SFY 2025 Local Warrant Apprehension & Absconding Grant Program

(WAAG)

Notice of Funding Availability (NOFA)

Online Submission Deadline: Friday, May 24, 2024, by 11:59 PM

Funded by:

State of Maryland

Governor’s Office of Crime Prevention and Policy*

100 Community Place

Crownsville, MD 21032-2022

www.goccp.maryland.gov

(410) 697-9338

Wes Moore, Governor

Aruna Miller, Lt. Governor

Dorothy J. Lennig, Esq., Executive Director

ELIGIBILITY

Funding through this opportunity is available to local law enforcement agencies that conduct warrant

apprehension and absconding services.

IMPORTANT LINKS

Grants Management System: (GMS) Application Instructions

All applications must be submitted online in the Grants Management System (GMS).

Hard copy applications are not accepted.

* Please note that the Governor’s Office of Crime Prevention, Youth, and Victim Services (GOCPYVS) was renamed to the Governor’s Office of

Crime Prevention and Policy by the Moore-Miller Administration, effective immediately, on 1/18/2024. This change does not invalidate previous,

current, or future agreements or documents referencing the agency as GOCPYVS.

Purpose

Thank you for applying for the SFY 2025 Local Warrant Apprehension & Absconding Grant Program

(WAAG) from the Governor’s Office of Crime Prevention and Policy. The primary purpose of WAAG

funding is to assist local law enforcement with reducing the number of open warrants, especially warrants for

violent crimes, and the apprehension of individuals who have absconded from a court-ordered drug and/or

alcohol treatment facility. This program supports the Office’s goals of improving the quality of life and creating

safer communities through a reduction in violent crime by apprehending wanted individuals. In addition, this

program supports the Office’s objectives of developing coordinated criminal justice strategies and increasing

the availability of data to support data-driven decisions.

If you need application or technical assistance, please contact:

Genevra Farrare, WAAG Grant Specialist

Courtney Thomas, Fiscal Grant Specialist

Courtney[email protected]

Quentin Jones, Criminal Justice Grants Division Director

If you need assistance with program criteria or program design, please contact:

The Governor's Office of Crime Prevention and Policy success is measured by sub-recipient success. It is

critical that we hear from you, our customers. The Moore-Miller administration is committed to providing the

best possible customer service to our citizens. To share your ideas on how the Office can best serve you and

provide support, please email the above program manager to provide your feedback or complete a

three-question customer experience survey.

Governor's Office of Crime Prevention and Policy's Mission:

To serve as a coordinating office that advises the Governor on criminal justice strategies. The Office plans,

promotes, and funds efforts with government entities, private organizations, and the community to advance

public policy, enhance public safety, reduce crime and juvenile delinquency, and serve victims.

Refer to Maryland’s Comprehensive State Crime Control and Prevention Plan 2024-2026 Annual Update.

2

I. Eligibility Criteria

The following entities in Maryland are eligible to submit no more than one (1) application for the SFY

2025 Warrant and Absconding Grant Program:

● Local law enforcement agencies

Note: Every applicant entity must comply with all applicable System of Award Management (SAM.gov)

and unique entity identifier(UEI) requirements throughout the grant cycle. Also refer to the Grants

Management System (GMS) Application Instructions. Grant funds are reimbursed based on actual

quarterly expenditures unless noted otherwise under Section VIII: Funding Specification.

II. Program Description

○ Requiring Agency

Governor’s Office of Crime Prevention and Policy (Office)

○ Opportunity Title

SFY 2025 Warrant Apprehension & Absconding Grant Program (WAAG)

○ Submission Date

Friday, May 24, 2024, by 11:59 PM

○ Anticipated Period of Performance

July 1, 2024 to June 30, 2025

○ Funding Opportunity Description

In 2022, the Maryland General Assembly passed Senate Bill 585 which established warrant

apprehension grants generally relating to warrants and absconding. Further, the legislation expanded

the definition of absconding in Correctional Services Article 6-101 to include an individual who leaves

an inpatient residential treatment facility who was placed under a court order for drug or alcohol

treatment without the permission of the administrator.

The main purposes of WAAG is to reduce open warrants, increase coordination and cooperation

between local law enforcement and state and federal authorities, and reduce the number of outstanding

warrants related to violent crime by apprehending wanted and absconding individuals to reduce crime

in Maryland communities.

The Office anticipates the availability of a minimum of $2,000,000 in grant funding and plans to make

up to 35 awards, ranging from $10,000 (minimum) to $150,000 (maximum). Please note, applications

that do not meet the minimum range, or those that exceed the maximum award allocation, are subject

to removal from consideration during the initial technical review.

All funding is contingent upon the final approval of the Governor's Office of Crime Prevention

and Policy's budget during Maryland’s 2024 Legislative Session of the General Assembly.

4

III. Program Requirements

○ Goals, Objectives, and Deliverables

Overall Goal

● Through coordination and cooperation between local law enforcement and state and federal

agencies, reduce the number of outstanding warrants in an agency’s jurisdiction, especially

those related to violent crimes.

Supported Activities:

● Overtime for officers to serve warrants

● Overtime for analysts to identify wanted/absconded individuals (prioritizing violent crime

warrants)

● Overtime to administer/manage a warrant program

● Travel costs for extradition warrants

● Equipment necessary for the safe execution of warrant arrests (i.e. shackles, handcuffs, face

masks, etc.)

● Services and resources necessary to carry out grant requirements (e.g., hire an administrator,

overtime for the administrator for timely notification of an absconded individual)

Deliverables

Program deliverables include:

● Quarterly, provide proof of grant funded expenditures and the purposes for which the funds were

expended

● Quarterly, submit performance metrics, progress reports, and financial report via the Grant

Management System (GMS) and upload supporting documentation

● At the end of the fourth quarter, submission of an after action report detailing the

accomplishments and areas for improvement of the projects completed within this program.

○ Performance Measures

The following is a sample list, and is not all inclusive of all potential outputs and outcomes measures

that may be included in the final awards:

● Total number of misdemeanor warrants served

● Total number of felony warrants served

● Total number of attempted warrant services

● Total number of wanted individuals who were arrested related to violent crime(s)

● Total number of firearms seized during warrant service

● Total number of warrants in the jurisdiction by type of warrant and related offense

● Total number of unserved warrants removed from databases through validation methods

(abated by death, charges dropped. etc)

● Total number of warrants reduced from the overall number of warrants in the jurisdiction

● Total number of apprehended absconding individuals

● Describe all situations where the service of a misdemeanor warrant led to the apprehension of a

felony offender

5

○ Definitions

● Absconding means willfully evading supervision including leaving an inpatient residential

treatment facility that an individual was placed in under a court order for drug or alcohol

treatment without the permission of the administrator. Absconding does not include missing a

single appointment with a supervising authority.

● Administrator means the program director or the clinical director of an alcohol or drug

abuse treatment facility or a healthcare facility.

● Arrest Warrant means a written order of the court which commands a law enforcement officer

to arrest a person and bring him before a magistrate. Judges and District court commissioners

issue arrest warrants. However, only judges issue “bench warrants.”

● Bench Warrant means an arrest warrant that a judge issues requiring law enforcement officers

to apprehend someone. The judge has the discretion of indicating the amount of the bond that

must be made before the accused may be released or leaving the amount of the bond to the

discretion of the District court commissioner that holds the hearing after the accused is taken

into custody. Bench warrants are often issued when a defendant fails to appear in court when

required to do so.

● Local Law Enforcement Agency means:

○ A police department of a county or municipality corporation in the State; and

○ The office of the sheriff that provides a law enforcement function in a county or municipal

corporation in the state.

● Retake Warrant means a written order signed by a Parole Commissioner, Maryland Parole

Commission, that authorizes and directs any sheriff, police officer, or any employee of the

Division of Parole and Probation authorized by the Director to execute retake warrants to take

the subject into custody and return him to the Department of Corrections. This warrant does not

charge the person with a crime and therefore no appearance before a District court

commissioner is necessary. A subject cannot post bail when taken into custody on the authority

of a Retake Warrant.

IV. Application Process

Applicants are required to apply for grant funding through the Office’s web-based application process,

which may be accessed through the web URL www.goccp.maryland.gov and clicking on Log in to the

Grant Management System (GMS), or by going directly to the login screen using the URL:

https://grants.goccp.maryland.gov.

In order to use the Office’s web-based application, you must have a User ID. If you have not previously

applied through the web, go to the following URL to obtain instructions and the information required to

obtain a User ID and password: http://goccp.maryland.gov/grants/requesting-access/.

The last day to request a User ID is Wednesday, May 15, 2024. If you have previously applied through

the web, use your existing User ID and password.

If you have previously applied to the Office, but do not have your User ID, or are having technical

assistance. If you need assistance completing the program-specific information required in the online

6

The Grant Management System (GMS) Help Desk operates Monday through Friday from 9 AM to

5 PM. The normal response time is 24 - 72 hours.

V. Training/Technical Assistance (TA)

To help applicants prepare and submit applications that reflect the Office’s established guidelines and

procedures, training is provided through training videos, which are located on the Office’s website, and

may be accessed through the following URL: http://goccp.maryland.gov/grants/gms-help-videos/.

Please review the training videos before you begin your application to familiarize yourself with system

guidelines, fiscal review, tips, civil rights requirements, etc.

Additionally, instructions for completing the online application can be found at GMS Application

Instructions. Applicants are encouraged to review these instructions before completing the online

application.

The Office will conduct a technical assistance conference call to provide further application assistance

and to answer questions. A NOFA technical assistance call will be held on Tuesday, April 16th, 2024,

from 11:00 am to 12:30 pm. We encourage applicants to use the Google Meeting link below:

Meeting Link: meet.google.com/wny-wkmk-ruo

Call-in Number: +1 413-659-6993

PIN: 972 622 502#

VI. Important Dates

Application Technical Assistance Call Tuesday, April 16, 2024

Deadline to Request a User ID Wednesday, May 15, 2024

Deadline to Submit an Online Application Friday, May 24, 2024, by 11:59 PM

Letters of Intent Emailed/Denial Letters Emailed July 2024

Award Documents July 2024

Sub-award Start Date July 1, 2024

Sub-award End Date June 30, 2025

VII. Application Evaluation

The Office, along with an internal or external review team, will assess the merits of the proposed

program. Applicants should review this program-specific NOFA in concert with the GMS Application

Instructions located at https://goccp.maryland.gov/gms-application-instructions/ when developing the

application to ensure all required elements are included and addressed. Scoring is as follows:

● Problem statement/needs justification (15 points total)

● Program goals and objectives (20 points total)

● Program strategy/program logic (10 points total)

● Performance measurement (outputs, outcomes, and impacts) (20 points total)

● Timeline (5 points total)

7

● Spending plan and budget (reasonableness, cost-effectiveness, detailed justification per line

item in GMS) (20 points total)

● Management capabilities (5 points total)

● Sustainability (5 points total)

The WAAG grant program is a competitive application process. The Office may conduct a three-tier

review, including internal staff and external independent reviewers, of each application submitted in

accordance with this Notice of Funding Availability. As part of the internal review, the Office’s staff will

also review the following for each application:

● Noted warrant data

● Scope (geographic size and location)

● Audit findings

● Performance history with previous awards

VIII. Funding Specifications

○ Funding Cycle

Commencement of awards funded under WAAG for

FY 2025 will begin July 1, 2024, and end on June

30, 2025. Grants funds will support a 12-month period. These funds cannot be extended beyond

June 30, 2025. Funds are paid on a quarterly reimbursable basis.

○ Allowable Costs for Direct Services

Sample Budget Spreadsheet Tool: For assistance in developing application budgets to include all

required elements, the Office has developed this GOCPP Budget Assistance Spreadsheet tool.

Applicants are encouraged to complete this spreadsheet as a tool, then transfer all information in the

online Grants Management System (GMS). Note: use of this tool is not required and should not be

uploaded into the GMS. The Budget entered into the GMS Budget Tab is the only budget that will be

reviewed and considered for each application.

The following is a list of services, activities, and costs that are eligible for support with WAAG funds

within a sub-recipient’s organization:

● Personnel (to include overtime or clerical data entry)

● Operating expenses

● Contractual services

● Equipment

● Other items that have a direct correlation to the overall success of a sub-recipient’s project

objectives and are necessary for the project to reach full implementation will be considered on a

case-by-case basis.

An applicant is strongly encouraged to refer to the GMS Application Instructions in tandem with this

program-specific NOFA before submitting their application to our Office in the GMS. A checklist of

required items can be found at the end of this document. Hard copy applications are not accepted.

Refer to Section IX below for post-award requirements. A successful applicant (post-award) must

submit reimbursable financial reporting requests in the GMS. Costs must be incurred during the

approved budget period and based on actual quarterly expenditures unless noted otherwise. To this

8

end, funds in excess of those the applicant has the financial capacity to await quarterly reimbursement

should not be requested.

○ Unallowable Costs

The following services, activities, and costs cannot be supported with the WAAG funding:

● Alcoholic beverages

● Bad debt

● Bonuses or Commissions

● Construction/Capital Expenses/Land Acquisition

● Honorarium

● Lobbying costs (including membership fees to organizations whose primary activity is lobbying)

● Meals

● Trinkets (items such as hats, mugs, portfolios, t-shirts, coins, and gift bags)

Please note that all costs must be reasonable, allocable, and allowable including indirect costs.

Additionally, GOCPP funding is reimbursable quarterly unless otherwise stated. To this end, funds in

excess of those the applicant has the financial capacity to await quarterly reimbursement should not be

requested.

The list above is not exhaustive. The Governor's Office of Crime Prevention and Policy reserves

the right to make additional budget reductions/restrictions and adjustments at its discretion.

○ Consultant Rates

The requirements related to consultant rates apply to all Office awards whether funded by State or

federal funds. The maximum allowable compensation rate for consultant services is $81.25 per hour or

$650 per day. Rates above this threshold will be considered on a case-by-case basis and require prior

approval. Additional information and the required procedures for requesting prior approval are found at

https://goccp.maryland.gov/preauth-for-consultant-fees/. Please note that charges at a rate above the

established maximum rate that are incurred prior to the issuance of an Office written approval will be

disallowed.

IX. Distribution of Funds & Reporting Requirements

The Governor's Office of Crime Prevention and Policy will distribute awarded funds to grantees on a

quarterly reimbursement of expenditures basis following the timely submission of corresponding

quarterly fiscal and programmatic reports. These reports must be submitted through the Grants

Management System. All programmatic electronic reports are due within 15 calendar days of the end of

each quarter. Financial electronic reports are due within 30 calendar days of the end of each quarter. All

reporting activity occurs through the Grant Management System, using the same User ID and

password used for the application process.

For further post-award instructions, read the Special Conditions specific to your award in the GMS and

read the General Conditions which can be found at:

http://www.goccp.maryland.gov/grants/general-conditions.php.

9

A. Electronic Funds Transfer (EFT)

The Office encourages the use of electronic funds transfer (EFT). To obtain the appropriate form, the

address to submit the form, and a general overview, including FAQs, refer to the following website:

https://marylandtaxes.gov/divisions/gad/eft-program.php.

See Form GADX-10 and the GAD 710 Form to instruct first-time vendors to update vendor information

with the General Accounting Division (GAD)/Comptroller of Maryland and to instruct existing vendors on

how to update changes in banking information.

B. Match

There is no match required for this funding source. Do NOT enter a match into your budget. If you

wish to show other financial or in-kind contributions to your program, it may be written into your

narrative.

C. Supplanting, Transparency, and Accountability

Supplanting is the use of Office grant funds to replace State or local funds that were previously

appropriated/budgeted for, or otherwise would have been spent on, the specific purpose(s) for which

this sub-award has been awarded. Any salaries, positions, personnel expenses, contractual expenses,

equipment, travel, and other expenses paid for with Office grant funds must be used to supplement

your organization's existing budget and may not replace any funds already included in your entity's

existing or projected budget.

A strong emphasis is being placed on accountability and transparency. Grantees must be prepared to

track, report on, and document specific outcomes, benefits, and expenditures attributable to grant

funds. Misuse of grant funds may result in a range of penalties including suspension of current and

future funds and civil/criminal penalties.

10

X. Application Checklist

What an Application MUST Include by the Deadline to be Considered for Funding:

_____ Face Sheet

_____ Project Summary

_____ Narrative

___ Problem Statement/Needs Justification

___ Program Goals and Objectives

___ Program Strategy/ Logic Model

___ Program Measurement

___ Timeline

___ Spending Plan

___ Management Capabilities

___ Sustainability

___ Applicant Disclosure of Pending Applications Statement

___ Unique Entity Identifier (UEI) and SAM.GOV Expiration Date

_____ Budget and Budget Justification

___ Personnel

___ Operating Expenses

___ Travel

___ Contractual Services (upload existing relevant contracts)

___ Equipment

___ Other

_____ Budget Prioritization

_____ Signed Certified Assurances REQUIRED

_____ Signed Certification Regarding Lobbying REQUIRED

_____ Screenshot Upload of SAM.gov/Unique Entity Identifier (UEI) Registration REQUIRED

_____ NEW: Certification of Applicable Financial Reporting Requirements and Required Financial

Report Uploading REQUIRED

_____ NEW: Subrecipient Organizational Capacity Questionnaire with applicable attachments

REQUIRED

*More information on each item above can be found in the GMS Application Instructions.

11

Revised February 2024

* Please note that the Governor's office of Crime Prevention, Youth, and Victim Services (GOCPYVS) was renamed to the Governor’s Office of

Crime Prevention and Policy by the Moore-Miller Administration, effective immediately, on 1/18/2024. This change does not invalidate previous,

current, or future agreements or documents referencing the agency as GOCPYVS.

Grants Management System (GMS)

Application Instructions

Governor’s Office of Crime Prevention and Policy (GOCPP)*

100 Community Place

Crownsville, Maryland 21032-2022

www.goccp.maryland.gov

(410) 697-9338

Wes Moore, Governor

Aruna Miller, Lt. Governor

Dorothy J. Lennig, Esq., Executive Director

Note: All applications must be submitted online in the Grant Management System (GMS).

Hard copy applications are not accepted.

2

TABLE OF CONTENTS

I. APPLICATION PROCESS 3

II. APPLICATION WEBSITE WORKSHEET 4

A. FACE SHEET TAB INSTRUCTIONS 4

B. SUMMARY TAB INSTRUCTIONS 6

C. NARRATIVE TAB INSTRUCTIONS 7

D. LETTERS OF SUPPORT/COMMITMENT 11

E. BUDGET TAB INSTRUCTIONS 11

PERSONNEL 12

OPERATING EXPENSES 14

TRAVEL 14

CONTRACTUAL SERVICES 14

EQUIPMENT 15

OTHER 15

F. BUDGET PRIORITIZATION TAB 16

G. DOCUMENTS TAB INSTRUCTIONS 17

H. APPLICATION STATUS DROP DOWN INSTRUCTIONS 17

I. SIGNATURE PAGES 18

J. SINGLE AUDIT REQUIREMENT/ CERTIFICATION OF APPLICABLE FINANCIAL REPORTING

REQUIREMENTS and REQUIRED FINANCIAL REPORT UPLOADING 18

K. PROOF OF 501(c)(3) STATUS 19

L. SUBRECIPIENT ORGANIZATIONAL CAPACITY QUESTIONNAIRE (SOCQ) NEW 19

M. NOFA CHECKLIST 19

N. POST AWARD INSTRUCTIONS 19

OUTPUT VS. OUTCOMES EXAMPLE 20

III. CERTIFIED ASSURANCES 22

IV. CERTIFICATION REGARDING LOBBYING 24

3

INTRODUCTION

The Governor’s Office of Crime Prevention and Policy (Office) is the designated State Administering

Agency (SAA) for Maryland. The Office allocates resources statewide and acts to distribute, monitor, and

report on spending under many state and federal grant assistance programs. The Office plans, promotes,

and funds efforts with government entities, private organizations, and the community to advance public

policy, enhance public safety, reduce crime and juvenile delinquency, and serve victims. The Office places

a significant emphasis on instituting strategic planning to align priorities at the State and local levels, to

ensure it remains ahead of threats that impact the State, and to continue to be good stewards of the funds

administered. For updates, refer to Maryland’s Comprehensive State Crime Control and Prevention Plan

2024-2026 Annual Update.

Grant funding is one of several tools that the Office utilizes to achieve its objectives per Executive Order

01.01.2024.05, Code of MD Regulations (COMAR), and the Code of Federal Regulations (CFR) 2 CFR

Part 200 - Uniform Administrative Requirements. Beginning in February of each calendar year, the Office

issues a Notice of Funding Availability (NOFA)

1

for grant programs based on an annual budget

appropriation. Eligible entities are encouraged to review annual updates to the programmatic and financial

requirements described on the Office’s website. Instructions to help applicants navigate the online

application portal and submit a complete application request are available at Grants Management

System(GMS) Application Instructions. For more information, contact the Program Staff as specified in the

program-specific NOFA or email support@goccp.freshdesk.com by the NOFA due date.

Note: All applications must be submitted online in the Grant Management System (GMS). Paper or email

applications are not accepted. Post-award, grant funds are issued on a quarterly, reimbursable basis.

I. APPLICATION PROCESS

All applications for grants administered by the Governor's Office of Crime Prevention and Policy

must be submitted utilizing the web-based application process, which may be accessed at

www.goccp.maryland.gov and clicking on GRANT MANAGEMENT SYSTEM, or by going directly

to the login screen using the URL: https://grants.goccp.maryland.gov.

In order to use the Office’s web-based application you must have a User ID.

For new applicants, go to the following web URL to obtain instructions and the information required

to obtain a User ID and password: http://goccp.maryland.gov/grants/requesting-access/.

The last day to request a User ID is specified within each Notice of Funding Availability (NOFA). If

you have previously applied through the web, use your same User ID and password.

If you have previously applied to the Office using the GMS, but do not have your User ID, or are

having technical issues with the system, contact the helpdesk via email at

support@goccp.freshdesk.com for assistance.The Grant Management System (GMS) Help Desk

operates Monday through Friday from 9 AM to 5 PM. The normal response time is 24 - 72 hours.

If you need assistance completing the program-specific information required in the online

application, please contact the Program Staff specified in the program-specific NOFA. Paper or

email applications are not accepted.

1

NOFAs are publicized through the following websites: https://goccp.maryland.gov/grants/ and Governor’s Grants Office ,

https://grants.maryland.gov/Pages/grants.aspx

4

II. APPLICATION WEBSITE WORKSHEET

NOTICE TO ALL APPLICANTS

The information collected on the grant application form is collected for the purposes of the

Governor's Office of Crime Prevention and Policy’s function. Failure to provide all of this

information may result in the denial of your application. The Governor's Office of Crime Prevention

and Policy is a government entity; upon submission, this application is considered public

information. The Governor's Office of Crime Prevention and Policy does not sell collected grant

information. Under the Maryland Public Information Act (PIA) (MD State Government Code Ann.

10-617 (h)(5)), you may request in writing to review grant award documentation. Please send

those requests to the Governor's office of Crime Prevention and Policy, 100 Community Place,

Crownsville, Maryland 21032-2022. For more information on the Public Information Act, please

click here: http://goccp.maryland.gov/public-information-act/.

Please refer to the Grant Menu Screen in the GMS. All requested information must be provided in

each section of the GMS in a narrative form.

A. FACE SHEET TAB INSTRUCTIONS

1. Project Title

The project title should be brief, precise, and reflect the proposed strategy. For example: "Maryland

Criminal Intelligence Network, Heroin Coordinator, Medication Assisted Treatment, Domestic

Violence Shelter Services.”

2. Applicant Agency

The unit of local government (county, city, town, or township), State agency, institution of higher

learning, or state/local public, private, community based or non-profit entity that is eligible to apply

for grant funds. Full details about the Applicant Agency (Federal ID, Unique Entity Identifier (UEI),

etc.) may be viewed by clicking the corresponding underlined organization field. If any information

needs to be revised, contact the Program Staff.

If the Government, Township, or Board of Commissioners mandates that the County Executive,

Mayor, or Commissioner sign all grant award documents (for all subordinate agencies) then the

Government, Township, or Board of Commissioners must be the Applicant Agency.

● DUNS Number

2

: Insert 00-000-0000 only (ie., 9 zeros)

On April 4, 2022, the DUNS number used across the federal government changed to a

twelve-character identification code assigned by the federal System of Award Management

(SAM) registration process. All entities seeking the Office’s grant funds must have an active

registration in the SAM.gov with a valid expiration date.

● SAM Expiration Date

3

: Enter your sam.gov expiration date only (M/D/Y format).

Every applicant entity must comply with all applicable SAM.gov unique entity identifier(UEI)

requirements. SAM.gov is the repository for certain standard information about federal

financial assistance applicants, recipients, and subrecipients. The UEI is a unique twelve-

character identification code assigned to your organization by the SAM.gov upon

registration.

2

DUN & Bradstreet Number feature is defunct in GMS. Enter 9 zeros only.

3

.For help with first-time registration, visit the Federal Service Desk, FSD.gov.

5

Once registered, entities must complete annual renewals to maintain an active status. It is

recommended that you begin the SAM.gov registration or renewal process 30 days prior

to any NOFA deadlines to allow for the time necessary to complete the full process,

including SAM.gov's entity validation process. If you intend to apply for a specific

opportunity, refer to the grant program-specific NOFA, and plan your SAM.gov registration

accordingly.

For additional support, visit SAM.gov Help. A screenshot of an active registration must

be uploaded in the document section of the GMS. Active registration must be

maintained throughout the grant life cycle.

SAM. Gov Public Search Record: When registering, please check the box that allows the

record to be a “public display record.'' This will enable periodic GOCPP compliance reviews

of subgrantee SAM.gov status.

Access to SAM.GOV: SAM.gov

More information on the UEI can be found here: Unique Entity Identifier Update | GSA.

3. Authorized Official

The Authorized Official must possess the authority to enter into a legal agreement on behalf of the

entity and bind it to the award terms and conditions. The Authorized Official on the submitted

application is the County Executive, Duly Authorized Official of the local unit of Government,

Mayor, Commissioner, Town Administrator (if confirmed), President (if confirmed), or if agencies

are permitted to apply directly, the head of the agency receiving the subaward.

An agency’s Authorized Official may be viewed by clicking his/her underlined name. A popup box

will appear after clicking their name. Procedures for revising an agency’s authorized official can be

obtained by contacting support@goccp.freshdesk.com; or by viewing the General Conditions at:

https://www.goccp.maryland.gov/grants/general-conditions.php.

4. Implementing Agency

The name of the entity that is responsible for the operation of the project. Full details about the

Implementing Agency (Federal ID, Unique Entity Identifier (UEI), etc.) may be viewed by clicking

the corresponding underlined organization field. Contact the Program Manager to make any

revisions.

5. 'Is service site?' Checkbox

Clicking these checkboxes automatically adds the Applicant and/or Implementing Organization to

the Service Site tab, which documents the location/locations in which the project will be

implemented (more details below in “12. Service Site Tab Instructions”).

6. Proposed Start/End Dates

Start and end dates are determined by the parameters of the NOFA and are populated

automatically. Projects may not exceed twelve (12) months, unless explicitly stated in the NOFA,

or commence before the Notice of Funding Availability defined start date. Grants must start on the

first day of a month and end on the last day of a month.

7. Preparer Information

Enter information about the person completing the application, including name, phone number, and

email address.

8. Officers’ Tab Instructions

6

To add a new officer or new contact to the Grant Management System, please view the

instructions located here: http://goccp.maryland.gov/grants/requesting-access/.

9. Project Director

Select the person who will be responsible for oversight and administration of the project on behalf

of the Applicant Agency. The Project Director is a primary contact for the grant who will receive

communications from the Office and will be responsible for disseminating information to others

within the Applicant Agency as needed. Selections are limited to Implementing/Applicant Agency

personnel in the Grant Management System. To make changes to personnel, view the instructions

located here: http://goccp.maryland.gov/grants/requesting-access/.

10. Fiscal Officer

Select the person who will be responsible for financial reporting and record keeping for the project.

The Fiscal Officer is a primary contact for the grant who will receive communications from the

Office and will be responsible for disseminating information to others within the Applicant Agency

as needed. You may select any contact currently in the Grant Management System. Use the

search windows to search by last name, organization, and/or job title. To make changes to

personnel, view the instructions located here: http://goccp.maryland.gov/grants/requesting-access/.

11. Civil Rights Contact

Select the Applicant Agency's point of contact for handling internal civil rights violation complaints

(usually a Human Resources or Personnel Manager). You may select any contact currently in the

Grant Management System. Use the search windows to search by last name, organization, and/or

job title. To make changes to personnel, view the instructions located here:

http://goccp.maryland.gov/grants/requesting-access/. For additional information, please refer to the

guidance provided for this role on completing Civil Rights Compliance forms as applicable.

12. Service Sites Tab Instructions

If the service site is either the Applicant Agency and/or the Implementing Agency, select the

associated "Is service site?" check box/boxes on the application Face Sheet. Otherwise, provide

the site name and full address, for the location/locations in which the project will be

implemented. If there is more than one location, please enter complete information for each site. If

the project has a statewide or countywide impact, please enter "statewide," or "county-wide" in the

'Site Name' field and the county served in the 'City' field. Whether an address is provided, or “state-

wide” or “county-wide” is entered, the ‘City’ field and nine (9) digit zip-code must be provided.

Example:

Site Name: Anytown Police Department

Address: 123 Main Street

Some City, MD 21000-0570

OR if Location is ‘County-wide’ or ‘Statewide’, you must still list a City and 9-digit zip for

funding source reporting.

B. SUMMARY TAB INSTRUCTIONS

The Project Summary should provide a concise summary of your proposal and be limited to 100

words or less. Use the template provided below for your project summary.

The ____(Implementing Agency's Name)

1

________(Project Title)

1

________ program helps to

_______________

2

in ____________

3

. The program _______.

4

Program funds provide personnel,

7

equipment, and training.

5

Make the following additions/changes to the above template:

1. The beginning of the first sentence contains the Implementing Agency's name and the

Project Title. The project title should be brief, precise, and reflect what is being funded. For

example: "Maryland Criminal Intelligence Network, Heroin Coordinator, Medication Assisted

Treatment, Domestic Violence Shelter Services' ' and not the funding source (for example it

should not be VAWA 2021 Funding).

2. Indicate what the project proposes to accomplish in general terms (examples include:

reduce existing gaps in services, foster collaboration and cooperation among partner

agencies and stakeholders, provide direct victim services, etc.).

3. Indicate the service area covered by the project. Local projects should list the specific

county. Multijurisdictional projects should list all counties covered, and statewide projects

should list Maryland.

4. Include one to two sentences describing the project's main function and who the project

benefits/serves.

5. The last sentence summarizes the budget categories proposed to be funded. Depending

on the request this could include: personnel, operating expenses, travel, contractual

services, equipment and/or other.

C. NARRATIVE TAB INSTRUCTIONS

Provide a description of the proposed project and an expected timeline for its implementation. The

contents of the GMS narrative are explained below. Incomplete narratives may be returned for

revision and/or are subject to removal from consideration during the initial technical review.

1. Problem Statement/Needs Justification

Include a detailed description of the nature and extent of the problem and/or need to be

addressed, the target population, and geographical area served. Provide the latest statistical data

to document the problem. What efforts, if any, have been made to address this problem in the

past? Also, refer to the Grant Program NOFA for any program-specific requirements that

should be included in this narrative section.

2. Program Purpose Area

Include a purpose/priority area statement aligned with the requirement section of the program-

specific NOFA.

Example: “Per the program-specific (Juvenile Justice Title II) NOFA, the proposed request for

funding is aligned with Purpose/Priority Area 1 of the NOFA: Youth Diversion.”

The Office strongly encourages the use of data and evidence in policy-making and program

development for criminal justice, juvenile justice, and crime victim services. For additional

information and resources on best practices or evidence-based programs, see the OJP Resource

Guide. In this narrative section of the GMS, the applicant shall describe how the proposed

strategy promotes best practices and Maryland’s current approach to advance public safety and

improve outcomes for youth and crime victims as outlined in Maryland’s Comprehensive State

Crime Control and Prevention Plan 2024-2026 Annual Update. Also, refer to the NOFA for any

program-specific requirements that should be included in this narrative section.

3. Project Goals and Objectives

Provide a statement that conveys the goals of the project. Goals identify the program’s intended

short and long-term results. Identify specific objectives you wish to accomplish through the

implementation of the project. Objectives are specific, quantifiable statements of the project’s

8

desired results, and should include the target level of achievement, thereby further defining

goals and providing the means to measure project performance.

Please note that if the continuation of a project previously funded by the Office is being

requested, a description of how the goals and objectives continue or build upon previous efforts

must be included. This section may be in an outline-style format (retaining all numbering,

lettering, and headers) with a brief, narrative description.

Example:

● Goal #1

● Objective #1: Enter program specific information

○ Supporting Activities

○ Resources

○ Program deliverables - a summary Outcomes versus Outputs is provided in the

reference sheet located at the end of this document.

Also, refer to the NOFA for any program-specific requirements that should be included in

this narrative section.

4. Project Strategy/ Logic Model

Explain in some detail how the project will address the problem and accomplish the project goals

and objectives. Include linkages to other programs, organizations, and stakeholders that will be

involved in or impacted by the project. The strategy should be based on an underlying logic—i.e., a

set of assumptions regarding the services the project provides, the impacts these services will

have on the clients it serves, and the projected results within the community or the targeted

population (See Figure 1: Program Logic below). Also, refer to the NOFA for any program-

specific requirements that should be included in this narrative section.

At a minimum, the strategy should address the following program elements:

Project Activities - Describe what the project proposes to do (e.g., education / training, case

management, crisis intervention, group therapy, criminal investigation, etc.).

9

Figure 1: Program Logic

5. Program Measurement

A summary Outcomes versus Outputs is provided in the reference sheet located at the end of this

document.

Output Measures - Identify and describe the immediate services provided by the project. Specify

how these outputs will be measured. (e.g., number of trained or counseled clients, arrests made,

crimes investigated, crimes solved, sessions held, officers trained, hours of patrol / outreach etc.).

Please note, if you are requesting continuation of a project previously funded by the Office, in

this section you must also demonstrate the positive outputs this funding provided through the

inclusion of performance measures data on the previous grant cycle.

Initial Outcome Measures - Identify and describe the substantive changes in the targeted

population’s knowledge, behavior, or disposition that are anticipated to result from the production

of the outputs and will drive the impact. Specify how these initial outcomes will be measured and

the tools that will be used to measure the change. (e.g., percent decrease in reported incidents of

crime; percent decrease in recidivism rates for the population targeted; percent increase in

awareness of victim services; percent increase in cases prosecuted through use of DNA tracking,

etc.).

Please note, if you are requesting continuation of a project previously funded by the Office, in

this section you must also demonstrate the positive outcomes this funding provided through the

inclusion of performance measures data on the previous grant cycle.

Impacts - Identify and describe the long-term outcomes that are anticipated to result from the

production of the outputs (e.g., lower crime rates, healthier population, increased public safety,

reduced spending on incarceration, etc.).

Please note, if you are requesting continuation of a project previously funded by the Office, in

10

this section you must also describe the impact of the previous funding and how this funding will

continue or build upon these efforts. Also, refer to the NOFA for any program-specific requirements

that should be included in this narrative section.

6. Timeline

Applicants must submit a detailed timeline/work plan. This timeline/work plan must include the

following:

● Key tasks that must be carried out to implement the project successfully

● Person(s) responsible for seeing that each task is completed within the proposed timeline

● Target dates for task completion

● Timeframe for achieving objectives

Also, refer to the NOFA for any program-specific requirements that should be included in

this narrative section.

7. Spending Plan

Detail the timeline for the implementation of each budget line item. Spending plan and timeline

must align with the proposed start/end dates. Also, refer to the NOFA for any program-

specific requirements that should be included in this narrative section.

8. Management Capabilities

Qualifications and Experience of Implementing Agencies: Provide a brief description of the

Implementing Agency’s experience and achievements that qualify the agency to conduct the

project. In a narrative format, also please expand on statements provided in the Applicant

Agency’s Subrecipient Organizational Capacity Questionnaire. (See Section I below).

Key Grant Personnel: List the names and provide a short professional biography of the project

director, key consultants, and the assigned fiscal officer. Describe the role of personnel listed on

the FACE SHEET TAB INSTRUCTIONS in the GMS.

In addition, applicants must provide the name and title of each staff person requested in the

budget. Please note: All documentation submitted to the Office is subject to the Public Information

Act. If the applicant prefers not to submit names of staff, they must develop a tracking system to be

used across all GOCPP funding sources which clearly identifies positions using non personal

identifiable information within the application. This information must be made available upon

request.

Additionally, indicate how all requested personnel are currently funded (i.e., provide the entire

budget for each position. If funded by more than one source, list percentages for each funding

source). Applicants must determine the appropriate methodology for allocating shared costs that

are budgeted and charged to multiple grants. Reimbursable funds charged to multiple costs in the

accounting and financial management system must be distributed in proportion using the principles

of reasonable, allowable, and allocable expenditures per budget category and line item, as

applicable.

Also, refer to the NOFA for any program-specific requirements that should be included in

this narrative section.

9. Sustainability

What prospects exist for continued financing of the project when grant funds are terminated? What

efforts have been or will be made to continue the methods, techniques, and operational aspects of

the project when the grant funds are concluded? Indicate planned future sources of funding or

11

proposed jurisdictional planning efforts. Include your plan to sustain your program to include a

description of match funds as applicable (cash, in kind, volunteer).

Note: Post award, grant funds are reimbursed on a quarterly basis unless otherwise stated in the

NOFA. Also, refer to the NOFA for any program-specific requirements that should be

included in this narrative section.

10. Applicant Disclosure of Pending Applications Statement

Although supplanting is prohibited, the leveraging of federal funding is encouraged. In instances

where leveraging occurs, all federal grant funds must be tracked and reported separately and may

not be used to fund the same line items. Additionally, federal funds may not be used as a match for

other federal awards.

Applicants must disclose all pending applications for federally funded assistance that includes

requests for funding to support the same project being proposed under this solicitation and will

cover the identical cost items outlined in the budget narrative and worksheet in the application

under this solicitation. The disclosure must include both direct applications for federal funding (e.g.

applications to federal agencies) and indirect applications for such funding (e.g. applications to

State agencies that will be subawarding federal funds).

The Office seeks this information to help avoid duplication of funding. Leveraging multiple funding

sources in a complementary manner to implement comprehensive programs or projects is

encouraged and is not seen as inappropriate duplication.

In this section, applicants that have pending applications as described above must provide the

following information about pending applications submitted within the last 12 months:

● the federal or state funding agency

● the solicitation name/project name

● the point of contact for information at the applicable funding agency

● the amount of the funding request as applicable

Applicants that do not have pending applications as described above must include a statement to

this effect in this section (e.g. “[Applicant Name] does not have pending applications submitted

within the last 12 months for federally funded assistance that include requests for funding to

support the same project being proposed under this solicitation and will cover the identical cost

items outlined in the budget narrative and worksheet in the application under this solicitation.”)

11. Unique Entity Identifier (UEI) and SAM.gov Expiration Date:

Enter your entity’s 12-character alphanumeric Unique Entity Identifier (UEI) issued by SAM.gov.

List a valid expiration date.

12. Person Completing the Project Narrative:

Include person completing project narrative: Include the following: Name, Job Title, Organization

Name, Telephone, Fax, and E-mail address.

12

D. LETTERS OF SUPPORT/COMMITMENT

If listed as a requirement in the NOFA, submit letters of commitment by partners who will

participate in the execution of the project or whose cooperation or support is necessary for its

success. Letters of support/commitment will only be accepted when they are uploaded with the

electronic application submission. Letters should be addressed to the Executive Director of the

GOCPP. If required, support letters must be updated in the Document section of the GMS

by the due date.

Also, refer to the NOFA and NOFA Checklist for any program-specific requirements that

should be included in this section.

E. BUDGET TAB INSTRUCTIONS

Complete a detailed budget for the proposed project. All 'Total Budget' fields will be rounded by the

Grant Management System to the nearest whole dollar.

Applicant designated prioritization of line items is required for all applications having multiple line

items. This prioritization will be considered should budgets need to be reduced. This requirement

is addressed following the Budget Tab Instructions under ‘Budget Priority Tab.’

Budgets must be clear and specific. Budgets must reflect one year of spending,unless stated

otherwise in the program specific NOFA and where applicable, be adjusted to reflect the start date

and holidays. The Office reserves the right to reduce budgets. Grant funds are reimbursed on a

quarterly basis unless otherwise noted in the NOFA.

Each budget line item must include a justification entry proportional to the application request.

Total project cost for each budget category tab in GMS may include Match Funds as required by

the program-specific NOFA. Applicants may satisfy match requirements with either Cash or In-Kind

services, including volunteer hours, as applicable per NOFA requirements. Please refer to the

Grant Match Calculator and Provisions as applicable.

The justification sections must contain brief statements (one to two sentences per line item) that

explain each line item and its relevance to the project goals and objectives. Do not state "See

Narrative, Goals, or Objectives”. Refer to the Grant Management System training videos for

further instructions https://goccp.maryland.gov/grants/gms-help-videos/.

Allowable Costs

4

General guidance on cost allocation and prorate - Applicants must determine the appropriate

methodology for allocating shared costs that are budgeted and charged to multiple grants.

Reimbursable funds charged to multiple costs in the accounting and financial management system

must be distributed in proportion using the principles of reasonable, allowable, and allocable

expenditures per budget category and line item, as applicable.

For example, organizations:

● Must explain the process used to prorate the funds between the sources which includes

funding sources and the general operating budget

● Identify the different rates in the spending plan.

● The organization must have a written policy in place concerning prorating and/or the

calculations used.

4

Effective SFY 25, reviews are conducted per 2 C.F.R. § 200.413 Direct costs.: Principles: Reasonable, Allowability and Allocability of

expenditures. Budget justifications will be reviewed to include adequate statements by the applicant related to proportional allocation of costs

referenced 2 CFR § 200.405.

13

● A copy of the prorating policy must be provided when requested.

Please visit the following page for additional guidance on suggested prorating strategies for

subgrantees from one of our federal partners:

https://ovc.ojp.gov/sites/g/files/xyckuh226/files/media/document/ovc-victim-assistance-prorating-

strategies-for-subgrantees-winter-2020.pdf

New Resource: Sample Budget Spreadsheet Tool: For assistance in developing application

budgets to include all required elements, the Office has developed a Budget Assistance

Spreadsheet as a resource. Applicants are encouraged to complete this spreadsheet as a tool,

then transfer all information in the Online Grants Management System (GMS).

Note: The use of this tool is not required and should not be uploaded in the GMS. The Budget

entered into the GMS Budget Tab is the only budget that will be reviewed and considered for each

application.

Unallowable Costs

The following services, activities, and costs cannot be supported by the Office:

● Alcoholic beverages

● Bonuses or Commissions

● Construction/Capital Expenses/Land Acquisition

● Corporate Formation (costs associated with incorporation fees, brokers’ fees, fees to

promoters, organizers or management consultants, attorneys, accountants, or investment

counselor in connection with establishment or reorganization of an organization)

● Fundraising

● Honorarium

● Lobbying costs (including membership fees to organizations whose primary activity is

lobbying)

● Meals (exception to consider food consumed by clients must be pre-approved.)

● Previous Debt Obligations

● Trinkets (items such as hats, mugs, portfolios, t-shirts, coins, and gift bags)

Please note that all costs must be reasonable, allocable, and allowable including indirect costs.

Additionally, the Office’s funding is reimbursable quarterly unless otherwise stated. To this end,

applicants must consider if the entity has the financial capacity to await reimbursement following

each reporting period.

The list above is not exhaustive. The Governor's Office of Crime Prevention and Policy

reserves the right to make additional budget reductions/restrictions and adjustments at its

discretion.

PERSONNEL

The salaries and fringe benefits for staff required to implement the project are listed in the

personnel category. Consultants must be listed in Contractual Services.

Note: Time and Effort reports (Timesheets) must be maintained for all personnel included in the

grant project. Refer to the bottom of the page at https://goccp.maryland.gov/grants/tips-and-

guidance/time-and-effort-reports/ for more information.

If you are paying an employee directly, they should be entered in the Personnel category. For

each position, list salary and fringe benefits as separate line items.

14

● The ‘Description of Position' field must contain the title of the position.

● Position line items (salary and fringe) are grouped via the ‘Description of Position' field.

● After completing the first Position's line item, use the dropdown to add additional budget

items to the position. Include Grant Funds request and/or Cash Match contribution.

● The ‘Description of Position' field is used to select existing positions and to add new

positions.

● For multiple staff in the same position, use a suffix (i.e., Position 1, Position 2, etc.)

● Multiple positions with the same hourly rate may be grouped (i.e., Overtime Patrols – 25

Officers).

Notes:

● For each salary line item, you must include the full annual salary amount, the

percentage of time that will be spent on the project, and the hourly rate. The hourly

rate can be calculated by full salary divided by 2,080.

● Fringe benefits may not exceed 30% of reported salary costs. For each line item entered,

you must include a justification that ties that item to the activities described in your

narrative.

Example justifications based on the Personnel category:

Justification (line 1):

The Community Outreach Coordinator helps prepare, schedule, and develop training

targeted for hospitals and other medical facilities.

Annual salary is $60,000. She will be devoting 33.33% of her time to this project. We are

requesting $60,000 *.3333 = $19,998, rounded to $20,000, in grant funds to support her

time on this project. Her hourly rate is $28.85.

Justification (line 2):

Fringe benefits @ 10% of salary. $20,000 * .10 = $2,000

Justification (line 3):

The Community Outreach Trainer makes presentations at hospitals and other medical

facilities. This position is supported with cash match funds from a private donor.

Annual salary is $40,000. She will be devoting 25% of her time to this project. We are

contributing $40,000 *.25 = $10,000 to support her time on this project. Her hourly rate is

$19.23.

Justification (line 4):

Fringe benefits @ 10% of salary. $10,000 * .10 = $1,000

15

OPERATING EXPENSES

Rental Space, Printing, and Communications. Communication expenses include items such as

telephone, fax, postage, and other expenditures such as photocopying. Note: Office supplies and

project supplies should NOT be listed under operating, and should be listed in the ‘Other’ category.

Each line item entered, must include a justification that ties that item to the activities described

in your narrative.

Refer to the Funding Specifications section of the NOFA for a list of allowable and unallowable

expenses specific to the program.

TRAVEL

Travel expenses may include mileage and/or other transportation costs, meals, and lodging

consistent with the local jurisdiction's travel regulations and may not exceed the State of Maryland

reimbursement rate specified below.

For each line item entered, you must include a justification that ties that item to the activities

described in your narrative. Dates for travel and training must be provided in the justification

and must fall within the award period.

● Mileage Reimbursement Allowance cannot exceed the $.67 cents/mile rate as of 1/1/2024.

○ Current mileage rates can be located at: Fleet Management Services

● Per Diem/Meal Allowance cannot exceed the State’s Meal & Incidental Expenses

Reimbursement Rates.

○ Current per diem rates can be located at:

https://dbm.gov/Pages/MealTipReimbursement.aspx.

● Lodging Per Diem Allowance cannot exceed the U.S. General Services Administration

(GSA) rates (excluding taxes).

○ Current lodging rates can be located at: Per Diem Rates | GSA.

CONTRACTUAL SERVICES

Consultant contracts for training or evaluation should be included here and shall be consistent with

federal guidelines. Payments to an outside agency for an employee or any other services are

considered Contractual Services.

For the line item description, enter the agency (consulting firm, temporary agency, etc.), a dash,

and then the nature of the service to be provided (e.g., Consultants ABC – training for Seminar).

Each line item entered requires a justification that ties that item to the activities described in your

narrative.

Consultant Rates: The following requirements related to consultant rates apply to all GOCPP’s

awards whether funded by State or federal funds. The maximum allowable compensation rate for

consultant services is $81.25 per hour or $650 per day. Rates above this threshold will be

considered on a case-by-case basis and require prior approval.

16

Additional information and the required procedures for requesting prior approval are found in the

Request for Preauthorization of Consultant Fees Form. Please note that charges at a rate above

the established maximum rate that are incurred prior to the issuance of GOCPP’s written approval

will be determined as a disallowed cost.

Important: Contracts in existence at the time of application must be uploaded into the Documents

section of the GMS during the application process. Contracts finalized post award must be

uploaded into the GMS once finalized and before any reimbursement for the related expenses will

be awarded.

EQUIPMENT

Equipment is defined as having a useful life in excess of one year and a procurement cost of

$5,000 or more per unit. Costs may include taxes, delivery, installation and similarly related

charges. Equipment with a unit cost less than $5,000 should be recorded in the ‘Other’ category

(see below). The procurement process used must be consistent with the Applicant Agency’s

written procurement guidelines. If such guidelines do not exist, refer to the State of Maryland

guidelines by accessing General Condition Regarding Procurement on the Office’s website under

the Grant’s Area.

Maintaining internal inventory records for equipment procured under this funding source is

mandatory. For post award inventory requirements, access General Condition Regarding Property

Inventory Report Forms on the Office’s website. Property Inventory Report Form (PIRFs) is

required for equipment that costs $5,000 or more per unit cost, unless the Special Conditions in

your grant packet state otherwise.

Each line item entered requires a justification that ties that item to the activities described in your

narrative.

OTHER

Include all other anticipated expenditures which are not included in the previous categories such

as registration fees, program and office supplies, and equipment with a useful life less than

one year and a procurement cost of less than $5,000. Include additional match funds to support

sustainability, as applicable. Refer to the provisions for match requirements. If applicable, upload a

federally Negotiated Indirect Cost Rate Agreement (NICRA) in the Document section of the GMS.

Each line item entered requires a justification that ties that item to the activities described in your

narrative.

INDIRECT COST RATE

Indirect costs may be charged to a subaward only if:

● The subrecipient has a current (unexpired) federally approved indirect cost rate; or

● The subrecipient is eligible to use, and elects to use, the de minimis indirect cost rate

described in the Part 200 Uniform Requirements, as set out at 2 C.F.R. 200.414(f).

Important: Applicants must identify in the narrative and budget justification if they are utilizing the

de minimis rate or if they are utilizing a negotiated indirect cost rate, and express mathematically

how they are arriving at the budgeted amount for indirect costs.

17

An applicant with a current (unexpired) federally approved indirect cost rate must attach a copy of

the indirect cost rate agreement to this application. An applicant that does not have a current

federally approved rate has the option of electing to use the 10% de minimis indirect cost rate. If an

eligible applicant elects the de minimis rate, costs must be consistently charged as either indirect

or direct costs, but may not be double charged or inconsistently charged as both. Please note that

the de minimis rate may no longer be used once an approved federally negotiated indirect cost

rate is in place. The revision to 2 CFR 200.414 (f) expands the use of the de minimis rate of 10

percent of modified total direct costs (MTDC) to all non-Federal entities (except for those described

in Appendix VII to Part 200- State and Local Government and Indian Tribe Indirect Cost Proposals,

paragraph D.1.b).

Indirect Cost Distribution Bases:

Modified Total Direct Cost, or MTDC (to be utilized if claiming De minimis): This base includes all

direct salaries and wages, applicable fringe benefits, materials and supplies, services, travel, and

subawards up to the first $25,000 of each subaward (regardless of the period of performance of

the subawards under the award). MTDC excludes equipment, capital expenditures, charges for

patient care, rental costs, tuition remission, scholarships and fellowships, participant support costs,

and the portion of each subaward in excess of $25,000. Other items may only be excluded when

necessary to avoid a serious inequity in the distribution of indirects costs, and with the approval of

the cognizant agency.

Direct Salaries and Wages: This base includes only the costs of direct salaries and wages incurred

by the organization.

Direct Salaries and Wages plus Fringe Benefits: This base includes the costs of direct salary and

wages and the direct fringe benefits incurred by the organization.

General guidance on cost allocation and prorate - Applicants must determine the appropriate

methodology for allocating shared costs that are budgeted and charged to multiple grants.

Reimbursable funds charged to multiple costs in the accounting and financial management system

must be distributed in proportion using the principles of reasonable, allowable, and allocable

expenditures per budget category and line item, as applicable.

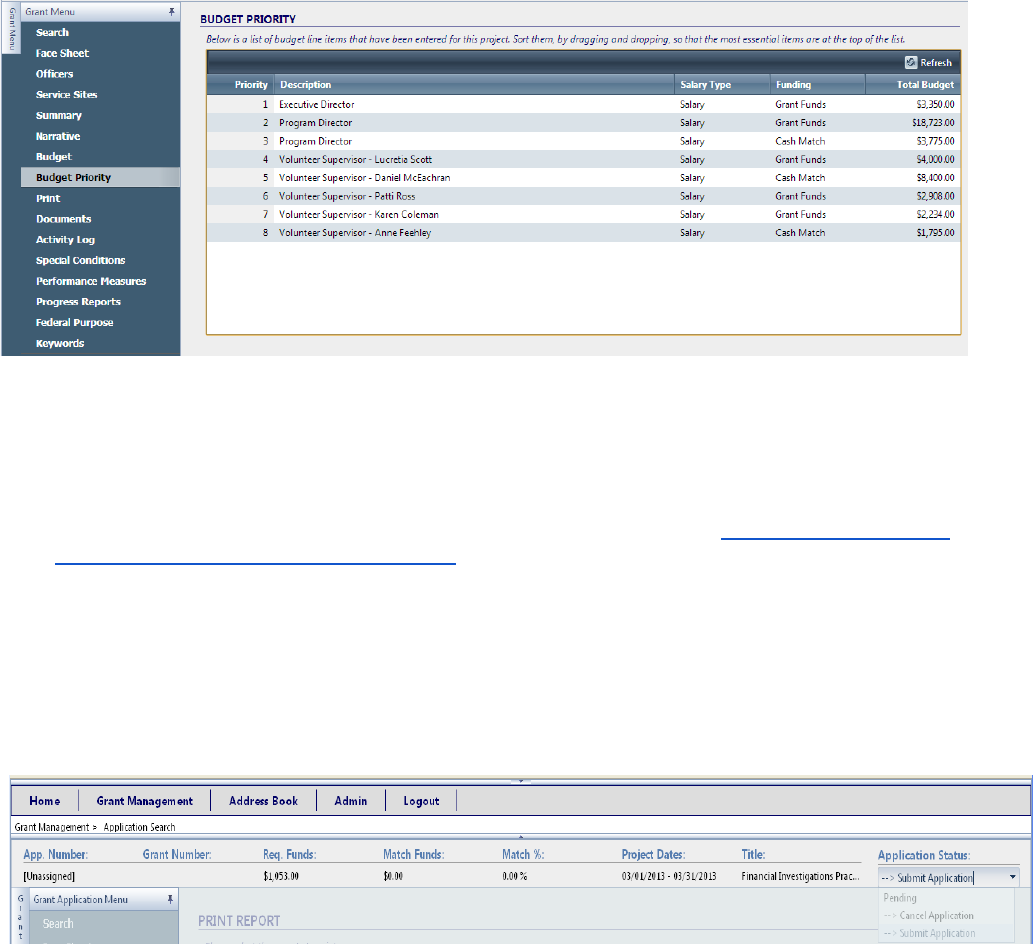

F. BUDGET PRIORITIZATION TAB

After completing the Budget tab, click on the Budget Priority tab in the Grant Management

System. This tab will provide a list of all budget line items that the applicant has entered in the

previous Budget tab. The Budget Priority tab allows the applicant to ‘drag and drop’ the budget line

items in order of priority for funding, beginning with the most essential line item.

18

G. DOCUMENTS TAB INSTRUCTIONS

If there are any additional required forms (e.g. Letters of Support) or other documents that the

applicants would like included with their application, use the Documents tab to attach those files.

Applicants can upload documents throughout the application process. This could include:

UEI/Current SAM registration, letters of support, etc. Please see the Documents Attachment

Guidance under Quick Reference Sheets additional information.

H. APPLICATION STATUS DROP DOWN INSTRUCTIONS

After completing and reviewing all sections of the application, use the 'Application Status'

dropdown to submit your application electronically. Selecting 'Submit Application' from the

dropdown performs a final validation check. If the validation check is successful, the application's

status changes to 'Awaiting Hard Copy'.

The GMS will process and send an email confirmation to applicant’s contacts. The email message will

include a pdf attachment of a formatted grant application packet as shown below.

19

I. SIGNATURE PAGES

The Certified Assurances and Federal Anti-Lobbying Certification must be signed by an Authorized

Representative. Both forms may only be signed by the Applicant Agency's Authorized

Official or the Alternative Authorized Official. Both forms must be generated by the online

application software. Please see the following Quick Reference Sheets for additional information

on generating and uploading these documents for successful submission:

● How to generate grant application signature pages

● How to attach documents to a grant application or grant award

In order for an alternate signatory to be valid, the Office must receive a signed, written notification

from the applicant agency's Authorized Official (on agency letterhead) stating that an alternate

signatory has been designated. More information on changing the Authorized Official or adding an

Alternative Authorized Official can be found in the General Conditions and on the Office’s

Changing Authorized Official webpage.

J. SINGLE AUDIT REQUIREMENT/ CERTIFICATION OF APPLICABLE FINANCIAL

REPORTING REQUIREMENTS and REQUIRED FINANCIAL REPORT UPLOADING

A non-Federal entity that expends $750,000 or more in Federal awards during the non-Federal

entities fiscal year must have a single audit conducted in accordance with 2 CFR §200.514 If this

applies to your organization, provide a screenshot of the audit report submitted to the Federal

Audit Clearinghouse and upload to the documents section of the application.

To ensure subrecipient compliance with applicable fiscal audit/reporting requirements and the

timely submission of copies of the subject documents to the Office, applicants must upload to the

Documents section of the GMS application the:

● Executed Certification of Applicable Financial Reporting Requirements Form; and

● Most recent editions of the financial reports that are indicated as applicable to the applicant

on the submitted Certification of Applicable Financial Reporting Requirements Form.

20

If the applicant indicates on the Certification of Applicable Financial Reporting Requirements Form

that their organization must file a single audit under 2 CFR §200.514, a screenshot verifying

submission to the Federal Audit Clearinghouse must be uploaded to the documents section of the

application.

Please note that the GOCPP is responsible for issuing a management decision for audit findings

that relate to grants awarded with federal funds in compliance with 2 CFR §200.521(c). Applicants

must submit copies of any Audit Findings and Corrective Action Plans with the application. Do not

send a copy of your audited financial statements; ONLY the applicable audit findings and/or

corrective action plan is required.

K. PROOF OF 501(c)(3) STATUS

New non-profit organizations applying for funding must upload to the Documents section of the

GMS application U. S. Internal Revenue Service documentation that substantiates the

organization’s tax exempt status under section 501(c)(3) of the Internal Revenue Code.

L. SUBRECIPIENT ORGANIZATIONAL CAPACITY QUESTIONNAIRE (SOCQ) NEW

The GOCPP’s desk review and site visit compliance areas, for issuing subaward, include

administering a pre-award assessment tool to determine risk and monitoring levels. The SOCQ is

a checklist used to review an applicant’s organizational stability, financial management practices,

and program operations. SOCQ is part of a complete application submitted in the online

GMS. Effective SFY 25, this assessment tool is required at the time of the application. In

addition, applicants must upload supporting Policy and Procedure attachments in the “Document”

section of the GMS. Depending on the risks posed, the Office will categorize “Risk Status” in the

GMS to track during the grant’s lifecycle. This form must be reliable information collected from the

applicant entity’s Chief Executive or Financial Officer.

M. NOFA CHECKLIST

Please refer to the program-specific NOFA to comply with all requirements and upload of

additional documents as applicable.

N. POST AWARD INSTRUCTIONS

Distribution of Funds and Reporting Requirements

For further post-award instructions, review the General Conditions and Special Conditions specific

to your award in the GMS.

The Office will distribute awarded funds to grantees on a quarterly reimbursement of expenditures

basis following the timely submission of corresponding quarterly fiscal and programmatic reports.

These reports must be submitted through the Grants Management System. All programmatic

electronic reports (Progress Reports and Performance Measures) are due within 15 calendar days

of the end of each quarter. Financial electronic reports are due within 30 calendar days of the end

of each quarter. All reporting activity occurs through the Grant Management System, using the

same User ID and password used for the application process.

Electronic Funds Transfer (EFT)

The Office encourages the use of electronic funds transfer (EFT). To obtain the appropriate form,

the address to submit the form, and a general overview, including FAQs, refer to the following

website, Comptroller of Maryland Electronic Funds Transfer (EFT) Program.

21

Notes:

● Grant financial reimbursement requests are processed on a quarterly schedule unless stated

otherwise in the program-specific NOFA. Please allow up to 30 days for the Office and the

Comptroller of Maryland to process financial reimbursement requests and complete bank

transactions. Refer to the Financial Reporting Tips for more information.

● Qualifying nonprofit entities may be eligible to apply for the Maryland Department of

Commerce’s Nonprofit, Interest-Free Micro Bridge Loan (NIMBL) Program. NIMBL Program

will allow entities to fill a funding gap between the award dates of a government grant and the

actual receipt date of those awarded funds that allow for the continued support of the entity’s

program.

● Refer to General Conditions , Grants Tips and Guidance, Civil Rights Compliance , 2 CFR

Subrecipient Monitoring and Management Guidance, and Federal Grants Financial Guide (DOJ

sample) for additional resource information.

● To review additional resources on a grant life cycle, refer Grants.gov Grants Learning Center

OUTPUT VS. OUTCOMES EXAMPLE

OUTPUT: A statistic that quantifies the number of services or products provided/produced as a result of

specific activities related to the program/project.

OUTCOME: A measurable change in the quality of life, change in behavior by a client, or an impact as a

result of the program. Outcomes can be numerical counts, standardized measures, level of functioning

scales, or client satisfaction.

SAMPLE OUTPUTS VS. OUTCOMES

Objective 1: Develop criminal justice strategies that are coordinated at the Local, State, and

Federal level.

Output:

● # of agencies/organizations receiving and sharing information since the implementation of the

technical solution

Outcomes:

● # of programs reporting an increase in program success due to coordination.

● During current fiscal / calendar year, # of project partners actively participating and

collaborating in programs.

Objective 2: Improve victim services for Maryland residents.

Outputs:

● # of victims served.

● # of victims that received medical accompaniment.

Outcomes:

● # of victims that received services and reported increased safety (self reported by victim).

● # of victims that received services who felt more informed of their rights.

Objective 3: Reduce victimization and criminal behavior in Maryland’s children.

Outputs:

● # of family engagement activities for youth in secure confinement.