1

Contents

Overview ............................................................ 2

Appropriations Overview ................................... 3

General and Miscellaneous Appropriations

Measures ........................................................... 3

Medical Marijuana, Hemp, and Associated

Products ............................................................. 5

Agriculture & Rural Measures ............................ 8

Agriculture Funding ........................................... 9

Business & Labor ................................................ 9

Corrections Funding ......................................... 13

Office of Juvenile Affairs Funding .................... 13

Economic Development & Commerce Measures

......................................................................... 14

Commerce Funding .......................................... 16

Historical Society Funding ................................ 17

Common Education ......................................... 17

Career & Technology Education Funding ......... 24

Common Education (K-12) Funding ................. 25

Higher Education ............................................. 27

Higher Education Funding ................................ 29

Hospital Authority Funding .............................. 29

Energy, Environment, & Utilities ...................... 30

Conservation Commission Funding ................. 34

Corporation Commission Funding ................... 34

Election Measures ........................................... 34

County and Municipal Government ................. 37

Public Finance .................................................. 40

State Government ........................................... 42

OMES Funding ................................................. 47

Health Measures ............................................. 47

Health Funding ................................................ 57

Health Care Authority Funding ....................... 60

Mental Health & Substance Abuse Funding .... 60

Human Services ............................................... 60

Human Services Funding ................................. 65

Insurance Measures ........................................ 66

Liquor, Smoking, & Tobacco ............................ 71

Judiciary/Court Measures ............................... 73

Judiciary Funding ............................................ 77

Professions & Occupations ............................. 78

Public Safety .................................................... 82

Public Safety and Law Enforcement Funding .. 91

Public Employees-

Retirement/Insurance/Pay/Benefits ............... 92

Taxation and Tax Exemptions ......................... 94

Tax Commission Funding ................................ 99

Transportation, Vehicle, and License Measures

........................................................................ 99

Transportation Funding ................................ 105

Veteran Measures ......................................... 107

Veterans Funding .......................................... 110

Senate & House Joint Resolutions ................ 110

Vetoed Measures .......................................... 110

Oklahoma State Senate: Session Overview

Oklahoma State Senate

Committee Staff

August 2021

2

Overview

The Oklahoma State Senate convened the 1

st

Session of the 58

th

Legislature on February

1, 2020, to tackle a host of issues ranging

from extending regulatory oversight related

to marijuana, encouraging economic growth

in the aftermath of COVID-19, adjusting

Senate and House Districts to match the

state’s population, and to continue reforming

the criminal justice system. The 58

th

Legislature also tackled the issue of rising

utility bills following the prolonged North

American winter storms of 2021.

The Oklahoma State Senate welcomed 7

new members to the body following the

2020 election, including Senators George

Burns, Jo Ana Dossett, Jessica Garvin,

Warren Hamilton, Jake Merrick, Cody

Rogers, and Blake Stephens.

At the beginning of the 1

st

Session of the

58

th

Legislature, the Senate remained

cautious as COVID-19 continued to infect

Oklahomans. Retaining the option for its

members to vote and appear for Senate

business remotely, the Senate cautiously

returned to normal business to maintain the

safety of the public, its members, and its

staff. Following the release of the vaccine in

March to members of the public, the Senate

began to phase out many of the COVID era

restrictions it imposed in the 2020 Session.

With the successful expansion of medical

marijuana growers and retailers throughout

the state, the Legislature grew concerned

with the emerging black market. To combat

these issues, the Senate voted to tighten

financial and license regulations.

The Senate also addressed matters relating

to criminal justice reform and public safety.

The passage of the Sarah Stitt Act and

various measures relating to “restorative

justice” as well as bail reform for medically

frail patients helps to alleviate crowded

prisons and provides prisoners with a viable

path to reintegration. The newly created

Unified State Law Enforcement

Commission will examine the question of

unifying state law enforcement entities to

both reduce the administrative costs of

public safety as well as increase

coordination.

Mask mandates and the specter of “vaccine

passports” also drove the Senate to action

with the passage of SB 658. The measure

prohibits any school district from

implementing a mask mandate without

consulting the county or state health

department as well as prohibits the use of

documents relating to proof of vaccination

for entry.

3

Appropriations Overview

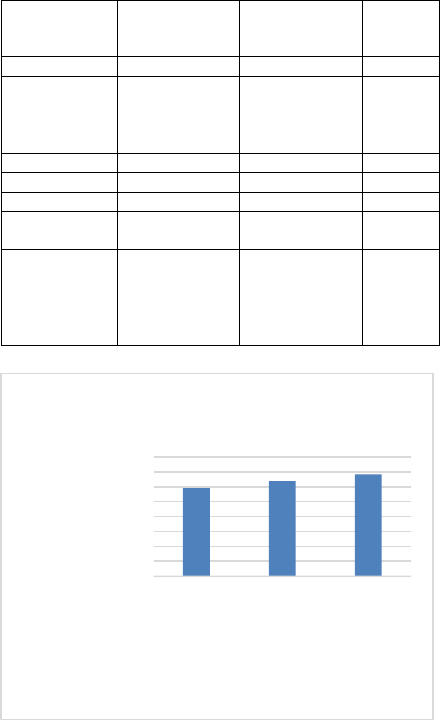

HB 2900 (Wallace/Thompson) became law

on May 24, 2021, with the approval of the

Governor. The measure provided $9.1

billion in total appropriations, which

included a $212 million increase for

common education. Additionally, the Health

Care Authority a $28 million budget

increase to incorporate newly eligible

Oklahomans that qualify for Medicaid

services.

Subcommittee

Budget

FY21 Total

FY22 GA Bill

Changes

from

Original

Education

$3,953,211,053

$4,165,614,219

5.37%

General

Government

and

Transportation

$1,019,645,842

$1,005,808,701

-1.36%

Health

$1,543,540,021

$1,761,300,769

14.11%

HHS

$844,317,829

$849,821,728

0.65%

NRR

$172,828,417

$157,248,036

-9.01%

Public Safety

and Justice

$859,247,741

$891,232,291

3.72%

Total FY'21

Appropriation

vs. Total

FY'22

Appropriation

$3,953,211,053

$4,165,614,219

5.37%

Additionally, the Legislature needed to

encourage economic recovery in the

pandemic’s aftermath. The Senate chose to

lower individual and corporate income taxes

in HB’s 2962 and 2960 respectively to

encourage investment and job growth.

General and Miscellaneous

Appropriations Measures

SB 1076 (Thompson/Wallace) directs the

Oklahoma Tourism and Recreation

Department to make available matching

funds to multicounty organizations using

funds appropriated to it in HB 2900.

SB 1077 (Thompson/Wallace) extends the

maximum 7% workers’ compensation

premium assessment for the Multiple Injury

Trust Fund for a five-year period until fiscal

year 2027.

SB 1083 (Thompson/Wallace) sunsets

provisions of law relating to the Oklahoma

Capitol Improvement Authority issuing

notes, bonds, or other evidences of

obligation for the construction of the State

Health Laboratory on July 1, 2025, if the

Authority has failed to issue such evidences

of obligation by the sunset date.

HB 2780 (Pfeiffer/Rader) adds unpaid

mixed beverage gross receipts tax to taxes

for which corporations, limited liability

corporations and other legal entities are

personally liable. The measure provides that

a claim for refund of erroneously paid sales

taxes may only be made if a vendor refuses

to honor proof of eligibility for sales tax

exemptions. Additionally, the measure

authorizes the Oklahoma Tax Commission

(OTC) to enter into a contract with a state

agency to assist in the collection of any state

tax, penalty, or interest in which that agency

has authority to collect and control. The

Commission must charge a collection

assistance fee to the agency equal to 10% of

the total amount collected. OTC may also

enter into the same type of contract with the

Oklahoma Employment Security

Commission and have the authority to

collect and enforce unemployment tax,

penalties, and interest. The OTC may

$2,000,000,000

$3,000,000,000

$4,000,000,000

$5,000,000,000

$6,000,000,000

$7,000,000,000

$8,000,000,000

$9,000,000,000

$10,000,000,000

FY20 Appropriation

FY21 Appropriation

FY 22 Appropriation

Total Appropriations

4

garnish the accrued earnings of a delinquent

taxpayer by sending notice and specific

procedures to the taxpayer’s employer and

places liability on the employer for the total

amount of delinquent taxes if they willfully

disregard or refuse a notice from OTC

regarding the delinquency of an employee.

The measure also increases the time period

from 5 days to 15 days, in which delinquent

taxes must be remitted when OTC contracts

with a debt collections agency. Additionally,

the measure removes the name of the

County Government Education Technical

Revolving Fund and alters it to an agency

special account to be used for the collection

and distribution of documentary stamp

revenues, the apportionment of which shall

start in the fiscal year ending June 30, 2022.

Any funds remaining in the revolving fund’s

reserve account on November 1, 2021, shall

be transferred to the special agency account.

The measure also allows OTC to distribute

funds from the agency special account to the

Oklahoma State University Center for Local

Government Technology or the Oklahoma

Cooperative Extension Service County

Training Program. The measure also limits

the liability of incentive payments made for

film production rebates to the balance of the

Oklahoma Film Enhancement Rebate

Program Revolving Fund.

HB 2870 (Wallace/Thompson) authorizes

the Commissioners of the Land Office to

pay fees to multiple custodial banks as well

as investment consultants from certain

funds. The measure also directs the CLO to

require written competitive bids for

custodial banks every 10 years rather than

every 5 years.

HB 2893 (Wallace/Thompson) modifies the

apportionment of taxes and fees collected

from the insurance premium tax to the

Oklahoma Firefighters Pension and

Retirement Fund, the Oklahoma Police

Pension and Retirement System, the Law

Enforcement Retirement Fund, and the

Education Reform Revolving Fund.

HB 2894 (Wallace/Thompson) eliminates

the second year of an insurance premium tax

apportionment change provided in HB 2741

(2020).

HB 2897 (Wallace/Thompson) creates a

revolving fund in the state treasury for the

Ethics Commission to be known as the

“Ethics Commission Online Filing

Revolving Fund.” The fund shall be a

continuing fund and the deposits to the fund

shall consist of the first $200,000.00

designated for deposit to the fund. Monies in

the fund may be used by the Commission to

develop, maintain, and administer the

Commission’s online filing system and for

payment of fees and charges to other state

agencies for information technology

services.

HB 2898 (Wallace/Thompson) provides that

all monies submitted by sheriffs to the

Oklahoma State Bureau of Investigation as

processing fees for applications for a

handgun license are to be deposited in the

General Revenue Fund beginning July 1,

2022.

HB 2907 (Wallace/Thompson) directs the

Oklahoma Conservation Commission’s

Master Irrigator Program to utilize

appropriated dollars as follows:

1) $90,000.00 for training and

2) $50,000.00 for research on the Ogallala

Aquifer

HB 2910 (Wallace/Thompson) authorizes

certain state agencies to establish a Capital

Account Fund consisting of funds from the

agencies’ standard appropriations for the

5

purpose of maintaining, repairing and

improving agency property.

HB 2911 (Wallace/Thompson) exempts the

Department of Tourism and Recreation from

the requirement that state agencies allocate

1.5% of expenditures for capital projects to

the Oklahoma Arts Council to fund the Art

in Public Places Act.

HB 2951 (Wallace/Thompson) creates the

State-Tribal Litigation Revolving Fund for

the purpose of hiring legal counsel and

paying expenses related to legal

controversies between the State and tribal

governments. The measure provides that if

these provisions are found unconstitutional,

the balance of the Fund shall be reverted to

the General Revenue Fund.

Medical Marijuana, Hemp, and

Associated Products

SB 460 (Paxton/Fetgatter) authorizes

industrial hemp growers to remediate any

industrial hemp so long as all THC is

removed and it is processed as Cannabidiol.

SB 862 (Paxton/Bush) provides that

buildings owned by a county or municipal

government as well as trusts or authorities

with a county or municipal government as

the beneficiary to be designated as smoke

free locations. Such locations prohibit the

use of tobacco, nicotine, marijuana, or other

lawful products consumed in a smoked or

vaporized manner.

SB 1033 (Leewright/Fetgatter) caps the

number of patients a caregiver may cultivate

medical marijuana plants for at no more than

5 licensed patients. The measure provides

for medical marijuana establishments to

maintain a building within 1000 feet of a

new school building provided the license for

such an establishment was granted prior to

the establishment of the building or there

was an error of measurement as it relates to

the distance of the dispensary from the

school. The measurement shall be based on

the distance in a straight line from the school

door nearest the front door of the retail

marijuana establishment to the front door of

the retail marijuana establishment. The

measure also clarifies that any original

medical marijuana business license issued

on or after June 26, 2018, by the Authority,

for a medical marijuana commercial grower,

a medical marijuana processor, or a medical

marijuana dispensary shall be deemed to

have been grandfathered into the location on

the date the original license was first issued

and provides for the grandfathered status to

be transferred is a change in ownership

occurs. The Medical Marijuana Authority

shall not deny any issuance or renewal of

licensure, deny any transfer of licensure due

to a change in ownership, or revoke any

license due to mistake in measurement by

the Authority. The measure authorizes

municipalities to object to the continued

licensure of the grandfathered medical

marijuana dispensary when it is operating

contrary to the required setback distance

from a public or private school. Upon the

municipal government providing the

required documentation outlined in the

measure, the Authority shall not renew or

transfer the medical marijuana dispensary

license and shall cause the license to be

revoked. The measure also clarifies that

“marijuana” shall not include any plant or

material containing delta-8 or delta-10

tetrahydrocannabinol which is grown,

processed or sold pursuant to the provisions

of the Oklahoma Industrial Hemp Program.

The State Department of Health is

authorized by the measure to enter into and

negotiate the terms of a Memorandum of

Understanding between the Department and

other state agencies concerning the

enforcement of laws regulating medical

marijuana by the measure. Additionally, the

6

measure requires each medical marijuana

research facility, medical marijuana

education facility, and medical marijuana

waste disposal facility develop written

standard operating procedures outlining the

way it operates its seed-to-sale tracking

system. Additionally, the measure authorizes

a publicly traded company as defined in the

measure may purchase up to 40% of the

equity in an existing Oklahoma business that

holds a valid Oklahoma medical marijuana

grower, processor or transporter license.

Such a business must hold a valid medical

marijuana grower, processor or transporter

license for at least 18 months prior to the

investment. A licensed medical marijuana

dispensary shall not be qualified for

investment or equity purchase. The measure

also expands medical marijuana waste to

include any products deemed to have failed

laboratory testing and cannot be remediated

or decontaminated. Medical marijuana waste

shall also include products from a medical

marijuana business facility deemed to have

gone out of business or products that are

unable to be lawfully transferred or sold the

to another commercial licensee. After

November 1, 2021, the measure eliminates

the cap on medical marijuana waste licenses

that may be issued. The State Department of

Health is authorized by the measure to enter

into a contract with the Oklahoma Tax

Commission to collect and enforce the 7%

tax on retail medical marijuana sales. The

assessment, collection, and enforcement

authority shall apply to any tax and any

penalty or interest liability on retail medical

marijuana sales existing at the time of

contracting. The Commission may charge

the Department a 1.5% fee on the gross

collection proceeds.

HB 2272 (Josh West/Murdock) requires

current medical marijuana business licensees

and applicants seeking licensure as a

medical marijuana business to respectively

submit an attestation confirming or denying

the existence of any foreign financial

interests in the medical marijuana business

operation and to disclose such ownership

within 60 days to the Oklahoma State

Bureau of Narcotics and Dangerous Drugs

Control or the Medical Marijuana Authority.

Failure to submit the attestation or

accompanying information to the Bureau

within the specified 60-day period shall

result in the immediate revocation of the

medical marijuana business license.

HB 2279 (Josh West/Kidd) creates the

Oklahoma Industrial Hemp Remediation

Program and provides definitions for terms

used in the act, including Hemp Program,

which is defined as the Oklahoma Hemp

Industrial Reform Program and any final

ruling from the USDA. The measure allows

a person licensed by the Oklahoma

Department of Agriculture, Food, and

Forestry whose hemp is deemed

noncompliant with the Hemp Program to

request approval from the Department to

remediate the hemp. The licensee must

promptly have the hemp extracted by a

licensed processor into concentrated form

and sampled by a certified laboratory for

THC levels if approved. If the samples are

below USDA levels for THC, the hemp is

compliant and can be sold commercially. If

the samples are noncompliant, the

Department must be notified and the

samples must be destroyed.

HB 2646 (Echols/Taylor) changes several

provisions of law relating to medical

marijuana usage, production, and disposal.

The measure provides that patient licenses

must be signed by an Oklahoma physician

licensed by and in good standing with the

State Board of Medical Licensure and

Supervision or the State Board of

Osteopathic Examiners. Patients are

authorized by the measure to request the

7

withdrawal of their caregiver’s license at

any time. The measure extends the time for

the Department of Health to review

dispensary licenses from 2 weeks to 90 days.

Additionally, the measure authorizes

dispensaries to package and sell prerolled

marijuana to licensed medical marijuana

patients and licensed caregivers. Such

products shall contain only the ground parts

of the marijuana plant and shall not include

marijuana concentrates or derivatives and

may not exceed 1 gram. Dispensaries are

also prohibited from displaying or offering

for sale products not contained in a sealed or

separate package. Commercial growers are

authorized by the measure to sell pre-rolled

marijuana to dispensaries. Such products

shall be subject to the same limitations

placed on dispensaries as it relates to

prerolled marijuana. Additionally, the

measure provides that the State Department

of Health may issue 2 types of processor

licenses for hazardous and non-hazardous

materials. Licensed commercial growers

may transfer medical marijuana that has

failed testing to a licensed processor only for

the purposes of decontamination or

remediation. The measure clarifies that the

Department may also inspect a processing

facility up to 2 times a year. The Department

is also directed to establish regulations

which require a medical marijuana business

to submit information to the Oklahoma

Medical Marijuana Authority deemed

reasonably necessary to assist the Authority

in the prevention of diversion of medical

marijuana by a licensed medical marijuana

business. Business licensees are required to

submit a sample or unit of medical

marijuana or medical marijuana product to

the quality assurance laboratory when the

Department has reason to believe the

medical marijuana or medical marijuana

product may be unsafe for patient

consumption. The measure establishes fines

for fraudulently reporting within a 2-year

period information as well. The fine is set at

$5,000.00 for the first violation and

$10,000.00 for second and subsequent

violations. Licensees whose license was

suspended or revoked during the 5 years

preceding an application shall be denied a

license. The Department is authorized by the

measure to issue a written order to any

licensee the Department has reason to

believe has committed a violation. The

written order shall state with specificity the

nature of the violation and shall become a

final order not more than 30 days after the

order is served to the licensee. The licensee

may request an administrative hearing. The

Department is authorized by the measure to

issue an emergency order in certain

circumstances. Entities failing to comply

with the emergency order shall be subject to

a $10,000.00 fine per day of noncompliance.

Additionally, unless the Department

determines otherwise, an application that has

been resubmitted but is still incomplete or

contains errors that are not clerical or

typographical in nature shall be denied. The

measure directs the Department to issue

medical marijuana transporter licenses to

licensed medical marijuana research

facilities, medical marijuana education

facilities and medical marijuana testing

laboratories upon issuance of such license

and upon renewal. Laboratories may not be

owned by any person with a business

interest in a licensed medical marijuana

business or any person who is related to a

person with an interest in the commercial

aspects of the industry. The measure

specifies that distance from schools is to be

measured from the nearest property line of

the school to the nearest perimeter wall of

the dispensary. Properties that are not used

for classroom instruction on core curriculum

and are not on the same campus as a

building used for such do not constitute a

school. The establishment of a school within

1,000 feet of an already existing dispensary

8

shall not be cause for revocation or

nonrenewal of the license. The measure also

authorizes the Department to appoint 8

additional members to the Medical

Marijuana Advisory Council. The measure

requires the makeup of the council to

include members of the medical marijuana

industry. Any person who manufactures,

distributes, dispenses, prescribes,

administers or uses for scientific purposes

any controlled dangerous substances within

or into this state without first obtaining a

registration issued by the Director of the

Oklahoma State Bureau of Narcotics and

Dangerous Drugs Control shall be subject to

the same statutory and administrative

jurisdiction of the Director as if that person

were an applicant or registrant.

Agriculture & Rural Measures

SB 775 (Murdock/Dempsey) authorizes the

Oklahoma Department of Agriculture, Food,

and Forestry to create a Livestock Offender

Registry and to provide access to this

registry to the public on the Department’s

website. Counties in which the offender is

convicted shall submit a certified copy of

the judgment and sentence confirming the

conviction for entry in the Livestock

Offender Registry to the Oklahoma

Department of Agriculture, Food, and

Forestry or to a statewide livestock

organization designated by the Department.

SB 812 (Murdock/Fetgatter) provides for the

court to order a person to surrender his or

her hunting or fishing license to an officer

from the Department of Wildlife

Conservation present at the hearing upon

conviction of a violation relating to certain

violations. The measure also authorizes the

court clerk to transmit the conviction

information by using an electronic method

authorized by the Department of Wildlife

Conservation.

SB 839 (Dahm/Sean Roberts) specifies that

a game warden shall not have the authority

to use or place a game or wildlife camera on

private property without the permission of

the owner or controller of the property.

SB 844 (Dahm/Gann) repeals the provision

of law entering Oklahoma into the Southern

Dairy Compact.

HB 1001 (Bush/Hall) clarifies the data

required to be maintained by a scrap metal

dealer. The measure provides that any

federally recognized identification card can

be used and requires a vehicle identification

number to be recorded if no license plate is

affixed. Items purchased by a buyer or sold

by a dealer must be captured digitally and

records of the transaction must be

maintained for at least 2 years after the date

of sale. The measure removes separate

requirements for recording data about

purchases of scrap metal under 35 pounds

and of purchases 35 pounds and over. The

person selling the scrap must provide either

a certificate of title, a notarized power of

attorney from the individual on the title

authorizing the seller to dispose of the

vehicle on their behalf, or a statement of

ownership from the seller accompanied by a

bill of sale from the lawful owner. The

measure places any copper wire that is 4

gauge or larger and any copper wire from

which the insulation or coating has been

burned or melted, as well as remote storage

batteries, under the provisions of the Scrap

Metal Dealers Act.

HB 1032 (Mize/Pugh) changes the name of

the Home Bakery Act of 2013 to the

Homemade Food Freedom Act. The

measure provides that the production and

sale of homemade food products that meet

the certain conditions outlined in the

measure shall be exempt from licensing

requirements. Such conditions shall regulate

9

the sale and delivery of non-time- or -

temperature-controlled-for-safety

homemade food products and requires such

products to be sold directly to the consumer

from the producer. Producers are also

required to complete at least 8 hours of

training approved by the Oklahoma

Department of Agriculture, Food, and

Forestry. Homemade food products must

also have a label affixed to its packaging.

HB 1620 (Mize/Montgomery) prevents any

political subdivision or the state government

from prohibiting agritourism activities,

which is defined as using livestock or other

animals for entertainment or educational

purposes.

HB 1631 (David Hardin/Murdock) requires

nutrient management plans for new or

expanding poultry feeding operations to be

prepared by the operator or designee of the

operator. The plan must be submitted to the

Oklahoma Department of Agriculture, Food

and Forestry for review and approval. Every

nutrient plan must be updated and submitted

to the Department every 6 years. The

measure also allows a current operator to

submit a 1-page amendment to the most

recently submitted plan in lieu of a renewal

plan.

HB 2214 (McDugle/Murdock) provides that

every annual license issued by the

Oklahoma Wildlife Conservation

Commission shall be valid for a full 365

days after issuance notwithstanding any

provision of law or rule to the contrary.

HB 2325 (Frix/Bergstrom) provides that

escort vehicle requirements shall not apply

to retail implement dealers transporting farm

implements from a retail distribution point

to a farm or other location within a 150 air-

mile radius from the distribution point.

HB 2364 (Burns/Murdock) prohibits anyone

from labelling a bovine product as

“Oklahoma Certified Beef” unless the

product was bred, born, raised, and

slaughtered in the state.

HB 2467 (Kerbs/Murdock) repeals the Fuel

Alcohol Act.

HB 2471 (Dick Lowe/Kidd) allows the

Department of Agriculture to establish

expiration dates and renewal due dates for

pesticide applicator licenses.

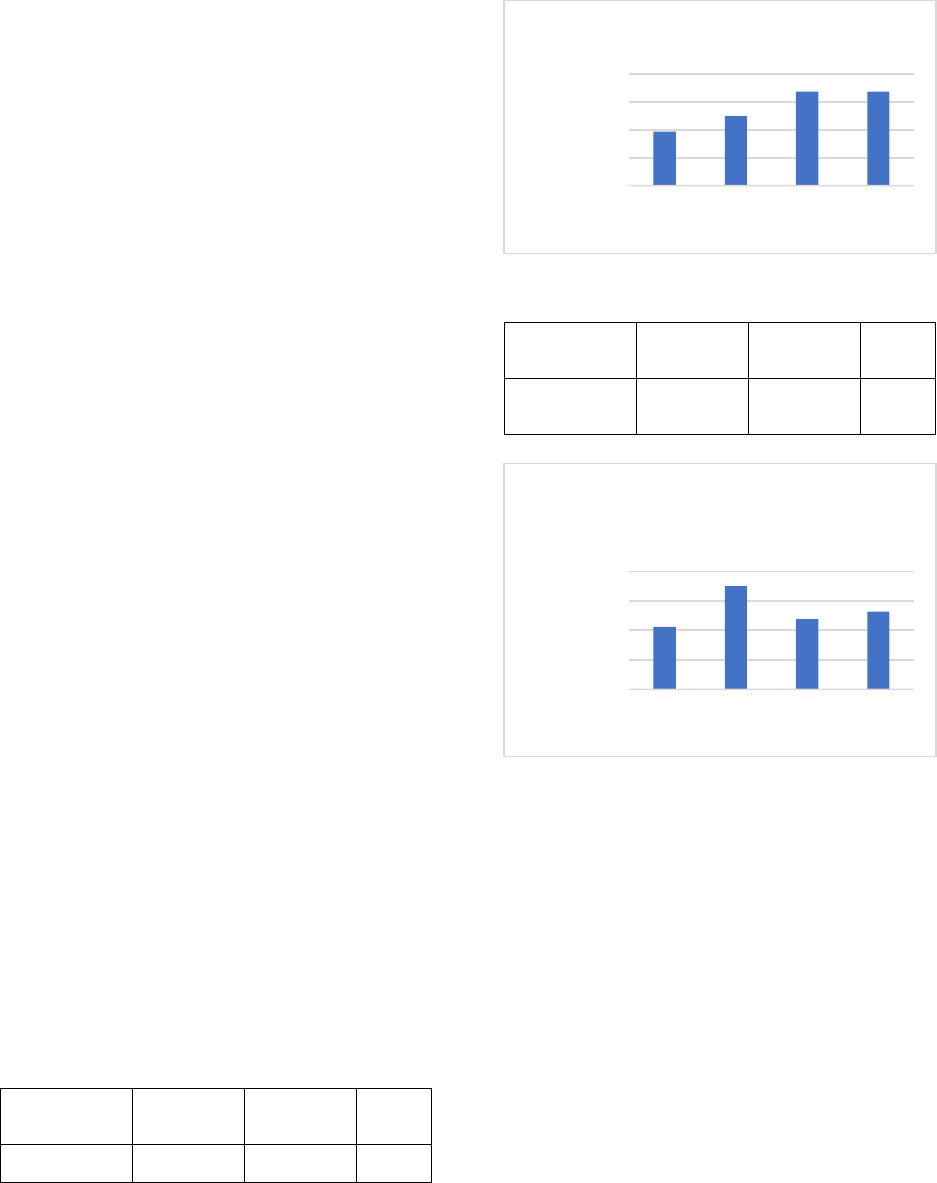

Agriculture Funding

HB 2906 (Wallace/Thompson) directs the

Department of Agriculture to utilize

appropriated dollars as follows:

1) $3 million for the Oklahoma State

University College of Veterinary Medicine;

2) $2 million for the Oklahoma State

University Agriculture Extension Service;

3) $1 million for the Oklahoma State

University Agriculture Experiment Stations;

4) $150,000.00 for facility improvements for

cattle stock shows; and

5) $300,000.00 to hire additional meat

inspectors.

Agency

FY21

Appropriation

FY22

Appropriation

Change

From

Original

Department

of

Agriculture

$26,989,607

$31,527,896

16.81%

Business & Labor

$0

$10,000,000

$20,000,000

$30,000,000

$40,000,000

FY19…

FY20…

FY21…

FY 22…

Department of Agriculture

10

SB 200 (Montgomery/Pae) authorizes a

victim of domestic violence, sexual

violence, or stalking to terminate a lease

without penalty by providing written notice

and a protective order within 30 days of the

incident to his or her landlord. The landlord

may waive the 30-day deadline.

Additionally, the measure prohibits any

landlord from denying renewal of or

terminating a lease because the applicant or

tenant is a victim or alleged victim of

domestic violence, sexual violence, or

stalking regardless of whether there exists a

current protective order. The measure also

prohibits any landlord from denying an

applicant tenancy or retaliate against a

tenant because the applicant or tenant has

previously terminated a rental agreement

using the provisions outlined in this

measure.

SB 228 (Montgomery/O’Donnell) modifies

certain provisions of the Oklahoma General

Corporation Act. The measure authorizes

written notice to be provided in an electronic

format as it applies to organization meetings

of a corporate board and notification

applying to the transfer of stock. The

measure additionally authorizes members of

a board to consent to an action that will be

effective at a future time, provided the

action occurs within 60 days. The measure

also creates a new section of law governing

the document form, signature requirements,

and delivery requirements of electronic

documents. The measure provides for the

issuance of capitol stock to be issued in one

or more transactions in a manner outlined in

a resolution passed by the board. The

resolution must fix a maximum number of

shares that may be issued and a schedule of

issuance. Stock may be issued in a manner

dependent upon facts ascertainable outside

the formula adopted by the board, provided

the manner in which such facts shall operate

upon the formula is clearly and expressly set

forth in the formula or in the resolution

approving the formula. The measure states

that a corporation may not send defective

corporate act to its shareholders for

ratification provided there are no shares of

valid stock outstanding and entitled to vote.

The measure also defines a stock ledger to

mean records administered by or on behalf

of the corporation in which the names of all

the corporation’s shareholders of record, the

address and number of shares registered in

the name of each such shareholder, and all

issuances and transfers of stock of the

corporation are recorded. The measure

removes outdated language relating to

telegrams and replaces it with electronic

transmissions as it relates to granting

consent for certain actions. The measure

requires corporation merger agreements to

clearly show any changes made to the

certificate of incorporation of the surviving

corporation or a statement showing that the

merger shall not amend the certificate if the

merger includes a domestic corporation. In

cases of consolidation, the certificate must

be as set forth in the consolidation

agreement.

SB 273 (Quinn/Miller) requires any person

preparing or persons charging a fee for the

preparation or assistance in preparation of

lien notices on personal property to register

with the Oklahoma Tax Commission and

submit a $50.00 annual registration fee. Any

person found to prepare or assist in the

preparation of a lien notice without

registration shall be assessed a $100.00

penalty. The provisions of this measure do

not apply to a lawful possessor or employee

of a lawful possessor of the property for

which such notices are issued.

SB 335 (Pederson/Newton) provides a

mechanism to revert burial sites to public or

private cemeteries. The measure requires the

site to be unused for 75 years and a

11

reasonable search to find the owner is to be

conducted by the entity responsible for the

site. A reasonable search, as defined by the

measure, includes sending a certified letter

to the last known address associated with the

site on record and publishing a description

of the site in a newspaper qualified to

publish public notices. If no address is on

file, no letter will be required. If no person

proves their claim on the site within one

year of publication in the paper, the site will

be deemed abandoned. Any person with a

legitimate claim on a site deemed abandoned

shall be compensated with a plot equal in

value to the site deemed abandoned.

SB 549 (Standridge/Frix) provides that

neither a relocation permit nor any outdoor

advertising sign permit shall be issued in

those areas in which a municipality or

county has lawfully enacted a prohibition on

the erection of an outdoor advertising sign.

SB 552 (Murdock/Martinez) increases the

maximum bracket amounts a pawn shop

may levy on finance charges by the

following amounts:

1) $250.00 from $100.00 for 20%,

2) $500.00 from $250.00 for 15%,

3) $1,000.00 from $500.00 for 10% and,

4) $5,000.00 from $1,000.00 for 5%

SB 568 (Montgomery/Hilbert) exempts sales

of securities offered by corporations that

meet the requirements of the federal

exemption for intrastate offerings sold to

persons residing in the state from the

provisions of the Oklahoma Uniform

Securities Act of 2004. Such sales shall be

limited to $5 million transactions and shall

not exceed $5,000.00 per individual. The

issuer shall be required to hold the funds in

an escrow account and shall be required to

make certain notifications. Certain entities

are prohibited from offering securities using

the provisions of the measure.

SB 792 (Leewright/Manger) provides for the

Insurance Commissioner to authorize a

bondsman exceeding the maximum amount

of Federal Deposit Insurance Corporation

basic deposit coverage when a state of

emergency or disaster is declared. The

measure also requires bondsmen to deposit

cash or other forms of compensation within

2 business days after receiving such

compensation in an established, separate

non-interest-bearing trust account.

Additionally, the measure provides for

bonds posted for a petition for revocation of

a suspended sentence, a petition for

acceleration of a deferred sentence or any

violation of a probationary term to be

exonerated by operation of law in certain

circumstances. Premiums for a bail bond

shall be considered earned when the

defendant on the bond is released from

custody and is not incarcerated in any

capacity or if the bondsman and the payor of

the bond premium have agreed in writing

that the purpose of the bond is to secure the

transfer of the defendant to another

jurisdiction. The payor of the premium or

the depositor of any collateral may request

the return of any unearned bond premiums.

SB 794 (Leewright/Wallace) requires the

Oklahoma Employment Security

Commission (OESC) to shift its filing

methods to prefer electronic e-filing and

provides for the Commission to complete

the process during its OESC 2020-21

business process transformation. All

claimants and employers tendering

documents to the Commission will be

expected to tender the documents

electronically. The measure also exempts

employees of private for-profit entities that

provide to or on behalf of an educational

institution from the requirement to pay

unemployment benefits in on the same terms

and subject to the same conditions as

12

benefits payable on the basis of other service

subject to the Employment Security Act of

1980. Additionally, the measure specifies

that an individual, seasonal employee shall

only be eligible for payments based on the

wages of the nonseasonal employment. The

OESC is required by the measure to send

notice of overpayment to any individual

receiving more compensation than he or she

is entitled to. If the individual disagrees with

this determination, the individual may file

an appeal of the determination with the

Appeal Tribunal within 10 days of receipt.

The OESC is also authorized to enter into an

agreement with the Department of Human

Services for information required to identify

persons that owe child support obligations.

The measure also requires the OESC to

return overpayments received in the

Employer's Unemployment Tax Account.

The measure directs the OESC to return the

remaining balance of the employer’s

unemployment tax account to the employer

upon terminating the employer’s account,

unless the balance has remained the same

for over 180 days and the employer has not

requested a refund.

SB 796 (Leewright/McEntire) increases the

cap on loan finance charges for supervised

lenders from 27% to 32% per year on that

part of the unpaid balances of the principal

which is $7,000.00 or less and adjusts the

other tiers accordingly. The measure also

provides for lenders to assess a up to a

$28.85 closing fee.

SB 1013 (Daniels/Kannady) provides for

litigation files and investigatory reports of

the Workers’ Compensation Commission to

be considered confidential. The measure

also allows an attorney of the Compliance

Division of the Commission or an

investigator of the Division to provide

testimony on matters the employee has

received through the performance of the

employee’s duties.

HB 1034 (Mize/Pugh) requires banks and

credit unions to transfer the money to the

known heirs of the deceased without

requiring the heirs to open an additional

account if the owner of a bank or credit

union account with $50,000.00 or less dies

and has no payable-on-death beneficiary if

no probate proceedings are pending. The

affidavit sworn to and signed by the known

heirs establishing jurisdiction, heirship and

intestacy may contain a clause indemnifying

the bank from any damages relating to the

release of the funds. The measure provides

that in the event of pending probate

proceedings, the release of the deposits in

the account shall be determined by the court.

HB 1112 (Talley/Allen) eliminates statutory

hunting seasons and authorizes the Wildlife

Conservation Commission to establish

hunting season timeframes.

HB 1772 (Sims/Pugh) requires the State

Board of Health to provide a multi-seasonal

license for snow cone stands that sell hot

beverages in addition to snow cones. Snow

cone stands that do not sell hot beverages

will be classified as a seasonal food

establishment.

HB 2026 (O’Donnell/Daniels) amends the

definition of employee as it relates to the

Administrative Workers’ Compensation Act

to no longer exclude persons who provide

services in a medical care or social services

program or participants in a work or training

program administered by the Department of

Human Services.

HB 2238 (May/Rader) provides that persons

are not prohibited from soliciting rides,

donations, employment, or business from

occupants of vehicles on roadways

13

maintained by a city or town if they are in

compliance with a permit and regulations

adopted by ordinance.

HB 2397 (Russ/Howard) includes

judgement liens and their holders as it

relates to current law regulating title

insurers.

HB 2398 (Russ/Howard) includes

judgement liens in certain requirements

regarding debt payments on real estate. The

measure also allows an agent representing a

mortgagor or debtor to request the release of

a mortgage or lien if the holder has failed to

do so within 30 days after payment of the

debt.

HB 2501 (Culver/Bullard) defines

“authorized agent or representative” within

the Oklahoma Abstractors Act. The measure

authorizes the release of an abstract to an

authorized agent or representative of the

owner.

HB 2568 (Chad Caldwell/Murdock)

authorizes Oklahoma banks and credit

unions to offer savings promotion raffles as

defined in the measure and provides that

such raffles shall not constitute a violation

of the provisions of Oklahoma lottery and

gambling laws.

HB 2677 (Marti/McCortney) modifies

several provisions of the Pharmacy Audit

Integrity Act. The measure strikes language

relating to appeal procedures to be

specifically described in a contract between

a pharmacy and the entity conducting the

audit and requires the auditing entity to give

the required written notice by certified letter.

A 30-day notice is required to be given prior

to a wholesale purchase audit as well. Audits

are reduced from 75 prescriptions per year

per pharmacist to 50 per year per pharmacist

and must be delivered within 10 days.

Pharmacists may reverse and resubmit

claims within 30 days of receipt of the final

audit report. Auditors are required to

conduct each pharmacy audit under identical

standards, regularity, and parameters as

similarly situated pharmacies. Additionally,

pharmacists are not required to open for

single-patient-use only packaging nor are

they required to submit a full dispensing

report in a wholesale purchase review.

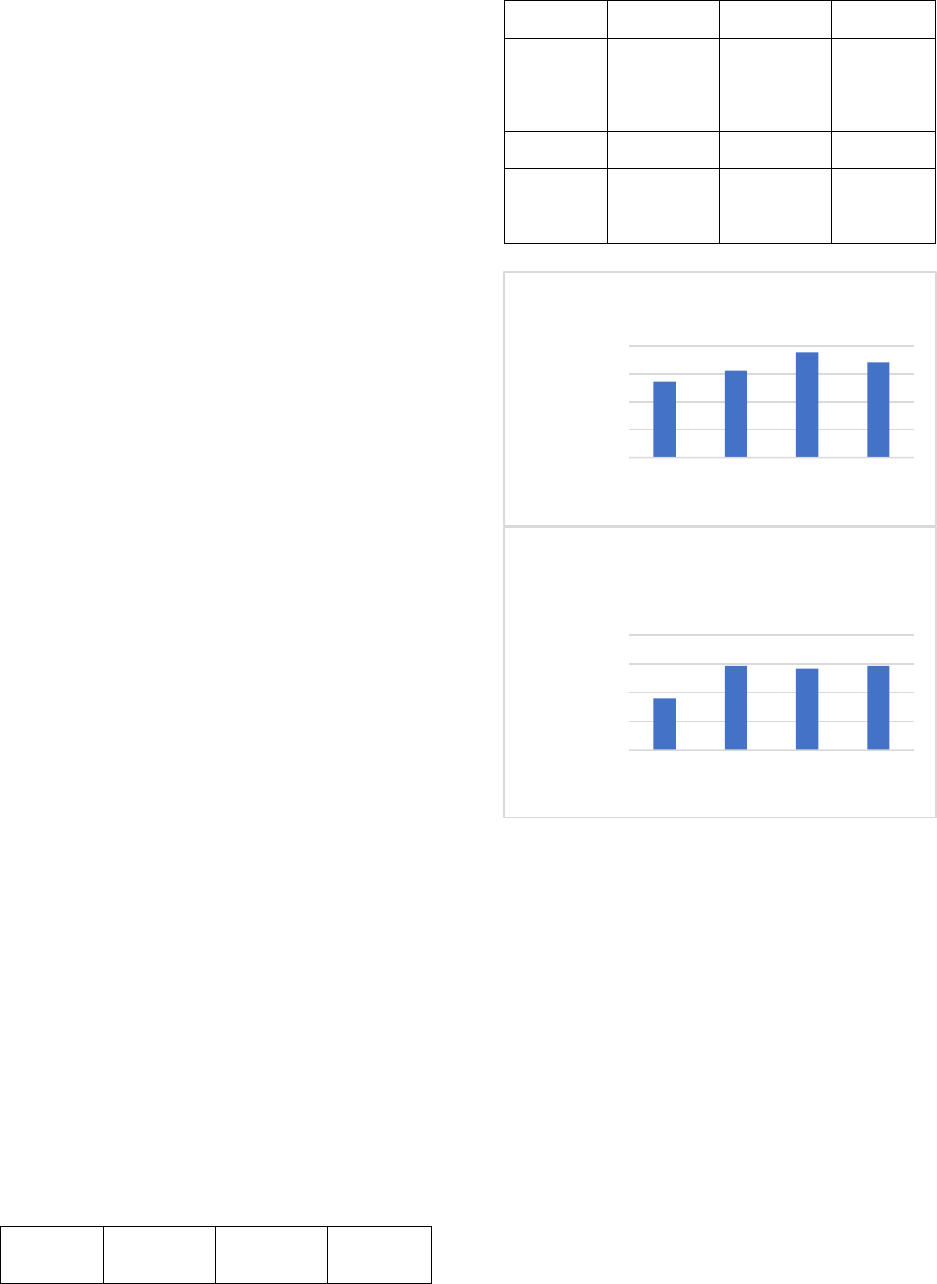

Corrections Funding

Agency

FY21

Appropriation

FY22

Appropriation

Change

From

Original

Department of

Corrections

$531,112,247

$544,278,904

2.48%

Pardon and

Parole

$2,273,400

$2,273,400

0.00%

Office of Juvenile Affairs Funding

Law Enforcement Funding

Agency

FY21

Appropriation

FY22

Appropriation

Change

From

Original

Office of

Juvenile

Affairs

$96,795,111

$93,033,434

-3.89%

$480,000,000

$500,000,000

$520,000,000

$540,000,000

$560,000,000

FY19…

FY20…

FY21…

FY 22…

Department of Corrections

$2,200,000

$2,250,000

$2,300,000

$2,350,000

$2,400,000

FY19…

FY20…

FY21…

FY 22…

Pardon and Parole Board

14

Economic Development & Commerce

Measures

SB 71 (Bergstrom/McDugle) requires the

Oklahoma Department of Commerce to, in

addition to the other rulemaking

requirements relating to the Oklahoma Local

Development and Enterprise Zone Incentive

Leverage Act, establish reporting

requirements for the purpose of collecting

data.

SB 587 (Howard/Boles) adds entities subject

to the jurisdiction of the State Board of

Career and Technology Education or the

Oklahoma State Regents for Higher

Education to the list of eligible local

government entities as it relates to the

Oklahoma Community Economic

Development Pooled Finance Act.

SB 608 (Hall/Fetgatter) creates the Filmed

in Oklahoma Act of 2021. The measure

provides for the establishment of an

incentive rebate program for certain film

projects and eligible television series

projects filmed or produced in Oklahoma

that meet the requirements outlined in the

measure. Such projects must provide

evidence that all Oklahoma crew and local

vendors have been paid and that there are no

pending liens against the production

company, file appropriate tax returns,

provide evidence of financing for production

prior to the commencement of principal

photography, provide evidence of a

certificate of general liability insurance with

a minimum coverage of $1 million and a

workers’ compensation policy, and provide

evidence that the projects are completed.

Companies cannot simultaneously claim the

rebate and the sales tax exemption provided

for in current law or the rebate provided in

the Compete with Canada Film Act. If a

production company has received the

exemption from sales taxes and submits a

claim for rebate pursuant to the provisions

of this act, the company shall be required to

fully repay the amount of the exemption to

the Tax Commission. The program shall be

administered by the Oklahoma Department

of Commerce and the Oklahoma Tax

Commission. The Department shall be

required to submit an annual report to the

President Pro Tempore of the Seante,

Speaker of the House, the Chair of the

Appropriations and Budget Committee of

the House of Representatives, the Chair of

the Appropriations Committee of the Senate,

and the Director of the Legislative Office of

Fiscal Transparency detailing the program

and incentive rebate payments on October 1

of each year. The total amount of rebate

payments conditionally pre-qualified by the

Department of Commerce each fiscal year

shall not exceed $30 million. The measure

also caps the amount of rebates awarded to

projects based on the expenditure of the

individual project. The base incentive

amount for a project filmed in this state shall

be a maximum of 20% of the qualified

production expenditure amount. An

incentive for a project filmed in this state for

wages paid to nonresident crew, not

including above-the-line personnel, before

July 1, 2023, shall be provided in the

amount of 7.5%. The measure provides

additional incentives to projects that film or

locate in certain areas outlined in the

measure. The measure also requires projects

to utilize apprentices and display a

Department-approved logo in the end credits

to qualify for the rebate. Additionally, the

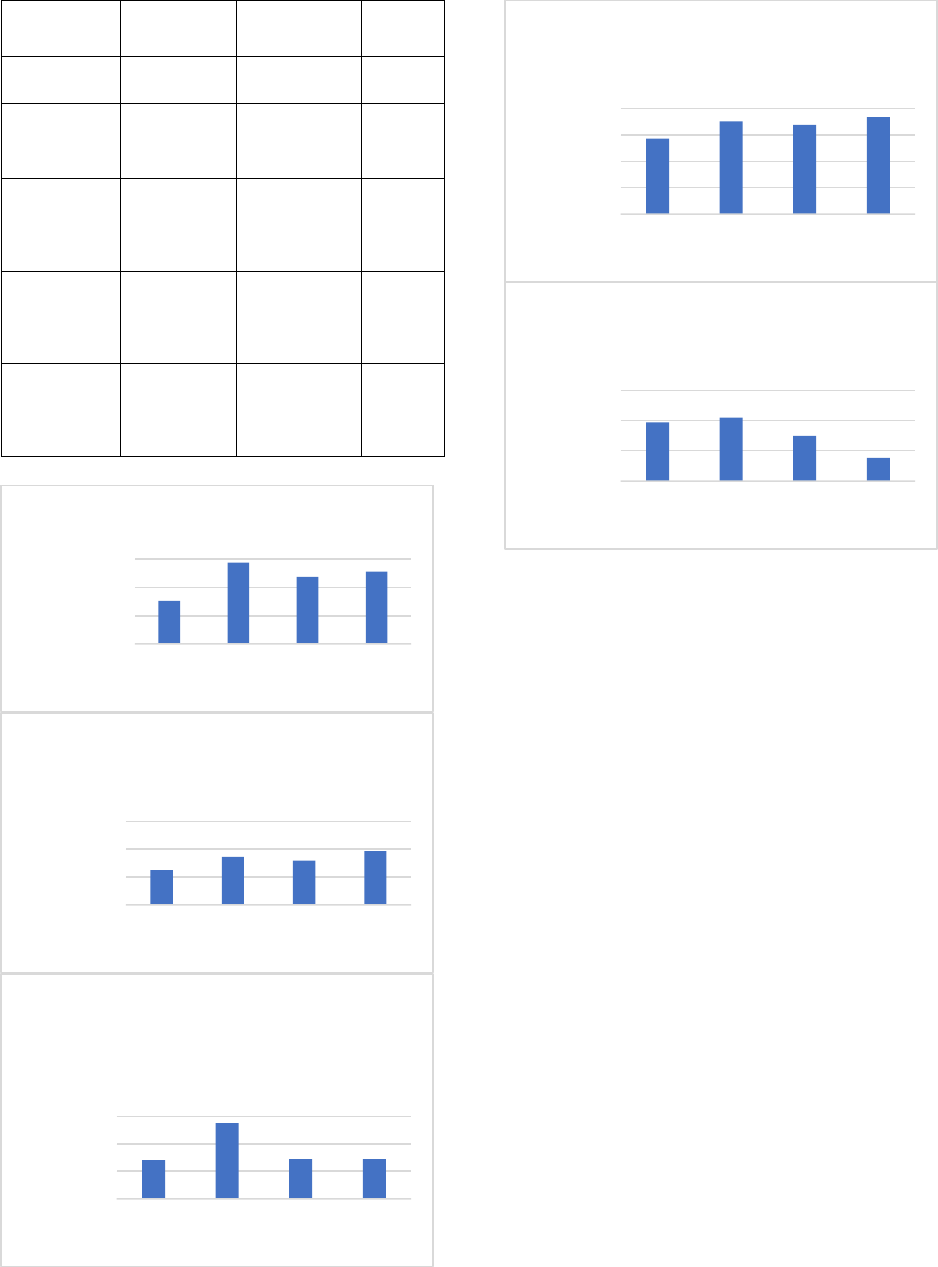

$90,000,000

$92,000,000

$94,000,000

$96,000,000

$98,000,000

FY19…

FY20…

FY21…

FY 22…

Office of Juvenile Affairs

15

measure creates the Filmed in Oklahoma

Program Revolving Fund and provides for

$30 million to be transferred to the Fund

using monies derived from the income tax.

SB 609 (Coleman/Hilbert) provides that the

minimum investment into real property must

be valued at a minimum of $500,000.00 to

qualify for the investment income tax

exemption during calendar year 2022. The

amount shall increase annually based on the

previous year’s increase in the Consumer

Price Index-All Urban Consumers. To

qualify for the exemption using newly

created jobs, the measure requires

corporations to maintain an average

annualized wage which equals or exceeds

the average wage requirement in the

Oklahoma Quality Jobs Program Act for the

year in which the real or personal property

was placed into service, depending on

location. Additionally, the measure expands

eligibility for the program to include

facilities engaged in the manufacturing,

compounding, processing or fabrication of

materials into articles of tangible personal

property. The measure also modifies the

definition of facility and facilities to specify

that the land, buildings, structures, and

improvements must be used directly and

exclusively in the manufacturing process.

Effective January 1, 2022, and for each

calendar year thereafter, for establishments

with a manufacturer exemption permit and

facilities engaged in manufacturing activities

classified in the NAICS Manual under

Industry numbers 311111 through 339999,

facility and facilities also includes

machinery, fixtures, equipment, and other

personal property used directly and

exclusively in the manufacturing process.

The measure specifies that districts that are

wholly or partially comprised or become

comprised of industries operating under

NAICS code 518210 shall not be subject to

certain findings requirements.

SB 659 (Rosino/Hilbert) creates the

Unmanned Aircraft Systems Development

Act of 2021. The measure establishes the

Oklahoma Aeronautics Commission as the

Clearinghouse for Unmanned Aircraft

Systems (UAS). The Clearinghouse shall

create a partnership between those persons

and entities that currently operate UAS,

those that desire to use this technology in the

future, and any other entity that supports the

research and development of UAS. The

measure also directs the Clearinghouse to

coordinate with other government entities to

develop UAS in the state. Additionally, the

measure updates several terms within the

Oklahoma Aeronautics Commission Act.

SB 739 (Leewright/Bashore) transfers the

regulatory authority relating to the

Oklahoma Tourism Development Act from

the Tourism and Recreation Department to

the Oklahoma Department of Commerce.

The measure also provides for the

Department of Commerce to prepare the

report required to determine the company’s

qualifications. The fee for utilizing the

Department in this manner is set at no less

than $5,000.00.

SB 893 (Pugh/Fetgatter) clarifies that

“qualified program” as it relates to the

income tax credit for aerospace employees

shall include graduate and undergraduate

programs. The undergraduate and graduate

programs of the same discipline of

engineering at an institution shall be part of

the qualified program if either program is

ABET accredited. The measure modifies

“qualified employee” to require such

persons to possess either an undergraduate

or graduate degree from a qualified program

by an institution or be a licensed

Professional Engineer.

16

SB 922 (Howard/Kendrix) creates the Invest

In Oklahoma Act. The measure directs the

Oklahoma Department of Commerce to

create the Invest In Oklahoma Fund to

provide entities funds with opportunities to

invest in Oklahoma-based private equity

funds, venture capital funds, and growth

funds. The Department is directed to select

venture capital funds to qualify for

investments within the Invest In Oklahoma

Fund based on factors outlined in the

measure. Qualified public entities may

invest up to 5% of their principal into the

Fund. The Department is directed to

maintain a list of entities participating in the

program.

SB 949 (Hall/Hill) transfers all

administrative rules and responsibilities

relating to the Oklahoma Film and Music

Office to be transferred from the Oklahoma

Tourism and Recreation Department to the

Oklahoma Department of Commerce.

HB 1124 (Phillips/Leewright) directs the

Department of Commerce to promulgate

rules and procedures for the establishment of

the State Broadband Deployment Grant

Program with the participation and advice of

the Rural Broadband Expansion Council.

The State Broadband Deployment Grant

Program shall include development of a

competitive grant program to award funding

to applicants seeking to expand access to

broadband Internet service. The measure

also creates the State Broadband

Deployment Grant Program Fund.

HB 2040 (McCall/Leewright) provides

definitions for certain telecommunications

and broadband related terms, including

“Broadband”, “Eligible entity”, “Served

area”, “Underserved area”, “Unserved area”,

and “Wireless Internet service provider”.

The measure also directs the Rural

Broadband Expansion Council to develop a

set of broadband incentive award guidelines

to recommend to the Legislature.

HB 2860 (Wallace/Thompson) creates the

Oklahoma Remote Quality Jobs Incentive

Act. The measure provides for quarterly

incentive payments for a 10-quarter period

for qualifying proxy establishments as

defined in the measure. Proxy

establishments must meet certain

qualifications to receive payments. Such

qualifications shall include roof of basic

health benefits plans for its remote workers

and meeting a certain threshold of

employees and wages. Establishments that

receive these incentive payments are not

eligible to receive credits or exemptions

provided by the Oklahoma Quality Jobs

Program Act, the Small Employer Quality

Jobs Incentive Act or the 21st Century

Quality Jobs Incentive Act. The measure

also directs the Department of Commerce

and the Tax Commission to prepare a

triennial report and to submit the report to

the President Pro Tempore of the Senate,

Speaker of the House, and Governor no later

than March 1, 2023 and every 3 years

thereafter.

HB 2928 (McCall/Leewright) directs

broadband service providers in the state to

submit a report containing their network

area coverage map to the Department of

Commerce and the Rural Broadband

Expansion Council by October 31, 2021.

The providers would be required to update

this map and report annually. OneNet must

provide mapping of all assets and network

coverage. Internet service providers are also

directed by the measure to disclose the

properties they serve, and average minimum

upload and download speeds at which they

provide services to those properties.

Commerce Funding

17

Agency

FY21

Appropriation

FY22

Appropriation

Change

from

Original

Department of

Commerce

$52,739,680

$22,077,680

-58.14%

Historical Society Funding

SB 1081 (Thompson/Wallace) apportions

the appropriations made to the Oklahoma

Historical Society in HB 2900 in the

following manner:

1) $150,000.00 shall be used to hire a grant

writer for Black Towns in Oklahoma

2) Not less than $150,000.00 shall be used to

provide grants for schools to provide

transportation to The Freedom Center &

Clara Luper Civil Rights Center, The

Greenwood Historic District, and The

Oklahoma City National Memorial &

Museum

Agency

FY21

Appropriation

FY22

Appropriation

Change

from

Original

Historical

Society

$21,524,457

$23,461,601

9.00%

Common Education

SB 13 (Stanley/Baker) requires a teacher

whose certificate was suspended by the State

Board of Education to be placed on

suspension while proceedings for revocation

or other action are pending before the Board.

These actions do not preclude the initiation

of due process procedures under the Teacher

Due Process Act.

SB 21 (Floyd/McEntire) requires rather than

allows each school district to adopt a policy

related to suicide awareness and training.

The measure requires a board of education

to provide districtwide training to all staff on

a biennial basis addressing suicide

awareness and prevention. It requires rather

than allows school districts beginning in the

2021-22 school year to provide a suicide

prevention training program, provide

curriculum made available by the

Department of Mental Health and Substance

Abuse Services or provide a suicide

prevention training program selected from a

list maintained by the Department of Mental

Health and Substance Abuse Services.

Additionally, the measure provides for

suicide awareness and prevention training

for students in grades 7-12 beginning in the

2022-23 school year.

SB 22 (Floyd/Tammy West) modifies the

powers and duties of school district boards

of education. The measure gives a right of

first refusal to purchase real or personal

property to a nonprofit organization that is

leasing the real or personal property from a

board of education when the decision is

made to dispose of the property, whether

such disposal is by public sale, public bid or

private sale. The measure states that if a

board of education receives a bid or offer for

the real or personal property, the board is to

provide notice to the nonprofit organization

leasing the property. The measure gives the

$0

$10,000,000

$20,000,000

$30,000,000

$40,000,000

$50,000,000

$60,000,000

FY19…

FY20…

FY21…

FY 22…

Department of Commerce

$0

$5,000,000

$10,000,000

$15,000,000

$20,000,000

$25,000,000

FY19…

FY20…

FY21…

FY 22…

Historical Society

18

nonprofit organization 30 days after receipt

of such notice to inform the board whether it

elects to purchase the property on the same

terms and conditions provided in the notice.

The measure states that if any portion of the

consideration in the purchase price is not in

cash, the nonprofit organization can pay fair

market value in cash of such non-cash

consideration.

SB 54 (Montgomery/Pae) directs the State

Department of Education beginning in the

2022-23 school year to designate a school

campus as a Purple Star School campus if

the school meets certain qualifications

related to availability of services for

military-connected students.

SB 68 (Simpson/Wolfley) directs a student

to be considered in compliance with the

residency requirements for school

attendance if the parent or legal guardian of

the student is transferred or is pending

transfer to a military installation within the

state while on active military duty. It directs

school districts to accept enrollment

applications for such students by electronic

means and directs the parent or legal

guardian of such a student to provide proof

of residence to the school district within 10

days after the published date of arrival. It

defines what shall constitute proof of

residence.

SB 69 (Simpson/Wolfley) allows a student

to enroll in a statewide virtual charter school

if the parent or legal guardian of the student

is transferred or is pending transfer to a

military installation within the state while on

active military duty. It directs statewide

virtual charter schools to accept enrollment

applications for such students by electronic

means and directs the parent or legal

guardian of such a student to provide proof

of residence to the statewide virtual charter

school within 10 days after the published

date of arrival. It defines what shall

constitute proof of residence.

SB 89 (Haste/Baker) creates the Health

Education Act. The measure directs the

State Department of Education to develop a

micro-credential for teachers teaching health

education and professional development

programs no later than the 2022-2023 school

year. It directs school districts by the 2023-

2024 school year to provide instruction

addressing all health education subject

matter standards adopted by the State Board

of Education. It allows health education to

be integrated into one or more existing

subjects. The measure requires teachers

assigned to teach health education as a

stand-alone course to be certified in physical

and health education. The measure also

directs the State Textbook Committee to

include a review of health and physical

education instructional materials as part of

its textbook review and adoption cycle. The

bill creates the Health Education Revolving

Fund to carry out the act and directs the

Healthy and Fit School Advisory Committee

within schools to study and make

recommendations regarding implementation

of the Health Education Act.

SB 121 (Hicks/Hasenbeck) requires each

school district board of education to adopt a

policy allowing school employees who are

lactating to take paid break time to maintain

their milk supply. The measure allows the

break time to run concurrently with any

break time and requires school district

boards of education to make reasonable

effort to provide a private, sanitary room for

employees to express milk or breastfeed a

child.

SB 128 (Rader/Dick Lowe) creates the

Seizure-Safe Schools Act. The Act requires

each school district with a student who has a

seizure disorder beginning Jan. 1, 2022, to

19

have at least 1 employee who has training to

administer or assist with self-administration

of seizure medication and recognize

symptoms of seizures and take steps to

respond. The measure states that before

seizure medication can be administered, the

parent or legal guardian of the student is to

provide written authorization to the school,

provide a statement from the student’s

health care provider, provide medication to

the school and collaborate on a seizure

action plan. It requires such authorization to

be renewed annually. The measure exempts

from disciplinary proceedings school

employees who take action in compliance

with the act. It provides immunity from civil

liability to a school employee who takes

action in compliance with the act, unless the

actions rise to the level of reckless or

intentional misconduct. It states that a

school nurse shall not be responsible for and

shall not be subject to disciplinary actions

for actions taken by a volunteer.

SB 211 (Dugger/Luttrell) modifies the

powers and duties of the Oklahoma Board of

Private Vocational Schools. The measure

authorizes the Board to develop applications

for sustained licenses, develop and present

optional training, conduct announced and

unannounced site visits, invoice a travel fee

for site visits, and collect data required to be

reported to the U.S. Department of

Education or any state or federal agency.

The measure allows for schools accredited

by a U.S. Department of Education-

approved accrediting organization for

multiple years to obtain a sustained license.

Additionally, the measure modifies fees for

reviewing a revised or replacement catalog

and provides fees for review of

documentation to be forwarded to the U.S.

Department of Education or another state or

federal agency, for optional training, for

review of enrollment agreements and for in-

state site visits. The measure also directs that

the Board’s base fees will increase by 7% in

fiscal year 2022.

SB 252 (Stanley/Baker) requires all public

and charter high schools to offer a minimum

of one computer science course beginning in

the 2024-25 school year. It also requires all

public and charter elementary and middle

schools to offer instruction in computer

science beginning in the 2024-25 school

year. It allows the courses to be offered in an

in-person setting or as a virtual or distance

course when a traditional classroom setting

is not feasible.

SB 302 (Coleman/Kannady) grants visiting

teams in all regular high school athletic

competitions the same rights to radio

broadcast, video stream and provide

telegraphic play-by-play accounts as the

home team in all seasonal high school

athletic competitions beginning in the 2021-

22 school year. To utilize these rights, the

visiting team must have either a valid

agreement between a media organization

and the school’s board of education or a

curricular program for students that provides

streaming for home games. The bill applies

to contracts for rights to radio broadcast,

video stream and provide telegraphic play-

by-play accounts entered into or renewed on

or after July 1, 2021.

SB 619 (Bullard/Kevin West) requires the

Oklahoma Tax Commission to pay interest

on tax refunds not paid within 45 days for

returns filed electronically and 90 days for

all other returns after the return is filed or

due, whichever is later. The measure also

allows the Commission to provide a later

due date for the returns of individuals and

certain entities if a state of emergency is

declared by the Governor or upon

declaration by the Internal Revenue Service

to postpone deadlines in disaster areas.

Lastly, the measure modifies the period of

20

underpayment for corporations to be 30 days

after the due date for returns established

under the Internal Revenue Code. The

measure authorizes the State Board of

Education to determine if apprenticeships,

internships, and mentorships are eligible for

academic credit toward meeting the

graduation requirements.

SB 642 (Pugh/Dustin Roberts) requires each

public school district and public charter

school in the state to offer students in grades

10 through 12 the opportunity to take the

Armed Services Vocational Aptitude Battery

(ASVAB) test and consult with a military

recruiter beginning in the 2021-22 school

year. It directs the ASVAB test to be

administered during normal school day

hours at a time that doesn’t conflict with

extracurricular activities. It requires the

district or charter school to provide notice of

the date, time and location of the test to

students in grades 10 through 12 and their

parents or legal guardians. The bill allows a

district or charter school to provide an

alternative test that is free and assesses a

student’s aptitude for success in a career

field that does not require postsecondary

education.

SB 658 (Standridge/Kevin West) requires

the State Department of Education and

school districts to provide in any notice or

publication provided to parents regarding

immunization requests the immunization

requirements of the school, including the

requirement to either provide current, up-to-

date immunization records or a signed and

completed exemption form. The measure

also prohibits any school district, institution

of Higher Education, the State Board of

Education, or the State Board of Career and

Technology Education from requiring a

vaccination against COVID-19 as a

condition of admittance to or attendance of

the school or institution. Such entities are

also prohibited from requiring a vaccine

passport as a condition of admittance or

implementing a mask mandate for students

that are not vaccinated against COVID-19.

Additionally, the measure also provides that

a board of education for a school district or

technology school district may only

implement a mandate to wear mask or any

other medical device after consultation with

the local county health department or city-

county health department. Such a mandate

must explicitly list the reasons for the

mandate and shall reference the specific

masks or medical devices that would meet

the requirements of the mandate. Any

mandate to implement wearing a mask or

any other medical device shall be

reconsidered at each regularly scheduled

board meeting.

SB 705 (Dahm/Gann) repeals sections of

law creating the Oklahoma Center for Rural

Development Act, which was established to

improve the effectiveness of citizens,

enterprises, and communities in rural

Oklahoma to better meet the quality of life

challenges in the new century.

SB 783 (Pugh/Boles) modifies the

Education Open Transfer Act. It states that

beginning Jan. 1, 2022, the transfer of any

student from one district to another shall be

approved at any time during the year unless

the number of transfers exceeds the capacity

of a grade level for a school site within a

district. If the number of transfer

applications exceeds the capacity of a school

site, the school district is to select transfer

students in the order in which they were

received. It allows a student to be granted a

one-year transfer, with the school district

retaining the ability to deny the continued

transfer if the student has a history of

absences or has committed certain acts that

are subject to out-of-school suspension. The

bill prohibits a student from transferring

21

more than twice per school year to one or

more districts. The measure directs each

school district board of education by Jan. 1,

2022, to adopt a policy to determine the

number of students a district has the

capacity to accept in each grade level for

each school site. It directs such capacity to

be established by the first day of January,

April, July and October, and it directs school

districts to post the capacity information on

their websites and report it to the State

Department of Education. It allows a denied

transfer request to be appealed within 10

days to the receiving school district board of

education. If the receiving school district

board of education denies the appeal, the bill

allows an appeal to be filed within 10 days

to the State Board of Education. It directs

each school district board of education to

submit to the State Department of Education

the number of student transfers approved

and denied and the reason for denial, and it

requires the Department to publish the data

on its website and share it with the Office of

Educational Quality and Accountability. The

measure directs the Office of Educational

Quality and Accountability to randomly

select 10% of the districts in the state to

conduct an audit of approved and denied

transfers. If the Office finds inaccurate

reporting of capacity levels, the bill directs

the Office to set the capacity levels. The bill

removes language regarding the transfer

application timeline. It clarifies that students

who are the dependent children of a member

of the active uniformed military services of

the United States on full-time active duty

status and students who are the dependent

children of a member of the military reserve

on active duty orders are to be eligible to

enroll in any school district regardless of the

district’s capacity. It removes language

allowing a receiving school district to

approve the transfer of a student whose

parent or legal guardian is employed as a

teacher. It also repeals statutory language

regarding emergency transfers.

SB 807 (Kidd/Baker) directs that school

support employees be entitled to pay for any

time lost when a school district is closed

because of an epidemic or when a closing

order is issued by an authorized health

officer.

HB 1018 (Sterling/Quinn) removes

language requiring the State Superintendent

of Public Instruction to compile and publish

the school law book.

HB 1046 (Kerbs/Montgomery) requires

school districts to provide a copy or a

hyperlink to a copy of the school district’s

most recent audit on the school district’s

website.

HB 1103 (Vancuren/Haste) requires schools

beginning in the 2022-23 school year to

administer biennially the Oklahoma