Chapter

1-1

Al-Mustaqbal university college

ACCOUNTING IN

ACTION 2

The Building Blocks of Accounting

Prepared by

Ezzulddin Hasan Kadhim

Chapter

1-2

The Building Blocks of Accounting

Ethics In Financial Reporting

LO 3 Understand why ethics is a fundamental business concept.

Standards of conduct by which one’s actions are

judged as right or wrong, honest or dishonest, fair or

not fair, are Ethics.

Recent financial scandals include: Enron,

WorldCom, HealthSouth, AIG, and others.

Congress passedSarbanes-Oxley Act of 2002.

Effective financial reporting depends on sound

ethical behavior.

Chapter

1-3

Ethics are the standards of conduct by which one's

actions are judged as:

a. right or wrong.

b. honest or dishonest.

c. fair or not fair.

d. all of these options.

Review Question

Ethics

LO 3 Understand why ethics is a fundamental business concept.

Chapter

1-4

Ethics are the standards of conduct by which one's

actions are judged as:

a. right or wrong.

b. honest or dishonest.

c. fair or not fair.

d. all of these options.

Review Question

Ethics

LO 3 Understand why ethics is a fundamental business concept.

Chapter

1-5

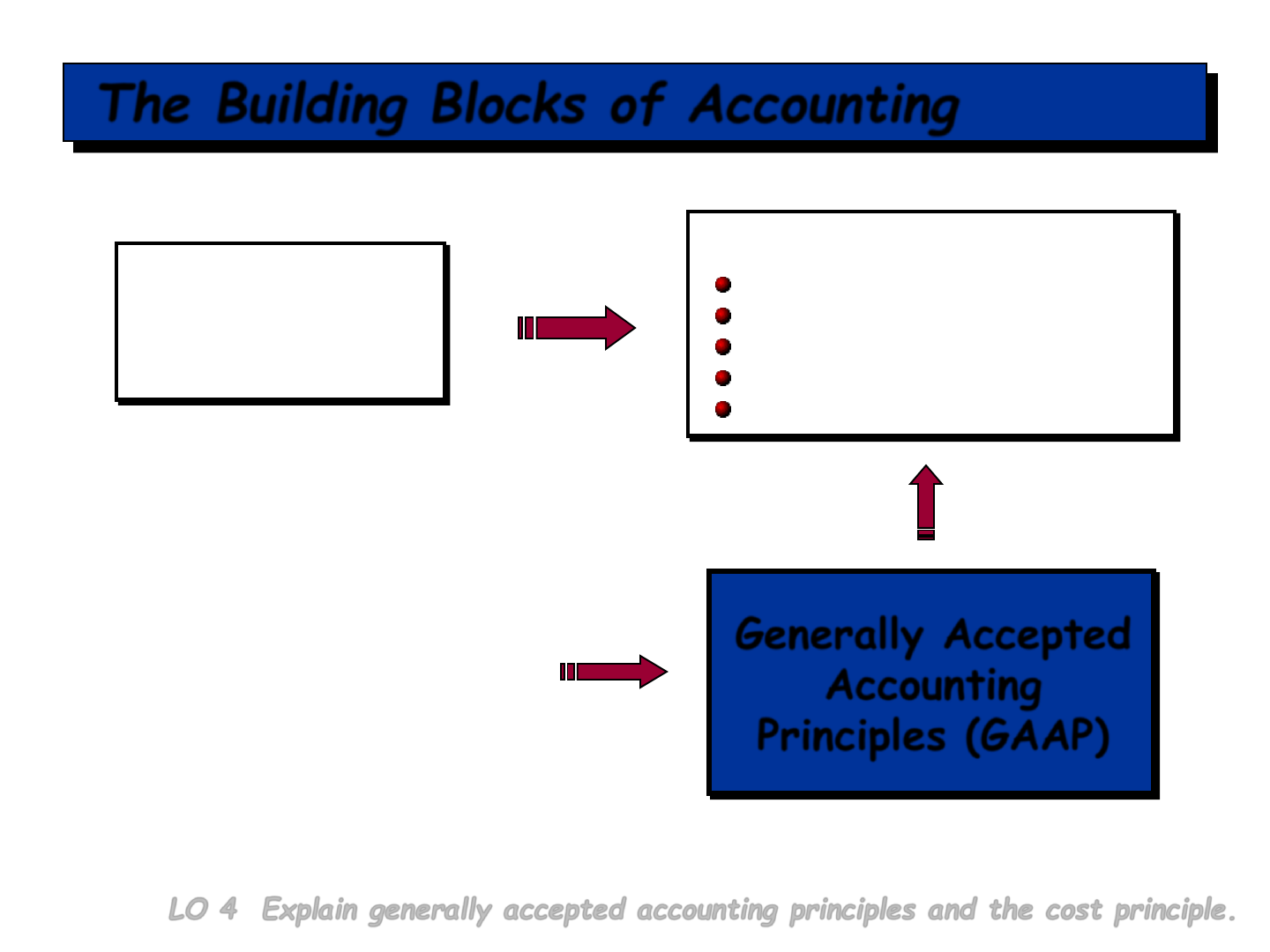

Various users

need financial

information

The accounting profession

has attempted to develop

a set of standards that

are generally accepted

and universally practiced.

Financial Statements

Balance Sheet

Income Statement

Statement of Owner’s Equity

Statement of Cash Flows

Note Disclosure

Generally Accepted

Accounting

Principles (GAAP)

The Building Blocks of Accounting

LO 4 Explain generally accepted accounting principles and the cost principle.

Chapter

1-6

Organizations Involved in Standard Setting:

Securities and Exchange Commission (SEC)

Financial Accounting Standards Board (FASB)

International Accounting Standards Board

(IASB)

LO 4 Explain generally accepted accounting principles and the cost principle.

The Building Blocks of Accounting

http://www.fasb.org/

http://www.sec.gov/

http://www.iasb.org/

Chapter

1-7

Cost Principle (Historical) – dictates that companies

record assets at their cost.

Issues:

Reported at cost when purchased and also over the

time the asset is held.

Cost easily verified, whereas market value is often

subjective.

Fair value information may be more useful.

The Building Blocks of Accounting

LO 4 Explain generally accepted accounting principles and the cost principle.

Chapter

1-8

Monetary Unit Assumption – include in the

accounting records only transaction data that can be

expressed in terms of money.

Economic Entity Assumption – requires that

activities of the entity be kept separate and distinct

from the activities of its owner and all other economic

entities.

Proprietorship.

Partnership.

Corporation.

Assumptions

LO 5 Explain the monetary unit assumption

and the economic entity assumption.

Forms of

Business Ownership

Chapter

1-9

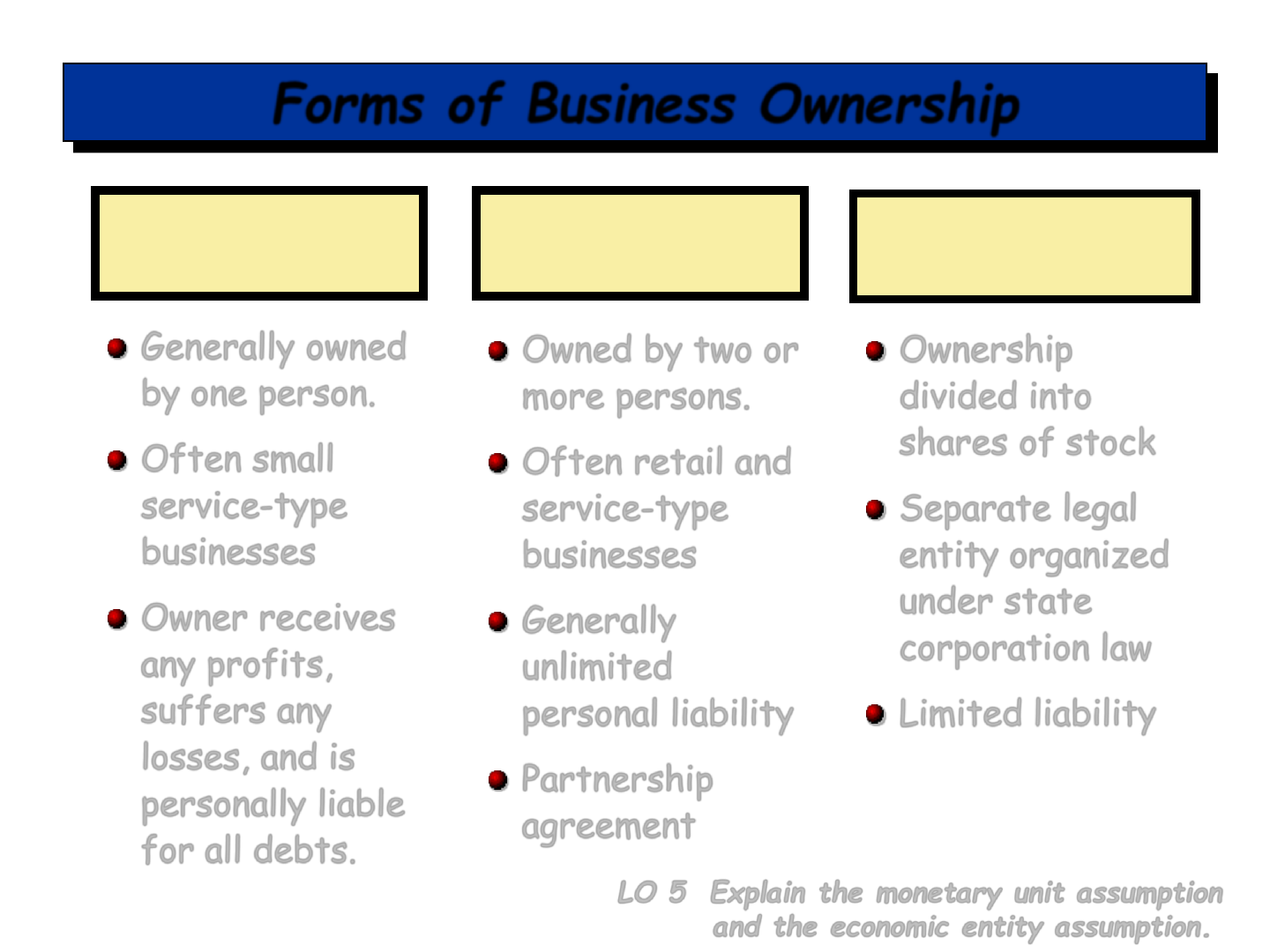

Proprietorship Partnership

Corporation

Owned by two or

more persons.

Often retail and

service-type

businesses

Generally

unlimited

personal liability

Partnership

agreement

Ownership

divided into

shares of stock

Separate legal

entity organized

under state

corporation law

Limited liability

Forms of Business Ownership

Generally owned

by one person.

Often small

service-type

businesses

Owner receives

any profits,

suffers any

losses, and is

personally liable

for all debts.

LO 5 Explain the monetary unit assumption

and the economic entity assumption.

Chapter

1-10

Combining the activities of Kellogg and General

Mills would violate the

a. cost principle.

b. economic entity assumption.

c. monetary unit assumption.

d. ethics principle.

Assumptions

LO 5 Explain the monetary unit assumption

and the economic entity assumption.

Review Question

Chapter

1-11

Combining the activities of Kellogg and General

Mills would violate the

a. cost principle.

b. economic entity assumption.

c. monetary unit assumption.

d. ethics principle.

Assumptions

LO 5 Explain the monetary unit assumption

and the economic entity assumption.

Review Question

Chapter

1-12

A business organized as a separate legal entity

under state law having ownership divided into

shares of stock is a

a. proprietorship.

b. partnership.

c. corporation.

d. sole proprietorship.

LO 5 Explain the monetary unit assumption

and the economic entity assumption.

Forms of Business Ownership

Review Question

Chapter

1-13

A business organized as a separate legal entity

under state law having ownership divided into

shares of stock is a

a. proprietorship.

b. partnership.

c. corporation.

d. sole proprietorship.

LO 5 Explain the monetary unit assumption

and the economic entity assumption.

Forms of Business Ownership

Review Question