CA/L/A/UniversityofCaliforniaUCCarePlan-PPO-NA/NA-NA/NA/01-21

1 of 13

Summary of Benefits and Coverage: What this Plan Covers & What You Pay For Covered Services Coverage Period: 01/01/2024– 12/31/2024

Anthem Blue Cross Life and Health Insurance Company:

University of California: UC Care Plan

Coverage for: Individual + Family | Plan Type: PPO

The Summary of Benefits and Coverage (SBC) document will help you choose a health plan. The SBC shows you how you and the

plan would share the cost for covered health care services. NOTE: Information about the cost of this plan (called the premium) will

be provided separately. This is only a summary. For more information about your coverage, or to get a copy of the complete terms

of coverage, www.UChealthplans.com. For general definitions of common terms, such as allowed amount, balance billing, coinsurance, copayment,

deductible, provider, or other underlined terms see the Glossary. You can view the Glossary at www.healthcare.gov/sbc-glossary/ or call (866) 406-1182 to

request a copy.

Important Questions

Answers

Why This Matters:

What is the overall

deductible?

$0/individual or $0/family for

UC Select Providers.

$500/individual or $1,000/family

for Anthem Preferred Providers.

$750/individual or $1,750/family

for Out-of-Network Providers.

Generally, you must pay all of the costs from providers up to the deductible amount before

this plan begins to pay. If you have other family members on the plan, each family member

must meet their own individual deductible until the total amount of deductible expenses paid

by all family members meets the overall family deductible.

Are there services

covered before you

meet your deductible?

Yes. Preventive care for UC

Select and Anthem Preferred

Providers, Emergency, and

Ambulance services.

This plan covers some items and services even if you haven’t yet met the deductible amount.

But a copayment or coinsurance may apply. For example, this plan covers certain preventive

services without cost-sharing and before you meet your deductible. See a list of covered

preventive services at https://www.healthcare.gov/coverage/preventive-care-benefits/.

Are there other

deductibles for

specific services?

No.

You don't have to meet deductibles for specific services.

What is the out-of-

pocket limit for this

plan?

$6,100/individual or

$9,700/family for UC Select

Providers. $7,600/individual or

$14,200/family for Anthem

Preferred Providers.

$9,600/individual or

$20,200/family for Out-of-

Network Providers.

The out-of-pocket limit is the most you could pay in a year for covered services. If you have

other family members in this plan, they have to meet their own out-of-pocket limits until the

overall family out-of-pocket limit has been met.

What is not included

in the out-of-pocket

limit?

Premiums, balance-billing

charges, expenses paid for

infertility services, and health care

this plan doesn't cover.

Even though you pay these expenses, they don’t count toward the out-of-pocket limit.

Will you pay less if

you use a network

provider?

Yes, UC Select and Anthem

Preferred. See

www.UChealthplans.com or

call (866) 406-1182 for a list

You pay the least if you use a provider in UC Select. You pay more if you use a provider in

Anthem Network. You will pay the most if you use an out-of-network provider, and you

might receive a bill from a provider for the difference between the provider’s charge and

what your plan pays (balance billing). Be aware your network provider might use an out-of-

* For more information about limitations and exceptions, see plan or policy document at www.UChealthplans.com.

2 of 13

of network providers.

network provider for some services (such as lab work). Check with your provider before you

get services.

Do you need a referral

to see a specialist?

No.

You can see the specialist you choose without a referral.

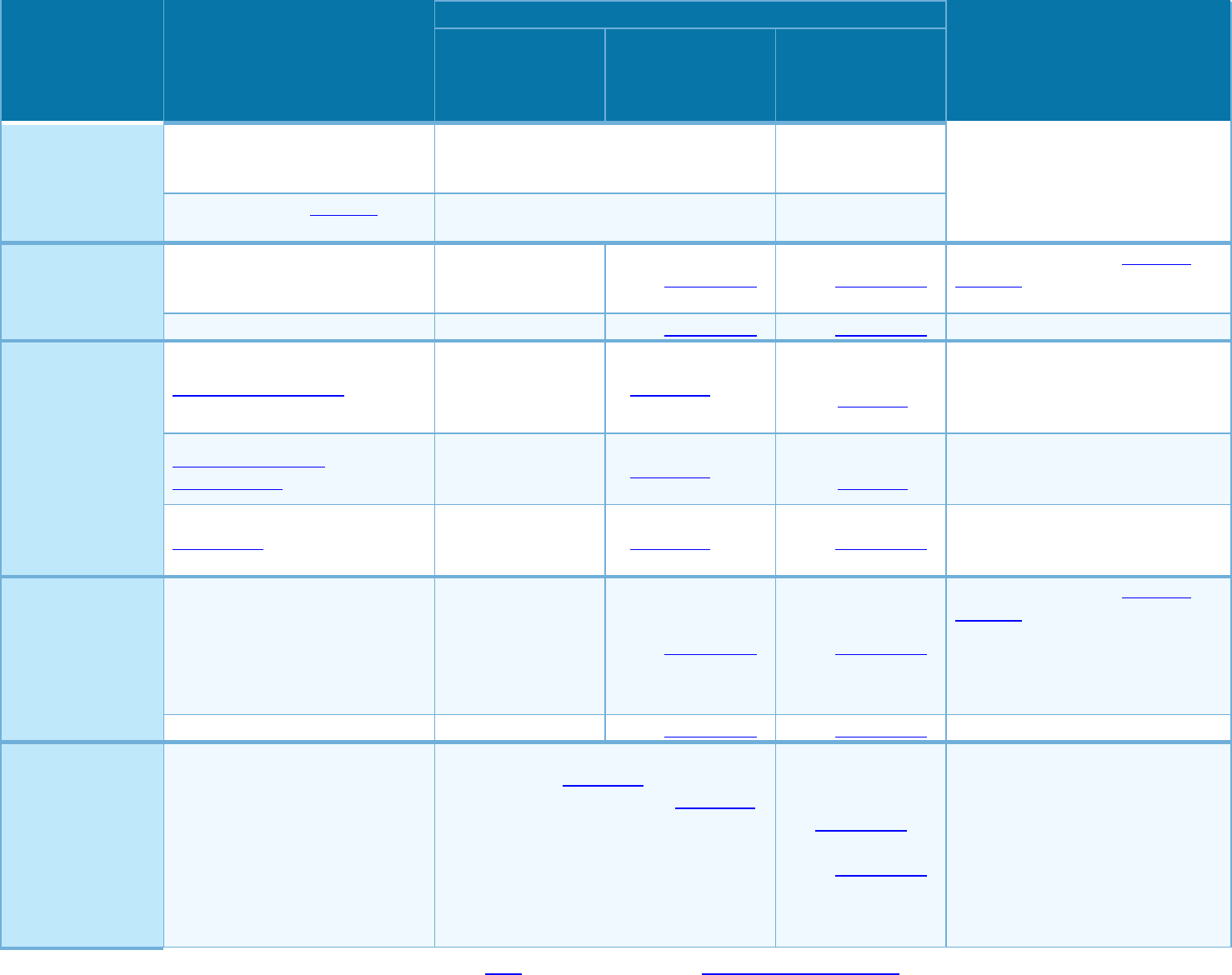

All copayment and coinsurance costs shown in this chart are after your deductible has been met, if a deductible applies.

Common

Medical Event

Services You May Need

What You Will Pay

Limitations, Exceptions, &

Other Important Information

UC Select

Provider

(You will pay

the least)

Anthem Preferred

Provider

(You will pay

more)

Out-of-Network

Provider

(You will pay

the most)

If you visit a

health care

provider’s office

or clinic

Primary care visit to treat an

injury or illness

$20/visit

30% coinsurance

50% coinsurance

--------none--------

Specialist visit

$20/visit

30% coinsurance

50% coinsurance

--------none--------

Preventive care/screening/

immunization

No charge

No charge

50% coinsurance

You may have to pay for services

that aren't preventive. Ask your

provider if the services needed are

preventive. Then check what your

plan will pay for.

If you have a test

Diagnostic test

(x-ray, blood work)

$20/visit

30% coinsurance

50% coinsurance

Cost may vary by site of service.

Imaging (CT/PET scans, MRIs)

$20/visit

30% coinsurance

50% coinsurance

Coverage for Out-of-Network

Provider is limited to $175

maximum/visit.

If you need

drugs to treat

your illness or

condition

More information

about

prescription

drug coverage is

available at

www.navitus.com

Tier 1 - Typically Generic

$5/prescription (preferred retail,

participating retail, and mail order – 30

days); $10/prescription (preferred retail

and mail order – 90 days);

$15/prescription (participating retail – 90

days)

50% coinsurance

Preferred retail, participating

retail, and mail order cover up to

a 90-day supply. Select specialty

pharmacies cover up to a 30-day

supply. Certain limitations may

apply, including, for example:

prior authorization and quantity

limits. *See prescription drug

section of the plan or policy.

Tier 2 - Typically Preferred /

Brand

$25/prescription (preferred retail,

participating retail, and mail order – 30

days); $50/prescription (preferred retail,

participating retail, and mail order – 90

days); $75/prescription (participating

retail – 90 days)

50% coinsurance

Tier 3 - Typically Non-Preferred

/ Brand

$40/prescription (preferred retail,

participating retail, and mail order – 30

days); $80/prescription (preferred retail,

50% coinsurance

* For more information about limitations and exceptions, see plan or policy document at www.UChealthplans.com.

3 of 13

Common

Medical Event

Services You May Need

What You Will Pay

Limitations, Exceptions, &

Other Important Information

UC Select

Provider

(You will pay

the least)

Anthem Preferred

Provider

(You will pay

more)

Out-of-Network

Provider

(You will pay

the most)

participating retail, and mail order – 90

days); $120/prescription (participating

retail – 90 days)

Tier 4 - Typically Specialty

(brand and generic)

30% coinsurance; $150 maximum per

prescription (select specialty pharmacies)

N/A

If you have

outpatient

surgery

Facility fee

(e.g., ambulatory surgery center)

$100/surgery

30% coinsurance

50% coinsurance

Coverage for Out-of-Network

Provider is limited to $175

maximum/visit.

Physician/surgeon fees

No charge

30% coinsurance

50% coinsurance

--------none--------

If you need

immediate

medical

attention

Emergency room care

$300/visit

$300/visit

deductible does

not apply

Covered as

In-Network

If directly admitted to a hospital,

ER copay is waived. No charge

for Emergency Room Physician

Fee.

Emergency medical

transportation

Not Applicable

$200/trip

deductible does

not apply

Covered as

In-Network

--------none--------

Urgent care

$20/visit

$20/visit

deductible does

not apply

50% coinsurance

--------none--------

If you have a

hospital stay

Facility fee (e.g., hospital room)

$250/admission

30% coinsurance

50% coinsurance

Coverage for Out-of-Network

Provider is limited to $300

maximum/day. If no pre-

authorization is obtained for out

of network providers, there will

be an additional $250 copay.

Physician/surgeon fees

No charge

30% coinsurance

50% coinsurance

--------none--------

If you need

mental health,

behavioral

health, or

substance abuse

services

Outpatient services

Office Visit: No charge for first 3 visit

then $20/visit deductible does not apply

Other Outpatient: $20/visit deductible

does not apply

Office Visit: 50%

coinsurance

Other Outpatient:

50% coinsurance

--------none--------

* For more information about limitations and exceptions, see plan or policy document at www.UChealthplans.com.

4 of 13

Common

Medical Event

Services You May Need

What You Will Pay

Limitations, Exceptions, &

Other Important Information

UC Select

Provider

(You will pay

the least)

Anthem Preferred

Provider

(You will pay

more)

Out-of-Network

Provider

(You will pay

the most)

Inpatient services

$250/admission deductible does

not apply

50% coinsurance

If no pre-authorization is

obtained for out of network

providers, there will be an

additional $250 copay. No charge

for Inpatient Physician Fee UC

Select Providers or Anthem

Preferred Providers. 50%

coinsurance for Inpatient

Physician Fee Out-of-Network

Providers.

If you are

pregnant

Office visits

$20/visit for

initial visit

30% coinsurance

50% coinsurance

Coverage for Out-of-Network

Provider is limited to $300

maximum/day. If no pre-

authorization is obtained for

Inpatient out of network

providers, there will be an

additional $250 copay. Maternity

care may include tests and

services described elsewhere in

the SBC (i.e. ultrasound.)

Childbirth/delivery professional

services

No charge

30% coinsurance

50% coinsurance

Childbirth/delivery facility

services

$250/admission

30% coinsurance

50% coinsurance

If you need help

recovering or

have other

special health

needs

Home health care

Not Applicable

30% coinsurance

50% coinsurance

100 visits/benefit period for

Anthem Preferred Providers and

Out-of-Network Providers

combined.

Rehabilitation services

$20/visit

30% coinsurance

50% coinsurance

*See Therapy Services section

Habilitation services

$20/visit

30% coinsurance

50% coinsurance

Skilled nursing care

Not Applicable

30% coinsurance

50% coinsurance

100 days limit/benefit period for

Anthem Preferred Providers and

Out-of-Network Providers

combined. $300 maximum/day

for Out-of-Network Providers.

Durable medical equipment

Not Applicable

30% coinsurance

50% coinsurance

--------none--------

Hospice services

Not Applicable

30% coinsurance

50% coinsurance

--------none--------

* For more information about limitations and exceptions, see plan or policy document at www.UChealthplans.com.

5 of 13

Common

Medical Event

Services You May Need

What You Will Pay

Limitations, Exceptions, &

Other Important Information

UC Select

Provider

(You will pay

the least)

Anthem Preferred

Provider

(You will pay

more)

Out-of-Network

Provider

(You will pay

the most)

If your child

needs dental or

eye care

Children’s eye exam

Not covered

Not covered

Not covered

*See Vision Services section

Children’s glasses

Not covered

Not covered

Not covered

Children’s dental check-up

Not covered

Not covered

Not covered

*See Dental Services section

Excluded Services & Other Covered Services:

Services Your Plan Generally Does NOT Cover (Check your policy or plan document for more information and a list of any other excluded

services.)

• Cosmetic surgery

• Dental care (adult)

• Dental Check-up

• Eye exams for a child

• Glasses for a child

• Routine eye care (adult)

• Long-term care

• Private-duty nursing

• Routine foot care unless you have been

diagnosed with diabetes.

• Weight loss programs

Other Covered Services (Limitations may apply to these services. This isn’t a complete list. Please see your plan document.)

• Acupuncture 24 visits/benefit period

combined with chiropractor for Anthem

Preferred Providers and Out-of-Network

Providers.

• Bariatric surgery

• Infertility Treatment - 2 cycles per lifetime

combined for GIFT, ZIFT and IVF (all

infertility services are excluded from OOPM)

• Chiropractic care 24 visits/benefit period

combined with acupuncture for Anthem

Preferred Providers and Out-of-Network

Providers.

• Hearing aids $2,000 maximum/every 36

months.

• Most coverage provided outside the United

States. See www.bcbsglobalcore.com

Your Rights to Continue Coverage: There are agencies that can help if you want to continue your coverage after it ends. The contact information for those

agencies is: Department of Labor, Employee Benefits Security Administration, (866) 444-EBSA (3272), www.dol.gov/ebsa/healthreform. Other coverage

options may be available to you too, including buying individual insurance coverage through the Health Insurance Marketplace. For more information about

the Marketplace, visit www.HealthCare.gov or call 1-800-318-2596.

Your Grievance and Appeals Rights: There are agencies that can help if you have a complaint against your plan for a denial of a claim. This complaint is

called a grievance or appeal. For more information about your rights, look at the explanation of benefits you will receive for that medical claim. Your plan

documents also provide complete information to submit a claim, appeal, or a grievance for any reason to your plan. For more information about your rights,

this notice, or assistance, contact:

ATTN: Grievances and Appeals, P.O. Box 4310, Woodland Hills, CA 91365-4310

* For more information about limitations and exceptions, see plan or policy document at www.UChealthplans.com.

6 of 13

Does this plan provide Minimum Essential Coverage? Yes

Minimum Essential Coverage generally includes plans, health insurance available through the Marketplace or other individual market policies, Medicare,

Medicaid, CHIP, TRICARE, and certain other coverage. If you are eligible for certain types of Minimum Essential Coverage, you may not be eligible for the

premium tax credit.

Does this plan meet the Minimum Value Standards? Yes

If your plan doesn’t meet the Minimum Value Standards, you may be eligible for a premium tax credit to help you pay for a plan through the Marketplace.

––––––––––––––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next section.––––––––––––––––––––––

The plan would be responsible for the other costs of these EXAMPLE covered services.

7 of 13

About these Coverage Examples:

This is not a cost estimator. Treatments shown are just examples of how this plan might cover medical care. Your actual costs will

be different depending on the actual care you receive, the prices your providers charge, and many other factors. Focus on the cost

sharing amounts (deductibles, copayments and coinsurance) and excluded services under the plan. Use this information to compare

the portion of costs you might pay under different health plans. Please note these coverage examples are based on self-only coverage.

Peg is Having a Baby

(9 months of in-network pre-natal care and a

hospital delivery)

Managing Joe’s type 2 Diabetes

(a year of routine in-network care of a well-

controlled condition)

Mia’s Simple Fracture

(in-network emergency room visit and follow

up care)

◼ The plan’s overall deductible

$0

◼ The plan’s overall deductible

$0

◼ The plan’s overall deductible

$0

◼ Specialist

copayment

$20

◼ Specialist

copayment

$20

◼ Specialist

copayment

$20

◼ Hospital (facility)

copayment

$250

◼ Hospital (facility)

copayment

$250

◼ Hospital (facility)

copayment

$250

◼ Other

copayment

$20

◼ Other

copayment

$20

◼ Other

copayment

$20

This EXAMPLE event includes services

like:

Specialist office visits (prenatal care)

Childbirth/Delivery Professional Services

Childbirth/Delivery Facility Services

Diagnostic tests (ultrasounds and blood work)

Specialist visit (anesthesia)

This EXAMPLE event includes services

like:

Primary care physician office visits (including

disease education)

Diagnostic tests (blood work)

Prescription drugs

Durable medical equipment (glucose meter)

This EXAMPLE event includes services

like:

Emergency room care (including medical supplies)

Diagnostic test (x-ray)

Durable medical equipment (crutches)

Rehabilitation services (physical therapy)

Total Example Cost

$12,700

Total Example Cost

$5,600

Total Example Cost

$2,800

In this example, Peg would pay:

In this example, Joe would pay:

In this example, Mia would pay:

Cost Sharing

Cost Sharing

Cost Sharing

Deductibles

$0

Deductibles

$0

Deductibles

$0

Copayments

$650

Copayments

$520

Copayments

$1,360

Coinsurance

$0

Coinsurance

$0

Coinsurance

$15

What isn’t covered

What isn’t covered

What isn’t covered

Limits or exclusions

$60

Limits or exclusions

$55

Limits or exclusions

$0

The total Peg would pay is

$710

The total Joe would pay is

$575

The total Mia would pay is

$1,375

NOTE: This Summary of Benefit and Coverage attempts to show you how you and the plan share the cost for covered health care services. Any summary of benefits

or cost sharing principals represents only a brief description of your benefits. Please read the booklet carefully to learn about provisions, benefits and

exclusions. If any perceived conflict exists between this summary and the Plan terms, the Plan terms govern.

The plan would be responsible for the other costs of these EXAMPLE covered services.

8 of 13

By authority of the Regents, University of California Human Resources, located

in Oakland, administers all benefit plans in accordance with applicable plan

documents and regulations, custodial agreements, University of California Group

Insurance Regulations for Faculty and Staff, group insurance contracts, and state

and federal laws. No person is authorized to provide benefits information not

contained in these source documents, and information not contained in these

source documents cannot be relied upon as having been authorized by the

Regents. Source documents are available for inspection upon request

(800-888-8267). What is written here does not constitute a guarantee of plan

coverage or benefits—particular rules and eligibility requirements must be met

before benefits can be received. The University of California intends to continue

the benefits described here indefinitely; however, the benefits of all employees,

retirees and plan beneficiaries are subject to change or termination at the time of

contract renewal or at any other time by the University or other governing

authorities. The University also reserves the right to determine new premiums,

employer contributions and monthly costs at any time. Health and welfare

benefits are not accrued or vested benefit entitlements. UC’s contribution toward

the monthly cost of the coverage is determined by UC and may change or stop

altogether, and may be affected by the state of California’s annual budget

appropriation. If you belong to an exclusively represented bargaining unit, some

of your benefits may differ from the ones described here. For more information,

employees should contact their Human Resources Office and retirees should call

the UC Retirement Administration Service Center (800-888-8267).

In conformance with applicable law and University policy, the University is an

affirmative action/equal opportunity employer. Please send inquiries regarding

the University’s affirmative action and equal opportunity policies for staff to

Systemwide AA/EEO Policy Coordinator, University of California, Office of the

President, 1111 Franklin Street, 5th Floor, CA 94607, and for faculty to the Office

of Academic Personnel and Programs, University of California Office of the

President, 1111 Franklin Street, Oakland, CA 94607.

Language Access Services:

9 of 13

(TTY/TDD: 711)

Albanian (Shqip): Nëse keni pyetje në lidhje me këtë dokument, keni të drejtë të merrni falas ndihmë dhe informacion në gjuhën tuaj. Për të kontaktuar me

një përkthyes, telefononi (866) 406-1182

Amharic (አማርኛ)፦ ስለዚህ ሰነድ ማንኛውም ጥያቄ ካለዎት በራስዎ ቋንቋ እርዳታ እና ይህን መረጃ በነጻ የማግኘት መብት አለዎት። አስተርጓሚ ለማናገር (866) 406-1182 ይደውሉ።

. (866) 406-1182

Armenian (հայերեն). Եթե այս փաստաթղթի հետ կապված հարցեր ունեք, դուք իրավունք ունեք անվճար ստանալ օգնություն և

տեղեկատվություն ձեր լեզվով: Թարգմանչի հետ խոսելու համար զանգահարեք հետևյալ հեռախոսահամարով՝ (866) 406-1182:

(866) 406-1182.

(866) 406-1182

(866) 406-1182

Chinese (中文):如果您對本文件有任何疑問,您有權使用您的語言免費獲得協助和資訊。如需與譯員通話,請致電 (866) 406-1182。

(866) 406-1182.

Dutch (Nederlands): Bij vragen over dit document hebt u recht op hulp en informatie in uw taal zonder bijkomende kosten. Als u een tolk wilt spreken,

belt u (866) 406-1182.

(866) 406-1182

French (Français) : Si vous avez des questions sur ce document, vous avez la possibilité d’accéder gratuitement à ces informations et à une aide dans votre

langue. Pour parler à un interprète, appelez le (866) 406-1182.

Language Access Services:

10 of 13

German (Deutsch): Wenn Sie Fragen zu diesem Dokument haben, haben Sie Anspruch auf kostenfreie Hilfe und Information in Ihrer Sprache. Um mit

einem Dolmetscher zu sprechen, bitte wählen Sie (866) 406-1182.

Greek (Ελληνικά) Αν έχετε τυχόν απορίες σχετικά με το παρόν έγγραφο, έχετε το δικαίωμα να λάβετε βοήθεια και πληροφορίες στη γλώσσα σας δωρεάν. Για να

μιλήσετε με κάποιον διερμηνέα, τηλεφωνήστε στο (866) 406-1182.

Gujarati (ગુજરાતી): ,

. , (866) 406-1182.

Haitian Creole (Kreyòl Ayisyen): Si ou gen nenpòt kesyon sou dokiman sa a, ou gen dwa pou jwenn èd ak enfòmasyon nan lang ou gratis. Pou pale ak yon

entèprèt, rele (866) 406-1182.

(866) 406-1182

Hmong (White Hmong): Yog tias koj muaj lus nug dab tsi ntsig txog daim ntawv no, koj muaj cai tau txais kev pab thiab lus qhia hais ua koj hom lus yam

tsim xam tus nqi. Txhawm rau tham nrog tus neeg txhais lus, hu xov tooj rau (866) 406-1182.

Igbo (Igbo): Ọ bụr ụ na ị nwere ajụjụ ọ bụla gbasara akwụkwọ a, ị nwere ikike ịnweta enyemaka na ozi n'asụsụ gị na akwụghị ụgwọ ọ bụla. Ka gị na ọkọwa

okwu kwuo okwu, kpọọ (866) 406-1182.

Ilokano (Ilokano): Nu addaan ka iti aniaman a saludsod panggep iti daytoy a dokumento, adda karbengam a makaala ti tulong ken impormasyon babaen ti

lenguahem nga awan ti bayad na. Tapno makatungtong ti maysa nga tagipatarus, awagan ti (866) 406-1182.

Indonesian (Bahasa Indonesia): Jika Anda memiliki pertanyaan mengenai dokumen ini, Anda memiliki hak untuk mendapatkan bantuan dan informasi

dalam bahasa Anda tanpa biaya. Untuk berbicara dengan interpreter kami, hubungi (866) 406-1182.

Italian (Italiano): In caso di eventuali domande sul presente documento, ha il diritto di ricevere assistenza e informazioni nella sua lingua senza alcun costo

aggiuntivo. Per parlare con un interprete, chiami il numero (866) 406-1182

(866) 406-1182

Language Access Services:

11 of 13

(866) 406-1182

Kirundi (Kirundi): Ugize ikibazo ico arico cose kuri iyi nyandiko, ufise uburenganzira bwo kuronka ubufasha mu rurimi rwawe ata giciro. Kugira uvugishe

umusemuzi, akura (866) 406-1182.

Korean (한국어): 본 문서에 대해 어떠한 문의사항이라도 있을 경우, 귀하에게는 귀하가 사용하는 언어로 무료 도움 및 정보를 얻을 권리가

있습니다. 통역사와 이야기하려면 (866) 406-1182로 문의하십시오.

(866) 406-1182.

(866) 406-1182.

(866) 406-1182

Oromo (Oromifaa): Sanadi kanaa wajiin walqabaate gaffi kamiyuu yoo qabduu tanaan, Gargaarsa argachuu fi odeeffanoo afaan ketiin kaffaltii alla argachuuf

mirgaa qabdaa. Turjumaana dubaachuuf, (866) 406-1182 bilbilla.

Pennsylvania Dutch (Deitsch): Wann du Frooge iwwer selle Document hoscht, du hoscht die Recht um Helfe un Information zu griege in dei Schprooch

mitaus Koscht. Um mit en Iwwersetze zu schwetze, ruff (866) 406-1182 aa.

Polish (polski): W przypadku jakichkolwiek pytań związanych z niniejszym dokumentem masz prawo do bezpłatnego uzyskania pomocy oraz informacji w

swoim języku. Aby porozmawiać z tłumaczem, zadzwoń pod numer (866) 406-1182.

Portuguese (Português): Se tiver quaisquer dúvidas acerca deste documento, tem o direito de solicitar ajuda e informações no seu idioma, sem qualquer

custo. Para falar com um intérprete, ligue para (844) 437-048(866) 406-1182 6.

(866) 406-1182

Language Access Services:

12 of 13

(866) 406-1182.

(866) 406-1182.

Samoan (Samoa): Afai e iai ni ou fesili e uiga i lenei tusi, e iai lou ‘aia e maua se fesoasoani ma faamatalaga i lou lava gagana e aunoa ma se totogi. Ina ia

talanoa i se tagata faaliliu, vili (866) 406-1182.

Serbian (Srpski): Ukoliko imate bilo kakvih pitanja u vezi sa ovim dokumentom, imate pravo da dobijete pomoć i informacije na vašem jeziku bez ikakvih

troškova. Za razgovor sa prevodiocem, pozovite (866) 406-1182.

Spanish (Español): Si tiene preguntas acerca de este documento, tiene derecho a recibir ayuda e información en su idioma, sin costos. Para hablar con un

intérprete, llame al (866) 406-1182.

Tagalog (Tagalog): Kung mayroon kang anumang katanungan tungkol sa dokumentong ito, may karapatan kang humingi ng tulong at impormasyon sa

iyong wika nang walang bayad. Makipag-usap sa isang tagapagpaliwanag, tawagan ang (866) 406-1182.

Thai (ไทย):

(866) 406-1182

(866) 406-1182.

(866) 406-1182

Vietnamese (Tiếng Việt): Nếu quý vị có bất kỳ thắc mắc nào về tài liệu này, quý vị có quyền nhận sự trợ giúp và thông tin bằng ngôn ngữ của quý vị hoàn

toàn miễn phí. Để trao đổi với một thông dịch viên, hãy gọi (866) 406-1182.

(866) 406-1182

(866) 406-1182.

Language Access Services:

13 of 13

It’s important we treat you fairly

That’s why we follow federal civil rights laws in our health programs and activities. We don’t discriminate, exclude people, or treat them differently on the

basis of race, color, national origin, sex, age or disability. For people with disabilities, we offer free aids and services. For people whose primary language isn’t

English, we offer free language assistance services through interpreters and other written languages. Interested in these services? Call the Member Services

number on your ID card for help (TTY/TDD: 711). If you think we failed to offer these services or discriminated based on race, color, national origin, age,

disability, or sex, you can file a complaint, also known as a grievance. You can file a complaint with our Compliance Coordinator in writing to Compliance

Coordinator, P.O. Box 27401, Mail Drop VA2002-N160, Richmond, VA 23279. Or you can file a complaint with the U.S. Department of Health and

Human Services, Office for Civil Rights at 200 Independence Avenue, SW; Room 509F, HHH Building; Washington, D.C. 20201 or by calling 1-800-368-

1019 (TDD: 1- 800-537-7697) or online at https://ocrportal.hhs.gov/ocr/portal/lobby.jsf. Complaint forms are available at

http://www.hhs.gov/ocr/office/file/index.html.