0

Charity & Nonprofit

BOARD SERVICE

IN WASHINGTON STATE

A QUICK GUIDE

Presented by:

R

evised January 2023

Washington State Office of the

ATTORNEY GENERAL

1

Guide for Charity or Nonprofit Board Service

Presented by

The Office of the Secretary of State and the Attorney General’s Office

The Office of the Secretary of State and the Office of the Attorney General have

prepared this Quick Guide for Board Service to help board members understand

their responsibilities as stewards of their organizations. Under Washington law,

board members of a Washington nonprofit organization are responsible for the

management of the business and affairs of the organization. This does not mean

that board members are required to manage the day-to-day activities of an

organization or to act in the role of an Executive Director. It does mean that

they must appoint officers and assign responsibilities to them so that the officers

can effectively carry out the daily tasks of running the organization. It also

means that board members must supervise and direct the officers and govern

the organization’s efforts in carrying out its mission. In carrying out their

responsibilities, the law imposes on board members the fiduciary duties of care,

loyalty and obedience to the law. Washington courts have held that the law

imposes the highest standard of integrity on the bearers of these duties.

This Quick Guide for Board Service is only a guide and is not meant to prescribe

the exact manner that board members must act in all situations. It is not a

substitute for legal advice. Each organization possesses a distinct composition

and experiences different circumstances and outcomes. This guide is provided

only as a reference tool to assist board members in performing their duties. It

does not contain all of the provisions, exceptions, limitations and requirements

of the law. For the exact requirements of the law, please refer to the source of

the law itself. Many of the guidelines in this publication are taken from the

Washington Nonprofit Corporation Act, located in the Revised Code of

Washington (RCW), Chapter 24.03A.

Board members of Washington state nonprofit organizations must discharge

their duties in good faith, in a manner that each member reasonably believes to

be in the best interests of the organization, and with the care that an ordinarily

prudent person in a like position would exercise under similar circumstances.

Good governance requires the board to balance its role as an oversight body

with its role as a force supporting the organization.

2

Under well-established principles of nonprofit corporation law, a board director

must meet certain standards of conduct and attention in carrying out his or her

fiduciary responsibilities to the organization. Several states have statutes

adopting some variation of these duties that a court of law would consider to

determine whether a board director acted improperly. These standards are

usually described as the Duty of Care, Duty of Loyalty and Duty of Obedience.

Duty of Care:

The Duty of Care describes the level of competence that is expected of a board

director and is commonly expressed as the duty of "care that an ordinarily

prudent person would exercise in a like position and under similar

circumstances." (See RCW 24.03A.495) This means that a board director ow

es

the duty to exercise reasonable care when he or she makes a decision as a

steward of the organization.

1. A

ctive Participation. A director should actively participate in the

management of the organization including setting direction, attending

meetings of the board, evaluating reports, reading minutes, reviewing

the performance and compensation of the executive director and so on.

Persons who do not have the time to participate as required should no

t

a

gree to serve on a board.

2. Committees. A board of directors may establish committees and may

rely on information, opinions or reports of these committees.

Committees operate subject to the direction and control of the board.

As a result, board members are still responsible for the committees and

should periodically scrutinize their work.

3. Board Actions. A board member who is present at a meeting when an

action is approved by the entire board is presumed to have agreed to

the action unless the member (1) objects to the meeting because it was

not lawfully called or convened and doesn’t otherwise participate in the

meeting; (2) votes against the action; or (3) is prohibited from voting on

the action because of a conflict of interest. Normally, the minutes will

record such objections to create a record of the dissent.

4. Minutes of Meetings. Written minutes should be taken at every board

meeting, by someone other than the chair. The minutes should

accurately reflect board discussions as well as actions taken at meetings.

3

The minutes should be reviewed and approved by all board members by

the next board meeting.

5. B

ooks and Records. A board member should have general knowledg

e

o

f the books and records of the organization as well as its general

operation. The organization’s articles, bylaws, accounting and

m

embership records, voting agreements and minutes must be made

available to board members who wish to inspect them for a proper

purpose.

6. A

ccurate Record Keeping. The board of directors should not only be

familiar with the content of the books and records, but should also

assure that the organization’s records and accounts are accurate. The

board is ultimately responsible to ensure that internal controls are

adequate to safeguard the organization’s assets and help prevent fraud.

This also means the board might take steps to require regular financial

audits by an independent certified public accountant. At the very least,

the board should be aware of what the financial records disclose

.

Man

y boards determine that an effective way to achieve adequate

financial oversight is to appoint a Finance Committee that includes a

t

least one member with a background in finance to focus on the financial

details and report to the full board. Often, the treasurer of the board

chairs this committee and the appointed members can include people

who are not on the board.

7. Assets. The board of directors has the duty to protect, preserve, invest

and manage the corporation’s assets and to do so in a manner consisten

t

w

ith the organization’s mission, donor restrictions, and legal

requirements. Oversight of appropriate internal controls will aid in the

protection of assets and the prevention of fraud.

8. Res

ources. The board of directors should assist the organization in

obtaining adequate resources to enable it to further its mission.

9. C

haritable Trusts. A trustee of a charitable trust has a higher standard

of care than a director of a nonprofit corporation. A trustee has the duty

to exercise the care that an ordinary person would employ in dealing

with that person’s own property. A trustee with a greater level of skill

must use that higher skill in carrying out the trustee’s duties.

4

10. Investigation. The board of directors has a duty to investigate warnings

or reports of officer or employee theft or mismanagement. The board

should adopt procedures to handle reports of inappropriate uses

of

r

esources or inaccurate reporting of financial affairs. These procedures

should include protections for anyone reporting the possibility of such

damaging activities. In some situations the board may have to report

misconduct to the appropriate authorities, such as the police or the

Attorney General. Where appropriate, a director should consult an

attorney or other professional for assistance. The board as a whole may

also seek such advice when needed to assist the members in dealing

with a difficult situation.

D

uty of Loyalty:

The duty of loyalty is a standard of faithfulness; a board member must give

undivided allegiance when making decisions affecting the organization. This

means that a board member can never use information obtained as a member

for personal gain, but must act in the best interests of the organization.

1. Conflicts of Interest. Under certain circumstances, a contract or

transaction between a nonprofit corporation and a board member or an

organization in which a board member has a material financial interest is

acceptable. However, if the transaction is challenged, the board member

will have the burden of establishing that the contract or transactions was

fair and reasonable, that there was full disclosure of the conflict and that

the contract or transaction was approved by other board members in

good faith.

2. W

ritten Policy. Boards should establish a written policy on avoiding

conflicts of interest.

3. L

oans. Washington State law disfavors a nonprofit corporation making a

loan to a board member or the board member’s family members. If a loan

is made, all officers and board members who participated in making the

loan will be liable for the amount until the loan is repaid.

5

4. Charitable Trust. In charitable trusts, transactions which otherwise might

c

onstitute a conflict of interest are permissible if the conflict was clearly

contemplated and allowed by the original settlor of the trust.

5. Corporate Opportunity. Board members of business organizations are

un

der a fiduciary obligation not to divert a corporate business opportunity

for their personal gain. A board member of a nonprofit corporation is also

subject to this duty. This duty means that a board member may not

engage in or benefit from a business opportunity that is available to and

suitable for the corporation unless the corporation decides not to engage

in the business opportunity and conflict of interest procedure is followed.

6. Internal Revenue Code. Other prohibitions relating to the duty of loyalty

are specified in the rules of the Internal Revenue Code regarding self-

dealing. These rules apply to private foundations.

Duty of Obedience:

The duty of obedience requires the board of directors to be faithful to the

organization's mission. They are not permitted to act in a way that is inconsistent

with the central goals of the organization. A basis for this rule lies in the public's

trust that the organization will manage donated funds and other resources to

fulfill the organization's mission.

1. Federal, State and Local Statutes. Board members should be familiar

with federal, state and local laws relating to nonprofit corporations,

charitable solicitations, sales and uses taxes, FICA (Social Security) and

income tax withholding, and unemployment and worker’s compensatio

n

obligations. They should also be familiar with the requirements of the

Internal Revenue Service (See Attachment A). Directors should see to it

that their organization’s status with federal, state and local agencies is

protected and current.

B

oard members should assure themselves that the provisions of the

Internal Revenue Code applying to 501(c)(3) organizations have been met

before advising donors that their contributions may be tax deductible.

2. Fili

ng Requirements. Board members must comply or assure compliance

with deadlines for tax and financial reporting, for registering with the

Secretary of State, for making Social Security payments, for income tax

6

withholding and so on. Additionally, if an organization is incorporated, its

directors have a duty to maintain its corporate status by submitting or

assuring submission of timely filings to the Office of the Secretary of State.

I

f the organization conducts fund raising activities, a separate annual

Charitable Solicitation Report may be required. See RCW 19.09.065

a

nd

the information about the Charitable Solicitations Act on the Secretary of

State’s website at https://www.sos.wa.gov/corporations-c

harities for

details.

3. G

overning Documents. Board members should ensure that the

organization’s mission is being accomplished in accordance with the

stated purpose in the organization’s articles of incorporation. T

hey should

be familiar with their organization’s governing documents and should

follow the provisions of those documents. Board members should be sure

that proper notice is given for meetings, that regular meetings are held,

and that members are properly appointed or elected.

4. Outside Help. Where appropriate, board members should obtain

opinions of legal counsel or accountants.

I

n addition to the three general fiduciary duties (Care, Loyalty and Obedience),

there are several specific responsibilities that should be observed by the board

of directors.

Reducing the Risk of Liability

A

lthough lawsuits against board members of nonprofit corporations occur less

frequently than those against board members of for-profit business

corporations, they are not unknown. Recent widespread publicity and, in some

cases, criminal convictions have highlighted the fiduciary role of board members

and officers of nonprofit organizations.

7

It is possible that board members of a charitable/nonprofit corporation will find

themselves sued as personal defendants in a lawsuit filed by an “outside third

party” that has incurred some personal injury or financial loss as a result of

dealings with the organization. To encourage citizens to serve as board

members for charities, the law cloaks volunteer board members with qualified

immunity. (See RCW 24.03A.540

) They cannot be sued for negligent acts. They

may, however, be subject to lawsuits alleging that a loss was due to their gross

negligence, willful or fraudulent acts.

NOTE –

The IRS may also hold board members personally liable if the

organization violates federal tax law. The most likely situation is the failure of

the organization to perform mandatory payroll withholding.

Because there is some degree of risk, including the cost of defending a frivolous

c

laim, board members should discuss with the organization’s legal counsel the

prospect of purchasing Directors and Officers (D & O) liability insurance

, and/or

including indemnification provisions in the organization’s governing documents.

The organization should carry insurance appropriate to its activities (including,

f

or example, general liability, errors and omission, automobile or malpractice)

in amounts to meet its needs. The absence of appropriate insurance may cause

an injured person to seek recourse from board members. If adequate insurance

is in force, an injured person is less likely to seek damages from a board member.

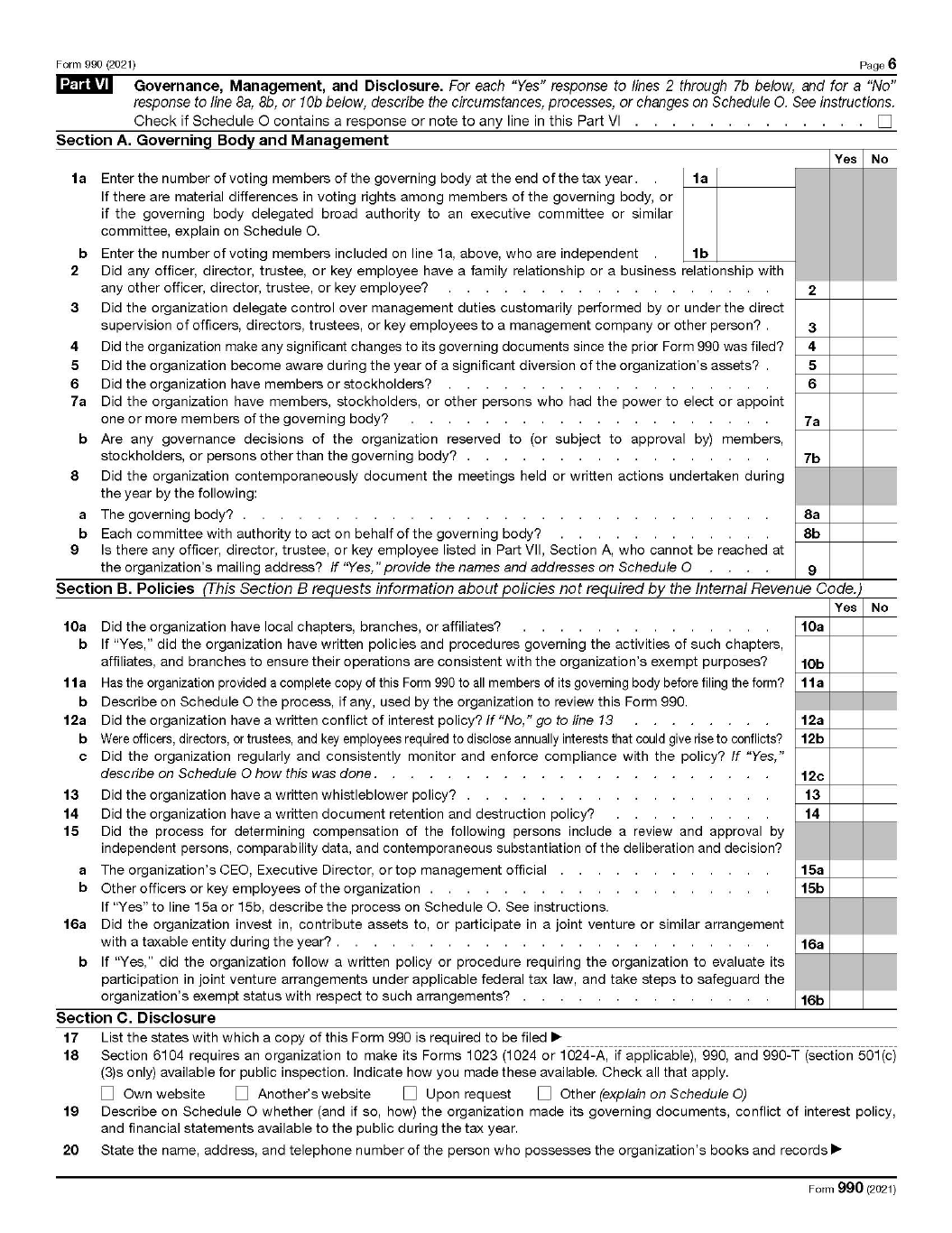

Federal Guidelines for Governance,

Management and Disclosure

The federal government has prescribed that certain governance practices are

desirable for non-profit entities that have federal tax-exempt status. While they

are not required by law, the federal Return of Organization Exempt from Income

Tax (Form 990) does require disclosure as to whether or not these practices are

in place. Potential donors may consider the absence of these features as

indications that the organization is not well run. Please refer to the applicable

questions that are included in Attachment A.

8

Attachment A

nonprofitwa.org ©2022 Nonprofit Association of Washington. All rights reserved.

Board Standards in Washington State

Introduction

This document provides an overview of key standards for charitable, nonprofit,

non-membership boards under state law, the Washington Nonprofit Corporation Act, effective

January 1, 2022. It is intended to provide general guidance about requirements for self-electing

boards. It also focuses on charitable nonprofits: nonprofits that are operated primarily or

exclusively for one or more charitable purposes that would qualify the organization for tax-

exempt status under Section 501(c)(3) of the Internal Revenue Code. This document does not

address membership nonprofits or federal law (see the Washington Nonprofit Handbook for more

information).

Read more:

The Washington Nonprofit Corporation Act: RCW (24.03A)

Definitions: RCW 24.03A.010(5)&(6)

This information is provided so that all nonprofit leaders can understand the key state legal

requirements for nonprofit boards. Some readers may be surprised that some conventions which

they assumed to be legal requirements are actually optional. For boards interested in innovating

or distributing leadership more broadly within their organization, it may be freeing to learn that

some responsibilities can be delegated to staff or advisory committees, or that the law does not

mandate the use of a specific decision-making method. This information can be used to determine

what work the board must do, and what can be delegated, shared, or done by others. For more

information on alternative leadership, see the Alternative Leadership Toolkit.

Disclaimer

This document is for educational purposes only. It is not meant to be comprehensive, and in no

way will this content be considered legal, business, or professional advice or counsel. It also does

not create an attorney-client relationship. For legal advice, please contact a licensed attorney.

In general, state law defines the parameters of board standards, and bylaws can be tailored within

the parameters. If a nonprofit’s bylaws are silent on an issue, the Washington Nonprofit

Corporation Act will provide the default standard. This document uses the terms “board

members” and “directors” interchangeably.

This document was prepared in partnership with Communities Rise and made possible by the support of the

Washington State Office of the Secretary of State.

Attachment B

9

Board Standards in Washington State

nonprofitwa.org Page 2

Board Members/Directors

Revised Code of

Washington

Section (link)

● Board members/directors must be individuals and do

not need to be residents of Washington State. Bylaws

can add additional qualifications as agreed upon by

the current board members.

24.03A.500

● 501(c)(3) public charities must have at least 3 board

members.

24.03A.505(2)

● Youth under the age of 18 may serve on a board. A

board may have either 3 youth directors, or ⅓ of the

total number directors on the board may be youth –

whichever number is fewer.

24.03A.505(3)

● The default board term length is 1 year, unless bylaws

state differently. The maximum board term length for

board members elected by other board members is

5 years.

24.03A.515(1)

24.03A.515(1)

● The law does not have a maximum or ceiling for the

number of terms a director can serve. Bylaws may

specify term limits.

● A board member may resign at any time orally at a

board meeting or in writing to the president, secretary

or another designated officer, as stated in the

organization’s bylaws.

24.03A.525(1)

● If a director’s term has expired, the director with the

expired term serves until their successor is chosen,

unless bylaws state differently

24.03A.515(6)

● The procedure for removing a board member does

not need to be included in bylaws. See the law for

specific information.

24.03A.530

Officers

● Required officers are president, secretary and

treasurer. The office of vice president is not required.

24.03A.585(1)

● Two offices may be held by the same individual,

except the offices of president and secretary must be

held by different people.

24.03A.585(3)

10

Board Standards in Washington State

nonprofitwa.org Page 3

Committees

● Board committees may have delegated authority

from the board to make decisions, for example, an

Executive Committee. There must be a minimum of

2 board members, and only board members may

serve as voting committee members.

24.03A.575(1)&(4)

● There are many things a board committee cannot do:

authorize distributions, change bylaws or articles,

make decisions on who is a board member or board

committee member, authorize a substantial change

to the organizational structure (such as merger,

selling a substantial amount of assets, dissolution,

etc.), or change a board resolution unless allowed by

a board resolution.

24.03A.575(5)

● Advisory committees do not have delegated authority

from the board and cannot make a decision on behalf

of the board. They make recommendations and

provide information to the board or do work not

required to be done by the board, such as organizing

an event, recruiting volunteers, or developing a

program evaluation. Anyone from the community

may serve on such a committee, unless otherwise

stated in the bylaws.

24.03A.575(7)

Decision-making

● If not included in bylaws, a quorum is a majority of

board members in office before a meeting starts.

Bylaws can provide for a higher quorum requirement

(like consensus), but bylaws cannot allow for a

quorum to be fewer than ⅓ of the number of directors

on the board. A quorum is required to make

decisions.

24.03A.565(1)

24.03A.565(2)

● The law does not allow board members to appear by

proxy (allowing someone else to act for them).

24.03A.565(5)

● A written vote by email or other written record can

only happen if there is 100% participation of all non-

conflicted board members, and every board member

affirmatively agrees to the proposed action.

24.03A.570

● A board may conduct meetings through the use of

one or more means of remote communication (such

as Zoom or conference call software) through which

all of the directors may simultaneously participate

with each other during the meeting.

24.03A.550

11

Board Standards in Washington State

nonprofitwa.org Page 4

Fiduciary Duties or Standards of

Conduct

● When serving on a nonprofit board, board directors

and officers have duties of care, obedience, and

loyalty to the nonprofit. Directors and officers must

act 1) in good faith (doing what’s honest, fair, and

legal), 2) with the care an ordinarily prudent person

in a similar position would take under similar

circumstances, and 3) in a way that the director or

officer reasonably believes to be in the nonprofit’s

best interests.

24.03A.495(1)

24.03A.590(1)

● Both board directors and officers, in taking board

action, may rely on the advice of or information

provided by experts such as a CPA, attorney, qualified

staff, or other professionals.

24.03A.495(3)

24.03A.590(3)

● Board officers also have a duty to tell their superiors

or the board as a whole information that is known to

be material (important), and information about

violations of law or breaches (violations) of duty.

24.03A.590(2)

Updated July 7, 2022

12

13

Attachment C

Twelve Principles of Governance That Power Exceptional Boards

Excerpted with permission from Boardsource

Exceptional boards add significant value to their organizations, making a discernible difference in their

advance on mission. Good governance requires the board to balance its role as an oversight body with its

role as a force supporting the organization. The difference between responsible and exceptional boards

lies in thoughtfulness and intentionality, action and engagement, knowledge and communication. The

following twelve principles offer chief executives a description of an empowered board that is a strategic

asset to be leveraged. They provide board members with a vision of what is possible and a way to add

lasting value to the organization they lead.

1. CONSTRUCTIVE PARTNERSHIP

Exceptional boards govern in constructive partnership with the chief executive,

recognizing that the effectiveness of the board and chief executive are interdependent.

They build this partnership through trust, candor, respect, and honest communication.

2. MISSION DRIVEN

Exceptional boards shape and uphold the mission, articulate a compelling vision, and

ensure the congruence between decisions and core values. They treat questions of

mission, vision, and core values not as exercises to be done once, but as statements of

crucial importance to be drilled down and folded into deliberations.

3. STRATEGIC THINKING

Exceptional boards allocate time to what matters most and continuously engage in

strategic thinking to hone the organization’s direction. They not only align agendas and

goals with strategic priorities, but also use them for assessing the chief executive, driving

meeting agendas, and shaping board recruitment.

4. CULTURE OF INQUIRY

Exceptional boards institutionalize a culture of inquiry, mutual respect, and constructive

debate that leads to sound and shared decision making. They seek more information,

question assumptions, and challenge conclusions so that they may advocate for

solutions based on analysis.

5. INDEPENDENT-MINDEDNESS

Exceptional boards are independent-minded. They apply rigorous conflict-of-interest

procedures, and their board members put the interests of the organization above all else

when making decisions. They do not allow their votes to be unduly influenced by loyalty

to the chief executive or by seniority, position, or reputation of fellow board members,

staff, or donors.

6. ETHOS OF TRANSPARENCY

Exceptional boards promote an ethos of transparency by ensuring that donors,

stakeholders, and interested members of the public have access to appropriate and

accurate information regarding finances, operations, and results. They also extend

transparency internally, ensuring that every board member has equal access to relevant

materials when making decisions.

14

7. COMPLIANCE WITH INTEGRITY

Exceptional boards promote strong ethical values and disciplined compliance by

establishing appropriate mechanisms for active oversight. They use these mechanisms,

such as independent audits, to ensure accountability and sufficient controls; to deepen

their understanding of the organization; and to reduce the risk of waste, fraud, and

abuse.

8. SUSTAINING RESOURCES

Exceptional boards link bold visions and ambitious plans to financial support, expertise,

and networks of influence. Linking budgeting to strategic planning, they approve

activities that can be realistically financed with existing or attainable resources, while

ensuring that the organization has the infrastructure and internal capacity it needs.

9. RESULTS-ORIENTED

Exceptional boards are results-oriented. They measure the organization’s progress

towards mission and evaluate the performance of major programs and services. They

gauge efficiency, effectiveness, and impact, while simultaneously assessing the quality of

service delivery, integrating benchmarks against peers, and calculating return on

investment.

10. INTENTIONAL BOARD PRACTICES

Exceptional boards purposefully structure themselves to fulfill essential governance

duties and to support organizational priorities. Making governance intentional, not

incidental, exceptional boards invest in structures and practices that can be thoughtfully

adapted to changing circumstances.

11. CONTINUOUS LEARNING

Exceptional boards embrace the qualities of a continuous learning organization,

evaluating their own performance and assessing the value they add to the organization.

They embed learning opportunities into routine governance work and in activities

outside of the boardroom.

12. REVITALIZATION

Exceptional boards energize themselves through planned turnover, thoughtful

recruitment, and inclusiveness. They see the correlation between mission, strategy, and

board composition, and they understand the importance of fresh perspectives and the

risks of closed groups. They revitalize themselves through diversity of experience and

through continuous recruitment.

# # #

Excerpted with permission from www.boardsource.org. For more information about BoardSource, visit

www.boardsource.org or call 800-883-6262. BoardSource (c) 2010.

Text may not be reproduced without written permission from BoardSource.

15

Attachment

D

HELPFUL COMPLIANCE INFORMATION FOR CHARITIES AND NONPROFITS

Office of the Secretary of State

Corporations & Charities

Financial information on registered

charities or the registration of

charities and commercial fundraisers

Telephone: (360) 725-0377

Toll-Free: (800) 332-GIVE

(Washington only)

www.sos.wa.gov/corporations-

charities/

Washington State Office of the

Attorney General

Consumer Protection Division

Charitable Asset Protection Team

The AG is the regulatory agency for

nonprofits and for charities that are

soliciting in the state of Washington.

Telephone: 206-464-7744

E-mail: charities@atg.wa.gov

Nonprofit Association of

Washington (NAWA)

State association for all nonprofits

in Washington; offers affordable

board education and resources for

running a nonprofit

www.nonprofitwa.org

855-299-2922

Business Licensing Services

Master Licensing Service

Business License

Telephone: (800) 451-7985

www.bls.dor.wa.gov

Department of Revenue

Washington State taxpayer services

(Annual Reporting, Exemptions,

Excise, sales, B&O taxes, etc.)

Telephone: (800) 647-7706

www.dor.wa.gov

Washington State

Gambling Commission

For those nonprofit organizations

that hold raffles, bingo, casino or

other games of chance.

Telephone: (360) 486-3440

www.wsgc.wa.gov/

Washington State

Liquor Control Board

For those nonprofit organizations

se

eking a special license to raffle or

sell liquor at specified date, time and

place.

Telephone: (360) 664-1600

www.liq.wa.gov/

Internal Revenue Service For Exempt Organization Division

Telephone: (877 )829-5500

www.irs.gov/charities

Communities Rise

For assistance in organizational

capacity-building in Washington

state

(Communities Rise is a Washington state

nonprofit corporation.)

Telephone: (206) 324-5850

www.communities-rise.org/

Washington Nonprofit Handbook

(Communities Rise Publication)

Handbook providing guidance on

many

legal issues facing nonprofit

organizations in Washington state

Washington Nonprofit Handbook

www.sos.wa.gov/sites/default/files/2022-

09/2022-Nonprofit-Handbook.pdf