The Importance of Your Pension

NRTA PENSION

EDUCATION TOOLKIT

There has been a lot of talk in the media recently about

retirement insecurity. For a while now, reporters have

been talking about how pensions are “disappearing” and

being replaced by 401(k) plans. Then, with the recent

economic downturn, many Americans’ retirement

savings accounts took a big hit.

You may wonder what this means for your retirement

security. The good news is, for those who have earned

the guaranteed lifetime benefits provided by group

pension plans, you are in a far better position to weather

the tough economic storms that come your way.

According to calculations by researchers at Boston College

and at NIRS, the retirement savings gap – the difference

between what American households will need to save for

retirement and what they are on course to save – is almost $7

trillion based on household net wealth, including appreciated

housing values. American workers are therefore right to

be anxious about their retirement security in the current

economic environment. And only a mere 2% of Americans

believe that it will be easier to prepare for retirement in the

future.

1

Older low- to middle-income workers, in particular, are

facing a daunting financial challenge recovering from the

Great Recession while preparing for retirement. Indeed,

37 percent of the middle-income workers age 45–54 are

projected to be downwardly mobile to lower income status in

retirement, based on a study by the Urban Institute.

2

All told,

9 out of ten workers fall short of target retirement savings

Your pension plan is

important because…

• The traditional and best

approach to achieving

retirement security

consists of a pension,

Social Security, and

individual savings. Your

pension helps you to

maintain your standard of

living in retirement, and

savings provides important

supplemental income for

unforeseen expenses.

• Group pension plans

provide guaranteed,

monthly income for life,

which makes financial

security in retirement much

more achievable for those

who have them.

• Not surprisingly, almost

all Americans still want

pensions.

• Pensions are an

economically efficient way

to fund retirement, which

means they are a prudent

use of taxpayer money.

• Pensions also help to boost

local economies, especially

in tough economic times.

The Current State of Retirement

Security in America

NRTA Pension Educaon Toolkit | Your Pension and You 2

benchmarks designed to allow older Americans to maintain their standard of living prior to reaching

typical retirement ages.

3

There are several reasons for this increase in retirement insecurity in America beyond the economic

downturn. First, roughly 78 million American workers (both public and private) have no access to any

retirement plan at work – the most effective way to save for retirement. Few of these individuals save for

retirement on their own, and many will retire, with less than enough money to meet their basic needs.

Moreover, in the private sector, and over the last few decades, many companies who do offer retirement

plans have been getting rid of their group pension plans and replacing them with individual savings plans,

like 401(k) plans.

4

Individual savings plans, like 401(k)s, were not originally intended to serve as the

primary source of retirement income for individuals. These plans started out as supplements to group

pension plans—and are still very effective as such – but are more suited to provide the additional income

that may be needed for retirement, or to deal with extraordinary life events—like an unexpected health

crisis, the loss of a spouse, etc.

The typical working-age household has only $3,000 saved in retirement accounts, while the typical near-

retirement age working household has just $12,000 saved.

5

To put this amount of retirement savings

into context, even the near-retiree savings amount is less than the modest average annual Social Security

benefit earned by retired Americans of $15,190.

Due to the above factors, as well as stagnating income, escalating personal debt and rising costs for

education and health care, workers today are less likely than their parents or grandparents to enjoy the

living standards of their working years when they retire. If these trends continue, Social Security (for those

who participate in the program) will be the main source of income for all but retirees in the top one quarter

of retiree income levels.

Retirement researchers have long acknowledged the importance of Social Security benefits, defined

benefit (DB) pension income, and supplemental individual savings—in providing Americans the greatest

opportunity to achieve financial security in retirement.

6

Each leg of this stool fills a specific, unique purpose.

Social Security provides a guaranteed, cost-of-living

adjusted income for life in retirement, and has proven

to be an effective way to keep older Americans out of

poverty.

7

It is the foundation of retirement security

for millions of Americans and their families.

Yet Social Security was never meant to be the sole

source of retirement income for American workers.

And, in fact, as many as 30% of state and local government

employees do not participate in Social Security at all.

8

The

second component—group pension plans—is also extremely

important in providing a reliable, steady source of income in

Social

Security

Benets

Dened

Benet

Pension

Supplemental

Individual

Savings

The Best Way to Achieve Retirement Security

NRTA Pension Educaon Toolkit | Your Pension and You 3

Amount of

Money in

Retirement

The monthly benefit is

determined by a set calculation—

usually based on years of service

and pay at the end of one’s career.

The money available in

retirement is simply the amount

that one has accumulated

in the savings plan, through

contributions and investment

earnings.

Pensions Provide Guaranteed, Monthly Income for Life

retirement. And for those retirees without Social Security, a pension may represent their only source of

guaranteed, inflation-adjusted monthly income, making their pension all the more important.

The final leg of the retirement stool consists of individual savings. You might save for retirement at work

in a defined contribution (DC) plan—a 401(k), 403(b), or 457 plan, for example. You might also save

in an individual retirement account (IRA), or have other savings. Having individual savings on top of

your pension and Social Security is a helpful way to ensure financial security, especially if you experience

hardships that may be hard to predict, for example, long-term care costs for yourself or a loved one.

Pensions are fundamentally different from savings because you cannot outlive the guaranteed monthly

income provided by your pension. No matter how long you may live, you can be sure that your pension

check will continue to come every month. Savings, on the other hand, can run out.

Also, your pension may provide other benefits as well, such as COLAs, disability protections, and benefits

for your spouse, should you die first.

9

Each of these characteristics is what makes your pension so unique

and so different from defined contribution plans.

Defined Benefit Plan

(Traditional Pension)

Defined Contribution Plan

(401(k)s, 403(b)s, 457s)

Contributions

In the public and private sectors,

contributions are made on

behalf of each employee by the

employer. In the public sector,

many pensions are “contributory,”

meaning that employees also

contribute to the plan out of their

own paychecks.

Employees make their own

contributions to their savings

account at whatever rate they

choose. Often, employers will

make a certain match—for

example, 50 cents on the dollar

up to 6% of pay—but they are

not required to contribute at all.

Investments

Contributions for all employees

are pooled, and invested by

professional asset managers in a

range of assets—stocks, bonds,

real estate, etc.

Employees usually make

all investment decisions

themselves. They can choose

from a range of investment

options offered by the plan.

NRTA Pension Educaon Toolkit | Your Pension and You 4

Pensions Are an Efficient Use of Taxpayer Funds

Another key feature of group pension plans is their pooled nature—meaning that all of the pension

contributions for all workers are put together in the same pot.

This pooled nature is important because it makes pension plans a good value for the money. By pooling

and professionally managing assets, pensions are able to achieve “economies of scale.” (This is the same

reason why shopping at a warehouse club saves consumers money—buying in bulk lowers the price.)

Research has found that a group pension can achieve a target retirement benefit at about half the cost

of individual retirement accounts.

12

So not only do group pensions do the retirement job more effectively than individual savings plans, but

they’re also a lot less expensive to boot—a fact that policymakers and taxpayers alike can take solace in.

It is important to note that many Americans do realize

just how important pensions are. With the trend away

from pensions in the private sector, it seems more and

more Americans are anxious about retirement—and are in

favor of having a pension.

Recent public opinion research has found…

• More than eight out of ten Americans are worried about

their ability to retire.

• 80% believe that the decline of pensions has made it

more difficult to achieve the American Dream.

• More than eight in ten Americans would participate in a

“new” pension system, if offered.

• 82% of Americans believe that all workers should have a

pension plan.

9

So, it’s not just that middle-class Americans need pensions.

It seems most Americans want pensions, too.

11

Americans Want Pensions

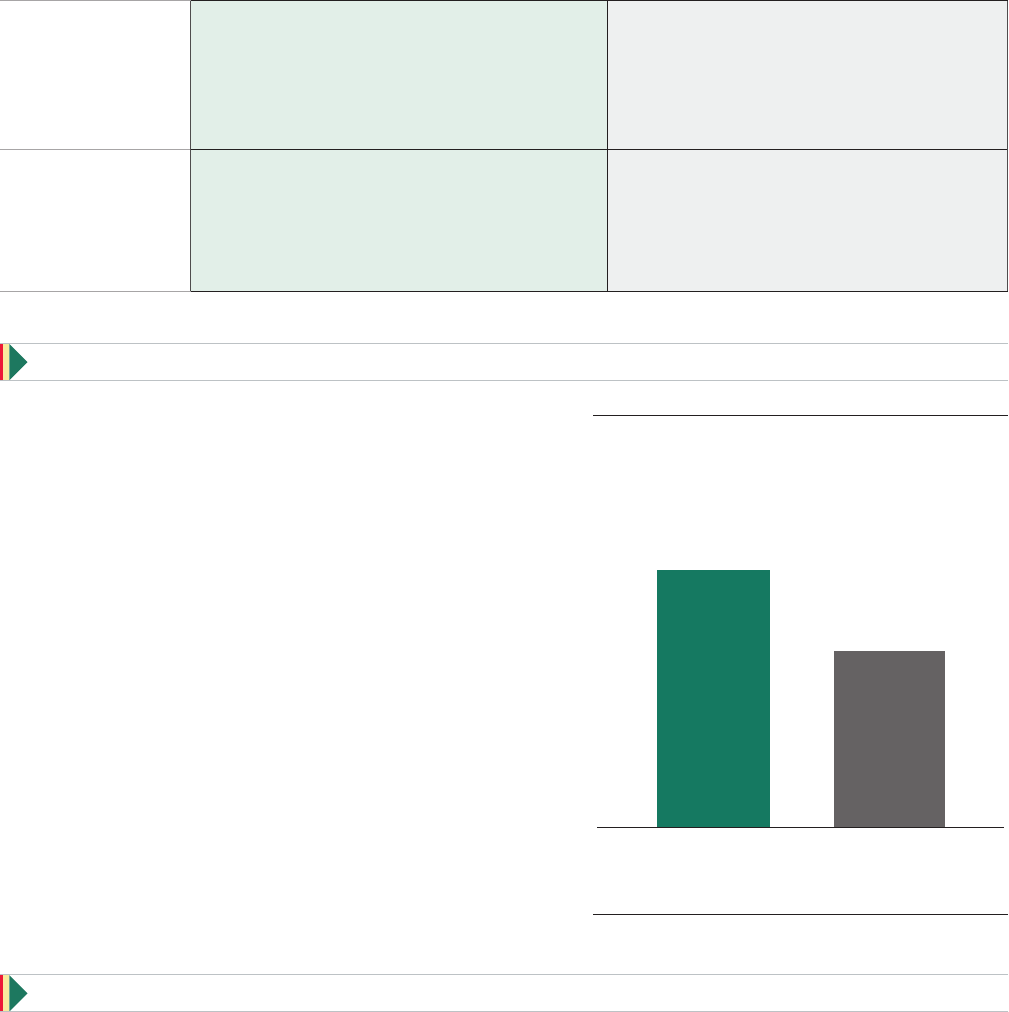

Private Sector Public Sector

Active U.S. Workers with a Group

Pension Plan, in millions 2009

10

17.9

million

14.6

million

Payout in

Retirement

Payouts are typically provided as

a monthly income stream that is

guaranteed for the remainder of

the retiree’s life.

Plans are not required to offer a

lifetime income payout. Payout

is often a one-time, lump sum

payment.

Supplemental

Benefits

Spousal protections, disability

benefits, and cost of living

adjustments are common.

Supplemental benefits are not

applicable.

NRTA Pension Educaon Toolkit | Your Pension and You 5

Group pension plans are also likely to benefit local businesses in your town. This is because when you

receive your pension check, you probably don’t stuff it under your mattress—you spend it in your local

economy. And the business where you make that purchase sees a boost in its profits. This means that

they may be able to expand their business or even hire more workers.

This simple act of you spending your pension income has very large economic effects. In 2009,

expenditures made out of public pension payments supported more than 6.5 million new American jobs

and over $1 trillion in total economic output nationwide.

13

Those are some huge economic impacts!

So, pensions do a great job of providing modest, secure retirement benefits—and they remain quite

popular among Americans. Public pensions make sense for taxpayers, too, because they are still a good

deal. As if that weren’t enough, pensions also help boost the economy. It’s a classic “win-win” situation

for employees, employers, taxpayers, and local business owners.

1

Oakley, D., and K. Kenneally. Pensions and Rerement Security 2013: A Roadmap for Policy Makers. Washington, DC:

Naonal Instute on Rerement Security.

2

Butrica, B., and M.Waid. 2013. What Are the Rerement Prospects of Middle-Class Americans? AARP Public Policy Instute

Research Report. Washington, DC: AARP.

3

Rhee, N. 2013. The Rerement Savings Crisis: Is It Worse Than We Think? Washington, DC: Naonal Instute on Rerement

Security.

4

It is important to remember that, despite the trend to 401(k)s, public sector workers are not the only Americans who have

dened benet pension plans. In fact, there are sll about 3.3 million more private sector workers with a pension than

public sector workers with a pension.

5

Rhee, op cit.

6

Munnell, A.H., Soto, M., Webb, A., Golub-Sass, F., and Muldoon, D. 2008. Health Care Costs Drive up the Naonal

Rerement Risk Index. Issue in Brief No. 8-3. Chestnut Hill, MA: Center for Rerement Research at Boston College. and

Munnell, A.H., Webb, A., and Golub-Sass, F. 2007. Is There Really a Rerement Savings Crisis? An NRRI Analysis. Issue in Brief

No. 7-11 Chestnut Hill, MA: Center for Rerement Research at Boston College.

7

Engelhardt, C.F., and Gruber, J. 2004. Social Security and the Evoluon of Elderly Poverty. Working Paper 10466. Cambridge,

MA: Naonal Bureau of Economic Research.

8

U.S. Government Accountability Oce. 2007. State and Local Government Reree Benets: Current Status of Benet

Structures, Protecons, and Fiscal Outlook for Funding Future Costs. Washington, DC: U.S. Government Accountability Oce.

9

Almeida, B. 2008. Rerement Readiness: What Dierence Does a Pension Make? Washington, DC: Naonal Instute on

Rerement Security.

10

Pension Benet Guaranty Corporaon. 2012. PBGC 2010 Databook. Washington, DC: PBGC. and U.S. Census Bureau. 2013.

State and Local Government Employee-Rerement Systems. Washington, DC: U.S. Census Bureau.

11

Perlman, B. 2013. Pensions & Rerement Security 2013: A Roadmap for Policymakers. Washington, DC: Naonal Instute

on Rerement Security.

12

Almeida, B., and Fornia, W. 2008. A Beer Bang for the Buck: The Economic Eciencies of Dened Benet Pension Plans.

Washington, DC: The Naonal Instute on Rerement Security.

13

Boivie, I. 2012. Pensionomics 2012: Measuring the Economic Impact of DB Pension Expenditures. Washington, DC: Naonal

Instute on Rerement Security.

Pensions Boost Local Economies