07/22

Malta

Netherlands Klachteninstituut Financiële

Dienstverlening

Postbus 93257

2509 AG Den Haag

www.kifid.nl

070-333 8 999

Norway Finansklagenemnda

Postboks 53

Skøyen 0212

Oslo – Norge

(+47) 23 13 19 60

Poland Biuro Rzecznika Finansowego

ul. Nowogrodzka 47A

00-695 Warszawa

E-mail: biuro@rf.gov.pl

Website: www.rf.gov.pl

Tel:

+48 22 333 73 26 –

Recepcja

+48 22 333 73 27 –

Recepcja

Fax: +48 22 333 73 29

Portugal Autoridade de Supervisão e

Fundos de Pensões

Av. da República, 76

1600-205 Lisbon

www.asf.com.pt (portal do

consumidor)

Tel: +351 21 790 31 00

Fax: +351 21 793 85 68

Romania Autoritatea de Supraveghere

Financiară

Splaiul Independenţei nr. 15

Sector 5

050092 Bucureşti

E-mail:

office@asfromania.ro

Website:

https://www.asfromania.ro

/en/

Tel: +40 21 668 12 00

Fax: +40 21 659 64 36

Slovakia Národná banka Slovenska

Odbor ochrany finančných

spotrebiteľov

Imricha Karvaša 1

813 25 Bratislava

https://www.nbs.sk/sk/spot

rebitel/kontaktujte-nas

Slovenia Slovensko zavarovalno združenje

GIZ

Železna cesta 14

SI-1001 Ljubljana

E-mail: irps@zav-

zdruzenje.si

+386 1 300938

Spain Servicio de Reclamaciones de la

Dirección General de Seguros y

Fondos de Pensiones

Paseo de la Castellana 44

28046 – Madrid

https://www.dgsfp.mineco.

es

Sweden National Board for Consumer

Disputes (ARN)

Allmänna

Reklamationsnämnden Box 174,

101 23

Stockholm

E-mail: arn@arn.se

Website: www.arn.se

08-508 860 00

11

FOS_en_Premium_T&C_07/22

CONDITIONS FOR BENEFICIARIES

WHAT’S INSIDE

DEFINITIONS 12

WHEN YOUR BENEFITS BEGIN AND END 16

AREA OF VALIDITY 16

DESCRIPTION OF BENEFITS 16

A. TRIP CANCELLATION 17

B. TRIP INTERRUPTION 19

C. TRAVEL DELAY 21

D. BAGGAGE 22

E. BAGGAGE DELAY 23

F. LOSS OF TRAVEL DOCUMENTS 24

G. EMERGENCY MEDICAL/DENTAL BENEFITS ABROAD 24

H. EMERGENCY TRANSPORTATION 25

I. SPORTS COVERAGE 28

J. TRAVEL SERVICES DURING YOUR TRIP 30

GENERAL EXCLUSIONS 31

CLAIMS INFORMATION 33

GENERAL PROVISIONS AND CONDITIONS 35

PRIVACY NOTICE 37

12

FOS_en_Premium_T&C_07/22

DEFINITIONS

Throughout these conditions for beneficiaries, words and any form of the word appearing in italics are

defined in this section.

Abroad Means a country, other than the country of residence, where the beneficiary does

not stay for more than 3 months per year.

Accident An unexpected and unintended event that causes injury, property damage, or

both.

Accommodation A hotel or any other kind of lodging for which you make a reservation or where you

stay and incur an expense.

Account holder The person who has subscribed to the Revolut Premium account.

Adoption proceeding

A mandatory legal proceeding or other meeting required by law to be attended by

you as a prospective adoptive parent(s) in order to legally adopt a minor child.

Baggage Personal property you take with you or acquire on your trip.

Beneficiary The account holder who has rights to claim under the collective insurance

agreement along with their children (including the stepchildren, foster children,

adopted children or children currently in the adoption process) up to a maximum

age of 17 years at the time of travel, when they travel with the account holder.

Climbing sports An activity utilizing harnesses, ropes, belays, crampons, or ice axes. It does not

include supervised climbing on artificial surfaces intended for recreational

climbing.

Cohabitant A person you currently live with and have lived with for at least 12 consecutive

months and who is at least 18 years old.

Computer System Any computer, hardware, software, or communication system or electronic device

(including but not limited to smart phone, laptop, tablet, wearable device), server,

cloud, microcontroller, or similar system, including any associated input, output,

data storage device, networking equipment, or backup facility.

Conditions for

beneficiaries

This document outlining the terms and conditions applicable for the benefits to

apply.

Country of residence The country where you have your primary residence and the same country where

the account holder’s Revolut account is held.

Covered reasons The specifically named situations or events for which you are covered under these

conditions for beneficiaries.

Cyber Risk Any loss, damage, liability, claim, cost, or expense of any nature directly or

indirectly caused by, contributed to by, resulting from, or arising out of or in

connection with, any one or more instances of any of the following:

1. Any unauthorized, malicious, or illegal act, or the threat of such act(s),

involving access to, or the processing, use, or operation of, any computer

system;

2. Any error or omission involving access to, or the processing, use, or

operation of any computer system;

3. Any partial or total unavailability or failure to access, process, use, or

operate any computer system; or

4. Any loss of use, reduction in functionality, repair, replacement, restoration

or reproduction of any data, including any amount pertaining to the value

of such data.

13

FOS_en_Premium_T&C_07/22

Departure date The date on which you are originally scheduled to begin your travel, as shown on

your travel itinerary.

Doctor Someone who is legally authorised to practice medicine or dentistry and is licensed

if required. This cannot be you, a travelling companion, your family member, a

travelling companion’s family member, the sick or injured person, or that person’s

family member.

Epidemic A contagious disease recognized or referred to as an epidemic by a representative

of the World Health Organization (WHO) or an official government authority.

Family member

Your

:

1. Spouse (by marriage, common law, domestic partnership, or civil union);

2. Cohabitants;

3. Parents and stepparents;

4. Children, stepchildren, foster children, adopted children, or children currently

in the adoption process;

5. Siblings;

6. Grandparents and grandchildren;

7. The following in-laws: mother, father, son, daughter, brother, sister, and

grandparent;

8. Aunts, uncles, nieces, and nephews;

9. Legal guardians and wards; and

10. Paid, live-in caregivers;

First responder Emergency personnel (such as a police officer, emergency medical technician, or

firefighter) who are among those responsible for going immediately to the scene

of an accident or emergency to provide aid and relief.

High-altitude

activity

An activity that includes, or is intended to include, going above 4500 meters in

elevation, other than as a passenger in a commercial aircraft.

High value items Collectibles, jewellery, watches, gems, pearls, furs, cameras (including video

cameras) and related equipment, musical instruments, professional audio

equipment, binoculars, telescopes, sporting equipment, mobile devices,

smartphones, computers, radios, drones, robots, and other electronics, including

parts and accessories for the aforementioned items.

Hospital An acute care facility that has a primary function of diagnosing and treating sick

and injured people under the supervision of doctors. It must:

1. Be primarily engaged in providing inpatient diagnostic and therapeutic

services;

2. Have organised departments of medicine and major surgery; and

3. Be licensed where required.

Illegal act

An act that violates law where it is committed.

Injury Physical bodily harm.

Local public

transportation

Local, commuter, or other urban transit system carriers (such as commuter rail, city

bus, subway, ferry, taxi, for-hire driver, or other such carriers) that transport you or

a travelling companion less than 150 kilometres.

Mechanical

breakdown

A mechanical issue, which prevents the vehicle from being driven normally,

including an electrical issue, flat tire, or running out of fluids (except fuel).

Medical escort A professional person contracted by our medical team to accompany an ill or

injured person while they are being transported. A medical escort is trained to

provide medical care to the person being transported. This cannot be a friend,

travelling companion, or family member.

14

FOS_en_Premium_T&C_07/22

Medically necessary Treatment that is required for your illness, injury, or medical condition, consistent

with your symptoms, and can safely be provided to you. Such treatment must meet

the standards of good medical practice and is not for your or the provider’s

convenience.

Natural disaster A large-scale extreme weather or geological event that damages property,

disrupts transportation or utilities, or endangers people, including without

limitation: earthquake, fire, flood, hurricane, or volcanic eruption.

Pandemic An epidemic that is recognized or referred to as a pandemic by a representative of

the World Health Organization (WHO) or an official government authority.

Political risk Any kind of events, organised resistance or actions intending or implying the

intention to overthrow, supplant or change the existing ruler or constitutional

government, including but not limited to:

• Nationalisation;

• Confiscation;

• Expropriation (including Selective Discrimination and Forced Abandonment);

• Deprivation;

• Requisition;

• Revolution;

• Rebellion;

• Insurrection;

• Civil commotion assuming to proportion of or amounting to an uprising;

• Military and usurped power.

Primary residence Your permanent, fixed home address for legal and tax purposes.

Pre-existing medical

condition

An injury, illness, or medical condition that, within the 120 days prior to and

including the booking date of the trip:

1. Caused a person to seek a medical examination, diagnosis, care or treatment

by a doctor;

2. Presented symptoms; or

3. Required a person to take medication prescribed by a doctor (unless the

condition or symptoms are controlled by that prescription and the prescription

has not changed).

The illness, injury or medical condition does not need to be formally diagnosed in

order to be considered a pre-existing medical condition.

Quarantine Mandatory involuntary confinement by order or other official directive of a

government, public or regulatory authority, or the captain of a commercial vessel

on which you are booked to travel during your trip, which is intended to stop the

spread of a contagious disease to which you or a travelling companion have been

exposed.

Reasonable and

customary costs

The amount usually charged for a specific service in a particular geographic area.

The charges must be appropriate to the availability and complexity of the service,

the availability of needed parts/materials/supplies/equipment, and the

availability of appropriately-skilled and licensed service providers.

Refund Cash, credit, or a voucher for future travel that you are eligible to receive from a

travel supplier, or any credit, recovery, or reimbursement you are eligible to receive

from your employer, another insurance company, a credit card issuer, or any other

entity.

15

FOS_en_Premium_T&C_07/22

Return Date The date on which you are originally scheduled to end your travel, as shown on

your travel itinerary.

Serious harm The deterioration of an untreated medical condition leading to:

• a more intensive or prolonged period of treatment being required;

• a permanent and irreversible impact to health; or

• death.

Serious illness An illness debilitating enough to prevent the patient from being able to carry out

any of their usual daily activities and which has required the patient to consult a

doctor.

Service animal Any dog that is individually trained to do work or perform tasks for the benefit of

an individual with a disability, including a physical, sensory, psychiatric,

intellectual, or other mental disability. Examples of work or tasks include, but are

not limited to guiding people who are blind, alerting people who are deaf, and

pulling a wheelchair. Other species of animals, whether wild or domestic, trained

or untrained, are not considered service animals. The crime deterrent effects of an

animal’s presence and the provision of emotional support, well-being, comfort, or

companionship are not considered work or tasks under this definition.

Severe weather Hazardous weather conditions including but not limited to windstorms, hurricanes,

tornados, fog, hailstorms, rainstorms, snow storms, or ice storms.

Sporting equipment Equipment or goods used to participate in a sport.

Terrorist event

An act carried out by an organized terrorist group recognized by the government

authority and applicable law of your country of residence that injures people or

damages property to achieve a political, ethnic, or religious result. It does not

include general civil protest, unrest, rioting, or acts of war.

Traffic accident An unexpected and unintended traffic-related event, other than mechanical

breakdown, that causes injury, property damage, or both.

Travel carrier A company licensed to commercially transport passengers between cities for a fee

by land, air, or water. It does not include:

1. Rental vehicle companies;

2. Private or non-commercial transportation carriers;

3. Chartered transportation, except for group transportation chartered by your

tour operator; or

4. Local public transportation.

Travel supplier A travel agent, tour operator, airline, cruise line, hotel, railway company, or other

travel service provider.

Travelling

companion

A person or service animal travelling with you or travelling to accompany you on

your trip. A group or tour leader is not considered a travelling companion unless

you are sharing the same room with the group or tour leader.

Trip Your travel for leisure purposes originally scheduled to begin from your primary

residence on your departure date and end on your return date to or within a

location:

• at least 100 km away from your primary residence; or

• abroad; or

• outside your city/town of residence, provided that your travel includes an

overnight stay.

16

FOS_en_Premium_T&C_07/22

WHEN YOUR BENEFITS BEGIN AND END

The Travel Cancellation benefit for each trip begins from the start date shown on the account holder’s

statement of insurance or the date you booked your trip (whichever is later) and ends on the earliest of the

below events:

1. When you start your trip;

2. When the account holder’s Premium account becomes no longer active;

3. When the account holder terminates their Premium account;

4. The account holder no longer meets the eligibility criteria for the Revolut Premium current account.

All other benefits for each trip begin when you start your trip and will end on the earliest of the below events:

1. When you return to your primary residence;

2. When the account holder’s Premium account becomes no longer active;

3. When the account holder terminates their Premium account;

4. You have exceeded the maximum per trip length of 90 consecutive days;

5. The account holder no longer meets the eligibility criteria for the Revolut Premium current account.

AREA OF VALIDITY

Provided you follow any travel advice issued by the government in your country of residence and in any

country you are travelling from, to or through, you will be entitled to the benefits in any country in the

world.

DESCRIPTION OF BENEFITS

In this section, we will describe the many different types of benefits which eligible beneficiaries are entitled

to. We explain each type of benefit and the specific conditions that must be met for the coverage to apply.

Please note that exclusions may apply.

The benefits are provided during leisure trips only and are not valid during

business trips, meaning any travel or stay undertaken for business/work purposes,

including but not limited to, training, meetings, internships or voluntary work.

It cannot include travel with the intent to receive health care or medical treatment

of any kind and it cannot last longer than 90 days. It must be scheduled to start

and end at your primary residence.

Uninhabitable A natural disaster, fire, flood, burglary, or vandalism has caused enough damage

(including extended loss of power, gas, or water) to make a reasonable person find

their home or destination inaccessible or unfit for use.

We, Us, or Our AWP P&C S.A. – Dutch Branch, trading as Allianz Assistance

You

or

Your

Each

beneficiary.

17

FOS_en_Premium_T&C_07/22

A. TRIP CANCELLATION

If your trip is cancelled or rescheduled for a covered reason listed below, we will reimburse you for your non-

refundable trip payments, deposits, cancellation fees, and change fees (less available refunds), up to the

maximum benefit for trip cancellation coverage listed in your Benefits Summary. Please note that this

benefit only applies before you have left for your trip.

Also, if you prepaid for shared accommodations and your travelling companion cancels their trip due to one

or more of the covered reasons listed below, we will reimburse any additional accommodation fees you are

required to pay.

IMPORTANT: You must notify all of your travel suppliers as soon as practicable once you know that you

will need to cancel your trip (this includes being advised to cancel your trip by a doctor). If you notify any

travel suppliers later than that and get a smaller refund as a result, we will not cover the difference. If a

serious illness, injury, or medical condition prevents you from being able to notify your travel suppliers within

that period, you must notify them as soon as you are able.

Covered reasons:

1. You or a travelling companion becomes ill or injured, or develops a medical condition disabling enough

to make you cancel your trip (including being diagnosed with an epidemic or pandemic disease such as

COVID-19).

The following conditions apply:

a. A doctor advises you or a travelling companion to cancel your trip before you cancel it.

2. A family member who is not travelling with you becomes ill or injured, or develops a medical condition

(including being diagnosed with an epidemic or pandemic disease such as COVID-19).

The following condition applies:

a. The illness, injury, or medical condition must be considered life threatening by a doctor, or require

hospitalization.

3. You, a travelling companion, family member, or your service animal dies on or after the start date shown

on the account holder’s statement of insurance.

4. You or a travelling companion is quarantined before your trip due to having been exposed to:

a. A contagious disease other than an epidemic or pandemic; or

b. An epidemic or pandemic (such as COVID-19), but only when the following conditions are met:

i. The quarantine is specific to you or a travelling companion, meaning that you or a travelling

companion must be specifically and individually designated by name in an order or directive to

be placed in quarantine due to an epidemic or pandemic; and

ii. The quarantine does not apply generally or broadly (a) to some segment or all of a population,

geographical area, building, or vessel (including shelter-in-place, stay-at-home, safer-at-home,

or other similar restriction), or (b) based on to, from, or through where the person is

travelling. This condition (ii) applies even if the quarantine order or directive specifically

designates you or a travelling companion by name to be quarantined.

5. You or a travelling companion is in a traffic accident on the departure date.

18

FOS_en_Premium_T&C_07/22

One of the following conditions must apply:

a. You or a travelling companion need medical attention; or

b. Your or a travelling companion’s vehicle needs to be repaired because it is not safe to operate.

6. You are legally required to attend a legal proceeding during your trip.

The following condition applies:

a. The attendance is not in the course of your occupation (for example, if you are attending in your

capacity as an attorney, court clerk, expert witness, law enforcement officer, or other such

occupation, this would not be covered).

7. Your primary residence becomes uninhabitable.

8. Your travel carrier cannot get you to your original itinerary’s destination for at least 24 consecutive hours

from the originally scheduled arrival time due to one of the following reasons:

A. A natural disaster;

B. Severe weather;

However, if you can get to your original destination another way, we will reimburse you for the following,

up to the trip cancellation maximum benefit shown in the Benefits Summary:

i. The necessary cost of the alternative transportation, less available refunds; and

ii. The cost of any lost prepaid accommodations caused by your delayed arrival, less available refunds.

The following condition applies:

a. Alternate transportation arrangements must be in a similar or lower class of service as you were

originally booked with your travel carrier.

9. You or a travelling companion is terminated or laid off by a current employer after your trip booking

date.

The following conditions apply:

a. The termination or layoff is not your or your travelling companion’s fault;

b. The employment must have been permanent (not temporary or contract); and

c. The employment must have been for at least 12 continuous months.

10. You or a travelling companion secures new permanent, paid employment, after your trip booking date,

that requires presence at work during the originally scheduled trip dates.

11. Your or a travelling companion’s primary residence is permanently relocated by at least 150 kilometres

due to a transfer by your or a travelling companion’s current employer. This coverage includes relocation

due to transfer by your spouse’s current employer.

12. You or a travelling companion serving as a first responder is called in for duty due to an accident or

emergency (including a natural disaster) to provide aid or relief during the originally scheduled trip

dates.

13. You or a travelling companion receive a legal notice to attend an adoption proceeding during your trip.

19

FOS_en_Premium_T&C_07/22

14. You, a travelling companion, or a family member serving in the armed forces is reassigned or has

personal leave status changed, except because of war or disciplinary action.(Not applicable for

beneficiaries living in Austria and Hungary)

15. You or a travelling companion is medically unable to receive an immunization required for entry into a

destination.

16. Your or travel companion's travel documents required for the trip are stolen

The following condition applies:

a. You must make diligent efforts and provide documentation of your efforts to obtain replacement

documents that would allow you to keep the originally scheduled trip dates

17. You or a traveling companion become ill or injured, or develop a medical condition (including being

diagnosed with an epidemic or pandemic disease such as COVID-19) disabling enough to prevent you

or the travelling companion from participating in the activity that is the main purpose of your trip.

The following condition applies:

a. A doctor advises you or the travelling companion not to participate in the activity before your

departure date.

B. TRIP INTERRUPTION

If you have to interrupt your trip or end it early due to one or more of the covered reasons listed below, we

will reimburse you, less available refunds, up to the maximum benefit for trip interruption coverage listed in

your Benefits Summary, for:

i. The prorated portion of your unused non-refundable trip payments and deposits.

ii. Additional accommodation fees you are required to pay, if you prepaid for shared accommodation and

your travelling companion has to interrupt their trip.

iii. Necessary transportation expenses you incur to continue your trip or return to your primary residence.

• We will reimburse you either for the return travel carrier ticket to your country of residence or for the

non-refundable portion of your original return ticket, but not both.

iv. Additional accommodation and transportation expenses if the interruption causes you to stay at your

destination (or the location of the interruption) longer than originally planned. There is a maximum

coverage of €200 in total for all beneficiaries per day for 5 days.

IMPORTANT: You must notify all of your travel suppliers as soon as practicable once you know that you

will need to interrupt your trip (this includes being advised to interrupt your trip by a doctor). If you notify

any travel suppliers later than that and get a smaller refund as a result, we will not cover the difference. If

a serious illness, injury, or medical condition prevents you from being able to notify your travel suppliers

within that period, you must notify them as soon as you are able.

Covered reasons:

1. You or a travelling companion becomes ill or injured, or develops a medical condition disabling enough

to make you interrupt your trip (including being diagnosed with an epidemic or pandemic disease such

20

FOS_en_Premium_T&C_07/22

as COVID-19).

The following conditions apply:

a. A doctor must either examine or consult with you or the travelling companion before you make a

decision to interrupt the trip.

b. You must not have travelled against your home country’s government advice or against local

authority advice at your trip destination.

2. A family member who is not travelling with you becomes ill or injured, or develops a medical condition

(including being diagnosed with an epidemic or a pandemic disease such as COVID-19).

The following condition applies:

a. The illness, injury, or medical condition must be considered life threatening by a doctor, or require

hospitalization.

3. You, a travelling companion, family member, or your service animal dies during your trip.

4. You or a travelling companion is quarantined during your trip due to having been exposed to:

a. A contagious disease other than an epidemic or pandemic; or

b. An epidemic or pandemic (such as COVID-19), but only when the following conditions are met:

i. The quarantine is specific to you or a travelling companion, meaning that you or a travelling

companion must be specifically and individually designated by name in an order or directive to

be placed in quarantine due to an epidemic or pandemic; and

ii. The quarantine does not apply generally or broadly (a) to some segment or all of a population,

geographical area, building, or vessel (including shelter-in-place, stay-at-home, safer-at-home,

or other similar restriction), or (b) based on to, from, or through where the person is travelling.

This condition (ii) applies even if the quarantine order or directive specifically designates you or

a travelling companion by name to be quarantined.

5. You or a travelling companion is in a traffic accident.

One of the following conditions must apply:

a. You or a travelling companion needs medical attention; or

b. The vehicle needs to be repaired because it is not safe to operate.

6. You are legally required to attend a legal proceeding during your trip.

The following condition applies:

a. The attendance is not in the course of your occupation (for example, if you are attending in your

capacity as an attorney, court clerk, expert witness, law enforcement officer or other such

occupation, this would not be covered).

7. Your primary residence becomes uninhabitable.

8. Your travel carrier cannot get you to your original itinerary’s destination for at least 24 consecutive hours

from the originally scheduled arrival time due to one of the following reasons:

A. A natural disaster; or

B. Severe weather.

21

FOS_en_Premium_T&C_07/22

However, if you can get to your original destination another way, we will reimburse you for the following,

up to the trip interruption maximum benefit shown in the Benefits Summary:

i. The necessary cost of alternate transportation, less available refunds; and

ii. The cost of any lost prepaid accommodations caused by your delayed arrival, less available refunds.

The following condition applies:

a. Alternate transportation arrangements must be in a similar or lower class of service as you were

originally booked with your travel carrier. (Not applicable for beneficiaries living in France)

9. You or a travelling companion serving as a first responder is called in for duty due to an accident or

emergency (including a natural disaster) to provide aid or relief during the originally scheduled trip

dates.

10. You or a travelling companion is a traveller on a hijacked aircraft, train, vehicle, or vessel.

11. You, a travelling companion, or a family member serving in the armed forces is reassigned or has

personal leave status changed, except because of war or disciplinary action. (Not applicable for

beneficiaries living in Austria and Hungary)

12. You miss at least 50% of the length of your trip due to one of the following:

A. A travel carrier delay (this does not include a travel carrier’s cancellation prior to your departure

date);

B. A strike, unless threatened or announced prior to the date your trip was booked;

C. A natural disaster;

D. Roads are closed or impassable due to severe weather;

E. Lost or stolen travel documents that are required and cannot be replaced in time for continuation

of your trip;

i. You must make diligent efforts and provide documentation of your efforts to obtain replacement

documents

F. Civil disorder, unless it rises to the level of political risk.

13. A travel carrier denies you or a travelling companion boarding based on a suspicion that you or a

travelling companion has a contagious medical condition (including an epidemic or pandemic disease

such as COVID-19). This does not include being denied boarding due to your refusal or failure to

comply with rules or requirements to travel or of entry to your destination.

C. TRAVEL DELAY

If your or a travelling companion’s trip is delayed for one of the covered reasons listed below, we will

reimburse you for the following expenses, less available refunds, up to the maximum benefit shown in your

Benefits Summary for travel delay:

i. Your lost prepaid trip expenses and additional expenses you incur while and where you are delayed for

meals, accommodation, communication and transportation, subject to a limit for the first complete 4

hours and a limit for each complete hour thereafter, as listed in your Benefits Summary, as follows:

• If you provide receipts, the With Receipts Daily Limit applies; or

22

FOS_en_Premium_T&C_07/22

• If you do not provide receipts or do not incur expenses, the No Receipts Daily Limit applies.

ii. If the delay causes you to miss the departure of your cruise or tour, necessary transportation expenses

to either help you rejoin your cruise/tour or reach your destination.

iii. If the delay causes you to miss the departure of your flight or train due to a local public transportation

delay on your way to the departure airport or train station, necessary transportation expenses to either

help you reach your destination or return home.

The delay must be for at least the Minimum Required Delay listed in your Benefits Summary and due to one

of the following covered reasons:

1. A travel carrier delay (this does not include a travel carrier’s cancellation prior to your departure date);

2. A strike, unless threatened or announced prior to date of booking your trip.

3. Quarantine during your trip due to having been exposed to:

a. A contagious disease other than an epidemic or pandemic; or

b. An epidemic or pandemic (such as COVID-19), but only when the following conditions are met:

i. The quarantine is specific to you or a travelling companion, meaning that you or a travelling

companion must be specifically and individually designated by name in an order or directive to

be placed in quarantine due to an epidemic or pandemic; and

ii. The quarantine does not apply generally or broadly (a) to some segment or all of a population,

geographical area, building, or vessel (including shelter-in-place, stay-at-home, safer-at-home,

or other similar restriction), or (b) based on to, from, or through where the person is travelling.

This condition (ii) applies even if the quarantine order or directive specifically designates you or

a travelling companion by name to be quarantined.

4. A natural disaster;

5. Lost or stolen travel documents;

6. Hijacking, except when it is a terrorist event;

7. Civil disorder, unless it rises to the level of political risk; or

8. A traffic accident.

9. A travel carrier denies you or a travelling companion boarding based on a suspicion that you or a

travelling companion has a contagious medical condition (including an epidemic or pandemic disease

such as COVID-19). This does not include being denied boarding due to your refusal or failure to comply

with rules or requirements to travel or of entry to your destination.

D. BAGGAGE

If your baggage is lost, damaged, or stolen while you are on your trip, we will pay you, less available refunds,

the lesser of the following, up to the maximum benefit listed for baggage loss in your Benefits Summary:

i. Cost to repair the damaged baggage; or

ii. Cost to replace the lost, damaged, or stolen baggage with the same or similar item, reduced by 10% for

each full year since the original purchase date, up to the maximum of 50% reduction.

The following conditions apply:

a. You have taken necessary steps to keep your baggage safe and intact and to recover it;

b. You have filed and retained a copy of a report giving a description of the property and its value with the

appropriate local authorities, travel carrier, hotel, or tour operator within 24 hours of discovery of the

loss;

c. You must file and retain a copy of a police report in the case of theft of any items;

23

FOS_en_Premium_T&C_07/22

d. You must provide original receipts or another proof of purchase for each lost, damaged, or stolen item.

For items without an original receipt or a proof of purchase, we will only cover 50% of the cost to

replace the lost, damaged, or stolen item with the same or similar item; and

e. You must report theft or loss of a cellular device to your network provider and request to block the device

The following items are not covered:

1. Animals, including remains of animals;

2. Cars, motorcycles, motors, aircraft, watercraft, and other vehicles and related accessories and

equipment;

3. Bicycles, skis, and snowboards (except while they are checked with a travel carrier) (Not applicable

for beneficiaries living in Germany);

4. Hearing aids, prescription eyewear, and contact lenses;

5. Artificial teeth, prosthetics, and orthopaedic devices;

6. Wheelchairs and other mobility devices (Not applicable for beneficiaries living in Italy);

7. Consumables, medicines, medical equipment/supplies, and perishables;

8. Tickets, passports, deeds, blueprints, stamps, and other documents;

9. Money, currency, credit cards, notes or evidences of debt, negotiable instruments, travellers cheques,

securities, bullion, and keys;

10. Rugs and carpets;

11. Antiques and art objects;

12. Fragile or brittle items;

13. Firearms and other weapons, including ammunition;

14. Intangible property, including software and electronic data;

15. Property for business or trade;

16. Property you do not own;

17. High value items stolen from a vehicle, locked or unlocked;

18. Baggage while it is:

a. Shipped, unless with your travel carrier;

b. In or on a car trailer;

c. Unattended in an unlocked motor vehicle; or

d. Unattended in a locked motor vehicle, unless baggage cannot be seen from the outside;

E. BAGGAGE DELAY

If your baggage is delayed by a travel supplier during your trip, we will reimburse you for expenses you incur

for the essential items you need until your baggage arrives, up to the maximum benefit shown in your

Benefits Summary for baggage delay.

The following conditions apply:

a. Your baggage must be delayed for at least the Minimum Required Delay listed under baggage delay in

your Benefits Summary.

b. If you do not provide receipts, the maximum amount payable is the No Receipts Limit listed in your

Benefits Summary. Only available for your outbound travel (not your return travel).

24

FOS_en_Premium_T&C_07/22

F. LOSS OF TRAVEL DOCUMENTS

If your passport or visa is lost, stolen or destroyed while you are on your trip, we will reimburse you, up to the

maximum benefit listed for Loss of Travel Documents in your Benefits Summary for the following:

i. The cost of your necessary extra travel and accommodation expenses as well as administration

costs for the issuing of the emergency passport and/or visa you need to continue your trip or return

to your primary residence; and

ii. The equivalent cost (based on the current standard replacement costs) of the period remaining on

your passport that is lost or has been stolen or destroyed.

The following conditions apply:

You must:

a. have taken necessary steps to keep your passport and/or visa safe and to recover it, where

possible;

b. file and retain a copy of a police report in the case of theft;

c. have filed and retained a copy of a loss report from the consulate or embassy you reported it to;

and

d. provide receipts for all expenses, including from the consulate or embassy confirming the cost of

the replacement or emergency passport or visa.

The following exclusions apply:

1. Reimbursement, unless you can provide receipts for the expenses claimed;

2. Losses caused by differences in exchange rates;

3. Passports or visas left unattended in a motor vehicle or a public area;

4. Foreign currency transaction fees imposed by your bank or credit card issuer;

5. The cost of any upgrades, pre-checking services or shipping fees;

G. EMERGENCY MEDICAL/DENTAL BENEFITS ABROAD

If you receive emergency medical or dental care while you are on your trip abroad for one of the following

covered reasons, we will reimburse the reasonable and customary costs of that care for which you are

responsible, up to the maximum benefit listed for emergency medical/dental coverage in your Benefits

Summary (dental care is subject to the maximum sublimit listed for dental care):

1. While on your trip abroad, you have a sudden, unexpected illness, injury, or medical condition that could

cause serious harm if it is not treated before your return home (including being diagnosed with an

epidemic or pandemic disease such as COVID-19).

2. While on your trip abroad, you have a dental injury or infection, a lost filling, or a broken tooth that

requires treatment.

If you need to be admitted to a hospital as an inpatient, we may be able to guarantee or advance payments,

where accepted, up to the limit of your emergency medical/dental benefit.

The following conditions and additional exclusions apply:

a. The care must be medically necessary to treat an emergency condition, and such care must be

provided by a doctor, dentist, hospital, or other provider authorized to practice medicine or dentistry.

25

FOS_en_Premium_T&C_07/22

b. This coverage will not pay for any care provided after your trip ends.

c. This coverage will not pay for any care for any illness, injury, or medical condition that did not

originate during your trip abroad;

d. This coverage will not pay for any non-emergency care or services in general and the following care

and services in particular:

1. Elective cosmetic surgery or care;

2. Annual or routine exams;

3. Long-term care;

4. Allergy treatments (unless the allergic reaction is life threatening);

5. Exams or care related to or loss of/damage to hearing aids, dentures, eyeglasses, and contact

lenses;

6. Physical therapy, rehabilitation, or palliative care (except as necessary to stabilize you);

7. Experimental treatment; and

8. Any other non-emergency medical or dental care.

e. You must not have travelled against the orders or advice of any government or other public authority

at any location to, from, or through which you are travelling on your trip.

H. EMERGENCY TRANSPORTATION

IMPORTANT:

• If your emergency is immediate or life threatening, seek local emergency care at once.

• We are not, and shall not be deemed to be, a provider of medical or emergency services.

• We act in compliance with all national and international laws and regulation, and our services are

subject to approvals by appropriate local authorities and active travel & regulatory restrictions.

Emergency Evacuation (Transporting you to the nearest appropriate medical facility)

If you become seriously ill or injured or develop a medical condition (including being diagnosed with an

epidemic or pandemic disease such as COVID-19) while on your trip, we will pay for local emergency

transportation from the location of the initial incident to a local doctor or local medical facility. If we

determine that the local medical facilities are unable to provide appropriate medical treatment:

1. Our medical team will consult with the local doctor to obtain information necessary to make

appropriate decisions regarding your overall medical condition; We will identify the closest

appropriate available hospital or other appropriate available facility, make arrangements to

transport you there, and pay for that transport; and

2. We will arrange and pay for a medical escort if we determine one is necessary.

The following conditions apply to items 1 and 2 above:

a. You or someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorize and arrange the transportation, we will only pay up to what we would

have paid if we had made the arrangements. We will not assume any responsibility for any transportation

arrangements that we did not authorize or arrange;

b. All decisions about your evacuation must be made by medical professionals licensed in the countries

where they practice;

c. You must comply with the decisions made by our assistance and medical teams. If you do not comply,

you effectively relieve us from any responsibility and liability for the consequences of your decisions, and

we reserve the right to not provide coverage;

26

FOS_en_Premium_T&C_07/22

d. One or more emergency transportation providers must be willing and able to transport you from your

current location to the identified hospital or facility.

e. You must not have travelled against the orders or advice of any government or other public authority at

any location to, from, or through which you are travelling on your trip.

Medical Repatriation (Getting you home after you receive care)

If you become seriously ill or injured or develop a medical condition (including being diagnosed with an

epidemic or pandemic disease such as COVID-19) while on your trip and our medical team confirms with the

treating doctor that you are medically stable to travel, we will:

1. Arrange and pay for you to be transported via regularly scheduled service on a common carrier in the

same class of service that you originally booked, unless a different class of service is otherwise medically

necessary, for the return leg of your trip, less available refunds for unused tickets. The transportation

will be to one of the following:

a. Your primary residence;

b. A location of your choice in your country of residence; or

c. A medical facility near your primary residence or in a location of your choice in your country of

residence. In either case, the medical facility must be willing and able to accept you as a patient and

must be approved by our medical team as medically appropriate for your continued care.

2. Arrange and pay for a medical escort if our medical team determines that one is necessary.

The following conditions apply:

a. Special accommodations must be medically necessary for your transportation (for example, if more than

one seat is medically necessary for you to travel).

b. You or someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorize and arrange the transportation, we will only pay up to what we would

have paid if we had made the arrangements. We will not assume any responsibility for any transportation

arrangements that we did not authorize or arrange;

c. All decisions about your repatriation must be made by medical professionals licensed in the countries

where they practice;

d. You must comply with the decisions made by our assistance and medical teams. If you do not comply,

you effectively relieve us from any responsibility and liability for the consequences of your decisions, and

we reserve the right to not provide coverage;

e. One or more emergency transportation providers must be willing and able to transport you from your

current location to the identified hospital or facility.

f. You must not have travelled against the orders or advice of any government or other public authority at

any location to, from, or through which you are travelling on your trip.

Transport to Bedside (Bringing a friend or family member to you)

If you are told by the treating doctor that you will be hospitalized for more than 72 hours during your trip or

that your condition is immediately life-threatening, we will arrange and pay for round-trip transportation in

economy class on a travel carrier for one friend or family member to stay with you.

The following condition applies:

a. You or someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorize and arrange the transportation, we will only pay up to what we would

have paid if we had made the arrangements.

27

FOS_en_Premium_T&C_07/22

b. You must not have travelled against the orders or advice of any government or other public authority at

any location to, from, or through which you are travelling on your trip.

Return of Dependents (Getting minors and dependents home)

If you die or are told by the treating doctor you will be hospitalized for more than 24 hours during your trip,

we will arrange and pay to transport your travelling companions who are under the age of 18, or are

dependents requiring your full-time supervision and care to one of the following:

1. Your primary residence; or

2. A location of your choice in your country of residence.

We will arrange and pay for an adult family member to accompany your travelling companions who are

under the age of 18 or are dependents requiring your full-time supervision and care, if we determine that it

is necessary.

Transportation will be on a travel carrier in the same class of service that was originally booked. Available

refunds for unused tickets will be deducted from the total amount payable.

The following conditions apply:

a. This benefit is only available while you are hospitalized, or if you die, and if you do not have an adult

family member travelling with you that is capable of caring for the travelling companions under the age

of 18 or dependents.

b. You or someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorize and arrange the transportation, we will only pay up to what we would

have paid if we had made the arrangements.

c. You must not have travelled against the orders or advice of any government or other public authority at

any location to, from, or through which you are travelling on your trip.

Repatriation of Remains (Getting your remains home)

We will arrange and pay for the reasonable and necessary services and supplies to transport your remains

to one of the following:

1. A funeral home near your primary residence; or

2. A funeral home located in your country of residence

The following conditions apply:

a. Someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorize and arrange the transportation, we will only pay up to what we would

have paid if we had made the arrangements; and

b. The death must occur while on your trip.

If a family member decides to make funeral, burial, or cremation arrangements for you at the location of

your death, we will reimburse the necessary expenses up to the amount it would have cost us to transport

your remains to a funeral home near your primary residence.

Search and Rescue

We will pay the cost of search and rescue activities by a professional rescue team, up to the maximum benefit

listed for search and rescue coverage in your Benefits Summary, if you are reported missing during your trip

or have to be rescued from a physical emergency.

28

FOS_en_Premium_T&C_07/22

I. SPORTS COVERAGE

Missed activity

If you cannot participate in one or more of your prepaid activities during your trip for a covered reason

listed below, we will reimburse you for your non‐refundable costs that you paid for the activities, less

available refunds, up to the maximum benefit for Missed Activity Coverage listed in your Benefits

Summary. Please note that this coverage only applies before the start of the activity.

Covered reasons:

1. You, a traveling companion, or a family member who is participating in the activity becomes ill or

injured, or develops a medical condition (including being diagnosed with an epidemic or a pandemic

disease such as COVID-19).

The following conditions apply:

a. The illness, injury, or medical condition must be disabling enough to make a reasonable person

not participate in the activity; and

b. A doctor advises you, a traveling companion, or a family member not to participate in the

activity before the activity takes place. If that isn’t possible, a doctor must either examine or

consult with you, the traveling companion, or the family member within 72 hours of the activity,

or as soon as reasonably possible, to confirm the decision not to attend.

2. Your family member who is not participating in the activity becomes ill or injured, or develops a

medical condition.

The following condition applies:

a. The illness, injury, or medical condition must be considered life threatening by a doctor, require

hospitalization, or require your care.

3. Your or a traveling companion dies on or after your policy’s coverage effective date.

4. Your family member or your service animal dies on or within 30 days prior to the scheduled start date

of the activity and on or after your policy’s coverage effective date.

5. Your prepaid activity is canceled by the supplier of the activity due to severe weather.

6. Your ski resort closes 75% or more of its ski trails due to lack or excess of snow.

The following condition applies:

a. The closure is for at least 50% of the normal operating hours on the calendar day you intend to

use the lift tickets.

Sporting equipment coverage

If your sporting equipment is lost or damaged by a travel supplier, or stolen, while you are on your trip, we

will pay you, less available refunds, the lesser of the following, up to the maximum benefit listed for Sporting

Equipment Damage, Loss, or Theft in your Benefits Summary:

i. Cost to repair the damaged sporting equipment; or

ii. Cost to replace the lost, damaged, or stolen sporting equipment with the same or similar item, reduced

by 10% for each full year of use since the original purchase date, up to the maximum of 50% reduction.

29

FOS_en_Premium_T&C_07/22

The following conditions apply:

a. You have taken necessary steps to keep your sporting equipment safe and intact and to recover it;

b. You have filed and have a copy of a report giving a description of the property and its value with the

appropriate local authorities, travel carrier, hotel, or tour operator within 24 hours of discovery of the

loss;

c. You must provide original receipts or another proof of purchase for each lost, stolen, or damaged item.

For items without an original receipt or a proof of purchase, we will only cover 50% of the current

market price of each item.

The following are not covered:

1. Items other than sporting equipment;

2. Animals, including remains of animals;

3. Cars, motorcycles, motors, drones, aircraft, watercraft, and other vehicles and related accessories

and equipment;

4. Hearing aids, prescription eyewear, and contact lenses, unless specifically designed for use in a

particular sport;

5. Prosthetics, and orthopedic devices, unless specifically designed for use in a particular sport;

6. Wheelchairs and other mobility devices, unless specifically designed for use in a particular sport;

7. Intangible property, including software and electronic data;

8. Property for business or trade;

9. Property you do not own;

10. Your gross negligence or willful and wanton conduct leading to loss, theft, or damage of your sporting

equipment; and (Not applicable for beneficiaries living in Germany);

11. Sporting equipment while it is:

a. Shipped, unless with your travel carrier;

b. In or on a car trailer; or

c. Unattended in an unlocked motor vehicle.

Sporting equipment rental coverage

If your sporting equipment is lost, damaged, or delayed by a travel supplier during your outbound travel, or

stolen while on your trip, we will reimburse the necessary costs for renting replacement sporting equipment

to use during your trip, up to the maximum benefit listed for Sporting Equipment Rental Coverage in your

Benefits Summary. This coverage does not include motorized equipment or vehicles.

The following condition applies:

a. You have filed a report giving a description of the property with the appropriate local authorities,

travel supplier, hotel, or tour operator within 24 hours of discovery of the loss.

Search and Rescue

We will pay the cost of search and rescue activities by a professional rescue team, up to the maximum benefit

listed for search and rescue coverage in your Benefits Summary, if you are reported missing during your trip

or have to be rescued from a physical emergency. The maximum benefit listed for this coverage is in addition

to any other search and rescue benefit that this policy provides.

30

FOS_en_Premium_T&C_07/22

J. TRAVEL SERVICES DURING YOUR TRIP

If you need travel services during your trip, we are available 24 hours a day. With our global reach and

multi-lingual staff, we are here to help you.

Finding a Doctor or Medical Facility

If you need care from a doctor or medical facility while you are travelling, we can assist you in finding one.

31

FOS_en_Premium_T&C_07/22

GENERAL EXCLUSIONS

This section describes the general exclusions applicable to all benefits under these conditions for

beneficiaries. An “exclusion” is something that is not covered and therefore no payment or service would

be available.

These conditions for beneficiaries do not provide benefits for any loss that results directly or indirectly

from any of the following general exclusions if they affect you, a travelling companion, or a family

member: