Florida Housing Finance Corporation

Credit Underwriting Report

Heritage Park at Crane Creek

State Apartment Incentive Loan Program (“SAIL”), Extremely Low Income

Loan (“ELI”) and Competitive 9% Housing Credits (“HC”)

RFA 2018-103 (2018-344CS)

Housing Credit and SAIL Financing for Homeless Housing Developments

Located in Medium and Large Counties

Section A: Report Summary

Section B: SAIL and ELI Loan Special and General Conditions and

HC Allocation Recommendation and Contingencies

Section C: Supporting Information and Schedules

Prepared by

First Housing Development Corporation of Florida

FINAL REPORT

October 17, 2019

Exhibit G

Page 1 of 48

FHDC

October 17, 2019

Heritage Park at Crane Creek

TABLE OF CONTENTS

Page

Section A

Report Summary

Recommendation A1-A11

Overview A12-A16

Use of Funds A17-A21

Operating Pro Forma A22-A24

Section B

SAIL and ELI Loan Special and General Conditions B1-B9

HC Allocation Recommendation and Contingencies B10

Section C

Supporting Information and Schedules

Additional Development & Third Party Information C1-C8

Applicant Information C9-C11

Guarantor Information C12

General Contractor Information C13-C14

Syndicator Information C15

Property Management Information C16-C17

Exhibits

15 Year Pro Forma 1.

Housing Credit Allocation 2. 1-2

Description of Features and Amenities 3. 1-5

Completion and Issues Checklist 4. 1-2

Exhibit G

Page 2 of 48

SAIL, ELI & HC CREDIT UNDERWRITING REPORT FHDC

October 17, 2019

Section A

Report Summary

Exhibit G

Page 3 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-1

October 17, 2019

Recommendation

First Housing Development Corporation of Florida (“First Housing”, “FHDC”, or “Servicer”)

recommends a SAIL Loan in the amount of $4,228,900, an ELI Loan in the amount of $240,600,

and an annual HC Allocation of $1,510,000 to finance the construction and permanent financing

of Heritage Park at Crane Creek (“Development”).

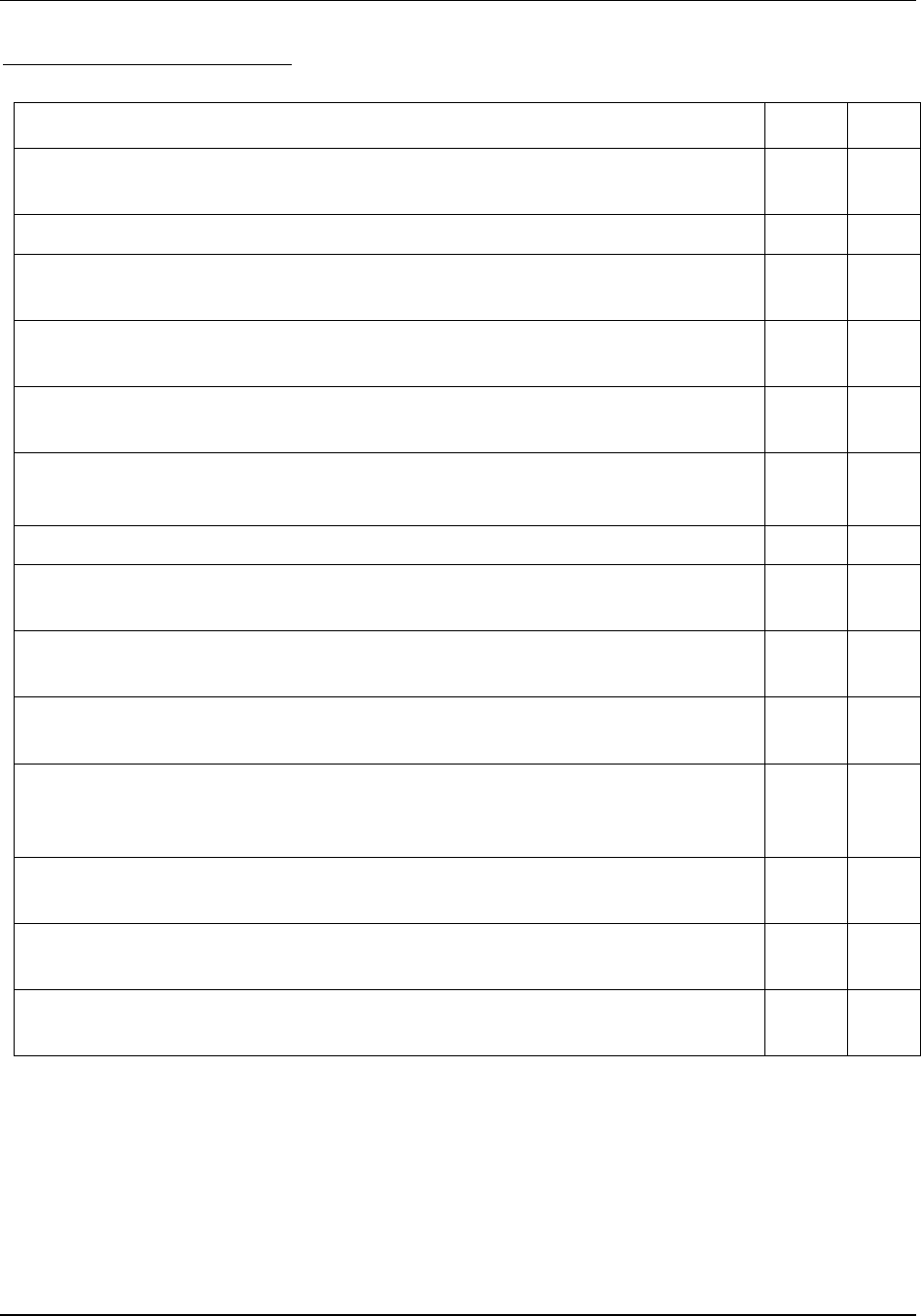

Development Name:

RFA/Program Numbers: /

Address:

City: Zip Code: County: County Size:

Development Category: Development Type:

Construction Type:

Demographic Commitment:

Primary: of the Units

Unit Composition:

# of ELI Units: ELI Units Are Restricted to AMI, or less. Total # of units with PBRA?

# of Link Units: Are the Link Units Demographically Restricted? # of NHTF Units:

Heritage Park at Crane Creek

DEVELOPMENT & SET-ASIDES

2018-344CS

New Construction

Mid-Rise (4 Stories)

Wood Framed

RFA 2018-103

Medium

Brevard

32901

Melbourne

2550 Grant Street

for

51.85%

0

0

Homeless

17

0

35%

Palm Bay-Melbourne-Titusville MSA, Brevard County, FL

657$

800$

406$

406$

787$

422$

787$

787$

Net

Restricted

Rents

353$

657$

657$

60%

60%

800$

406$

406$

787$

Annual Rental

Income

31,968$

$89

78,840$

86,599108

60%

1,0792.0 2

2 2.0

2 2.0

2

3 2.0

Market3

3 2.0

3 2.0

Market

1,079

2.0

1

3

2

60%1,079

1,079

$876

$876

897$ $1,011

Bed

Rooms

1.0

2.0

Bath

Rooms

1.0

PBRA

Contr

Rents

1

1

1

1

1.0

1.0

10

13

2 8

114$

114$

18

$589

$1,011

$729

12

13

114$

1,100$

897$

471$

471$

475$

897$

618

935

935

935

935

$89

AMI%

35%

35%

Utility

Allow.

$72

Gross HC

Rent

$425

$729

618

618

Applicant

Rents

333$

333$

$72

$7218

$89

Units

Low

HOME

Rents

60%

60%

8

High

HOME

Rents

Square

Feet

Market

35% $511

618

950$

787$

406$

406$

71,928$

Appraiser

Rents

333$

333$

657$

800$

38,976$

87,696$

113,328$

148,200$

124,800$

950$

CU Rents

333$

333$

657$

5,652$

16,956$

950$

21,528$

26,400$

766,272$

471$

471$

897$

1,100$ 1,100$

471$

471$

897$

Exhibit G

Page 4 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-2

October 17, 2019

The Applicant has selected the Homeless demographic where at least 70%, but less than 80%, of

the units must be set-aside for Homeless individuals and families and at least 20% of the units for

Persons with Special Needs (which may be the same units set aside for Homeless individuals and

families). Since the Application, the Applicant submitted a petition for variance from provisions

of Request for Applications 2018-103 (“RFA”), which was approved at the March 22, 2019 Board

Meeting. The Applicant requested to increase the number of units from 80 to 108, and to set aside

51.85% of the total units (56 units) for Homeless individuals and families, rather than the 70% set-

aside requirement of the RFA. Additionally, the Applicant requested a waiver to set aside 14.81%

of the total units (16 units) for Persons with Special Needs, rather than the 20% set-aside

requirement of the RFA. Please refer to Waiver Requests/Special Conditions for additional

information regarding the petition.

The Applicant has selected to serve the following:

· Persons receiving benefits under the Social Security Disability Insurance (“SSDI”)

program or the Supplemental Security Income (“SSI”) program or from veterans’ disability

benefits.

· Adult persons requiring independent living services in order to maintain housing or

develop independent living skills and who have a Disabling Condition that neither

currently impairs nor is likely to impair their physical mobility, such as persons with a

mental illness.

The Applicant must irrevocably commit to the Homeless demographic commitment selected for a

minimum of 50 years. The Persons with Special Needs commitment is required for a minimum of

12 years. After the initial 12 years, the Applicant may submit a request to FHFC that allows the

Applicant to commit to a different population(s) demographic commitment provided 2.b. of

Exhibit A if the appropriate Level 1 or Level 2 Accessibility Requirements are met at the

Development for the population(s).

Based on the RFA, the Applicant must commit to set aside 15% of the total units (17 units) in the

Development to serve ELI Households. The Applicant is eligible for ELI Loan Funding. The

required ELI Set-Aside units cannot exceed 5 percent of the total units for ELI Loan Funding (in

this case the Applicant has selected 4 units, based on the original number of units).

ELI Loan Amount per Bedroom Count: Brevard County

Two (2) One-Bedroom units at $55,300 = $110,600

Two (2) Two-Bedroom unit at $65,000 = $130,000

Total = $240,600

Exhibit G

Page 5 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-3

October 17, 2019

The ELI Set-Aside Units are required for a minimum of 50 years. However, after 15 years, all of

the ELI Set-Aside Units associated with the ELI Loan Funding (4 units) may convert to serve

residents at or below 60% of Average Median Income (“AMI”). However, the ELI Set-Aside Units

that were not associated with the ELI Funding will remain ELI Set Aside Units for the entire

Compliance Period of 50 Years.

Since 51.85% of the units (56 units) are to be set aside for individuals and/or families that meet

the definition of Homeless and 14.81% of the total units (16 units) are to be set aside for Persons

with Special Needs. The Persons with Special Needs set aside units may be the same units set aside

for Homeless individuals and families.

All Applicants must meet the following requirements specific to its commitment, pursuant to the

RFA, to serve Homeless households:

1. Have an executed agreement to participate in the Continuum of Care’s Homeless

Management Information System (HMIS); and will contribute data on the Development’s

tenants to the Continuum of Care’s HMIS data system or, if serving Survivors of Domestic

Violence, is providing aggregate data reports to the Continuum of Care. The executed

agreement shall be required at least 6 months prior to the expected placed in service date.

2. Commit to be a housing provider in the Continuum of Care’s Homeless Coordinated Entry

system as required by the U.S. Department of Housing and Urban Development.

Buildings: Residential - Non-Residential -

Parking: Parking Spaces - Accessible Spaces -

Set Asides:

Absorption Rate:

units per month for

months.

Occupancy Rate at Stabilization: Physical Occupancy Economic Occupancy

Occupancy Comments

DDA: QCT: Multi-Phase Boost: QAP Boost:

Site Acreage: Density: Flood Zone Designation:

Zoning: Flood Insurance Required?:

Program

1

93.00%

N/A

5.0

No

Yes

X

17

35%

R-2

Term (Years)

% AMI

N/A - New Construction

15.08

7.16

No

No

50

SAIL/ELI/HC

15.7%

60%

207 30

58.4%

# of Units

% of Units

50

94.00%

25

0

SAIL/HC

63

Exhibit G

Page 6 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-4

October 17, 2019

Applicant/Borrower:

% Owners hip

99.9900%Enterprise Housing Credit Investments and/or its assignees ("Enterprise")

General Partner

Rosemary Village Apartments, LLLP

0.0100%

DEVELOPMENT TEAM

C4 Rosemary, LLC

C4 Rosemary, LLC

Developer:

CC Guarantor 2:

OD Guarantor 3:

Rosemary Village Apartments, LLLP

C4 Rosemary, LLC

OD Guarantor 1:

Construction Completion

Guarantor(s):

Limited Partner

CC Guarantor 3:

Rosemary Village Apartments, LLLP

Carrfour

Carrfour

Operating Deficit

Guarantor(s):

Syndicator:

CC Guarantor 1:

Meridian Appraisal Group, Inc. ("Meridian")

Royal American Construction Company, Inc. ("Royal American")

Carrfour Supportive Housing, Inc. ("Carrfour")

Behar Font & Partners, PA

Market Study Provider:

Enterprise

OD Guarantor 2:

Crossroads Management, LLC ("Crossroads")

Integra Realty Recources - Tampa Bay ("Integra")

General Contractor 1:

Appraiser:

Management Company:

Architect:

Exhibit G

Page 7 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-5

October 17, 2019

Steadytown,

Steadytown

Lender

0.00%

$0

FHFC - SAIL

FHFC - ELI

$4,228,900 $240,600 $3,000,000

$ -

2nd Source

1st Source

N/A

17.9

19% N/A

Loan to Cost - SAIL

Only

Operating Deficit &

Debt Service Reserves

Debt Service

Coverage

Restricted Market

Financing LTV

# of Months covered

by the Reserves

N/AN/A

4.13 1.07

55% 55%

30 -

-

0.00%0.00% 0.00%

15

-

15

0.00%

Second

Other5th Source4th Source3rd Source

0.48% 0.00% 0.00% 0.00%

-

- - 30

34%

First

34% 34%

33% 55%

19% 20%

Third Fourth Fifth

4.60 1.07

1.07

$865,529

159% 168%

31%

Lender/Grantor

Amount

Underwritten Interest

Rate

All In Interest Rate

Loan Term

281%

0.48%

PERMANENT FINANCING INFORMATION

Lien Position

Market Rate/Market

Financing LTV

Amortizati on

Loan to Cost -

Cumulative

281% 281%

Per Rule Chapter 67-48.0072(11), the maximum debt service coverage (“DSC”) shall be 1.50 to

1.00 for the SAIL Loan, including all superior mortgages. The DSC is 4.60 to 1.00, which exceeds

the maximum threshold. In extenuating circumstances, such as when the Development has deep

or short-term subsidy, the DSC may exceed 1.50x, if the Credit Underwriter’s favorable

recommendation is supported by the projected cash flow analysis as illustrated in Exhibit 1. In this

instance, the above extenuating circumstances apply, based on the deep subsidy of 17 units at or

below 35% of the AMI, exceeding the maximum threshold is permitted.

Exhibit G

Page 8 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-6

October 17, 2019

$0.9375

Housing Credit (HC) Syndication Price

Year 15 Pro Forma Income Escalation Rate

Deferred Developer Fee

Market Rent/Market Financing Stabili zed Value

HC Annual Allocation - Initial Award

$1,510,000

Rent Restri cted Market Financing Stabilized Value

HC Annual Allocation - Qualified in CUR

Projected Net Operating Income (NOI) - 15 Year

3.00%

Projected Net Operating Income (NOI) - Year 1

$145,027

$1,130,000

$1,510,000

$2,660,000

$420,054

$13,570,000

Year 15 Pro Forma Expense Escalation Rate

2.00%

$99,258

$1,510,000

As-Is Land Value

HC Annual Allocation - Equity Letter of Interest

Third Mortgage

Fourth Mortgage

$204,128

Perm Loan/Unit

Permanent

Construction

Lender

Source

BOA

FHFC - SAIL

FHFC - ELI

Steadytown

Housing Credit Equity Enterprise

$240,600

$3,000,000

$131,076

Deferred Developer Fee $3,889Carrfour

$39,156

$0

$14,156,250

$240,600

$3,000,000

$4,228,900

First Mortgage

Second Mortgage

CONSTRUCTION/PERMANENT SOURCES:

$427,464 $420,054

$2,228

$27,778

$10,350,000

$4,228,900

$3,798,840

$22,045,804TOTAL $22,045,804

$0

The SAIL Loan will take first lien position upon conversion to permanent financing, when the

Bank of America, N.A. (“BOA”) construction loan will be paid in full.

Credit Underwriter:

Date of Final CUR:

TDC PU Limitation at Application:

TDC PU Limitation at Credit Underwriting:

Minimum 1st Mortgage per Rule: Amount Dev. Fee Reduced for TDC Limit:

$209,777

$261,812

N/A $0

First Housing

TBD

Based on Rule Chapter 67-48, the minimum qualified first mortgage determination does not apply

to any Development that qualifies as a Homeless or Persons with Special Needs. The permanent

first mortgage will be the SAIL Loan.

Exhibit G

Page 9 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-7

October 17, 2019

Changes from the Application:

COMPARISON CRITERIA YES NO

Does the level of experience of the current team equal or exceed that of the

team described in the Application?

X

Are all funding sources the same as shown in the Application? 1.

Are all local government recommendations/contributions still in place at the

level described in the Application?

N/A

Is the Development feasible with all amenities/features listed in the

Application?

X

Do the site plans/architectural drawings account for all amenities/features

listed in the Application?

X

Does the applicant have site control at or above the level indicated in the

Application?

X

Does the applicant have adequate zoning as indicated in the Application? X

Has the Development been evaluated for feasibility using the total length of

set-aside committed to in the Application?

X

Have the Development costs remained equal to or less than those listed in the

Application?

2.

Is the Development feasible using the set-asides committed to in the

Application?

X

If the Development has committed to serve a special target group (e.g. elderly,

large family, etc.), do the development and operating plans contain specific

provisions for implementation?

X

SAIL ONLY: If points were given for match funds, is the match percentage the

same as or greater than that indicated in the Application?

N/A

HC ONLY: Is the rate of syndication the same as or greater than that shown in

the Application?

X

Is the Development in all other material respects the same as presented in the

Application?

3-6

The following are explanations of each item checked "No" in the table above:

1. The Construction First Mortgage changed since the Application from JP Morgan Chase

Bank, N.A. to BOA. Additionally, the Syndicator changed from National Equity Fund, Inc.

to Enterprise.

Exhibit G

Page 10 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-8

October 17, 2019

2. The Total Development Cost (“TDC”) has increased a total of $4,166,184 from

$17,879,620 to $22,045,804 or 23.3% since the Application. The increase is mainly due

to an increase in construction costs and Developer Fee, which is explained by an increase

in total number of units by 28 units. Furthermore, the per unit cost went down 8.7%, from

$223,495 to $204,128.

3. The Application indicated a total set-aside percentage of 100%. The total set-aside

percentage is now 74.1% and was approved at the March 22,

2019 Board meeting. Please

see Waiver Requests/Special Conditions for further information.

4. Since the Application, the number of units has increased from 80 to 108 and was approved

at the March 22, 2019 Board Meeting.

5. The increase in number of units resulted on the following change in unit mix:

Unit Mix (from) Unit Mix (to)

40 one bedroom/one bath

34 two bedroom/two bath

6 three bedroom/two bath

Total 80 units

12 ELI Set Aside Units

49 one bedroom/one bath

51 two bedroom/two bath

8 three bedroom/two bath

Total 108 units

17 ELI Set Aside Units

The Applicant must submit a unit mix change request to FHFC Staff. Approval of this

request is a condition to close.

6. The Application indicated the Development category was Garden Apartments; however,

the Development category is now Mid-Rise, containing four stories. Rule Chapter 67-48

states the Development type selected at Application must be maintained and cannot be

changed. The Applicant has requested a rule waiver, which will be presented at the October

FHFC Board meeting; Closing is conditioned upon a Board approval of the Development

category change rule waiver.

7. FHFC Staff approved the Applicant’s request to decrease the number of residential

buildings from 2 to 1 on November 9, 2018.

The above changes have no substantial material impact to the SAIL Loan, ELI Loan, or HC

recommendation for this Development.

Does the Development Team have any FHFC Financed Developments on the Past

Due/Noncompliance Report?

Exhibit G

Page 11 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-9

October 17, 2019

According to the FHFC Asset Management Noncompliance Report, dated May 13, 2019, the

Development has the following noncompliance item(s) not in the correction period:

Ø None

According to the FHFC Past Due report, dated August 12, 2019, the Development Team has the

following past due item(s):

Ø None

Closing of the loan is conditioned upon verification that any outstanding past due, and/or

noncompliance items noted at the time closing and the issuance of the annual HC allocation

recommended herein, have been satisfied.

Strengths:

1. The Principals, Developer, and Management Company are experienced in affordable

multifamily housing.

2. The Principals have sufficient experience and substantial financial resources to develop

and operate the proposed Development.

3. Meridian prepared a Market Study for the Development, dated August 6, 2019 (Report

Date). The weighted average occupancy rate for existing properties in the Competitive

Market Area (“CMA”) is 98.7%. Meridian projects an average absorption rate of 25 units

per month based on the market rate and affordable absorption comparables.

Other Considerations:

None

Mitigating Factors:

None

Waiver Requests/Special Conditions:

Ø The Applicant submitted a Petition for Waiver of Rule 67-48.004(3)(j) for a Change in

Total Set-Aside Percentage and Variance from Provisions of RFA 2018-103, dated March

Exhibit G

Page 12 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-10

October 17, 2019

4, 2019, which requested the following and was approved at the March 22, 2019 Board

meeting:

· Increase the number of units in the Development from 80 to 108, the additional 28

units to be available at market rate.

· Decrease the Total Set-Aside Percentage from 100% to 74.1%.

· Waive Section Four A.2.a.(1) of the RFA and decrease the percentage of units set

aside for Homeless persons from 70% to approximately 51.85% and decrease the

percentage of unit set aside for Persons with Special Needs from 20% to

approximately 14.81%.

· Waive Section Four A.6.d.(2)(a) of the RFA, which requires the Applicant to set

aside a total of at least 80% of the Development’s total units at 60% AMI or less.

· This waiver will not decrease the total number of units set aside for low-income

tenants, for Homeless individuals or families, or for Persons with Special Needs

from the Applicant’s original commitment in the RFA.

Ø The Application indicated the Development category was Garden Apartments; however,

the Development category is now Mid-Rise, containing four stories. Rule Chapter 67-48

states the Development type selected at Application must be maintained and cannot be

changed. The Applicant has requested a rule waiver, which will be presented at the October

FHFC Board meeting; Closing is conditioned upon Board approval of this rule waiver.

Additional Information:

1. First Housing reviewed the requirements in RFA 2018-103 regarding TDC limitation per

unit. First Housing used a hybrid TDC limitation calculation, as provided by FHFC staff,

based on an email dated September 18, 2019, which allows the Developer to increase the

TDC limitation for the new Development type of mid-rise wood. However, the hybrid TDC

limits the Developer Fee at the maximum TDC limitation for the original Development

type indicated in the Application. The hybrid TDC limitation for the Development is

$261,812 per unit, after the multiplier and upward adjuster, which includes a 16%

Developer fee capped at $29,443 for garden wood developments. The Development TDC

excluding land costs and lender reserves is $193,943 per unit, which includes Developer

Fee of $25,645 per unit. The Development TDC meets the TDC limitation requirement

established by FHFC staff.

2. Per the RFA, a Resident Community-Based Service Coordination Plan is required to be

submitted and reviewed prior to the final credit underwriting report. The plan has been

submitted to Florida Housing and approved on September 11, 2019.

Exhibit G

Page 13 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-11

October 17, 2019

3. Per the RFA, a Tenant Selection Plan is required to be submitted and reviewed prior to the

final credit underwriting report. The plan has been submitted and approved by Florida

Housing.

Issues and Concerns:

None

Recommendation:

First Housing recommends a SAIL Loan in the amount of $4,228,900, an ELI Loan in the amount

of $240,600 and an annual HC Allocation of $1,510,000 to finance the construction and permanent

financing of the Development.

These recommendations are based upon the assumptions detailed in the Report Summary (Section

A) and Supporting Information and Schedules (Section C). In addition, these recommendations

are subject to the SAIL and ELI Loan Special and General Conditions and the HC Allocation

Recommendation and Contingencies (Section B). This recommendation is only valid for six

months from the date of the report.

The reader is cautioned to refer to these sections for complete information.

Prepared by: Reviewed by:

Thais Pepe Ed Busansky

Senior Credit Underwriter Senior Vice President

Exhibit G

Page 14 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-12

October 17, 2019

Overview

Construction Financing Sources:

Construction Sources Lender Application Revised Applicant Underwriter

Construction

Interest Rate

Annual

Construction Debt

Service

First Mortgage BOA $9,500,000 $10,500,000 $10,350,000 4.29% $444,015

Second Mortgage FHFC - SAIL $4,228,900 $4,228,900 $4,228,900 0.48% $20,299

Third Mortgage FHFC - ELI $240,600 $240,600 $240,600 0.00% $0

Fourth Mortgage Steadytown $0 $3,000,000 $3,000,000 0.00% $0

Housing Credit Equity Enterprise $2,657,334 $3,807,870 $3,798,840 N/A N/A

Deferred Developer Fee Carrfour $2,218,000 $3,586,983 $427,464 N/A N/A

Total $18,844,834 $25,364,353 $22,045,804 $464,314

First Mortgage:

First Housing reviewed an executed Term Sheet, dated August 13, 2019, provided by BOA. The

Term Sheet indicates BOA will provide a construction loan in the amount not to exceed

$10,500,000, 80% loan to cost, or 80% loan to value, subject to BOA underwriting. The term of

the loan will be twenty-four (24) months, plus one 6-month extension option. Payments of interest

only will be required until maturity. The loan will bear interest at a rate of one Month London

Interbank Offered Rate (“LIBOR”) plus 210 basis points (“bps”). The construction interest is

calculated based upon the current 1 Month LIBOR rate of 1.94% (as of September 9, 2019), plus

a 2.10% spread, and a 0.25% underwriting cushion, for an “all-in” interest rate of 4.29%. First

Housing estimated the construction loan in the amount of $10,350,000, based on the Deferred

Developer Fee estimated during the permanent financing phase.

FHFC SAIL Loan:

First Housing reviewed an invitation to enter credit underwriting, dated June 27, 2018, from FHFC

with a preliminary SAIL Loan in the amount of $4,228,900. According to the RFA, the SAIL Loan

shall be non-amortizing and will bear a blended overall simple interest rate of 0.48% determined

by the weighted average of 52% of the Homeless Households at 0% interest and the remaining

48% of the units at 1.00% simple interest per annum. The SAIL Loan term is 15 years, of which 2

years is for the construction/stabilization period. Annual payments of all applicable fees will be

required. To the extent that development cash flow is available, annual interest payments at the

0.48% rate will be required; any unpaid interest will be deferred until cash flow is available.

However, at the maturity of the SAIL Loan, all principal and unpaid interest will be due.

Exhibit G

Page 15 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-13

October 17, 2019

FHFC ELI Loan:

First Housing reviewed an invitation to enter credit underwriting, dated June 27, 2018, from FHFC

with a preliminary ELI Loan in the amount of $240,600. According to the RFA, the ELI Loan shall

be non-amortizing and shall have an interest rate of zero percent (0%), with principal forgivable

at maturity provided the units for which the ELI Loan amount is awarded are targeted to ELI

Households for the first 15 years of the 50-year Compliance Period. The ELI Loan term is 15 years,

of which 2 years is for the construction/stabilization period. However, after 15 years, all of the ELI

Set-Aside units associated with the ELI Loan Funding (4 units) may convert to serve residents at

or below 60% of AMI. The ELI set-aside units that were not associated with the ELI Loan Funding

will remain ELI set-aside units for the entire Compliance Period. Annual payments of all

applicable fees will be required.

Steadytown Loan:

First Housing reviewed a Loan Commitment from Steadytown, Inc. and/or its affiliates

(“Steadytown”), dated February 8, 2019, for a loan in the amount of $3,000,000. The loan will be

non-interest bearing, and will amortize based on 80% of available cash flow, after payment of all

senior loans. The loan is non-recourse and non-amortizing with a 30-year term, including 2 years

for construction. Should the loan not be paid off at maturity, the term of the loan could be extended

an additional 20 year to be coterminous with the 50 year affordability period, at which time

repayment of any outstanding balance will be due.

Housing Credit Equity:

First Housing has reviewed an executed Letter of Interest (“LOI”), dated August 12, 2019,

indicating Enterprise, or its assignee, will acquire 99.99% ownership interest in the Partnership.

Based on the LOI, the annual HC allocation is estimated to be in the amount of $1,510,000 and a

syndication rate of $0.9375 per dollar. Enterprise anticipates a net capital contribution of

$14,156,250 paid in six installments, and has committed to make available 25.0% or $3,539,060

of the total net equity at closing. An additional $259,780 or 1.8% will be available during

construction, for a total of $3,798,840 available

during construction. The first installment meets

the FHFC requirement that 15% of the total equity must be contributed at or prior to the closing.

Deferred Developer Fee:

To balance the sources and uses of funds during construction, the Developer is required to defer

$427,464 or approximately 15.4% of the Developer Fee of $2,769,693, which excludes the portion

being used to fund the Operating Deficit Reserve (“ODR”).

Exhibit G

Page 16 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-14

October 17, 2019

Permanent Financing Sources:

Permanent Sources Lender Application Revised Applicant Underwriter Term Yrs. Amort. Yrs.

Interest

Rate

Annual Debt

Service

First Mortgage FHFC - SAIL $4,228,900 $4,228,900 $4,228,900 15 0 0.48% $20,299

Second Mortgage FHFC - ELI $240,600 $240,600 $240,600 15 0 0.00% $0

Third Mortgage Steadytown, Inc. $0 $3,000,000 $3,000,000 30 30 0.00% $100,000

Housing Credit Equity Enterprise $13,286,671 $14,156,250 $14,156,250 N/A N/A N/A N/A

Deferred Developer Fee Carrfour $2,218,000 $3,586,983 $420,054 N/A N/A N/A N/A

Total $19,974,171 $25,212,733 $22,045,804 $120,299

FHFC SAIL Loan:

First Housing reviewed an invitation to enter credit underwriting, dated June 27, 2018, from FHFC

with a preliminary SAIL Loan in the amount of $4,228,900. According to the RFA, the SAIL Loan

shall be non-amortizing and will bear a blended overall simple interest rate of 0.48% determined

by the weighted average of 52% of the Homeless Households at 0% interest and the remaining

48% of the units at 1.00% simple interest per annum. The SAIL Loan term is 15 years, of which 2

years is for the construction/stabilization period. Annual payments of all applicable fees will be

required. To the extent that development cash flow is available, annual interest payments at the

0.48% rate will be required; any unpaid interest will be deferred until cash flow is available.

However, at the maturity of the SAIL Loan, all principal and unpaid interest will be due.

The annual multiple program Compliance Monitoring Fee for the SAIL Loan is $938. The annual

Permanent Loan Servicing Fee is based on 25 bps of the outstanding loan amount, with a minimum

monthly fee of $216, and a maximum monthly fee of $859.

FHFC ELI Loan:

First Housing reviewed an invitation to enter credit underwriting, dated June 27, 2018, from FHFC

with a preliminary ELI Loan in the amount of $240,600. According to the RFA, the ELI Loan shall

be non-amortizing and shall have an interest rate of zero percent (0%), with principal forgivable

at maturity provided the units for which the ELI Loan amount is awarded are targeted to ELI

Households for the first 15 years of the 50-year Compliance Period. The ELI Loan term is 15 years,

of which 2 years is for the construction/stabilization period. However, after 15 years, all of the ELI

Set-Aside units associated with the ELI Loan Funding (4 units) may convert to serve residents at

or below 60% of AMI. The ELI set-aside units that were not associated with the ELI Loan Funding

will remain ELI set-aside units for the entire Compliance Period. Annual payments of all

applicable fees will be required.

Exhibit G

Page 17 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-15

October 17, 2019

The annual multiple program Compliance Monitoring Fee for the ELI Loan is $938. The annual

Permanent Loan Servicing Fee is based on 25 bps of the outstanding loan amount, with a minimum

monthly fee of $216, and a maximum monthly fee of $859.

Steadytown Loan:

First Housing reviewed a Loan Commitment from Steadytown, dated February 8, 2019, for a loan

in the amount of $3,000,000. The loan will be non-interest bearing, and will amortize based on

80% of available cash flow, after payment of all senior loans. The loan is non-recourse and non-

amortizing with a 30-year term, including 2 years for construction. Should the loan not be paid off

at maturity, the term of the loan could be extended an additional 20 year to be coterminous with

the 50 year affordability period, at which time repayment of any outstanding balance will be due.

For presentation purposes, First Housing used a 30-year amortization schedule.

Housing Credit Equity:

Based on an executed LOI, dated August 12, 2019, Enterprise, or its assignee, will acquire 99.99%

ownership interest in the Partnership. Based on the LOI, the annual HC allocation is estimated to

be in the amount of $1,510,000 and a syndication rate of $0.9375 per dollar. Enterprise anticipates

a net capital contribution of $14,156,250 paid in six installments as follows:

Capital Contributions Amount Percentage of Total When Due

1st Installment $3,539,060 25.00%

Financial Closing

2nd Installment $259,780 1.84%

During Construction

3rd Installment $5,662,500 40.00%

Construction Completion

4th Installment $849,000 6.00%

FHFC Reserve Funding

5th Installment $3,586,130 25.33%

Stabilization/Conversion

6th Installment $259,780 1.84%

Receipt of Form(s) 8609

Total $14,156,250 100.00%

Annual Credit Per Syndication Agreement

$1,510,000

Calculated HC Exchange Rate

$0.9375

Limited Partner Ownership Percentage

99.99%

Proceeds Available During Construction

$3,798,840

Exhibit G

Page 18 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-16

October 17, 2019

Deferred Developer Fee:

To balance the sources and uses of funds during the permanent funding period, the Developer is

required to defer $420,054 or approximately 15.2% of the Developer Fee of $2,769,693(which

excludes the portion being used to fund the ODR).

Exhibit G

Page 19 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-17

October 17, 2019

Uses of Funds

CONSTRUCTION COSTS:

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Accessory Buildings

$200,000 $0 $0 $0 $0

New Rental Units

$7,970,000 $9,548,396 $10,773,850 $99,758 $750,000

Off-Site Work

$0 $750,000 $0 $0 $0

Recreational Amenities

$364,000 $0 $0 $0 $0

Site Work

$250,000 $843,265 $0 $0 $0

Constr. Contr. Costs subject to GC Fee

$8,784,000 $11,141,661 $10,773,850 $99,758 $750,000

General Conditions

$0 $0 $646,431 $5,985 $0

Overhead

$0 $0 $215,477 $1,995 $0

Profit

$1,200,000 $1,508,339 $646,431 $5,985 $0

General Liability Insurance

$0 $0 $39,082 $362 $0

Payment and Performance Bonds

$0 $0 $101,438 $939 $0

Contract Costs not subject to GC Fee

$0 $0 $227,292 $2,105 $0

Total Construction Contract/Costs

$9,984,000 $12,650,000 $12,650,000 $117,130 $750,000

Hard Cost Contingency

$485,000 $732,500 $625,474 $5,791 $0

Other: Recreational Amenities

$0 $453,400 $453,400 $4,198 $453,400

$10,469,000 $13,835,900 $13,728,874 $127,119 $1,203,400

Total Construction Costs:

Notes to the Total Construction Costs:

1. The Applicant has provided an executed construction contract, dated July 23, 2019, in the

amount of $12,650,000. This is a Standard Form of Agreement between Owner, Rosemary

Village Apartments, LLLP and General Contractor (“GC”), Royal American Construction

Company, Inc. where the basis of payment is the Cost of the Work Plus a Fee with a

Guaranteed Maximum Price (“GMP”). Per the contract, substantial completion is to be

achieved by no later than 365 days from the date of commencement. The construction

contract specifies a 10% retainage until 50% of construction completion, and no retainage

thereafter.

2. First Housing utilized the Schedule of Values to complete the construction costs.

3. The GC Contract includes $131,579 in allowance, of which $10,000 is for building sign,

$82,000 is for perimeter fencing, and $39,579 is for demucking. Allowances total

approximately 1% of the GMP.

4. The GC fee is within the maximum 14% of hard costs allowed by Rule Chapter 67-48,

excluding General Liability Insurance and Payment and Performance Bonds (“P&P

Exhibit G

Page 20 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-18

October 17, 2019

Bonds”). The GC fee stated herein is for credit underwriting purposes only, and the final

GC fee will be determined pursuant to the final cost certification process as per Rule

Chapter 67-48.

5. Contract Costs not subject to GC Fee include $183,000 for appliances, $39,292 for window

treatments, and $5,000 for building permits.

6. First Housing adjusted Hard Cost Contingency to 5% of the total construction contract

(excluding General Liability Insurance and P&P Bonds), which is within the allowable 5%

of total hard costs for new construction developments as required by Rule Chapter 67-48.

7. The General Contractor has budgeted for P&P Bonds to secure the construction contract.

GENERAL DEVELOPMENT COSTS:

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Accounting Fees

$50,000 $40,000 $40,000 $370 $20,000

Appraisal

$10,000 $10,000 $4,500 $42 $0

Architect's Fee - Site/Building Design

$322,000 $428,050 $428,050 $3,963 $0

Architect's Fee - Supervision

$30,000 $40,000 $40,000 $370 $0

Building Permits

$44,800 $60,480 $60,480 $560 $0

Builder's Risk Insurance

$60,000 $60,000 $60,000 $556 $0

Engineering Fees

$65,000 $65,000 $65,000 $602 $0

Environmental Report

$15,000 $95,000 $95,000 $880 $0

FHFC Administrative Fees

$83,050 $83,050 $83,050 $769 $83,050

FHFC Application Fee

$3,000 $3,000 $3,000 $28 $3,000

FHFC Credit Underwriting Fee

$21,659 $21,659 $20,031 $185 $20,031

FHFC Compliance Fee

$200,000 $200,000 $211,801 $1,961 $211,801

Impact Fee

$364,146 $491,598 $491,598 $4,552 $0

Lender Inspection Fees / Const Admin

$59,075 $59,075 $59,075 $547 $19,075

Green Building Cert. (LEED, FGBC, NAHB)

$60,000 $50,000 $50,000 $463 $0

Insurance

$75,000 $75,000 $75,000 $694 $0

Legal Fees - Organi zational Costs

$215,000 $225,000 $225,000 $2,083 $65,000

Market Study

$5,000 $5,000 $5,500 $51 $5,500

Marketing and Advertisi ng

$180,000 $180,000 $180,000 $1,667 $180,000

Plan and Cost

Review Analysis

$0 $0 $2,050 $19 $0

Property Taxes

$50,000 $50,000 $50,000 $463 $20,000

Soil Test

$15,000 $15,000 $15,000 $139 $0

Survey

$25,000 $25,000 $25,000 $231 $0

Title Insurance and Recording Fees

$150,080 $137,075 $137,075 $1,269 $137,075

Utility Connection Fees

$544,400 $308,377 $308,377 $2,855 $0

Soft Cost Contingency

$100,000 $0 $137,479 $1,273 $0

Other: Photos, Printing, Website

$25,000 $15,000 $15,000 $139 $5,000

$2,772,210 $2,742,364 $2,887,066 $26,732 $769,532

Total General Development Costs:

Exhibit G

Page 21 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-19

October 17, 2019

Notes to the General Development Costs:

1. General Development Costs are the Applicant's updated estimates, which appear

reasonable.

2. First Housing has utilized actual costs for: FHFC Credit Underwriting, Market Study,

Appraisal, and Plan and Cost Analysis (“PCA”).

3. Per the RFA, the FHFC Administrative Fee is based on 5.5% of the recommended annual

Housing Credit allocation.

4. FHFC Compliance Fee of $211,801 is based on the compliance fee calculator spreadsheet

provided by FHFC.

5. First Housing adjusted the Soft Cost Contingency to be 5% of the General Development

Costs less the soft cost contingency, as allowed by RFA 2018-103 and Rule Chapter 67-48

for new construction developments.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Construction Loan Commitment Fee

$140,000 $139,500 $93,150 $863

Construction Loan Closing Costs

$10,000 $10,000 $10,000 $93 $0

Construction Loan Interest

$457,000 $396,000 $497,297 $4,605 $115,000

Permanent Loan Closing Costs

$20,000 $20,000 $20,000 $185 $20,000

SAIL Commitment Fee

$0 $0 $42,289 $392 $0

SAIL Closing Costs

$0 $0 $12,750 $118 $0

SAIL-ELI Commitment Fee

$0 $0 $2,406 $22 $0

SAIL-ELI Closing Costs

$0 $0 $6,750 $63 $0

Other: Pre-Development Loan Interest

$0 $10,000 $10,000 $93 $0

$627,000 $575,500 $694,642 $6,432 $135,000

$13,868,210 $17,153,764 $17,310,582 $160,283 $2,107,932

Dev. Costs before Acq., Dev. Fee & Reserves

FINANCIAL COSTS:

Total Financial Costs:

Notes to the Financial Costs:

1. The Construction Loan Commitment Fee of $93,150 is based on a commitment fee of

0.90% on the construction loan amount of $10,350,000.

2. The Construction Loan Interest of $497,297 was estimated by First Housing based on an

estimated interest rate of 4.29% for a construction term of 24 months, and an average

outstanding balance of 56%.

Exhibit G

Page 22 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-20

October 17, 2019

3. SAIL Commitment Fee is based on 1% of the SAIL Loan.

4. First Housing has included $12,750 for SAIL and $6,750 for SAIL ELI Closing Costs.

5. SAIL ELI Commitment Fee is based on 1% of the ELI Loan.

6. Enterprise entered into a predevelopment Loan Agreement with the Applicant, on

September 5, 2019, for $1,000,000 to be used to fund the acquisition and predevelopment

costs. Interest shall accrue at a rate of 5% per annum, however no interest shall accrue for

the first six months following the date of this Agreement.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Building Acquisition Cost

$0 $0 $0 $0 $0

$0 $0 $0 $0 $0

NON-LAND ACQUISITION COSTS

Total Non-Land Acquisition Costs:

Notes to the Non-Land Acquisition Costs:

1. As this is new construction, there are no non-land acquisition costs.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR Cost Per Unit

HC Ineligible

Costs - CUR

Developer Fee - Unapportioned

$2,218,000 $3,597,273 $2,769,693 $25,645 $0

DF to fund Operating Debt Reserve

$693,410 $0 $865,529 $8,014 $0

$2,911,410 $3,597,273 $3,635,222 $33,659 $0

DEVELOPER FEE ON NON-ACQUISTION COSTS

Total Other Development Costs:

Notes to Developer Fee on Non-Acquisition Costs:

1. The recommended Developer Fee does not exceed 21% of TDC before Developer Fee,

ODR, land costs, and escrows as allowed by RFA 2018-103. A portion of the Developer

Fee (5% of development costs before Developer Fee and reserves and is estimated to be

$865,529 ) must be placed in an ODR account to be held by FHFC or its Servicer. Any

disbursements from said ODR account shall be reviewed and approved by FHFC or its

Servicer. At the end of the Compliance Period, any remaining balance of the ODR less

amounts that may be permitted to be drawn (which includes Deferred Developer Fee and

reimbursements for authorized member/partner and guarantor loan(s)), will be used to pay

FHFC loan debt; if there is no FHFC loan debt on the Development at the end of the

Compliance Period, any remaining balance shall be used to pay outstanding FHFC fees. If

any balance is remaining in the ODR after the payments above, the amount should be

placed in a Replacement Reserve account for the Development. In no event shall the

payments of amounts to the Applicant or the Developer from the ODR account cause the

Exhibit G

Page 23 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-21

October 17, 2019

Developer Fee or General Contractor Fee to exceed the applicable percentage limitations

provided for in Rule Chapter 67-48.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Land Acquisition Cost

$1,100,000 $1,100,000 $1,100,000 $10,185 $1,100,000

$1,100,000 $1,100,000 $1,100,000 $10,185 $1,100,000

LAND ACQUISITION COSTS

Total Acquisition Costs:

Notes to Acquisition Costs:

1. First Housing has reviewed a Vacant Land Contract, executed on April 18, 2018, between

Keith P. Donald (“Seller”) and Rosemary Village Apartments, LLLP (“Buyer”). First

Housing also reviewed an Addendum to the Vacant Land Contract, in which the purchase

price of the property is the lesser of $1,100,000 or the Appraised Property Value, but no

less than $600,000 (minimum purchase price). Based on this contract, the closing must

occur on or before September 30, 2019. Additionally, First Housing reviewed a

Amendment to Vacant Land Contract, dated September 30, 2019, between the Seller and

the Buyer, extending the closing date to November 30, 2019.

2. Based on the appraiser’s analysis, the land value is $1,130,000, which supports the

purchase price.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

Reserves - Start-Up/Lease-up Expenses

$0 $0 $0 $0 $0

$0 $0 $0 $0 $0

RESERVE ACCOUNTS

Total Reserve Accounts:

Notes to Reserve Accounts

1. No additional reserves are required for the Development.

Applicant Costs

Revised

Applicant Costs

Underwriters

Total Costs - CUR

Cost Per Unit

HC Ineligible

Costs - CUR

$17,879,620 $21,851,037 $22,045,804 $204,128 $3,207,932

TOTAL DEVELOPMENT COSTS:

TOTAL DEVELOPMENT COSTS

Notes to Total Development Costs:

1. The Total Development Costs have increased a total of $4,166,184 from $17,879,620 to

$22,045,804 or 23.3% since the Application. The increase is mainly due to an increase in

construction costs and Developer Fee, which is explained by an increase in total number

of units by 28 units. Furthermore, the per unit cost went down 8.7%, from $223,495 to

$204,128.

Exhibit G

Page 24 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-22

October 17, 2019

Operating Pro Forma – Heritage Park at Crane Creek

FINANCIAL COSTS: Year 1

Year 1

Per Unit

OPERATING PRO FORMA

Gross Potential Rental Income $766,272 $7,095

Other Income

Mi scell a neous $13,000 $120

Gross Potential Income $779,272 $7,215

Les s:

Physica l Va c. Loss Percenta ge: 6.00% $46,756 $433

Col lection Loss Percenta ge: 1.00% $7,793 $72

Total Effective Gross Income $724,723 $6,710

Fi xed:

Real Es tate Taxes $55,073 $510

Ins urance $54,000 $500

Va ria ble:

Mana gement Fee Percentage: 6.00% $43,483.38 $403

General and Adminis tra ti ve $48,600 $450

Payroll Expenses $156,600 $1,450

Uti li ti es $89,100 $825

Marketi ng and Advertising $3,240 $30

Maintenance and Repairs /Pes t Control $59,400 $550

Grounds Maintenance and La nds capi ng $10,800 $100

Security $27,000 $250

Res erve for Re place ments $32,400 $300

Total Expenses $579,696 $5,368

Net Operating Income $145,027 $1,343

Debt Service Payments

Fi rst Mortga ge - SAIL $20,299 $188

Second Mortga ge - ELI $0 $0

Third Mortga ge - Steadytown $100,000 $926

$11,246 $104

$3,530 $33

Tota l Debt Service Pa yments $135,075 $1,251

Cas h Fl ow after Debt Service $9,952 $92

FINANCIAL COSTS:

Annual

Per Unit

Debt Service Coverage Ratios

DSC - First Mortgage plus Fe es 4.60x

DSC - Second Mortga ge plus Fe es 4.13x

DSC - Third Mortgage plus Fees 1.07x

Financial Ratios

Operating Expens e Rati o 79.99%

Break-even Economi c Occupa ncy Rati o (all de bt) 92.14%

INCOME:

EXPENSES:

Fi rst Mortga ge Fees - SAIL

Second Mortga ge Fees - ELI

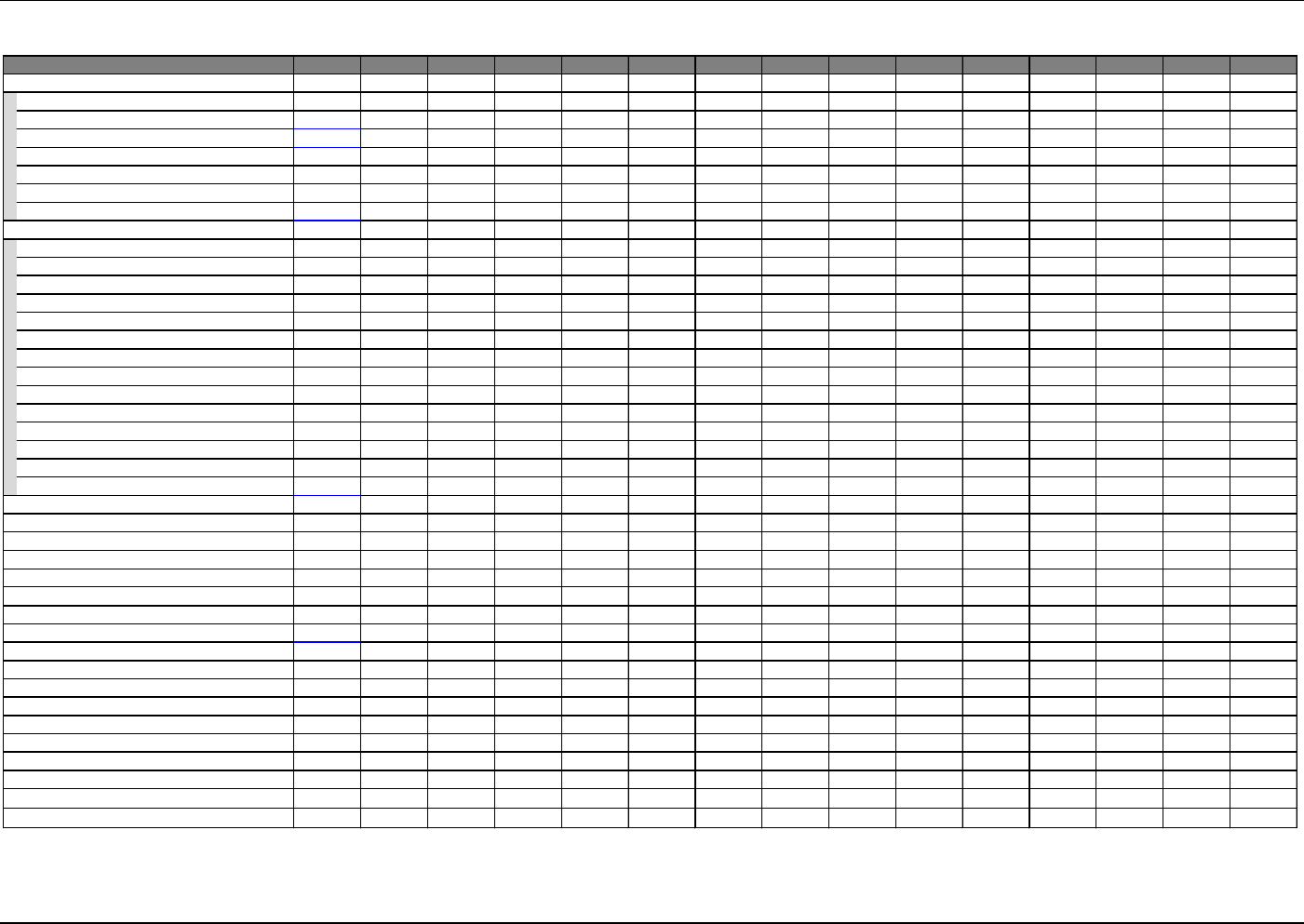

Notes to the Operating Pro Forma and Ratios:

1. The Development will be utilizing Housing Credits in conjunction with SAIL and ELI

financing, which will impose rent restrictions. The rent levels are based on the 2018

maximum low income housing tax credits (“LIHTC”) rents published on FHFC’s website

for Brevard County less the applicable utility allowance. Please note First Housing

Exhibit G

Page 25 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-23

October 17, 2019

utilized the appraiser’s estimated achievable rents. The homeless rents were based on

45% housing burden of the estimated average income, less utility allowance. Below is

the rent roll for the Development:

Palm Bay-Melbourne-Titusville MSA, Brevard County, FL

657$

800$

406$

406$

787$

422$

787$

787$

Net

Restricted

Rents

353$

657$

657$

60%

60%

800$

406$

406$

787$

Annual Rental

Income

31,968$

$89

78,840$

86,599108

60%

1,0792.0 2

2 2.0

2 2.0

2

3 2.0

Market3

3 2.0

3 2.0

Market

1,079

2.0

1

3

2

60%1,079

1,079

$876

$876

897$ $1,011

Bed

Rooms

1.0

2.0

Bath

Rooms

1.0

PBRA

Contr

Rents

1

1

1

1

1.0

1.0

10

13

2 8

114$

114$

18

$589

$1,011

$729

12

13

114$

1,100$

897$

471$

471$

475$

897$

618

935

935

935

935

$89

AMI%

35%

35%

Utility

Allow.

$72

Gross HC

Rent

$425

$729

618

618

Applicant

Rents

333$

333$

$72

$7218

$89

Units

Low

HOME

Rents

60%

60%

8

High

HOME

Rents

Square

Feet

Market

35% $511

618

950$

787$

406$

406$

71,928$

Appraiser

Rents

333$

333$

657$

800$

38,976$

87,696$

113,328$

148,200$

124,800$

950$

CU Rents

333$

333$

657$

5,652$

16,956$

950$

21,528$

26,400$

766,272$

471$

471$

897$

1,100$ 1,100$

471$

471$

897$

2. The Vacancy rate of 6% and Collection loss rate of 1% is based on appraisal’s estimate,

which considers the demographic commitment.

3. Miscellaneous Income is comprised of revenue from vending income, late charges, pet

deposits, forfeited security deposits and other miscellaneous sources. Total

Miscellaneous Income of approximately $120 per unit per year is supported by the

appraisal.

4. Based upon operating data from comparable properties, third-party reports (appraisal and

market study) and First Housing's independent due diligence, First Housing represents

that, in its professional opinion, estimates for Rental Income, Vacancy, Other Income,

and Operating Expenses fall within a band of reasonableness.

5. The Applicant has submitted a Management Agreement, dated August 28, 2019, which

reflects a management fee equal to 6% of the Effective Gross Potential Gross Revenue,

or $33.80 per unit per month, whichever is higher, which was supported by the appraisal.

6. The landlord is responsible for common area electric, water and sewer, trash collection

and cable for the clubhouse. Tenant will be responsible for electric, cable and internet.

Exhibit G

Page 26 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page A-24

October 17, 2019

7. Replacement Reserves of $300/unit/year are required per Rule Chapter 67-48.

8. Per Rule Chapter 67-48.0072(11), the maximum debt service coverage (“DSC”) shall be

1.50 to 1.00 for the SAIL Loan, including all superior mortgages. The DSC is 4.60 to

1.00, which exceeds the maximum threshold. In extenuating circumstances, such as when

the Development has deep or short-term subsidy, the DSC may exceed 1.50x, if the

Credit Underwriter’s favorable recommendation is supported by the projected cash flow

analysis as illustrated in Exhibit 1. In this instance, the above extenuating circumstances

apply, based on the deep subsidy of 17 units at or below 35% of the AMI, exceeding the

maximum threshold as permitted.

9. Refer to Exhibit I, Page 1 for a 15-Year Pro Forma, which reflects rental income

increasing at an annual rate of 2%, and expenses increasing at an annual rate of 3%.

Exhibit G

Page 27 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

October 17, 2019

Section B

SAIL and ELI Loan Special and General Conditions

HC Allocation Recommendation and Contingencies

Exhibit G

Page 28 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-1

October 17, 2019

Special Conditions

This recommendation is contingent upon the review and approval of the following items by Florida

Housing and First Housing at least two weeks prior to Loan Closing. Failure to submit and to

receive approval of these items within this time frame may result in postponement of the SAIL

and ELI Loan closing date.

1. Satisfactory receipt and review of updated financials for the Guarantors, dated within 90

days of closing or Audited Financial Statements within one year.

2. Receipt of firm commitments from BOA, Steadytown, and Enterprise are conditions to

close.

3. Confirmation that the $1,000,000 Predevelopment loan from Enterprise is paid off by

closing.

4. Receipt and satisfactory review of the Final signed, sealed “approved for construction”

plans and specifications by the Construction Consultant and the Servicer.

5. Approval by FHFC Board of the rule waiver to allow the Development category to change

from Garden Apartments to Mid-Rise with four stories.

6. The Applicant must submit a unit mix change request to FHFC Staff. Approval of this

request is a condition to close.

7. Any other reasonable requirements of the Servicer, Florida Housing, or its legal counsel.

Exhibit G

Page 29 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-2

October 17, 2019

General Conditions

This recommendation is contingent upon the review and approval of the following items by Florida

Housing and First Housing at least two weeks prior to Loan Closing. Failure to submit and to

receive approval of these items within this time frame may result in postponement of the SAIL

and ELI Loan closing date.

1. Payment of any outstanding arrearages to FHFC, its legal counsel, Servicer or any agent

or assignee of FHFC for past due issues applicable to the Development team (Applicant

or Developer or Principal, Affiliate or Financial Beneficiary, as described in 67-48.0075

(5) F.A.C. of an Applicant or a Developer).

2. GLE is to act as construction inspector during the construction phase.

3. At all times there will be undisbursed loan funds (collectively held by Florida Housing, the

first mortgage lender and any other source) sufficient to complete the Development. If at

any time there are not sufficient funds to complete the Development, the Applicant will be

required to expend additional equity on Development Costs or to deposit additional equity

with Florida Housing which is sufficient (in Florida Housing’s judgment) to complete the

Development before additional loan funds are disbursed. This condition specifically

includes escrowing at closing all equity necessary to complete construction or another

alternative acceptable to Florida Housing in its sole discretion.

4. During construction, the Developer is only allowed to draw a maximum of 50% of the total

Developer Fee but in no case more than the payable Developer Fee during construction,

which is determined to be "developer's overhead". No more than 35% of "developer's

overhead" will be funded at closing. The remainder of the "developer's overhead" will be

disbursed during construction on a pro rata basis, based on the percentage of completion

of the Development, as approved and reviewed by FHFC and the Servicer. The remaining

unpaid Developer Fee (if applicable) shall be considered attributable to "developer's

profit", and may not be funded until the Development has achieved 100% lien free

completion, and only after retainage has been released.

5. Signed and sealed survey, dated within 90 days of loan closing, unless otherwise approved

by Florida Housing, and its legal counsel, based upon the particular circumstances of the

transaction. The Survey shall be certified to Florida Housing, and its legal counsel, as well

as the title insurance company, and shall indicate the legal description, exact boundaries of

the Development, easements, utilities, roads, and means of access to public streets, total

acreage and flood hazard area and any other requirements of Florida Housing.

Exhibit G

Page 30 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-3

October 17, 2019

6. Building permits and any other necessary approvals and permits (e.g., final site plan

approval, Department of Environmental Protection, Army Corps of Engineers, the Water

Management District, Department of Transportation, etc.) or a letter from the local

permitting and approval authority stating that the above referenced permits and approvals

will be issued upon receipt of applicable fees (with no other conditions), or evidence of

100% lien-free completion, if applicable. If a letter is provided, copies of all permits will

be required as a condition of the first post-closing draw.

7. Final "as permitted" (signed and sealed) site plans, building plans and specifications. The

geotechnical report must be bound within the final plans and specifications, if applicable.

8. Final sources and uses of funds schedule itemized by source and line item, in a format and

in amounts approved by the Servicer. A detailed calculation of the construction loan

interest based upon the final draw schedule, documentation of the closing costs, and draft

loan closing statement must also be provided. The sources and uses of funds schedule will

be attached to the Loan Agreement as the approved Development budget.

9. A final construction draw schedule showing itemized sources and uses of funds for each

monthly draw. SAIL Program loan proceeds shall be disbursed during the construction

phase in an amount per draw that does not exceed the ratio of the SAIL Loan to the Total

Development Costs, unless approved by First Housing. ELI Loan proceeds shall be

disbursed during the construction phase in an amount per draw which does not exceed the

ratio of the ELI Loan to the TDC, unless approved by First Housing. The closing draw

must include appropriate backup and ACH wiring instructions.

10. Evidence of insurance coverage pursuant to the RFA governing this proposed transaction

and, as applicable, the FHFC Insurance Guide.

11. A 100% Payment and Performance Bond or a Letter of Credit (“LOC”) in an amount not

less than 25% of the construction contract is required in order to secure the construction

contract between the GC and the Applicant. In either case, Florida Housing must be listed

as co-obligee. The P&P Bonds must be from a company rated at least "A-" by A.M. Best

& Co with a financial size category of at least FSC VI. FHFC, and/or legal counsel must

approve the source, amount(s) and all terms of the P&P Bonds, or LOC. If the LOC option

is utilized, the LOC must include "evergreen" language and be in a form satisfactory to

Florida Housing, its legal counsel and its Servicer.

12. Architect, Construction Consultant, and Developer Certifications on forms provided by

FHFC will be required for both design and as built with respect to Section 504 of the

Exhibit G

Page 31 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-4

October 17, 2019

Rehabilitation Act, Americans with Disabilities Act, and the Federal Fair Housing Act

requirements, if applicable.

13. Applicant is to comply with any and all recommendations noted in the Plan and Cost

Review prepared by GLE.

14. At the end of the Compliance Period, any remaining balance of the ODR less amounts that

may be permitted to be drawn (which includes Deferred Developer Fee and

reimbursements for authorized member/partner and guarantor loan(s) pursuant to the

operating/partnership agreement), will be used to pay FHFC loan debt; if there is no FHFC

loan debt on the proposed Development at the end of the Compliance Period, any remaining

balance shall be used to pay any outstanding FHFC fees. If any balance is remaining in the

ODR after the payments above, the amount should be placed in a Replacement Reserve

account for the Development. In no event shall the payments of amounts to the Applicant

or the Developer from the Reserve Account cause the Developer Fee or General Contractor

Fee to exceed the applicable percentage limitations provided for in Rule Chapter 67-48.

Any and all terms and conditions of the ODR must be acceptable to Florida Housing, its

legal counsel, and its Servicer.

15. A copy of an Amended and Restated Operating Agreement reflecting purchase of the HC

under terms consistent with the assumptions contained within this Credit Underwriting

Report. The Amended and Restated Operating Agreement shall be in a form and of

financial substance satisfactory to Servicer and to FHFC and its legal counsel.

This recommendation is contingent upon the review and approval of the following items by Florida

Housing, and its legal counsel at least two weeks prior to Loan Closing. Failure to receive

approval of these items, along with all other items listed on Florida Housing counsel’s due

diligence, within this time frame may result in postponement of the SAIL Loan closing date.

1. Documentation of the legal formation and current authority to transact business in Florida

for the Applicant, the general partner/principal(s)/manager(s) of the Applicant, the

guarantor, and any limited partners of the Applicant.

2. Signed and sealed survey, dated within 90 days of closing, unless otherwise approved by

Florida Housing, and its legal counsel, based upon the particular circumstances of the

transaction. The Survey shall be certified to Florida Housing and its legal counsel, as well

as the title insurance company, and shall indicate the legal description, exact boundaries of

the Development, easements, utilities, roads, and means of access to public streets, total

acreage and flood hazard area and any other requirements of Florida Housing.

Exhibit G

Page 32 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-5

October 17, 2019

3. An acceptable updated Environmental Audit Report, together with a reliance letter to

Florida Housing, prepared within 180 days of closing, unless otherwise approved by

Florida Housing, and legal counsel, based upon the particular circumstances of the

transaction. Applicant to comply with any and all recommendations and remediation

restrictions noted in the Environmental Assessment(s) and Updates and the Environmental

Review, if applicable.

4. Title insurance pro forma or commitment for title insurance with copies of all Schedule B

exceptions, in the amount of the SAIL and ELI Loan naming FHFC as the insured. All

endorsements required by FHFC shall be provided.

5. Florida Housing and its legal counsel shall review and approve all other lenders closing

documents and the limited partnership or other applicable agreement. Florida Housing shall

be satisfied in its sole discretion that all legal and program requirements for the Loan(s)

have been satisfied.

6. Evidence of insurance coverage pursuant to the RFA governing this proposed transaction

and, as applicable, the FHFC Insurance Guide.

7. Receipt of a legal opinion from the Applicant's legal counsel acceptable to Florida Housing

addressing the following matters:

a. The legal existence and good standing of the Applicant and of any partnership or

limited liability company that is the general partner of the Applicant (the "GP") and of

any corporation or partnership that is the managing general partner of the GP, of any

corporate guarantor and any manager;

b. Authorization, execution, and delivery by the Applicant and the guarantor, of all

Loan(s) documents;

c. The Loan(s) documents being in full force and effect and enforceable in accordance

with their terms, subject to bankruptcy and equitable principles only;

d. The Applicant's and the Guarantor's execution, delivery and performance of the Loan(s)

documents shall not result in a violation of, or conflict with, any judgments, orders,

contracts, mortgages, security agreements or leases to which the Applicant is a party or

to which the Development is subject to the Applicant’s Partnership Agreement and;

e. Such other matters as Florida Housing or its legal counsel may require.

Exhibit G

Page 33 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-6

October 17, 2019

8. Evidence of compliance with the local concurrency laws, if applicable.

9. Such other assignments, affidavits, certificates, financial statements, closing statements

and other documents as may be reasonably requested by Florida Housing or its legal

counsel in form and substance acceptable to Florida Housing or its legal counsel, in

connection with the Loan(s).

10. UCC Searches for the Applicant, its partnerships, as requested by legal counsel.

11. Any other reasonable conditions established by Florida Housing and its legal counsel.

Exhibit G

Page 34 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-7

October 17, 2019

Additional Conditions

This recommendation is also contingent upon satisfaction of the following additional conditions:

1. Compliance with all provisions of Sections 420.507 and 420.5087 Florida Statutes, Rule

Chapter Rule 67-48 F.A.C. (SAIL and 9% HC Programs), Rule Chapter 67-53, F.A.C.,

Rule Chapter 67-60 F.A.C., RFA 2018-103, Section 42 I.R.C. (Housing Credits), and

any other State or Federal requirements.

2. Acceptance by the Applicant and execution of all documents evidencing and securing the

SAIL and ELI Loans in form and substance satisfactory to Florida Housing, including,

but not limited to, the Promissory Note(s), the Loan Agreement(s), the Mortgage and

Security Agreement(s), and the Land Use Restriction Agreement(s) and/or Extended

Land Use Agreement(s) and Final Cost Certificate.

3. Guarantors to provide the standard FHFC Construction Completion Guaranty, to be

released upon lien-free completion, as approved by the Servicer.

4. For the SAIL Loan, Guarantors are to provide the standard FHFC Operating Deficit

Guaranty. If requested in writing by the Applicant, the Servicer will consider a

recommendation to release the Operating Deficit Guaranty if all conditions are met,

including achievement of a 1.15x debt service coverage for the permanent first mortgage

SAIL Loan, as determined by FHFC, or its Servicer, and 90 percent occupancy, and 90

percent of the gross potential rental income, net of utility allowances, if applicable, for a

period equal to 12 consecutive months, all as certified by an independent Certified Public

Accountant, and verified by the Servicer. The calculation of the debt service coverage

ratio shall be made by FHFC or the Servicer. Notwithstanding the above, the Operating

Deficit Guaranty shall not terminate earlier than three (3) years following the final

certificate of occupancy.

5. Guarantors to provide the Standard FHFC Environmental Indemnity Guaranty.

6. Guarantors to provide the Standard FHFC Guaranty of Recourse Obligations.

7. If applicable, receipt and satisfactory review of Financial Statements from all Guarantors

dated within 90 days of Loan Closing.

8. A Mortgagee Title Insurance policy naming Florida Housing as the insured in the amount

of the Loan(s) is to be issued immediately after closing. Any exceptions to the title

Exhibit G

Page 35 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-8

October 17, 2019

insurance policy must be acceptable to Florida Housing or its legal counsel. The form of

the title policy must be approved prior to closing.

9. Property tax and hazard insurance escrow are to be established and maintained by the

First Mortgagee Lender, Fiscal Agent, or the Servicer. In the event the reserve account is

held by Florida Housing's Loan(s) servicing agent, the release of funds shall be at Florida

Housing's sole discretion.

10. Replacement Reserves in the amount of $300 per unit per year will be required to be

deposited on a monthly basis into a designated escrow account, to be maintained by the

First Mortgagee or Florida Housing's Loan(s) servicing agent. However, Applicant has

the option to prepay Replacement Reserves, as allowed per Rule 67-48 F.A.C., in the

amount of $32,400 (one-half the required Replacement Reserves for Years 1 and 2), in

order to meet the applicable DSC loan requirements. Applicant can waive this election,

if at closing of the loan(s) the required DSC is met without the need to exercise the option.

It is currently estimated that Replacement Reserves will be funded from Operations in

the amount of $300 per unit per year for years 1 and 2, followed by $300 per unit per

year thereafter. The initial replacement reserve will have limitations on the ability to be

drawn. New construction developments shall not be allowed to draw during the first five

(5) years or until the establishment of a minimum balance equal to the accumulation of

five (5) years of replacement reserves per unit. The amount established as a replacement

reserve shall be adjusted based on a CNA to be received by FHFC or its servicers,

prepared by an independent third party and acceptable to FHFC and its servicers at the

time the CNA is required, beginning no later than the tenth year after the first residential

building in the Development receives a certificate of occupancy, a temporary certificate

of occupancy, or is placed in service, whichever is earlier (“initial replacement reserve

date”). A subsequent CNA is required no later than the 15

th

year after the initial

Replacement Reserve Date and subsequently every five (5) years thereafter.

11. A minimum of 10% retainage holdback on all construction draws until the Development

is 50% complete, and 0% retainage thereafter is required. Retainage will not be released

until successful completion of construction and issuance of all certificates of occupancy.

The construction contract specifies a 10% retainage until 50% of construction

completion, at which time retainage shall be reduced to 0%, which satisfies the minimum

requirement.

12. Closing of all funding sources prior to or simultaneous with the SAIL and ELI Loan.

13. Satisfactory completion of a pre-loan closing compliance audit conducted by FHFC or

Servicer, if applicable.

Exhibit G

Page 36 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-9

October 17, 2019

14. Satisfactory resolution of any outstanding past due and/or noncompliance items.

15. Any other reasonable requirements of the Servicer, Florida Housing, or its legal counsel.

Exhibit G

Page 37 of 48

SAIL, ELI, & HC CREDIT UNDERWRITING REPORT FHDC

Heritage Park at Crane Creek Page B-10

October 17, 2019

Housing Credit Allocation Recommendation

First Housing Development Corporation has estimated a preliminary annual HC allocation of

$1,510,000. Please see the HC Allocation Calculation in Exhibit 2 of this report for further details.

Contingencies

The HC allocation will be contingent upon the receipt and satisfactory review of the following

items by First Housing and Florida Housing by the deadline established in the Preliminary

Determination. Failure to submit these items within this time frame may result in forfeiture of the

HC Allocation.