1

Annual Report 2019–20

ANNUAL REPORT

DEPARTMENT

OF POLICE, FIRE

& EMERGENCY

MANAGEMENT

2019–2020

dpfem.tas.gov.au

Department of Police, Fire and Emergency Management

2

Annual Report 2019–20

Department of Police, Fire and Emergency Management Annual Report 2019–20

© Government of Tasmania 2020

Excerpts from this publication may be reproduced, with appropriate acknowledgement,

as permitted under the Copyright Act 1968.

An electronic version of this report is available at www.dpfem.tas.gov.au

For further information please contact:

Department of Police, Fire and Emergency Management

47 Liverpool Street, HOBART, TAS 7000

GPO Box 308, HOBART, TAS 7001

Email: tasmania.police@police.tas.gov.au

Published October 2020

ISSN: 2207-0494 (print)

ISSN: 2207-508 (online)

Published by: Before Creative

Disclaimer: The information in this Annual Report 2019–20 is correct at the time of publication.

3

Annual Report 2019–20

Contents

ABBREVIATIONS AND ACRONYMS 4

Tasmania Police Business Priorities 22

Performance Measures 23

LETTER TO THE MINISTER 5

OUTPUT GROUP 2: CRIME 24

Tasmania Police Business Priorities 24

SECRETARY’S FOREWORD 6

Performance Measures 26

OUTPUT GROUP 3: TRAFFIC POLICING 27

2019–20 OUR YEAR IN REVIEW 8

Tasmania Police Business Priorities 27

Performance Measures 28

OUR DEPARTMENT 10

Our Vision, Mission, Values and Principles

Our Strategic Framework

Our Performance Measures

Our Key Deliverables

Corporate Governance

Agency Management Group

Corporate Management Group

Committees and Boards

Organisational Structure Changes

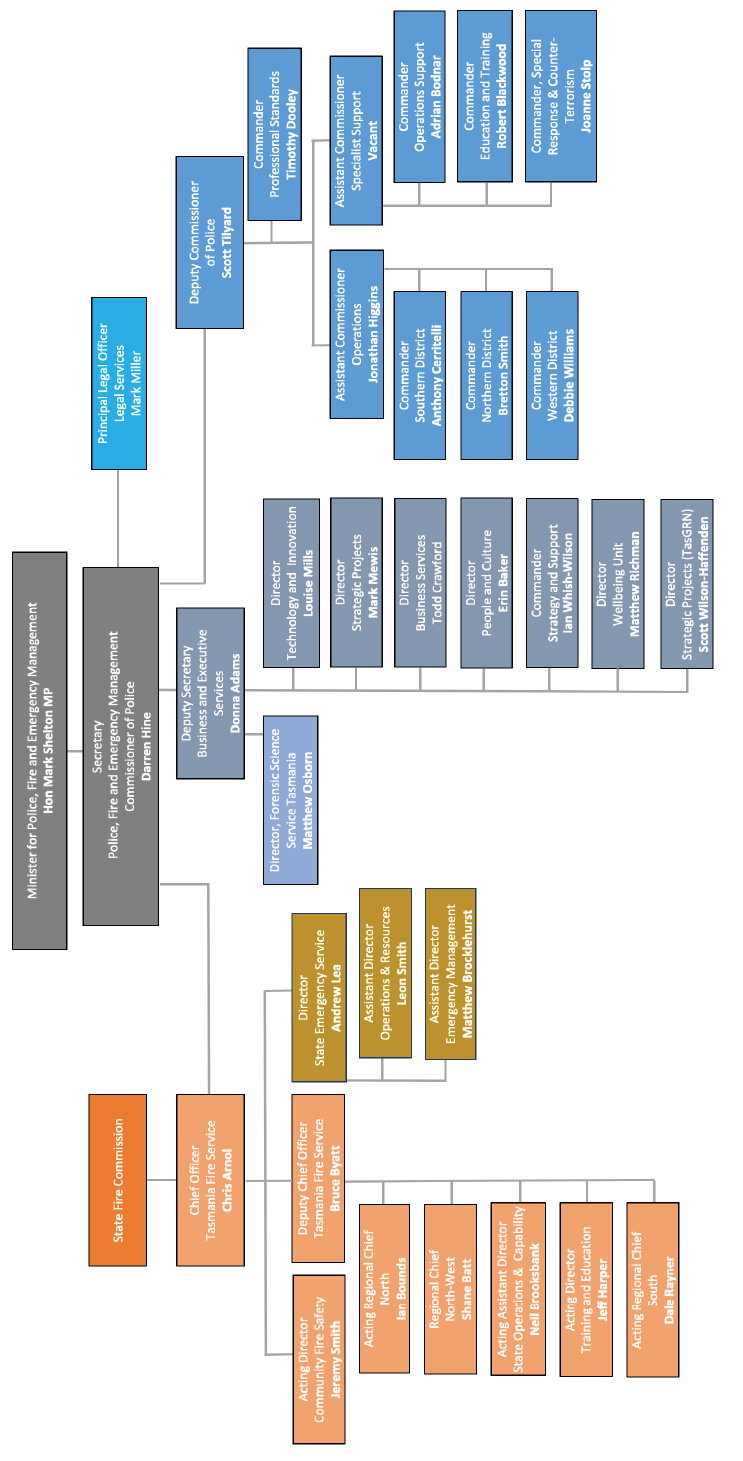

Organisational Structure of the Department of Police,

Fire and Emergency Management (at 30 June 2020)

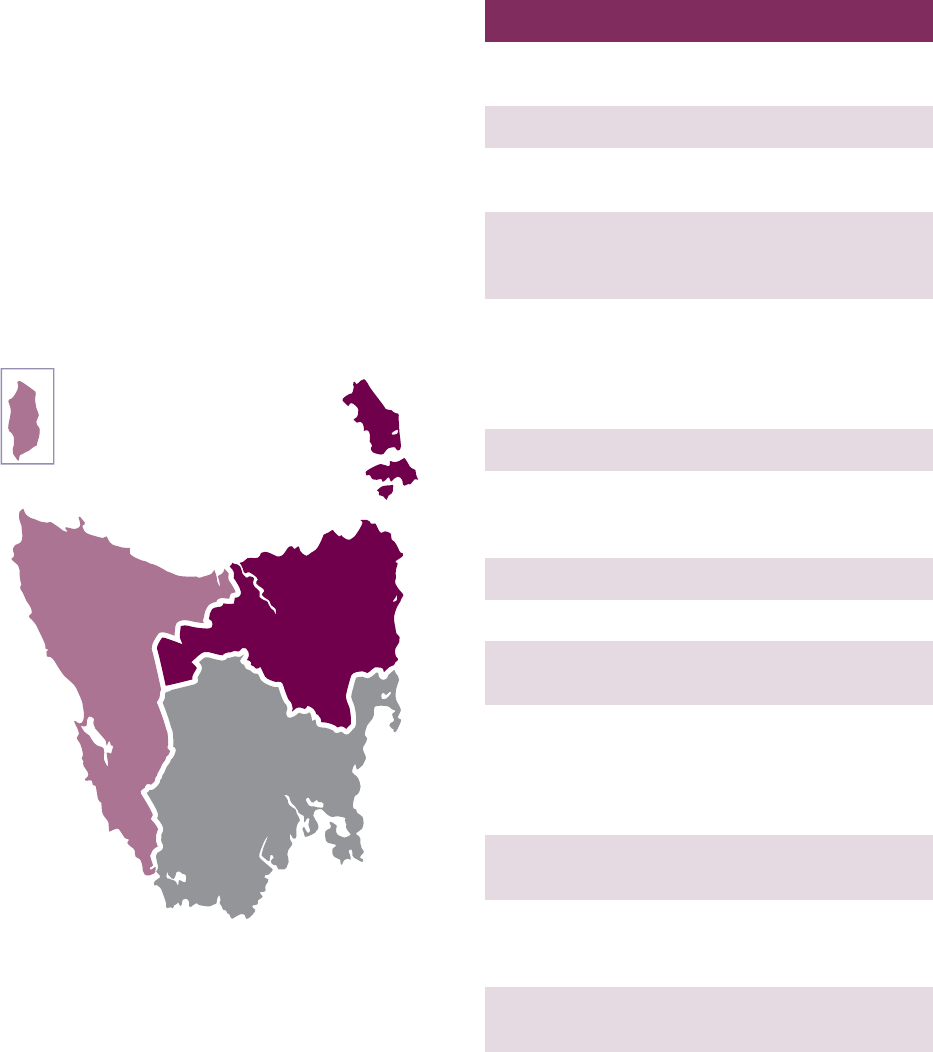

Tasmania Police Commands

Our Geographical Police Districts

Police Support Commands

Business and Executive Services

Forensic Science Service Tasmania

Tasmania Fire Service

State Emergency Service

DPFEM COVID-19 REPORT

10

OUTPUT GROUP 4:

10

EMERGENCY MANAGEMENT 29

11

Tasmania Police Business Priorities 29

11

Performance Measures 30

11

11

11

2019–20 COMPLIANCE INDEX 31

11

12

OUR COMPLIANCE REPORT 33

12

13

Corporate Governance 33

Statutory and Non-statutory Boards and Committees 34

13

Legislation Administered and Enacted by the Department 37

15

Public Access and Information Disclosure 38

15

Our People and Policies 41

16

Compliance Reporting to Other Legislation 48

17

Royal Commission Reporting 53

17

Pricing Policy 53

Risk Management 53

18

Asset Management 54

Procurement 55

List of Tables: 2019–20 Annual Report 61

OUR PERFORMANCE MEASURES 20

Financial Statements 62

Budget Allocation 20

Auditors Report 117

Contact Us 121

Output Groups 20

Our Key Deliverables 21

OUTPUT GROUP 1: PUBLIC SAFETY 22

4

Annual Report 2019–20

Abbreviations and Acronyms

AA Audit Act

AAS Australian Accounting Standards

AASB Australian Accounting Standards Board

ABS Australian Bureau of Statistics

ATO Australian Tax Office

C Contracts

CALD Culturally and linguistically diverse

DNA Deoxyribonucleic acid

Department of Police, Fire and

DPFEM Emergency Management

Department of Primary Industry, Parks,

DPIPWE Water and Environment

EMA Emergency Management Act 2006

Emergency Services Computer Aided

ESCAD Dispatch

ED Employment Direction

Ex Excluding

FC Financial Controls

Financial Management Association

FMAA of Australia

FR Financial Reporting

FSST Forensic Science Service Tasmania

FTE Full Time Equivalent

GP General Practitioner

GPS Global Positioning System

GST Goods and Services Tax

International Financial Reporting

IFRS Standards

km/h Kilometres per hour

LGBTIQ+ Lesbian, gay, bisexual, transgender,

gender diverse, intersex, queer,

asexual and questioning

LED

LGA

n/a

PF

PP

PIDA

PSSRA

RTIA

SOG

SCC

SES

SSA

SSR

TFS

TasGR N

TMRN

TI

Light Emitting Diode

Local Government Area

Not applicable

Procurement Framework

Procurement Processes

Public Interest Disclosure Act 2002

Public Sector Superannuation Reform

Act 2016

Right to Information Act 2009

Special Operations Group

State Control Centre

State Emergency Service

State Service Act 2000

State Service Regulations 2011

Tasmania Fire Service

Tasmania Government Radio Network

Tasmanian Mobile Radio Network

Treasurer's Instructions

5

Annual Report 2019–20

Letter to the Minister

Hon Mark Shelton MP

Minister for Police, Fire and Emergency Management

Parliament House

HOBART TAS 7000

Dear Minister

In accordance with the requirements of section 36(1) of the State Service Act 2000 and section 27 of the Financial

Management and Audit Act 1990, I am pleased to submit for presentation to Parliament, the 2019–20 Annual Report

for the Department of Police, Fire and Emergency Management.

Yours sincerely

D L Hine AO APM

Secretary

6

Annual Report 2019–20

Secretary’s Foreword

2019–20 will be remembered

for the most serious public

health emergency in our

lifetime, COVID-19.

To support our response, in

March 2020 the first State of

Emergency in living memory was

declared under the Emergency

Management Act 2006 (EMA).

This is the legal framework

for emergency powers, such

as border restrictions, which

helped limit the impact of the

virus on our community.

While the Department of

Health is the lead agency, as

State Controller under the

EMA, I exercised responsibility

for coordinating the whole of

government response to the COVID-19 pandemic.

Police officers and State Service employees from across

government have taken up positions within the State

Control Centre (SCC), working in policy, legal, planning,

public information and recovery areas. Others across the

Department continued to deliver policing and support

services while their colleagues were seconded to the SCC.

Police officers have enforced compliance with the

unprecedented restrictions on movement, and have

gone about their business professionally and with good

judgement. That has been a significant factor in Tasmania

Police maintaining high levels of public confidence and

trust during a challenging period and contributed to

maintaining a safe place to live and work.

The COVID-19 response and recovery will be part of

the ‘new normal’ for the foreseeable future. It has been

a remarkable community effort to date to bring the virus

under control and I want to thank all Tasmanians for their

individual commitment to the response.

The pandemic had a significant impact on policing

activities, resulting in reductions in crime and public

order offences in the reporting period. There was an

approximate 2% reduction in recorded crime, including

assaults, burglaries, stolen motor vehicles and arson

related offences, influenced by the period of COVID-19

restrictions. Fraud offences continued to increase,

and this will be a focus of a new Crime and Intelligence

Command to be established in July 2020.

We are on track to deliver the State Government’s

commitment of an additional 125 police officers by 2022.

A further 30 officers were added to our establishment

during 2019–20. This included four officers to establish a

full time Special Operations Group capability, an allocation

to create a Crime and Intelligence Command, and a

position in each of the three regional Drug Investigation

Services to target serious drug offenders, including those

trafficking in crystal methamphetamine (Ice). At the

completion of the program, we will have 1,358 FTE which

will be the highest number of police in the agency’s history.

DPFEM provides housing for Tasmania Police officers

stationed in remote and country towns throughout the

State. The Upgrade Police Housing project has continued

to renovate properties, delivering quality accommodation

for police officers and their families. Renovations were

completed on a number of police properties in the

North-West and North-East, including two houses on

Flinders Island.

In June 2020, the Department received an additional

$8.7 million to upgrade 29 police houses in regional areas,

and $7 million to upgrade infrastructure at the Launceston

Police Station, which last received a makeover in 2006.

The health and welfare of our people was a continued

focus during the year. An online hub, MyPulse, was launched

to provide resources including mental health screening

and face to face health clinics for emergency service

responders and State Service employees. We have also

committed to increasing the number of Wellbeing Support

and Critical Incident Stress Management peers available

to provide support to those who need it. In August 2019,

a new business unit, Wellbeing Support, was established

and located in non-emergency service buildings to increase

confidentiality of the services provided.

In October 2019, Project Unify successfully delivered

Phase One of a significant program of reform establishing

a secure, reliable, contemporary and integrated policing

operational information system known as ‘Atlas’. Project

Unify also delivered a new integrated search facility known

as ‘Compass’.

Atlas now holds core data sets and the intelligence

management functions with some 78 million records

being migrated into the new system.

Planning continues for future phases to transition aging

applications into the Atlas system ensuring the best

possible access, security and support for operational police

and the Tasmanian community.

7

Annual Report 2019–20

Tasmania Police collaborated with the Department

of Justice on a nation-leading trial, using electronic

technology, to monitor the movement of high-risk family

violence perpetrators to improve safety for victims and

their children.

The two-year trial used electronic tracking devices for

perpetrators to ensure they do not approach their victims.

Selected victims of family violence were offered the

option to have a portable device with duress capability

to alert police to a potential breach of a family violence

order. The preliminary results from the trial show a

significant reduction in high risk incidents, assaults and

threats of family violence. The Tasmanian Institute of Law

Enforcement Studies will undertake an evaluation of the

trial for consideration of the Government.

We celebrated the 50th anniversary of our Tasmania

Police Pipe Band during the year. The Pipe Band would be

familiar to many Tasmanians from their performances at

community and ceremonial events including the Hobart

Christmas Pageant, Government House events and

Tasmania Police graduations.

The Pipe Band is comprised of committed volunteers who

represent Tasmania Police with pride. A highlight of the

celebrations was the Pipe Band’s invitation to play at the

Royal Edinburgh Military Tattoo, which is testament

to their talent and professionalism.

My thanks to everyone in the Department for your

hard work in challenging circumstances. I am proud of

the policing and emergency management service we

provide to the Tasmanian community.

D L Hine AO APM

Secretary

8

Annual Report 2019–20

2019–20

Our Year in Review

Key Business Priorities

The key business priorities for Tasmania Police and Business and Executive Services are established within

the strategic framework of Future Focus 2017–20.

The following information provides a summary of the key business priorities for 2019–20 that are of strategic

or whole-of-department significance.

HEALTH AND WELLBEING DIGITAL INFORMATION TASMANIAN RISK

Launched MyPulse, a central online

STRATEGY MANAGEMENT FUND

hub for wellbeing, targeted

Commenced planning for a new Completed the transition of

at career frontline responders

Departmental Digital Information Workers Compensation insurance

across the Department and

strategy. This strategy is future to the Tasmanian Risk Management

Ambulance Tasmania. MyPulse

investment in technology and Fund for both employees and

provides physical and mental health

communications, including volunteers following the State Fire

screens, e-learning modules and

information security. It is anticipated Commission endorsement

face-to-face wellbeing training.

that the strategy will be released in 2018 –19.

in the first half of 2020–21.

Provided a mix of proactive and

MEMORANDUM OF

preventative health and wellbeing

DIVERSITY AND

UNDERSTANDING

programs, such as the Ready for

INCLUSION

BETWEEN TASMANIA

Response 12-week fitness and

POLICE, STATE FIRE

Tasmania Police launched a number

nutrition program, so that our

COMMISSION AND

of recruitment strategies targeted

emergency personnel can perform

DPFEM BUSINESS AND

at attracting applicants from diverse

at their optimal best.

EXECUTIVE SERVICES

backgrounds, including CALD,

The Memorandum of Understanding

Aboriginal and Torres Strait Islander

NEW NORFOLK STATION,

for corporate services is currently

population and members of the

LONGFORD STATION

being developed through a Working

LGBTIQ+ community.

AND SORELL EMERGENCY

Group. The Working Group is

SERVICES HUB

Tasmania Police collaborated with

determining the level of service

Progressed work on developing

various organisations to identify

required and how best to meet the

contemporary police stations for

suitable police recruit applicants

needs of the individual service arms.

the Longford and New Norfolk

from CALD backgrounds, including

communities, as well as the new

providing support and advice to

PROJECT UNIFY

Emergency Services Hub in Sorell.

those applicants unable to meet

Delivered Atlas; a new secure,

These investments will provide

entry requirements. It is intended

reliable, contemporary and integrated

fit-for-purpose, modern and well-

that these strategies will increase the

operational policing information

equipped accommodation from

diversity of police recruit applicants

system. Atlas went live on

which to respond to the needs

and subsequent representation on

16 October 2019, along with a new,

of the community.

recruit courses, to better reflect

enhanced search facility known as

our community.

Compass. Atlas provides new services

ONLINE LEARNING SYSTEM

for managing warrants, searches,

The Department also procured

Released a new online learning

intelligence submissions and child

an unconscious bias training program

system that provides a modern,

safety referrals. It holds core data

targeted at Departmental leaders,

user-friendly learning environment

sets and the intelligence management

managers and supervisors that

for staff and volunteers. During

function with some 78 million

aims to improve decision-making

COVID-19, this system allowed for

records being migrated into the

and professional relationships

ongoing learning from an online

new system.

and creating a more open and

platform which staff and volunteers

inclusive organisation.

could access from home.

9

Annual Report 2019–20

POLICE RECRUITMENT

Continued to progress police

recruitment towards meeting

the Tasmanian Government’s

commitment to increase police

numbers by 125 by mid-2022.

40 recruits and 11 Accelerated

Training Program members

graduated during 2019–20.

A further three recruit courses and

two Accelerated Training Program

courses are scheduled for 2020–21.

At the completion of the recruitment

campaign, Tasmania Police will have

1,358 FTE, the highest number of

police officers in the agency’s history.

PROJECT AUTHENTICATE

(BODY WORN CAMERAS)

Deployed 751 body worn camera

devices to all general uniform

policing units.

Body worn cameras are an additional

tool for police officers and contribute

to a safer working environment for

frontline members.

The delivery of the body

worn camera devices has

also complemented existing

accountability measures and

streamlined processes regarding

complaints against police officers.

CAPABILITY REVIEW

PROJECT

Completed the Capability Review

Project in December 2019, producing

the Next Generation Policing report

which identifies a range of capabilities

and recommendations to consider

in relation to future requirements

and needs.

POLICE OFFICER

ALLOCATION MODEL

Finalised the Police Officer Allocation

Model in December 2019, providing

a rational model to inform the

allocation of police officers to

positions or locations. The model

takes account of various factors,

including offence rates, calls for

service, family violence, disadvantage

index, population, demographics,

socio-economic and geographical

considerations, while also recognising

professional judgement. The model

is being used to support the current

and future increases in police

numbers.

AT-RISK YOUTH STRATEGY

Implemented the Policing

At-Risk Youth Strategy 2019–2022

in September 2019. Key components

of the strategy are ensuring

interventions occur at the earliest

opportunity and coordinating efforts

amongst agencies to promote a more

holistic approach. The strategy will

allow Tasmania Police to focus its

resources on those most at risk, at

FATIGUE MANAGEMENT

POLICY

Tasmania Police is working with

a specialist external consultant to

develop the draft policy. This work

will continue to be progressed

during 2020–21.

RAPID RESPONSE

CAPABILITY

Four full time Special Operations

Group positions have been filled

and work commenced towards

developing a full time Special

Operations Group model,

including an enhanced rapid

response capability.

the earliest possible opportunity.

10

Annual Report 2019–20

Our Department

The Department of Police, Fire and Emergency

Management is an all-hazards emergency management

agency responsible for providing quality policing, fire and

emergency management services to

the Tasmanian community.

The Department consists of Tasmania Police, Tasmania

Fire Service, State Emergency Service, and Forensic

Science Service Tasmania, with corporate support

provided by Business and Executive Services.

Although the Tasmania Fire Service and State Emergency

Service are significant areas of the Department, they

are not extensively addressed in this report. More

information is available in the 2019–20 State Fire

Commission Annual Report.

Our Vision, Mission,

Values and Principles

The Department has a common vision, mission and values

for all its operational areas, and this is supported by a set

of principles. These guide the delivery of our services and

the behaviours of our people.

OUR VISION

A safe, secure and resilient Tasmania.

OUR MISSION

To provide effective policing, fire and emergency

management services.

OUR VALUES

INTEGRITY

We believe in honest, professional, transparent and

ethical behaviour in all aspects of our business.

EQUITY

We believe in fair, consistent and inclusive behaviour

when interacting with our people and our community.

ACCOUNTABILITY

We believe in being answerable for our decisions and

actions, behaving professionally and being responsible

for our outcomes.

OUR PRINCIPLES

COMMUNITY FOCUS

We will engage and work with the community to

provide effective services for the community.

COLLABORATION

We will work together and with others to achieve

positive outcomes.

VALUES-LED

Our service and behaviours will reflect our values.

PROFESSIONAL

We will be respectful, honest, confident and

competent.

ACCOUNTABLE

We will be responsible and transparent.

Our Strategic Framework

The Department’s overarching strategic framework

is established by Future Focus 2017-2020. Future Focus

identifies four areas of strategic focus for the Department

as a whole, and for its operational services.

These focus areas are:

COMMUNITY SERVICE

Delivering what the community needs to be safe,

engaged and reassured.

LEADERSHIP

Having the skills and resources to be informed,

accountable and innovative in what we do.

PEOPLE

Looking after our workforce and planning for the future.

COMMUNICATION

Ensuring that our messages are heard by the community

and that their voices are heard by us.

11

Annual Report 2019–20

These focus areas have been incorporated into our

business priorities for the 2019–20 reporting period.

Our 2019–20 Year in Review summary provides highlights

of our key priority areas that are of strategic or whole-of-

department significance.

Our Performance Measures

OUTPUT GROUPS

The Department (excluding the Tasmania Fire Service)

has four Output Groups with a specific aim and set of

priorities. These Output Groups are:

• Public Safety

• Crime

• Traffic Policing

• Emergency Management

Further information on the Output Groups are in the

Our Performance Measures Chapter.

Our Key Deliverables

The 2019–20 Government Services Budget Paper No. 2,

Volume 1 includes a budget allocation for a range of key

deliverables for the Department.

An update of our progress against these key deliverables

is outlined in the Our Performance Measures Chapter.

Corporate Governance

The Secretary, Mr Darren Hine, is responsible for

managing the Department and also holds the positions

of Commissioner of Police and State Emergency

Management Controller.

The high-level governance and decision-making forums

for the Department are outlined below.

Agency Management Group

The Agency Management Group provides a forum for

whole-of-agency decision-making and coordination. The

Group consists of the Secretary, Deputy Commissioner of

Police, Chief Fire Officer and Deputy Secretary of Business

and Executive Services.

Corporate Management Group

The Corporate Management Group brings together

strategic decision-makers from Tasmania Police, including

Business and Executive Services.

Committees and Boards

The Department has a range of committees and boards

to provide assurance that we effectively manage our

resources and risk, and to deliver our key priorities.

Further information and membership of all the above

groups is listed under the Boards and Committees section

in the Compliance section of this Annual Report.

Organisational Structure Changes

During 2019–20, the Department underwent the following

structural changes:

WELLBEING SUPPORT

On 4 August 2019, the Wellbeing Support business unit

was established in Business and Executive Services. The

Director, Wellbeing Support reports to the Deputy

Secretary, Business and Executive Services.

Wellbeing Support has offices in Hobart, Ulverstone and

Launceston which are now geographically separated from

agency hubs to ensure that confidentiality is enhanced.

NORTHERN DISTRICT (TASMANIA POLICE)

On 1 July 2019, the new St Helens Division was created in

the Northern District. Details of the reallocation of police

stations can be found in the Our Organisational Structure,

Northern District section.

SOUTHERN DISTRICT (TASMANIA POLICE)

The Southern District was restructured and two new

divisions, Clarence Division and East Coast Division, were

established. Details of the reallocation of police stations

can be found in the Our Organisational Structure, Southern

District section.

12

Annual Report 2019–20

Department of Police, Fire and Emergency Management Organisational Structure (as at 30 June 2020)

13

Annual Report 2019–20

Tasmania Police Commands

Tasmania Police consists of seven commands; three

geographical police districts and four support commands:

• Southern, Northern and

Western Districts

• Education and Training

• Operations Support

• Professional Standards, and

• Special Response and

Counter-Terrorism.

TASMANIA POLICE DISTRICTS MAP

WESTERN DISTRICT

NORTHERN DISTRICT

SOUTHERN DISTRICT

Our Geographical Police Districts

SOUTHERN DISTRICT

Headquarters 43 Liverpool Street

Address HOBART TAS 7000

Size

1

25,518 square kilometres

Population as at 275,434

30 June 2019

2

Police positions 1.79

per 1,000

population

3

DIVISION STATIONS

Bridgewater Bothwell, Bridgewater, Bushy Park,

Hamilton, Kempton, Liawenee,

Maydena, New Norfolk, Oatlands

Clarence Bellerive, Clarence Plains

East Coast Bicheno, Dunalley, Nubeena,

Orford, Richmond, Sorell,

Swansea, Triabunna

Glenorchy Glenorchy

Hobart Hobart

Kingston Alonnah, Cygnet, Dover, Geeveston,

Huonville, Kingston, Woodbridge

SUPPORT SERVICES

Criminal

Hobart, Glenorchy, Bellerive,

Investigation

Bridgewater, Kingston, Family

Services

Violence Unit

District Support Road and Public Order Services,

Services Community Support Services

Drug

Crime Management Unit, Dog

Investigation

Handling Unit

Services

Prosecution Coronial Services

Services

14

Annual Report 2019–20

NORTHERN DISTRICT WESTERN DISTRICT

Headquarters

Address

137–149 Cimitiere Street,

LAUNCESTON TAS 7250

Size

1

19,975 square kilometres

Population as at 146,258

30 June 2019

2

Police positions 1.77

per 1,000

population

3

DIVISION STATIONS

Deloraine Campbell Town, Deloraine,

Evandale, Longford,

Perth, Westbury

North-East Beaconsfield, Bridport,

Derby, Exeter, George Town,

Gladstone, Lady Barron,

Ringarooma, Scottsdale

Launceston Launceston, Newnham,

Ravenswood

St Helens Fingal, St Marys, St Helens,

Whitemark

SUPPORT SERVICES

Northern

Crime Management Unit, Criminal

Criminal

Investigation Branch, Dog Handler

Investigation

Unit, Drug Investigation Services,

Services

Family Violence Unit,

Forensic Services

District Support Community Support Services,

Services Coronial Services, Early Intervention

and Youth Action Unit,

Prosecution Services, Road

and Public Order Services

Headquarters

Address

88–90 Wilson Street,

BURNIE TAS 7320

Size

1

22,526 square kilometres

Population as at 112 ,765

30 June 2019

2

Police positions 2.12

per 1,000

population

3

DIVISION STATIONS

Burnie Burnie, Smithton, Wynyard

Devonport Devonport, Latrobe, Port Sorell,

Railton, Sheffield

Central West Currie, Penguin, Queenstown,

Rosebery, Strahan, Ulverstone,

Waratah, Zeehan

SUPPORT SERVICES

Western

Crime Investigation Branch

Criminal

Devonport and Burnie, Crime

Investigation

Management Unit, Family Violence

Services

Unit, Dog Handler Unit,

Drug Investigation Services,

Forensic Services

District Support Road and Public Order Services,

Services Prosecution Services, Community

Support Services

1. Area of Tasmania Police Districts is the sum of the land area of Local Government Areas (LGA) contained in the District. Source of area

data: Australian Bureau of Statistics (ABS), 3218.0 Regional Population Growth, Australia; Table 6. Provisional Estimated Resident Population

for 30 June 2019, LGA, Tasmania. Released 25 March 2020. Note: The sum of the land area for Western District does not include the South

West Heritage area, as it does not have a specified LGA.

2. Source: ABS, 3218.0 Regional Population Growth, Australia; Table 6. Provisional Estimated Resident Population for 30 June 2019, LGA,

Tasmania. Released 25 March 2020.

3. Rate is District police FTE positions provided by DPFEM People and Culture per 1,000 persons (District population/1,000). These figures are

not directly comparable with those in previous annual reports.

15

Annual Report 2019–20

Police Support Commands

EDUCATION AND TRAINING

Tasmania Police Academy,

151 South Arm Highway, ROKEBY TAS 7019

Provides education and training support across the

Department, including developing and conducting

promotional courses, police recruitment and training.

Education and Training includes:

• Recruit Training Services

• Learning and Development Services

• Library

• Business Operations.

OPERATIONS SUPPORT

30-32 Bathurst Street,

HOBART TAS 7000

Provides specialist functions and state-wide support

to other Tasmania Police commands, through the

following divisions:

• Firearms Services

• Forensic Services

• Investigative and Intelligence Support Services

• Marine and Rescue Services

(including helicopter operations)

• Radio Dispatch Services

• Safe Families Coordination Unit

• Serious Organised Crime Division

• State Community Policing.

PROFESSIONAL STANDARDS

37–43 Liverpool Street,

HOBART TAS 7000

Professional Standards has state-wide responsibility to

protect and promote integrity and ensure policing in

Tasmania is a trusted profession. The Command reports

directly to the Deputy Commissioner of Police and is

comprised of two divisions:

• Internal Investigations

• Management Review.

The major function of Internal Investigations is to

receive, administer and investigate complaints made

against members of Tasmania Police, including allegations

of serious criminal offences, corruption, and high-risk

behaviours involving police.

Management Review is responsible for audit, review and

evaluation, to develop and contribute to policies and

training that set the standards for performance, conduct

and integrity of police.

SPECIAL RESPONSE AND

COUNTER-TERRORISM

47 Liverpool Street,

HOBART TAS 7000

Provides a focal point for whole-of-government security

activities and projects involving counter-terrorism. It

liaises with the private sector, the Australian Government

and other jurisdictions in relation to counter-terrorism

arrangements and contributes to the development of

national counter-terrorism policies.

The Special Response and Counter-Terrorism Command

is a member of the Tasmanian Security and Emergency

Management Group, and works closely with the

Emergency Management Unit, the State Emergency

Service and the Office of Security and Emergency

Management, Department of Premier and Cabinet.

Special Response and Counter-Terrorism also manages a

range of specialist capabilities, maintained as part of the

response to a terrorism incident, through the following

units:

• Policy Development

• Emergency and Risk Management

• Special Operations Group

• Protective Security.

Business and Executive Services

47 Liverpool Street,

HOBART TAS 7000

Business and Executive Services provides support to the

Department through the following business units:

BUSINESS SERVICES

Provides core corporate services across the Department

and consists of the following units:

• Audit and Risk

• Engineering and Fleet Management Services

• Finance and Payroll Services

• Information Services

• Property and Procurement Services.

TECHNOLOGY AND INNOVATION

Provides core information technology communication

systems and services across the Department. It also

supports the operations of the Triple Zero and Emergency

Services Computer Aided Dispatch (ESCAD) systems

for Tasmanian Police, Ambulance Tasmania, Tasmania Fire

Service and State Emergency Service. It consists of the

following units:

• Communications Systems and Technology

• Emergency Services Business Support Unit

• Information Security

• Information Technology Services.

16

Annual Report 2019–20

PEOPLE AND CULTURE

Provides high-level advice and services across the

Department in the following areas:

• Employment Conditions and Strategy

• Organisational Development

• Injury Management and Advisory Service

• Work Health and Safety.

STRATEGY AND SUPPORT

Provides high-level support and advice across the

Department, and consists of the following units:

• Legislation Development and Review Services

(including Right to Information Services)

• Media and Communications

• Policy Development and Research Services

• Reporting Services.

STRATEGIC PROJECTS

Manages and develops projects of strategic significance to

the Department and comprises the following:

• Business Improvement Unit

• Tasmanian Government Radio Network Project

• Project Unify.

WELLBEING SUPPORT

Provides preventative health and wellbeing programs

through the following services:

• Critical Incident Stress Management

• Clinical Psychological Services

• Wellbeing Support

• Health and Wellbeing program.

Forensic Science Service Tasmania

St Johns Avenue,

NEW TOWN TAS 7008

Forensic Science Service Tasmania (FSST) is a nationally

accredited service, providing a comprehensive range of

forensic biology and forensic chemistry services including:

• examination of major crime scenes

• screening of evidence items

• identification of biological material

• DNA profiling and maintenance of the Tasmanian

DNA database

• toxicology analysis

• identification and confirmation of illicit drugs

• botanical cannabis identification

• investigation of clandestine drug laboratories

• analysis of glass, paint and fibres

• detection and identification of explosives and trace

ignitable fluids

• general identification of unknown chemicals

and powders

• calibration and certification of evidential breathalysers.

17

Annual Report 2019–20

Tasmania Fire Service

Head Office,

Corner of Argyle and Melville Streets,

HOBART TAS 7000

The Tasmania Fire Service is the operational area of the

State Fire Commission and includes over 230 fire brigades

across Tasmania. These fire brigades are comprised

of 335 career firefighters and approximately 5,139

volunteer firefighters.

The Tasmania Fire Service undertakes:

• emergency responses

• emergency call handling and dispatch

• fire investigation

• training

• community fire education

• building safety

• fire equipment sales and service

• fire alarm monitoring

• implementation of mitigation and prevention

programs for both structure fires and bushfires

• risk modelling and predictive services.

State Emergency Service

State Headquarters and Head Office,

Corner of Argyle and Melville Streets,

HOBART TAS 7000

The State Emergency Service (SES) prepares for and

responds to many types of emergencies such as severe

storms and floods, road crash rescue, search and rescue,

and a range of other general rescue activities.

SES also supports other emergency service organisations

in planning, public information, warnings and media. Each

of Tasmania’s SES units provides a 24/7 response service

to their local communities through the help of committed

employees and a 600 strong volunteer workforce.

In addition to operational and training activities, the SES

is responsible for emergency management planning,

emergency risk management and supporting recovery. SES

provides education to Tasmanian emergency management

stakeholders by:

• helping them prepare for future emergencies

• helping them to understand their role, and

• increasing awareness of the role of SES and others.

SES provides advice to the State and Local Governments,

and to the State Emergency Management Committee and

Regional Emergency Management Committees.

Further information about the operations of the Tasmania

Fire Service and the SES are reported 2019–20 State Fire

Commission Annual Report.

18

Annual Report 2019–20

DPFEM COVID-19 Report

STATE CONTROLLER

The Commissioner of Police, Darren Hine, is also the

State Controller, whereby he can become responsible

for co-ordinating the whole-of-government response to

an emergency. In March 2020 he recommended that the

Premier declare a State of Emergency due to the threat

posed to the Tasmanian community by COVID-19.

In a State of Emergency, the State Controller is granted

additional powers to enable the coordination of the

emergency response. These powers include the ability

to limit and control the movement of people, take over

premises and direct government employees to perform

certain work.

Most significantly, based on Public Health advice, the

State Controller has issued legal Directions requiring the

quarantine of arrivals into the State under the Emergency

Management Act 2006. This has also included the legal

responsibility for approving any exemptions from

quarantine requirements.

STATE CONTROL CENTRE

DPFEM has played a crucial role in Tasmania’s emergency

response to the COVID-19 worldwide pandemic, including

operating the State Control Centre (SCC).

The SCC was established on 19 March 2020 when the

Premier declared a State of Emergency.

While the Department of Health was the Response

Management Authority for leading the operational

response, the role of the SCC was to co-ordinate whole-

of-government activities, recovery and consequential

management for the emergency. Although each

Government agency remained in control of its own

functional area, the SCC ensured the co-ordination of all

relevant stakeholder input and activities.

At its peak, around 50 staff from across government were

working in the SCC in functional areas including:

• State Controller

• Public Information Unit

• Policy

• State Operational Liaison Advisor - Public Health

• Operational liaison officers in all agencies as the State

Emergency Management Team

• Legal

• Administration and Planning

• Recovery

The main emergency response elements that have

been managed by government agencies include:

• Border control

• Hotel quarantine

• Exemptions from quarantine

• COVID safe workplaces

19

Annual Report 2019–20

COMPLIANCE CHECKS

Tasmania Police and volunteers from SES and TFS

performed compliance checking of those in home

quarantine. The checks involved phone calls and location

checks, ensuring people were staying home during their

quarantine period.

The numbers of people in home quarantine around the

State varied from several hundred to a peak of more than

5,000 during the North-West outbreak.

During the period of the ‘stay at home’ requirements,

police also conducted checks to establish that people

were outside of their home only for essential reasons.

The Australian Defence Force also supported compliance

checks on the North-West.

During the North-West outbreak police conducted traffic

check points to ensure compliance with the additional ‘stay

at home’ requirements in place for the region.

Between 25 March 2020 and 30 June 2020, the teams

conducted more than 17,000 compliance checks.

AR

RIVALS INTO TASMANIA

Tasmania Police met every flight and ferry that arrived into

Tasmania and remained in attendance while passengers

were processed by DPIPWE’s border officers. Police

officers escorted each bus going to Government hotel

quarantine to assist government liaison officers who remain

on site at hotels.

Photo credit: Mark Forteath, DPFEM

20

Annual Report 2019–20

Our Performance Measures

Budget Allocation

The Department’s budget allocation, key deliverables and performance

information is outlined in the 2019–20 Government Services Budget Paper

No. 2, Volume 1.

In 2019–20, an expenditure budget of $261.795 million was allocated to the

Department. This does not include the Tasmania Fire Service (TFS) and State

Emergency Service, which report separately to the State Fire Commission for

the purposes of financial reporting.

A comprehensive financial statement for 2019–20 is included at the end of this

Annual Report.

Output Groups

The Department (excluding TFS) has four Output

Groups, each with a specific aim and set of priorities,

as outlined below:

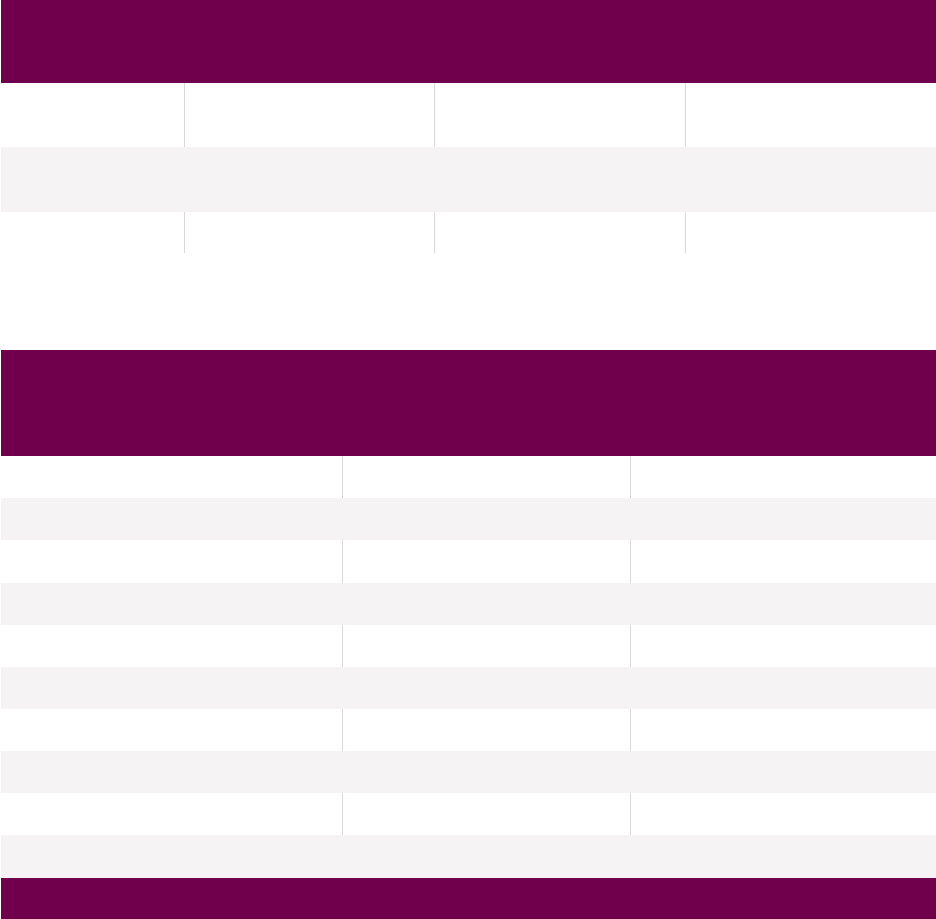

OUTPUT GROUP AIM KEY FOCUS AREAS

1. Public Safety For the community to feel safe and be safe 1.1 Support to the Community

2. Crime To reduce crime 2.1 Investigation of Crime

2.2 Poppy Security

2.3 Fisheries Security

2.4 Support to Judicial Services

3. Traffic Policing To improve driver behaviour through traffic

law enforcement

3.1 Traffic Policing

4. Emergency To contribute towards community

4.1 State Emergency Management Services

Management resilience through effective security

4.2 State Security and Rescue Operations

and emergency management

Each Output Group has a set of Performance Measures that are used to

assess the efficiency and effectiveness of the Department.

Our progress against these Performance Measures are contained in

the Summary of Performance Information at the end of each of the

Output Group Chapters.

In addition, the Tasmania Police Business Priorities are developed to provide an

enhanced focus on priority areas. Our performance in relation to the 2019–20

priority areas is provided at the beginning of each Output Group chapter.

21

Annual Report 2019–20

Our Key Deliverables

The Budget Paper provides a summary of the Budget

and Forward Estimate allocations for a range of key

deliverables within the Department.

An update of our progress against these key deliverables

are outlined below:

POLICE EQUIPMENT – SPECIAL

OPERATIONS GROUP

The State Government provided the Special Operations

Group (SOG) $100,000 per annum for the purchase of

new equipment. This funding supports the Government’s

commitment to establish a full time core SOG.

Although disrupted due to importation issues surrounding

COVID-19, some key SOG equipment has been updated

and replaced.

POLICE INFRASTRUCTURE – SPECIAL

OPERATIONS GROUP FACILITY

As part of the State Government’s commitment to a full

time core SOG and an enhanced rapid response capability,

a one-off capital allocation of $1 million was provided in

2019–20 to enable the construction of a secure, fit-for-

purpose SOG facility.

A concept design for the facility and

a suitable site have been selected, and work on the facility

is expected to be completed in the 2020–21

financial year.

Four full time SOG positions have been filled and work has

commenced towards developing a business case for a full

time SOG model.

ADDITIONAL POLICE OFFICERS

The State Government provided additional funding

to further support its 2018 election commitment to

increase police numbers to 1,358 FTE by mid-2022. Two

recruit courses graduated in the 2019–20 period, with

40 constables and a further 11 constables completing the

Accelerated Training Program.

There were 1,276 FTE police officers as at 30 June 2020,

with an additional 44 trainees completing recruit training.

A further three recruit courses and two Accelerated

Training Program course are scheduled for 2020–21.

This recruitment has seen a mix of both new recruits and

Accelerated Training Program members that include police

officers joining from other Australian and New Zealand

police services. This allows for a mix of experienced and

new members to join Tasmania Police at a time of high

recruitment.

UPGRADE POLICE HOUSING

In 2019–20 the Department continued to deliver the

Upgrade Police Housing – State-wide Capital Investment

Program. This program began in 2015–16 and was further

extended in 2019–20 with $6 million allocated through to

2022-23.

This initiative improves the quality of police residences

in remote country or community areas through a mix of

construction, renovation, purchase and lease of residences

in order to meet the program outputs. The scope of the

program includes ensuring residences are safe, dry, warm

and contemporary.

In 2019–20, the Upgrade Police Housing project spent

a total of $2.75 million on providing renovations to

police residences across the State, including Lady Barron,

Whitemark, Bicheno, Bridport, Scottsdale and Bushy Park.

The Department also purchased residences at Smithton

and Swansea during the reporting period.

22

Annual Report 2019–20

Output Group 1: Public Safety

The aim of this Output Group is for the community to feel safe and be safe.

Public Safety relates to personal safety in the community, maintaining public

order and the provision of safety initiatives that assist in developing safe,

secure and resilient communities.

Tasmania Police Business Priorities

The Tasmania Police Business Priorities have highlighted high visibility policing

and policing public places as priority action areas in 2019–20.

The performance outcomes for the key focus areas are reported in

Table 1 below with more detailed information provided in Table 2

Performance Measures.

TABLE 1: PUBLIC SAFETY KEY FOCUS AREAS AND PERFORMANCE OUTCOMES

PRIORITY AREA KEY FOCUS AREA PERFORMANCE OUTCOMES

High-visibility

Satisfaction with policing Performance Measure 1

policing

services

Satisfaction with police in

Performance Measure 2

dealing with public order

issues

Response times Tasmania Police revised the methodology used to calculate

response times during 2019–20. The new median-based

methodology brings police in line with other Tasmanian

emergency service agencies and follows the findings of a

KPMG review.

In 2019–20, Tasmania Police recorded a median response time

of 15 minutes for high priority operational dispatch incidents,

which was similar to 14 minutes the previous year. Tasmania

Police also recorded a median response time of 20 minutes

for low priority incidents, compared to 19 minutes the

previous year.

Policing public

Public place assaults Performance Measure 3

places

Public order incidents Performance Measure 4

Satisfaction with safety in Performance Measures 6 and 7

public places

Safety in crowded place Performance Measures 6 and 7

23

Annual Report 2019–20

-

Performance Measures

TABLE 2: SUMMARY OF PERFORMANCE INFORMATION – OUTPUT GROUP 1: PUBLIC SAFETY

GOVERNMENT SERVICES

BUDGET PAPER

PERFORMANCE MEASURE

UNIT OF

MEASURE

2016–17

ACTUAL

2017–18

ACTUAL

2018–19

ACTUAL

2019–20

TARGET

2019–20

ACTUAL

1. Satisfaction with police

services

4

% 79 88 85 ≥ nat av

(78)

81

2. Satisfaction with police in

dealing with public order

problems

4

% 72 77 79 ≥ nat av

(71)

75

3. Public Place Assaults

5

Number 807 818 889 ≤ 3 yr av

(838)

794

4. Public order incidents

5,6

Number 16,182 17,284 14,841 ≤ 3 yr av

(16,102)

15,241

5. Cost of policing per capita

7

Dollars 456 493 473 n/a

n/a

8

6. Perceptions of safety in public

places – during the day

4

% 94 94 93 ≥ nat av

(90)

89

7. Perceptions of safety in public

places – during the night

4

% 57 60 60 ≥ nat av

(53)

56

8. Perceptions of safety at home –

alone during the night

4

%

91 91 90

≥ nat av

(88)

88

9. Family Violence Incidents

5,6

Number 3,165 3,476 3,642 ≤ 3 yr av

(3,428)

3,576

10. Offences Against the Person

5

Number 4,310 4,633 4,687 ≤ 3 yr av

(4,543)

4,554

11. Offences Against the Person

clearance rate

5,6

% 92 94 91 ≥ 3 yr av

(92)

91

Sources: National Survey of Community Satisfaction with Policing 2019–20, Department of Police, Fire and Emergency Management (DPFEM)

Offence Reporting System 2, Emergency Services Computer-Aided Dispatch System, Command and Control System and Family Violence

Management System.

4. This indicator is derived from the National Survey of Community Satisfaction with Policing 2019–20; and DPFEM Offence Reporting System 2,

Emergency Services Computer-Aided Dispatch System, Command and Control System, and Family Violence Management System.

5. Data for 2018–19 have been revised from the figures published in the 2018–19 DPFEM Annual Report.

6. Data for 2016–17 and 2017–18 have also been revised from the figures published in the 2018–19 DPFEM Annual Report.

7. Data for this indicator have been revised to reflect 2018–19 dollars as per the Report on Government Services 2020.

8. This figure is not available until the Report on Government Services 2021 is released in January 2021.

24

Annual Report 2019–20

Output Group 2: Crime

The crime output relates to the detection and apprehension of offenders,

including investigation of serious and organised crime. The Department aims

to reduce the number of offences committed against both people and property

through crime detection strategies and legislative reform.

Tasmania Police Business Priorities

The Tasmania Police Business Priorities have highlighted youth offending, serious

and organised crime, violence against women and children, and volume crime

as priority areas for action during 2019–20.

The performance outcomes for the key focus areas are reported against in Table 3

below with more detailed information provided in Table 4 Performance Measures.

TABLE 3: CRIME KEY FOCUS AREAS AND PERFORMANCE OUTCOMES

PRIORITY

AREA

KEY FOCUS

AREA

PERFORMANCE OUTCOMES

Youth Offending

Finalise and

implement

Policing At-Risk

Youth Strategy

The Policing At-Risk Youth Strategy 2019-22 commenced in September 2019,

with the aim of intervening as early as possible with at-risk youth.

The strategy aims to co-ordinate policing efforts and resources to prevent

children reoffending. This work will require a realignment of policing

activities across the State to identify child offenders who are at greatest

risk of reoffending. Tasmania Police will also review how we can work more

effectively with schools to identify young people showing signs of becoming

repeat offenders earlier.

Throughout the life of this strategy, our response to youth justice issues will

continue to evolve with increased opportunities for improvement through the

sharing of services, knowledge and skills.

Serious and

Person offences See the Public Safety Chapter in Table 1: Summary of Performance

organised crime

Information - Public Safety Performance Measures 10 and 11

Serious crime Performance Measure 3 and 4

offenders

Serious drug Performance Measure 7

offenders

Violence against

Family violence

women and

response

children

Priority family

violence

perpetrators

See the Public Safety Chapter in Table 1: Summary of Performance Information -

Public Safety Performance Measure 9

In the reporting period, Tasmania Police recorded 3,576 family violence

incidents (under the Family Violence Act 2004), as well as 2,328 matters

classified as family arguments or family information reports (family-related

incidents not involving family violence).

There has been an upward trend in reported family violence incidents over

the past five years. This sustained level of reporting suggests a cultural change

through reduced level of tolerance by the community and persons affected by

family violence, and greater community and victim awareness and confidence

in family violence responses and services.

During 2019–20 Tasmania Police provided 3,015 notifications to schools

regarding 4,421 students affected by family violence.

25

Annual Report 2019–20

PRIORITY

AREA

KEY FOCUS

AREA

PERFORMANCE OUTCOMES

Violence against

Review of

women and

electronic

children

monitoring

(Project Vigilance)

Assaults and

sexual assaults

against women

and children

9,10

As a commitment to the protection of women and children from family

violence, the Department established a technology trial involving the GPS

monitoring of high-risk family violence perpetrators. Victims of family violence

could also voluntarily opt into the trial, where they were provided a small

portable device with duress capability to prompt early police intervention

where there was potential for a breach of a current Family Violence Order.

Between November 2018 and April 2020, 73 perpetrators participated in the

trial. Of these 73 perpetrators, 52 were subject to electronic monitoring for

at least six months. Initial data suggests a significant drop in family violence

involving those offenders.

From 1 July 2020, the initiative will move from project status to ‘business

as usual’.

1,564 assaults against women

117 sexual assaults against women

317 assaults against children

74 sexual assaults against children

Volume Crime

Home Burglaries

Car Burglaries

11

Recidivist

Offending

12

Community

Resilience

Property Crime

1,219 offences

1,620 offences

53%

The use of various crime prevention initiatives within the geographical police

districts have been successful in both disrupting and preventing crime, as well

as building community resilience.

Tasmania Police engages with vulnerable people in the community including

the elderly to provide advice and support on reducing their attraction as

volume crime targets.

Tasmania Police provides a number of strategies to engage with at-risk youth

who are vulnerable as potential volume crime offenders. These strategies

include youth diversion programs to deter offending and positive interaction

such as mentoring, to build relationships with at-risk youth.

The use of social media in combatting crime has been a valuable tool in

eliciting timely and effective information from the public and for police to

communicate important information directly to the Tasmanian community.

The identification of suspects and their locations are some of the outcomes

achieved through the use of social media in a criminal investigation context.

Performance Measures 5 and 6

9. Women are defined as female victims aged 18 years or more at the date of report.

10. Children are defined as victims aged 17 years or less at the date of report.

11. The indicator Motor Vehicle Burglaries is being reported on for this key focus area.

12. The indicator Crime Offender Recidivism Rate is being reported on for this key focus area. It measures the number of unique

persons charged by police for crime offences in the previous reporting year who were subsequently charged for a crime offence

in the twelve-month period that immediately followed.

26

Annual Report 2019–20

Performance Measures

TABLE 4: SUMMARY OF PERFORMANCE INFORMATION – OUTPUT GROUP 2: CRIME

GOVERNMENT SERVICES

BUDGET PAPER -

PERFORMANCE MEASURE

UNIT OF

MEASURE

2016–17

ACTUAL

2017–18

ACTUAL

2018–19

ACTUAL

2019–20

TARGET

2019–20

ACTUAL

INVESTIGATION OF CRIME

1. Total Offences

13

Number 27,439 26,303 27,936 ≤ 3 yr av

27,386

(27,226)

2. Total Offences clearance

rate

13,14,15

% 47 51 47 ≥ 3 yr av

(48)

49

3. Serious Crime

13

Number 573 513 601 ≤ 3 yr av

(562)

556

4. Serious Crime clearance

rate

13,14,15

% 79 83 78 ≥ 3 yr av

(80)

87

5. Offences Against Property

13

Number 21,937 20,495 21,910 ≤ 3 yr av

(21,447)

21,452

6. Offences Against Property

clearance rate

13,14,15

% 37 40 36 ≥ 3 yr av

(38)

38

7. Serious Drug Offenders

13,14

Number 490 497 352 ≥ 3 yr av

(446)

283

POPPY SECURITY

8. Number of poppy crop

Number 2.91 1.10 0.57 ≤ 3 yr av

0.79

interferences per 1,000

(1.46)

hectares sown

FISHERIES SECURITY

9. Marine Offenders

13

Number 1,408 1,478 1,479 ≥ 3 yr av

1,335

(1,455)

SUPPORT TO JUDICIAL SERVICES

10. State charges prosecuted

13

Number 50,524 52,706 54,267 ≥ 3 yr av

53,364

(52,499)

Sources: DPFEM Offence Reporting System 2, Prosecution System, Information Bureau, Fines and Infringement Notices Database,

Drug Offence Reporting System and Drug Investigation Services.

Performance Information Comments

against the person and financially damaging offences

The Summary of Performance Information reports on

against property. The performance measure ‘State

measures relating to crime detection and investigation.

charges prosecuted’ is a measure of the number of

The performance measure ‘Total Offences’ includes

charges that were prosecuted across the whole State.

all offences which generate an offence report, while

‘Serious Crime’ includes the most severe offences

13. Data for 2018–19 have been revised from the figures published in the 2018–19 DPFEM Annual Report.

14. Data for 2016–17 and 2017–18 have also been revised from the figures published in the 2018–19 DPFEM Annual Report.

15. An offence is considered ‘cleared’ if an offender has been identified and: proceeded against by police or cannot be proceeded against

and further investigation cannot be established; or if the offence is withdrawn by the victim.

27

Annual Report 2019–20

Output Group 3: Traffic Policing

The aim of this Output Group relates to the improvement of driver

behaviour, traffic law compliance, and minimising road trauma.

The Department aims to improve road safety, reduce the incidence of

inattentive driving and diminish the use of alcohol or drugs whilst driving.

This is achieved through the provision of high visibility patrols on highways

and arterial roads, targeting high-risk driver behaviour and attendance at,

or investigation of, vehicle crashes.

Tasmania Police Business Priorities

The Tasmania Police Business Priorities have highlighted the development of

the Tasmania Police Road Safety Strategy and high-risk road behaviour as

priority areas for action in 2019–20.

The performance outcomes for the key focus areas are reported against

in Table 5 below with more detailed information provided in Table 6

Performance Measures.

TABLE 5: TRAFFIC POLICING KEY FOCUS AREAS AND PERFORMANCE OUTCOMES

PRIORITY AREA KEY FOCUS AREA PERFORMANCE OUTCOMES

Tasmania Police

Develop Tasmania Police

Road Safety

Road Safety Strategy

Strategy

Serious and fatal crashes

Tasmania Police implemented the Tasmania Police Road Safety

Strategy 2019–2021 during the reporting period. The Strategy

outlines how Tasmania Police aims to reduce the likelihood,

severity and consequence of crashes by focusing on five priority

areas: speed; alcohol and drug driving; distraction; safety

restraints; and fatigue.

The Strategy supports the State’s Towards Zero Tasmanian Road

Safety Strategy 2017-2026, which is based on the holistic Safe

Systems approach to road safety and reducing road trauma. The

Strategy supports the direction of Towards Zero by focusing the

enforcement efforts of Tasmania Police on those behaviours and

actions that most contribute to serious injury and fatal crashes.

Performance Measure 7

High-risk road

High-risk drivers and Performance Measure 1

behaviour

motorcycle riders

Evade police offenders 392 offenders

Speeding Performance Measure 2

Use of seatbelts

16

1,638 offenders

Alcohol and drug use Performance Measures 3, 4, 5 and 6

Mobile phone use

17

2,070 offenders

16. The indicator Seatbelt Compliance Offenders is being reported on for this key focus area.

17. The indicator Mobile Phone Offenders is being reported on for this key focus area.

28

Annual Report 2019–20

Performance Measures

TABLE 6: SUMMARY OF PERFORMANCE INFORMATION – OUTPUT GROUP 3: TRAFFIC POLICING

GOVERNMENT SERVICES

BUDGET PAPER -

PERFORMANCE MEASURE

1

UNIT OF

MEASURE

2016–17

ACTUAL

2017–18

ACTUAL

2018–19

ACTUAL

2019–20

TARGET

2019–20

ACTUAL

1. High-Risk Traffic Number 32,198 31,184 31,076 26,000 28,280

Offenders

18,19,20,21

2. Speeding Offenders

18,20

Number 44,945 4 0,913 41,216 42,000 36,719

3. Random Breath Tests Number 505,445 478,219 438,322 440,000 281,175

22

4. Drink Driving Offenders

18,20

Number 2,296 2,173 1,908 2,550 1,542

23

5. Oral Fluid Tests Number 3,726 3,936 4,518 3,340 4,959

6. Drug Driving Offenders

18,20,21

Number 2,159 2,213 2,428 1,720 2,657

7. Fatal and Serious Number 266 263 274 ≤ 3 yr av 244

Injury Crashes

20,21

(268)

Sources: Department of Police, Fire and Emergency Management Prosecution System, Fines and Infringements Database, Information Bureau

System, Traffic Crash Reporting System, Manual Police District Reporting and the Department of State Growth Crash Data Manager System.

Performance Information Comments

The performance measure ‘high-risk traffic offenders’

compliance offenders, mobile phone offenders,

includes offenders who have committed one or more

dangerous and reckless driving offenders, and drink

of the following offences: detected speeding by 15 km/h

and drug driving offenders.

or more by speed cameras or police officers, seatbelt

18. In 2017–18, traffic offender counting rules were revised to include offenders from prosecutions and youth cautions.

19. In 2017–18, the ‘high-risk traffic offenders’ definition was updated to include mobile phone offenders.

20. Data for 2018–19 have been revised from the figures published in the 2018–19 DPFEM Annual Report.

21. Data for 2016–17 and 2017–18 have also been revised from the figures published in the 2018–19 DPFEM Annual Report.

22. This key performance indicator has been affected by the impacts of COVID-19. Roadside static Random Breath Testing and Random

Drug Testing was suspended to reduce the risk of COVID-19 transmission. However, other forms of testing continued on a more targeted

and risk-assessed basis.

23. This key performance indicator may have been affected by the impacts of COVID-19. Given the reduction of the static Random Breath

Testing, it follows there may be a reduction in the number of offenders detected.

29

Annual Report 2019–20

Output Group 4:

Emergency Management

The Emergency Management output focuses on the provision of whole-of-

government policies relating to counter-terrorism and terrorist threats, and the

provision of search and rescue operations.

(Note: A summary of performance outputs for the State Emergency Service is

reported in the State Fire Commission Annual Report 2019–20.)

Tasmania Police Business Priorities

The Tasmania Police Business Priorities have highlighted leadership and effective

incident management during emergency responses, and operational preparedness,

as priority areas for action in 2019–20.

The performance outcomes for the key focus areas are reported against in Table 7

below with more detailed information provided in Table 8 Performance Measures.

TABLE 7: EMERGENCY MANAGEMENT KEY FOCUS AREAS AND PERFORMANCE OUTCOMES

PRIORITY AREA KEY FOCUS AREAS REPORTING REFERENCE

Provide leadership

Implement strategic A pilot course in relation to Contemporary Strategic

and effective incident

command arrangements Command was developed but, due to COVID-19, was

management during

unable to be conducted within the reporting period.

emergency responses

Pending the status of border restrictions, it is anticipated

that the course will be piloted in the next financial year.

Operational

Frontline capability and

preparedness

capacity

Work continued, in conjunction with the Australia New

Zealand Counter-Terrorism Committee, to develop an

enhanced online counter-terrorism awareness training

program for frontline police officers. Unfortunately,

the completion of this work was delayed due to the

COVID-19 outbreak.

The Henty Mine disaster on the West Coast impacted

considerably on Tasmania Police resources and tested mine

disaster recovery capacity.

Following the declaration of a State of Emergency in

response to COVID-19, Tasmania Police tested its

emergency management preparedness and capability in

a live environment. During this period, Police Operation

Centres with key personnel were established, mandatory

COVID-19 training was implemented, all members were

required to be familiar with personal protective equipment

and procedures, and ensuring that frontline operational

positions were not compromised by quarantined staff.

(refer to the COVID-19 Report Chapter for further

information relating to the police response.)

30

Annual Report 2019–20

TABLE 7: EMERGENCY MANAGEMENT KEY FOCUS AREAS AND PERFORMANCE OUTCOMES (CONT)

PRIORITY AREA KEY FOCUS AREAS REPORTING REFERENCE

Operational

Develop enhanced rapid Work commenced to explore and identify options for

preparedness

response capability the development of an enhanced rapid response capability.

This has been supported by development of a state-wide

SOG capability and the appointment of four full time SOG

members. These members will work as part of a project

group to develop and implement plans for the future

SOG operating environment, including any additional

full-time component.

Future work will involve the development of a business case

relevant to expenditure of $1million for a purpose built,

secure facility that meets the needs of the SOG, including

the establishment of both working and steering groups.

Performance Measures

TABLE 8: SUMMARY OF PERFORMANCE INFORMATION – OUTPUT GROUP 4: EMERGENCY MANAGEMENT

GOVERNMENT SERVICES

BUDGET PAPER -

PERFORMANCE MEASURE

UNIT OF

MEASURE

2016–17

ACTUAL

2017–18

ACTUAL

2018–19

ACTUAL

2019–20

TARGET

2019–20

ACTUAL

STATE SECURITY AND RESCUE OPERATIONS

1. Number of search and rescue Number 345 304 250 n/a

262

operations conducted by police

2. Number of exercises managed

Number 31 19 28 ≥ prev yr

11

25

by Special Response and

Counter-Terrorism Command

3. Total helicopter hours

24

Number 748 751 867 n/a

1,135

24. Data for 2018–19 have been revised from the figures published in the 2018–19 DPFEM Annual Report.

25. This performance indicator has been affected by the impacts of COVID-19. A number of scheduled exercises were cancelled to reduce

the risk of COVID-19 transmission.

31

Annual Report 2019–20

2019–20

Compliance Index

COMPLIANCE SOURCE PAGE NO

AIDS TO ACCESS

Table of contents Auditor-General’s Special Report

Inside front cover

no. 4 of 1993,

Standard of Annual Reporting

by Government Departments

Table of compliance This page

Abbreviations 4

OUR DEPARTMENT

Our role SSR s. 9(a)(i) 10

Organisational chart SSR s. 9(a)(ii) 12

Output Group Structure SSR s. 9(a)(iii) 11

Organisational structure changes SSR s. 9(a)(iv) 11

Our Divisions SSA s. 36(1)(a) 13

TI FR-4

Statutory and non-statutory bodies SSR s.9(d) 34

STRATEGIC PRIORITIES

Major initiatives to give effect to SSR s. 9(a)(v) 21

Government policy

Performance report SSA s. 36(1)(a) See Key Deliverables

TI FR-4

Chapter and Output

Group Chapters

LEGISLATION

Legislation administered SSR s. 9(d) 37

Legislation enacted during the year SSR s. 9(d) 37

PUBLIC ACCESS AND INFORMATION DISCLOSURE

Appeals process SSR s. 9(c)(iii) 38

Contact details SSR s. 9(c)(ii) 121

Community awareness SSR s. 9(c)(i) 38

Gifts and Benefits Tasmanian Government Gifts, 38

Benefits and Hospitality Policy

Publications SSR s. 9(c)(i) 38

Public interest disclosure PIDA s. 86 39

Right to information requests RTIA s. 23 and s. 53 40

OUR PEOPLE AND POLICIES

Human Resource information SSA s. 36(1a) 41

Industrial democracy and employee participation SSR s. 9(b)(iv) 44

32

Annual Report 2019–20

Occupational health and safety (incl. WHS Plan) SSR s. 9(b)(vi) 47

ED No. 27 s5(2)

Performance management SSA s. 36(1)(ba) 44

ED No. 26

Superannuation contributions PSSRA s. 55 44

Workplace diversity State Service Diversity and 45

Inclusion Framework 2017-20

Workplace health and wellbeing ED No. 23 47

COMPLIANCE REPORTING TO OTHER LEGISLATION

State Controller to provide report on any

Section 63 EMA See Declaration of

authorisation or declaration of State of Emergency

a State of Alert page 48

made

ROYAL COMMISSIONS

Deaths in Custody Royal Commission into 53

Aboriginal Deaths in Custody

PRICING POLICY

Pricing policy TI FR-4 (4.1.2) 53

RISK MANAGEMENT

Risk management TI FR-4 (4.1.5) 53

ASSET MANAGEMENT AND PROCUREMENT

Asset management TI FR-4 (4.1.6) 54

Capital projects TI FR-4 (4.1.3) 55

Contract extensions TI FR-4 (4.1.8.6.1) 55

Contracts where an exemption from the TI FR-4 (4.1.8.5) 55

requirement to disaggregate has been approved

Confidentiality of Government contracts TI FR-4 (4.1.8.1) 55

Contracts with value over $50,000 TI FR-4 (4.1.8.2) 55

Debts written off TI FC-14 58

Exemptions from Treasurer’s Instructions TI FC- (1.2) 58

Grants TI FC-12 n/a

Limited/direct procurement TI FR-4 (4.1.8.5) 59

Loss and damage TI FC-4 59

Support for local business TI FR-4 (4.1.8.2) 60

FINANCIAL STATEMENTS

Audit report FMA s. 42 (4) 117

AA s. 19(4)

Financial statements FMA s. 42 (1) 62

Head of agency certification TI FR-2 64

TI FR-3 (3.1)

FMA s. 42

Significant financial performance directives which TI FR-4 (4.1.1) n/a

affected the achievement of operational objectives

33

Annual Report 2019–20

Our Compliance Report

The Department continued to meet its compliance requirements in

2019–20. This section of the Annual Report outlines our statutory

reporting responsibilities.

Corporate Governance

Membership of the executive governance and high-level decision-making

forums for the Department are outlined below. Further information on the

functions of these forums is outlined in the Our Department chapter of this

Annual Report.

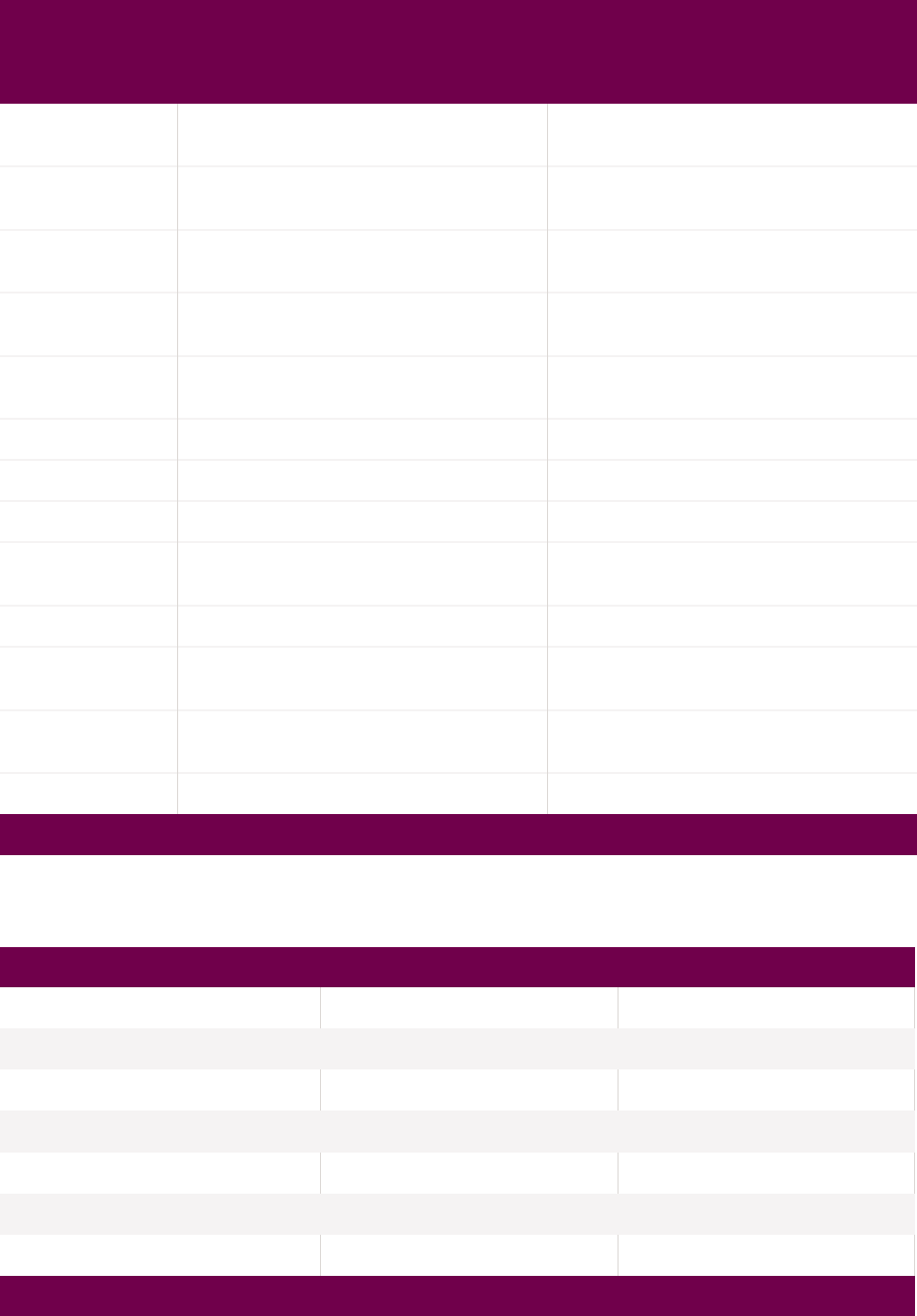

AGENCY MANAGEMENT GROUP MEMBERSHIP

MEMBER POSITION

Secretary/Commissioner of Police Chair

Deputy Commissioner of Police Member

Chief Officer, Tasmania Fire Service Member

Deputy Secretary, Business and Executive Services Member

Manager, Media and Communications Adviser

Manager, Office of the Commissioner Adviser

Manager, Office of the Deputy Secretary, Business and Executive Services Adviser

Principal Staff Officer, Chief Fire Officer Adviser

CORPORATE MANAGEMENT GROUP MEMBERSHIP

MEMBER POSITION

Secretary/Commissioner of Police Chair

Deputy Commissioner of Police Member

Deputy Secretary, Business and Executive Services Member

Assistant Commissioner of Police, Operations Member

Assistant Commissioner of Police, Specialist Support Member

Manager, Office of the Commissioner Adviser

Manager, Office of the Deputy Secretary, Business and Executive Services Adviser

Manager, Media and Communications Adviser

Staff Officers Adviser

34

Annual Report 2019–20

Statutory and Non-statutory

Boards and Committees

The Department has a range of governance committees and boards to ensure

that our resources to deliver key priorities are managed effectively.

AUDIT AND RISK COMMITTEE

The Audit and Risk Committee is a statutory board that operates in accordance

with Section 51 of the Financial Management Act 2016.

The Committee oversights risk management, and internal and external audit

activities. It provides high-level assistance and advice with respect to matters

of financial reporting and corporate governance. The Deputy Secretary of

Business and Executive Services chairs the Committee which meets quarterly,

with an additional extraordinary meeting scheduled with the Tasmanian Audit

Office in relation to audit findings of financial statements.

AUDIT AND RISK COMMITTEE MEMBERSHIP

MEMBERS POSITION

Deputy Secretary, Business and Executive Services Chair

Deputy Commissioner of Police Member