are located on the Carriers and Benefit Plans webpage.

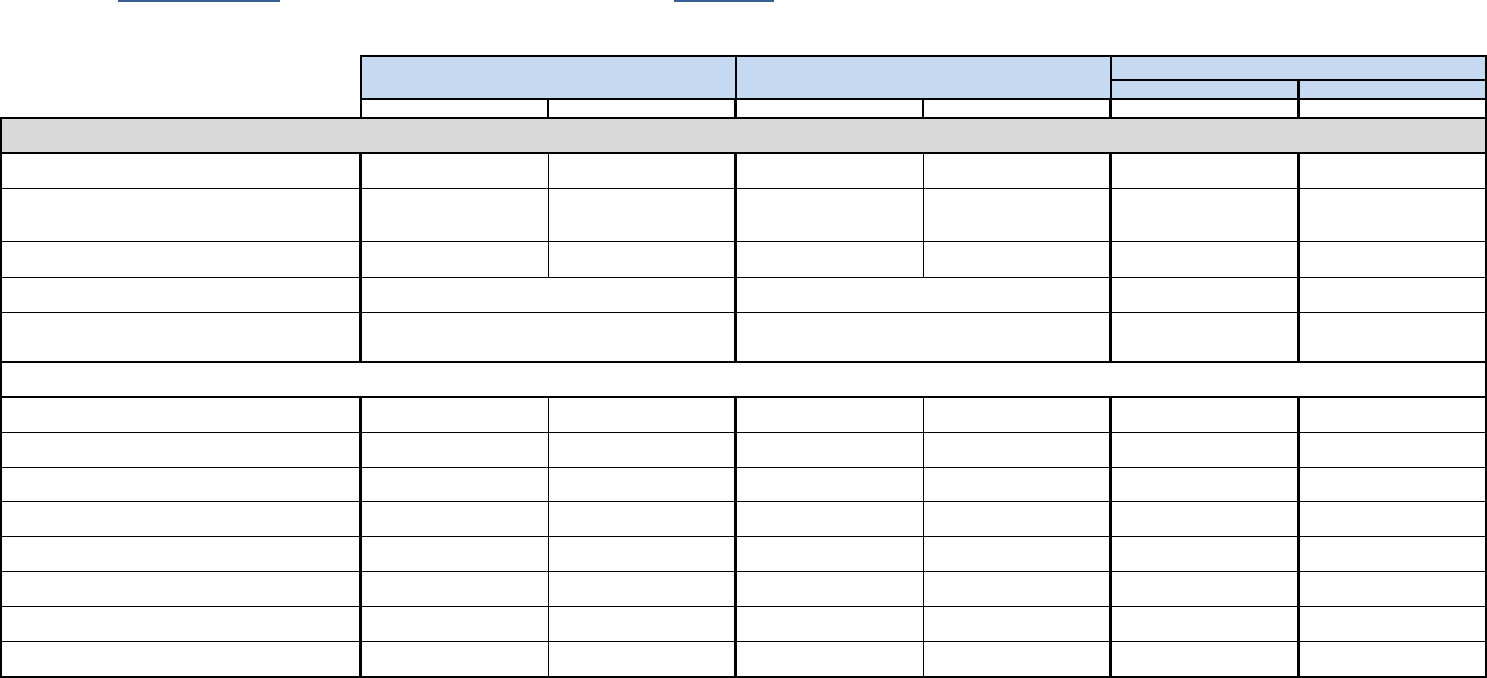

Blue Care Network Health Alliance Plan

In-Network Out-of-Network In-Network Out-of-Network In-Network In-Network

Deductible

3

$400/individual

4

$800/family

$800/individual

4

$1,600/family

$1,600/individual

5

$3,200/family

$3,200/individual

5

$6,400/family

$125/individual

6

$250/family

$125/individual

6

$250/family

Coinsurance

10% for most services.

20% for acupuncture

20% for most services

50% for mental health and

substance use disorder

20% for most services

40% for acupuncture

40% for most services N/A N/A

Out-Of-Pocket Maximum

7

$2,000/individual

$4,000/family

$3,000/individual

$6,000/family

$4,000/individual

$8,000/family

$8,000/individual

$16,000/family

$2,000/individual

$4,000/family

$2,000/individual

$4,000/family

Health Savings Account (HSA) Employer Annual Contribution N/A N/A

Annual gynecological exam, 1 per plan year Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Childhood Immunization (through age 16) Covered 100% Covered 80% Covered 100%

Covered 60%

after deductible

Covered 100% Covered 100%

Colonoscopy

12

Covered 100%

Covered 80%

after deductible

Covered 100%

Covered 60%

after deductible

Covered 100% Covered 100%

Fecal occult blood screening

12

Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Flexible sigmoidoscopy

12

Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Health maintenance exam, 1 per plan year Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Immunizations, annual flu shot, & Hepatitis C screening for

those at risk

Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Mammography

12

Covered 100%

Covered 80%

after deductible

Covered 100%

Covered 60%

after deductible

Covered 100% Covered 100%

State Health Plan PPO (80%)

State High Deductible Health Plan with HSA

1

HMOs (85%)

2

2

The State will pay up to 85% of the applicable HMO total premium, capped at the dollar amount which the State pays for the same coverage code under the SHP PPO.

3

Deductible amounts for all health plans are effective January 1 and renew annually on a calendar basis. The deductible for the HDHP is combined for medical and pharmacy.

4

The SHP PPO individual deductible is the maximum amount that applies to any one family member. The family deductible is the combined maximum deductible amount that applies to any combination of family members. One family member is not required to reach the

individual deductible before that family deductible can be met. Additionally, one family member cannot contribute in excess of the maximum amount of the individual deductible.

5

The HDHP Individual deductible only applies to employee only coverage. The HDHP Family deductible applies to the coverage of employee plus spouse and/or other dependents. The applicable deductible must be fulfilled prior to services being paid by the plan. Any one

member of the family or any combination of family members may fulfill the entire family deductible.

This comparison chart is intended as an easy-to-read benefit summary. Additional limitations, exclusions, and/or prior authorizations may apply to covered services. Payment amounts are based on the carrier's approved amount, less any

applicable deductible, copay amounts, and/or coinsurance. Pre-existing conditions are covered with the applicable deductibles and copays for the covered benefit. Contact information, websites, plan booklets and Summary of Benefits

2024 Comparison of PPO, State HDHP, and HMO Plans

Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan

Retail-$10/$30/$60

Mail Order-$20/$60/$120

$750/individual

8

$1,500/family

After deductible is met, the following copays apply

10

:

Retail-$10/$30/$60

Mail Order-$20/$60/$120

Deductible, Copays, Out-of-Pocket Maximum, and Prescription Drugs

Retail-$10/$30/$60

Mail Order-$20/$60/$120

Preventive Services

11

6

The HMO individual deductible is the maximum amount that applies to any one family member. The family deductible is the combined maximum deductible amount that applies to any combination of family members. One family member is not required to reach the individual

deductible before that family deductible can be met. Additionally, one family member cannot contribute in excess of the maximum amount of the individual deductible. Check with your HMO to see if any Out-of-Network services are covered and the applicable Out-of-Network

deductible that would apply.

Prescription Drug copays

9

1

MSP DROP employees (bargaining unit T01 and Command Officers) and OEAIs are excluded from enrollment in the State HDHP with HSA.

7

Out-Of-Pocket Maximum amounts for all health plans are effective January 1 and renew annually on a calendar basis. Only In-Network deductibles, fixed-dollar copayments, prescription drug copayments,

and coinsurance apply toward the out-of-pocket maximum.

9

The SHP PPO and State HDHP with HSA only allow a 30-day supply at a retail pharmacy and 90-day supply through mail order. BCN allows up to a 90-day supply of non-specialty medications at both retail and mail order. HAP allows a 30-day supply at a retail pharmacy and

90-day supply through mail order. HAP allows select medications as a 90-day supply at retail.

Premiums for each benefit plan are located on the Insurance Rates webpage.

N/A

Retail-$10/$30/$60

Mail Order-$20/$60/$120

8

Funded 100% on the 1st pay period of each plan year. The State will make a contribution of $750 for an individual employee or $1,500 for employees who enroll effective January 1st with one or more dependents. This contribution will be prorated for employees who enroll mid-

year based on the number of pay periods remaining in the plan year at the time of enrollment in the HDHP.

10

The deductible does not apply to certain preventive medications under the State HDHP with HSA.

11

Preventive Services are not subject to the deductible.

12

Patient Protection and Affordable Care Act (PPACA) guidelines apply.

are located on the Carriers and Benefit Plans webpage.

Blue Care Network Health Alliance Plan

In-Network Out-of-Network In-Network Out-of-Network In-Network In-Network

State Health Plan PPO (80%)

State High Deductible Health Plan with HSA

1

HMOs (85%)

2

This comparison chart is intended as an easy-to-read benefit summary. Additional limitations, exclusions, and/or prior authorizations may apply to covered services. Payment amounts are based on the carrier's approved amount, less any

applicable deductible, copay amounts, and/or coinsurance. Pre-existing conditions are covered with the applicable deductibles and copays for the covered benefit. Contact information, websites, plan booklets and Summary of Benefits

2024 Comparison of PPO, State HDHP, and HMO Plans

Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan

Deductible, Copays, Out-of-Pocket Maximum, and Prescription Drugs

Premiums for each benefit plan are located on the Insurance Rates webpage.

Pap smear screening - laboratory services only

12

,

1 per plan year

Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Prostate specific antigen screening

12

,

1 per plan year

Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Well-baby and child care Covered 100% Not Covered Covered 100% Not covered Covered 100% Covered 100%

Office and Outpatient hospital visits, consultations, and urgent

care visits

$20 copay

(deductible not applicable)

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

$20 copay

(deductible not applicable)

$20 copay

(deductible not applicable)

Outpatient and home visits

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

$20 copay

(deductible not applicable)

$20 copay

(deductible not applicable)

Telemedicine (Medical) -

via the Carrier's online vendor

$0 copay

(deductible not applicable)

Not Covered

Covered 80%

after deductible

Not covered

$10 Copay

(deductible not applicable)

$10 Copay

(deductible not applicable)

Telemedicine (Behavioral Health) -

via the Carrier's online vendor

$0 copay

(deductible not applicable)

Not Covered

Covered 80%

after deductible

Not covered

$0 copay

(deductible not applicable)

$10 Copay

(deductible not applicable)

Telemedicine (Medical) -

via the Provider's online tool

$20 copay

(deductible not applicable)

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

$20 copay

(deductible not applicable)

$20 copay

(deductible not applicable)

Telemedicine (Behavioral Health) -

via the Provider's online tool

$20 copay

13

(deductible not applicable)

Covered 50% of allowed

amount or billed charges

(whichever is less)

Covered 80%

after deductible

Covered 60%

after deductible

$0 copay

(deductible not applicable)

$0 copay

(deductible not applicable)

Ambulance services - medically necessary

Covered 100%

after deductible

Covered 100%

after deductible

Hospital emergency room for medical emergency or

accidental injury

$200 copay

(Waived if admitted

as inpatient)

$200 copay

(Waived if admitted

as inpatient)

Diagnostic tests and x-rays

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

after deductible

(May require authorization)

Covered 100%

after deductible

Laboratory and pathology tests

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

(May require authorization)

Covered 100%

Radiation therapy

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

after deductible

(Requires authorization)

Covered 100%

after deductible

Delivery and nursery care

Covered 90%

after deductible

Covered 80%

after deductible

Covered 100%

after deductible

Covered 100%

after deductible

Prenatal care

11

Postnatal care

11

12

Patient Protection and Affordable Care Act (PPACA) guidelines apply.

Covered 100%

Covered 100%

Covered 100%

Covered 100%

Covered 90%

after deductible

$200 copay

(Waived if admitted as inpatient)

Covered 80%

after deductible

Covered 60%

after deductible

Maternity Services (Includes care by a certified nurse midwife SHP PPO Only)

Diagnostic Services

Covered 80%

after deductible

Emergency Medical Care

Physician Office Services

11

Preventive Services are not subject to the deductible.

Preventive Services

11

(continued)

13

$20 copay or 10% coinsurance (whichever is less) for Telemedicine via an in-network provider's online tool for Behavioral Health.

are located on the Carriers and Benefit Plans webpage.

Blue Care Network Health Alliance Plan

In-Network Out-of-Network In-Network Out-of-Network In-Network In-Network

State Health Plan PPO (80%)

State High Deductible Health Plan with HSA

1

HMOs (85%)

2

This comparison chart is intended as an easy-to-read benefit summary. Additional limitations, exclusions, and/or prior authorizations may apply to covered services. Payment amounts are based on the carrier's approved amount, less any

applicable deductible, copay amounts, and/or coinsurance. Pre-existing conditions are covered with the applicable deductibles and copays for the covered benefit. Contact information, websites, plan booklets and Summary of Benefits

2024 Comparison of PPO, State HDHP, and HMO Plans

Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan

Deductible, Copays, Out-of-Pocket Maximum, and Prescription Drugs

Premiums for each benefit plan are located on the Insurance Rates webpage.

Chemotherapy

Dialysis services

Inpatient consultations

Semi-private room, inpatient physician care, general nursing

care, hospital services, and supplies (unlimited days)

Covered 100%

after deductible

(Requires authorization)

Home health care

Covered 90%

after deductible

(participating providers

only; unlimited visits)

Not Covered

Covered 80%

after deductible

(participating providers only;

unlimited visits)

Not Covered

Covered 100%

After Deductible,

$20 Copay

Covered 100%

After Deductible,

$20 Copay

(Unlimited visits;

excludes PT/OT/ST)

Hospice care

Covered 100%

(participating provider only)

Not Covered

Covered 80%

after deductible

(participating provider only)

Not Covered

Covered 100%

After Deductible

(Inpatient care requires

authorization)

Covered 100%

after deductible

Skilled nursing care

(up to 120 days per confinement)

Covered 90%

after deductible

(Blue Cross approved facility)

Not Covered

Covered 80%

after deductible

(Blue Cross approved facility)

Not Covered

Covered 100%

after deductible

(Requires authorization)

Covered 100%

after deductible

Anesthesia

Covered 100%

After Deductible

Covered 100%

After Deductible

Female voluntary sterilization

12

Covered 100% Covered 100% Covered 100%

Male voluntary sterilization

Covered 100%

after deductible

Surgery - includes related surgical services

Covered 90%

after deductible

Covered 100%

after deductible

(Requires authorization)

Bone marrow-specific criteria applies

Covered 100%

(in designated facilities)

Not Covered

Covered 80%

after deductible

(in designated facilities)

Not Covered

Covered 100%

after deductible

(In designated facilities;

requires authorization)

Covered 100%

after deductible

(in designated facilities)

Kidney, cornea, and skin

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

after deductible

(Subject to medical criteria;

requires authorization)

Covered 100%

after deductible

(subject to medical criteria)

Alternative to Hospital Care

Human Organ Transplants

Covered 60%

after deductible

Covered 80%

after deductible

Covered 100%

Covered 80%

after deductible

Covered 100%

after deductible

12

Patient Protection and Affordable Care Act (PPACA) guidelines apply.

Hospital Care

Surgical Services

Covered 90% after deductible

Covered 80% after deductible

Covered 60%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 90%

after deductible

Covered 100%

after Deductible

Covered 100%

after deductible

are located on the Carriers and Benefit Plans webpage.

Blue Care Network Health Alliance Plan

In-Network Out-of-Network In-Network Out-of-Network In-Network In-Network

State Health Plan PPO (80%)

State High Deductible Health Plan with HSA

1

HMOs (85%)

2

This comparison chart is intended as an easy-to-read benefit summary. Additional limitations, exclusions, and/or prior authorizations may apply to covered services. Payment amounts are based on the carrier's approved amount, less any

applicable deductible, copay amounts, and/or coinsurance. Pre-existing conditions are covered with the applicable deductibles and copays for the covered benefit. Contact information, websites, plan booklets and Summary of Benefits

2024 Comparison of PPO, State HDHP, and HMO Plans

Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan

Deductible, Copays, Out-of-Pocket Maximum, and Prescription Drugs

Premiums for each benefit plan are located on the Insurance Rates webpage.

Liver, heart, lung, pancreas, and other specified organ

transplants

Covered 100%

(in designated facilities)

Not Covered

Covered 80%

after deductible

(in designated facilities)

Not Covered

Covered 100%

after deductible

(In designated facilities;

requires authorization)

Covered 100%

after deductible

(in designated facilities)

Acupuncture

Not Covered Not Covered

Allergy injections Covered 100% Covered 100%

Allergy testing and therapy (non-injection)

Covered 100%

after deductible

Autism - Spectrum Disorder Applied Behavioral Analysis

(ABA) treatment

Covered 100%

Bariatric Surgery

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

After Deductible

(Limited one per lifetime;

requires authorization)

Covered 100%

After Deductible,

$1,000 Copay per admission;

One procedure per lifetime

Cardiac Rehabilitation & Pulmonary Rehabilitation

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered, $20 Copay

(Limited to 36 visits per

plan year)

Covered 100%

after deductible

Chiropractic/spinal manipulation

$20 copay

(Up to 24 visits per

calendar year)

Covered 80%

after deductible

(Up to 24 visits per

calendar year)

Covered 80%

after deductible

(up to 24 visits per

calendar year)

Covered 60%

after deductible

(up to 24 visits per

calendar year)

Chiropractic spinal

manipulation when

referred by PCP,

Covered After Deductible,

$20 Copay. Deductible

applies to x-rays.

Covered

$20 Copay

(Manipulations only,

up to 24 visits per

plan year)

Durable medical equipment Covered 100%

Covered 80%

of the Blue Cross approved

amount plus, the difference

between charge and approved

amount

Covered 80%

after deductible

Covered 60%

after deductible

of the Blue Cross approved

amount plus, the difference

between charge and approved

amount

Covered 100%

(Must be authorized and

obtained from a BCN supplier)

Covered 100%

Hearing Aids

Covered 100%

(standard and binaural aids)

Not Covered

Covered 80%

after deductible

Not Covered

Covered (for conventional

standard hearing aids; Limited

to one monaural with a max

benefit of $654 or one binaural

with a max benefit of $1,177;

every 36 months)

Covered, copay based

on type of Hearing Aid.

Deductible does not

apply. Through a

NationsHearing provider

only. Limit of coverage is

one (1) Hearing Aid per

ear per plan year.

Hearing Care Exam

$20 copay

for office visit

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

(Performed in Physician's

Office, $20 copay may apply)

Covered 100%

($20 Office copay

may apply)

Infertility Counseling & Treatment Not Covered Not Covered Not Covered Not Covered

Covered 100%

After Deductible

(Excludes in-vitro fertilization)

Covered 100%

After Deductible;

(One attempt of artificial

insemination per lifetime)

Nutritional & Health education and counseling Covered 100% Not Covered Covered 100% Not Covered Covered 100%

Covered 100%

(Limitations apply)

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 60% after deductible

(if performed by a participating acupuncturist

or under the supervision of a M.D. or D.O.)

Human Organ Transplants (continued)

Covered 90%

after deductible

Covered 80% after deductible

(if performed by a participating acupuncturist

or under the supervision of a M.D. or D.O.)

Other Services

Covered 100%

After Deductible

are located on the Carriers and Benefit Plans webpage.

Blue Care Network Health Alliance Plan

In-Network Out-of-Network In-Network Out-of-Network In-Network In-Network

State Health Plan PPO (80%)

State High Deductible Health Plan with HSA

1

HMOs (85%)

2

This comparison chart is intended as an easy-to-read benefit summary. Additional limitations, exclusions, and/or prior authorizations may apply to covered services. Payment amounts are based on the carrier's approved amount, less any

applicable deductible, copay amounts, and/or coinsurance. Pre-existing conditions are covered with the applicable deductibles and copays for the covered benefit. Contact information, websites, plan booklets and Summary of Benefits

2024 Comparison of PPO, State HDHP, and HMO Plans

Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan

Deductible, Copays, Out-of-Pocket Maximum, and Prescription Drugs

Premiums for each benefit plan are located on the Insurance Rates webpage.

Orthognathic Surgery

Covered 90%

after deductible

(Limitations apply)

Covered 80%

after deductible

(Limitations apply)

Covered 80%

after deductible

(Limitations apply)

Covered 60%

after deductible

(Limitations apply)

Covered 100%

After Deductible

(Limitations apply)

Covered 100%

After Deductible

Oral Surgery

Covered 90%

after deductible

(Limitations apply)

Covered 80%

after deductible

(Limitations apply)

Covered 80%

after deductible

(Limitations apply)

Covered 60%

after deductible

(Limitations apply)

Covered 100%

After Deductible

(For accidental injury;

limitations apply)

Covered 100%

After Deductible

*Limited to emergency oral

surgery/dental services for the

prompt stabilization of

traumatic injury to natural

teeth or related body tissue

resulting from a

nonoccupational injury

Prosthetic and orthotic appliances Covered 100%

Covered 80%

of the Blue Cross approved

amount plus, the difference

between charge and approved

amount

Covered 80%

after deductible

Covered 60%

after deductible

of the Blue Cross approved

amount plus, the difference

between charge and approved

amount

Covered 100%

(Must be authorized and

obtained from a BCN supplier)

Covered 100%

Private duty nursing

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

After Deductible

(Requires authorization)

Covered 100%

Rabies treatment after initial emergency room visit

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Office visit $20 copay;

Injections Covered 100%

Office visit $20 copay;

Injections Covered 100%

Temporomandibular Joint Syndrome (TMJS)

Covered 90%

after deductible

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

After Deductible

(Limitations apply)

Covered 100%

After Deductible

Vision Screening (performed in a physician’s office, one exam

per plan year)

Covered 100% Not Covered Covered 100% Not Covered Covered 100% Covered 100%

Wig, wig stand, adhesives Not covered Not covered

Covered 100%

for hair prosthesis (wig or hair

piece) for hair loss due to a

medical condition or the

treatment of a medical

condition. One per calendar

year; max benefit $225 per

year.

Covered 100%;

$300 lifetime maximum

benefit

Alcohol & Chemical Dependency Benefits - Inpatient

Covered 100%

14

Halfway House 100%

(requires authorization)

Covered 50% of allowed

amount or billed charges

(whichever is less)

14

Halfway House 50% (requires

authorization)

Covered 80%

14

after deductible

(requires authorization)

Covered 60%

14

after deductible

(requires authorization)

Covered 100%

After Deductible

(Requires authorization)

Covered 100%

After Deductible

(Requires authorization)

Alcohol & Chemical Dependency Benefits - Outpatient

Covered 90%

of network rates

Covered 50% of allowed

amount or billed charges

(whichever is less)

Covered 80%

after deductible

Covered 60%

after deductible

Covered 100%

$20 Copay

(deductible not applicable)

Upon meeting medical conditions, eligible for a lifetime

maximum reimbursement of $300. (Additional wigs covered for

children due to growth).

Behavioral Health / Substance Use Disorder

Other Services (continued)

14

Two 28-day admissions per year with at least 60 days between admissions. Inpatient days may be utilized for Intensive Outpatient Program (IOP) treatment at 2:1 ratio. One inpatient day equals two IOP days.

are located on the Carriers and Benefit Plans webpage.

Blue Care Network Health Alliance Plan

In-Network Out-of-Network In-Network Out-of-Network In-Network In-Network

State Health Plan PPO (80%)

State High Deductible Health Plan with HSA

1

HMOs (85%)

2

This comparison chart is intended as an easy-to-read benefit summary. Additional limitations, exclusions, and/or prior authorizations may apply to covered services. Payment amounts are based on the carrier's approved amount, less any

applicable deductible, copay amounts, and/or coinsurance. Pre-existing conditions are covered with the applicable deductibles and copays for the covered benefit. Contact information, websites, plan booklets and Summary of Benefits

2024 Comparison of PPO, State HDHP, and HMO Plans

Blue Cross Blue Shield of Michigan

Blue Cross Blue Shield of Michigan

Deductible, Copays, Out-of-Pocket Maximum, and Prescription Drugs

Premiums for each benefit plan are located on the Insurance Rates webpage.

Behavioral Health Benefit - Inpatient

Covered 100%

(up to 365 days per year

15

;

requires authorization)

Covered 50% of allowed

amount or billed charges

(whichever is less); up to 365

days per year

15

; requires

authorization

Covered 80%

after deductible

(unlimited days

15

; requires

authorization)

Covered 60%

after deductible

(unlimited days

15

; requires

authorization)

Covered 100%

After Deductible

(Requires authorization)

Covered 100%

After Deductible

(Requires authorization)

Behavioral Health Benefit - Outpatient

Covered 90% of

network rates

Covered 50% of allowed

amount or billed charges

(whichever is less)

$20 Copay

(deductible not applicable)

Intensive Outpatient Program (IOP) - Behavioral Health and

Substance Use Disorder

Covered 100%

Covered 50% of allowed

amount or billed charges

(whichever is less)

$20 Copay

(deductible not applicable)

Outpatient Physical, Speech, Occupational, and Massage

therapy - facility and clinic services

17

Outpatient Physical therapy - physician's office

Covered 80%

after deductible

Covered 80%

after deductible

Covered 60%

after deductible

Covered 60% after deductible

Covered 80% after deductible

16

Massage therapy is not a covered benefit under the HMOs.

17

Massage therapy is performed by a massage therapist must be supervised by a chiropractor and be part of a formal course of physical therapy. Massage therapy is provided as part of a formal course of physical therapy treatment and when billed alone is not a covered

benefit.

Covered, $20 Copay

(Requires authorization;

unlimited visits for spectrum

disorder)

Covered 90%

after deductible

15

Inpatient days may be utilized for partial day hospitalization (PHP) at 2:1 ratio. One inpatient day equals two PHP days.

Behavioral Health / Substance Use Disorder (continued)

Outpatient Physical, Speech, Occupational, and Massage Therapy

15

(Combined maximum of 90 visits per calendar year)

Covered, $20 Copay

(Up to combined

max of 100 visits

per plan year)

Covered 100%