whipmedia.com

Streaming Satisfaction Report

Key Highlights

© 2022 Whip Media

All product names, logos, and brands are property of their respective owners.

Streaming Satisfaction Report

Evolving Perceptions of Value:

The Shifting Sands of SVOD

Following its recent price increase and facing greater competition from rivals,

Netflix ranks last in the industry in terms of perceived value. This appears to

have fueled its recent subscriber losses in the US.

The contrast in perceived value between HBO Max and Netflix is stark, as

HBO Max emerges with a clear lead over Netflix and most other SVODs

across virtually all satisfaction and loyalty measures.

Apple TV+ made by far the biggest gains in customer satisfaction and likelihood

to keep a service, fueled by audience enthusiasm for its slate of original series.

US Edition | June 2022

whipmedia.com

Streaming Satisfaction Report

What a dierence a year makes. When we released a similar analysis

in 2021, Netflix was among the leading SVODs in customer satisfaction

and was the runaway leader as the indispensable streaming service.

The platform was at the top of its game, enjoying a lead it built in an

environment of minimal competition. But, after a period of remarkable

growth that was accelerated by the Covid-19 pandemic, the SVOD

marketplace has matured. Consumers started comparing Netflix’s content

with that of its new competitors, took into account its recently increased

price, and the perception of the service took a hit. Perception met

reality on April 19, 2022, when Netflix announced a net loss of 200,000

subscribers worldwide, including over 600,000 in the US/Canada region.

Wall Street erased a third of the company’s value in one day. As a result,

observers re-evaluated the company’s future, as well as the subscription

video business as a whole.

Meanwhile, rival services HBO Max and Disney+ have solidified their

already favorable positions in consumers’ minds, and at lower price points

than Netflix’s. Apple TV+ has made the greatest gain in satisfaction, built

on the success of its original series, though it still trails most of the SVODs

in overall satisfaction.

While the industry sorts out how to make subscription video on demand

profitable, there is no doubt that the consumer continues to demand

SVOD. However, the marketplace is dynamic, and consumers often cancel

one subscription while acquiring another.

Whip Media surveyed nearly 2,500 users of our TV Time app in the US

to uncover their satisfaction with, and perceptions of, these services.

Satisfaction as a metric is more sensitive than just looking at subscriber

counts. After all, many people stay with a service for a time, even if they

are less than happy, before they cancel. Many have speculated about

why the consumer may have behaved a particular way, but these results

put specific weight to these platforms’ elements, revealing why users are,

or are not, churning. This is especially relevant for Netflix, as the causes

of their recent losses, and projected ones, are put into clear focus. The

results are instructive for all, though, as understanding how consumers

view their oerings is key to succeeding.

Introduction

whipmedia.com

Streaming Satisfaction Report

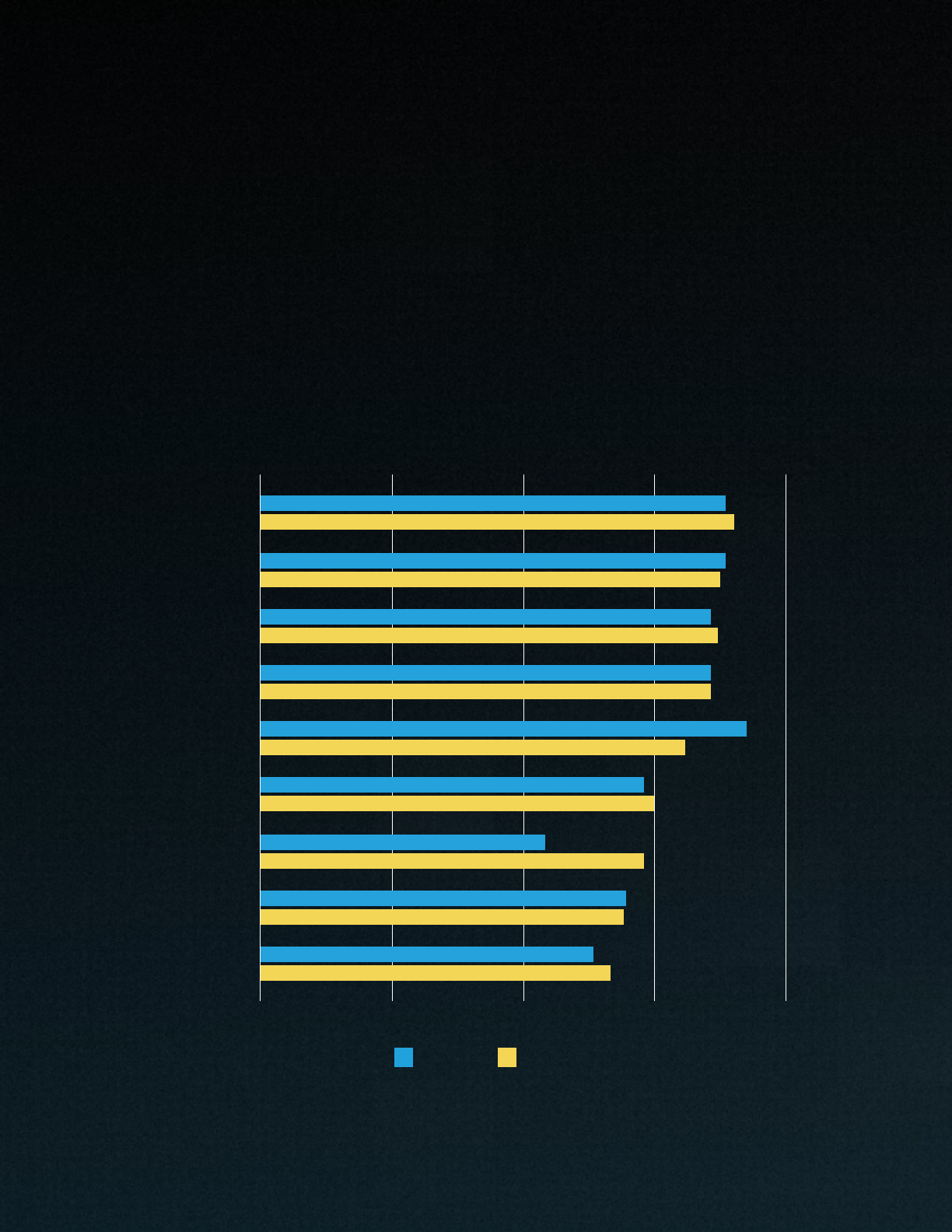

HBO Max has the highest satisfaction (very satisfied plus satisfied) among

the major SVOD platforms. In 2021, HBO Max also led on this question,

but it now has a higher margin of victory. Netflix ranked a very close

second last year but fell to fourth on the list, due to a 10 point decline,

the most significant in the survey. Apple TV+ made the strongest move to

the upside, increasing 14 points in satisfaction. Last year it was the lowest

performing service on this measure; it has now moved ahead of Amazon,

Discovery+ and Peacock.

100%75%50%25%0%

HBO Max

2021

Disney+

Hulu

Netflix

Paramount+

Apple TV+

Amazon

Discovery+

Peacock

HBO Max Cements Its Lead As The Most

Satisfying SVOD, Netflix Falls

Overall SVOD Satisfaction | 2022 vs. 2021

Very Satisfied + Satisfied

Only participants who were subscribers to the specific platform

at the time of the survey could respond to the question.

2022

92%

88%

89%

90%

75%

62%

75%

72%

62%

94%

88%

87%

80%

79%

76%

72%

72%

68%

whipmedia.com

Streaming Satisfaction Report

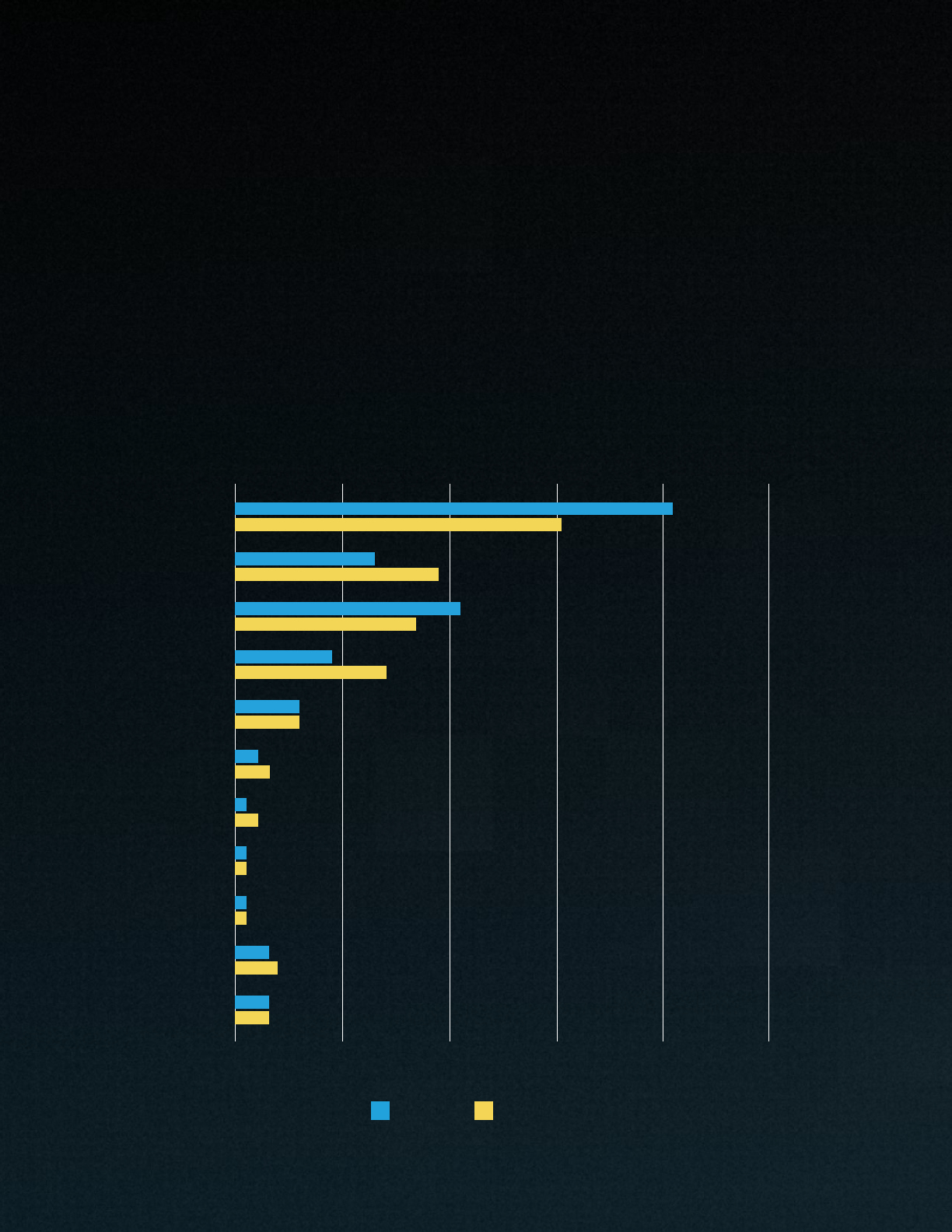

Most SVOD users plan to hold onto their services, but across a range of

likelihoods. Like last year, HBO Max, Hulu, and Disney+ form the top tier on

this question. Amazon is there too, but given their lower satisfaction scores,

this likely has much to do with other benefits of Prime membership. Netflix

saw the biggest decline, a 12 point decrease. It was top of the list last year,

but is now ranked fifth. Apple TV+ made the strongest gain, up 19 points.

Netflix Users Less Likely To Keep The Service

Than Last Year, Apple TV+ More Likely

100%75%50%25%0%

HBO Max

2021

Hulu

Disney+

Amazon

Netflix

Paramount+

Apple TV+

Discovery+

Peacock

Likelihood To Keep Service | 2022 vs. 2021

Very Likely + Likely

2022

Only participants who were subscribers to the specific platform

at the time of the survey could respond to the question.

89%

89%

86%

86%

93%

73%

54%

70%

63%

91%

88%

87%

86%

81%

75%

73%

69%

67%

whipmedia.com

Streaming Satisfaction Report

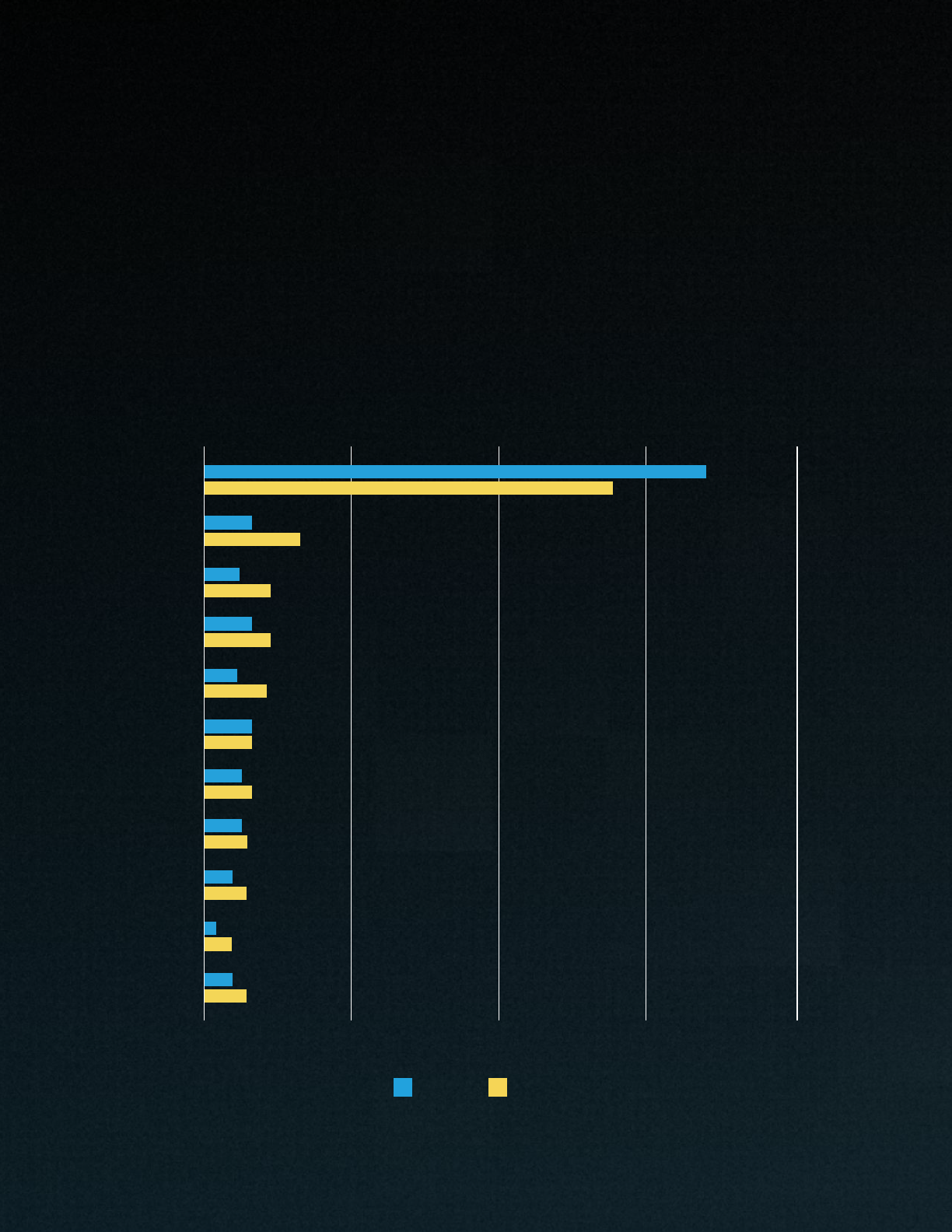

Netflix continues to be the service that a plurality of consumers view as

indispensable. However, that dominance has been significantly diminished

over the past year. HBO Max picked up 6 of the 10 points Netflix declined on

this question, moving past Hulu into second position. Netflix’s lead over its

closest competitor is down to only 12 points; last year it was 20. It is worth

noting that among respondents with children, Disney+ goes up to 18% on

this question, moving it into second place, but only a point ahead of HBO

Max and 2 ahead of Hulu. No other service made a change of more than 2

points in that category.

Is There An Indispensable Service?

50%40%30%20%10%0%

Netflix

2021

HBO Max

Hulu

Disney+

Amazon

Paramount+

Apple TV+

Discovery+

Peacock

Other

None

If You Can Only Keep One, Which One? | 2022 vs. 2021

2022

41%

13%

21%

9%

6%

2%

1%

1%

1%

3%

3%

1%

1%

31%

19%

17%

14%

6%

3%

4%

3%

2%

whipmedia.com

Streaming Satisfaction Report

Subscribers were asked to evaluate each of the SVODs in terms of the

quality of their original series, library series and movies. For these three

types of content, HBO Max and Disney+ clearly lead in top two box

satisfaction (very satisfied or satisfied). Viewers also see Apple TV+ as

having high-quality original programs, but recognize that their library and

movies are lacking. While Netflix also scores well with its original series, it

is worth noting that it is 9 points lower than the similarly priced HBO Max.

Netflix ranks ahead of most services on movie quality, but significantly

behind HBO Max and Disney+.

Amazon, even with its large catalog, ranks only above Apple TV+ for quality

of library. Hulu’s strong performance on library is notable, benefitting from

titles provided by its corporate parents Comcast and Disney.

Elements Of Satisfaction

Quality Of Programming

100%75%50%25%0%

HBO Max

Quality of Original Series Quality of Library Series Quality of Movies

Apple TV+

Disney+

Netflix

Hulu

Paramount+

Amazon

Discovery+

Peacock

Quality Of Content Satisfaction

Very Satisfied + Satisfied

Only participants who were subscribers to the specific platform

at the time of the survey could respond to the question.

whipmedia.com

Streaming Satisfaction Report

HBO Max leads in satisfaction with variety for every content category,

with Disney+ close behind. Netflix’s variety of originals earns them a

more competitive position than on quality, but it still lags behind HBO

Max and Disney+ on library and movies.

Hulu’s library is again competitive with the leaders’, while Apple TV+

is far behind everyone. Amazon is again unimpressive on all three

types of content, despite its large amount of titles. It ranks behind

Discovery+ for variety of series (originals or library). Discovery+’s brand

is narrower than Amazon’s, so this result should be of particular concern

to Amazon. It is also noteworthy that Paramount+ and Peacock, both

backed by major Hollywood studios, rank rather low on satisfaction with

their variety of movies.

Variety Of Programming

100%75%50%25%0%

HBO Max

Variety of Original Series Variety of Library Series Variety of Movies

Netflix

Disney+

Apple TV+

Hulu

Paramount+

Discovery+

Amazon

Peacock

Variety Of Content Satisfaction

Very Satisfied + Satisfied

Only participants who were subscribers to the specific platform

at the time of the survey could respond to the question.

whipmedia.com

Streaming Satisfaction Report

Despite faltering on content satisfaction measures, Netflix is clearly

best in breed for both user experience and suggesting content

to subscribers. It is somewhat surprising that Amazon, the most

experienced streamer after Netflix, ranks near the bottom on both of

these aspects. Given their data-driven focus, one might expect their

recommendation engine would rank higher than most. It stands to

reason that, given their large amount of content, their satisfaction

scores could increase with some improvement in this area.

User Experience / Program Suggestions

100%75%50%25%0%

Netflix

User Experience Program Recommendation

Disney+

Hulu

HBO Max

Apple TV+

Paramount+

Discovery+

Amazon

Peacock

User Experience / Program Recommendation Satisfaction

Very Satisfied + Satisfied

Only participants who were subscribers to the specific platform

at the time of the survey could respond to the question.

88%

82%

76%

75%

71%

66%

64%

62%

61%

71%

62%

61%

63%

47%

48%

58%

48%

44%

whipmedia.com

Streaming Satisfaction Report

Satisfaction with the value a service provides is a key measure because

it reflects the relationship between quality of content and price. The

contrast in perceived value between HBO Max and Netflix is perhaps

the most important finding of this research. These services are similarly

priced, (per month, Netflix standard service is $15.49, HBO Max ad-free

is $14.99) and yet HBO Max is considered the most satisfying value of

all the services we surveyed and Netflix was lowest.

The platforms at the bottom of the list, Peacock, Apple TV+ and Netflix, are

essentially the same in terms of top two box satisfaction. However, when

we look at bottom two box satisfaction, which combines unsatisfied and

very unsatisfied, users’ negative feelings towards Netflix come into clearer

focus. A noteworthy 20% of Netflix users expressed dissatisfaction with the

service, 8 points higher than the next closest platform.

Value

0%

25%

50%

75%

100%

Hulu

Paramount+

Amazon

Discovery+

Peacock

Apple TV+

Netflix

Disney+

HBO Max

0%

25%

50%

75%

100%

Discovery+

Hulu

Paramount+

Amazon

Peacock

Apple TV+

Netflix

Disney+

HBO Max

Value Dissatisfaction

Very Unsatisfied + Unsatisfied

Only participants who were subscribers to the specific platform

at the time of the survey could respond to the question.

Value Satisfaction

Very Satisfied + Satisfied

Only participants who were subscribers to the specific platform

at the time of the survey could respond to the question.

whipmedia.com

Streaming Satisfaction Report

Video subscriptions continue to increase in general, but consumers

are also canceling services more, often to move on to others. Last year,

32% of our respondents said that in the last 12 months they canceled

at least one of the SVODs in our survey. That number rose by 12 points

this year–and most of the platforms felt it. No platform saw a decrease

in their cancelation rates versus last year. Apple TV+ had the biggest

increase, though we can’t say how much of that was due to expiring

free promotions from device purchases.

Churn

80%60%40%20%0%

None

2021 2022

Apple TV+

Paramount+

Netflix

Peacock

Disney+

Hulu

HBO Max

Amazon

Discovery+

Other

Canceled The Service | 2022 vs. 2021

68%

4%

4%

6%

6%

6%

5%

5%

4%

4%

2%

6%

6%

6%

56%

13%

9%

9%

8%

6%

4%

6%

whipmedia.com

Streaming Satisfaction Report

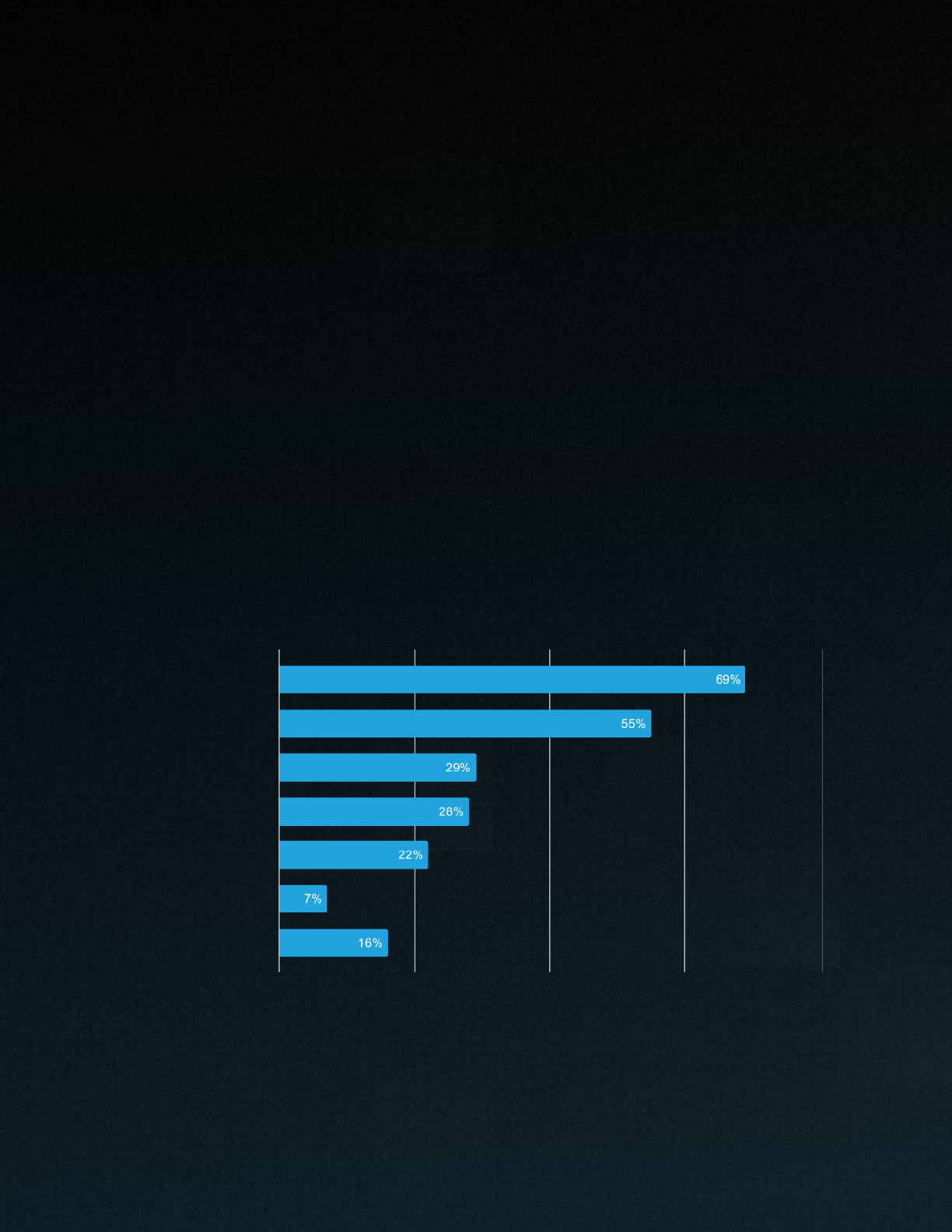

Some of the SVODs made changes to their oerings that we theorized

might impact subscriptions. We asked respondents specifically about

these issues to gauge their eect.

Why Did People Cancel Certain Services?

Value was clearly on the minds of those respondents who canceled

Netflix. The number one reason our respondents cited for canceling

Netflix was the price increase (69%). It is noteworthy that respondents

were not limited to one answer on this question. The good news for

Netflix was that only 22% cited seeing “all the programming I was

interested in” as a reason. Cancelers of HBO Max and Disney+ cited

that reason about twice as much.

They increased the

subscription price

I was not getting

enough value from it

The library programming

didn’t interest me

The original programming

didn’t interest me

I saw all the programming

I was interested in

The user experience

was unpleasant

Other - Please Specify

Netflix

80%60%40%20%0%

Why Cancel Netflix?

Among Those Who Canceled Netflix n=233

whipmedia.com

Streaming Satisfaction Report

As a response to the pandemic’s impact on theater attendance, HBO

Max eectively used Warner Brothers films to help drive subscriptions

by putting them on the service at the same time they were premiering in

theaters. That policy ended at the beginning of 2022 and we wondered

if it impacted them negatively. Not so much: Only 14% of those who

canceled cited this issue as a reason. Users were far more likely to cite

exhausting all the content they had interest in as a driver to leave.

HBO Max

I was not getting

enough value from it

They discontinued premiering

movies on HBO Max at the same

time they premiered in theaters

The library programming

didn’t interest me

The original programming

didn’t interest me

I saw all the programming

I was interested in

The user experience

was unpleasant

Other - Please Specify

Why Cancel HBO Max?

Among Those Who Canceled HBO Max n=139

80%60%40%20%0%

48%

43%

14%

13%

12%

9%

22%

whipmedia.com

Streaming Satisfaction Report

Disney made several films available for streaming simultaneously with

their theatrical premieres in 2021 for an additional cost. This hasn’t

happened in 2022, and it doesn’t appear to be a driver of Disney+

cancelations. At only 5%, this reason was chosen far less than the “I saw

all the programming I was interested in” option (44%).

Disney+

I was not getting

enough value from it

They discontinued the option to pay to

view a movie on the service at the same

time it was released in theaters

The library programming

didn’t interest me

The original programming

didn’t interest me

I saw all the programming

I was interested in

The user experience

was unpleasant

Other - Please Specify

Why Cancel Disney+?

Among Those Who Canceled Disney+ n=143

80%60%40%20%0%

45%

44%

26%

19%

5%

5%

23%

whipmedia.com

Streaming Satisfaction Report

By exploring the satisfaction with specific elements of their product, the

platforms, and their suppliers, can understand how to better serve their

customers. The results certainly confirm that content counts. While Netflix

is at the top of the class for ease of use and program recommendation,

users’ satisfaction with the service has dropped significantly because they

feel the price paid for the programming oered is not as equitable as it

was a year ago. HBO Max, Disney+ and Hulu form the top tier in overall

satisfaction and value satisfaction, so they are pleasing their customers.

The others have areas they can address.

Apple TV+ has made great strides over the last year in overall satisfaction

on the strength of its original series, but it still ranks near the bottom of

the SVODs in overall value, despite a relatively low price. Suppliers with

libraries to sell can justly claim that adding their product to the platform

fills the single biggest hole in the oering and will make Apple’s value

proposition to the consumer much more compelling.

Both Paramount+ and Peacock have made modest gains in satisfaction

versus last year. In the case of Paramount+, our respondents view the

quality of their original series as on par with Hulu’s and their library ahead

of Amazon’s. The perceived variety of both its originals and library is well

behind Hulu’s though, so suppliers can pitch projects to help diversify their

slate. Peacock’s original series ranked lowest in the survey so content

providers have an opportunity with them too. Both services should see

gains in satisfaction with their series and movies libraries as more of their

licensed titles are returned to them from existing output deals.

Amazon’s service clearly has a perception problem. Their library is

enormous, yet viewers’ perception of their quality and variety are ranked

near the bottom of the list on satisfaction. The low regard expressed for

their program recommendations is also puzzling, given their data driven

approach and tech talent. However, part of program recommendation

relies on having titles that users will like, and the results aren’t

encouraging there.

Conclusions

whipmedia.com

Streaming Satisfaction Report

TV Time, a Whip Media company, is the world’s largest TV and movie tracking app for consumers. Every day,

over a million people use TV Time to keep track of the shows and movies they’re watching, discover what to

watch next and engage in a global community of more than 21 million registered fans.

For more information, visit whipmedia.com

ABOUT TV TIME

ABOUT WHIP MEDIA

Streaming Satisfaction Report

Finally, there is Netflix. Despite its well reported subscriber losses, and declines

in satisfaction, Netflix is still in a healthy position. Its satisfaction scores for both

quality and variety of original and library series remain strong. Its user experience

is the best of all the SVODs. However, its service is now generally priced higher

than its competitors (depending on the tier), and the competitors also have highly

regarded content. They will continue to need compelling shows to compete, and

they might want to more frequently do additional seasons of their hits, a strategy

they’ve often shunned. That will help build their library and, maybe, prevent churn.

Understanding customer satisfaction is imperative, especially when their

perceptions don’t match reality. It also clarifies the size of known issues and lends

them urgency. The industry may be aware of some of these issues, but the data

shows that viewers know them too, and are acting on that information.

The survey was fielded with 2,460 US TV Time app users from April 29 to May 4, 2022. All results were weighted to balance

with the US general population by gender and age (18-54). The 2021 survey was gender and age balanced for 13-54.

METHODOLOGY

Whip Media is reimagining content licensing to create a smarter, more connected entertainment ecosystem.

We help leading entertainment companies succeed in today’s high-volume, high-velocity global content

environment with a market-leading cloud software platform that combines unique, actionable insights with

scalable, connected workflows for licensing, content planning and financial operations.

1 https://www.hollywoodreporter.com/business/digital/netix-q1-2022-earnings-1235132028/