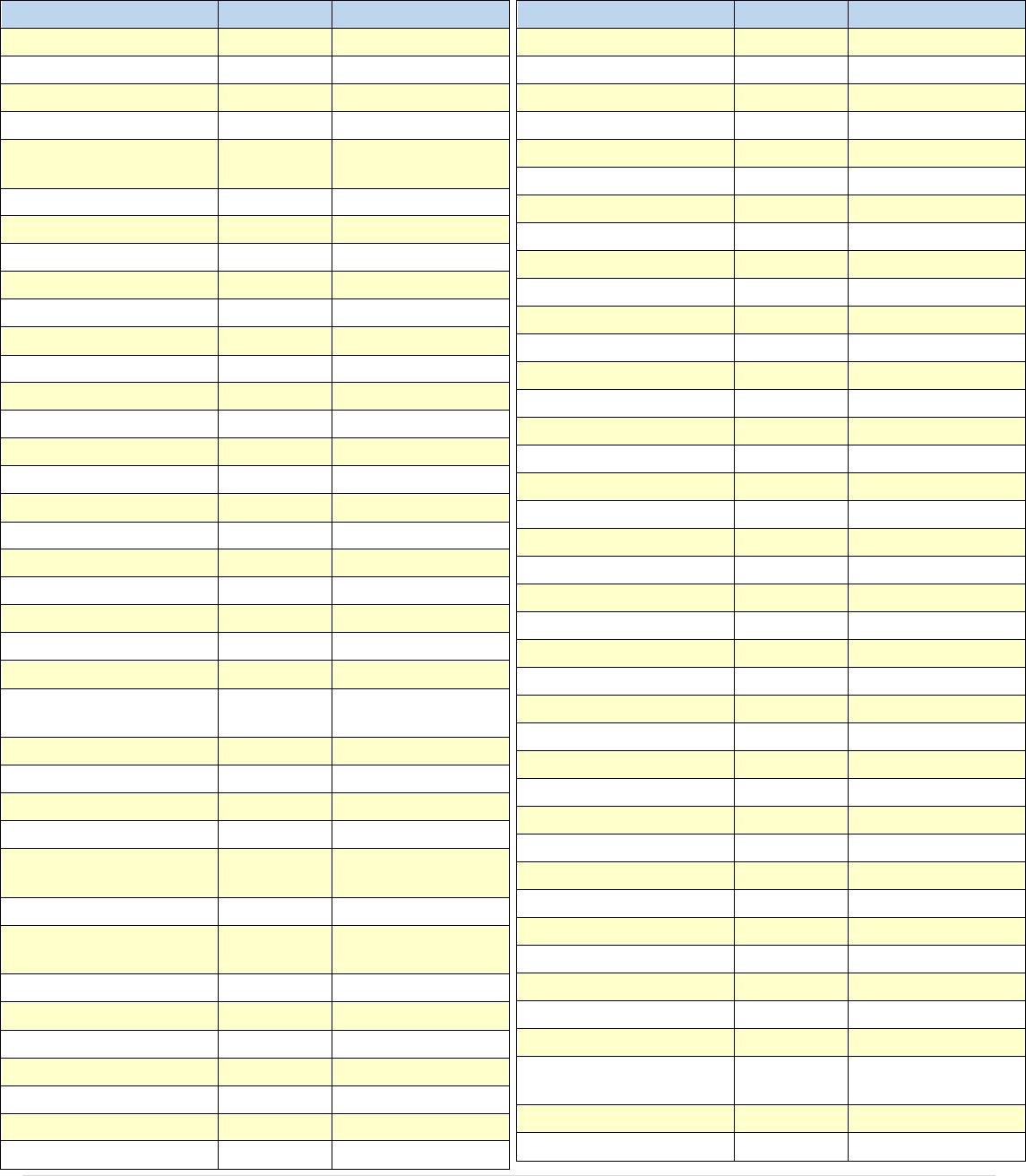

California City and County Sales and Use Tax Rates

Effective 01/01/2023 t

hrough 03/31/2023

1 | Page

Note: “*” next to city indicates incorporated city

City

Rate

County

Acampo

7.750%

San Joaquin

Acton

9.500%

Los Angeles

Adelaida

7.250%

San Luis Obispo

Adelanto*

7.750%

San Bernardino

Adin

7.250%

Modoc

Agoura

9.500%

Los Angeles

Agoura Hills*

9.500%

Los Angeles

Agua Caliente

8.500%

Sonoma

Agua Caliente Springs

7.750%

San Diego

Agua Dulce

9.500%

Los Angeles

Aguanga

7.750%

Riverside

Ahwahnee

7.750%

Madera

Al Tahoe

7.250%

El Dorado

Alameda*

10.750%

Alameda

Alamo

8.750%

Contra Costa

Albany*

10.750%

Alameda

Alberhill (Lake

Elsinore*)

7.750%

Riverside

Albion

7.875%

Mendocino

Alderpoint

7.750%

Humboldt

Alhambra*

10.250%

Los Angeles

Aliso Viejo*

7.750%

Orange

Alleghany

7.250%

Sierra

Almaden Valley

9.125%

Santa Clara

Almanor

7.250%

Plumas

Almondale

9.500%

Los Angeles

Alondra

9.500%

Los Angeles

Alpaugh

7.750%

Tulare

Alpine

7.750%

San Diego

Alta

7.250%

Placer

Alta Loma (Rancho

Cucamonga*)

7.750%

San Bernardino

Altadena

9.500%

Los Angeles

Altaville

7.250%

Calaveras

Alton

7.750%

Humboldt

Alturas*

7.250%

Modoc

Alviso (San Jose*)

9.375%

Santa Clara

Amador City*

7.750%

Amador

City

Rate

County

Amargosa (Death

Valley)

7.750%

Inyo

Amboy

7.750%

San Bernardino

American Canyon*

7.750%

Napa

Anaheim*

7.750%

Orange

Anderson*

7.750%

Shasta

Angels Camp*

7.750%

Calaveras

Angelus Oaks

7.750%

San Bernardino

Angwin

7.750%

Napa

Annapolis

8.500%

Sonoma

Antelope

7.750%

Sacramento

Antelope Acres

9.500%

Los Angeles

Antioch*

9.750%

Contra Costa

Anza

7.750%

Riverside

Apple Valley*

7.750%

San Bernardino

Applegate

7.250%

Placer

Aptos

9.000%

Santa Cruz

Arbuckle

7.250%

Colusa

Arcadia*

10.250%

Los Angeles

Arcata*

8.500%

Humboldt

Argus

7.750%

San Bernardino

Arleta (Los Angeles*)

9.500%

Los Angeles

Arlington (Riverside*)

8.750%

Riverside

Armona

7.250%

Kings

Army Terminal

10.250%

Alameda

Arnold

7.250%

Calaveras

Aromas

7.750%

Monterey

Aromas

8.250%

San Benito

Arrowbear Lake

7.750%

San Bernardino

Arrowhead Highlands

7.750%

San Bernardino

Arroyo Grande*

7.750%

San Luis Obispo

Artesia*

9.500%

Los Angeles

Artois

7.250%

Glenn

Arvin*

8.250%

Kern

Ashland

10.250%

Alameda

Asti

8.500%

Sonoma

Atascadero*

8.750%

San Luis Obispo

Athens

9.500%

Los Angeles

Atherton*

9.375%

San Mateo

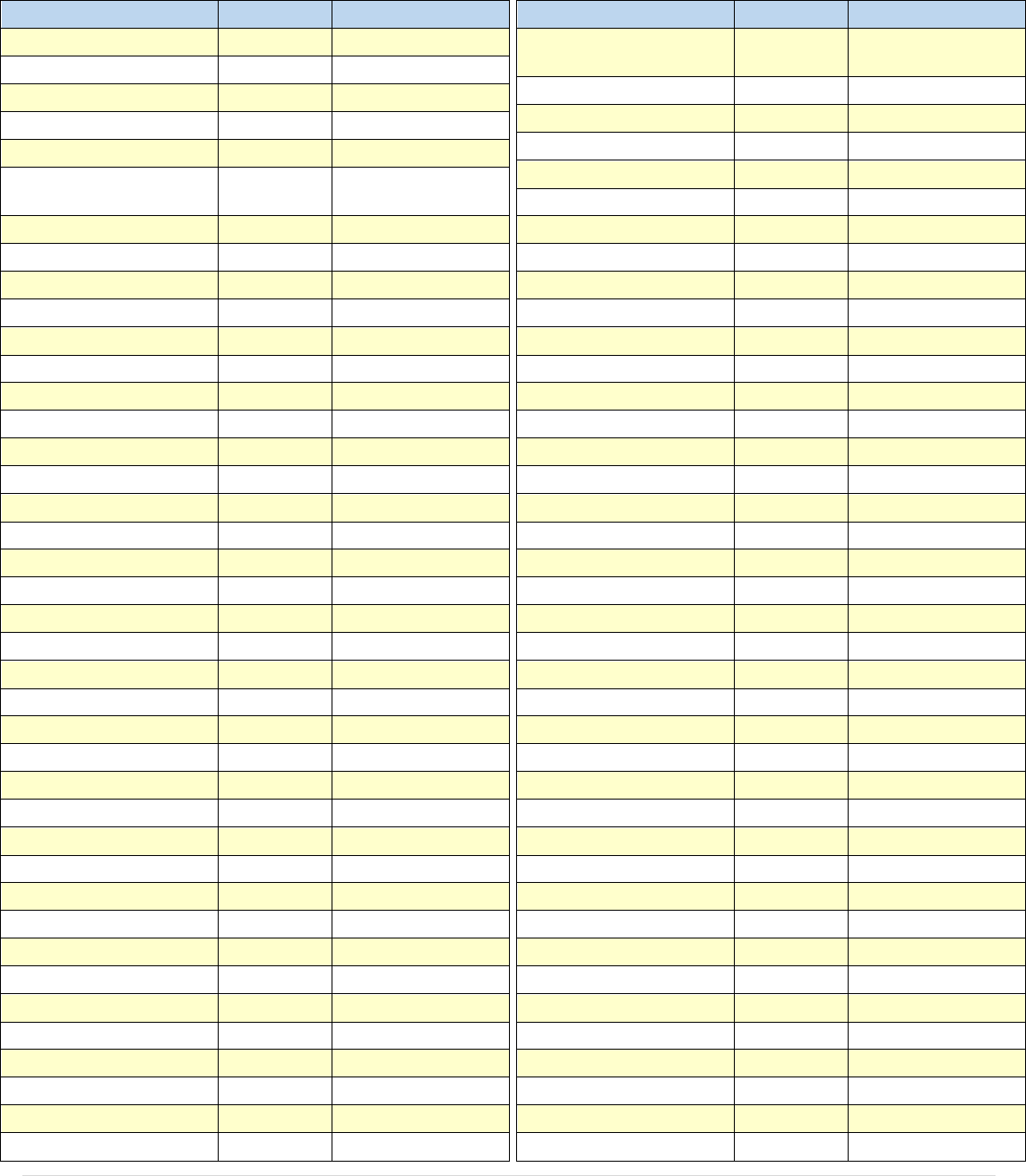

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

2 | Page

City

Rate

County

Atwater*

8.250%

Merced

Atwood

7.750%

Orange

Auberry

7.975%

Fresno

Auburn*

7.250%

Placer

Avalon*

10.000%

Los Angeles

Avenal*

7.250%

Kings

Avery

7.250%

Calaveras

Avila Beach

7.250%

San Luis Obispo

Azusa*

10.250%

Los Angeles

Badger

7.750%

Tulare

Bailey

9.500%

Los Angeles

Baker

7.750%

San Bernardino

Bakersfield*

8.250%

Kern

Balboa (Newport

Beach*)

7.750%

Orange

Balboa Island (Newport

Beach*)

7.750%

Orange

Balboa Park (San

Diego*)

7.750%

San Diego

Baldwin Park*

9.500%

Los Angeles

Ballard

7.750%

Santa Barbara

Ballico

7.750%

Merced

Ballroad

7.750%

Orange

Bangor

7.250%

Butte

Banning*

7.750%

Riverside

Banta

7.750%

San Joaquin

Bard

7.750%

Imperial

Barrington

9.500%

Los Angeles

Barstow*

8.750%

San Bernardino

Bartlett

7.750%

Inyo

Barton

7.975%

Fresno

Base Line

7.750%

San Bernardino

Bass Lake

7.750%

Madera

Bassett

9.500%

Los Angeles

Baxter

7.250%

Placer

Bay Point (formally

West Pittsburg)

8.750%

Contra Costa

Bayside

7.750%

Humboldt

Baywood Park

7.250%

San Luis Obispo

Beale A.F.B.

8.250%

Yuba

Bear River Lake

7.750%

Amador

Bear Valley

7.250%

Alpine

City

Rate

County

Bear Valley

8.750%

Mariposa

Beaumont*

7.750%

Riverside

Beckwourth

7.250%

Plumas

Bel Air Estates (Los

Angeles*)

9.500%

Los Angeles

Belden

7.250%

Plumas

Bell Gardens*

10.250%

Los Angeles

Bell*

9.500%

Los Angeles

Bella Vista

7.250%

Shasta

Bellflower*

10.250%

Los Angeles

Belmont*

9.875%

San Mateo

Belvedere*

8.250%

Marin

Ben Lomond

9.000%

Santa Cruz

Benicia*

8.375%

Solano

Benton

7.250%

Mono

Berkeley*

10.250%

Alameda

Bermuda Dunes

7.750%

Riverside

Berry Creek

7.250%

Butte

Bethel Island

8.750%

Contra Costa

Betteravia

7.750%

Santa Barbara

Beverly Hills*

9.500%

Los Angeles

Bieber

7.250%

Lassen

Big Bar

7.250%

Trinity

Big Basin

9.000%

Santa Cruz

Big Bear City

7.750%

San Bernardino

Big Bear Lake*

7.750%

San Bernardino

Big Bend

7.250%

Shasta

Big Creek

7.975%

Fresno

Big Oak Flat

7.250%

Tuolumne

Big Pine

7.750%

Inyo

Big River

7.750%

San Bernardino

Big Sur

7.750%

Monterey

Biggs*

7.250%

Butte

Bijou

7.250%

El Dorado

Biola

7.975%

Fresno

Biola College (La

Mirada*)

9.500%

Los Angeles

Birds Landing

7.375%

Solano

Bishop*

8.750%

Inyo

Black Hawk

8.750%

Contra Costa

Blairsden

7.250%

Plumas

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

3 | Page

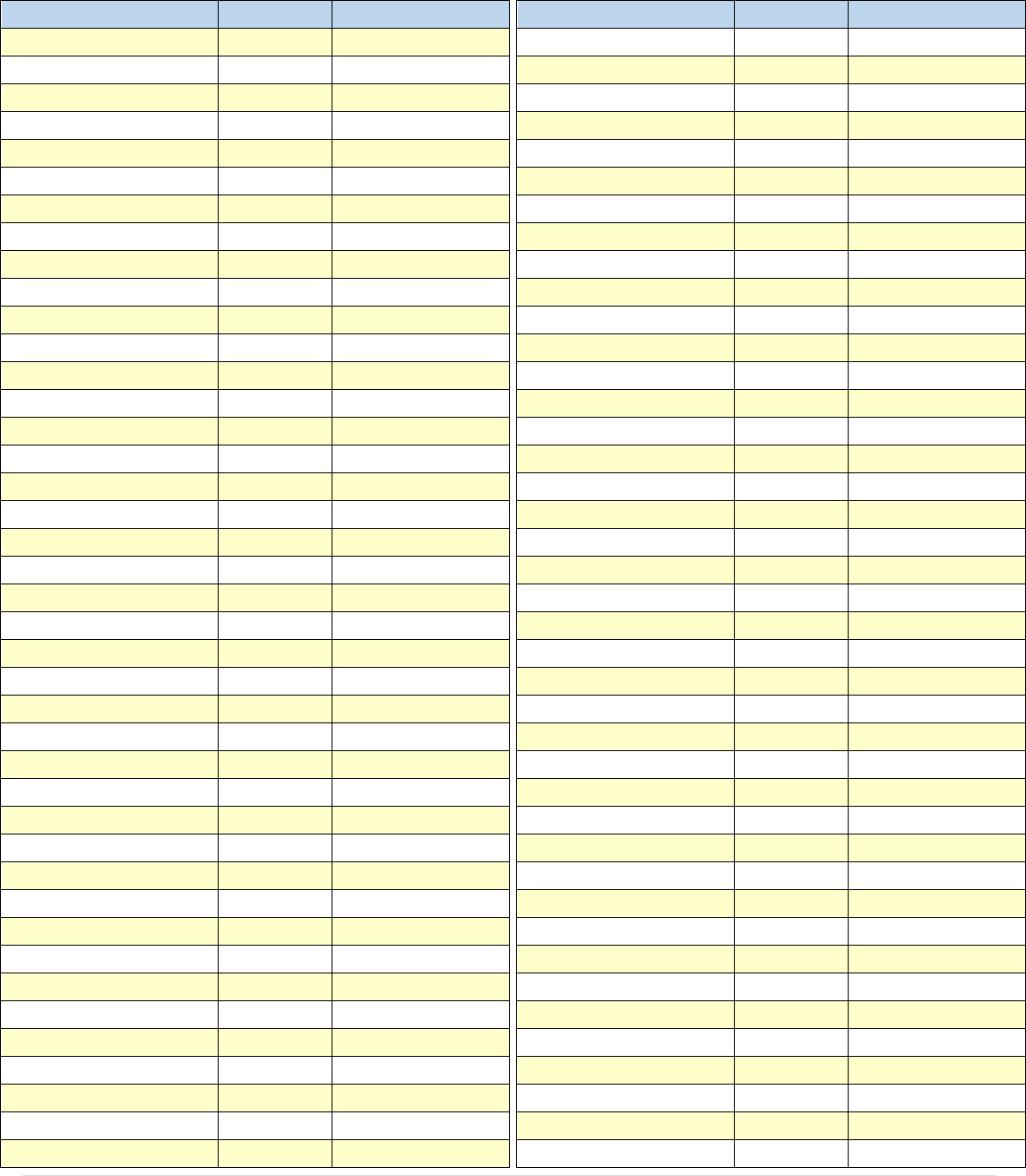

City

Rate

County

Blocksburg

7.750%

Humboldt

Bloomington

7.750%

San Bernardino

Blossom Hill

9.125%

Santa Clara

Blossom Valley

9.125%

Santa Clara

Blue Jay

7.750%

San Bernardino

Blue Lake*

7.750%

Humboldt

Blythe*

8.750%

Riverside

Bodega

8.500%

Sonoma

Bodega Bay

8.500%

Sonoma

Bodfish

7.250%

Kern

Bolinas

8.250%

Marin

Bolsa

7.750%

Orange

Bombay Beach

7.750%

Imperial

Bonita

7.750%

San Diego

Bonny Doon

9.000%

Santa Cruz

Bonsall

7.750%

San Diego

Boonville

7.875%

Mendocino

Boron

7.250%

Kern

Borrego Springs

7.750%

San Diego

Bostonia

7.750%

San Diego

Boulder Creek

9.000%

Santa Cruz

Boulevard

7.750%

San Diego

Bouquet Canyon (Santa

Clarita*)

9.500%

Los Angeles

Bowman

7.250%

Placer

Boyes Hot Springs

8.500%

Sonoma

Bradbury*

9.500%

Los Angeles

Bradford

10.250%

Alameda

Bradley

7.750%

Monterey

Branscomb

7.875%

Mendocino

Brawley*

7.750%

Imperial

Brea*

7.750%

Orange

Brents Junction

9.500%

Los Angeles

Brentwood (Los

Angeles*)

9.500%

Los Angeles

Brentwood*

8.750%

Contra Costa

Briceland

7.750%

Humboldt

Bridgeport

8.750%

Mariposa

Bridgeport

7.250%

Mono

Bridgeville

7.750%

Humboldt

Brisbane*

9.375%

San Mateo

City

Rate

County

Broderick (West

Sacramento*)

8.250%

Yolo

Brookdale

9.000%

Santa Cruz

Brookhurst Center

7.750%

Orange

Brooks

7.250%

Yolo

Browns Valley

8.250%

Yuba

Brownsville

8.250%

Yuba

Bryn Mawr

7.750%

San Bernardino

Bryte (West

Sacramento*)

8.250%

Yolo

Buellton*

7.750%

Santa Barbara

Buena Park*

7.750%

Orange

Burbank*

10.250%

Los Angeles

Burlingame*

9.625%

San Mateo

Burney

7.250%

Shasta

Burnt Ranch

7.250%

Trinity

Burrel

7.975%

Fresno

Burson

7.250%

Calaveras

Butte City

7.250%

Glenn

Butte Meadows

7.250%

Butte

Buttonwillow

7.250%

Kern

Byron

8.750%

Contra Costa

Cabazon

7.750%

Riverside

Cabrillo

9.500%

Los Angeles

Cadiz

7.750%

San Bernardino

Calabasas Highlands

9.500%

Los Angeles

Calabasas Park

9.500%

Los Angeles

Calabasas*

9.500%

Los Angeles

Calexico*

8.250%

Imperial

Caliente

7.250%

Kern

California City*

7.250%

Kern

California Hot Springs

7.750%

Tulare

California Valley

7.250%

San Luis Obispo

Calimesa*

7.750%

Riverside

Calipatria*

7.750%

Imperial

Calistoga*

7.750%

Napa

Callahan

7.250%

Siskiyou

Calpella

7.875%

Mendocino

Calpine

7.250%

Sierra

Calwa

7.975%

Fresno

Camarillo*

7.250%

Ventura

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

4 | Page

City

Rate

County

Cambria

7.250%

San Luis Obispo

Cambrian Park

9.125%

Santa Clara

Cameron Park

7.250%

El Dorado

Camino

7.250%

El Dorado

Camp Beale

8.250%

Yuba

Camp Connell

7.250%

Calaveras

Camp Curry

8.750%

Mariposa

Camp Kaweah

7.750%

Tulare

Camp Meeker

8.500%

Sonoma

Camp Nelson

7.750%

Tulare

Camp Pendleton

7.750%

San Diego

Camp Roberts

7.750%

Monterey

Campbell*

9.375%

Santa Clara

Campo

7.750%

San Diego

Campo Seco

7.250%

Calaveras

Camptonville

8.250%

Yuba

Canby

7.250%

Modoc

Canoga Annex

9.500%

Los Angeles

Canoga Park (Los

Angeles*)

9.500%

Los Angeles

Cantil

7.250%

Kern

Cantua Creek

7.975%

Fresno

Canyon

8.750%

Contra Costa

Canyon Country (Santa

Clarita*)

9.500%

Los Angeles

Canyon Lake*

7.750%

Riverside

Canyondam

7.250%

Plumas

Capay

7.250%

Yolo

Capistrano Beach (Dana

Point*)

7.750%

Orange

Capitola*

9.000%

Santa Cruz

Cardiff By The Sea

(Encinitas*)

7.750%

San Diego

Cardwell

7.975%

Fresno

Carlotta

7.750%

Humboldt

Carlsbad*

7.750%

San Diego

Carmel Rancho

7.750%

Monterey

Carmel Valley

7.750%

Monterey

Carmel-by-the-Sea*

9.250%

Monterey

Carmichael

7.750%

Sacramento

Carnelian Bay

7.250%

Placer

Carpinteria*

9.000%

Santa Barbara

City

Rate

County

Carson*

10.250%

Los Angeles

Cartago

7.750%

Inyo

Caruthers

7.975%

Fresno

Casitas Springs

7.250%

Ventura

Casmalia

7.750%

Santa Barbara

Caspar

7.875%

Mendocino

Cassel

7.250%

Shasta

Castaic

9.500%

Los Angeles

Castella

7.250%

Shasta

Castle A.F.B.

7.750%

Merced

Castro Valley

10.250%

Alameda

Castroville

7.750%

Monterey

Cathedral City*

8.750%

Riverside

Catheys Valley

8.750%

Mariposa

Cayucos

7.250%

San Luis Obispo

Cazadero

8.500%

Sonoma

Cecilville

7.250%

Siskiyou

Cedar

9.500%

Los Angeles

Cedar Crest

7.975%

Fresno

Cedar Glen

7.750%

San Bernardino

Cedar Ridge

7.500%

Nevada

Cedarpines Park

7.750%

San Bernardino

Cedarville

7.250%

Modoc

Central Valley

7.250%

Shasta

Century City (Los

Angeles*)

9.500%

Los Angeles

Ceres*

8.375%

Stanislaus

Cerritos*

9.500%

Los Angeles

Challenge

8.250%

Yuba

Chambers Lodge

7.250%

Placer

Charter Oak

9.500%

Los Angeles

Chatsworth (Los

Angeles*)

9.500%

Los Angeles

Cherry Valley

7.750%

Riverside

Chester

7.250%

Plumas

Chicago Park

7.500%

Nevada

Chico*

7.250%

Butte

Chilcoot

7.250%

Plumas

China Lake NWC

(Ridgecrest)

8.250%

Kern

Chinese Camp

7.250%

Tuolumne

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

5 | Page

City

Rate

County

Chino Hills*

7.750%

San Bernardino

Chino*

7.750%

San Bernardino

Chiriaco Summit

7.750%

Riverside

Cholame

7.250%

San Luis Obispo

Chowchilla*

8.750%

Madera

Chualar

7.750%

Monterey

Chula Vista*

8.750%

San Diego

Cima

7.750%

San Bernardino

Citrus Heights*

7.750%

Sacramento

City of Commerce*

10.250%

Los Angeles

City of Industry*

9.500%

Los Angeles

City Terrace

9.500%

Los Angeles

Claremont*

9.500%

Los Angeles

Clarksburg

7.250%

Yolo

Clayton*

8.750%

Contra Costa

Clear Creek

7.250%

Siskiyou

Clearlake Highlands

(Clearlake*)

8.750%

Lake

Clearlake Oaks

7.250%

Lake

Clearlake Park

(Clearlake*)

8.750%

Lake

Clearlake*

8.750%

Lake

Clements

7.750%

San Joaquin

Clinter

7.975%

Fresno

Clio

7.250%

Plumas

Clipper Mills

7.250%

Butte

Cloverdale*

8.500%

Sonoma

Clovis*

7.975%

Fresno

Coachella*

8.750%

Riverside

Coalinga*

8.975%

Fresno

Coarsegold

7.750%

Madera

Cobb

7.250%

Lake

Cohasset

7.250%

Butte

Cole

9.500%

Los Angeles

Coleville

7.250%

Mono

Colfax*

7.250%

Placer

College City

7.250%

Colusa

College Grove Center

7.750%

San Diego

Colma*

9.375%

San Mateo

Coloma

7.250%

El Dorado

Colorado

8.750%

Mariposa

City

Rate

County

Colton*

7.750%

San Bernardino

Columbia

7.250%

Tuolumne

Colusa*

7.250%

Colusa

Commerce*

10.250%

Los Angeles

Comptche

7.875%

Mendocino

Compton*

10.250%

Los Angeles

Concord*

9.750%

Contra Costa

Cool

7.250%

El Dorado

Copperopolis

7.250%

Calaveras

Corcoran*

8.250%

Kings

Cornell

9.500%

Los Angeles

Corning*

7.750%

Tehama

Corona Del Mar

(Newport Beach*)

7.750%

Orange

Corona*

8.750%

Riverside

Coronado*

7.750%

San Diego

Corralitos

9.000%

Santa Cruz

Corte Madera*

9.000%

Marin

Coso Junction

7.750%

Inyo

Costa Mesa*

7.750%

Orange

Cotati*

9.500%

Sonoma

Coto De Caza

7.750%

Orange

Cottonwood

7.250%

Shasta

Coulterville

8.750%

Mariposa

Courtland

7.750%

Sacramento

Covelo

7.875%

Mendocino

Covina*

10.250%

Los Angeles

Cowan Heights

7.750%

Orange

Coyote

9.125%

Santa Clara

Crannell

7.750%

Humboldt

Crenshaw (Los

Angeles*)

9.500%

Los Angeles

Crescent City*

8.250%

Del Norte

Crescent Mills

7.250%

Plumas

Cressey

7.750%

Merced

Crest

7.750%

San Diego

Crest Park

7.750%

San Bernardino

Cresta Blanca

10.250%

Alameda

Crestline

7.750%

San Bernardino

Creston

7.250%

San Luis Obispo

Crockett

8.750%

Contra Costa

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

6 | Page

City

Rate

County

Cromberg

7.250%

Plumas

Cross Roads

7.750%

San Bernardino

Crowley Lake

7.250%

Mono

Crows Landing

7.875%

Stanislaus

Cucamonga (Rancho

Cucamonga*)

7.750%

San Bernardino

Cudahy*

10.250%

Los Angeles

Culver City*

10.250%

Los Angeles

Cummings

7.875%

Mendocino

Cupertino*

9.125%

Santa Clara

Curry Village

8.750%

Mariposa

Cutler

7.750%

Tulare

Cutten

7.750%

Humboldt

Cuyama

7.750%

Santa Barbara

Cypress*

7.750%

Orange

Daggett

7.750%

San Bernardino

Dairy Farm

7.375%

Solano

Daly City*

9.875%

San Mateo

Dana Point*

7.750%

Orange

Danville*

8.750%

Contra Costa

Dardanelle

7.250%

Tuolumne

Darwin

7.750%

Inyo

Davenport

9.000%

Santa Cruz

Davis Creek

7.250%

Modoc

Davis* (U.C. Davis

campus rate is 7.25%)

8.250%

Yolo

Death Valley

7.750%

Inyo

Death Valley Junction

7.750%

Inyo

Deer Park

7.750%

Napa

Del Kern (Bakersfield*)

8.250%

Kern

Del Mar Heights (Morro

Bay*)

7.750%

San Luis Obispo

Del Mar*

8.750%

San Diego

Del Monte Grove

(Monterey*)

9.250%

Monterey

Del Rey

7.975%

Fresno

Del Rey Oaks*

9.250%

Monterey

Del Rosa

7.750%

San Bernardino

Del Sur

9.500%

Los Angeles

Delano*

8.250%

Kern

Deleven

7.250%

Colusa

Delhi

7.750%

Merced

City

Rate

County

Denair

7.875%

Stanislaus

Denny

7.250%

Trinity

Descanso

7.750%

San Diego

Desert Center

7.750%

Riverside

Desert Hot Springs*

7.750%

Riverside

Di Giorgio

7.250%

Kern

Diablo

8.750%

Contra Costa

Diamond Bar*

9.500%

Los Angeles

Diamond Springs

7.250%

El Dorado

Dillon Beach

8.250%

Marin

Dinkey Creek

7.975%

Fresno

Dinuba*

8.500%

Tulare

Discovery Bay

8.750%

Contra Costa

Dixon*

7.375%

Solano

Dobbins

8.250%

Yuba

Dogtown

8.250%

Marin

Dollar Ranch

8.750%

Contra Costa

Dorris*

7.250%

Siskiyou

Dos Palos*

7.750%

Merced

Dos Rios

7.875%

Mendocino

Douglas City

7.250%

Trinity

Douglas Flat

7.250%

Calaveras

Downey*

10.000%

Los Angeles

Downieville

7.250%

Sierra

Doyle

7.250%

Lassen

Drytown

7.750%

Amador

Duarte*

10.250%

Los Angeles

Dublin*

10.250%

Alameda

Ducor

7.750%

Tulare

Dulzura

7.750%

San Diego

Duncans Mills

8.500%

Sonoma

Dunlap

7.975%

Fresno

Dunnigan

7.250%

Yolo

Dunsmuir*

7.750%

Siskiyou

Durham

7.250%

Butte

Dutch Flat

7.250%

Placer

Eagle Mountain

7.750%

Riverside

Eagle Rock (Los

Angeles*)

9.500%

Los Angeles

Eagleville

7.250%

Modoc

Earlimart

7.750%

Tulare

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

7 | Page

City

Rate

County

Earp

7.750%

San Bernardino

East Highlands

(Highland*)

7.750%

San Bernardino

East Irvine (Irvine*)

7.750%

Orange

East Los Angeles

9.500%

Los Angeles

East Lynwood

(Lynwood*)

10.250%

Los Angeles

East Nicolaus

7.250%

Sutter

East Palo Alto*

9.875%

San Mateo

East Porterville

7.750%

Tulare

East Rancho Dominguez

9.500%

Los Angeles

East San Pedro (Los

Angeles*)

9.500%

Los Angeles

Eastgate

9.500%

Los Angeles

Easton

7.975%

Fresno

Eastside

7.750%

San Bernardino

Eastvale*

7.750%

Riverside

Echo Lake

7.250%

El Dorado

Echo Park (Los

Angeles*)

9.500%

Los Angeles

Edgemont (Moreno

Valley*)

7.750%

Riverside

Edgewood

7.250%

Siskiyou

Edison

7.250%

Kern

Edwards

7.250%

Kern

Edwards A.F.B.

7.250%

Kern

El Cajon*

8.250%

San Diego

El Centro*

8.250%

Imperial

El Cerrito*

10.250%

Contra Costa

El Dorado

7.250%

El Dorado

El Dorado Hills

7.250%

El Dorado

El Granada

9.375%

San Mateo

El Macero

7.250%

Yolo

El Modena

7.750%

Orange

El Monte*

10.000%

Los Angeles

El Nido

7.750%

Merced

El Portal

8.750%

Mariposa

El Segundo*

9.500%

Los Angeles

El Sobrante

8.750%

Contra Costa

El Toro (Lake Forest*)

7.750%

Orange

El Toro M.C.A.S.

7.750%

Orange

El Verano

8.500%

Sonoma

City

Rate

County

El Viejo

7.875%

Stanislaus

Eldridge

8.500%

Sonoma

Elizabeth Lake

9.500%

Los Angeles

Elk

7.875%

Mendocino

Elk Creek

7.250%

Glenn

Elk Grove*

7.750%

Sacramento

Elmira

7.375%

Solano

Elmwood

10.250%

Alameda

Elverta

7.750%

Sacramento

Emerald Hills (Redwood

City*)

9.875%

San Mateo

Emeryville*

10.500%

Alameda

Emigrant Gap

7.250%

Placer

Empire

7.875%

Stanislaus

Encinitas*

7.750%

San Diego

Encino (Los Angeles*)

9.500%

Los Angeles

Enterprise

7.250%

Shasta

Escalon*

7.750%

San Joaquin

Escondido*

7.750%

San Diego

Esparto

7.250%

Yolo

Essex

7.750%

San Bernardino

Etiwanda (Rancho

Cucamonga*)

7.750%

San Bernardino

Etna*

7.250%

Siskiyou

Ettersburg

7.750%

Humboldt

Eureka*

9.250%

Humboldt

Exeter*

8.750%

Tulare

Fair Oaks

7.750%

Sacramento

Fairfax*

9.000%

Marin

Fairfield*

8.375%

Solano

Fairmount

8.750%

Contra Costa

Fall River Mills

7.250%

Shasta

Fallbrook

7.750%

San Diego

Fallbrook Junction

7.750%

San Diego

Fallen Leaf

7.250%

El Dorado

Fallon

8.250%

Marin

Fancher

7.975%

Fresno

Farmersville*

8.750%

Tulare

Farmington

7.750%

San Joaquin

Fawnskin

7.750%

San Bernardino

Feather Falls

7.250%

Butte

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

8 | Page

City

Rate

County

Fellows

7.250%

Kern

Felton

9.000%

Santa Cruz

Fenner

7.750%

San Bernardino

Fernbridge (Fortuna*)

8.500%

Humboldt

Ferndale*

7.750%

Humboldt

Fiddletown

7.750%

Amador

Fields Landing

7.750%

Humboldt

Fig Garden Village

(Fresno*)

7.975%

Fresno

Fillmore*

7.250%

Ventura

Finley

7.250%

Lake

Firebaugh*

7.975%

Fresno

Fish Camp

8.750%

Mariposa

Five Points

7.975%

Fresno

Flinn Springs

7.750%

San Diego

Flintridge (LaCanada/

Flintridge*)

9.500%

Los Angeles

Florence

9.500%

Los Angeles

Floriston

7.500%

Nevada

Flournoy

7.250%

Tehama

Folsom*

7.750%

Sacramento

Fontana*

7.750%

San Bernardino

Foothill Ranch

7.750%

Orange

Forbestown

7.250%

Butte

Forest Falls

7.750%

San Bernardino

Forest Glen

7.250%

Trinity

Forest Knolls

8.250%

Marin

Forest Park

9.500%

Los Angeles

Forest Ranch

7.250%

Butte

Foresthill

7.250%

Placer

Forestville

8.500%

Sonoma

Forks of Salmon

7.250%

Siskiyou

Fort Bidwell

7.250%

Modoc

Fort Bragg*

8.875%

Mendocino

Fort Dick

8.250%

Del Norte

Fort Irwin

7.750%

San Bernardino

Fort Jones*

7.250%

Siskiyou

Fort Ord

7.750%

Monterey

Fort Ord (Marina*)

9.250%

Monterey

Fort Ord (Seaside*)

9.250%

Monterey

Fort Seward

7.750%

Humboldt

City

Rate

County

Fortuna*

8.500%

Humboldt

Foster City*

9.375%

San Mateo

Fountain Valley*

8.750%

Orange

Fowler*

8.975%

Fresno

Frazier Park

7.250%

Kern

Freedom

9.000%

Santa Cruz

Freedom (Watsonville*)

9.250%

Santa Cruz

Freeport

7.750%

Sacramento

Freestone

8.500%

Sonoma

Fremont*

10.250%

Alameda

French Camp

7.750%

San Joaquin

French Gulch

7.250%

Shasta

Freshwater

7.750%

Humboldt

Fresno*

8.350%

Fresno

Friant

7.975%

Fresno

Friendly Valley (Santa

Clarita*)

9.500%

Los Angeles

Frontera

7.750%

Riverside

Fullerton*

7.750%

Orange

Fulton

8.500%

Sonoma

Galt*

8.250%

Sacramento

Garberville

7.750%

Humboldt

Garden Grove*

8.750%

Orange

Garden Valley

7.250%

El Dorado

Gardena*

10.250%

Los Angeles

Garey

7.750%

Santa Barbara

Garnet

7.750%

Riverside

Gasquet

8.250%

Del Norte

Gaviota

7.750%

Santa Barbara

Gazelle

7.250%

Siskiyou

George A.F.B.

7.750%

San Bernardino

Georgetown

7.250%

El Dorado

Gerber

7.250%

Tehama

Geyserville

8.500%

Sonoma

Giant Forest

7.750%

Tulare

Gillman Hot Springs

7.750%

Riverside

Gilroy*

9.125%

Santa Clara

Glassell Park (Los

Angeles*)

9.500%

Los Angeles

Glen Avon

7.750%

Riverside

Glen Ellen

8.500%

Sonoma

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

9 | Page

City

Rate

County

Glenburn

7.250%

Shasta

Glencoe

7.250%

Calaveras

Glendale*

10.250%

Los Angeles

Glendora*

10.250%

Los Angeles

Glenhaven

7.250%

Lake

Glenn

7.250%

Glenn

Glennville

7.250%

Kern

Gold River

7.750%

Sacramento

Gold Run

7.250%

Placer

Golden Hills

7.250%

Kern

Goleta*

7.750%

Santa Barbara

Gonzales*

8.750%

Monterey

Goodyears Bar

7.250%

Sierra

Gorman

9.500%

Los Angeles

Goshen

7.750%

Tulare

Government Island

10.250%

Alameda

Graeagle

7.250%

Plumas

Granada Hills (Los

Angeles*)

9.500%

Los Angeles

Grand Terrace*

7.750%

San Bernardino

Granite Bay

7.250%

Placer

Grass Valley*

8.500%

Nevada

Graton

8.500%

Sonoma

Green Valley

9.500%

Los Angeles

Green Valley Lake

7.750%

San Bernardino

Greenacres

7.250%

Kern

Greenbrae (Larkspur*)

9.000%

Marin

Greenfield*

9.500%

Monterey

Greenview

7.250%

Siskiyou

Greenville

7.250%

Plumas

Greenwood

7.250%

El Dorado

Grenada

7.250%

Siskiyou

Gridley*

7.250%

Butte

Grimes

7.250%

Colusa

Grizzly Flats

7.250%

El Dorado

Groveland

7.250%

Tuolumne

Grover Beach*

8.750%

San Luis Obispo

Guadalupe*

8.750%

Santa Barbara

Gualala

7.875%

Mendocino

Guasti (Ontario*)

7.750%

San Bernardino

Guatay

7.750%

San Diego

City

Rate

County

Guerneville

8.500%

Sonoma

Guinda

7.250%

Yolo

Gustine*

8.250%

Merced

Hacienda Heights

9.500%

Los Angeles

Halcyon

7.250%

San Luis Obispo

Half Moon Bay*

9.375%

San Mateo

Hamilton A.F.B.

(Novato*)

8.500%

Marin

Hamilton City

7.250%

Glenn

Hanford*

7.250%

Kings

Happy Camp

7.250%

Siskiyou

Harbison Canyon

7.750%

San Diego

Harbor City (Los

Angeles*)

9.500%

Los Angeles

Harmony

7.250%

San Luis Obispo

Harris

7.750%

Humboldt

Hat Creek

7.250%

Shasta

Hathaway Pines

7.250%

Calaveras

Havasu Lake

7.750%

San Bernardino

Hawaiian Gardens*

10.250%

Los Angeles

Hawthorne*

10.250%

Los Angeles

Hayfork

7.250%

Trinity

Hayward*

10.750%

Alameda

Hazard

9.500%

Los Angeles

Healdsburg*

9.000%

Sonoma

Heber

7.750%

Imperial

Helena

7.250%

Trinity

Helendale

7.750%

San Bernardino

Helm

7.975%

Fresno

Hemet*

8.750%

Riverside

Herald

7.750%

Sacramento

Hercules*

9.250%

Contra Costa

Herlong

7.250%

Lassen

Hermosa Beach*

9.500%

Los Angeles

Herndon

7.975%

Fresno

Hesperia*

7.750%

San Bernardino

Heyer

10.250%

Alameda

Hickman

7.875%

Stanislaus

Hidden Hills*

9.500%

Los Angeles

Highgrove

7.750%

Riverside

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

10 | Page

City

Rate

County

Highland Park (Los

Angeles*)

9.500%

Los Angeles

Highland*

7.750%

San Bernardino

Highway City (Fresno*)

7.975%

Fresno

Hillcrest (San Diego*)

7.750%

San Diego

Hillsborough*

9.375%

San Mateo

Hillsdale (San Mateo*)

9.625%

San Mateo

Hilmar

7.750%

Merced

Hilt

7.250%

Siskiyou

Hinkley

7.750%

San Bernardino

Hobergs

7.250%

Lake

Hollister*

9.250%

San Benito

Hollywood (Los

Angeles*)

9.500%

Los Angeles

Holmes

7.750%

Humboldt

Holt

7.750%

San Joaquin

Holtville*

7.750%

Imperial

Holy City

9.125%

Santa Clara

Homeland

7.750%

Riverside

Homestead

7.250%

Kern

Homestead

7.750%

Riverside

Homewood

7.250%

Placer

Honby

9.500%

Los Angeles

Honeydew

7.750%

Humboldt

Hood

7.750%

Sacramento

Hoopa

7.750%

Humboldt

Hope Valley (Forest

Camp)

7.250%

Alpine

Hopland

7.875%

Mendocino

Hornbrook

7.250%

Siskiyou

Hornitos

8.750%

Mariposa

Horse Creek

7.250%

Siskiyou

Horse Lake

7.250%

Lassen

Hughson*

7.875%

Stanislaus

Hume

7.975%

Fresno

Huntington

7.750%

Orange

Huntington Beach*

7.750%

Orange

Huntington Lake

7.975%

Fresno

Huntington Park*

10.250%

Los Angeles

Huron*

8.975%

Fresno

Hyampom

7.250%

Trinity

City

Rate

County

Hyde Park (Los

Angeles*)

9.500%

Los Angeles

Hydesville

7.750%

Humboldt

Idria

8.250%

San Benito

Idyllwild

7.750%

Riverside

Ignacio (Novato*)

8.500%

Marin

Igo

7.250%

Shasta

Imola (Napa*)

7.750%

Napa

Imperial Beach*

8.750%

San Diego

Imperial*

7.750%

Imperial

Independence

7.750%

Inyo

Indian Wells*

7.750%

Riverside

Indio*

8.750%

Riverside

Industry*

9.500%

Los Angeles

Inglewood*

10.000%

Los Angeles

Inverness

8.250%

Marin

Inyo

7.750%

Inyo

Inyokern

7.250%

Kern

Ione*

7.750%

Amador

Iowa Hill

7.250%

Placer

Irvine*

7.750%

Orange

Irwindale*

10.250%

Los Angeles

Isla Vista

7.750%

Santa Barbara

Island Mountain

7.250%

Trinity

Isleton*

8.750%

Sacramento

Ivanhoe

7.750%

Tulare

Ivanpah

7.750%

San Bernardino

Jackson*

7.750%

Amador

Jacumba

7.750%

San Diego

Jamacha

7.750%

San Diego

Jamestown

7.250%

Tuolumne

Jamul

7.750%

San Diego

Janesville

7.250%

Lassen

Jenner

8.500%

Sonoma

Johannesburg

7.250%

Kern

Johnsondale

7.750%

Tulare

Johnstonville

7.250%

Lassen

Johnstown

7.750%

San Diego

Jolon

7.750%

Monterey

Joshua Tree

7.750%

San Bernardino

Julian

7.750%

San Diego

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

11 | Page

City

Rate

County

Junction City

7.250%

Trinity

June Lake

7.250%

Mono

Juniper

7.250%

Lassen

Jurupa Valley*

7.750%

Riverside

Kagel Canyon

9.500%

Los Angeles

Kaweah

7.750%

Tulare

Keddie

7.250%

Plumas

Keeler

7.750%

Inyo

Keene

7.250%

Kern

Kelsey

7.250%

El Dorado

Kelseyville

7.250%

Lake

Kelso

7.750%

San Bernardino

Kensington

8.750%

Contra Costa

Kentfield

8.250%

Marin

Kenwood

8.500%

Sonoma

Kerman*

8.975%

Fresno

Kernville

7.250%

Kern

Keswick

7.250%

Shasta

Kettleman City

7.250%

Kings

Keyes

7.875%

Stanislaus

King City*

8.750%

Monterey

Kings Beach

7.250%

Placer

Kings Canyon National

Park

7.750%

Tulare

Kingsburg*

8.975%

Fresno

Kinyon

7.250%

Siskiyou

Kirkwood

7.250%

Alpine

Kit Carson

7.750%

Amador

Klamath

8.250%

Del Norte

Klamath River

7.250%

Siskiyou

Kneeland

7.750%

Humboldt

Knights Ferry

7.875%

Stanislaus

Knights Landing

7.250%

Yolo

Knightsen

8.750%

Contra Costa

Korbel

7.750%

Humboldt

Korbel

8.500%

Sonoma

Kyburz

7.250%

El Dorado

L.A. Airport (Los

Angeles*)

9.500%

Los Angeles

La Canada- Flintridge*

9.500%

Los Angeles

La Crescenta

9.500%

Los Angeles

City

Rate

County

La Cresta Village

7.250%

Kern

La Grange

7.875%

Stanislaus

La Habra Heights*

9.500%

Los Angeles

La Habra*

8.250%

Orange

La Honda

9.375%

San Mateo

La Jolla (San Diego*)

7.750%

San Diego

La Mesa*

8.500%

San Diego

La Mirada*

9.500%

Los Angeles

La Palma*

8.750%

Orange

La Porte

7.250%

Plumas

La Puente*

10.000%

Los Angeles

La Quinta*

8.750%

Riverside

La Selva Beach

9.000%

Santa Cruz

La Verne*

10.250%

Los Angeles

La Vina

9.500%

Los Angeles

Ladera

9.375%

San Mateo

Ladera Heights

9.500%

Los Angeles

Ladera Ranch

7.750%

Orange

Lafayette*

8.750%

Contra Costa

Laguna Beach*

7.750%

Orange

Laguna Hills*

7.750%

Orange

Laguna Niguel*

7.750%

Orange

Laguna Woods*

7.750%

Orange

Lagunitas

8.250%

Marin

Lake Alpine

7.250%

Alpine

Lake Arrowhead

7.750%

San Bernardino

Lake City

7.250%

Modoc

Lake City

7.500%

Nevada

Lake Elsinore*

8.750%

Riverside

Lake Forest*

7.750%

Orange

Lake Hughes

9.500%

Los Angeles

Lake Isabella

7.250%

Kern

Lake Los Angeles

9.500%

Los Angeles

Lake Mary

7.250%

Mono

Lake San Marcos

7.750%

San Diego

Lake Shastina

7.250%

Siskiyou

Lake Sherwood

7.250%

Ventura

Lakehead

7.250%

Shasta

Lakeport*

8.750%

Lake

Lakeshore

7.975%

Fresno

Lakeside

7.750%

San Diego

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

12 | Page

City

Rate

County

Lakeview

7.750%

Riverside

Lakeview Terrace (Los

Angeles*)

9.500%

Los Angeles

Lakewood*

10.250%

Los Angeles

Lamont

7.250%

Kern

Lancaster*

10.250%

Los Angeles

Landers

7.750%

San Bernardino

Landscape

10.250%

Alameda

Lang

9.500%

Los Angeles

Larkfield

8.500%

Sonoma

Larkspur*

9.000%

Marin

Larwin Plaza

7.375%

Solano

Lathrop*

8.750%

San Joaquin

Laton

7.975%

Fresno

Lawndale*

10.250%

Los Angeles

Laws

7.750%

Inyo

Laytonville

7.875%

Mendocino

Le Grand (Also Legrand)

7.750%

Merced

Lebec

7.250%

Kern

Lee Vining

7.250%

Mono

Leggett

7.875%

Mendocino

Leisure World

7.750%

Orange

Leisure World (Seal

Beach*)

8.750%

Orange

Lemon Cove

7.750%

Tulare

Lemon Grove*

7.750%

San Diego

Lemoore*

7.250%

Kings

Lennox

9.500%

Los Angeles

Lenwood

7.750%

San Bernardino

Leona Valley

9.500%

Los Angeles

Leucadia (Encinitas*)

7.750%

San Diego

Lewiston

7.250%

Trinity

Liberty Farms

7.375%

Solano

Likely

7.250%

Modoc

Lincoln Acres

7.750%

San Diego

Lincoln Heights (Los

Angeles*)

9.500%

Los Angeles

Lincoln Village

7.750%

San Joaquin

Lincoln*

7.250%

Placer

Linda

8.250%

Yuba

Linden

7.750%

San Joaquin

City

Rate

County

Lindsay*

8.750%

Tulare

Linnell

7.750%

Tulare

Litchfield

7.250%

Lassen

Little Lake

7.750%

Inyo

Little Norway

7.250%

El Dorado

Little Valley

7.250%

Lassen

Littleriver

7.875%

Mendocino

Littlerock (Also Little

Rock)

9.500%

Los Angeles

Live Oak

9.000%

Santa Cruz

Live Oak*

7.250%

Sutter

Livermore*

10.250%

Alameda

Livingston*

7.750%

Merced

Llano

9.500%

Los Angeles

Loch Lomond

7.250%

Lake

Locke

7.750%

Sacramento

Lockeford

7.750%

San Joaquin

Lockheed

9.000%

Santa Cruz

Lockwood

7.750%

Monterey

Lodi*

8.250%

San Joaquin

Loleta

7.750%

Humboldt

Loma Linda*

7.750%

San Bernardino

Loma Mar

9.375%

San Mateo

Loma Rica

8.250%

Yuba

Lomita*

10.250%

Los Angeles

Lompoc*

8.750%

Santa Barbara

London

7.750%

Tulare

Lone Pine

7.750%

Inyo

Long Barn

7.250%

Tuolumne

Long Beach*

10.250%

Los Angeles

Longview

9.500%

Los Angeles

Lookout

7.250%

Modoc

Loomis*

7.500%

Placer

Lorre Estates

9.125%

Santa Clara

Los Alamitos*

9.250%

Orange

Los Alamos

7.750%

Santa Barbara

Los Altos Hills*

9.125%

Santa Clara

Los Altos*

9.125%

Santa Clara

Los Angeles*

9.500%

Los Angeles

Los Banos*

8.750%

Merced

Los Gatos*

9.250%

Santa Clara

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

13 | Page

City

Rate

County

Los Molinos

7.250%

Tehama

Los Nietos

9.500%

Los Angeles

Los Olivos

7.750%

Santa Barbara

Los Osos

7.250%

San Luis Obispo

Los Padres

7.250%

San Luis Obispo

Los Serranos (Chino

Hills*)

7.750%

San Bernardino

Lost Hills

7.250%

Kern

Lost Lake

7.750%

Riverside

Lotus

7.250%

El Dorado

Lower Lake

7.250%

Lake

Loyalton*

7.250%

Sierra

Lucerne

7.250%

Lake

Lucerne Valley

7.750%

San Bernardino

Lucia

7.750%

Monterey

Ludlow

7.750%

San Bernardino

Lugo

9.500%

Los Angeles

Lynwood*

10.250%

Los Angeles

Lytle Creek

7.750%

San Bernardino

Macdoel

7.250%

Siskiyou

Maclay

9.500%

Los Angeles

Mad River

7.250%

Trinity

Madeline

7.250%

Lassen

Madera*

8.250%

Madera

Madison

7.250%

Yolo

Magalia

7.250%

Butte

Malaga

7.975%

Fresno

Malibu*

9.500%

Los Angeles

Mammoth Lakes*

7.750%

Mono

Manhattan Beach*

9.500%

Los Angeles

Manteca*

8.250%

San Joaquin

Manton

7.250%

Tehama

Manzanita Lake

7.250%

Shasta

Mar Vista

9.500%

Los Angeles

Marcelina

9.500%

Los Angeles

March A.F.B.

7.750%

Riverside

Mare Island (Vallejo*)

8.375%

Solano

Maricopa*

7.250%

Kern

Marin City

8.250%

Marin

Marina Del Rey

9.500%

Los Angeles

Marina*

9.250%

Monterey

City

Rate

County

Marine Corps

(Twentynine Palms*)

7.750%

San Bernardino

Mariner

7.750%

Orange

Mariposa

8.750%

Mariposa

Markleeville

7.250%

Alpine

Marsh Manor

9.375%

San Mateo

Marshall

8.250%

Marin

Martell

7.750%

Amador

Martinez*

9.750%

Contra Costa

Marysville*

8.250%

Yuba

Mather

7.250%

Tuolumne

Mather

7.750%

Sacramento

Maxwell

7.250%

Colusa

Maywood*

9.500%

Los Angeles

McArthur

7.250%

Shasta

McClellan

7.750%

Sacramento

McCloud

7.250%

Siskiyou

McFarland*

7.250%

Kern

McKinleyville

7.750%

Humboldt

McKittrick

7.250%

Kern

Mead Valley

7.750%

Riverside

Meadow Valley

7.250%

Plumas

Meadow Vista

7.250%

Placer

Meadowbrook

7.750%

Riverside

Mecca

7.750%

Riverside

Meeks Bay

7.250%

El Dorado

Meiners Oaks

7.250%

Ventura

Mendocino

7.875%

Mendocino

Mendota*

7.975%

Fresno

Menifee*

8.750%

Riverside

Menlo Park*

9.375%

San Mateo

Mentone

7.750%

San Bernardino

Merced*

8.250%

Merced

Meridian

7.250%

Sutter

Mettler

7.250%

Kern

Meyers

7.250%

El Dorado

Middletown

7.250%

Lake

Midland

7.750%

Riverside

Midpines

8.750%

Mariposa

Midway City

7.750%

Orange

Milford

7.250%

Lassen

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

14 | Page

City

Rate

County

Mill Creek

7.250%

Tehama

Mill Valley*

8.250%

Marin

Millbrae*

9.375%

San Mateo

Millville

7.250%

Shasta

Milpitas*

9.375%

Santa Clara

Mineral

7.250%

Tehama

Mineral King

7.750%

Tulare

Mint Canyon

9.500%

Los Angeles

Mira Loma

7.750%

Riverside

Mira Vista

8.750%

Contra Costa

Miracle Hot Springs

7.250%

Kern

Miramar (San Diego*)

7.750%

San Diego

Miramonte

7.975%

Fresno

Miranda

7.750%

Humboldt

Mission Hills (Los

Angeles*)

9.500%

Los Angeles

Mission Viejo*

7.750%

Orange

Mi-Wuk Village

7.250%

Tuolumne

Moccasin

7.250%

Tuolumne

Modesto*

7.875%

Stanislaus

Moffett Field

9.125%

Santa Clara

Mojave

7.250%

Kern

Mokelumne Hill

7.250%

Calaveras

Monarch Beach (Dana

Point*)

7.750%

Orange

Moneta

9.500%

Los Angeles

Mono Hot Springs

7.975%

Fresno

Mono Lake

7.250%

Mono

Monolith

7.250%

Kern

Monrovia*

10.250%

Los Angeles

Monta Vista

9.125%

Santa Clara

Montague*

7.250%

Siskiyou

Montalvo (Ventura*)

7.750%

Ventura

Montara

9.375%

San Mateo

Montclair*

9.000%

San Bernardino

Monte Rio

8.500%

Sonoma

Monte Sereno*

9.125%

Santa Clara

Montebello*

10.250%

Los Angeles

Montecito

7.750%

Santa Barbara

Monterey Bay Academy

9.000%

Santa Cruz

Monterey Park*

9.500%

Los Angeles

City

Rate

County

Monterey*

9.250%

Monterey

Montgomery Creek

7.250%

Shasta

Montrose

9.500%

Los Angeles

Mooney

7.750%

Tulare

Moonridge

7.750%

San Bernardino

Moorpark*

7.250%

Ventura

Moraga*

9.750%

Contra Costa

Moreno Valley*

7.750%

Riverside

Morgan Hill*

9.125%

Santa Clara

Morongo Valley

7.750%

San Bernardino

Morro Bay*

8.750%

San Luis Obispo

Morro Plaza

7.250%

San Luis Obispo

Moss Beach

9.375%

San Mateo

Moss Landing

7.750%

Monterey

Mount Hamilton

9.125%

Santa Clara

Mount Hebron

7.250%

Siskiyou

Mount Hermon

9.000%

Santa Cruz

Mount Laguna

7.750%

San Diego

Mount Shasta*

7.500%

Siskiyou

Mount Wilson

9.500%

Los Angeles

Mountain Center

7.750%

Riverside

Mountain Mesa

7.250%

Kern

Mountain Pass

7.750%

San Bernardino

Mountain Ranch

7.250%

Calaveras

Mountain View*

9.125%

Santa Clara

Mt. Aukum

7.250%

El Dorado

Mt. Baldy

7.750%

San Bernardino

Murphys

7.250%

Calaveras

Murrieta*

8.750%

Riverside

Muscoy

7.750%

San Bernardino

Myers Flat

7.750%

Humboldt

Napa*

7.750%

Napa

Naples

9.500%

Los Angeles

Nashville

7.250%

El Dorado

National City*

8.750%

San Diego

Naval (Port Hueneme*)

8.750%

Ventura

Naval (San Diego*)

7.750%

San Diego

Naval Air Station

(Alameda*)

10.750%

Alameda

Naval Air Station

(Coronado*)

7.750%

San Diego

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

15 | Page

City

Rate

County

Naval Air Station

(Lemoore*)

7.250%

Kings

Naval Hospital

(Oakland*)

10.250%

Alameda

Naval Hospital (San

Diego*)

7.750%

San Diego

Naval Supply Center

(Oakland*)

10.250%

Alameda

Naval Training Center

(San Diego*)

7.750%

San Diego

Navarro

7.875%

Mendocino

Needles*

7.750%

San Bernardino

Nelson

7.250%

Butte

Nevada City*

8.375%

Nevada

New Almaden

9.125%

Santa Clara

New Cuyama

7.750%

Santa Barbara

New Idria

8.250%

San Benito

Newark*

10.750%

Alameda

Newberry

7.750%

San Bernardino

Newberry Springs

7.750%

San Bernardino

Newbury Park

(Thousand Oaks*)

7.250%

Ventura

Newcastle

7.250%

Placer

Newhall (Santa Clarita*)

9.500%

Los Angeles

Newman*

7.875%

Stanislaus

Newport Beach*

7.750%

Orange

Nicasio

8.250%

Marin

Nice

7.250%

Lake

Nicolaus

7.250%

Sutter

Niland

7.750%

Imperial

Nipomo

7.250%

San Luis Obispo

Nipton

7.750%

San Bernardino

Norco*

8.750%

Riverside

Norden

7.500%

Nevada

North Edwards

7.250%

Kern

North Fork

7.750%

Madera

North Gardena

9.500%

Los Angeles

North Highlands

7.750%

Sacramento

North Hills (Los

Angeles*)

9.500%

Los Angeles

North Hollywood (Los

Angeles*)

9.500%

Los Angeles

North Palm Springs

7.750%

Riverside

City

Rate

County

North San Juan

7.500%

Nevada

North Shore

7.750%

Riverside

Northridge (Los

Angeles*)

9.500%

Los Angeles

Norton A.F.B. (San

Bernardino*)

8.000%

San Bernardino

Norwalk*

10.250%

Los Angeles

Novato*

8.500%

Marin

Nubieber

7.250%

Lassen

Nuevo

7.750%

Riverside

Nyeland Acres

7.250%

Ventura

Oak Park

7.250%

Ventura

Oak Run

7.250%

Shasta

Oak View

7.250%

Ventura

Oakdale*

8.375%

Stanislaus

Oakhurst

7.750%

Madera

Oakland*

10.250%

Alameda

Oakley*

8.750%

Contra Costa

Oakville

7.750%

Napa

Oasis

7.750%

Riverside

Oban

9.500%

Los Angeles

O'Brien

7.250%

Shasta

Occidental

8.500%

Sonoma

Oceano

7.250%

San Luis Obispo

Oceanside*

8.250%

San Diego

Ocotillo

7.750%

Imperial

Ocotillo Wells

7.750%

San Diego

Oildale

7.250%

Kern

Ojai*

7.250%

Ventura

Olancha

7.750%

Inyo

Old Station

7.250%

Shasta

Olema

8.250%

Marin

Olinda

7.250%

Shasta

Olive View (Los

Angeles*)

9.500%

Los Angeles

Olivehurst

8.250%

Yuba

Olivenhain (Encinitas*)

7.750%

San Diego

Olympic Valley

7.250%

Placer

Omo Ranch

7.250%

El Dorado

O'Neals

7.750%

Madera

Ono

7.250%

Shasta

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

16 | Page

City

Rate

County

Ontario*

7.750%

San Bernardino

Onyx

7.250%

Kern

Opal Cliffs

9.000%

Santa Cruz

Orange Cove*

7.975%

Fresno

Orange*

7.750%

Orange

Orangevale

7.750%

Sacramento

Orcutt

7.750%

Santa Barbara

Ordbend

7.250%

Glenn

Oregon House

8.250%

Yuba

Orick

7.750%

Humboldt

Orinda*

9.750%

Contra Costa

Orland*

7.750%

Glenn

Orleans

7.750%

Humboldt

Oro Grande

7.750%

San Bernardino

Orosi

7.750%

Tulare

Oroville*

8.250%

Butte

Otay (Chula Vista*)

8.750%

San Diego

Oxnard*

9.250%

Ventura

Pacheco

8.750%

Contra Costa

Pacific Grove*

9.250%

Monterey

Pacific House

7.250%

El Dorado

Pacific Palisades (Los

Angeles*)

9.500%

Los Angeles

Pacifica*

9.375%

San Mateo

Pacoima (Los Angeles*)

9.500%

Los Angeles

Paicines

8.250%

San Benito

Pajaro

7.750%

Monterey

Pala

7.750%

San Diego

Palermo

7.250%

Butte

Pallett

9.500%

Los Angeles

Palm City

7.750%

Riverside

Palm City (San Diego*)

7.750%

San Diego

Palm Desert*

7.750%

Riverside

Palm Springs*

9.250%

Riverside

Palmdale*

10.250%

Los Angeles

Palo Alto*

9.125%

Santa Clara

Palo Cedro

7.250%

Shasta

Palo Verde

7.750%

Imperial

Palomar Mountain

7.750%

San Diego

Palos Verdes Estates*

9.500%

Los Angeles

Palos Verdes/Peninsula

9.500%

Los Angeles

City

Rate

County

Panorama City (Los

Angeles*)

9.500%

Los Angeles

Paradise*

7.750%

Butte

Paramount*

10.250%

Los Angeles

Parker Dam

7.750%

San Bernardino

Parkfield

7.750%

Monterey

Parlier*

8.975%

Fresno

Pasadena*

10.250%

Los Angeles

Paskenta

7.250%

Tehama

Paso Robles*

8.750%

San Luis Obispo

Patterson*

7.875%

Stanislaus

Patton

7.750%

San Bernardino

Pauma Valley

7.750%

San Diego

Paynes Creek

7.250%

Tehama

Pearblossom

9.500%

Los Angeles

Pearland

9.500%

Los Angeles

Pebble Beach

7.750%

Monterey

Pedley

7.750%

Riverside

Peninsula Village

7.250%

Plumas

Penn Valley

7.500%

Nevada

Penngrove

8.500%

Sonoma

Penryn

7.250%

Placer

Pepperwood

7.750%

Humboldt

Permanente

9.125%

Santa Clara

Perris*

7.750%

Riverside

Perry (Whittier*)

9.500%

Los Angeles

Pescadero

9.375%

San Mateo

Petaluma*

9.500%

Sonoma

Petrolia

7.750%

Humboldt

Phelan

7.750%

San Bernardino

Phillipsville

7.750%

Humboldt

Philo

7.875%

Mendocino

Pico Rivera*

10.250%

Los Angeles

Piedmont*

10.250%

Alameda

Piedra

7.975%

Fresno

Piercy

7.875%

Mendocino

Pilot Hill

7.250%

El Dorado

Pine Grove

7.750%

Amador

Pine Valley

7.750%

San Diego

Pinecrest

7.250%

Tuolumne

Pinedale (Fresno*)

7.975%

Fresno

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

17 | Page

City

Rate

County

Pinetree

9.500%

Los Angeles

Pinole*

9.750%

Contra Costa

Pinon Hills

7.750%

San Bernardino

Pioneer

7.750%

Amador

Pioneertown

7.750%

San Bernardino

Piru

7.250%

Ventura

Pismo Beach*

7.750%

San Luis Obispo

Pittsburg*

9.250%

Contra Costa

Pixley

7.750%

Tulare

Placentia*

8.750%

Orange

Placerville*

8.250%

El Dorado

Plainview

7.750%

Tulare

Planada

7.750%

Merced

Plaster City

7.750%

Imperial

Platina

7.250%

Shasta

Playa Del Rey (Los

Angeles*)

9.500%

Los Angeles

Pleasant Grove

7.250%

Sutter

Pleasant Hill*

9.250%

Contra Costa

Pleasanton*

10.250%

Alameda

Plymouth*

7.750%

Amador

Point Arena*

8.375%

Mendocino

Point Mugu

7.250%

Ventura

Point Reyes Station

8.250%

Marin

Pollock Pines

7.250%

El Dorado

Pomona*

10.250%

Los Angeles

Pond

7.250%

Kern

Pondosa

7.250%

Siskiyou

Pope Valley

7.750%

Napa

Poplar

7.750%

Tulare

Port Costa

8.750%

Contra Costa

Port Hueneme*

8.750%

Ventura

Porter Ranch (Los

Angeles*)

9.500%

Los Angeles

Porterville*

9.250%

Tulare

Portola Valley*

9.375%

San Mateo

Portola*

7.250%

Plumas

Portuguese Bend

(Rancho Palos Verdes*)

9.500%

Los Angeles

Posey

7.750%

Tulare

Potrero

7.750%

San Diego

City

Rate

County

Potter Valley

7.875%

Mendocino

Poway*

7.750%

San Diego

Prather

7.975%

Fresno

Presidio (San

Francisco*)

8.625%

San Francisco

Presidio of Monterey

(Monterey*)

9.250%

Monterey

Priest Valley

7.750%

Monterey

Princeton

7.250%

Colusa

Proberta

7.250%

Tehama

Project City

7.250%

Shasta

Prunedale

7.750%

Monterey

Pt. Dume

9.500%

Los Angeles

Pulga

7.250%

Butte

Pumpkin Center

7.250%

Kern

Quail Valley (Menifee*)

8.750%

Riverside

Quartz Hill

9.500%

Los Angeles

Quincy

7.250%

Plumas

Rackerby

8.250%

Yuba

Rail Road Flat

7.250%

Calaveras

Rainbow

7.750%

San Diego

Raisin City

7.975%

Fresno

Ramona

7.750%

San Diego

Ranchita

7.750%

San Diego

Rancho Bernardo (San

Diego*)

7.750%

San Diego

Rancho California

7.750%

Riverside

Rancho Cordova *

8.750%

Sacramento

Rancho Cucamonga*

7.750%

San Bernardino

Rancho Dominguez

9.500%

Los Angeles

Rancho Mirage*

7.750%

Riverside

Rancho Murieta

7.750%

Sacramento

Rancho Palos Verdes*

9.500%

Los Angeles

Rancho Park (Los

Angeles*)

9.500%

Los Angeles

Rancho Santa Fe

7.750%

San Diego

Rancho Santa

Margarita*

7.750%

Orange

Randsburg

7.250%

Kern

Ravendale

7.250%

Lassen

Ravenna

9.500%

Los Angeles

Raymond

7.750%

Madera

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

18 | Page

City

Rate

County

Red Bluff*

7.500%

Tehama

Red Mountain

7.750%

San Bernardino

Red Top

7.750%

Madera

Redcrest

7.750%

Humboldt

Redding*

7.250%

Shasta

Redlands*

8.750%

San Bernardino

Redondo Beach*

9.500%

Los Angeles

Redway

7.750%

Humboldt

Redwood City*

9.875%

San Mateo

Redwood Estates

9.125%

Santa Clara

Redwood Valley

7.875%

Mendocino

Reedley*

9.225%

Fresno

Refugio Beach

7.750%

Santa Barbara

Represa (Folsom Prison)

7.750%

Sacramento

Requa

8.250%

Del Norte

Rescue

7.250%

El Dorado

Reseda (Los Angeles*)

9.500%

Los Angeles

Rheem Valley (Moraga*)

9.750%

Contra Costa

Rialto*

7.750%

San Bernardino

Richardson Grove

7.750%

Humboldt

Richardson Springs

7.250%

Butte

Richfield

7.250%

Tehama

Richgrove

7.750%

Tulare

Richmond*

9.750%

Contra Costa

Richvale

7.250%

Butte

Ridgecrest*

8.250%

Kern

Rimforest

7.750%

San Bernardino

Rimpau (Los Angeles*)

9.500%

Los Angeles

Rio Bravo (Bakersfield*)

8.250%

Kern

Rio Del Mar

9.000%

Santa Cruz

Rio Dell*

8.750%

Humboldt

Rio Linda

7.750%

Sacramento

Rio Nido

8.500%

Sonoma

Rio Oso

7.250%

Sutter

Rio Vista*

8.125%

Solano

Ripley

7.750%

Riverside

Ripon*

7.750%

San Joaquin

River Pines

7.750%

Amador

Riverbank*

7.875%

Stanislaus

Riverdale

7.975%

Fresno

Riverside*

8.750%

Riverside

City

Rate

County

Robbins

7.250%

Sutter

Rocklin*

7.250%

Placer

Rodeo

8.750%

Contra Costa

Rohnert Park*

9.000%

Sonoma

Rohnerville

7.750%

Humboldt

Rolling Hills Estates*

9.500%

Los Angeles

Rolling Hills*

9.500%

Los Angeles

Romoland (Menifee*)

8.750%

Riverside

Rosamond

7.250%

Kern

Rose Bowl (Pasadena*)

10.250%

Los Angeles

Roseland

8.500%

Sonoma

Rosemead*

9.500%

Los Angeles

Roseville*

7.750%

Placer

Ross*

8.250%

Marin

Rossmoor

7.750%

Orange

Rough and Ready

7.500%

Nevada

Round Mountain

7.250%

Shasta

Rowland Heights

9.500%

Los Angeles

Royal Oaks

7.750%

Monterey

Rubidoux

7.750%

Riverside

Ruby Valley

7.750%

Humboldt

Rumsey

7.250%

Yolo

Running Springs

7.750%

San Bernardino

Ruth

7.250%

Trinity

Rutherford

7.750%

Napa

Ryde

7.750%

Sacramento

Sacramento*

8.750%

Sacramento

Saint Helena*

8.250%

Napa

Salida

7.875%

Stanislaus

Salinas*

9.250%

Monterey

Salton City

7.750%

Imperial

Salyer

7.250%

Trinity

Samoa

7.750%

Humboldt

San Andreas

7.250%

Calaveras

San Anselmo*

8.750%

Marin

San Ardo

7.750%

Monterey

San Benito

8.250%

San Benito

San Bernardino*

8.750%

San Bernardino

San Bruno*

9.875%

San Mateo

San Carlos (San Diego*)

7.750%

San Diego

San Carlos*

9.375%

San Mateo

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

19 | Page

City

Rate

County

San Clemente*

7.750%

Orange

San Diego*

7.750%

San Diego

San Dimas*

9.500%

Los Angeles

San Fernando*

10.250%

Los Angeles

San Francisco*

8.625%

San Francisco

San Gabriel*

10.250%

Los Angeles

San Geronimo

8.250%

Marin

San Gregorio

9.375%

San Mateo

San Jacinto*

8.750%

Riverside

San Joaquin*

7.975%

Fresno

San Jose*

9.375%

Santa Clara

San Juan Bautista*

9.000%

San Benito

San Juan Capistrano*

7.750%

Orange

San Juan Plaza (San Juan

Capistrano*)

7.750%

Orange

San Leandro*

10.750%

Alameda

San Lorenzo

10.250%

Alameda

San Lucas

7.750%

Monterey

San Luis Obispo*

8.750%

San Luis Obispo

San Luis Rey

(Oceanside*)

8.250%

San Diego

San Marcos*

7.750%

San Diego

San Marino*

9.500%

Los Angeles

San Martin

9.125%

Santa Clara

San Mateo*

9.625%

San Mateo

San Miguel

7.250%

San Luis Obispo

San Pablo*

9.500%

Contra Costa

San Pedro (Los

Angeles*)

9.500%

Los Angeles

San Quentin

8.250%

Marin

San Rafael*

9.250%

Marin

San Ramon*

8.750%

Contra Costa

San Simeon

7.250%

San Luis Obispo

San Tomas

9.125%

Santa Clara

San Ysidro (San Diego*)

7.750%

San Diego

Sand City*

8.750%

Monterey

Sanger*

8.725%

Fresno

Santa Ana*

9.250%

Orange

Santa Barbara* (U.C.

Santa Barbara campus

rate is 7.75%)

8.750%

Santa Barbara

Santa Clara*

9.125%

Santa Clara

City

Rate

County

Santa Clarita*

9.500%

Los Angeles

Santa Cruz*

9.250%

Santa Cruz

Santa Fe Springs*

10.500%

Los Angeles

Santa Margarita

7.250%

San Luis Obispo

Santa Maria*

8.750%

Santa Barbara

Santa Monica*

10.250%

Los Angeles

Santa Nella

7.750%

Merced

Santa Paula*

8.250%

Ventura

Santa Rita Park

7.750%

Merced

Santa Rosa Valley

7.250%

Ventura

Santa Rosa*

9.250%

Sonoma

Santa Ynez

7.750%

Santa Barbara

Santa Ysabel

7.750%

San Diego

Santee*

7.750%

San Diego

Saratoga*

9.125%

Santa Clara

Saticoy

7.250%

Ventura

Sattley

7.250%

Sierra

Saugus (Santa Clarita*)

9.500%

Los Angeles

Sausalito*

8.750%

Marin

Sawtelle (Los Angeles*)

9.500%

Los Angeles

Sawyers Bar

7.250%

Siskiyou

Scotia

7.750%

Humboldt

Scott Bar

7.250%

Siskiyou

Scotts Valley*

9.750%

Santa Cruz

Sea Ranch

8.500%

Sonoma

Seabright (Santa Cruz*)

9.250%

Santa Cruz

Seal Beach*

8.750%

Orange

Seaside*

9.250%

Monterey

Sebastopol*

9.250%

Sonoma

Seeley

7.750%

Imperial

Seiad Valley

7.250%

Siskiyou

Selby

8.750%

Contra Costa

Selma*

8.475%

Fresno

Seminole Hot Springs

9.500%

Los Angeles

Sepulveda (Los

Angeles*)

9.500%

Los Angeles

Sequoia National Park

7.750%

Tulare

Shadow Hills (Los

Angeles*)

9.500%

Los Angeles

Shafter*

7.250%

Kern

Shandon

7.250%

San Luis Obispo

California City and County Sales and Use Tax Rates

Effective 01/01/2023 through 03/31/2023

20 | Page

City

Rate

County

Sharpe Army Depot

7.750%

San Joaquin

Shasta

7.250%

Shasta

Shasta Lake*

7.250%

Shasta

Shaver Lake

7.975%

Fresno

Sheepranch

7.250%

Calaveras

Shell Beach (Pismo

Beach*)

7.750%

San Luis Obispo

Sheridan

7.250%

Placer

Sherman Island

7.750%

Sacramento

Sherman Oaks (Los

Angeles*)

9.500%

Los Angeles

Sherwin Plaza

7.250%

Mono

Shingle Springs

7.250%

El Dorado

Shingletown

7.250%

Shasta

Shively

7.750%

Humboldt

Shore Acres

8.750%

Contra Costa

Shoshone

7.750%

Inyo

Sierra City

7.250%

Sierra

Sierra Madre*

10.250%

Los Angeles

Sierraville

7.250%

Sierra

Signal Hill*

10.250%

Los Angeles

Silver Lake

7.750%

Amador

Silverado Canyon

7.750%

Orange

Simi Valley*

7.250%

Ventura

Sisquoc

7.750%

Santa Barbara

Sites

7.250%

Colusa

Sky Valley

7.750%

Riverside

Skyforest

7.750%

San Bernardino

Sleepy Valley

9.500%

Los Angeles

Sloat

7.250%

Plumas

Sloughhouse

7.750%

Sacramento

Smartsville

8.250%

Yuba

Smith River

8.250%

Del Norte

Smithflat

7.250%

El Dorado

Smoke Tree (Palm

Springs*)

9.250%

Riverside

Smoke Tree

(Twentynine Palms*)

7.750%

San Bernardino

Snelling

7.750%

Merced

Soda Springs

7.500%

Nevada

Solana Beach*

7.750%

San Diego

Soledad*

9.250%

Monterey

City

Rate

County

Solemint

9.500%

Los Angeles

Solvang*

7.750%

Santa Barbara

Somerset

7.250%

El Dorado

Somes Bar

7.250%

Siskiyou

Somis

7.250%

Ventura

Sonoma*

9.000%

Sonoma

Sonora*

7.750%

Tuolumne

Soquel

9.000%

Santa Cruz

Soulsbyville

7.250%

Tuolumne

South Dos Palos

7.750%

Merced

South El Monte*

10.250%

Los Angeles

South Fork

7.750%

Humboldt

South Gate*

10.250%

Los Angeles

South Laguna (Laguna

Beach*)

7.750%

Orange

South Lake Tahoe*

8.750%

El Dorado

South Pasadena*

10.250%

Los Angeles

South San Francisco*

9.875%

San Mateo

South Shore (Alameda*)

10.750%

Alameda

South Whittier

9.500%

Los Angeles

Spanish Flat

7.750%

Napa

Spreckels

7.750%

Monterey

Spring Garden

7.250%

Plumas

Spring Valley

7.750%

San Diego

Springville

7.750%

Tulare

Spyrock

7.875%

Mendocino

Squaw Valley

7.975%

Fresno

St. Helena*

8.250%

Napa

Standard

7.250%

Tuolumne

Standish

7.250%

Lassen

Stanford

9.125%

Santa Clara

Stanislaus

7.250%

Tuolumne

Stanton*

8.750%

Orange

Steele Park

7.750%

Napa

Stevenson Ranch

9.500%

Los Angeles