Pursuant to R.I. Gen. Laws § 44-30-101, beginning after December 31,

2019, Rhode Island residents are required to maintain health insurance,

known as “Minimum Essential Coverage” or be subject to a tax known as

the “Shared Responsibility Payment Penalty”. Rhode Island’s individual

health insurance mandate is based, in part, on the federal mandate estab-

lished under the Patient Protection and Affordable Care Act (Pub. Law

111-148).

The Rhode Island Individual Health Insurance Mandate requires each ap-

plicable individual to have health insurance coverage, have a health cover-

age exemption, or make a shared responsibility payment with their Rhode

Island personal income tax return.

Forms RI-1040 and RI-1040NR include a checkbox on page 1 to indicate if

all members of your tax household had minimum essential coverage for the

full year. Part-year residents filing Form RI-1040NR may check the check-

box on page 1, line 15b if all members of the tax household had minimum

essential health coverage for the months they were Rhode Island residents.

Form IND-HEALTH and the Shared Responsibility Worksheet are to be

used and filed with your personal income tax return if not all members of

your tax household had minimum essential coverage for the full year, and

you are unable to check the "Full-year health care coverage" checkbox on

page 1 of Form RI-1040 or RI-1040NR.

Use these instructions to determine your Shared Responsibility Payment if

for any month during the year you or another member of your tax household

did not have minimum essential health coverage. If you can claim any part-

year exemptions for specific members of your tax household, use Form IND-

HEALTH form. This will reduce the amount of your shared responsibility

payment.

Coverage exemptions

If you cannot check the "Full-year health care coverage" checkbox on page

1 of Form RI-1040 or RI-1040NR, Form IND-HEALTH must be completed.

If you or a member of your tax household did not have full-year health cov-

erage and were not granted an exemption, Form IND-HEALTH must still be

completed.

Shared responsibility payment

You must make a shared responsibility payment if, for any month, you or an-

other member of your tax household did not have minimum essential health-

care coverage or a coverage exemption. See the Shared Responsibility

Worksheet to determine your payment, if any. Report your Shared Respon-

sibility Payment on Form RI-1040, line 12b or Form RI-1040NR, line 15b.

Who Must File

Form IND-HEALTH, along with the Shared Responsibility Worksheet, must

be filed if all

of the following apply:

• You are filing a Form RI-1040 or RI-1040NR.

• You cannot be claimed as a dependent by another taxpayer.

• For one or more months of 2022, you or someone else in your tax

household did not have minimum essential coverage.

Use Form IND-HEALTH to report or claim a coverage exemption if you can

claim any part-year exemptions or exemptions for specific members of your

tax household. This will reduce the amount of your shared responsibility pay-

ment.

Not required to file a tax return

If you are not required to file a tax return, your tax household is exempt from

the shared responsibility payment and you do not need to file a tax return to

claim the coverage exemption. However, if you are not required to file a tax

return but choose to file anyway, enter “NC” for each month and for each

tax household member on Form IND-HEALTH.

In Summary

If, during 2022, each individual who is a member of your tax household for

any month had coverage for all the months they were members of your tax

household and residents of Rhode Island, you will check the “Full-year health

care coverage” box on your return.

If, during 2022, one or more members of your tax household did not have

minimum essential coverage, complete Form IND-HEALTH being sure to list

ALL members of your tax household (not just those with months of non-

coverage). You will also need to complete the Shared Responsibility Work-

sheet. Be sure to attach both the form and the worksheet to your tax return.

BIRTH, DEATH, OR ADOPTION

An individual is included in your tax household in a month only if he or she

is alive for the full month.

Adoption:

If you adopt a child during the year, the child is included in your tax house-

hold only for the full months that follow the month in which the adoption oc-

curs.

Use Coverage Exemption Code “H1” for the month in which the adoption

occurred and for all of the months preceding that month.

For example, if you adopt a child on October 10, 2022, you would enter “H1”

for the months of January through October on Form IND-HEALTH.

Birth:

If you or your spouse gives birth during the year, the child is included in your

tax household only for the full months that follow the month in which the birth

occurs.

Use Coverage Exemption Code “H1” for the month in which the birth oc-

curred and for all of the months preceeding that month.

For example, if you or your spouse gave birth in

April of 2022, you would

enter “H1” for the months of January through April on Form IND-HEAL

TH.

Death:

If a member of your tax household passes away during the year, the house-

hold member is included in your tax household only for the full months pre-

ceding the month in which the passing occurs.

Use Coverage Exemption Code “H2” for the month in which the death oc-

curred and for the months following for the rest of the year.

For example, if a member of the tax household passes away in May of 2022,

you would enter “H2” for the months of May through December on Form

IND-HEALTH.

CHILD

Means any individual under the age of eighteen (18).

For the purposes of minimum essential coverage and for calculating the

shared responsiblity payment, a dependent under the age of eighteen (18)

on January 1st of the calendar year is considered a child for the entire cal-

endar year.

DEFINITIONS

PURPOSE OF FORM

Page IND-1

GENERAL INSTRUCTIONS

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

COVERAGE EXEMPTION CODES AND REASONS

Page IND-9 of these Instructions includes a chart of coverage exemptions

allowed under 26 U.S. Code § 5000A(e). In addition to those exemptions

allowed under 26 U.S. Code § 5000A(e), the chart includes other valid cir-

cumstances in which a member of your tax household may be exempt

from minimum essential coverage requirements.

These Coverage Exemptions, if applicable, may be used to reduce your

Shared Responsibility Payment.

The Coverage Exemption Reasons are:

Income Below the Filing Threshold

Coverage Considered Unaf

fordable

Short Coverage Gap

Citizens Living Abroad & Certain Noncitizens

Members of a Healthcare Sharing Ministry

Minimum Essential Health Coverage

Incarceration

Aggregate Self Only Coverage Considered Unaffordable

HealthSource RI Exemption

Member of Tax Household Born or Adopted During the Year

Member of Tax Household Died During the Year

DEPENDENT

An individual who is or may become eligible for minimum essential cover-

age under the terms of a health insurance plan because of a relationship

to a qualified individual or enrollee.

DEPENDENTS OF MORE THAN ONE TAXPAYER

Your tax household does not include someone you can, but do not, claim as

a dependent if the dependent is properly claimed on another taxpayer's re-

turn.

HOUSEHOLD INCOME

Your household income is your modified adjusted gross income (MAGI)

plus the MAGI of each individual in your tax household whom you claim as

a dependent if that individual is required to file a tax return because his or

her income meets the income tax return filing threshold.

MINIMUM ESSENTIAL COVERAGE

“Minimum essential coverage” has the same meaning as set forth in 26

U.S.C § 5000A(f), as in effect on December 15, 2017:

1. In general.

The term "minimum essential coverage" means any of the following:

a. Government sponsored programs. Coverage under:

(1) The Medicare program under the Social Security Act, 42

U.S.C. § 1395(c) et seq.,

(2) The Medicaid program under the Social Security Act, 42

U.S.C. § 1396 et seq.,

(3) The CHIP program under the Social Security Act, 42 U.S.C.

§ 1397(aa) et seq.,

(4) Medical coverage under 10 U.S.C. § 1071 et seq., including

coverage under the TRICARE program;

(5) A health care program under 38 U.S.C. §§ 1701 et seq. or

1801 et seq., as determined by the Secretary of Veterans Af-

fairs, in coordination with the Secretary of Health and Human

Services and the Secretary of the Treasury,

(6) A health plan under 22 U.S.C. § 2504(e) (relating to Peace

Corps volunteers); or

(7) The Nonappropriated Fund Health Benefits Program of the

Department of Defense, established under the National Defense

Authorization Act for Fiscal Year 1995, 10 U.S.C. § 1587 (1995)

note.

b. Employer-sponsored plan. Coverage under an eligible employer-

sponsored plan.

c. Plans in the individual market. Coverage under a health plan of-

fered in the individual market within a state.

d. Grandfathered health plan. Coverage under a grandfathered

health plan.

e. Other coverage. Such other health benefits coverage, such as a

state health benefits risk pool, as the federal Secretary of Health

and Human Services, in coordination with the Secretary of the Treas-

ury, recognizes for purposes of this subsection.

2. Eligible employer-sponsored plan.

The term "eligible employer-sponsored plan" means, with respect to any

employee, a group health plan or group health insurance coverage offered

by an employer to the employee which is:

a. A governmental plan (within the meaning of the Public Health Serv-

ice Act, 42 U.S.C. § 300gg-91(d)(8)), or

b. Any other plan or coverage offered in the small or large group mar-

ket within a state.

c. Such term shall include a grandfathered health plan described in §

15.6 (G)(1)(d) of this Part offered in a group market.

3. Excepted benefits not treated as minimum essential coverage.

The term "minimum essential coverage" shall not include health insurance

coverage which consists of coverage of excepted benefits:

a. Described in the Public Health Service Act, 42 U.S.C. § 300gg-

91(c)(1); or

b. Described in the Public Health Service Act, 42 U.S.C. § 300gg-

91(c)(2), (3) or (4) if the benefits are provided under a separate pol-

icy, certificate, or contract of insurance.

4. Individuals residing outside United States or residents of territo-

ries.

Any applicable individual shall be treated as having minimum essential

coverage for any month:

a. If such month occurs during any period described in 26 U.S.C. §

911(d)(1)((A)) or ((B)) which is applicable to the individual, or

b. If such individual is a bona fide resident of any possession of the

United States (as determined under 26 U.S.C. § 937(a)) for such

month.

MODIFIED ADJUSTED GROSS INCOME

Modified Adjusted Gross Income (“MAGI’) is determined by adding to your

federal adjusted gross income any amount excluded from gross income

under section 911, and any amount of interest received or accrued by the

taxpayer during the taxable year which is exempt from tax.

See page IND-6 of these instructions for tables to assist you in calculating

the MAGI for your tax household.

PART YEAR RESIDENT

An individual who is a Rhode Island resident as defined in R.I. Gen. Laws

§ 44-30-5 for less than the full calendar year is only required to maintain

minimum essential health coverage for those months as a Rhode Island

resident.

A part year resident should enter Coverage Exemption Code “N’

for those

months during which he or she was not a resident of Rhode Island as well

as the month in which the individual either became or ceased to be a

Rhode Island resident.

For example, a member of your tax household moves to the state of

Alaska in September of 2022, you would enter “N” for the months of Sep-

tember through December for that tax household member on Form IND-

HEALTH.

Individuals residing outside United States or residents of territories.

Any applicable individual shall be treated as having minimum essential

coverage for any month:

a. If such month occurs during any period described in 26 U.S.C. §

911(d)(1)((A)) or ((B)) which is applicable to the individual, or

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Page IND-2

b. If such individual is a bona fide resident of any possession of the

United States (as determined under 26 U.S.C. § 937(a)) for such

month.

SHARED RESPONSIBILITY PAYMENT PENALTY

Tax assessed when a taxpayer fails to maintain minimum essential cover-

age for each month of the calendar year

SHORT COVERAGE GAP

You generally can claim a coverage exemption for yourself or another

member of your tax household for each month of a gap in coverage of less

than 3 consecutive months. If an individual had more than one short cov-

erage gap during the year, the individual is exempt only for the month(s) in

the first gap. If an individual had a gap of 3 months or more, the individual

is not exempt for any of those months.

TAX HOUSEHOLD

For purposes of Form IND-HEALTH, your tax household generally includes

you, your spouse (if filing a joint return), and any individual you claim as a

dependent on your tax return. It also generally includes each individual you

can, but do not, claim as a dependent on your tax return.

Code “A” = Coverage Considered Unaffordable

You can claim a coverage exemption for yourself or another member of

your tax household for any month in which:

The individual is eligible for coverage under an employer plan and 1

that coverage is considered unaffordable, or

The individual isn’t eligible for coverage under an employer plan and 2

the coverage available for that individual through the Marketplace is

considered unaffordable.

Coverage is considered unaffordable if the individual's required con-3

tribution (described later) is more than 8.09% (0.0809) of household

income.

Use the Af

fordability Worksheet on page IND-10 to help you determine if

coverage is considered unaffordable for one or more months throughout

the year for yourself or another family member allowing you to use Code

“A” for that month(s).

Code “B” = Short Coverage Gap

You generally can claim a coverage exemption for yourself or another

member of your tax household for each month of a gap in minimum es-

sential coverage of less than three (3) consecutive months. If an individual

had more than one short coverage gap during the year, the individual is

exempt only for the month(s) in the first gap. If an individual had a gap of

three (3) months or more, the individual is not exempt for any of those

months.

For example:

Single gap in coverage less than three consecutive months

Ruth had coverage from her employer for her and her spouse for every

month through July. Her spouse was able to sign up for coverage for

them, but the coverage was not effective until October. Because they

were only without coverage for the months of August and September, Ruth

and her spouse are eligible for the short coverage gap exemption for the

months of August and September. Ruth and her spouse would each enter

“B” for the months of August and September.

Single gap in coverage for three or more consecutive months

Eddie had coverage each month until September. This left Eddie without

coverage for three months - October, November and December. Because

Eddie did not have minimum essential coverage for three or more consec-

utive months, he is not

eligible for the Short Coverage Gap exception.

Multiple gaps in coverage

Teddy had coverage for every month except February, March, October,

and November. Teddy is eligible for the short coverage gap exemption

only for February and March. Teddy would enter “B” for the months of Feb-

ruary and March only, and would be subject to the Shared Responsibility

Payment Penalty for the months of October and November.

Code “C” = Citizens Living Abroad and Certain Noncitizens

You can claim a coverage exemption for yourself or another member of

your tax household to which any of the following apply.

The individual is a U.S. citizen or a resident alien who is physically

present in a foreign country (or countries) for at least 330 full days

during any period of 12 consecutive months. You can claim the cover-

age exemption for any month during your tax year that is included in

the 12-month period. For more information, see Physical Presence

Test in Pub. 54.

The individual is a U.S. citizen who is a bona fide resident of a foreign

country (or countries) for an uninterrupted period which includes the

entire tax year. You can claim the coverage exemption for the entire

year. For more information, see Bona Fide Residence Test in Pub.

54.

The individual is a resident alien who is a citizen or national of a for-

eign country with which the U.S. has an income tax treaty with a

nondiscrimination clause and who is a bona fide resident of a foreign

country for an uninterrupted period that includes the entire tax year.

You can claim the coverage exemption for the entire year. For more

information, see Bona Fide Residence Test in Pub. 54.

· The individual is a bona fide resident of a U.S. territory. You can claim

the coverage exemption for the entire year.

The individual isn’t lawfully present in the U.S. and isn’t a U.S citizen

or U.S. national. For this purpose, an immigrant with Deferred Action

for Childhood Arrivals (DACA) status is not considered lawfully pres-

ent and therefore qualifies for this exemption. For more information

about who is treated as lawfully present for purposes of this coverage

exemption, visit www.HealthCare.gov.

The individual is a nonresident alien, including (1) a dual-status alien

in the first year of U.S. residency and (2) a nonresident alien or dual-

status alien who elects to file a joint return with a U.S. spouse. You

can claim the coverage exemption for the entire year. This exemption

doesn't apply if you are a nonresident alien for 2022, but met certain

presence requirements and elected to be treated as a U.S. resident.

For more information, see Pub. 519.

Code “D” = Members of a Health Care Sharing Ministry

You can claim a coverage exemption for yourself or another member of

your tax household for any month in which the individual was a member of

a health care sharing ministry for at least one (1) day in the month.

Use Coverage Exemption Code "D" for the months which apply.

In general, a health care sharing ministry is a tax-exempt organization

whose members share a common set of ethical or religious beliefs and

share medical expenses in accordance with those beliefs, even after a

member develops a medical condition. For you to qualify for this exemp-

COVERAGE EXEMPTION DESCRIPTIONS

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Page IND-3

tion, the health care sharing ministry (or a predecessor) must have been in

existence and sharing medical expenses continuously and without inter-

ruption since December 31, 1999. An individual who is unsure whether a

ministry meets the requirements should contact the ministry for further in-

formation.

Code “E” = Members of Indian Tribes or Individuals

Otherwise Eligible for Services from an Indian

Health Care Provider

You can claim a coverage exemption for yourself or another member of

your tax household for any month in which the individual was a member of

a federally recognized Indian tribe, including an Alaska Native Claims Set-

tlement Act (ANCSA) Corporation Shareholder (regional or village), for at

least 1 day in the month. The list of village or regional corporations formed

under ANCSA is available at:

https://www.ncsl.org/research/state-tribal-institute/list-of-federal-and-state-

recognized-tribes.aspx

You also can claim a coverage exemption for yourself or another member

of your tax household for any month in which the individual was eligible for

services through an Indian health care provider or through the Indian

Health Service.

Use Coverage Exemption Code "E" for the months which apply.

Code "F" = Incarceration

You can claim a coverage exemption for yourself or another member of

your tax household for any month in which the individual was incarcerated

for at least one (1) day in the month. For this purpose, an individual is con-

sidered incarcerated if he or she was confined, after the disposition of

charges, in a jail, prison, or similar penal institution or correctional facility.

Use Coverage Exemption Code "F" for the months in which the individual

was incarcerated.

For example, if the individual was incarcerated from March 24 until June 1,

enter “F” for the months of March through June on Form IND-HEALTH.

See Code “X” on page IND-5 if there was a time period when the house-

hold member had minimum essential coverage for the months prior to or

after incarceration.

Code “G1” = Aggregate Self-only Coverage

Considered Unaffordable

You and any other members of your tax household you list on your 2022

tax return (such as yourself, your spouse if filing jointly, and your depend-

ents) who can't be claimed as a dependent on someone else's 2022 tax

return can claim a coverage exemption for all months in 2021 if, for at

least one month in 2022, all of the following conditions apply:

1) The cost of self-only coverage through employers for two or more mem-

bers of your tax household doesn't exceed 8.09% of household income

when tested individually,

2) The cost of family coverage that the members of your tax household de-

scribed in condition 1 could enroll in through an employer exceeds 8.09%

of household income, and

3) The combined cost of the self-only coverage identified in condition 1

exceeds 8.09% of household income.

If you meet the requirements just described, you and any other members

of your tax household that you list on your 2022 tax return who can't be

claimed as dependents on someone else's 2022 tax return are exempt for

the entire year.

Use Coverage Exemption Code "G1” for you and your household mem-

bers for the entire year if you are eligible for this coverage exemption.

Code “H1” = Member of Tax Household Born

or Adopted During the Year

Your tax household for a month only includes individuals who were alive

for the entire month. In general, if an individual was added to your tax

household by birth or adoption and that individual had minimum essential

coverage, you do not need to file Form IND-HEALTH solely to report that

fact.

For example, if all members of your tax household, as well as the newborn

or adopted individual, had minimum essential coverage for every month of

the year they are part of your tax household and residents of Rhode Is-

land, check the “Full-year health care coverage” box on Form RI-1040,

line 12b or Form RI-1040NR, line 15b. You do not need to file Form IND-

HEALTH.

However, if you had or adopted a child during 2022 and you are claiming a

coverage exemption (other than code “H1”) for one or more months on

Form IND-HEALTH, you can claim a coverage exemption for that child for

the months before (and including) the month when the child was born or

adopted.

To claim this coverage exemption, enter code “H1” for the month in which

the child was born or adopted and the months preceding that month to the

beginning of the year.

For example, Jamison was born in September. His parents did not have

minimum essential coverage for any of 2022. When Jamison’s parents

complete Form IND-HEALTH, code “H1” would be entered for Jamison for

the months of January through September. October, November and De-

cember would be left blank.

In addition, if Jamison was born in October rather than September, when

Jamison’s parents complete Form IND-HEALTH, code “H1” would be en-

tered for Jamison for the months of January through October and code “B”

would be entered for the months of November and December. Even

though Jamison’s parents cannot claim the Short Coverage Gap (code “B’)

exemption, they can claim it for their newborn child.

Code “H2” = Member of Tax Household

Died During the Year

Your tax household for a month only includes individuals who were alive

for the entire month. In general, if a member of your tax household died

during the year, you do not need to file Form IND-HEALTH solely to report

that fact.

For example, if all members of your tax household, including the decedent

prior to death, had minimum essential coverage for every month they are

part of your tax household and residents of Rhode Island, check the “Full-

year health care coverage” box on Form RI-1040, line 12b or Form RI-

1040NR, line 15b. You do not need to file Form IND-HEALTH.

However, if a member of your tax household died during 2022 and you are

claiming a coverage exemption (other than code “H2”) for one or more

months on Form IND-HEALTH, you can claim a coverage exemption for

the months following (and including) the month of his or her death.

To claim this coverage exemption, enter code “H2” for the month in which

the household member passed away along with the months through the

end of the year.

For example, Nick did not have minimum essential coverage from January

through April. Nick had coverage starting in May and until he passed

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Page IND-4

away in July. When Form IND-HEALTH is completed for the tax house-

hold which Nick is a part of, no code would be entered in January through

April; May and June would have code “X” and the rest of the year would

have code “H2”.

Code “N” = Nonresident During the Year

An individual who is a Rhode Island resident as defined in R.I. Gen. Laws

§ 44-30-5 for less than the full calendar year is only required to maintain

minimum essential health coverage for those months during which the in-

dividual is a Rhode Island resident.

Part-year Resident of Rhode Island:

A part-year resident who, along with all members of his/her tax household

had minimum essential coverage for all of the months when they were

Rhode Island residents, does not need to file Form IND-HEALTH. Instead,

the box on RI-1040NR, line 15b will be checked.

A part year resident

who, along with all members of his/her tax household

did not maintain minimum essential coverage for all of the months when

they were Rhode Island residents, should enter Coverage Exemption

Code “N’ for those months during which he or she was not a resident of

Rhode Island as well as the month in which the individual either became

or ceased to be a Rhode Island resident.

For example, a member of your tax household moves to the state of

Alaska in September of 2022. During the months prior to September the

household member had minimum essential coverage from January until

May

. You would enter “N” for the months of September through December

for that tax household member on Form IND-HEALTH.

See Code “X” in the next column for the time period when the household

member had minimum essential coverage prior to moving out of state.

Nonresident of Rhode Island:

A full-year nonresident is not subject to Rhode Island’s requirement to

maintain minimum essential health coverage. The full-year nonresident

will not complete Form IND-HEALTH and will not check the “Full-year

health care coverage” box on Form RI-1040NR.

Code “NC” = Income Below Filing Threshold

You qualify for this exemption if your household income is less than the

amount of gross income requiring you to file a return as set forth in R.I.

Gen. Laws § 44-30-51.

First, determine your household income for the taxable year (see definition

of Household Income on page IND-2). Then compare your household in-

come to the state filing threshold that applies to you based on your filing

status and your dependents.

If you qualify for this coverage exemption, everyone in your tax household

is exempt for the entire year.

Minimum filing threshold:

Standard Deduction Amounts:

Single $9,300

Married Joint $18,600

Qualifying Widow(er)

$18,600

Married Separate $9,300

Head of Household $13,950

Exemption Amount: $4,350

Multiply the Exemption Amount above by the number of members you would

claim on your personal income tax return and then add that to the applicable

Standard Deduction Amount from the list above.

If your gross income or the income of your household is less than the mini-

mum threshold required for filing a tax return for tax year 2022, enter Cov-

erage Exemption Code “NC” for each month and for each household

member on Form IND-HEALTH.

Code “X” = Minimum Essential Health Coverage

If you and each member of your tax household had minimum essential

health coverage for each month of tax year 2022, you should check the

box on Form RI-1040, line 12b or Form RI-1040NR, line 15b to indicate

your tax household had minimum essential health coverage for the whole

year. You will not complete Form IND-HEALTH.

If, at some point during tax year 2022, you or a member of your household

did not have minimum essential coverage, you should enter Coverage Ex-

emption Code “X” for those months in which you and other members of

your tax household DID have minimum essential health coverage.

You are considered to have minimum essential coverage for a month if

you have that coverage for at least one (1) day during that month.

Code “RI” = HealthSource RI Exemption

HealthSource RI will be accepting applications from Rhode Islanders who

may be exempt from the Shared Responsibility Payment. You may apply

for an exemption from HealthSource RI for the following categories:

Members of Certain Religious Sects

Members of certain religious sects (enter ECN). An individual may claim a

coverage exemption for members of recognized religious sects only if the

Marketplace has granted the individual an exemption.

Hardship Affecting Ability to Purchase Coverage

You can claim a coverage exemption for yourself or another member of

your tax household for 2022 if you experienced a hardship that prevented

you from obtaining minimum essential coverage. Hardship exemptions

usually cover the month before the hardship, the months of the hardship,

and the month after the hardship.

Hardships can include:

Being homeless;

Being evicted or facing eviction or foreclosure;

Receiving a shut-off notice from a utility company;

Experiencing domestic violence;

Experiencing the death of a close family member;

Experiencing a fire, flood, or other natural or human-caused disaster that

caused substantial damage to your property;

Filing for bankruptcy;

Having unreimbursed medical expenses in the last 24 months that re-

sulted in substantial debt;

Experiencing unexpected increases in necessary expenses due to caring

for an ill, disabled, or aging family member;

Your child was denied Medicaid and CHIP

, and another person is required

by court order to provide coverage to the child;

Experiencing personal circumstances that create a hardship, such as

when no affordable plans provide access to needed specialty care; or

Experiencing a hardship not included in this list that prevented you from

getting health insurance.

Use Coverage Exemption Code “RI” on Form IND-HEALTH for the months

to which one of the above exemptions applies.

You must apply to HealthSource RI for an exemption certificate. You

will need to enter the Exemption Certificate number on Form IND-

HEALTH.

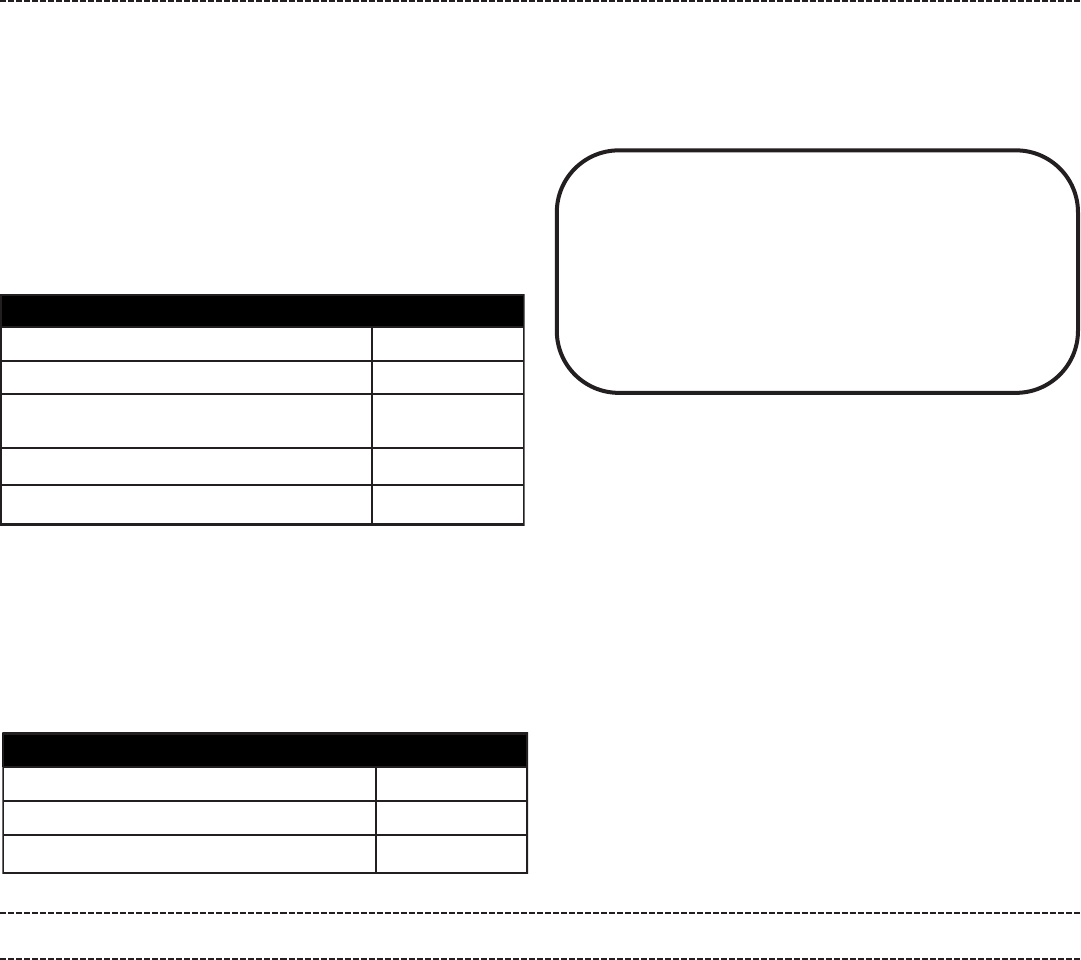

MODIFIED AGI CALCULATION

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Page IND-5

Modified Adjusted Gross income (Modified AGI).

For purposes of Form IND-HEALTH and the Penalty Calculation Work-

sheet, your Modified AGI is your Adjusted Gross Income plus certain other

items from your tax return.

To determine your Modified AGI, enter the amounts from the Federal Form

1040 into T

able 1 in the column to the right. You will need to complete this

table for ALL members of your tax household who were required to file

Federal Form 1040 for tax year 2022.

If you have one or more dependents with:

1) a filing requirement AND

2) you reported the dependent's income on Form 8814, you must include

each dependent's Modified AGI in the calculation of your household in-

come.

Using Table 2 below, enter the income amounts from Federal Form 8814

for each applicable dependent.

If you do not have one or more dependents that meet the criteria requiring

Table 2 to be completed, you can enter the Modified AGI amount calcu-

lated above for ALL members of your tax household on line 4 of the

Shared Responsiblity Worksheet.

Table 1

Form 1040, line 2a.

Form 1040, line 11.

Foreign earned income ex

clusion or Housing

exclusion from Form 2555, line 45.

Housing deduction from Form 2555, line 50.

Modified AGI. Total all of the above.

Table 2

Form 8814, line 1b.

Form 8814, line 4 or 5, whichever is smaller.

Dependent’s Modified AGI.

Page IND-6

NOTE:

The Modified Adjusted Gross Income amount to be used on the

2022 Shared Responsiblity Worksheet - Individual Mandate Penalty

Calculation form MUST include the Modified AGI for each applicable

member of your tax household.

Be sure to complete Table 1 for each applicable individual filing

his/her own Federal Form 1040, and Table 2 for each applicable de-

pendent with income being claimed on Federal Form 8814 and in-

cluded in a household member’s Federal Form 1040.

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

FORM IND-HEALTH LINE BY LINE INSTRUCTIONS

If you cannot check the "Full-year health care coverage” checkbox on page 1 of Form RI-1040 or RI-1040NR, Form IND-HEALTH and the Shared Respon-

sibility Worksheet must be completed and attached to your RI-1040 or RI-1040NR.

Form IND-HEALTH is used to list each member of your tax household and the months of minimum essential coverage, coverage exemption

and non-coverage.

Each member of your tax household is to be listed separately in one of the sections. Complete additional Form(s) IND-HEALTH as needed.

Complete each section of Form IND-HEALTH with information for a member of your tax household.

Name: Enter this household member’s name.

Social security number: Enter this household member’s social security number.

Checkbox: If this household member was under the age of eighteen as of January 1, 2022, check the box.

Exemption number: If an individual qualified for an exemption through HealthSource RI, enter the exemption number(s) in the space provided.

In the section where the months of the year are shown, you will either enter one of the Coverage Exemption Codes from the reference chart on page

IND-9 for each corresponding month in which the household member had minimum essential health coverage or a coverage exemption. If an exemption

did not apply, leave the corresponding months blank.

Number of months for which an exemption did not apply: In each household member’s section, enter the number of months that are blank and do not

contain a coverage exemption code.

Name:

JOHN JONES

Social Security Number:

123-45-6789

Exemption Number:

N N N X X X X X

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

Check ü if under

18 years of age

as of 01/01/2022

Number of months for which an exemption did not apply.

4

Do this for each member of your tax household. Once this is done, you will need to add up the total number of months during which the adult (over the

age of 18) and child (under the age of 18 as of January 1, 2022) members of your tax household did not have minimum essential health coverage or a

coverage exemption.

For all of the adult members of your household - find those household members that do not have the under 18 years of age checkbox checked and

add the number of months from lines 1 through 5 in which these adult members of your tax household did not have minimum essential health coverage

or a coverage exemption.

Enter this number on line 6a on the bottom of Form IND-HEALTH and on line 1a of the Shared Responsibility Worksheet.

For all of the child members of your household - find those household members that have the under 18 years of age checkbox checked and add the

number of months from lines 1 through 5 in which these child members of your tax household did not have minimum essential health coverage or an ex-

emption.

Enter this number on line 6b on the bottom of Form IND-HEALTH and on line 1c of the Shared Responsibility Worksheet.

For example:

John Jones moved to Rhode Island in March. He did not have any health insurance until he found a full-time job in August. From that point on, John

had minimum essential coverage.

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

The Shared Responsibility Payment is determined by comparing the results of three different calculations listed below and taking the

higher of percentage of income method OR the Flat Dollar Method (but not to exceed the Average Bronze Plan amount).

Percentage of Income Method - 2.5 % of your Modified Adjusted Gross Income above the tax filing threshold.

Flat Dollar Amount Penalty - The maximum penalty amount is $2,085 (300% of the flat dollar amount penalty).

Average Bronze Plan amount as determined by HealthSource RI. For calendar year 2022, the Average Bronze Plan amount is

$308 per month.

SHARED RESPONSIBILITY WORKSHEET

GENERAL INFORMATION

LINE BY LINE INSTRUCTIONS

Line 1 - Enter the number of months that members of the

household DID NOT HAVE coverage or an exemption

For tax year 2022, the Monthly Penalty Rates are:

Adult $57.92

Child* $28.96

*Child is an individual under 18 years of age as of January 1.

Line 1a - Total number of months without coverage or an exemption for all

adults in the household. This number can be found in box 6a of Form IND-

HEALTH.

Line 1b - Adult No Coverage Penalty. Multiply line 1a by $57.92.

Line 1c - Total number of months without coverage or an exemption for all

children. This number can be found in box 6b of Form IND-HEALTH.

Line 1d - Children No Coverage Penalty

Multiply line 1c by $28.96.

Line 2 - Penalty Total Based on Calculations

Add the amounts from lines 1b and 1d.

Line 3 - Flat Fee Method Penalty

Enter amount from line 2 or the Maximum Flat Fee Penalty (using the Flat

Fee Method Worksheet located on the bottom of page IND-8), whichever

is less.

Line 4 - Modified Adjusted Gross Income

Using the table(s) on page IND-6 of these instructions enter your Modified

Adjusted Gross Income. If married filing separately and living in the same

household, each spouse must combine their income figures from their

separate returns when completing this section. If you have no filing re-

quirement enter zero.

STEP 1: FLAT FEE METHOD

STEP 2: PERCENTAGE OF INCOME METHOD

Page IND-7

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Line 5 - Federal Standard Deduction

Using the chart below, enter your Federal Standard Deduction from Fed-

eral Form 1040.

Federal Standard Deduction for tax year 2022:

Married Filing Jointly $25,900

Married Filing Separately $12,950

Head of Household $19,400

Single $12,950

Qualifying Widow(er) $25,900

If you and your spouse file married filing separately and living in the same

household, each spouse must combine their deductions from their sepa-

rate returns when completing this section.

Line 6 - Subtract the Federal Standard Deduction amount on line 5 of the

worksheet from your Modified Adjusted Gross Income on line 4 of the

worksheet.

Line 7 - Income Percentage Amount

Multiply the amount on line 6 by 2.5% (0.025).

Line 8 - Household Size

Enter the total number of members in your household, including yourself,

your spouse (if living in the same household at any point during the year)

and any dependents as claimed on Form IND-HEALTH.

NOTE: All members should be listed on the Individual Mandate schedule.

If you need more space, complete an additional Form IND-HEALTH.

Line 9 - Number of Household Periods

Multiply the number of household members from line 8 by 12.0.

Line 10 - Months Subject to Penalty

Add the total number of months of no health coverage or no exemption for

all adults from line 1a and the total number of months of no health cover-

age or no exemption for all children under the age of 18 from line 1c.

Line 11 - Uninsured/unexempted Apportionment Ratio

Divide line 10 by line 9. Carry apportionment to four decimal places

(0.0000).

For example, if there are two adult members and two children in your tax

household, line 9 would be 48 (4 household members times 12). If you

lost your health coverage in August of 2022, line 10 would be 16 (4 house-

hold members times 4 months). 16/48 = 0.2500

Line 12 - Multiply line 11 by line 7.

Line 13 - Enter the amount from line 3 or line 12, whichever is greater.

Line 14a - Enter the number of months subject to the penalty from line 10

of the worksheet.

Line 14b - Multiply the number of months from line 14a times $308 and

enter the total here.

Note: For tax year 2022, the average monthly bronze plan amount

was $308.

Line 14c - Household Amounts

Use the list provided to find the number of total household members that

applies to your household and enter the corresponding dollar amount.

This amount represents the Average Bronze Plan annual amount.

Number of Household members Amounts

1 $3,696

2 $7,392

3 $11,088

4 $14,784

5 or More $18,480

Line 14d - Enter the amount from line 14b or line 14c, whichever is less.

Line 15 - Individual Mandate Fee

Enter the amount from line 13 or line 14d, whichever is less.

Enter this amount on Form RI-1040, page 1, line 12b or Form RI-1040NR,

page 1, line 15b.

STEP 3: BRONZE PLAN METHOD

Page IND-8

1. For each month, enter the number of ADULTS

without coverage or an exemption

8. Maximum Flat Fee Penalty: Divide line 7 by 12.0.. $

7. Enter the total of all of the amounts on line 6......... $

6. For each month, enter the amount from line 5 or

$2,085, whichever is less

5. For each month, add lines 2 and 4

4. For each month, multiply the number of

CHILDREN by $347.50

3. For each month, enter the number of CHILDREN

without coverage or an exemption

2. For each month, multiply the number of ADULTS

times $695

Flat Fee Method Worksheet

Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec

FLAT FEE METHOD WORKSHEET

Complete lines 1 and 3 of the Flat Fee Method Worksheet using the information from Form IND-HEALTH

Page IND-9

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Coverage Exemption Reasons

Exemption

Code

Income Below Filing Threshold:

Your gross income or your household income was less than your applicable minimum threshold for filing a tax return.

NC

Coverage Considered Unaffordable:

The required contribution is more than 8.09% of your household income.

A

Short Coverage Gap:

You went without coverage for less than 3 consecutive months during this year.

B

Citizens Living Abroad and Certain Noncitizens:

You were:

- A U.S. citizen or a resident alien who was physically present in a foreign country or countries for at least 330 full

days during any period of 12 consecutive months.

- A U.S. citizen who was a bona fide resident of a foreign country or countries for an uninterrupted period that in-

cludes the entire tax year.

- A bona fide resident of a U.S. territory.

- A resident alien who was a citizen or national of a foreign country with which the U.S. has an income tax treaty

with a nondiscrimination clause, and you were a bona fide resident of a foreign country for an uninterrupted period

that includes the entire tax year;

- Not lawfully present in the U.S. and not a U.S. citizen or U.S. national.

- A nonresident alien including (1) a dual-status alien in the first year of U.S. residency and (2) a nonresident alien

or dual-status alien who elects to file a joint return with a U.S. spouse.

C

Members of a Health Care Sharing Ministry:

You were a member of a health care sharing ministry.

D

Members of Federally Recognized Indian Tribes:

You were either a member of a federally recognized Indian tribe or you were otherwise eligible for services through

an Indian health care provider or the Indian Health Service.

E

Incarceration:

You were in jail, prison, or similar penal institution or correctional facility after the disposition of charges.

F

Aggregate Self Only Coverage Considered Unaffordable:

Two or more family members’ aggregate cost of self-only employer-sponsored coverage was more than 8.09% of

household income, as was the cost of any available employer-sponsored coverage for the entire family.

G1

Member of Tax Household Born or Adopted During the Year:

The months before and including the month that the individual was added to your tax household by birth or adop-

tion. Claim this exemption only if you are also claiming another exemption or period of no coverage on Form IND-

HEALTH.

H1

Member of Tax Household Died During the Year:

The months after the month that a member of your tax household died during the year. You should claim this ex-

emption only if you are also claiming another exemption period of no coverage on Form IND-HEALTH.

H2

Nonresident of Rhode Island:

The months during which the individual was a resident of another state as well as the month in which the individual

either became or ceased to be a Rhode Island Resident. Claim this exemption only if you are claiming another ex-

emption on Form IND-HEALTH or have a period of no coverage during your time as a Rhode Island resident.

N

Minimum Essential Health Coverage:

You had minimum essential health coverage for part of 2022. If you had minimum essential health coverage for the

entire year, see Form RI-1040 or RI-1040NR instructions.

X

Healthsource RI Exemption:

An exemption you received through HealthSource RI for which you were provided a valid Exemption Certificate

Number.

RI

Types of Coverage Exemptions

This chart shows all of the coverage exemptions available for tax year 2022, including information about each exemption and the code

that is to be used on Form IND-HEALTH when you claim the exemption. If your coverage exemption was granted by HealthSource RI,

you will need to enter the Exemption Certificate Number (ECN) provided by HealthSource RI on Form IND-HEALTH.

These Coverage Exemption Reasons and Codes are also listed on the top of Form IND-HEALTH for easy reference.

Affordability Worksheet

for use with Code “A” = Coverage Considered Unaffordable

For help relating to questions about health insurance go to https://healthsourceri.com/affordability-sheet/.

Use this worksheet to determine whether coverage for each individual in your tax household is considered unaffordable allowing you to

use Exemption Code “A”.

An individual is eligible for the affordability exemption for any month in which the Required Contribution from (B), is more than the

Affordability Threshold from (A). To claim this coverage exemption, enter code “A” on Form IND-HEALTH for the month(s) to which the

exemption applies as determined below.

(A) Affordability Threshold

Enter 8.09% (0.0809) of your household income (see Household income

) in the box to the

right. For this purpose, increase household income by the amount of any premium that is paid

through a salary reduction arrangement and excluded from gross income.

(B) Required Contribution Amount

For each member of your tax household, enter in the columns provided the amount the individual must pay for coverage for the first

situation below that applies to that person. If the required contribution is the same for the whole year, enter the annual required contri-

bution in the space for each month.

Situations (use the first that applies to each member of your tax household, including you, for each month):

1. The lowest cost self-only policy offered to each member of your tax household by his or her employer.

2. The lowest cost family policy offered by your employer or your spouse's employer (if you are filing a joint return).

The policy must cover everyone in your tax household:

Who you list on your 2022 tax return (such as yourself, your spouse if filing jointly, and your dependents) and who cannot a

be claimed as a dependent on someone else’s 2022 tax return,

Who isn't eligible for other employer coverage, and b

Who doesn't qualify for another coverage exemption. c

3. The amount from the Marketplace Coverage Affordability Worksheet.

For each individual, coverage is considered unaffordable and the individual is exempt for any month in which the Required Contribution

Amount is more than the Affordability Threshold.

Member(s) of your tax household.Enter one name per column.

Annualized required contribution for:

January

February

March

April

May

June

July

August

September

October

November

December

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Page IND-10

$

Individual Health Insurance Mandate for Rhode Island Residents

Individual Health Insurance Form and Shared Responsibility Worksheet

Marketplace Coverage Affordability Worksheet

for use with Code “A” = Coverage Considered Unaffordable

Use this worksheet to figure an individual's required contribution for any month in which the individual isn't eligible for employer-spon-

sored coverage. Complete a separate worksheet for each part of the year in which the number of people in your tax household who are

neither exempt nor eligible for minimum essential coverage (other than individual market coverage) was different. For reference tables

related to health insurance premiums and plans and for help relating to questions on health coverage go to:

https://healthsourceri.com/affordability-sheet/

.

Page IND-11

Footnotes:

1 – Figure the nontaxable social security benefits received by that individual by subtracting Federal Form 1040, line 6b from Federal Form

1040, line 6a.

2 – If the result is less than 1.38 and you meet the Medicaid eligibility requirements, you are eligible for Medicaid and therefore not eligible for a

premium tax credit. Enter -0- on line 10.