EN

This text is made available for information purposes only.

A summary of this decision is published in all EU languages in the Official Journal of the European

Union.

Case No COMP/M.6497 –

HUTCHISON 3G AUSTRIA

/ ORANGE AUSTRIA

Only the EN text is authentic.

REGULATION (EC) No 139/2004

MERGER PROCEDURE

Article 8 (2)

Date: 12/12/2012

EUROPEAN COMMISSION

Strasbourg, 12.12.2012

C(2012) 9198final

COMMISSION DECISION

of 12.12.2012

addressed to:

Hutchison 3G Austria Holdings GmbH

declaring a concentration to be compatible with the internal market and the EEA

agreement

(Case No M.6497 – HUTCHISON 3G AUSTRIA / ORANGE AUSTRIA)

(Text with EEA relevance)

(Only the English text is authentic.)

PUBLIC VERSION

EN 2 EN

TABLE OF CONTENTS

1. THE PARTIES............................................................................................................. 7

2. THE CONCENTRATION........................................................................................... 8

2.1. The acquisition of Yesss! by TA.................................................................................. 9

2.2. Acquisition of Orange assets by TA from H3G........................................................... 9

3. UNION DIMENSION ................................................................................................. 9

4. PROCEDURE ............................................................................................................ 10

4.1. General procedure ...................................................................................................... 10

4.2. Referral Request......................................................................................................... 11

5. RELEVANT MARKETS........................................................................................... 11

5.1. Introduction................................................................................................................ 11

5.2. Product markets.......................................................................................................... 12

5.2.1. Mobile telecommunications services to end customers ............................................. 12

5.2.1.1. Private and business customers.................................................................................. 12

5.2.1.1.1. The view of the Notifying Party............................................................................... 12

5.2.1.1.2. The Commission's assessment ................................................................................. 12

5.2.1.2. Pre-paid and post-paid services.................................................................................. 13

5.2.1.2.1. The view of the Notifying Party............................................................................... 13

5.2.1.2.2. The Commission's assessment ................................................................................. 14

5.2.1.3. Type of Technology (2G, 3G and Future 4G Technologies) ..................................... 14

5.2.1.3.1. The view of the Notifying Party............................................................................... 14

5.2.1.3.2. The Commission's assessment ................................................................................. 15

5.2.1.4. Voice telecommunications and data services............................................................. 16

5.2.1.4.1. The view of the Notifying Party............................................................................... 16

5.2.1.4.2. The Commission's assessment ................................................................................. 16

5.2.1.5. Fixed and mobile data services .................................................................................. 18

5.2.1.5.1. The view of the Notifying Party............................................................................... 18

5.2.1.5.2. The Commission's assessment ................................................................................. 18

5.2.1.6. Conclusion.................................................................................................................. 19

5.2.2. Wholesale market for access and call origination on public mobile telephone net-

works.......................................................................................................................... 19

5.2.2.1. The view of the Notifying Party................................................................................. 19

5.2.2.2. The Commission's assessment ................................................................................... 19

5.2.2.3. Conclusion.................................................................................................................. 20

5.2.3. Wholesale market for international roaming.............................................................. 20

EN 3 EN

5.2.4. Wholesale market for mobile call termination........................................................... 20

5.3. Geographic markets ................................................................................................... 21

5.3.1. Mobile telecommunications services to end customers ............................................. 21

5.3.2. Wholesale access and call origination on public mobile telephone networks ........... 21

5.3.3. Wholesale market for international roaming.............................................................. 22

5.3.4. Wholesale market for mobile call termination........................................................... 22

6. COMPETITIVE ASSESSMENT IN THE MARKET FOR MOBILE TELECOM-

MUNICATION SERVICES TO END CUSTOMERS ............................................. 23

6.1. Introduction................................................................................................................ 23

6.2. Factors likely to lead to a significant impediment to effective competition.............. 24

6.3. Description of the market........................................................................................... 27

6.3.1. Market players in Austria (MNOs, MVNOs, resellers) ............................................. 27

6.3.1.1. MNOs......................................................................................................................... 27

6.3.1.2. MVNOs and second brands ....................................................................................... 29

6.3.1.3. Resellers ..................................................................................................................... 30

6.3.2. Regulatory requirements for setting up mobile telecommunications networks......... 30

6.3.2.1. General authorisation ................................................................................................. 30

6.3.2.2. Allocation of frequencies ........................................................................................... 30

6.3.2.3. Approval of customer terms and conditions .............................................................. 30

6.3.2.4. Ancillary regulatory requirements ............................................................................. 31

6.3.3. Regulatory requirements for installing new masts..................................................... 31

6.3.4. Spectrum auctions ...................................................................................................... 33

6.4. Market shares and market structure post-merger....................................................... 34

6.4.1. Introduction................................................................................................................ 34

6.4.2. Market shares on the overall market for mobile telecommunications services to end

customers.................................................................................................................... 34

6.4.3. HHI and other indicators of the competitive dynamics in the market ....................... 36

6.4.3.1. HHI and delta values.................................................................................................. 36

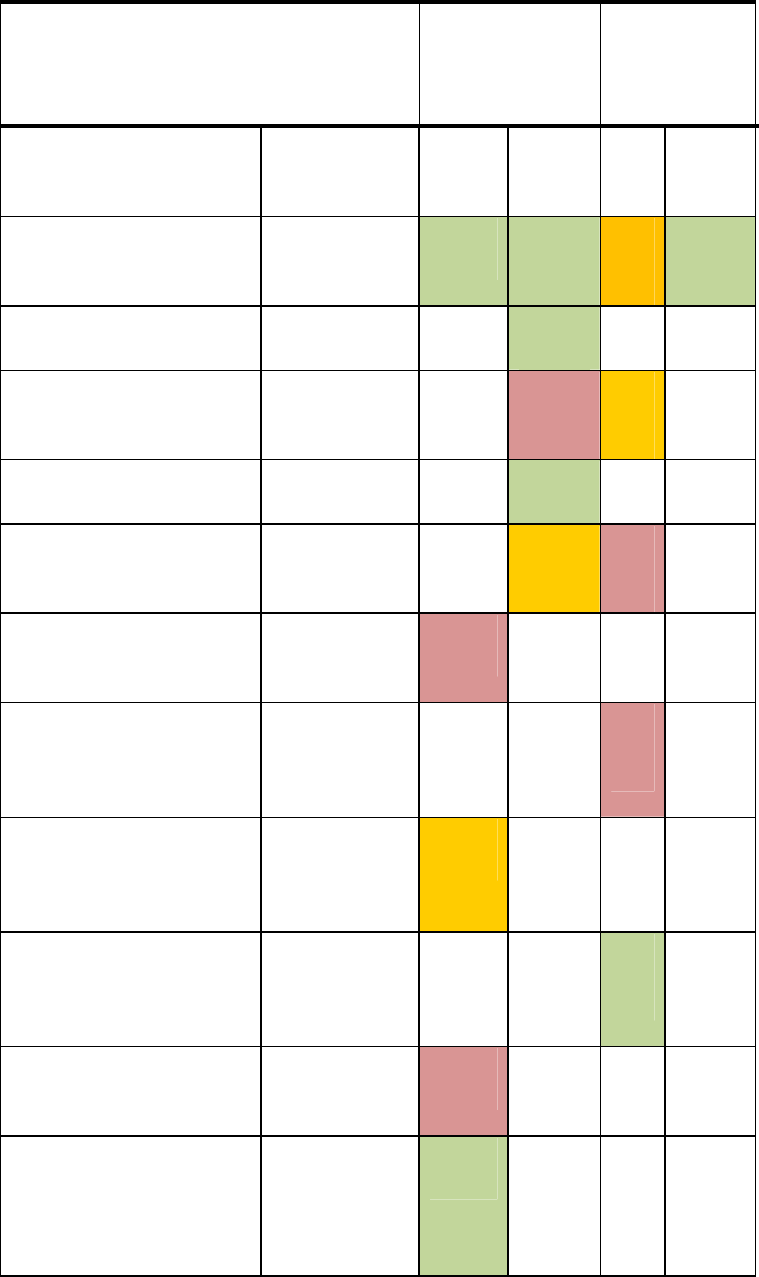

6.4.3.2. Differential effects of the transaction according to market segments........................ 36

6.4.3.2.1. Post-paid private voice and data segment ................................................................ 39

6.4.3.2.2. Data-only segment.................................................................................................... 41

6.4.3.2.3. Indications of market strength based on new business ............................................ 43

6.4.3.2.3.1. New business for post-paid private voice and data ............................................... 45

6.4.3.2.3.2. New business for data-only devices ...................................................................... 46

6.5. Switching and closeness of competition .................................................................... 46

6.5.1. Diversion ratios .......................................................................................................... 48

EN 4 EN

6.5.1.1. The view of the Notifying Party................................................................................. 48

6.5.1.2. The Commission's assessment ................................................................................... 48

6.5.1.2.1. Evidence on switching from the MNP Data............................................................. 48

6.5.1.2.2. Evidence from surveys............................................................................................. 50

6.5.2. Other evidence on closeness of competition.............................................................. 50

6.5.2.1. The view of the Notifying Party................................................................................. 50

6.5.2.2. Analysis of market data.............................................................................................. 50

6.5.2.2.1. Private post-paid voice-enabled segment................................................................. 50

6.5.2.2.2. Data-only segment.................................................................................................... 54

6.5.2.3. Results of market investigation.................................................................................. 58

6.5.2.4. Internal documents..................................................................................................... 59

6.5.3. Conclusion.................................................................................................................. 62

6.6. H3G as important competitive force (Pre-merger v. Post-merger)............................ 62

6.6.1. The view of the Notifying Party................................................................................. 62

6.6.2. The Commission's assessment ................................................................................... 63

6.6.2.1. Current competitive strength of H3G......................................................................... 63

6.6.2.1.1. Internal documents ................................................................................................... 64

6.6.2.1.2. Conclusions on H3G as an important competitive force.......................................... 65

6.6.2.2. Impact of the Proposed Transaction on H3G's incentives to compete....................... 65

6.6.3. Conclusion.................................................................................................................. 69

6.7. Absence of countervailing factors.............................................................................. 69

6.7.1. Barriers to entry and likelihood of new entry ............................................................ 69

6.7.1.1. Prerequisites for market entry .................................................................................... 69

6.7.1.2. Non-availability of spectrum...................................................................................... 70

6.7.1.3. Return on investment ................................................................................................. 70

6.7.1.4. Results of market investigation.................................................................................. 71

6.7.1.5. Lack of MVNOs......................................................................................................... 71

6.7.1.6. Conclusion.................................................................................................................. 72

6.7.2. Countervailing buyer power....................................................................................... 73

6.8. Anticipated effect of the proposed transaction on prices in the post-paid phone seg-

ment (voice and data)................................................................................................. 73

6.8.1. Post-paid private segment (voice and data) ............................................................... 74

6.8.1.1. UPP analysis............................................................................................................... 74

6.8.1.2. Arguments put forward by the Notifying Party ......................................................... 78

6.8.1.2.1. The UPP analysis on the post-paid segment ............................................................ 78

6.8.1.2.2. Appropriateness of the UPP framework................................................................... 78

EN 5 EN

6.8.1.2.3. SSNIP test objections ............................................................................................... 81

6.8.1.2.4. Correct UPP analysis application............................................................................. 82

6.8.1.2.5. Efficiencies and UPP analysis.................................................................................. 83

6.8.1.2.6. Predicted price increases .......................................................................................... 84

6.8.1.3. Conclusion.................................................................................................................. 84

6.8.2. Segment of data-only devices .................................................................................... 85

6.8.3. Conclusions................................................................................................................ 85

6.9. Reaction by other competitors post-merger ............................................................... 86

6.9.1. MNOs......................................................................................................................... 86

6.9.2. Other service providers (MVNO) .............................................................................. 89

6.10. Framework of analysis as regards the competitive constraint due to Orange in the

absence of the merger................................................................................................. 90

6.10.1. The view of the Notifying Party................................................................................. 91

6.10.2. The Commission's assessment ................................................................................... 92

6.10.2.1.Absence of a failing firm defence .............................................................................. 92

6.10.2.2.Development of Orange's market share ..................................................................... 92

6.10.2.3.Further current indicators of Orange's competitive position...................................... 92

6.10.2.4.Orange's plans in the absence of the merger .............................................................. 93

6.10.3. Conclusion.................................................................................................................. 94

6.11. Conclusions on non-coordinated effects .................................................................... 94

7. EFFICIENCIES.......................................................................................................... 95

7.1. Capacity increase ....................................................................................................... 96

7.1.1. Verifiability................................................................................................................ 96

7.1.2. Merger specificity ...................................................................................................... 97

7.1.3. Benefit to consumers.................................................................................................. 99

7.2. Faster LTE rollout.................................................................................................... 100

7.2.1. Verifiability.............................................................................................................. 100

7.2.2. Merger specificity .................................................................................................... 100

7.2.3. Benefits to consumers .............................................................................................. 100

7.3. Improved network coverage..................................................................................... 100

7.4. Reduction of alleged scale disadvantages ................................................................ 101

7.5. Conclusion................................................................................................................ 102

8. COORDINATED EFFECTS ................................................................................... 102

9. OTHER MARKETS ................................................................................................ 103

9.1. Wholesale access and call origination on public mobile telephone networks ......... 103

9.2. Wholesale market for international roaming............................................................ 104

EN 6 EN

9.3. Wholesale market for mobile call termination......................................................... 105

10. The Views of Interested Third Parties ..................................................................... 107

10.1. T-Mobile Austria...................................................................................................... 107

10.2. Tele2......................................................................................................................... 108

11. GENERAL CONCLUSION OF THE COMPETITIVE ASSESSMENT IN THE

RELEVANT MARKETS......................................................................................... 108

12. COMMITMENTS SUBMITTED BY THE NOTIFYING PARTY........................ 109

12.1. Procedure.................................................................................................................. 109

12.2. Description of the First Commitments..................................................................... 109

12.3. Assessment of the First Commitments..................................................................... 111

12.4. Description of the Final Commitments.................................................................... 112

12.4.1. Commitment to enter into an Upfront MVNO Agreement...................................... 113

12.4.2. Commitment to make wholesale access available ................................................... 113

12.4.3. Commitment to divest spectrum and additional rights ............................................ 114

12.4.4. The Resolution of the Austrian Telecom Regulator Telekom-Control-Kommission

(TKK) of 22 October 2012 ("Beschluss")................................................................ 116

12.5. Assessment of the Final Commitments.................................................................... 116

13. CONDITIONS AND OBLIGATIONS.................................................................... 119

COMMISSION DECISION

of 12.12.2012

addressed to:

Hutchison 3G Austria Holdings GmbH

declaring a concentration to be compatible with the internal market and the

EEA agreement

(Case No M.6497 – HUTCHISON 3G AUSTRIA / ORANGE AUSTRIA)

(Text with EEA relevance)

(Only the English text is authentic.)

THE EUROPEAN COMMISSION,

Having regard to the Treaty on the Functioning of the European Union,

Having regard to the Agreement on the European Economic Area, and in particular

Article 57 thereof,

Having regard to Council Regulation (EC) No 139/2004 of 20 January 2004 on the

control of concentrations between undertakings,

1

and in particular Article 8(2) thereof,

Having regard to the Commission's decision of 28 June 2012 to initiate proceedings in

this case,

Having given the undertakings concerned the opportunity to make known their views

on the objections raised by the Commission,

Having regard to the opinion of the Advisory Committee on Concentrations,

2

Having regard to the final report of the Hearing Officer in this case,

3

WHEREAS:

1. THE PARTIES

(1) On 7 May 2012, the Commission received a notification of a proposed con-

centration pursuant to Article 4 of Regulation (EC) No 139/2004 (the "Mer-

ger Regulation") by which the undertaking Hutchison 3G Austria Holdings

GmbH ("H3G Austria Holdings", Austria) (the "Notifying Party"), the parent

1

OJ L 24, 29.1.2004, p. 1 ("the Merger Regulation"). With effect from 1 December 2009, the

Treaty on the Functioning of the European Union ("TFEU") has introduced certain changes,

such as the replacement of "Community" by "Union" and "common market" by "internal mar-

ket". The terminology of the TFEU will be used throughout this Decision.

2

OJ C ...,...200. , p....

3

OJ C ...,...200. , p....

8

company of Hutchison 3G Austria GmbH ("H3G", Austria) and an indirect

wholly owned subsidiary of Hutchison Whampoa Limited ("HWL", Hong

Kong), acquires within the meaning of Article 3(1)(b) of the Merger Regula-

tion control of Styrol Holding 1 GmbH ("Styrol", Austria) and its indirect

wholly owned subsidiary Orange Austria Telecommunications GmbH ("Or-

ange", Austria), excluding Yesss! Telekommunikation GmbH ("Yesss!"), by

way of purchase of shares (together "the Parties").

(2) HWL is a multi-national conglomerate headquartered in Hong Kong. The

operations of HWL and of its associated companies consist of six core busi-

nesses: ports and related services, property and hotels, retail, energy, infra-

structure; and telecommunications. In the European Union, subsidiaries of

HWL include mobile network operators in Austria, Denmark, Ireland, Italy,

Sweden, and the United Kingdom.

(3) H3G is a mobile network operator (MNO) active in Austria under the brand

name "3" and wholly owned by HWL.

(4) Orange is an Austrian MNO. Orange and its parent company Styrol are cur-

rently owned by Stubai S.C.A. ("Stubai"), a wholly-owned subsidiary of the

private equity investment fund Mid Europa Partners ("MEP"), and Orange

Belgium S.A., a wholly-owned subsidiary of France Télécom S.A. Yesss!

Telekommunikation GmbH is a fully-owned subsidiary of Orange.

2. THE CONCENTRATION

(5) On 2 February 2012, H3G Austria Holdings, on the one hand, and Stubai and

Orange Belgium S.A., on the other hand, entered into an agreement for the

sale and transfer of the share capital of Styrol, the indirect owner of 100% of

the share capital of Orange (the "Proposed Transaction"). Since H3G Austria

Holdings will immediately sell Yesss! to Telekom Austria AG ("TA"),

4

there

will be no effective concentration of economic power between H3G and Or-

ange as a whole including Yesss!.

5

The onward sale of Yesss! therefore con-

stitutes a separate transaction for merger control purposes.

(6) As a result of the Proposed Transaction, Orange (excluding Yesss!)

6

will be

solely controlled by H3G Austria Holdings. The operation therefore consti-

tutes a concentration within the meaning of Article 3(1)(b) of the Merger

Regulation.

(7) Two further transactions are conditional on the Proposed Transaction but

separate from it for the purposes of applying the Merger Regulation since

4

See paragraph (8) and following.

5

See paragraph 32 of the Commission Consolidated Jurisdictional Notice under Council Regu-

lation (EC) No 139/2004 on the control of concentrations between undertakings, OJ C 95

16.4.2008, p. 1. (the "Consolidated Jurisdictional Notice").

6

In the remainder of this Decision "Orange" shall refer to Orange only, excluding Yesss!, un-

less otherwise stated.

9

control of the assets concerned is acquired by an undertaking other than

H3G.

7

2.1. The acquisition of Yesss! by TA

(8) Firstly, H3G will immediately sell-on Yesss!, in a back-to-back operation,to

TA, the telecoms incumbent which owns the mobile market leader A1 (the

Yesss! Acquisition). Yesss! is a "no frills" mobile virtual network operator

(MVNO) currently fully-owned by Orange and providing services on its

network.

(9) Although the sell-on of Yesss! constitutes a separate concentration as the

Yesss! Acquisition involves the ultimate acquisition of control by a separate

undertaking, TA, both concentrations, H3G / Orange and TA / Yesss!, are in-

ter-conditional. Completion of the H3G / Orange transaction is conditional

upon the fulfilment of all conditions agreed between H3G Austria Holdings

and TA in relation to the Yesss! Acquisition. One of these conditions is prior

merger control clearance of the Proposed Transaction.

(10) The Yesss! Acquisition was notified to the Bundeswettbewerbsbehörde

("BWB") on 31 May 2012 which requested the Austrian Cartel Court ("Ober-

landesgericht Wien als Kartellgericht erster Instanz") to open proceedings on

28 June 2012. The concentration subject to Union jurisdiction is the acquisi-

tion of Orange Austria (minus the "Yesss!" business) by H3G.

2.2. Acquisition of Orange assets by TA from H3G

(11) Secondly, TA will acquire from H3G certain sites, spectrum frequencies and

intellectual property rights currently owned by Orange ("TA spectrum deal").

According to the Notifying Party, the transfer of frequencies must be ap-

proved by the Austrian Telecommunications Regulator ("Rundfunk & Tele-

kom Regulierungs-GmbH" ("RTR") and "Telekom-Control Kommission"

("TKK")).

3. UNION

DIMENSION

(12) The undertakings concerned have a combined aggregate worldwide turnover

of more than EUR 5 000 million (HWL: EUR 26 597; Orange: EUR 485.1).

8

Each of them has a Union-wide turnover in excess of EUR 250 million

(HWL: EUR […]*; Orange: EUR […]*). Even though Orange is active in

Austria only, HWL does not achieve more than two-thirds of its aggregate

Union-wide turnover within one and the same Member State. The Proposed

Transaction therefore has a Union dimension.

7

See paragraph 41 of the Consolidated Jurisdictional Notice.

8

Turnover calculated in accordance with Article 5(1) of the Merger Regulation and the Com-

mission Consolidated Jurisdictional Notice.

* Parts of this text have been edited to ensure that confidential information is not disclosed;

those parts are enclosed in square brackets and marked with an asterisk.

10

4. PROCEDURE

4.1. General procedure

(13) Based on a market investigation, the Commission raised serious doubts as to

the compatibility of the Proposed Transaction with the internal market and

adopted a decision to initiate proceedings pursuant to Article 6(1)(c) of the

Merger Regulation on 28 June 2012 ("the Article 6(1)(c) decision").

(14) On 29 June 2012 the Commission held a state of play meeting where, at the

request of the Notifying Party, some minimum requirements for a possible

remedy solution were discussed with the Notifying Party.

(15) The Notifying Party submitted written comments in response to the Article

6(1)(c) decision on 11 September 2012.

(16) During the second phase investigation, the Commission sent several requests

for information to the Notifying Party and to Orange, in particular the re-

quests of 4 July 2012, 13 July 2012 and 27 July 2012. It also sent a request

for information to the Notifying Party alone on 20 July 2012. The Notifying

Party and Orange both responded to those requests.

(17) From 1 July to 19 July 2012 the Commission also sent requests for informa-

tion to several competitors of the notifying party and potential (MVNO)

market entrants.

(18) On 30 July 2012, the Commission adopted a decision pursuant to Article

10(3), second subparagraph, third sentence to extend the procedure by a total

of 15 working days with the agreement of the Notifying Party. Accordingly,

the legal deadline for the Commission to adopt a decision pursuant to Article

8(1), (2) or (3) of the Merger Regulation was extended to 27 November

2012.

(19) On 28 August 2012 the Commission adopted a decision pursuant to Article

10(3) second subparagraph, third sentence to extend the procedure by a total

of 3 working days with the agreement of the Notifying Party. Accordingly,

the legal deadline for the Commission to adopt a decision pursuant to Article

8(1), (2) or (3) of the Merger Regulation was extended until 30 November

2012.

(20) On 20 September 2012 the Commission sent a Statement of Objections ("the

SO") to the Notifying Party under Article 18 of the Merger Regulation.

(21) On 5 October 2012 the Notifying Party submitted its response to the SO.

Orange commented on the SO on 4 October 2012.

(22) On 10 October 2012, the Commission's Hearing Officer afforded the Notify-

ing Party the opportunity to make itself heard in an oral hearing. Following

their requests, T-Mobile Austria ("T-Mobile") and Tele2 as well as UPC

(Liberty Global) were admitted as interested third parties to the Oral Hearing.

11

4.2. Referral Request

(23) On 29 May 2012, the BWB requested, on the basis of Article 9(2)(a) of the

Merger Regulation, a referral of the Proposed Transaction from the Commis-

sion to Austria (the "Referral Request").

9

(24) In the Referral Request, the BWB asserted that the Proposed Transaction

threatened to significantly affect competition in the Austrian telecommunica-

tions market which presented all the characteristics of distinct markets in ac-

cordance with Article 9(2)(a). According to the BWB's assessment, the Pro-

posed Transaction threatened to affect competition in two ways.

(25) The BWB's first concern relates to the loss of a competitor in an already

highly concentrated market. The reduction from four to three MNOs might

therefore reduce competitive pressure. In the BWB's view, H3G and Orange

are also price leaders. Thus Orange's disappearance might also lead to a

change of incentives for H3G to act less price-aggressively.

(26) Furthermore, the BWB is of the opinion that there are already indications of

coordination in the market. In its view, the market structure after the merger

would increase the potential for collusive behaviour while new market en-

tries would be unlikely.

(27) The BWB did not send any reminder pursuant to Article 9(5) of the Merger

Regulation after the Commission adopted the Article 6(1)(c) decision on 28

July 2012. The Commission therefore decided to deal with the aspects raised

by the Austrian competition authority itself pursuant to Article 9(3)(a) of the

Merger Regulation.

5. RELEVANT MARKETS

5.1. Introduction

(28) In previous Commission decisions

10

the mobile telecommunications services

product markets have been defined as follows:

11

9

See Doc ID1863.

10

See Case No COMP/M.5650 – T-Mobile/Orange; Commission Decision of 27 November

2007 in Case No COMP/M.4947 – Vodafone/Tele2 Italy/Tele2 Spain, OJ C 300, 12.12.2007,

p. 4; Commission Decision 2007/193/EC of 26 April 2006 in Case No COMP/ M.3916 – T-

Mobile Austria/Tele.ring, OJ L 88, 29.3.2007, p. 44; Commission Decision of 24 September

2004 in Case No COMP/ M.3530 – TeliaSonera/Orange, OJ C 263, 26.10.2004, p. 7; and

Commission Decision of 16 September 2003 in Case No COMP/M.3245 – Voda-

fone/Singlepoint, OJ C 242, 9.10.2003, p. 5.

11

See also, to the extent relevant, the Commission's Recommendations of 11 February 2003 and

17 December 2007 on Relevant Product and Service Markets within the electronic communi-

cations sector: Commission Recommendation of 11 February 2003 on Relevant Product and

Service Markets within the electronic communication networks and services, OJ L 114,

8.5.2003, p. 45; Commission Recommendation (2007/879/EC) of 17 December 2007 on rele-

vant product and service markets within the electronic communications sector susceptible to

ex ante regulation in accordance with Directive 2002/21/EC of the European Parliament and

of the Council on a common regulatory framework for electronic communications networks

and services, OJ L 344, 28.12.2007, p. 65.

12

(a) mobile telecommunications services to end customers (retail mobile

telecommunications services market);

(b) wholesale access and call origination on public mobile telephone net-

works;

(c) wholesale market for international roaming; and

(d) wholesale market for mobile call termination

(29) The activities of H3G and Orange would, on this basis, overlap in the market

for mobile telecommunications services to end customers. The Parties are al-

so potential competitors on the market for wholesale access and call origina-

tion on public mobile telephone networks. There is also a link between the

activities of H3G and Orange on the wholesale market for international

roaming and the wholesale market for mobile call termination.

5.2. Product markets

5.2.1. Mobile telecommunications services to end customers

(30) The Notifying Party notes that, in previous decisions, the Commission did

not further subdivide the market for the provision of mobile telecommunica-

tions services to end customers by type of customer (corporate or private,

post-paid subscribers or pre-paid customers) or by type of network technol-

ogy (2G/GSM or 3G/UMTS). The Commission therefore assessed previous

cases on the basis of an overall market for the provision of mobile telecom-

munications services to end customers.

12

The Notifying Party argues that a

similar approach should be adopted in this case.

(31) In Sections 5.2.1.1 to 5.2.1.6, the Commission considers whether for the pur-

poses of this case it is necessary to further subdivide the market for mobile

telecommunications services to end customers.

5.2.1.1. Private and business customers

5.2.1.1.1. The view of the Notifying Party

(32) As regards the possible sub-segmentation of the market for mobile telecom-

munications to end customers depending on the type of customer, the Notify-

ing Party considers that the service provided to private and business custom-

ers is essentially the same and that there is supply side substitutability by

network operators.

5.2.1.1.2. The Commission's assessment

(33) In previous decisions, the Commission did not subdivide the market between

private and business customers.

13

In Case M.5650 – T-Mobile/Orange, the

12

See Case No COMP/M.5650 – T-Mobile/Orange; Case No COMP/M.4947 – Vodafone/Tele2

Italy/Tele2 Spain; Case No COMP/ M.3916 – T-Mobile Austria/Tele.ring; Case No COMP/

M.3530 – TeliaSonera/Orange; Case No COMP/M.3245 – Vodafone/Singlepoint.

13

See Case No COMP/M.5650 – T-Mobile/Orange; Case No COMP/ M.3916 – T-Mobile Aus-

tria/Tele.ring.

13

Commission found that although business customers were considered "heavy

users" as opposed to private customers who use mobile telecommunications

more scarcely, the service offered was substantially the same as that offered

to private customers.

(34) In the light of the responses to the market investigation, nonetheless, the

Commission notes that there might be distinct demand as between private

and business customers. Business customers have, to some degree, different

needs from private customers, can easily be identified and are therefore tar-

geted with specific offers. Certain larger customers might even be offered

tailor-made tariff plans and additional services. Whilst some business cus-

tomers did suggest that they might switch to residential tariffs in the event

that there were to be a small but significant non-transitory increase in the

price of business services, the majority indicated that they would not do

so.

14,15

Any such substitutability as there might be would, moreover, operate

only in one direction, since private customers could not switch to business

tariffs.

(35) Therefore, the Commission considers that due to supply side considerations

there is an overall product market for private and business customers as re-

gards mobile telecommunications services to end customers.

16

5.2.1.2. Pre-paid and post-paid services

5.2.1.2.1. The view of the Notifying Party

(36) As regards a possible distinction between pre-paid and post-paid services, the

Notifying Party submits that the line is becoming increasingly blurred as hy-

brid products, such as pre-paid customers paying by way of a debit order and

post-paid customers paying by way of a pre-paid card are becoming more

important. Moreover, there is an increasing number of offers under which

post-paid customer are not bound to any commitment period.

(37) As regards supply side substitution, the Notifying Party submits that now all

MNOs are active in both the pre-paid and the post-paid segment.

14

Responses to Commission questionnaire 2 to Business Customers and Consumer Associa-

tions, Doc ID 508.

15

Consumer association's response to Commission questionnaire 2 to Business Customers and

Consumer Associations, Doc ID 508; the questions were worded as follows: "In the Austrian

retail market for mobile telephony, do you consider that the services offered to pri-

vate/residential post-paid

customers and business customers are different?" and "Would your

company / consumers switch from a business tariff to a private / residential customer tariff

, if

the price of all available business tariffs increased on a non-temporary basis by 5–10% while

prices of private / residential tariffs would remain constant?"

16

This does not necessarily imply that supply-side substitution is capable in this case of exercis-

ing a competitive constraint between the two segments. As further argued in the competitive

assessment (Section 6), the Commission considers that this is not the case.

14

5.2.1.2.2. The Commission's assessment

(38) The Commission has previously found that the distinction between the two

segments is becoming blurred due to the development of different types of

offers.

17

(39) In the light of the responses to the market investigation, the Commission

considers that there are also some arguments in support of this position in

this case, at least as regards retail customers (for large business customers

pre-paid offers do not generally appear to be suitable). One consumer asso-

ciation noted that regardless of whether an offer was pre-paid or post-paid,

"[f]rom consumers' point of view the lower offer is more attractive."

18

Fur-

thermore it may be that some forms of pre-paid in fact allow for automatic

top-up and in this respect are more similar to post-paid. On the other hand,

for occasional use (by children, non-residents, etc.) post-paid would seem

less suitable as an alternative, whilst pre-paid may be less suitable for inten-

sive use and international roaming.

(40) The availability of handset promotions is also different between the two

segments. Post-paid services have, until now, in the Austrian market, often

been characterised by subsidised prices for handsets which are then offset

against the revenues obtained by operators during the period (typically 24

months) in which customers are contractually locked into a given plan. Pre-

paid services (and certain post-paid services like bob

19

which lack this char-

acteristic) can be cancelled at any moment or use can simply cease, at which

point no further payments are necessary.

(41) The Commission's conclusion is that pre-paid and post-paid are part of the

same market, at least in view of supply-side substitution. At the same time,

there is a distinct segment of demand which is often targeted by pre-paid of-

fers where the user concerned makes infrequent calls but may themselves be

called more frequently. The interaction between the pre-paid and post-paid

segments will further be considered in the competitive assessment.

5.2.1.3. Type of Technology (2G, 3G and Future 4G Technologies)

5.2.1.3.1. The view of the Notifying Party

(42) The Notifying Party proposes that in this case it would also be inappropriate

to draw a distinction based on the generation of network technology. It sub-

mits that to date, more than half of the SIM cards in Austria are already 3G

cards. There are no new 2G-only offers on the market anymore. Further, cus-

17

See Case No COMP/M.5650 – T-Mobile/Orange; Case No COMP/ M.3916 – T-Mobile Aus-

tria/Tele.ring.

18

Consumer association's response to Commission questionnaire 2 to Business Customers and

Consumer Associations, Doc ID 508; the question was worded as follows: "Would your com-

pany / consumers switch from post-paid / pay monthly services to pre-paid / pay-as-you-go

subscription, if the price of all available post-paid services increased on a non-temporary basis

by 5–10% while prices of pre-paid would remain constant?"

19

See Recital (110).

15

tomers cannot distinguish a voice call received on a 2G or a 3G network.

Therefore, in its view, a subdivision of the mobile end-customer market by

type of network technology is not appropriate.

5.2.1.3.2. The Commission's assessment

(43) In previous decisions the Commission considered that there was a single

market for the provision of mobile telecommunications services to end cus-

tomers, in so far as they could be provided on both a 2G and a 3G basis.

20

Even though voice telecommunications and data services, such as text mes-

saging, access to e-mail services or general Internet access, can be provided

on 2G or 3G networks, 2G networks provide a much lower speed. Other ser-

vices, such as video telecommunications, mobile TV or other multimedia

services, require the faster transmission speed which only a 3G network can

provide. On the other hand, access to each of these technology layers is a

function of the generation of handset which the end-user possesses, since us-

ers of 2G-only handsets cannot access 3G and a fortiori LTE

21

services.

(44) In the light of the responses to the market investigation the Commission con-

siders that the subdivision of the mobile end-customer market by type of

network technology is not appropriate.

22

For instance, the vast majority of

market participants argued that, for them, a change to LTE was not important

and that they were not willing to pay a premium for LTE technology.

23

Fur-

thermore, one consumer organisation noted that "consumers do not differen-

tiate based on technology but only with regard to their own needs. Even after

the introduction of UMTS, there have been no specific UMTS tariffs. […]

However customers will be ready to pay for more data volume if needed (as

they already do)."

24

Moreover, in terms of coverage, LTE is expected to be

20

See Case No COMP/M.5650 – T-Mobile/Orange, paragraph 24; Case No COMP/ M.3916 –

T-Mobile Austria/Tele.ring, paragraph 18.

21

LTE stands for Long Term Evolution, marketed as 4G LTE. The technology is a standard for

wireless communication of high-speed data for mobile phones and data terminals.

22

See responses to Commission questionnaires 1 to Competitors, Doc ID 496; 2 to Business

Customers and Consumer associations, Doc ID 508; 3 to Distributors and Resellers, Doc ID

498; 4 to Network Operators outside Austria (MNOs and MVNOs), Doc ID 372; the question

was worded as follows: "In the cases M.3916 – T-Mobile Austria/tele.ring and M.5650 – T-

Mobile/Orange United Kingdom, the Commission concluded that there was an overall relevant

market for the provision of mobile telecommunications services to end customers and did not

further subdivide the market by […] technology (2G/GSM or 3G/UMTS networks). Do you

consider this holds today?"

23

See responses to Commission questionnaire 2 to Business Customers and Consumer associa-

tions, Doc ID 508; the questions were worded as follows: "How important would it be for

your company / consumers to switch to LTE?" and "Do you think that your company / con-

sumers would be prepared to pay a premium for LTE?"

24

Consumer association's response to Commission questionnaire 2 to Business Customers and

Consumer associations, Doc ID 508; the question was worded as follows: "Do you think that

your company / consumers would be prepared to pay a premium for LTE?" ("Konsument[en]

differenzieren nicht nach Technologie, sondern nach deren Bedürfnissen. Auch nach der Ein-

führung von UMTS sind keine eigenen UMTS-Tarife entstanden. Es ist nicht zu erwarten,

16

complemented by 3G.

25

It is also important to note that LTE in Austria is not

yet ready to be used for voice traffic and such a development is not expected

before 2015; therefore voice traffic will need for the time being to fall back

on the legacy 2G and 3G technology layers.

(45) Notwithstanding this, there are clear performance differences for data traffic

over 2G, 3G and LTE networks, the importance of which to a given user will

vary depending on that user's pattern of use. The Notifying Party is aware of

the importance of network quality to users, particularly data-intensive users,

and seeks to differentiate its service offering on this basis. For the moment,

however, such commercial differentiation does not foreclose use of the latest

available network technology layer to users with devices supporting access to

that layer, and therefore a distinction for market definition purposes appears

superfluous.

(46) The Commission therefore considers that in view of the limited customer

differentiation between different types of technology and the fact that all

MNOs offer a combination of mobile services over both 2G and 3G net-

works, there are at present no distinct product markets for different types of

network services.

5.2.1.4. Voice telecommunications and data services

(47) Voice telecommunications and data services, such as access to email services

or general Internet services, are often provided together as a bundled tariff

plan offering. With the introduction of smartphones, a wide variety of data

intensive applications has emerged through the use of mobile handsets. On

the other hand, data consumption also takes place on a standalone basis, sep-

arate from voice services, through mobile broadband dongles, 3G/4G enabled

tablets or mobile 3G/4G routers.

5.2.1.4.1. The view of the Notifying Party

(48) In relation to the different services provided over the mobile network (voice,

SMS and data), the Notifying Party agrees with the Commission's previous

practice, based on the definition of a single mobile telecommunications ser-

vices market.

5.2.1.4.2. The Commission's assessment

(49) The Commission has considered whether there is an overall market for all

mobile retail services which would encompass both voice and data services.

Alternatively, the Commission considered whether the market should be

subdivided into a market for voice retail mobile services and data retail mo-

bile services. This latter market would include both mobile broadband over

dass es eigene LTE-Tarife geben wird, allerdings werden die Konsument[en] bei Bedarf bereit

sein, für mehr Datenvolumen zu zahlen (wie jetzt auch schon).".)

25

See MNO's response to Commission questionnaire 4 to Network Operators outside Austria

(MNOs and MVNOs), Doc ID 372; the question was worded as follows: 21.1 "How long do

you expect the LTE technology cycle to last? What do you con-sider to be the time horizon for

LTE revenues?"

17

smartphones and over data-only devices. Finally, as another alternative, the

Commission considered whether voice and mobile broadband over voice-

enabled devices belong in one market and mobile broadband over data-only

devices forms a distinct market.

(50) Voice and mobile broadband over smartphones are commonly acquired to-

gether in a bundle and used over the same mobile handset, which is often

provided at a subsidised price as part of the bundled offering, whereas mobile

broadband over data-only devices is purchased and consumed independently

of any voice services. In the light of the market investigation, the Commis-

sion has confirmed the increasing importance of and demand for data ser-

vices as well as the decrease in voice only offers (without data). A vast ma-

jority of the participants in the market investigation considers that (except for

data-only devices) data and voice are usually purchased in a bundle. Some

respondents even considered "voice only [as] not relevant anymore".

26

A

significant number of respondents highlighted that such combinations were

required for smartphones.

(51) Notable exceptions to bundled services of voice and data were dongles, tab-

lets and 3G/4G mobile routers which use data only services only.

27

Such de-

vices do not necessarily support voice traffic (other than through Voice over

Internet Protocol (VoIP)). Moreover, the market penetration of data-only de-

vices is increasing, making it more attractive to devise tariff plans specifi-

cally suited to mobile broadband over data-only devices and indeed in some

cases to offer such plans in a bundle with a device of the type in question.

This fact is not altered by the consideration, put forward by the Notifying

Party, that all SIM cards in Austria are technically capable of offering all

services, since the accompanying tariff plans incentivise one type of use (in a

data-only device) or the other (in a voice-enabled device, that is to say a

phone).

(52) It follows that, from a demand perspective, services designed for use on a

voice-enabled device are distinguished from services designed for use on a

data-only device. However, the Commission considers that due to supply-

side considerations and notably the fact that all providers (or at least all

MNOs) offer both types of service, it is not appropriate to depart from its

previous practice of defining a single market including all services provided

whether for data-only devices or for voice-enabled devices.

26

Business customer's response to the Commission questionnaire 2 to Business Customers and

Consumer Associations, Doc ID 508; the question was worded as follows: "Do you think that

data and voice are usually purchased together in a bundle or separately?"

27

Responses to Commission questionnaire 2 to Business Customers and Consumer associations,

Doc ID 508; the question was worded as follows: "Does your company / Do consumers pur-

chase mobile broadband services (whether 2G or 3G) in Austria in conjunction with voice ser-

vices or separately?"

18

5.2.1.5. Fixed and mobile data services

5.2.1.5.1. The view of the Notifying Party

(53) The Notifying Party argues that mobile data services increasingly offer a

substitute to traditional fixed line internet services. There is evidence that

mobile broadband may provide an effective alternative to fixed line services

for many Austrian residential customers. The Notifying Party considers,

however, that a number of differences between the product offerings suggest

that fixed line services are not fully substitutable with mobile data services

and that substitution may be limited to certain types of internet use (such as

residential use). Thus the Notifying Party believes that it is premature to de-

cide on whether mobile data services and fixed internet services are part of a

single product market.

5.2.1.5.2. The Commission's assessment

(54) The RTR/TKK in its Telecommunications Markets Ordinance has found that

mobile broadband access by residential customers is a substitute for fixed

line internet services.

28

The Commission does not dispute this finding in rela-

tion to Austria.

(55) However, for the assessment in this case, the question is the reverse, namely

not whether fixed broadband is substitutable with mobile but whether fixed

broadband services are a substitute for mobile data services in general or for

mobile broadband specifically. The Ordinance does not cover this question.

(56) The results of the market investigation have shown that there is only limited

substitutability for mobile data services by fixed broadband.

29

Mobile data

services delivered on a smartphone in a bundle with voice services could not

be fully substituted by fixed broadband in terms of their type of use (that is to

say, in a mobile handset device). Most importantly, there is limited substitut-

ability between mobile data over dongles, tablets, etc. and fixed broadband

because of the restriction in mobility. Only mobile data services offer cus-

tomers the possibility to access the internet universally whilst on the move.

Customers for whom mobility is important (including in locations where Wi-

Fi is unavailable or less satisfactory) would not consider fixed line services

as an alternative.

30

Some respondents to the market investigation consider

28

See Novelle der TKMVO 2003 samt erläuternden Bemerkungen – "Breitbandmarktdefini-

tionsverordnung", Federal Law Gazette ("Bundesgesetzblatt") II Nr 38/2005 of 29.4.2005; 2.

Novelle der TKMV 2008 samt erläuternden Bemerkungen", available at

http://www.rtr.at/de/tk/TKMV2008

(retrieved 31 October 2012).

29

MNOs' response to Commission questionnaire 1 to Competitors Doc ID 496; the question was

worded as follows: 72 "Do you consider that, in Austria, retail fixed broadband services are

exercising competitive constraints on retail mobile broadband services?"

30

Whilst in certain countries there are relatively dense urban public wifi subscription networks,

raising at least the possibility of substitution for certain users, this is not the case in Austria.

19

that mobile broadband is "indispensable for mobile devices, because users

want to be independent from fixed broadband".

31

(57) In the light of the foregoing the Commission considers that fixed broadband

services are not a substitute for mobile data services and therefore do not

form part of the same product market.

5.2.1.6. Conclusion

(58) For the purpose of this decision, the Commission considers that there is a

single market in Austria for the provision of mobile telecommunications ser-

vices to end customers.

5.2.2. Wholesale market for access and call origination on public mobile telephone

networks

(59) Wholesale network access is provided by MNOs to MVNOs. This includes

the provision of a range of wholesale telecommunications services on a mo-

bile telephone network for the purpose of providing retail mobile telecom-

munications services to end customers. These services include wholesale

network access and call origination, call termination and international roam-

ing, whether for voice, SMS or data services. The wholesale market for these

services is therefore (i) on the supply-side, the MNOs who own their mobile

networks and (ii) on the demand-side, the MVNOs who seek access to the

MNO network in order to provide their retail services.

32

5.2.2.1. The view of the Notifying Party

(60) The Notifying Party agrees with the Commission's approach in previous cas-

es and submits that the Proposed Transaction should be assessed on the basis

that there is a market for network access and call origination on public mo-

bile telephone networks.

5.2.2.2. The Commission's assessment

(61) In previous decisions, the Commission considered wholesale network access

and call origination to be part of the same product market. It noted that

wholesale network access and call origination were key elements required to

provide retail mobile telecommunications services. These elements were typ-

ically supplied together by an MNO, hence both services could be considered

as part of the same market.

33

31

Business Customer's response to Commission questionnaire 2 to Business Customers and

Consumer Associations Doc ID 508; the question was worded as follows: "To what extent is

mobile broadband access an existing or rapidly emerging alternative to fixed broadband inter-

net access?"

32

Commission Decision of 20 August 2007 in Case No COMP/M.4748 – T-Mobile/Orange

Netherlands, OJ C 243, 17.10.2007, p. 1, paragraph 17; Commission Decision of 1 March

2010 in Case No COMP/M.5650 – T-Mobile/Orange, OJ C 108, 28.4.2010, p. 4, paragraph

28.

33

See Case No COMP/M.5650 – T-Mobile/Orange, paragraph 27; Case No COMP/M.4947 –

Vodafone/Tele2 Italy/Tele2 Spain, paragraph 15.

20

(62) In the market investigation, market participants unanimously affirmed that

this approach is also appropriate in this case.

5.2.2.3. Conclusion

(63) In view of the foregoing, the Commission considers that there is a distinct

wholesale market for access and call origination on public mobile telephone

networks in Austria.

5.2.3. Wholesale market for international roaming

(64) International roaming is a service which allows mobile subscribers to use

their mobile handsets and SIM cards to make and receive calls, to send and

receive text messages and to use other data services when abroad. In order to

be able to offer this service to their customers, MNOs conclude wholesale

agreements with one another providing access and capacity on mobile net-

works in the foreign country.

34

(65) Demand for wholesale international roaming services comes first from for-

eign mobile operators who wish to provide their own customers with mobile

services outside their own network and, downstream, from subscribers wish-

ing to use their mobile telephones outside their own countries.

(66) Roaming agreements can be concluded with a preferred foreign operator

which offers specific conditions, as can be seen in particular in the creation

of international roaming alliances such as the Freemove Alliance or the Vo-

dafone partners.

(67) Therefore the Commission concludes that there is a separate wholesale mar-

ket for international roaming.

5.2.4. Wholesale market for mobile call termination.

(68) Call termination is the service provided by network operator B to network

operator A whereby a call originating in operator A's network is delivered to

the user in operator B's network. Call termination thus allows users of differ-

ent networks to communicate with one another. Call termination is a whole-

sale service which the various network operators provide one another on the

basis of interconnection agreements, upstream of the provision of telecom-

munications services to end customers.

35

(69) As established in previous Commission decisions,

36

there is no substitute for

call termination on each individual network since the operator transmitting

the outgoing call can reach the intended recipient only through the operator

34

See Case No COMP/M.5650 – T-Mobile/Orange, paragraph 32.

35

See Case No COMP/M.5650 – T-Mobile/Orange, paragraph 36.

36

See Commission Decision 2001/98/EC of 13 October 1999 in Case No IV/M.1439 – Te-

lia/Telenor, OJ L 40, 9.2.2001, p. 1; Commission Decision of 10 July 2002 in Case No

COMP/ M.2803 – Telia/Sonera, OJ C 201, 24.8.2002, p. 19 and Commission Decision of 10

June 2005 in Case No COMP/M.3806 – Télefonica/ Cesky Telecom, OJ C 156, 28.6.2005, p.

3. See also Revised Commission Recommendation of 17 December 2007 referring to whole-

sale voice call termination on individual mobile networks.

21

of the network to which the recipient is connected. Each individual network

therefore constitutes a separate market for termination. This applies both to

fixed networks and to mobile networks.

37

(70) Therefore the Commission concludes that there is a separate wholesale mar-

ket for mobile call termination.

5.3. Geographic markets

5.3.1. Mobile telecommunications services to end customers

(71) The Notifying Party suggests defining the relevant geographic market for the

market for mobile telecommunications services to end customers, in line with

previous Commission decisions,

38

as national in scope.

(72) In the market investigation the vast majority of respondents considered the

relevant geographic markets to be national, that is to say, limited to the terri-

tory of Austria but no smaller.

39

There appears to be no relevant commercial

practice or ability to discriminate between users on the basis of their location

within the Austrian territory.

(73) In view of the foregoing, the Commission concludes that in this case the mar-

ket for mobile telecommunications services to end customers is national in

scope (that is to say, Austria).

5.3.2. Wholesale access and call origination on public mobile telephone networks

(74) The Notifying Party likewise suggests defining the relevant geographic mar-

ket for the market for wholesale access and call origination on public mobile

telephone networks, in line with previous Commission decisions,

40

as na-

tional in scope.

(75) In its previous decisions the Commission defined the geographic scope of the

product market for wholesale access and call origination on public mobile

telephone networks as national. This is due to regulatory barriers as the geo-

graphical scope of the licences granted to MNOs is in principle limited to ar-

37

See Commission Decision of 10 January 2006 in Case No COMP/M.4035– Téléfonica /O2,

OJ C 29, 4.2.2006, p. 14, paragraph 9 and following; Case No COMP/M.4947 – Voda-

fone/Tele2 Italy/Tele2 Spain, paragraph 13; Revised Commission Recommendation of 17 De-

cember 2007 referring to wholesale voice call termination on individual mobile networks, p.

24.

38

Case No COMP/M.5650 – T-Mobile/Orange; Case No COMP/M.4748 – T-Mobile/Orange

Netherlands; Case No COMP/ M.3916 – T-Mobile Austria/Tele.ring.

39

Responses to Commission questionnaires 1 to Competitors, Doc ID 496; 2 to Business Cus-

tomers and Consumer Associations, Doc ID 508; 4 to Network Operators outside Austria

(MNOs and MVNOs) Doc ID 372; the question was worded as follows: "In the cases M.3916

– T-Mobile Austria / Tele.ring and M.5650 – T-Mobile / Orange United Kingdom, the Com-

mission concluded that the geographic market for mobile telecommunications services to end

customers should be defined in national terms (for example restricted to Austria). Do you con-

sider this holds today?"

40

Case No COMP/M.5650 – T-Mobile/Orange; Case No COMP/M.4748 – T-Mobile/Orange

Netherlands; Case No COMP/ M.3916 – T-Mobile Austria/Tele.ring.

22

eas which do not extend beyond the borders of a Member State. Moreover,

the coverage of mobile networks tends to correspond to national borders,

with the result that the supply of access and origination at wholesale level is

national in scope.

(76) In the market investigation the vast majority of respondents confirmed the

relevant geographic markets to be national, that is to say, limited to the terri-

tory of Austria but no smaller.

41

(77) In view of the foregoing, the Commission concludes that in this case the mar-

ket for wholesale access and call origination on public mobile telephone net-

works is national in scope (that is to say, Austria).

5.3.3. Wholesale market for international roaming

(78) The Notifying Party suggests defining the relevant geographic scope of the

market for wholesale international roaming, in line with previous Commis-

sion decisions,

42

as national in scope. The Commission has based this view

on the fact that wholesale international roaming agreements can be con-

cluded only with companies which have an operating licence in the relevant

country and licences to provide mobile services are restricted to a national

territory. This was also confirmed in the market investigation.

43

(79) In view of the foregoing, the Commission concludes that in this case the

wholesale market for international roaming is national in scope (that is to

say, Austria).

5.3.4. Wholesale market for mobile call termination

(80) In line with the Commission's previous decisions,

44

the Notifying Party sub-

mits that the relevant geographic market for call termination in mobile (and

fixed) networks is national in scope, since the concrete size of the market

41

Responses to Commission questionnaires 1 to Competitors, Doc ID 496; 2 to Business Cus-

tomers and Consumer Associations, Doc ID 508; 4 to Network Operators outside Austria

(MNOs and MVNOs) Doc ID 372; the question was worded as follows: "In the cases M.3916

– T-Mobile Austria / Tele.ring and M.5650 – T-Mobile / Orange United Kingdom, the Com-

mission concluded that due to regulatory barriers, since the geographical scope of the licences

granted to MNOs is in principle limited to areas which do not extend beyond the borders of a

Member State, the geographic market for the provision of wholesale access and call origina-

tion on public mobile telephone networks is national. Do you consider this holds today?"

42

Case No COMP/M.5650 – T-Mobile/Orange; Case No COMP/M.4748 – T-Mobile/Orange

Netherlands; Case No COMP/ M.3916 – T-Mobile Austria/Tele.ring.

43

Responses to Commission questionnaires 1 to Competitors, Doc ID 496; 2 to Business Cus-

tomers and Consumer Associations, Doc ID 508; 4 to Network Operators outside Austria

(MNOs and MVNOs) Doc ID 372; the question was worded as follows: "In the cases M.3916

– T-Mobile Austria / Tele.ring and M.5650 – T-Mobile / Orange United Kingdom, the Com-

mission concluded that the geographic market for the provision of international roaming is na-

tional, on the fact that wholesale international roaming agreements can be concluded only with

companies which have an operating licence in the relevant country and licences to provide

mobile services are restricted to the national territory. Do you consider this holds today?"

44

Case No COMP/M.5650 – T-Mobile/Orange; Case No COMP/M.4748 – T-Mobile/Orange

Netherlands; Case No COMP/ M.3916 – T-Mobile Austria/Tele.ring.

23

corresponds to the geographic dimension of the network which, in general, is

limited to the national borders. This is essentially owing to regulatory barri-

ers as the geographic scope of the licences is in principle limited to areas

which do not extend beyond the borders of a Member State. This view was

confirmed by the results of the market investigation.

45

(81) In view of the foregoing, the Commission concludes that in this case the

wholesale market for mobile call termination is national in scope (that is to

say, Austria).

6. COMPETITIVE ASSESSMENT IN THE MARKET FOR MOBILE

TELECOMMUNICATION SERVICES TO END CUSTOMERS

(82) The following assessment focuses on the market for mobile telecommunica-

tions services to end customers.

6.1. Introduction

(83) The Proposed Transaction will bring together two of the four MNOs in Aus-

tria. H3G and Orange are, respectively, the fourth and third MNOs ranked by

market share size in the Austrian market for mobile telecommunications ser-

vices to end customers. Despite their lower market shares compared to the

other two MNOs, TA and T-Mobile, the Commission considers that the

transaction will lead to a significant impediment of effective competition.

(84) The market is already highly concentrated. The intended consolidation will

eliminate a fully-fledged competitor from the market and reduce the number

of market players from four to three. The competition concerns identified by

the Commission in this case are a consequence of four essential factors: the

market structure, the high diversion ratios between the Parties, the significant

margins which they realise, and the pre-merger importance of the Parties

with regard to the acquisition of new business.

46

The market structure means

that competition concerns would arise as a result of the Proposed Transaction

in particular owing to high barriers to entry, the absence of significant buyer

power and the existence on the part of competitors of an incentive to follow

price increases by the merged entity. Furthermore, the argument of the Noti-

fying Party according to which the competitive constraint posed by Orange in

the market is likely to deteriorate in the near to medium term cannot be ac-

cepted on the basis of the evidence.

45

Responses to Commission questionnaires 1 to Competitors, Doc ID 496; 2 to Business Cus-

tomers and Consumer Associations, Doc ID 508; 4 to Network Operators outside Austria

(MNOs and MVNOs) Doc ID 372; the question was worded as follows: "In the cases M.3916

– T-Mobile Austria / Tele.ring and M.5650 – T-Mobile / Orange, the Commission concluded

that the geographic markets for wholesale call termination are national, since they correspond

to the geographic dimension of the network which in general is limited to national borders. Do

you consider this holds today?"

46

With the exception of the business and prepaid segments as set out in Section 6.4.3.2.

24

(85) The qualitative, as well as quantitative, evidence collected by the Commis-

sion during its market investigation confirms each of the key elements in its

analysis.

6.2. Factors likely to lead to a significant impediment to effective competition

(86) A merger may significantly impede effective competition in a market by re-

moving important competitive constraints on one or more sellers, who con-

sequently have increased market power. The most direct effect of the merger

will be the loss of competition between the merging firms. Non-merging

firms in the same market can also benefit from the reduction of competitive

pressure that results from the merger. These effects are non-coordinated ef-

fects.

(87) Often, a merger giving rise to such non-coordinated effects would signifi-

cantly impede effective competition by creating or strengthening the domi-

nant position of a single firm, which, typically, would have an appreciably

larger market share than the next competitor post-merger.

(88) However, as set out in recital 25 in the preamble to the Merger Regulation,

mergers in oligopolistic markets, involving the elimination of important

competitive constraints that the Parties previously exerted upon each other

together with a reduction of competitive pressure on the remaining competi-

tors may, even where there is little likelihood of coordination between the

members of the oligopoly, also result in a significant impediment to effective

competition notwithstanding that they do not give rise to or strengthen a

dominant position.

(89) Recitals 24 and 25 in the preamble to the Merger Regulation clarify that all

mergers giving rise to such non-coordinated effects should be declared in-

compatible with the internal market.

(90) The Notifying Party argues that, with a combined market share of under

25%, there is a presumption that the Proposed Transaction does not raise

competition concerns. It claims that the Commission's prior decisions under

the Merger Regulation concerning non-coordinated effects are, with very few

exceptions, associated with market shares indicative of dominance.

47

(91) To support this point, the Notifying Party cites four decisions that involved

concerns in the absence of dominance in which the Commission opened a

Phase II

48

investigation or commitments were accepted in Phase I].

49

The

Notifying Party distinguishes these cases from the case at hand. In none of

47

See paragraph 22 of the Notifying Party's "Response to the Commission's decision of 28 June

2012 pursuant to Article 6(1)(c) of Regulation 139/2004" of 11 September 2012.

48

The expression "Phase II" refers to the in-depth proceedings the Commission opens once it

has established that a notified concentration gives rise to serious doubts. Phase I therefore re-

fers to the Commission's investigation preceding such a decision.

49

See cases Case No COMP/ M.3916 – T-Mobile/teleMobile Austria/Tele.ring; Commission

Decision of 12 March 2009 in Case No COMP/M.5355 – BASF/CIBA, OJ C 122, 30.5.2009,

p. 5; Commission Decision of 12 November 2009 in Case No COMP/M.5549 – EDF/Segebel,

OJ C 57, 9.3.2010, p. 9; Commission Decision of 22 December 2008 in Case No

COMP/M.5224 – EDF/British Energy, OJ C 38, 17.2.2009, p. 8.

25

the four cases was the merged entity the smallest. Rather, the mergers in

those cases gave rise either to the market leader or to the second largest com-

petitor. The Notifying Party argues that the Commission has never previously

raised concerns based on non-coordinated effects against a merger creating

the smallest player with two large and viable competitors, even in cases

which did not involve the creation or strengthening of a dominant position.

(92) The Commission considered the arguments and the decisional precedents

cited by the Notifying Party. The Commission disagrees that any legal pre-

sumption exists for mergers based on allegedly low market shares. The "legal

presumption" of the Merger Regulation cited by the Notifying Party

50

is in

fact no more than "an indication" that the undertakings concerned may not be

liable to impede effective competition if their market shares do not exceed

25% either in the internal market or in a substantial part of it.

51

The Merger

Regulation does not contain any legally binding rule that concentrations lead-

ing to a combined market share of under 25% should be cleared as a matter

of principle.

(93) Moreover, the Commission's precedents include a number of cases with low

market shares where the Commission found concerns. In case M.5224 –

EDF/Segebel

52

for instance, the market shares of the Parties were even

smaller and the main competitor was much stronger than in this case. None-

theless, the Commission identified serious concerns that the Parties remedied