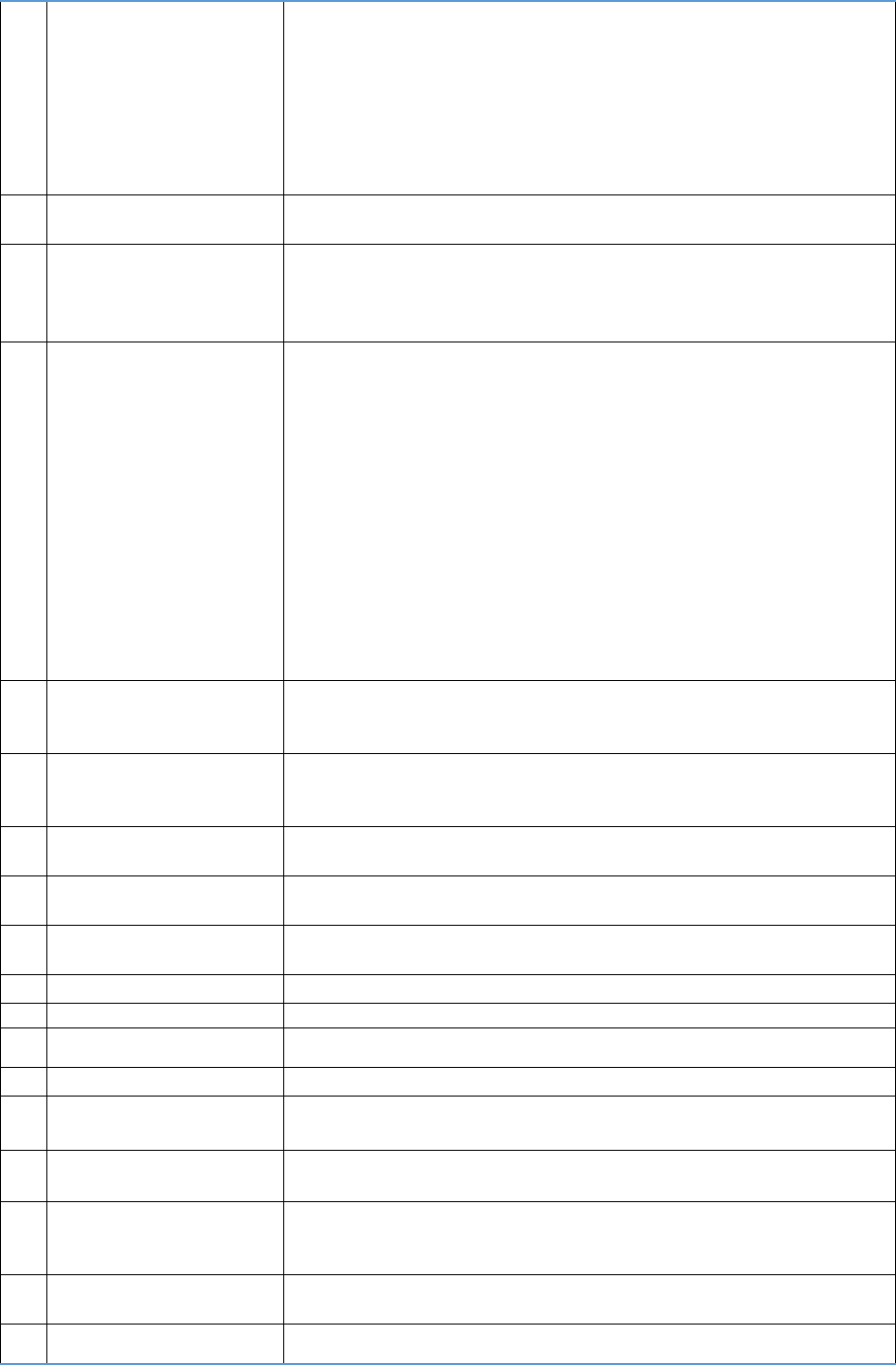

COVERAGE SUMMARY

This Coverage Summary sets out a brief description only of the coverage provided under each section and the most

we will pay in total for all claims under each section.

Important: Sub-limits apply to some benefits. All costs and expenses must be reasonable and customary costs. Terms,

conditions, limits and exclusions apply as set out in the Policy Wording. Maximum benefits stated, including sub-limits,

are per insured adult.

The definitions of the words and phrases in the DEFINITIONS section of the Policy Wording also apply in this Coverage

Summary.

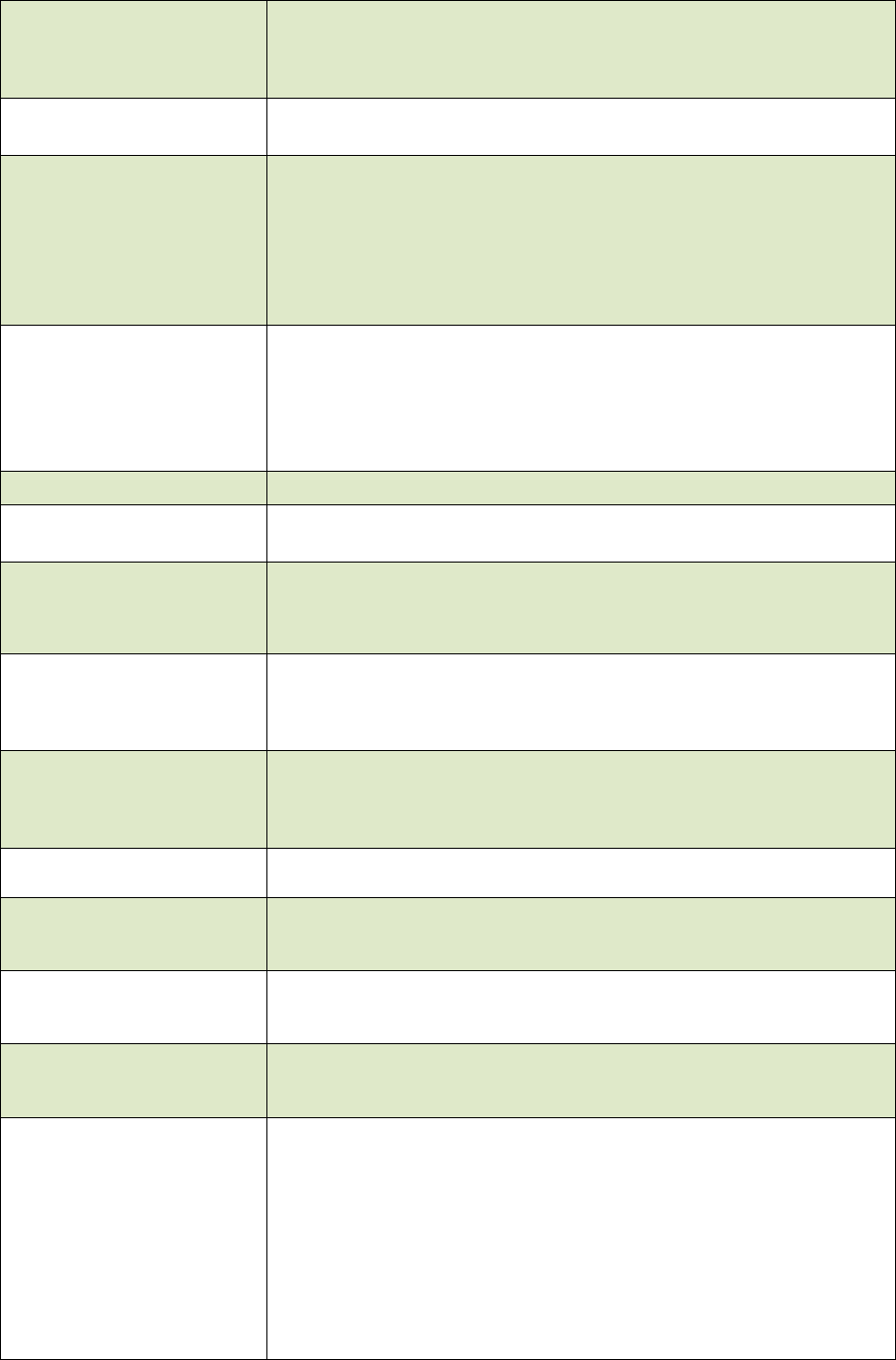

COVERAGE

WHEN IT APPLIES

MAXIMUM BENEFIT

(SGD$)

Baggage

Your baggage is lost, damaged, or stolen while on your trip.

Maximum benefit for all high value items: $1,000

$5,000

Baggage Delay

Your baggage is delayed by an airline, cruise line, or other

travel carrier while on your trip.

Minimum Required Delay – 6 hours

No Receipts Daily Limit: $200 (Outbound Only)

With Receipts Daily Limit: $400

Overseas Emergency

Medical and Dental

(a)

You have to pay for emergency medical or dental

treatment while on your trip.

Emergency Dental Treatment Maximum Sublimit: $2,000

Continuation of medical treatment in Singapore for

maximum of 14 days sublimit: $2,500

$200,000

Emergency Transportation

Transportation is needed following a medical emergency

while on your trip.

Emergency Evacuation

Medical Repatriation

Repatriation of Remains

Transport to Bedside

Up to Actual Cost

Up to Actual Cost

Up to Actual Cost

$5,000

Travel Accident

You suffer a death or disability as a result of a travel

accident during your trip.

Death: $100,000

Loss of sight or limb(s): $50,000

Permanent disablement : $100,000

$100,000

(a)

Aggregate limit per event for medical expenses is SGD$ 2,200,000

IMPORTANT MATTERS

WHO WE ARE

This policy is underwritten by Tokio Marine Insurance Singapore Ltd., as the insurer. The insurer may be referred

to as “we”, “our” and “us” in this policy wording.

AWP Services Singapore Pte. Ltd. (operating under the consumer-facing branding of Allianz Travel) has been

appointed by Tokio Marine Insurance Singapore Ltd. to act as agent to arrange the policy and provide general

advice and as service provider to provide other services on our behalf.

WHAT THIS POLICY INCLUDES

This document is our Revolut Travel NAC Insurance Policy Wording.

This travel insurance policy covers only the sudden and unexpected specific situations, events, and losses

included in this policy, and only under the terms and conditions described. Not every loss is covered, even if it is

due to something sudden, unexpected, or out of your control.

You need to read this policy carefully and note the exclusions in each section along with the GENERAL

EXCLUSIONS to make sure you understand it and ensure that it meets your needs.

If you need any clarification on your coverage or our Policy Wording, please contact our Customer Care Team at

[+65 6280 0316]

Your policy consists of three parts:

1. The Policy Wording; and

2. Any other document we tell you forms part of your policy.

Please retain these documents in a safe place.

WHO THIS POLICY COVERS

Who is eligible to be insured on this policy?

You are eligible for this policy if you meet the following criteria:

a) you are the Accountholder or legal spouse of Accountholder of Revolut Premium or Metal; and

b) your Revolut Premium or Metal account remains valid during policy coverage start and end dates; and

c) Prior to leaving Singapore, at least fifty percent (50%) of the total cost of the Accountholder’s / spouse’s

overseas return travel ticket (i.e. Travel ticket from and returning to Singapore) has been paid for from the

Accountholder’s account. If the travel conveyance fare is incorporated as part of a travel package this

requirement is deemed satisfied provided that the total cost of the travel package is fully charged to the

Accountholder’s account.; and

d) you are ordinarily Singapore resident; and

e) you will purchase your policy in Singapore before you start your trip; and

f) you intend to return to Singapore after your trip; and

g) the departure date on your policy reflects the date you are originally scheduled to begin your travel, as

shown on your travel itinerary.

The policy is issued in Singapore and is subject to the Insurance Act (Cap 142) (the “Act”) and all rules, regulations,

subsidiary legislation and government orders enacted thereunder. The Act provides that you are treated as being

ordinarily resident in Singapore if:

a) You are a citizen of Singapore, unless you have resided outside Singapore continuously for 5 or more years

preceding the application date of the policy and are not currently residing in Singapore;

b) You are a permanent resident, unless you have resided in Singapore for less than a total of 183 days in the 12

months preceding the application date of the policy;

c) You have a work pass or permit required under the Employment of Foreign Manpower Act (Cap. 91A), unless

you have resided in Singapore for less than a total of 183 days in the 12 months preceding the application date

of the policy; or

d) You have a pass or permit required under the Immigration Act (Cap. 133) that has duration longer than 90

days and you have resided in Singapore continuously for at least 90 days in the 12 months preceding the

application date of the policy.

If you do not satisfy any one of the aforesaid definitions of being “ordinarily resident in Singapore”, you must

notify us immediately.

The insurance will be invalid if we have previously informed you that we do not want to insure you (anymore).

In this case, we will refund any premium paid by you.

If requested by us, you will need to prove your eligibility by providing us with documentation including but not

limited to:

i) a copy of your passport; or

ii) Singapore residency documents; or

iii) a copy of your current visa; or

iv) other official documents confirming your right to reside in Singapore; and

v) a copy of your travel itinerary.

EMERGENCY ASSISTANCE

If during your trip you are to be hospitalised, require evacuation or repatriation services, need to make

alternative travel or accommodation arrangements or have lost your baggage, travel documents or money,

please notify us as soon as possible.

We provide our customers with easy access to our 24-hour emergency assistance service. A phone call will put

you directly in touch with a medical or travel specialist who will be able to assist you and confirm the cover

available under your policy. You will be advised of any steps you will need to follow in claiming under your policy.

You can call collect from anywhere in the world for emergency medical and travel assistance.

EMERGENCY PHONE NUMBER

Call: +65 6995 1118

OTHER CONTACT DETAILS

Email: sg.travelhelp@allianz.com

Phone: +65 6280 0316

WHEN WE MAY CANCEL THIS POLICY

We may cancel this Policy by sending ninety (90) days’ notice by registered letter to the Policyholder at its last

known address and in such Event will return to the Policyholder the premium paid less the pro rata portion

thereof for the period the Policy has been in force. The Policy may be cancelled at any time by the Policyholder

by giving ninety (90) days’ notice to Us and provided no claim has arisen during the then current Period of

Insurance the Policyholder shall be entitled to a return of premium paid on a pro-rated basis less the period the

Policy has been in force and subject to any adjustment of premium required by the terms or conditions of this

Policy.

CORRECTNESS OF STATEMENTS AND FRAUD

If any claim under this policy is in any respect fraudulent, or if any false declaration is made or false or incorrect

information is used in support of any claim, then we can, at our sole discretion, not pay your claim and cancel

your cover under this policy from the date that the incorrect statement or fraudulent claim was made.

DUTY OF DISCLOSURE

When you use this insurance policy, you must disclose to us all material facts.

A material fact is one that may influence a prudent insurer in deciding whether or not to accept the cover

and, if so, on what terms and conditions.

Examples of information you may need to disclose include:

• anything that increases the risk of an insurance claim;

• any criminal conviction;

• if another insurer has cancelled or refused to insure or renew insurance, has imposed special terms, or refused

any claim;

• any insurance claim or loss made or suffered in the past.

These examples are a guide only. If there is any doubt as to whether any particular piece of information

needs to be disclosed, this should be referred to us.

If you fail to comply with your duty of disclosure it may result in:

• us refusing to insure you;

• us providing you with this insurance on altered terms;

• the amount we pay if you make a claim being reduced; or

• us refusing to pay a claim.

CHANGE OF CIRCUMSTANCES

During the period of insurance, you must tell us immediately of any material change in the circumstances

surrounding the subject matter of this insurance that:

• increases the risk we are insuring, or

• alters the nature of the risk we are insuring.

Once you have told us, we may immediately change the terms of your cover or cancel it. If you fail to tell us, we

may apply these changes retrospectively from the date you ought to have reasonably told us.

JURISDICTION AND CHOICE OF LAW

This policy is governed by and construed in accordance with the laws of Singapore and you agree to submit to

the exclusive jurisdiction of the courts of Singapore. You agree that it is your intention that this Jurisdiction and

Choice of Law clause applies.

SANCTIONS REGULATION

Notwithstanding anything contained in this policy we will not provide cover nor will we make any payment or

provide any service or benefit to any person or party where providing such cover, payment, service or benefit

would expose us to or violate any applicable trade or economic sanction or any law or

regulation.

DISPUTE RESOLUTION PROCESS

Any dispute about any matter arising under, out of, or in connection with this policy shall first be referred to the

Financial Industry Disputes Resolution Centre Ltd (“FIDReC”). This applies as long as the dispute can be brought

before FIDReC. If the dispute cannot be referred to or resolved by FIDReC, it shall be referred to and finally

resolved by arbitration in Singapore in accordance with the Arbitration Rules of the Singapore International

Arbitration Centre (“SIAC Rules”) for the time being in force, which rules are deemed to be incorporated by

reference in this clause. The tribunal shall consist of one (1) arbitrator.

EXCLUSION OF RIGHTS UNDER CONTRACTS (RIGHTS OF THIRD PARTIES) ACT

Any person or entity who is not a party to this policy shall have no rights under the Contracts (Right of Third

Parties) Act (Cap. 53B) to enforce any terms of the policy.

POLICY OWNERS’ PROTECTION SCHEME

This policy is protected under the Policy Owners’ Protection Scheme which is administered by the Singapore

Deposit Insurance Corporation (SDIC). Coverage for the policy is automatic and no further action is required. For

more information on the types of benefits that are covered under the scheme as well as the limits of coverage,

where applicable, please contact the Company or visit the GIA or SDIC websites (www.gia.org.sg or

www.sdic.org.sg).

PERSONAL DATA USE

Any information collected or obtained in relation to this policy, whether contained in the application or

otherwise obtained may be used and/or disclosed to Tokio Marine Insurance Singapore Ltd. associated

individuals/companies within Tokio Marine Group or any independent third parties (within or outside Singapore)

for any matters relating to the application, any policy issued and to provide advice or information about Tokio

Marine Insurance Singapore Ltd.’s products and services which Tokio Marine Insurance Singapore Ltd. believes

may be of the policyholder and/or the insured person’s interest and to communicate with the policyholder

and/or the insured person for any purpose. Such data may also be used for audit, business analysis and

reinsurance purposes, amongst others.

Tokio Marine Insurance Singapore Ltd. may collect, use, disclose and/or process such data in accordance with

the Personal Data Protection Act 2012 for the purposes and uses described in Tokio Marine Insurance Singapore

Ltd.’s Privacy Policy. The Privacy Policy can be found at Tokio Marine Insurance Singapore Ltd.’s website.

WHAT’S INSIDE

DEFINITIONS 7

PRE-EXISTING MEDICAL CONDITIONS 11

WHEN YOUR COVERAGE BEGINS AND ENDS 12

DESCRIPTION OF COVERAGES 13

A. BAGGAGE COVERAGE 12

B. BAGGAGE DELAY COVERAGE 13

C. OVERSEAS EMERGENCY MEDICAL AND DENTAL COVERAGE 14

D. EMERGENCY TRANSPORTATION COVERAGE 15

E. TRAVEL ACCIDENT COVERAGE 17

GENERAL EXCLUSIONS 19

CLAIMS 22

DEFINITIONS

Throughout this policy, words and any form of the word appearing in italics have the meaning detailed in this

section.

Accident

An unexpected and unintended event that causes injury, property damage,

or both.

Accommodation

A hotel or any other kind of lodging for which you make a reservation or

where you stay and incur an expense.

Accountholder

The person who has subscribed to the Revolut Premium or Metal account

Baggage

Personal property you take with you or acquire on your trip. Refer to the

Baggage Coverage Section for details about any items that are not covered.

Climbing sports

An activity utilising harnesses, ropes, belays, crampons, or ice axes. It does

not include supervised climbing on artificial surfaces intended for

recreational climbing.

Cohabitant

A person you currently live with and have lived with for at least 12

consecutive months and who is at least 18 years old.

Computer System

Any computer, hardware, software, or communication system or electronic

device (including but not limited to smart phone, laptop, tablet, wearable

device), server, cloud, microcontroller, or similar system, including any

associated input, output, data storage device, networking equipment, or

backup facility.

Covered reasons

The specifically named situations or events for which you are covered under

this policy.

Cyber Risk

Any loss, damage, liability, claim, cost, or expense of any nature directly or

indirectly caused by, contributed to by, resulting from, or arising out of or in

connection with, any one or more instances of any of the following:

1. any unauthorised, malicious, or illegal act, or the threat of such act(s),

involving access to, or the processing, use, or operation of, any

computer system;

2. any error or omission involving access to, or the processing, use, or

operation of any computer system;

3. any partial or total unavailability or failure to access, process, use, or

operate any computer system; or

Any loss of use, reduction in functionality, repair, replacement, restoration

or reproduction of any data, including any amount pertaining to the value of

such data.

Departure date

The date on which you are originally scheduled to begin your travel, as shown

on your travel itinerary.

Doctor

Someone who is legally authorised to practice medicine or dentistry and is

licensed if required. This cannot be you, a travelling companion, your family

member, a travelling companion’s family member, the sick or injured person,

or that person’s family member.

Epidemic

A contagious disease recognised or referred to as an epidemic by a

representative of the World Health Organization (WHO) or an official

government authority.

Family member

Your:

1. spouse (by marriage, common law, domestic partnership, or civil union);

2. cohabitants;

3. parents and stepparents;

4. children, stepchildren, foster children, adopted children, or children

currently in the adoption process;

5. siblings;

6. grandparents and grandchildren;

7. the following in-laws: mother, father, son, daughter, brother, sister, and

grandparent;

8. aunts, uncles, nieces, and nephews;

9. legal guardians and wards;

10. paid, live-in caregivers; and

11. service animals.

High-altitude activity

An activity that includes, or is intended to include, going above 4500 meters

in elevation, other than as a passenger in a commercial aircraft.

High value items

Collectibles, jewellery, watches, gems, pearls, furs, cameras (including video

cameras) and related equipment, musical instruments, professional audio

equipment, binoculars, telescopes, sporting equipment, hearing aids,

prescription eyewear, contact lenses, artificial teeth, prosthetics,

orthopaedic devices, wheelchairs, mobility devices, medical equipment,

mobile devices, smartphones, computers, radios, drones, robots, and other

electronics, including parts and accessories for the aforementioned items.

Hospital

An acute care facility that has a primary function of diagnosing and treating

sick and injured people under the supervision of doctors. It must:

1. be primarily engaged in providing inpatient diagnostic and therapeutic

services;

2. have organised departments of medicine and major surgery; and

3. be licensed where required.

Illegal act

An act that violates the law where it is committed.

Injury

External or internal bodily injury caused solely and directly by violent,

accidental, external and discernible means.

Local public transportation

Local, commuter, or other urban transit system carriers (such as commuter

rail, city bus, subway, ferry, taxi, for-hire driver, or other such carriers) that

transport you or a travelling companion less than 150 kilometers.

Medical escort

A professional person contracted by our medical team to accompany an ill

or injured person while they are being transported. A medical escort is

trained to provide medical care to the person being transported. This cannot

be a friend, travelling companion, or family member.

Medically necessary

Treatment that is required for your illness, injury, or medical condition,

consistent with your symptoms, and can safely be provided to you. Such

treatment must meet the standards of good medical practice and is not for

your or the provider’s convenience.

Mental illness

Means any illness, condition or disorder listed in the current edition of the

Diagnostic and Statistical Manual of Mental Disorders.

Pandemic

An epidemic that is recognised or referred to as a pandemic by a

representative of the World Health Organization (WHO) or an official

government authority.

Permanent disablement

An injury which within 90 days from the accident, results in paraplegia,

quadriplegia, tetraplegia, the loss of one or more limbs, loss of sight in one

or both eyes, loss of hearing in both ears, or total loss of speech.

Policy

This travel insurance contract. This Policy Wording and any other document

we tell you forms part of your policy.

Political risk

Any kind of events, organised resistance or actions intending or implying the

intention to overthrow, supplant or change the existing ruler or

constitutional government, including but not limited to:

● Nationalisation;

● Confiscation;

● Expropriation (including Selective Discrimination and Forced

Abandonment);

● Deprivation;

● Requisition;

● Revolution;

● Rebellion;

● Insurrection;

● Civil commotion assuming to proportion of or amounting to an uprising;

● Military and usurped power.

Primary residence

Your permanent, fixed home address in Singapore for legal and tax purposes.

Pre-existing medical condition

Any medical or physical conditions, injuries, mental illnesses, signs,

symptoms or circumstances:

a) which you are aware of, or ought to have been aware of; or

b) for which advice, care, treatment, medication or medical attention has

been sought, given or recommended; or

c) which have been diagnosed as a medical condition or illness, or which are

indicative of an illness; or

d) which are of such a nature to require, or which potentially may require

medical attention; and

e) which are of such a nature as would have caused a prudent, reasonable

person to seek medical attention prior to the start date of cover under this

policy.

The illness, injury, or medical condition does not need to be formally

diagnosed in order to be considered a pre-existing medical condition.

This definition applies to you, your family members and your travelling

companions.

Public place

Any area to which the public has access (whether authorised or not)

including but not limited to accommodation foyers and grounds,

restaurants, public toilets, beaches, airports, railway stations, bus

terminals, taxi stands and wharves.

Quarantine

Mandatory involuntary confinement by order or other official directive of a

government, public or regulatory authority, or the captain of a commercial

vessel on which you are booked to travel during your trip, which is intended

to stop the spread of a contagious disease to which you or a travelling

companion has been exposed.

Reasonable and customary

costs

The amount usually charged for a specific service in a particular geographic

area. The charges must be appropriate to the availability and complexity of

the service, the availability of needed parts/materials/supplies/equipment,

and the availability of appropriately skilled and licensed service providers.

Refund

Cash, credit, or a voucher for future travel that you are eligible to receive

from a travel supplier, or any credit, recovery, or reimbursement you are

eligible to receive from your employer, another insurance company, a credit

card issuer, or any other entity.

Service animal

Any dog that is individually trained to do work or perform tasks for the

benefit of an individual with a disability, including a physical, sensory,

psychiatric, intellectual, or other mental disability. Examples of work or tasks

include, but are not limited to guiding people who are blind, alerting people

who are deaf, and pulling a wheelchair. Other species of animals, whether

wild or domestic, trained or untrained, are not considered service animals.

The crime deterrent effects of an animal’s presence and the provision of

emotional support, well-being, comfort, or companionship are not

considered work or tasks under this definition.

Terrorist event

An act, including but not limited to the use of force or violence, of any person

or group(s) of persons, whether acting alone or on behalf of or in connection

with any organisation(s), which constitutes terrorism as recognised by the

government authority or under the laws of Singapore and is committed for

political, religious, ethnic, ideological or similar purposes, including but not

limited to the intention to influence any government and/or to put the

public, or any section of the public, in fear. It does not include general civil

disorder or unrest, protest, rioting, political risk, or acts of war.

Travel carrier

A company licensed to commercially transport passengers between cities for

a fee by land, air, or water. It does not include:

1. rental vehicle companies;

2. private or non-commercial transportation carriers;

3. chartered transportation, except for group transportation chartered by

your tour operator; or

4. local public transportation.

Travel supplier

A travel agent, tour operator, airline, cruise line, accommodation, railway

company, or other travel service provider.

Travelling companion

A person with whom you have made arrangements before your policy was

issued, to travel with you for at least 75% of the duration of your trip. A

group or tour leader is not considered a travelling companion unless you

are sharing the same room with the group or tour leader.

Trip

Your travel to, within, and/or from a location away from your primary

residence, which is originally scheduled to begin on your departure date and

end on the coverage end date listed on your Certificate of Insurance. The

maximum duration of your trip cannot exceed 90 days. All trip related

expenses must be paid for at least fifty percent (50%) of the cost using the

covered account including but not limited to transportation and

accommodation.

Unattended

Leaving your baggage and any personal effects including money and

Identity documents:

1. who is not a travelling companion or who is not a family member;

or

2. who is a travelling companion or who is a family member but who

fails to keep your baggage and effects under close supervision; or

3. where they can be taken without your knowledge; or

4. at such a distance from you or outside of your line of sight, that

you are unable to prevent them from being taken.

We, Us, or Our

Tokio Marine Insurance Singapore Ltd. acting through AWP Services

Singapore Pte. Ltd. trading as Allianz Travel.

You or Your

Revolut accountholder and any members of their Family travelling with

them who qualify for cover for the relevant Journey under this policy.

PRE-EXISTING MEDICAL CONDITIONS

IMPORTANT INFORMATION ABOUT PRE-EXISTING MEDICAL CONDITIONS

When used in this policy wording or in any other documents which form part of your policy, the phrase pre-

existing medical condition has a special meaning.

Pre-existing medical condition means:

Any medical or physical conditions, injuries, mental illnesses, signs, symptoms or circumstances:

a) which you are aware of, or ought to have been aware of; or

b) for which advice, care, treatment, medication or medical attention has been sought, given or recommended;

or

c) which have been diagnosed as a medical condition or illness, or which are indicative of an illness; or

d) which are of such a nature to require, or which potentially may require medical attention; and

e) which are of such a nature as would have caused a prudent, reasonable person to seek medical attention prior

to the start date of cover under this policy.

The illness, injury, or medical condition does not need to be formally diagnosed in order to be considered a pre-

existing medical condition.

This definition applies to you, your family members and your travelling companions

You can also find this definition of ‘pre-existing medical condition’ in the DEFINITIONS section of this Policy

Wording.

General exclusion for pre-existing medical conditions

It is important to know that this policy does not provide coverage for any loss that results directly or indirectly

from, or that is related to:

a) your pre-existing medical condition(s), or any complications attributable to those condition(s); or

b) pre-existing medical condition(s) of your travelling companion or any complications attributable to those

condition(s); or

c) pre-existing medical condition(s) of your family members or any complications attributable to those

condition(s).

Please refer to the GENERAL EXCLUSIONS if:

• you are travelling against the medical advice of a doctor;

• you are travelling with the intention of obtaining medical treatment.

WHEN YOUR COVERAGE BEGINS AND ENDS

Coverage start and end dates:

Cover is only provided for losses that occur for any trip commencing on or after 1 July 2022.

Your policy will end on the earliest of:

1. the 90

th

day of the trip;

2. the day you end your trip and arrive back to your primary residence, if you end your trip early;

3. the day you arrive at a medical facility in Singapore for further care if you end your trip due to a medical

reason;

4. When you (the holder of Revolut Technologies Singapore Pte. Ltd.’s Plan Account) cease to hold such

account and whereupon the cover of your legal spouse under this Master Policy (if any) will also terminate

immediately

5. When the Master Policy is terminated; or

6. When the Revolut Technologies Singapore Pte. Ltd.’s Plan Account Program is terminated.

Automatic policy extensions:

If your return travel is delayed beyond the end of your policy due to a covered reason under this policy, we will

extend your coverage period until the earliest of when you:

1. reach your final trip destination or your primary residence;

2. decline to continue on to your final trip destination or primary residence once you are able;

3. decline medical repatriation after your treating doctor and we confirm you are medically stable to travel; or

4. arrive at a medical facility in Singapore for further care following a medical evacuation or medical

repatriation.

DESCRIPTION OF COVERAGES

In this section, we will describe the different insurance coverages which are included in your policy. We explain

each type of coverage and the conditions that must be met for the coverage to apply. If the conditions of

coverage are not met, your claim will not be paid.

Specific exclusions may apply to individual coverages, and you must check the GENERAL EXCLUSIONS for

exclusions applying to all coverages under this policy.

We will only provide cover under this policy for events and covered reasons that are sudden, unforeseeable and

outside of your control occurring during your coverage period.

A. BAGGAGE COVERAGE

`

If your baggage is lost, damaged, or stolen while you are on your trip, we will pay you, less available refunds, the

lesser of the following, up to the maximum benefit listed for Baggage Coverage in your Coverage Summary:

i. cost to repair the damaged baggage; or

ii. cost to replace the lost, damaged, or stolen baggage with the same or similar item, depreciated by 10% for

each full year since the original purchase date, up to the maximum of 50% depreciation.

The following conditions apply:

a. You must have taken reasonable steps to keep your baggage safe and intact and to recover it;

b. You must have filed and retained a copy of a report giving a description of the property and its value with

the appropriate local authorities, travel carrier, accommodation, or tour operator within 24 hours of

discovery of the loss;

c. You must file and retain a copy of a police report in case of theft of any one or more high-value items;

d. You must provide original receipts or another proof of purchase for each lost, damaged, or stolen item. For

items without an original receipt or a proof of purchase, we will only cover 50% of the cost to replace the

lost, damaged, or stolen item with the same or similar item; and

e. You must report theft or loss of a cellular device to your network provider and request to block the device

What is not covered

The following items are not covered under this section:

1. Animals, including remains of animals;

2. Cars, motorcycles, motors, aircraft, watercraft, and other vehicles and related accessories and equipment;

3. Bicycles, skis, and snowboards (except while they are checked with a travel carrier);

4. Tickets, passports, deeds, blueprints, stamps, and other documents;

5. Money, currency, credit cards, notes or evidences of debt, negotiable instruments, travellers’ cheques,

securities, bullion, and keys;

6. Rugs and carpets;

7. Antiques and art objects;

8. Fragile or brittle items;

9. Firearms and other weapons, including ammunition;

10. Intangible property, including software and electronic data;

11. Property for business or trade;

12. Property you do not own;

13. High value items stolen from a car, locked or unlocked;

14. Baggage while it is:

a. shipped, unless with your travel carrier;

b. in or on a car trailer;

c. unattended in an unlocked motor vehicle; or

d. unattended in a locked motor vehicle, unless the baggage cannot be seen from the outside;

15. Baggage left unattended in a public place.

B. BAGGAGE DELAY COVERAGE

If your baggage is delayed by a travel supplier during your trip, we will reimburse you for expenses you incur for

the essential items you need until your baggage arrives, up to the maximum benefit shown in your Coverage

Summary for Baggage Delay.

The following condition applies:

a. Your baggage must be delayed for at least the Minimum Required Delay listed under Baggage Delay in your

Coverage Summary.

b. If you do not provide receipts, the maximum amount payable is the No Receipts Limit listed in your Coverage

Summary. This coverage is only available for your outbound travel (not your return travel).

C. OVERSEAS EMERGENCY MEDICAL AND DENTAL COVERAGE

Overseas Emergency Medical Care:

We will reimburse the reasonable and customary costs for which you are responsible for your emergency

medical care, if, during your trip, you require immediate medical attention because you have:

1. a sudden, unexpected illness, injury, or medical condition (including being diagnosed with an epidemic or

pandemic disease such as COVID-19).

We will reimburse you up to the maximum benefit listed for Emergency Medical and Dental Coverage in your

Coverage Summary.

If you need to be admitted to a hospital as an inpatient, we may be able to guarantee or advance payments,

where accepted, up to the maximum benefit listed for Emergency Medical and Dental Coverage in your Coverage

Summary.

Emergency Dental Treatment:

We will reimburse the reasonable and customary costs of your emergency dental treatment, if during your trip:

1. you develop a dental infection; or

2. you break a tooth or experience a dental injury; or

3. you lose a filling.

We will reimburse you up to the maximum sub-limit listed for Emergency Dental Treatment listed in the

Emergency Medical and Dental Coverage section of your Coverage Summary.

Continuation of medical care in Singapore

We will reimburse you up to the maximum benefit listed in the Coverage Summary for your continuing medical

care in Singapore.

The following conditions apply:

i. The illness, injury or medical condition must have occurred during your trip.

ii. The costs must be reasonable and customary costs incurred within 14 days of the date you return to

Singapore.

iii. If you did not have treatment for the illness, injury or medical condition during your trip, you must seek

treatment within 48 hours of the date and time you arrived back to Singapore or we will not pay.

iv. In all cases, for claims related to COVID-19, you must have received a positive COVID-19 test during your

trip or we will not pay regardless of condition iii.

The following conditions apply to Overseas Emergency Medical and Dental coverage:

a. The care must be medically necessary to treat an emergency condition, and such care must be provided by

a doctor, dentist, hospital, or other provider authorised to practice medicine or dentistry;

b. You, or someone acting on your behalf, must wherever possible contact us prior to treatment or

hospitalisation. Failure to obtain our prior approval before any hospitalisation or treatment may result in

your claim being declined; and

c. We have the option of returning you to Singapore for further treatment if you are medically fit to travel and

we will cover the costs for your repatriation. If you decline to return, we will not reimburse you for any

ongoing overseas medical expenses including medication; and

d. You must not have travelled against the orders or advice of any government or other public authority at any

location to, from, or through which you are traveling on your trip.

What is not covered:

We will not pay for losses arising directly or indirectly from:

a. private medical care when public health care or treatment is available to you, or for any medical care you

receive under a Reciprocal Healthcare Agreement between Singapore and the country you are in;

b. any care for any illness, injury, or medical condition that did not originate during your trip while outside

Singapore;

c. hospitalisation or surgical treatment where our prior approval has not been sought and obtained, unless

notification is not possible;

d. non-emergency care or services including but not limited to the following care and services:

1. Elective cosmetic surgery or care;

2. Annual or routine exams;

3. Long-term care;

4. Allergy treatments (unless life threatening);

5. Exams or care related to or loss of/damage to hearing aids, dentures, eyeglasses, and contact lenses;

6. Physical therapy, rehabilitation, or palliative care (except as necessary to stabilise you);

7. Experimental treatment; and

8. Any other non-emergency medical or dental care.

D. EMERGENCY TRANSPORTATION COVERAGE

IMPORTANT:

● If your emergency is immediate or life threatening, seek local emergency care at once.

● We are not, and shall not be deemed to be, a provider of medical or emergency services.

● We act in compliance with all national and international laws and regulations, and our services are subject

to approvals by appropriate local authorities and active travel and regulatory restrictions.

Emergency Evacuation (Transporting you to the nearest appropriate medical facility)

If you become seriously ill or injured or develop a medical condition (including being diagnosed with an epidemic

or pandemic disease such as COVID-19) while on your trip, we will pay for local emergency transportation from

the location of the initial incident to a local doctor or local medical facility. If we determine that the local medical

facilities are unable to provide appropriate medical treatment:

1. Our Emergency Assistance Team will consult with the local doctor to obtain information necessary to make

appropriate decisions regarding your overall medical condition;

2. We will identify the closest appropriate available hospital or other appropriate available facility, make

arrangements to transport you there, and pay for that transport; and

3. We will arrange and pay for a medical escort if we determine one is necessary.

The following conditions apply to items 1, 2, and 3 above:

a. You or someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorise and arrange the transportation, we will only pay up to what we would have

paid if we had made the arrangements. We will not assume any responsibility for any transportation

arrangements that we did not authorise or arrange;

b. You must comply with the decisions made by our Emergency Assistance Team. If you do not comply, you

effectively relieve us from any responsibility and liability for the consequences of your decisions, and we

reserve the right to not provide coverage;

c. One or more emergency transportation providers must be willing and able to transport you from your

current location to the identified hospital or facility.

d. You must not have traveled against the orders or advice of any government or other public authority at any

location to, from, or through which you are traveling on your trip.

Medical Repatriation (Getting you home after you receive care)

If you become seriously ill or injured or develop a medical condition (including being diagnosed with an epidemic

or pandemic disease such as COVID-19) while on your trip and our Emergency Assistance Team confirms with the

treating doctor that you are medically stable to travel, we will:

1. Arrange and pay for you to be transported via regularly scheduled service on a common carrier in the same

class of service that you originally booked, unless a different class of service is otherwise medically necessary,

for the return leg of your trip, less available refunds for unused tickets. The transportation will be to one of

the following:

a. Your primary residence;

b. A location of your choice in your country of primary residence; or

c. A medical facility near your primary residence or in a location of your choice in your country of primary

residence. In either case, the medical facility must be willing and able to accept you as a patient and

must be approved by our medical team as medically appropriate for your continued care.

2. Arrange and pay for a medical escort if our medical team determines that one is necessary.

The following conditions apply:

a. Special accommodations must be medically necessary for your transportation (for example, if more than

one seat is medically necessary for you to travel).

b. You or someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorise and arrange the transportation, we will only pay up to what we would have

paid if we had made the arrangements. We will not assume any responsibility for any transportation

arrangements that we did not authorise or arrange;

c. You must comply with the decisions made by our assistance and medical teams. If you do not comply, you

effectively relieve us from any responsibility and liability for the consequences of your decisions, and we

reserve the right to not provide coverage;

d. One or more emergency transportation providers must be willing and able to transport you from your

current location to the identified hospital or facility;

e. You must not have traveled against the orders or advice of any government or other public authority at any

location to, from, or through which you are traveling on your trip.

Transport to Bedside (Bringing a friend or family member to you)

If you are told by the treating doctor that you will be hospitalised for more than 120 hours during your trip or

that your condition is immediately life-threatening, we will arrange and pay for round-trip transportation in

economy class on a travel carrier for one friend or family member to stay with you.

The following conditions apply:

a. You or someone on your behalf must contact us, and we must make all transportation arrangements in

advance. If we did not authorise and arrange the transportation, we will only pay up to what we would have

paid if we had made the arrangements.

b. You must not have traveled against the orders or advice of any government or other public authority at any

location to, from, or through which you are traveling on your trip.

Repatriation of Remains (Getting your remains home)

We will arrange and pay for the reasonable and customary cost to transport your remains to one of the following:

1. A funeral home near your primary residence; or

2. A funeral home located in your country of primary residence

The following conditions apply:

a. Someone on your behalf must contact us, and we must make all transportation arrangements in advance.

If we did not authorise and arrange the transportation, we will only pay up to what we would have paid if

we had made the arrangements; and

b. The death must occur while on your trip.

If a family member decides to make funeral, burial, or cremation arrangements for you at the location of your

death, we will reimburse the necessary expenses up to the amount it would have cost us to transport your

remains to a funeral home near your primary residence.

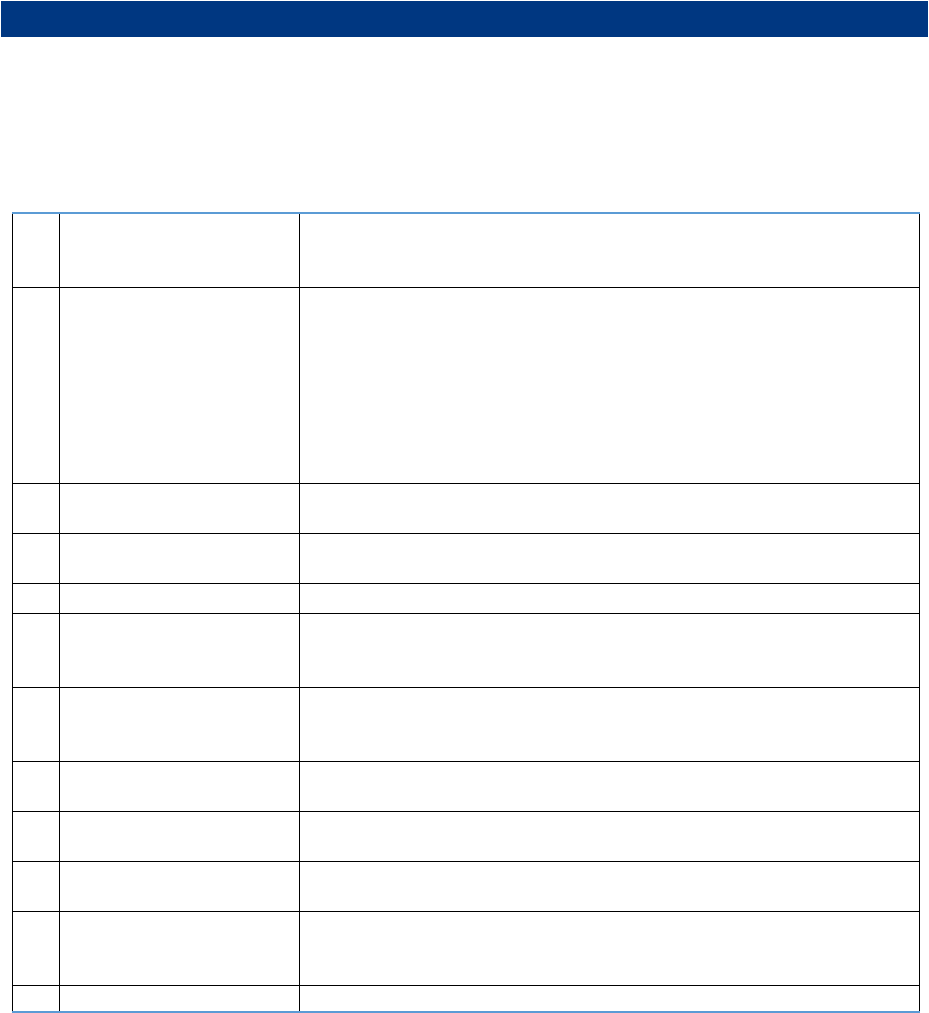

E. TRAVEL ACCIDENT COVERAGE

We will pay up to the maximum benefit for Travel Accident Coverage listed in your Coverage Summary if:

a) an accident occurs during your trip outside of Singapore; and

b) you sustain an injury which within 90 days from the date of the accident, causes your death or permanent

disablement.

We will pay according to the following Schedule of Compensation:

Schedule of Compensation

Percentage of Capital Benefit

1. Death

100%

2. Permanent total disablement

100%

3. Permanent and Incurable paralysis of all limbs

100%

4. Permanent total loss of sight of both eyes

100%

5. Permanent total loss of or the of use of two limbs

100%

6. Permanent total loss of speech

100%

7. Permanent total loss of hearing in:

a) both ears

b) one ear

75%

15%

8. Permanent total loss of sight in one eye

50%

9. Loss of or the permanent total loss of use of one limb

50%

The following condition applies:

a. If the accident is during a flight, the flight must be operated by a commercial airline company and be

between two commercial airports.

What is not covered:

We will not pay claims arising directly or indirectly from:

1. Your participation in manual or hazardous work;

2. Deliberate exposure to danger unless in the attempt to save a human life;

3. Disease or any disease process, illness or any natural causes;

4. The accidental death or permanent disablement of any person under the age of 16 years;

5. You not following our instructions or requirements under any other coverage this policy provides.

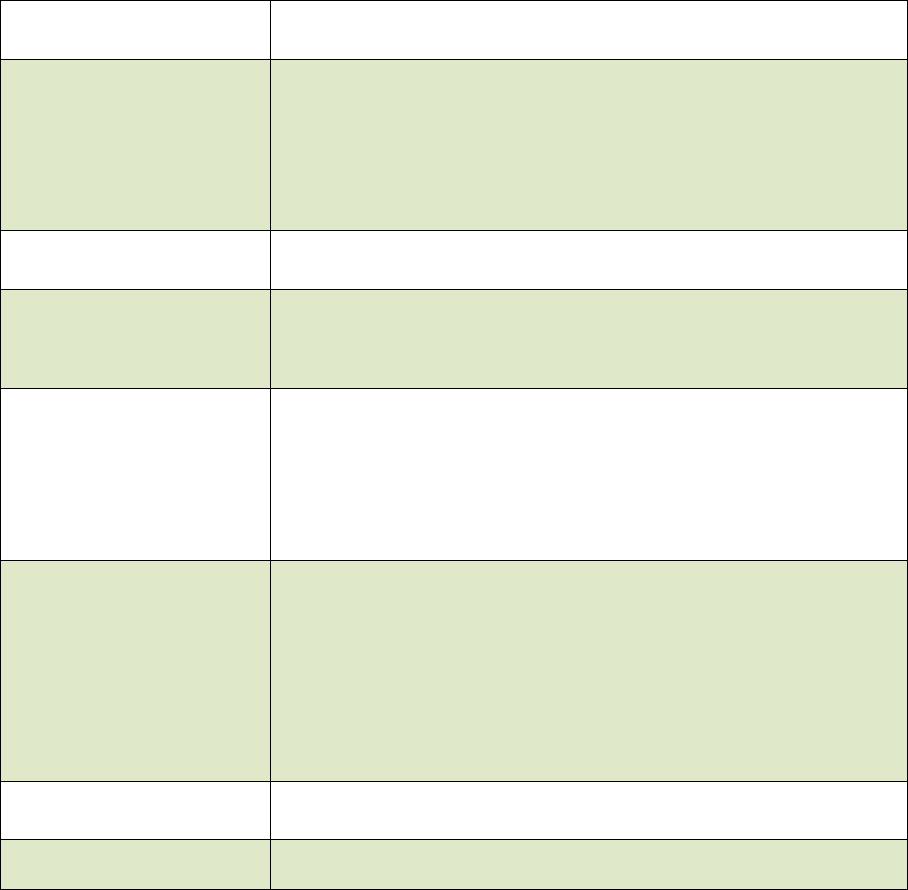

GENERAL EXCLUSIONS

The General Exclusions apply to each coverage. An “exclusion” is something that is not covered by this insurance

policy, and if an exclusion applies to your claim, no payment is available to you.

This policy does not provide coverage for any loss that results directly or indirectly from or that is related to any

of the following:

1.

Things you were aware of

Any loss, condition, or event that was known, foreseeable, intended, or

expected when your policy was purchased.

2.

Pre-existing medical

conditions

a) Your pre-existing medical condition(s), including any complications

attributable to those condition(s).

b) Pre-existing medical condition(s) of your travelling companion including

any complications attributable to those condition(s);

c) Pre-existing medical condition(s) of your family members including any

complications attributable to those condition(s).

3.

Travelling for medical

treatment

You travelling with the intention to receive health care, medical treatment,

or dental treatment of any kind while on your trip.

4.

Travelling against medical

advice

You travelling against the medical advice of a doctor regarding your health

or medical condition.

5.

Self-harm and suicide

Your intentional self-harm or your suicide or attempted suicide.

6.

Pregnancy and childbirth

Pregnancy or childbirth except for sudden unforeseen medical

complications or emergencies occurring within the first 20 weeks/140 days

of your pregnancy.

7.

A child born overseas

A child born overseas during your coverage period, unless, after the birth

you apply for cover and we agree in writing to include the child in this

cover.

8.

Fertility and abortion

Fertility treatments or you undergoing an abortion where it is not deemed

medically necessary to do so by a doctor.

9.

Alcohol and drugs

The use or abuse of alcohol or drugs, or any related physical symptoms.

This does not apply to drugs prescribed by a doctor and used as prescribed.

10.

Intent to cause loss

Acts committed by you, your travelling companion or your family member

with the intent to cause loss.

11.

Working as a crew

member

Operating or working as a crew member (including as a trainee or

learner/student) aboard any aircraft or commercial vehicle or commercial

watercraft.

12.

Motorcycles and mopeds

You riding a moped or motorcycle in the following circumstances:

i. without a helmet (whether as a driver or a passenger); or

ii. without a valid driver’s license as required in the country you

are in; or

iii. where a valid license is not required in the country you are

in, and you do not have a full Singapore license qualifying

you to ride the moped or motorcycle you are riding on, as

specified by Singapore’s regulators.

13.

Professional sports

Participating in or training for any professional or semi-professional

sporting competition.

14.

Amateur sports

Participating in or training for any amateur sporting competition while on

your trip. This does not include participating in informal recreational

sporting competitions and tournaments organised by accommodations,

resorts, or cruise lines to entertain their guests.

15.

Extreme Sports

Participating in extreme, high-risk sports and activities including but not

limited to:

a. Skydiving, BASE jumping, hang gliding, or parachuting;

b. Bungee jumping;

c. Caving, rappelling, or spelunking;

d. Skiing or snowboarding outside marked trails or in an area

accessed by helicopter;

e. Climbing sports or free climbing;

f. Any high-altitude activity;

g. Personal combat or fighting sports;

h. Racing or practicing to race any motorised vehicle or watercraft;

i. Free diving; or

j. Scuba diving at a depth greater than 20 meters or without a dive

master.

16.

Illegal acts

An illegal act resulting in a conviction, except when you, a traveling

companion, a family member, or your service animal is the victim of such

act.

17.

Epidemics and pandemic

diseases

An epidemic or pandemic, except when and to the extent that an epidemic

or pandemic is expressly referenced in and covered under Overseas

Emergency Medical/Dental Coverage.

18.

Natural disasters

Natural disaster, except when and to the extent that a natural disaster is

expressly referenced in.

19.

Pollution and

contamination

Air, water, or other pollution, or the threat of a pollutant release, including

thermal, biological, and chemical pollution or contamination.

20.

Nuclear reaction and

radiation

Nuclear reaction, radiation, or radioactive contamination.

21.

War

War (declared or undeclared) or acts of war.

22.

Military duty

Military duty.

23.

Political risk

Political risk.

24.

Cyber risk

Cyber risk.

25.

Civil unrest

Civil disorder or unrest, except when and to the extent that civil disorder

or unrest is expressly referenced in.

26.

Terrorism

Terrorist events. This exclusion does not apply to Emergency Medical or

Emergency Transportation Coverage.

27.

Government authorities

Acts, travel alerts/bulletins, or prohibitions by any government or public

authority, except when and to the extent that an act, travel alert/bulletin,

or prohibition by a government or public authority.

28.

Travel supplier

restrictions

A travel supplier’s restrictions on any baggage, including medical supplies

or equipment.

29.

Damaged property

Ordinary wear and tear or defective materials or workmanship.

30.

Gross negligence

An act of gross negligence by you or a travelling companion.

31.

Travel against

government advice

Travel against the orders or advice of any government or other public

authority.

32.

Sanctions

Any coverage, benefit, or services for any activity that would violate any

applicable law or regulation, including without limitation any

economic/trade sanction or embargo.

CLAIMS

CLAIMS

First check you are covered by your policy by reading the appropriate coverage section in this policy and

the GENERAL EXCLUSIONS applying to all sections to see exactly what is, and is not covered.

HOW TO MAKE A CLAIM AND WHAT IS REQUIRED

You must give notice of your claim as soon as possible. The fastest and easiest way to make a claim is to visit our

online claims portal: https://www.allianztravel.com.sg/claims.html

Alternatively, you can call the contact number shown on the back cover of this Policy Wording for assistance. If

there is a delay in claim notification, or you do not provide sufficient detail to process your claim, we can reduce

your claim by the amount of prejudice we have suffered because of the delay.

You must give any information we reasonably ask for to support your claim at your expense, such as but not

limited to:

Your original trip booking invoice(s) and travel documents showing the dates and times of travel.

Relevant reports such as police reports, valuations and medical reports;

Original receipts or proof of purchase, bills or invoices and account ownership for all out-of pocket

expenses that you have to pay. If required we may ask you to provide us with translations into English

of any such documents to enable our assessment of your claim.

You must co-operate at all times in relation to providing supporting evidence and such other

information that may reasonably be required Including details of any other insurance you have convert

for the same losses.

If you think that you may have to cancel your trip or shorten your trip you must tell us as soon as

possible. Contact us using the contact number shown on the back cover of this Policy Wording.

For medical, or dental claims, contact us as soon as practicable.

For loss or theft of your baggage, report it immediately to the police and obtain a written notice of your report.

For damage or misplacement of your baggage, caused by the airline or any other operator or accommodation

provider, report the damage or misplacement to an appropriate official and obtain a written report, including

any offer of settlement that they may make. Submit full details of any claim in writing within 30 days of your

return to your primary residence.

CLAIMS ARE PAYABLE IN SINGAPORE DOLLARS TO YOU

We will pay all claims in Singapore dollars. We will pay you unless you tell us to pay someone else. The rate of

currency exchange that will apply is the rate at the time you incurred the expense. Payment will be made by

direct credit to a Singapore bank account nominated by you.

YOU MUST NOT ADMIT FAULT OR LIABILITY

You must not admit that you are at fault, for any accident, incident or event causing a claim under your policy,

and you must not offer or promise to pay any money, or become involved in legal action, without our approval.

YOU MUST HELP US TO RECOVER ANY MONEY WE HAVE PAID

If we have a claim against someone in relation to the money we have to pay or we have paid under your policy,

you must do everything you can to help us do that in legal proceedings. If you are aware of any third party that

you or we may recover money from, you must inform us.

IF YOU CAN CLAIM FROM ANYONE ELSE, WE WILL ONLY MAKE UP THE DIFFERENCE

If you can make a claim against someone in relation to a loss or expense covered under this policy and they do

not pay you the full amount of your claim, we will make up the difference. You must claim from them first.

OTHER INSURANCE

If any loss, damage or liability covered under this policy is covered by another insurance policy, you must give us

details of that insurance policy. We will only make any payment under this policy once the other insurance policy

is exhausted. If we have paid your claim in full first, we may seek contribution from your other insurer. You must

give us any information we reasonably ask for to help us make a claim from your other insurer.

SUBROGATION

We may, at our discretion undertake in your name and on your behalf, control and settlement of proceedings

for our own benefit in your name to recover compensation or secure indemnity from any party in respect of

anything covered by this policy. You are to assist and permit to be done, everything required by us for the

purpose of recovering compensation or securing indemnity from other parties to which we may become entitled

or subrogated, upon us paying your claim under this policy regardless of whether we have yet paid your claim

and whether or not the amount we pay you is less than full compensation for your loss. These rights exist

regardless of the section of this policy under which your claim is paid.

RECOVERY

We will apply any money we recover from someone else under a right of subrogation in the following

order:

1. To us, our costs (administration and legal) arising from the recovery.

2. To us, an amount equal to the amount that we paid to you under your policy.

3. To you, your uninsured loss (less your excess).

4. To you, your excess.

Once we pay your total loss we will keep all money left over.

If we have paid your total loss and you receive a payment from someone else for that loss or damage,

you must pay us the amount of that payment up to the amount of the claim we paid you.

If we pay you for lost or damaged property and you later recover the property or it is replaced by a third

party, you must pay us the amount of the claim we paid you.

FRAUD

Insurance fraud places additional costs on honest policyholders. Fraudulent claims force insurance premiums to

rise. We encourage the community to assist in the prevention of insurance fraud. You can help by reporting

insurance fraud by calling Allianz Partners on +65 6280 0316. All information will be treated as confidential and

protected to the full extent under law.

CONTACT US

For Customer Service and Claims Enquiries

Call: +65 6280 0316

Email: sg.travelhelp@allianz.com

To File a Claim, please:

Visit: https://www.allianz-assistance.com.sg/claims.html

24 HOUR EMERGENCY ASSISTANCE

Call: +65 6995 1118

This policy is issued and managed by AWP Services Singapore Pte. Ltd. trading as Allianz Travel and underwritten

by Tokio Marine Insurance Singapore Ltd