A Stochastic, Dynamic Model for Optimizing Home Video Release

Franco Berbeglia

∗

, Timothy Derdenger, Sridhar Tayur

Tepper School of Business, Carnegie Mellon University, Pittsburgh PA 15213

September 21, 2021

Abstract

We study how innovations in the home video viewing experience affect the optimal home

video window—the time duration between theater market exit (a random variable) and home

video release—in the movie industry. We specifically analyze the case when there are two home

video products with different technological qualities: DVDs and Blu-rays. A dynamic discrete

choice model connects theater and home video markets through the theatrical performance,

window duration, and discounted value of waiting. Different from extant literature, our con-

sumers are forward looking and may postpone their purchases for higher expected utilities in the

future. Furthermore, the three markets are intertwined, so changing the release date for a home

video of one technological quality will have an impact on the box office revenue, which will in

turn impact home videos of all other technological qualities. We estimate the model parameters

using panel data (for action movies) on the weekly level for home videos and box office. We

conduct a counterfactual analysis in which the home video windows for DVDs and Blu-rays are

jointly optimized. We find that an immediate after-theater release of lower technological quality

home videos (DVDs) combined with a 5-week delay on higher technological quality home videos

(Blu-rays) is optimal. We attribute this result to consumer heterogeneity, where there is greater

substitution between higher technological quality home videos and theaters. Our methods can

also be applied to the “streaming versus theater” trade-off analysis.

1 Introduction

Home video release timing is among the most important decisions for movie distribution. As a

market segmentation strategy, it separates two different consumer experiences: theaters and home

∗

1

videos. For the last few decades, the home video window—the time between theater market exit

and home video release—has been decreasing. At the same time, the technological quality of the

home video experience has improved, from VHS in the 1990s to 4K Ultra HD today. This poses

a question for the movie industry: is it optimal to further decrease the home video window as the

technological quality of home videos increases, or should the window be increased? Furthermore, as

several technologies of home videos are available at the same time, for example DVD and Blu-ray

during the 2010’s, which technological quality home video should be released first, and how far

ahead of the other, in order to maximize studio revenue?

Advertising plays an important role in movie distribution. In general, 80% of the advertising

budget is spent during theatrical release, while the remaining 20% is left for the home video re-

lease. This generates incentives for studios to release their home videos early, as the advertising

expenditure in theaters will have a stronger spillover effect on home video consumption. However,

at the same time, some consumers may be willing to delay the box office purchase decision to the

home video market if the wait is not too long, reducing the box office revenue. This reduction in

box-office receipts impacts the home video market as well, as it is well known that the theatrical

revenue serves as a quality signal that drives home video demand. This trade-off illustrates the

intertwining factors that affect the optimal choice for the release of home videos; this choice might

also differ depending the varying technological qualities of home videos. The theatrical financial

performance, and the associated run length, are stochastic, adding to the complexity of the setting.

In the past few years, we have seen several efforts from distributors to shrink the home video

window. With the start of the COVID-19 pandemic in December 2019 and the limited market

power of theaters, these efforts expanded. In July 2020 AMC (the world’s largest movie theater

chain) and Universal struck an agreement to release home videos just 17 days after theatrical

release (Watson 2020). Similar agreements were implemented by other studios, with Warner Bros.

announcing it will release all of its 2021 films simultaneously in theaters and on the HBO Max

platform (Schwartzel and Flint 2020). Recently, ViacomCBS launched its own streaming platform,

Paramount+, which will release Paramount and some MGM titles just 45 days after theatrical

release (Kit 2021). These changes were made in the midst of a market dominanted by home

viewing; thus, it remains uncertain whether theaters will regain their influence on the market.

This paper expands the growing set of examples that use structural estimation in empirical

operations management, see Terwiesch et al. (2020). Structural estimation is a technique that

estimates parameters of theoretical economic models, where these parameters are estimated using

2

methods such as generalized method of moments or maximum likelihood. A structural model is

complex and often involves sequential decision-making under uncertainty or strategic environments

where beliefs about other agents’ actions matter. The benefit of structural models are the powerful

counterfactual analyses they may provide, wherein our case these pertain to the supply side and

the optimization of the home video window (e.g. the revenue impact of delaying or advancing

home video release). Specifically, this paper develops a dynamic structural model for the box office

market and the home video market, consisting of two technological qualities, DVDs and Blu-rays

1

.

The model is built around release timing strategies, and it is able to quantify the change in revenue

associated with advancing or delaying home video releases. In order to do this, modeling consumer

forward looking behavior is critical. We model the home video market as an infinite horizon model

for each movie and technological quality, where consumers decide whether to buy the disc, or to

delay their purchase in each period. We model the box office market for each movie as a dynamic

program with a finite horizon. During each period, consumers face the decision whether to buy a

ticket or wait for the next period. The terminal continuation value of the box office market is set

as the discounted value of the home video market, which depends on whether the consumer owns

a DVD or Blu-ray player.

Consumer behavior drives the movie industry and thus it is vital that consumer demand is

properly modeled and estimated to assess a firm’s supply side decision. Moreover, understanding

how the industry functions and which decisions studios and theaters make is equally important

to correctly model both the demand and supply sides. For instance, the time a movie remains in

theaters is not a decision the studios make unilaterally, but one that theaters decide, depending

on film performance. Thus, consumers in the box office market do not know the horizon of such

a market, and have to form expectations about its duration in each period. Under our setting,

consumers form dynamic expectations about the time a movie remains in theaters. These expec-

tations depend on movie performance and time since release. Consumers are also forward looking

in the evolution of the movie quality over time, the home video market value, and the home video

window, all of which determine the terminal continuation value of the box office market. A major

technical effort in this paper is the development and estimation of the demand for all the three

markets using a structural model.

With the demand estimates available for the box office, DVD, and Blu-ray markets, we are able

1

This can be seen as a proxy for Full HD and 4K videos today. It is simple to add other home videos as the data

becomes available

3

to perform a series of counterfactual analyses to determine the optimal home video window. First,

we estimate the impact of modifying the simultaneous release of DVDs and Blu-rays, which was

the industry practice at the time of data collection. We leave everything constant, while adjusting

for the advertising build-up (as having a shorter home video window increases the advertising

build-up coming from theaters) and the box office revenue signal. We find that it is optimal to

set the DVD and Blu-ray release 2.3 weeks after theatrical exit to achieve a 4.47% increase in

studio revenue

2

, which has little impact for theaters. Second, we estimate the impact of separately

modifying the home video window for DVDs and Blu-rays. This allows the studio to further

exploit market segmentation, as consumers express heterogeneous preferences depending on the

technological quality of the home video player they possess. We find that the optimal strategy

is to release DVDs within a week of theatrical exit, but to delay Blu-rays about 5.15 weeks from

theatrical exit. This strategy increases studio revenue by 5.36% with respect to the data, and again,

the impact to theaters is minimal.

Let us provide the insights behind these results: They are driven by the different substitution

patterns that home videos of varied technological quality present to theaters. Lower technological

quality home videos, such as DVDs, have a low ex-ante value function for their market compared

to the market for higher technological quality home videos, such as Blu-rays. This makes DVD

owners less likely to delay the box office purchase decision compared to Blu-ray player owners when

shortening the home video window. Thus, the studios can reap all the benefits of the advertising

spillover effect from theaters while posing minimal competition to theaters. The trade-off is more

nuanced for Blu-rays. Shortening their home video window will increase substitution from theaters,

and will further impact the DVD market, as the quality signal coming from box office revenue is

reduced. This result captures consumer heterogeneity in the box office market; Blu-ray player

owners value picture quality above everything else, whereas DVD player owners value timing and

pricing above picture quality. This allows the studios to perform market segmentation strategies

on releases to boost revenue.

The technical contributions of our paper include the modeling and estimation of (a) a finite

horizon, dynamic, discrete choice model, with a horizon length that follows a path dependent

distribution, and (b) different technological quality home videos (DVD and Blu-ray) that compete

with the box office market for each particular movie. These techniques can be used in other markets

2

Studio revenue captures all of the home video revenue, and a share of the box office revenue that comes from

imposing a standard theater-distributor contract.

4

in the entertainment industry such as (a) video on demand sales and rentals, and (b) shows with

multiple episodes. Beyond entertainment, these methods are applicable in fast fashion, where

consumer trends are likewise unknown in a path dependent manner, and can have continuation

value after the season.

The remainder of this paper is organized as follows: Section 2 presents the related literature,

Section 3 describes the industry and shows the main attributes of the dataset used, Section 4

presents the structural model including consumer utility specifications and the consumers’ optimal

purchase problem, Section 5 explains the estimation and identification procedure for the model

parameters, Section 6 shows and describes the parameter estimates of the model, and Section 7

presents the counterfactual analysis on the home video windows. We conclude in Section 8.

2 Literature Review

Below we divide the relevant literature into two distinct areas: structural estimation in empirical

operations management and movie related research–including movie release timing.

2.1 Structural Estimation in Empirical Operations Management

The use of structural estimation has been growing in empirical operations management research.

Terwiesch et al. (2020) presents a detailed summary of the current papers, presenting the research

questions, key parameters, and methods.

The majority of operations papers that use structural estimation address supply side related

questions. To do so, they estimate consumer demand using methodologies from Rust (1987), Berry

(1995), and/or Nevo (2000), for input into the supply side model. Rust (1987) develops a regener-

ative optimal stopping problem for bus engine replacement, Berry et al. (1995) develops techniques

for empirically analyzing demand and supply in markets with differentiated products, and obtain

demand and cost estimates, whereas Nevo (2000) develops a practitioner’s guide for estimating

random-coefficients logit models. In our case, we base our demand model on the framework of

Gowrisankaran and Rysman (2012), which combines Berry et al. (1995) for modeling the discrete

choice demand and Rust (1987) for the optimal stopping decisions to estimate a dynamic discrete

choice demand model. We also employ the works of Nevo (2000) to obtain the final fixed-effect

estimates, and Derdenger (2014) to connect the box office and home video markets.

Recently, there has been several structural estimation papers in the service management space.

5

Ak¸sin et al. (2013) studies the decision-making process of callers in call centers as an optimal

stopping problem based on Rust (1987), where the utility of a caller is modeled as a function of her

waiting cost and reward for service. After the utility parameters are estimated, the authors conduct

a counterfactual analysis to assess the impact of changes in the service discipline. This presents

several similarities with our paper, where the decision-making for customers is also modeled as

an optimal stopping problem for each market, and, furthermore, we use counterfactual analysis to

assess the impact of changes in the home video window on movie revenue. In a similar fashion, Hu

et al. (2021) study the mechanism of customer retrials in call centers through a dynamic structural

model in order to provide economically feasible solutions to reduce retrials. Guajardo et al. (2016)

use the framework from Nevo (2000) to study the impact of service attributes (warranty length,

after-sales service quality) on consumer demand in the U.S. automobile industry. Allon et al. (2011)

use the framework from Berry et al. (1995) to study the consumer cost of waiting in the fast food

industry. Finally, Li et al. (2014) use a structural model to analyze whether consumers are strategic

in their decisions of executing or delaying flight ticket purchases. Similarly to our paper, Guajardo

et al. (2016), Allon et al. (2011), and Li et al. (2014) all use the generalized method of moments

(GMM) to finalize their respective estimation procedures.

2.2 Movie Release Timing and Other Relevant Research

The problem of finding the optimal inter-release times of sequentially released products has been

widely studied in several industries. Moorthy and Png (1992) analyze the optimal timing and

quality of sequential product releases. Lehmann and Weinberg (2000) analyze the problem of

demand cannibalization between box office and home videos while trying to reap gains as quickly

as possible.

We extended this general line of research in several dimensions. First, we capture box office

consumer forward looking behavior and allow advertising expenditure to accumulate over time.

The latter increases the incentives to shorten inter-release times and is a major driver for shorter

inter-release times. We additionally focus on how the optimal inter-release times change as the

technological quality of home videos increases from DVDs to Blu-rays, while creating heterogeneous

consumer preferences between these products. Another innovation of our model is that consumers

form expectations about the evolution of movie quality during each market, as well as on the

time a movie remains in theaters. We develop a discrete hazard model to asses the probability

distribution of the remaining time in theaters of a movie that is dependent on the time since

6

release and performance thus far.

Other relevant work on movie release timing may be found in the study of the trade-off between

seasonality and freshness for DVD; see Mukherjee and Kadiyali (2018). August et al. (2015) and

Calzada and Valletti (2012) analyze, through theoretical models in different settings, the conditions

under which day-and-date, direct-to-video, or delayed home video releases are optimal release timing

strategies for the movie industry.

Finally, there are numerous papers that empirically analyze demand in the movie industry. This

includes Eliashberg and Shugan (1997), Eliashberg et al. (2000), Elberse (2007), Eliashberg et al.

(2014), and Packard et al. (2016), who study the impact of critics’ reviews, star actors, networks

of cast and crew, and opening weekend box office on overall revenue performance. Lehmann and

Weinberg (2000), Elberse and Anand (2007), and Rao et al. (2017) analyze the impact of advertising

on box office revenue. However, these papers only do so in a non-structural reduce form manner.

3 Industry Setting and Data

The motion picture industry comprises three stages: production, distribution and exhibition. The

production stage consists of the development of a motion picture and is a creative process with

important economic implications for the parties involved. The process usually begins with an idea,

concept, or true event, which a writer captures in a screenplay. If a producer is interested in

the screenplay, she may sign an option agreement with the writer, which gives the producer the

possibility of purchasing the complete screenplay, and provides an upfront payment for the writer.

Substantial financing is needed to begin production, a cost that is lowered when the producer is

affiliated with a studio. Upon the signature of a studio contract, the producer gives up several

rights, including sequels, spin-offs, and merchandising. At the same time, the producer increases

her chances of obtaining bank loans and securing favorable distribution and exhibition deals. These

contracts benefit the studios, as they provide a constant inflow of products from successful films.

Many producers face financing issues when they cannot reach a deal with a studio; in such cases

the studio must obtain financing from other sources, which is difficult when no distribution deals

are guaranteed (Vogel 2014).

The distribution stage begins once a movie has completed production, and it includes the

distribution to theaters, home video markets, as well as the marketing activities in each market

where the movie is released. Distributors face a wide range of decisions in this stage, including

7

when to release the movie in each channel and the advertising strategy for the motion picture.

Among distributors there is a clear distinction between major and independent firms. The major

distributors—usually referred to as “The Big Six”—include Paramount, Sony, Twentieth Century

Fox, Universal, Walt Disney, and Warner Bros. These studios produce, finance, and distribute their

own movies. At the same time, they also finance and distribute films produced by independent film

makers who are associated with the studio. Ensuring a strong US theatrical box-office gross is very

important for these studios, because it is a performance metric to indicate sales potential in other

distribution channels such as global theatrical, home video, and pay television (Eliashberg et al.

2006). Simultaneously, the growing importance of non-theatrical channels as a source of revenue

is generating incentives for the studios to reduce the time between theatrical and non-theatrical

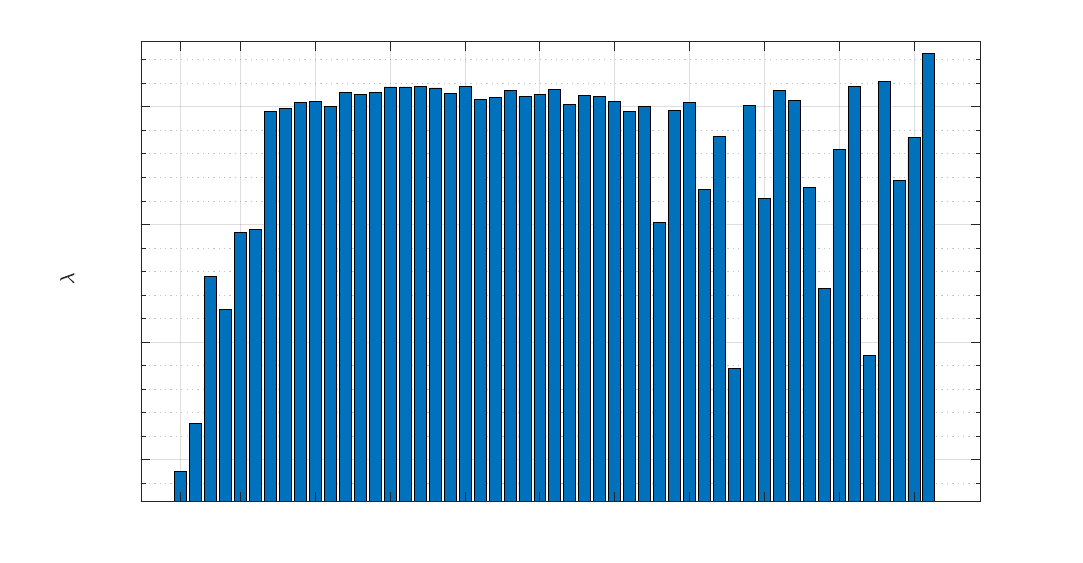

releases. Figure 1 shows the evolution of the average DVD release windows, (time between theatrical

and DVD releases), for major studios and years. This reduction in non-theatrical windows poses

several questions, which we address in this paper. One of them was proposed by Eliashberg et al.

(2006): “To what extent are theatrical and nontheatrical windows substitutes or complements (i.e.,

either negatively or positively affecting each other’s revenue potential)? For example, does the

availability of DVDs deter people from going to the theater?”. Building upon this question, we

analyze the optimal non-theatrical window across different technological quality home videos, which

present different substitution patters with theaters.

In the exhibition stage, major studios have limited control. The contractual agreements between

exhibitors and distributors involve a minimum playing time, as well as terms on how the box office

revenue is shared between the parties involved. Beyond these, it is up to each individual theater

to control the total playing time for each movie (beyond that set minimum). Studios generate a

strong buzz prior to and during their theatrical release—combining advertising, word of mouth,

and media attention—which drives demand for the motion picture in other distribution channels

(Eliashberg et al. 2006).

3.1 Data

We estimate our model using panel data for box office, DVD, and Blu-ray sales. The data are at

the weekly level for all panels. For each week that a movie is in the box office, our data include

revenue ($), ticket sales, number of theaters, and other characteristics. For each movie and week in

a home video environment, our data include unit sales, revenue ($), and average price. We observe

149 movies, across box office, DVD and Blu-ray, with observations between the years 2009 and

8

Figure 1: Evolution of the number of days between theatrical and DVD release for major studios.

Source: https://www.natoonline.org.

2018. Out of those 149 movies, only 113 had Blu-ray releases, while all of them had a DVD release.

We also obtain advertising expenditure data for each movie at the monthly level from Ad$pender.

For each movie we also have information on its characteristics, such as distributor, domestic box

office revenue, production budget, home window lengths and release dates. We also scraped poster

images from www.themoviedb.org and applied color theory on them to extract hue information;

the procedure is described in section 5.3.4. We create market shares by dividing the unit sales

by the number of consumers, for the box office, or number of DVD/Blu-ray player owners for the

home videos. We use data from the U.S. Census Bureau to get the number of consumers within

each movie rating per year, and data from the Consumer Electronic Association to get information

on DVD/Blu-ray player ownership. These data are interpolated to the monthly level, assuming

a linear growth rate. We adjust inflation in all revenues to January 2019 dollars using data from

the Bureau of Labor Statistics. To create our final dataset, we remove box office panel weeks

with fewer than 100 theaters and we define the start of the home window as the week in which

a movie is in less than 100 theaters. The final dataset consists of 1, 797 observations across 149

movies for the box office, 44, 800 for DVDs (across the same 149 movies), and 25, 373 observations

for Blu-rays across a subset of 113 movies. Table 1 presents summary statistics of the production

budget, advertising expenditure, and revenue per medium of the final dataset, and Table 2 presents

9

a summary of the home windows and time in theaters. It is important to note that the difference

between the DVD and Blu-ray home video windows is due to the different sample sizes, and not

due to different home video release dates for the same movie, as the industry practice has been one

of simultaneous release of DVD and Blu-Ray when both were made available.

Mean Median Standard Deviation

Production budget $ 121,775,960 $99,979,420 $ 77,255,980

Domestic box office revenue $ 122,169,272 $ 82,897,417 $ 106,867,804

Total DVD revenue $ 37,480,615 $ 26,050,639 $ 42,840,121

Total Blu-ray revenue $ 22,478,904 $ 16,729,886 $ 19,335,287

Total advertising expenditure $ 27,612,363 $ 27,170,200 $ 11,091,510

Table 1: Data summary on revenues, advertising and budgets.

Mean Median Standard Deviation Maximum Minimum

DVD home window (weeks) 6.6951 6.2857 3.6906 16.2857 0.2857

Blu-ray home window 6.1871 6.2857 3.6453 16.2857 0.2857

Time in theaters (weeks)) 11.4007 11.0000 3.1829 22.0000 6.0000

Table 2: Data summary on timing characteristics.

3.2 Data Analysis

We present reduced form results that show the connection between relevant covariates and revenue.

We retrieve estimates through a two stage process: (1) fixed effects regression that includes time

dependent characteristics, and (2) retrieval of movie characteristics from movie fixed effects.

Table 3 shows the box office reduced form using panel data on weekly box office ticket sales. It

shows the first stage regression on top, and the fixed effect GLS (General Least Squares) retrieval

of static movie characteristics at the bottom. The sign of the coefficients is quite intuitive; as a

movie ages, the demand for it decreases, while an increase in advertising expenditure yields greater

demand

3

. The average box office price per week is not significant, probably due to the low variation

3

We create advertising covariates following Dub´e et al. (2005), we describe the procedure in Section 5.3.3.

10

of price across both time and titles

4

. The “lag 1st3weeks box revenue” covariate represents the

total lagged box office revenue until the current period, or period 3 included, whichever comes first.

This shows that if a movie performs well in the first few weeks after release, it will drive up demand

for the consecutive weeks, but with diminishing returns, as the quadratic component is negative.

The fixed effects regression shows that production budget and time in theaters are major drivers

for box office demand. The home window contribution is smaller in magnitude, but presents the

expected substitution pattern with a positive sign, which means that box office revenue increases

by delaying home video releases.

Table 4 shows the home video reduced form using panel data on home video sales. The top of the

table shows the first stage regression in which DVD and Blu-ray weekly sales are regressed against

time dependent covariates, and an interaction between them and a Blu-ray indicator variable with

movie/medium fixed effects. We then run a fixed effects GLS regression for DVDs and Blu-rays

separately on time independent characteristics. In the first stage regression, we controlled for price

endogeneity using lagged prices as instrumental variables. We can see that home video demand

lowers with age and price. Advertising expenditure has a positive impact on home video sales, but

this effect is lower for Blu-rays. The fixed effects GLS regression shows an increasing demand for

home videos with an increase in box office opening revenue within the ranges of box office revenues

observed. As for the home video window, DVD demand seems to be larger with lower windows,

while Blu-rays exhibit concave demand shape with a maximum in around 8 weeks.

These reduced form results suggest several features that are important to embed into a structural

model. These include expectations about the home video window and time in theaters during the

theatrical market, box office revenue as a signal of movie quality for the home video market, and

advertising. Furthermore, the significant coefficients for age in both markets show that freshness is

an important factor for viewing.

4 Demand model

We discuss the structural model that captures the relationship between box office ticket sales,

home video sales, and the forward-looking behavior of consumers. The box office and home video

markets are linked through the home video window, which is the time between theatrical exit and

home video release. Shrinking this window leads to higher freshness on the home video market

4

To control for price endogeneity we used lagged prices as an instrument.

11

Box office: two-stage reduced form

Time Dependent Variables Estimates

Age (weeks) -0.8184 (0.0161)***

Age

2

(weeks

2

) 0.0223 (0.0008)***

Price ($) -0.6720 (0.5636)

Advertising 0.50933 (0.1361)***

log(lag 1st3weeks box revenue) 0.23651 (0.0474)***

log(lag 1st3weeks box revenue)

2

-0.0128 (0.0027)***

Movie fixed effects

Month fixed effects

N 1,797

Time Independent Variables Estimates

Constant 7.3604 (1.3068)***

log(production budget) 0.2551 (0.0343)***

Time in theaters (week) 0.4945 (0.0297)***

Time in theaters

2

(week

2

) -0.0111 (0.0011)***

Home window (week) 0.0039 (0.0170)

Home window

2

(week

2

) 0.0024 (0.0010)***

Release year fixed effects

Distributor fixed effects

Color fixed effects

N 149

***

p < .01,

**

p < 0.05,

*

p < .1

Table 3: Reduced form estimates of a two-stage fixed effects model on weekly box office ticket

sales.

12

Home video: two-stage reduced form

Time Dependent Variables Estimates Home Video Estimates Blu-ray Indicator

Age (weeks) -0.0119 (0.0035)*** -0.0866 (0.0263)***

Age

2

(weeks

2

) 0.0000 (0.0000)*** -0.1119 (0.0365)***

Price ($) -0.0182 (0.0012)*** -0.2212 (0.0499)***

Advertising 0.6462 (0.0078)*** -0.2832 (0.0647)***

Movie fixed effects X X

Month fixed effects X X

Year fixed effects X X

N 70,253 25,373

Time Independent Variables Estimates DVD Indicator Estimates Blu-ray Indicator

Constant 33.3590 (0.5997)*** 51.2524 (0.9777)***

log(1st3week box revenue) -3.3500 (0.0705)*** -5.6018 (0.1139)***

log(1st3week box revenue)

2

0.1030 (0.0021)*** 0.1709 (0.0033)***

Home window (week) -0.0233 (0.0053)*** 0.0989 (0.0061)***

Home window

2

(week

2

) 0.0015 (0.0003)*** -0.0056 (0.0004)***

Release year fixed effects X X

Distributor fixed effects X X

Color fixed effects X X

N 149 113

***

p < .01,

**

p < 0.05,

*

p < .1

Table 4: Reduced form estimates of a two stage fixed effects model on weekly home video sales.

13

and a greater spillover of advertising spent for the theatrical market, but it may lead to demand

cannibalization from theaters. Consumers in the box office market form expectations about this

home video window and decide whether to watch the movie in the current week, or delay their

decision to the following one. Consumers form expectations about the evolution of prices, movie

quality, and theatrical run time (equivalently, the start of the window). Since we are interested in

analyzing the aforementioned trade-off disregarding competition, we consider each movie to be a

monopoly.

The timeline in our model is as follows: Consumers own either a DVD or a Blu-ray player when

a movie is released in theaters. In each week of the theatrical market, consumers decide whether or

not to buy a box office ticket. They continue to make such a decision until they elect to watch the

movie, or wait until the theatrical run time is over. After the theatrical run is over, we enter the

home video window. During this period, consumers are not able to watch the movie in theaters, nor

buy a home video for this movie. Then, the home video is released and we enter the video time. In

each period (week) of the home video market, consumers decide whether or not they will purchase

their respective discs (DVD or Blu-ray). This is the situation where both DVD and Blu-ray are

made available simultaneously. They continue to make such a decision in each period until they

elect to purchase the home video. Figure 2 shows the described timeline of the model. In order

to estimate the model involving the discussed forward-looking behavior, we use the frameworks of

Gowrisankaran and Rysman (2012) and Derdenger (2014). The former paper embeds consumer

expectations about price, movie characteristics, and other (unobservable) factors that might evolve

over time. The latter paper is used to link the utilities between the theatrical and home video

markets.

Figure 2: Timeline of movie distribution.

Next, we present the utility specifications for the home video and theatrical markets, first

discussing the associated utilities for home videos and then for box office tickets.

14

4.1 Home video utility

We now outline the utility model for home video consumption. The home video utility specification

follows that of Gowrisankaran and Rysman (2012); it is an infinite horizon model. Our specification

allows for model parameters to differ between DVDs and Blu-rays so that the expected value of

the home market for users who hold a DVD or a Blu-ray player are different. This term plays an

important role in the box office market, since it enters through the terminal continuation value of

such a finite horizon model.

In the home video market, each consumer decides in each time period t whether or not to

purchase a home video for movie/medium j. If consumer i decides to purchase a home video for

movie/medium j of technological quality k ∈ {DVD, Blu-ray}

5

in time period t, she obtains a

utility given by

u

h

i,j,t

= f

h

j,t

+ α

p,h

k

p

h

j,t

+

h

i,j,t

, (1)

where f

h

j,t

is the flow utility from the home video, p

h

j,t

is the price of the home video, α

p,h

k

is the

price sensitivity for home videos of technological quality k, and

h

i,j,t

is an idiosyncratic shock which

we assume to be the realization of a Type-1 Extreme Value distribution that is independent and

identically distributed across consumers, products, and time periods.

6

A consumer who does not purchase a movie/medium j of technological quality k ∈ {DVD, Blu-ray}

in period t receives

u

h

0,j,t

= βE[V

h

k

(Ω

h

j,t+1

)|Ω

h

j,t

] +

h

0,j,t

, (2)

where Ω

h

j,t

, is the industry state of movie/medium j at period t, involving the flow utility, price

disutility, and all history factors that influence the home video’s future attributes. Finally, V

h

k

(Ω

h

j,t

)

represents the value of having the purchase possibility of home video j of technological quality

k ∈ {DVD, Blu-ray}, when the state of home video j is Ω

h

j,t

, while β is the weekly discount factor.

The home video flow utilities depend on movie characteristics with the following relation:

f

h

j,t

= α

fe,h

j

+ α

x,h

k

x

h

j,t

+ ξ

h

j,t

, (3)

where x

h

j,t

are time dependent observable movie characteristics (for DVD and Blu-ray), such as age,

advertising expenditure, price, month, and year; α

fe,h

j

are movie/medium fixed effects; α

x,h

k

are

5

Movie/medium j includes information about the technological quality of the home video, so we defer from adding

subscript k to denote such technological quality when subscript j is present.

6

Let superscript h and b denote utility specification for home video and box office, respectively.

15

time dependent characteristics coefficients that depend on whether the technological quality of the

home video is a DVD or a Blu-ray; and ξ

h

j,t

are unobservable characteristics that vary both over

time and across movies. It is important to remark that we don’t explicitly express the dependence

of f

h

j,t

on k since j (movie/medium) already includes that information.

The estimation of the model parameters involves a second stage in which the movie medium

fixed effects are regressed on time fixed movie characteristics, following Nevo (2000). Examples

of movie characteristics involve opening box office revenue, distributor, the home window length,

poster colors and release year.

4.2 Box office utility

Unlike the home video market, the box office market has a finite horizon. The consumer type

is denoted by the subscript k ∈ {DVD, Blu-ray}, which provides a source of heterogeneity that

depends on the technological quality of the home video player owned. This heterogeneity enters

exclusively in the outside option and not in the purchase utility, as we assume that the box office

ticket purchase continuation value is zero for both consumer types

7

. In each period t, consumer

i considers whether or not to watch a particular movie j. Once a consumer watches movie j, she

exits the box office market for movie j. If consumer i decides to purchase a box office ticket for

movie j in time period t, she obtains utility given by

u

b

i,j,t

= φ · (

˜

f

b

j,t

+ ˜α

p,b

p

b

j,t

) +

b

i,j,t

= f

b

j,t

+ α

p,b

p

b

j,t

+

b

i,j,t

, (4)

where f

b

j,t

is the flow utility from observable and unobservable box office characteristics, p

b

j,t

is the

price of the box office ticket, and

b

i,j,t

is an idiosyncratic shock. The parameter φ is a scaling

parameter that permits the comparison between the home video and box office markets; it serves

as a utility normalization factor, since we forced the error terms for both markets to have the same

variance.

A consumer who does not watch movie j in period t and who owns a home video player of

technological quality k ∈ {DVD, Blu-ray} receives

u

b

0,k,j,t

= βE[V

b

k

(Ω

b

j,t+1

)|Ω

b

j,t

] +

b

0,j,t

, (5)

7

This can be transformed into a setting in which consumers obtain a flow utility in each period and the discounted

sum of these utilities is equal to the purchase utility in our model

16

where Ω

b

j,t

, is the industry state of movie j in theaters at period t, involving the flow utility, price

disutility, and all history factors that influence the movie’s future attributes. (For instance, revenue

and time since release, number of theaters available, etc. are important to forming expectations

about the last period of the market). Finally, V

b

k

(Ω

b

j,t

) represents the value of having a box office

ticket purchase possibility when the state of movie j is Ω

b

j,t

and the consumer has a home video

player of technological quality k ∈ {DVD, Blu-ray}. Note that the outside option depends on j

since we are modeling each movie as a monopoly, and the continuation value of delaying the box

office purchase decision is different for each movie.

The box office flow utilities depend on the movie features with the following relation:

f

b

j,t

= α

fe,b

j

+ α

x,b

x

b

j,t

+ ξ

b

j,t

, (6)

where x

b

j,t

are observable box office movie characteristics that vary over time, α

x,b

are the coefficients

of observable time dependent movie characteristics, α

fe,b

j

are movie fixed effects, and ξ

b

j,t

are the

unobservable components of the flow utility that vary both over time, and across movies. Examples

of time-dependent box office movie characteristics include advertising expenditure, average price,

month, age, and performance up to current period. Similarly to the home video market, the

estimation of the model parameters involves a second stage in which fixed effects are regressed

on time invariant movie characteristics. Examples of movie characteristics involve distributor,

production budget, and release year. Note that in (4) and (6) we assume that the consumer

purchase utility specification about movies in theaters does not depend on the type of home video

owned (DVD or Blu-ray), but this heterogeneity enters in (5), the outside option.

This utility specification generates a challenge. The box office market has a finite horizon; thus,

the model has to embed consumer’s expectations about the market’s horizon, the home window

length, and the value of the home video market in order to quantify continuation values. To embed

consumer’s expectations we must make assumptions on what factors affect the movie’s industry

state Ω

b

j,t

. This is analyzed within the consumer’s problem, in section 4.3.2.

4.3 Consumer’s problem

We now outline the consumer’s decision process, which incorporates the forward looking behavior

about the evolution of the movie industry states Ω

b

j,t

. We begin by describing the decision process

for the home video market as it is independent of the value functions of the box office market. We

then describe the finite horizon model of the box office market, where the home video value enters

17

through the terminal continuation value.

4.3.1 Home video market

The home video market consists of two separate markets differentiated by technological quality.

We distinguish between them with subscript k ∈ {DVD, Blu-ray}. Each of them can be seen as an

optimal stopping problem with an infinite horizon. In each period, consumers have the possibility

to purchase their respective home video disc, or to wait. Following Equations (1) and (2), the value

function prior the realization of ~

h

j,t

.

= (

h

i,j,t

,

h

0,j,t

) for a consumer who owns home video player

k ∈ {DVD, Blu-ray} can be written as

V

h

k

(Ω

h

j,t

) =

Z

max

f

h

j,t

+ α

p,h

k

p

h

j,t

+

h

i,j,t

, βE[V

h

k

(Ω

h

j,t+1

)|Ω

h

j,t

] +

h

0,j,t

g

(~

h

j,t

)d~

h

j,t

, (7)

where g

(·) is the probability density function of ~

h

j,t

. From (7), the first element of the max operator

indicates the purchase utility, while the second indicates the expected discounted value of delaying

the purchase decision to the next period.

We proceed by using the aggregation properties of the extreme value distribution to express

(7) in a simpler form, and then we make assumptions on how consumers form expectations about

future movie industry states. Specifically, we can write

V

h

k

(Ω

h

j,t

) = ln

exp(δ

h

j,t

) + exp(βE[V

h

k

(Ω

h

j,t+1

)|Ω

h

j,t

])

, (8)

where

δ

h

j,t

= f

h

j,t

+ α

p,h

p

h

j,t

, (9)

the logit inclusive value, is defined as the ex-ante present discounted lifetime value of buying a

home video at period t, as opposed to waiting for the next period. We make the assumption that

consumers consider only the current value of δ

h

j,t

to form the expectations of the evolution of V

h

to

the next period. So the history of the past values of δ

h

j,t

does not matter. Thus, we have

V

h

k

(δ

h

j,t

) = ln

exp(δ

h

j,t

) + exp(βE[V

h

k

(δ

h

j,t+1

)|δ

h

j,t

])

. (10)

We employ rational expectations for future values of δ

h

j,t

by imposing a simple linear autoregressive

specification:

δ

h

j,t+1

= ν

h

1,k

+ ν

h

2,k

δ

h

j,t

+ η

h

j,t+1,k

, (11)

18

where η

h

j,t+1

is normally distributed with zero mean and unobserved at time t, while ν

h

1,k

and ν

h

2,k

are general parameters to be estimated for k ∈ {DVD, Blu-ray}. This assumption ensures that

consumers are on average correct about the movie quality evolution. It is important to remark that

the optimal consumer decisions, given a movie state δ

h

j,t

, will depend on the joint solution of the

Bellman equation (10) and the movie state regression (11).

Once these two equations are solved, we can obtain the value functions V

h

k

(δ

h

j,t

), and we then use

them to estimate the individual purchase probabilities. The movie/medium j purchasing probability

for a consumer at period t is given as a function of δ

h

j,t

, and is

ˆs

h

j,t

(δ

h

t

) =

exp(δ

h

j,t

)

exp(V

h

k

(δ

h

j,t

))

. (12)

4.3.2 Box office market

The box office market differs from the home video market in a few salient ways. First, the market

has a finite horizon that is unknown by the consumers, and second, the discounted home video

value enters the box office model through the terminal continuation value of this unknown horizon.

This allows consumers to substitute between the box office market and the home video market, if

this terminal continuation value is large enough. Recall that the home video value differs between

the technological quality of the home video, that is, DVD or Blu-ray, which may drive different

substitution patterns between the different technological quality markets and the box office.

In order to model the unknown finite horizon, we use the time and revenue since release as drivers

for a distribution of possible horizons. We use the data in order to fit a discrete hazard model that

gives the probability for each possible horizon. This captures the endogeneity of theatrical runtime,

where each theater decides based on performance whether to keep a movie in theaters or not. This

procedure is described in Section 4.3.3

Following Equations (4) and (5) and using the aggregation properties of the extreme value

distribution, similarly to how we arrived at Equation (8) in the home video market, we obtain the

following value function equation for V

b

k,|T

, the box office value function at time period t conditional

on having a horizon at T and owning a home video player of type k ∈ {DVD, Blu-ray}:

V

b

t,k|T

(Ω

b

j,t

) = ln

exp(δ

b

j,t

) + exp(βE[V

b

t+1,k|T

(Ω

b

j,t+1

)|Ω

b

j,t

])

∀t = 1, . . . , T − 1, (13)

where

δ

b

j,t

= f

b

j,t

+ α

p,b

k

p

b

j,t

, (14)

19

Ω

b

j,t

is the state of the industry of movie j at time t, and T is the unknown horizon of the market,

following a probability distribution that depends on t and the revenue since release. Finally, the

terminal value function is set using expectations on the home video window (NT

k,j

), and the home

video value of movie j with technological quality k (V

h

k,j

):

V

b

T,k|T

(Ω

b

j,T

) = ln

exp(δ

b

j,T

) + exp(E[β

NT

k,j

V

h

k,j

])

. (15)

Since the horizon of the problem is unknown, consumers form a probability distribution over

probable horizons, g

T

(Ω

b

j,t

), which depends on the industry state of the movie Ω

b

j,t

at time t. Then

Equations (13) and (15) can be solved for each T and aggregated using the probability distribution

over possible horizons for each time period. Finally we have

V

b

t,k

(Ω

b

j,t

) =

X

T

V

b

t,k|T

(Ω

b

j,T

)g

T

(Ω

b

j,t

) ∀t = 1, . . . , T, and k ∈ {DVD, Blu-ray}, (16)

where the probability distribution over values of T is created from data using a hazard model that

depends on the revenue and weeks since release. Subsection 4.3.3 provides details on this procedure.

We assume that consumers consider only the current value of δ

b

j,t

, the time since release, t, and

the revenue since release, r

t

, to form expectations about the future values of purchase decisions.

Then our state variables can be assumed to be (t, r

t

, and δ

b

j,t

), since time (t) and revenue since

release (r

t

) are important to determining the probability distribution over possible horizons. Then,

Equations (13), (15), and (16) can be rewritten as

V

b

t,k|T

(δ

b

j,t

) = ln

exp(δ

b

j,t

) + exp(βE[V

b

t+1,k|T

(δ

b

j,t+1

)|δ

b

j,t

]

∀t = 1, . . . , T − 1, ∀k ∈ {DVD, Blu-ray}(17)

V

b

T,k|T

(δ

b

j,T

) = ln

exp(δ

b

j,T

) + exp(E[β

NT

k,j

V

h

k,j

])

, and (18)

V

b

t,k

(δ

b

j,t

, r

t

) =

P

T

V

b

t,k|T

(δ

b

j,t

)g

T

(t, r

t

) ∀t = 1, . . . , T, and k ∈ {DVD, Blu-ray}. (19)

Once again, we employ rational expectations for future values of δ

b

, by imposing a linear autore-

gressive specification:

δ

h

j,t+1

= ν

b

1

+ ν

b

2

δ

h

j,t

+ η

b

j,t+1

, (20)

where η

b

j,t+1

is normally distributed with zero mean and unobserved at time t, while ν

b

1

and ν

b

2

are

general parameters for all movies to be estimated. This assumption ensures that consumers are on

average correct about the movie quality evolution.

We assume that consumer expectations about the home video window in (15) are based on

perfect foresight. We do so because if we did not use perfect foresight, we would need to model

20

consumer beliefs, and when we ran a counterfactual analysis on these home video windows, they

would not be consistent with the estimated beliefs. By using perfect foresight, we ensure that model

beliefs are consistent with our optimized counterfactual home video window lengths.

Note that equations (17), (18), (19), and (20) must be solved jointly. This is because a change

in the Bellman equation will yield different ν

b

1

and ν

b

2

coefficients, which will impact the Bellman

equations. Specifically, these equations need to be solved twice, one time for DVD player owners,

and another time for Blu-ray player owners. The difference between these two comes in the terminal

continuation values used in (15)

8

. The fixed point will depend on the continuation value used, but

we refrain from using it as a variable for V

b

t

. Note that both consumer types have the same quality

vector, δ

b

j,t

, since the difference between types lies in the outside option.

Once these equations are solved, we can compute the individual purchase probabilities for each

consumer segment. For simplicity, we now refrain from using k to identify consumer types and we

use the suprascript b − dvd for DVD player owners and b − blu for Blu-ray player owners instead.

The probabilities that a DVD and a Blu-ray player owner purchase a ticket for movie j in period t

is given by

ˆs

b−dvd

jt

(δ

b

j,t

, r

t

) =

exp(δ

b

j,t

)

exp(V

b−dvd

t

(δ

b

j,t

, r

t

))

and ˆs

b−blu

jt

(δ

b

j,t

, r

t

) =

exp(δ

b

j,t

)

exp(V

b−blu

t

(δ

b

j,t

, r

t

))

, (21)

respectively. And based on the remaining weight of Blu-ray player owners for movie j at time

period t, w

b−blu

j,t

, we can compute the purchase probability of a random consumer:

ˆs

b

jt

(δ

b

jt

) = (1 − w

b−blu

j,t

)ˆs

b−dvd

jt

(δ

b

jt

, r

t

) + w

b−blu

jt

ˆs

b−blu

jt

(δ

b

jt

, r

t

). (22)

4.3.3 Discrete-Time Proportional Hazard Model for time in theaters

Theaters decide when to stop showing a movie, depending on how the movie is performing. To

capture this, we build a Discrete-Time Proportional Hazard Model following Cameron and Trivedi

(2005) (section 17.10.1). This model gives a probability distribution for the remaining time in

theaters, given the number of weeks the movie has been in theaters and the total revenue until

then. Let T be the number of weeks a movie is in theaters, and R(t) the box office total revenue

by period t; we define the discrete time hazard function

λ

d

(t|R

t−1

) = P r[T = t|T ≥ t, R

t−1

], t = 1, . . . , M,

8

Both the home video value and the home window length may differ between DVDs and Blu-rays.

21

which denotes the probability t is the last week this movie is in theaters, given it is in theaters in

week t and the total revenue until week t − 1 is R

t−1

. Then, the associated discrete-time survivor

function is

S

d

(t|R

t−1

) = P r[T ≥ t|R

t−1

] =

t−1

Y

s=1

1 − λ

d

(s|R

s−1

)

.

We can then specialize the continuous PH model to obtain the following expression for the discrete

time hazard

λ

d

(t|R

t−1

) = 1 − exp

− exp (ln λ

0t

+ β

R

log(R

t−1

))

, (23)

where λ

0t

for t = 1, . . . , M and β

R

are parameters to be estimated. The associated discrete-time

survivor function is

S

d

(t|R

t−1

) =

t−1

Y

s=1

exp

− exp (ln λ

0t

+ β

R

log(R

t−1

))

.

We can finally write the likelihood function as

L(β

R

, λ

01

, . . . , λ

0M

) =

N

Y

i=1

h

T

i

−1

Y

s=1

exp

− exp (ln λ

0s

+ β

R

log(R

s−1

))

i

×

1−exp

− exp (ln λ

0T

i

+ β

R

log(R

T

i

−1

))

,

where i refers to each individual movie, and T

i

for the time in theaters of such a movie. We can

the use the data to maximize this function over the parameters, and obtain our final Discrete-Time

Proportional Hazard Model. The results for the hazard model can be found in Appendix A.

5 Estimation and identification

The estimation procedure to recover model parameters follows that of Gowrisankaran and Rysman

(2012) and Derdenger (2014). Since the estimation of the box office market depends on the home

video value, we estimate the home video market first and then we proceed with the box office

market.

We will use ~α

b

and ~α

h

to denote (α

fe,b

, α

x,b

, α

p,b

) and (α

fe,h

, α

x,h

, α

p,h

), respectively; these

are the vector of all fixed effects and observable characteristics coefficients. We now discuss the

identification of the structural parameters (~α

h

, ~α

b

, β), which requires solving the home video market

and using its results to solve the box office market. We do not attempt to estimate β, since it is

well known that estimating the discount factor in dynamic decision models is a notoriously difficult

task (Gowrisankaran and Rysman 2012, Magnac and Thesmar 2002). The problem in estimating

22

the discount factor is that consumer waiting can be explained by moderate preferences for movies,

or by little discounting of the future. Thus, we set β = 0.9995 on a weekly level (equivalent to

0.974 yearly), leaving (~α

h

, ~α

b

, φ) to estimate.

In order to allow for the comparison between box office and home video utilities, we must

identify the scaling parameter φ. To do so, we impose the following constraint in estimation:

α

p,b

= φα

p,dvd

. (24)

With φ identified, we redefine ~α

b

.

= (α

fe,h

, α

x,h

), since α

p,b

is not to be directly estimated.

Following Berry et al. (1995) and Gowrisankaran and Rysman (2012), we specify a generalized

method of moments (GMM) function

G(~α

h

, ~α

b

, φ) = Z

0

~

ξ(~α

h

, ~α

b

, φ), (25)

where

~

ξ(~α

h

, ~α

b

, φ) is the stacked vector unobserved characteristics of the box office market (ξ

b

jt

),

DVD market (ξ

dvd

jt

) and Blu-ray market (ξ

blu

jt

), for which the predicted shares equal the observed

shares, and Z is a matrix of exogenous instrumental variables. To control for price endogeneity,

instrumental variables consist of lagged home video prices and the price difference from the times

mean price for the home market, and observed box office prices for the box office market given

that this price is assumed exogenous. Note, the explicit assumption given the set of instruments

for box office prices is that box office ticket prices are not correlated with unobserved box office

movie quality (ξ

b

jt

) given they do not vary by movie or by run time. We estimate the parameters

to satisfy

(ˆα

h

, ˆα

b

,

ˆ

φ) = arg min

(~α

h

,~α

b

,φ)

n

G(~α

h

, ~α

b

, φ)

0

W G(~α

h

, ~α

b

, φ)

o

, (26)

where W is a weighing matrix. Thus, to estimate (~α

h

, ~α

b

, φ) we must first solve for ξ(~α

h

, ~α

b

, φ),

which requires solving for the shares of all markets. We first discuss how to solve for home

video shares and then for box office shares. In the following sections, we explain how to obtain

ˆα

h

, ˆα

b

(φ) and

~

ξ(ˆα

h

, ˆα

b

(φ), φ) based on an initial guess of φ. The optimal value ˆα

h

is independent

of φ and can be solved separately. Given a guess for φ, one can solve for the optimal ˆα

b

(φ) easily,

which will depend on the chosen φ. Finally, the optimal solution for

ˆ

φ can be obtained by solving

a single variable optimization problem, which includes a subproblem that finds ˆα

b

(φ):

ˆ

φ = arg min

φ

n

G(ˆα

h

, ˆα

b

(φ), φ)

0

W G(ˆα

h

, ˆα

b

(φ), φ

o

. (27)

23

5.1 Home video shares

The consumer decision problem for the home video market is defined in Section 4.3.2 as the fixed

point of the Bellman equation (10), and the market evolution equation (11). We stack the DVD and

Blu-ray panel data, to find the vector δ

h

j,t

for which the predicted shares (ˆs

h

jt

) equals the observed

shares (ˆs

h

jt

) for each movie and time period; namely,

s

h

j,t

= ˆs

h

j,t

(δ

h

j,t

) ∀j, t. (28)

The construction of the observed market shares originate from observed sales and the market size

for each movie in each period. The initial home video market size is set to the number of U.S.

households for DVD discs, which assumes complete market penetration of DVD players. For Blu-

ray discs, the market size is set to the cumulative number of Blu-ray players sold up to period t.

In recovering the market size for subsequent periods, we subtract all sales until such period from

the initial market size.

Following Gowrisankaran and Rysman (2012) and Berry et al. (1995) the solution to equation

(28) can be solved using a fixed point iteration:

δ

h.new

j,t

= δ

h.old

j,t

+ ψ

h

·

log(s

h

j,t

) − log

ˆs

h

j,t

δ

h

j,t

)

!

, (29)

where ψ

h

is a tuning parameter set to 0.6.

We now summarize the procedure to solve the home video consumer’s problem and obtain

the vector δ

h

j,t

that simultaneously satisfies equations (10) and (11), with the predicted shares in

Equation (12) equal to the observed shares. It is important to remark that this procedure is done

separately for DVDs and Blu-rays.

1. Initialize δ

h

j,t

= log(s

h

j,t

+ 0.00001).

2. Define the 25-point vector: V

temp

i

= 1 for i ∈ {1, . . . , 25}.

3. Find OLS estimates of AR(1) parameters ν

hv

1

and ν

hv

2

following Equation (11).

4. Perform a 25-point Gaussian Quadrature procedure on δ

h

j,t

using the estimates ν

hv

1

and ν

hv

2

to find a discretized grid, Z

i

for i ∈ {1, . . . , 25}, for δ

h

j,t

as well as the transition probability

matrix across the grid, M

z

.

5. Set V

h

(Z

i

) ← V

temp

i

∀i ∈ {1, . . . , 25}.

24

6. Loop V

h

(Z

i

) ← log

exp(Z

i

) + exp(βE[V

h

(Z

0

i

)|Z

i

])

until a fixed point on V

h

(Z

i

) is reached

(tolerance set to 10

−10

), where the Gaussian Quadrature grid and transition probabilities are

used to compute βE[V

h

(Z

0

i

)|Z

i

] ∀i ∈ {1, . . . , 25}, and Z

0

i

is the transition state from Z

i

.

7. Interpolate the vector δ

h

j,t

on Z

i

and V

h

(Z

i

) to obtain estimates of V

h

(δ

h

j,t

), and compute the

predicted marketshares, ˆs

h

j,t

, using Equation (12), and set V

temp

i

← V

h

(Z

i

).

8. Set δ

h

j,t

← δ

h

j,t

+ ψ

h

·

log(s

h

j,t

) − log

ˆs

h

j,t

!

with ψ

h

= 0.6, and go to step 3 until a fixed

point on δ

h

j,t

with a tolerance of 10

−10

is reached.

After finding the output δ

h

j,t

vector that comes from the procedure above (satisfying the Bellman

equation (10), the market evolution equation (11), and making the predicted shares equal the

observed shares), we save the home video value for each movie j and medium k, DVD or Blu-ray,

at the beginning of this market. We then use this value, V

h

k,j

, as the terminal continuation value

for the box office market as used in equation (15).

5.2 Box office shares

Similar to the above home video market, market share is determined by specifying the movie’s

potential market size in each period t. Additionally, the market size for subsequent periods is

calculated by subtracting all sales prior to period t from the initial market size. For the box office

market, the initial market size for each movie is set at the U.S. population within the age segment

of the movie’s rating (e.g. PG13 movies would include the number of people older than 13).

Once the home video market is solved, the home video values enter the terminal continuation

values in the box office market and we seek a fixed point between equations (17), (18), (19), and

(20). This is done for DVD and Blu-ray player owners separately, and then we use (21) and (22)

to compute the predicted box office market shares.

As in the home video market, we wish to find a vector δ

b

j,t

for which the predicted shares equals

the observed shares for each movie and time period; namely,

s

b

j,t

= ˆs

b

jt

(δ

b

j,t

) ∀j, t. (30)

We solve (30) by iterating over

δ

b.new

jt

= δ

b.old

jt

+ ψ

box

·

log(s

b

j,t

) − log

ˆs

b

j,t

δ

b

j,t

!

, (31)

25

where ψ

h

is a tuning parameter set to 0.6.

We now summarize the procedure to solve the box office consumer’s problem and obtain the

vector δ

b

j,t

that simultaneously satisfies equations (17), (18), (19), and (20), with the predicted

shares in Equation (22) equal to the observed shares.

1. Initialize δ

b

j,t

= log(s

b

j,t

+ 0.00001).

2. Define the 25-point vector: V

temp

i

= 1 for i ∈ {1, . . . , 25}.

3. Find OLS estimates of AR(1) parameters ν

box

1

and ν

box

2

following Equation (20).

4. Perform a 25-point Gaussian Quadrature procedure on δ

b

j,t

using the estimates ν

box

1

and ν

box

2

to find a discretized grid, Z

i

for i ∈ {1, . . . , 25}, for δ

b

j,t

as well as the transition probability

matrix across the grid, M

z

.

5. For all T ∈ {1, . . . , 51} set V

b

T,k|T

(Z

i

) = log

exp(Z

i

) + exp(β

NT

k,j

V

h

k,j

.

6. Perform a backwards induction procedure using the transition probabilities to set V

b

t,k|T

(Z

i

) ←

log

exp(Z

i

) + exp(βE[V

b

t+1,k|T

(Z

0

i

)|Z

i

])

for all t ∈ {1, . . . , T − 1}, T ∈ {2, . . . , 51} and k ∈

{DVD, Blu-ray}.

7. Interpolate the vector δ

b

j,t

on Z

i

and V

b

t,k|T

(Z

i

) for all t ∈ {1, . . . , T − 1}, T ∈ {2, . . . , 51} and

k ∈ {DVD, Blu-ray}.

8. Use the discrete time proportional hazard model presented in section 4.3.3 to compute

V

b

t,k

(δ

b

j,t

, r

t

) using Equation (19).

9. Compute the predicted marketshares, ˆs

b

j,t

, using Equation (22) and set δ

b

j,t

← δ

b

j,t

+ ψ

b

·

log(s

b

j,t

) − log

ˆs

b

j,t

!

with ψ

b

= 0.6, and go to step 3 until a fixed point on δ

b

j,t

with a

tolerance of 10

−10

is reached.

5.3 Recovery of

~

ξ, ~α

h

and ~α

b

We use the estimated δ

b

and δ

h

on a set of regressions involving different movie characteristics.

We begin by exposing the retrieval of characteristic coefficients for the home video market, and we

proceed with the box office market. By the end of this subsection we describe our procedure to

generate advertising and poster color covariates.

26

5.3.1 Home video

To recover the unobserved characteristics ξ

dvd

and ξ

blu

, which are required to compute the GMM

objective function (27), we regress δ

hv

as the purchase utility from equations (1) and (3) on a set

of covariates. The covariates involve movie-technology specific dummy variables

9

(α

fe,h

j

), age and

the squared age of the movie in weeks, goodwill advertising stock, price, and, month and year

dummies. The formation of the goodwill advertising stock follows that of Dub´e et al. (2005) and it

is explained in detail in subsection 5.3.3. For each covariate, we create a new one that is multiplied

by a Blu-ray dummy as shown in (3).

Like other studies of market power since Bresnahan (1981), we allow price to be endogenous

to unobserved characteristics (ξ

h

), but we assume that movie characteristics are exogenous. This

assumption is justified when movie characteristics are determined in advance, independently of

unobserved ones at the moment the home videos are sold. As it is common in the literature, we

use lagged prices and price differences from the mean as instruments in a two stage least squares

regression.

This first stage regression to identify the contribution of time-dependent characteristics, must

be performed after every fixed point on δ

h

j,t

is achieved. This is because we need α

p,h

to obtain

α

p,b

according to equation (24) in order to obtain the flow utilities for the box office after finding

a fixed point in such a market.

A second stage regression of our model can be performed after estimating

ˆ

φ to recover estimates

of non-time varying characteristics. This involves regressing the fixed effects obtained in the first

stage regression with movie specific characteristics such as the logarithm of the total first three

weeks of box office revenue and its squared term, home window and its square term, logarithm of

the production budget for the film, distributor dummies, and poster color dummies (subsection 5.3.4

explains in detail the creation of the poster color dummies). Following Nevo (2000), we perform a

minimum distance procedure: let y = (y

1

, . . . , y

J

)

0

denote the J ×1 vector of fixed movie-technology

coefficients (α

fe,h

j

) from Equation (3); let X be the J × K(K < J ) matrix of movie characteristics,

and ξ

fe,h

is the movie specific deviation of the unobserved characteristics. Then, we have

y = Xβ

h

+ ξ

fe,h

. (32)

We do not make any assumptions on the error variance covariance matrix (Ω) since we can compute

9

A movie that is both on DVD and Blu-ray will have separate dummy variables for the panel rows that correspond

to DVD and Blu-ray.

27

it from our first stage regression; thus, instead of of using an Ordinary Least Squares (OLS)

procedure we perform a Generalized Least Squares (GLS) one. The GLS estimator is defined as

β

h

GLS

= arg min

b

(y − Xb)

0

Ω

−1

(y − Xb), (33)

which can be rewritten as arg min

b

[Ω

−1/2

(y − Xb)]

0

[Ω

−1/2

(y − Xb)]. This can be seen as an OLS

objective function of ˜y =

˜

Xb +

˜

ξ

fe,h

, with ˜y

.

= Ω

−1/2

y,

˜

X

.

= Ω

−1/2

X and

˜

ξ

fe,h

.

= Ω

−1/2

ξ

fe,h

.

Thus, the GLS estimator can be written as

ˆ

β

h

GLS

= (

˜

X

0

˜

X)

−1

˜

X

0

˜y = (X

0

Ω

−1

X)

−1

XΩ

−1

y, with

ˆ

ξ

fe,h

= ˆy −X

ˆ

β

h

GLS

. Furthermore, we can write the variance of the GLS estimator as V AR(

ˆ

β

h

GLS

) =

(X

0

ΩX)

−1

.

5.3.2 Box office

For each value of φ, we impose constraint (24) and regress

ˆ

δ

b

j,t

.

= δ

b

j,t

− φα

p,dvd

p

b

j,t

as the flow

utilities in equation (6), which involves movie specific dummy variables, the logarithm of the first

three week revenue

10

, age and the squared age of the movie in weeks, goodwill advertising stock,

and current month fixed effects. This yields ξ

b

(φ), which allows for the computation of the GMM

objective function (27). We refrain from using a two stage least squares regression as used in the

home video market, because the endogeneity of price has already been subtracted with the use of

the utility scaling parameter.

We then perform a second stage regression that finds the taste components for the movie

specific characteristics, that is, release year, logarithm of production budget, distributor dummies,

and poster color dummies. We use the same GLS estimator as in the home video second stage

regression.

The procedure to compute the GMM objective function and estimate φ may be summarized as

follows:

1. Recover

ˆ

δ

b

j,t

= δ

b

j,t

− φα

p,dvd

p

b

j,t

given φ.

2. Run a movie fixed effects regression of

ˆ

δ

b

j,t

on time dependent movie characteristics to estimate

α

fe,b

j

and α

x,b

from equation. (6)

3. Compute ξ

b

j,t

(~α

b

(φ)) =

ˆ

δ

b

j,t

− α

fe,b

j

+ α

x,b

x

b

j,t

.

4. Construct ξ(~α

h

, ~α

b

, φ) and compute the objective function of equation (27).

10

For the first week, we set this covariate as 0, whereas for weeks 2 and 3 we add all revenue in previous weeks

until then.

28

5.3.3 Goodwill advertising stock

Following Dub´e et al. (2005), we implement a simple advertising model that captures the “carry-

over” of advertising to posterior periods. Let A

j,t

, g

j,t

and g

a

j,t

denote the advertising expenditure,

goodwill stock and augmented goodwill stock for movie j in period t. The augmented goodwill

stock is what enters in the consumer’s utility function, and it is increased by advertising over an

already present goodwill stock:

g

a

j,t

= g

j,t

+ ψ(A

j,t

), (34)

where ψ is the goodwill production function. Dub´e et al. (2005) discuss some possibilities for ψ;